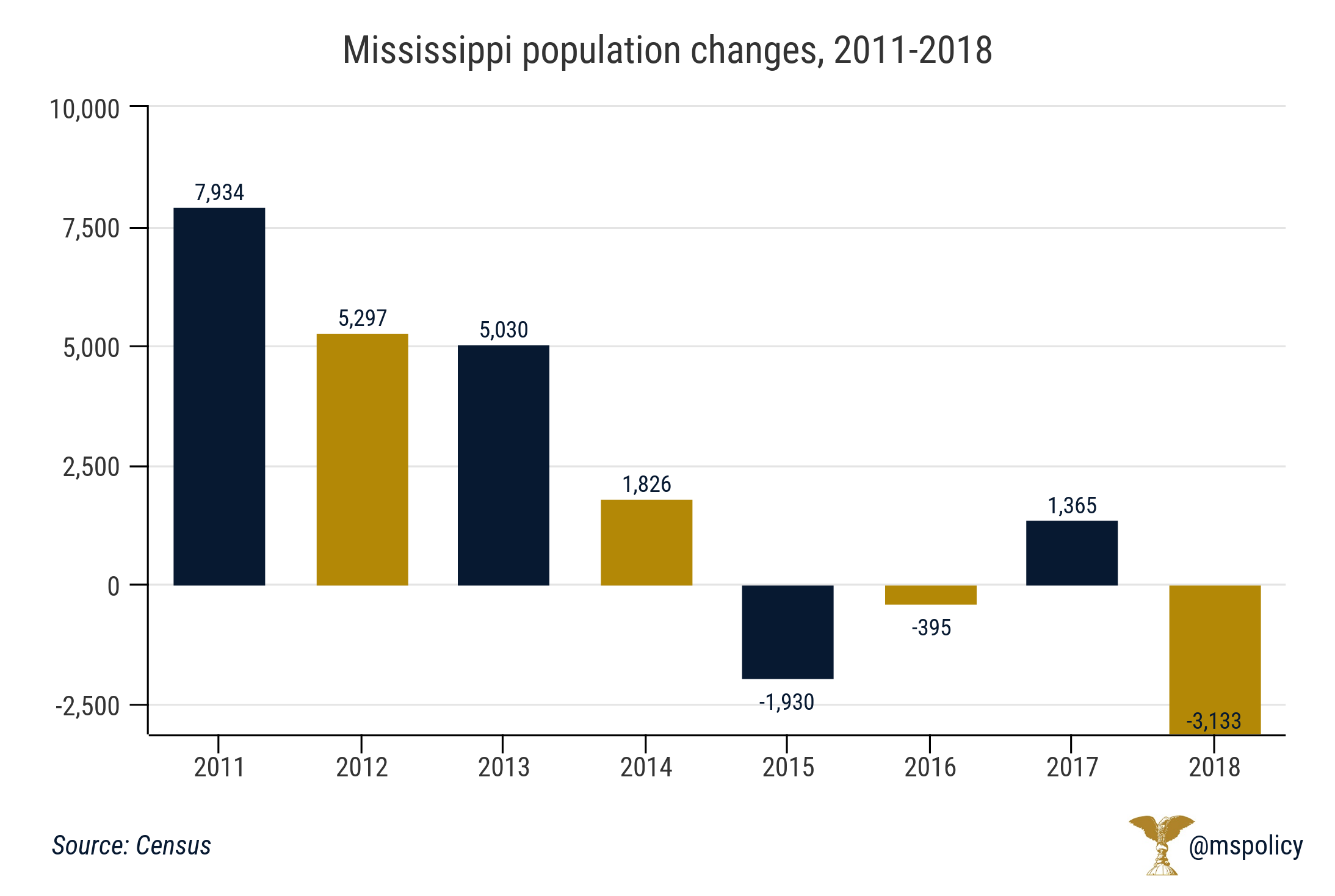

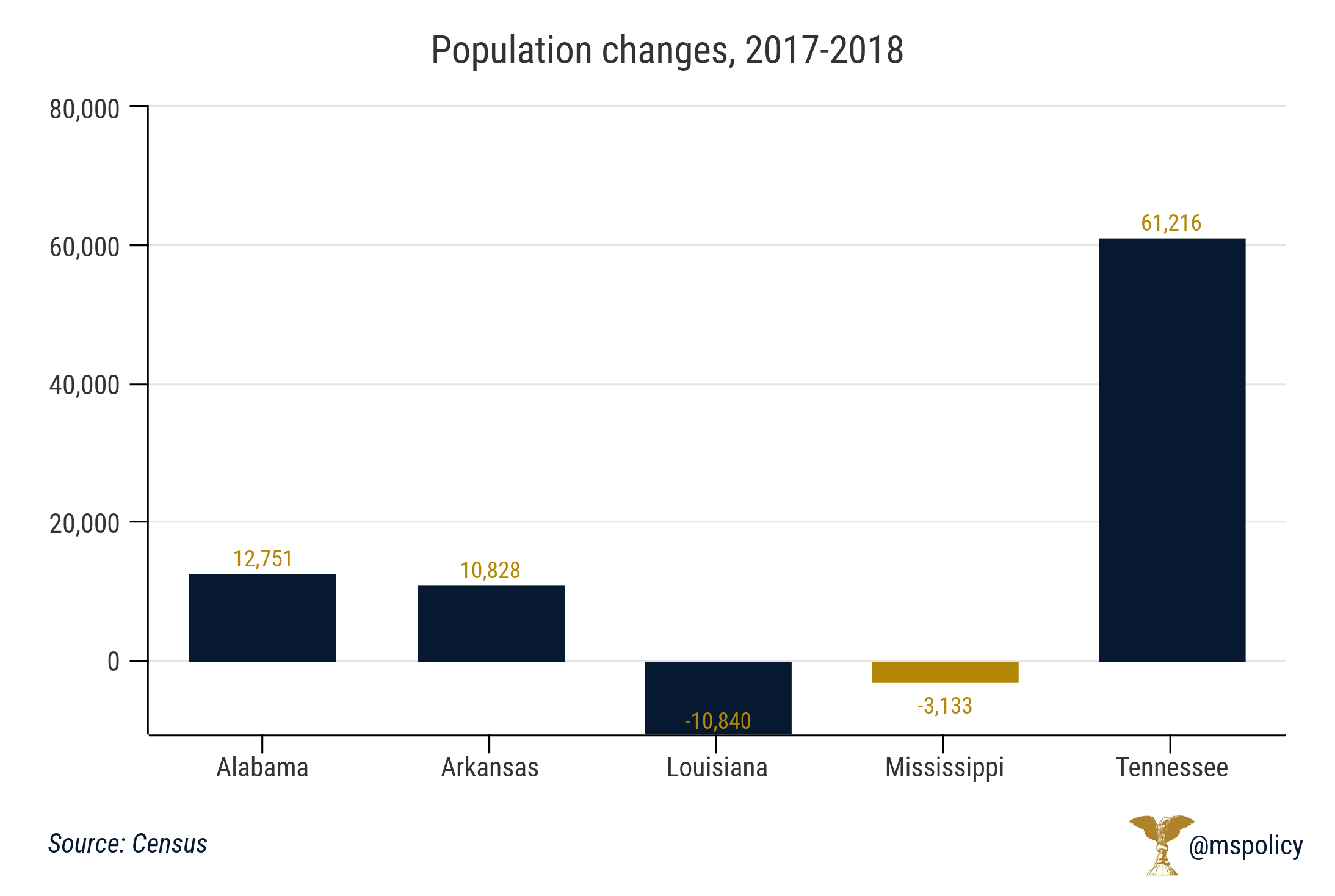

Mississippi and Louisiana both experienced population declines over the previous year, standing out among neighboring states and most of the South.

Louisiana had the fourth highest population loss, in terms of real numbers, at 10,840. Mississippi’s population declined by 3,133. While Mississippi has now seen a population loss in three of the past four years, this was the biggest decline since the official 2010 Census.

The 2018 population estimate is 2,986,530. Mississippi experienced a short population increase of more than 20,000 residents during the first half of the decade, but the population is now down more than 4,000 people since 2014.

Among other neighboring states, over the past year, the population in Alabama increased by 12,751, in Arkansas it increased by 10,828, and it increased by 61,216 in Tennessee.

Tennessee’s population boom isn’t a surprise, or anything new. The state has added more than 400,000 residents since the 2010 Census.

And it’s part of a migration trend. People are leaving progressive income tax states and moving to income tax free states. Over the past year, 339,396 Americans moved to no income tax states, including Tennessee. And 292,947 left progressive income tax states.

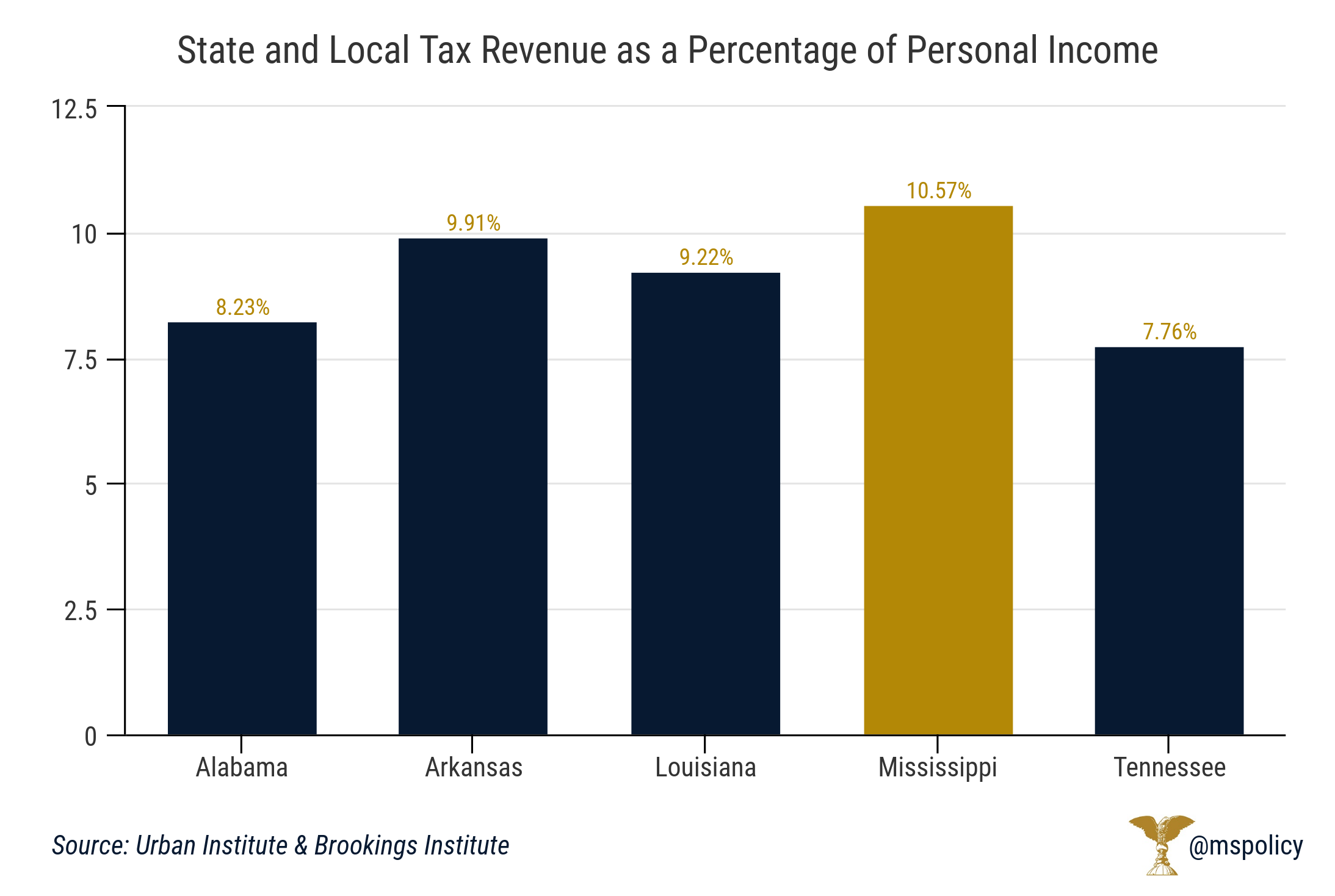

Mississippians have among the highest tax burdens

As Census data shows, Mississippi’s tax burden is hurting the state. As a percentage of personal income, Mississippians have a state and local tax revenue rate of 10.57 percent. The national average is 10.08 and the Southeast average is 8.57.

Among neighboring states, Alabama has a rate of 8.23, Arkansas is 9.91, Louisiana is 9.22, and the income-tax free state of Tennessee is 7.76. This means Tennessee runs their government for about 25 percent cheaper than Mississippi. Mississippi is the only state in the Southeast, save for West Virginia, over 10 percent. The Mountaineer state is the highest in the region at 11.23.

Mississippi’s percentage has gone up steadily over the past few years. From 2010-2012, it ranged from 9.84 to 9.88. But this trend has, unfortunately, been going in the wrong direction.

The battle to preserve our natural rights of life, liberty and property is as arduous today as it was 242 years ago, when George Washington and his men made a daring defense.

Though we don’t fight our would-be rulers with muskets and bayonets today, we remain in a war to defend our constitutional rights from those who would continue to challenge them.

Our weapons today are different but our commitment to win must be no less earnest.

Our founders understood the high purpose and necessity of such a defense. They knew the opportunity of a constitutional republic was won by their generation but that it would also require an ever-vigilant citizenry to defend it from well-meaning but power-seeking governments, generation after generation.

As active and engaged citizens, we have a role as defenders of the blessings of liberty for all Mississippians. Whether a lawyer representing an entrepreneur who is prevented from starting a business by unnecessary and burdensome regulations, a policy advocate working with members of the legislature to push for limited government, a community activist working to ensure equality under the law, or an ordinary citizen writing an Op-Ed for the local newspaper, we’re all defending our shared blessings of liberty.

These blessings were not granted to us by government; they are natural to each of us as individuals. And none of us can be denied these blessings or given any modifier that makes our blessings preferable or subordinate to any others’.

As we celebrate the eternal blessings of the Christmas Season with family and friends, let’s take the time to think about that incredible crossing on Christmas night, 1776. When the hopes of independence lay in the balance, our country’s first president planned and executed the bold attack on the British.

George Washington led famished, cold, tired men across the Delaware in the darkness as rain turned to sleet and then to snow, and the winds blew without relief. The American colonists prevailed in that fight at Trenton and eventually, thanks to a spirit that would not be subdued, our independence was won.

With that enduring spirit in mind this Christmas season, we should take the time to recognize how rich our blessings are and how worthy of a robust defense is liberty.

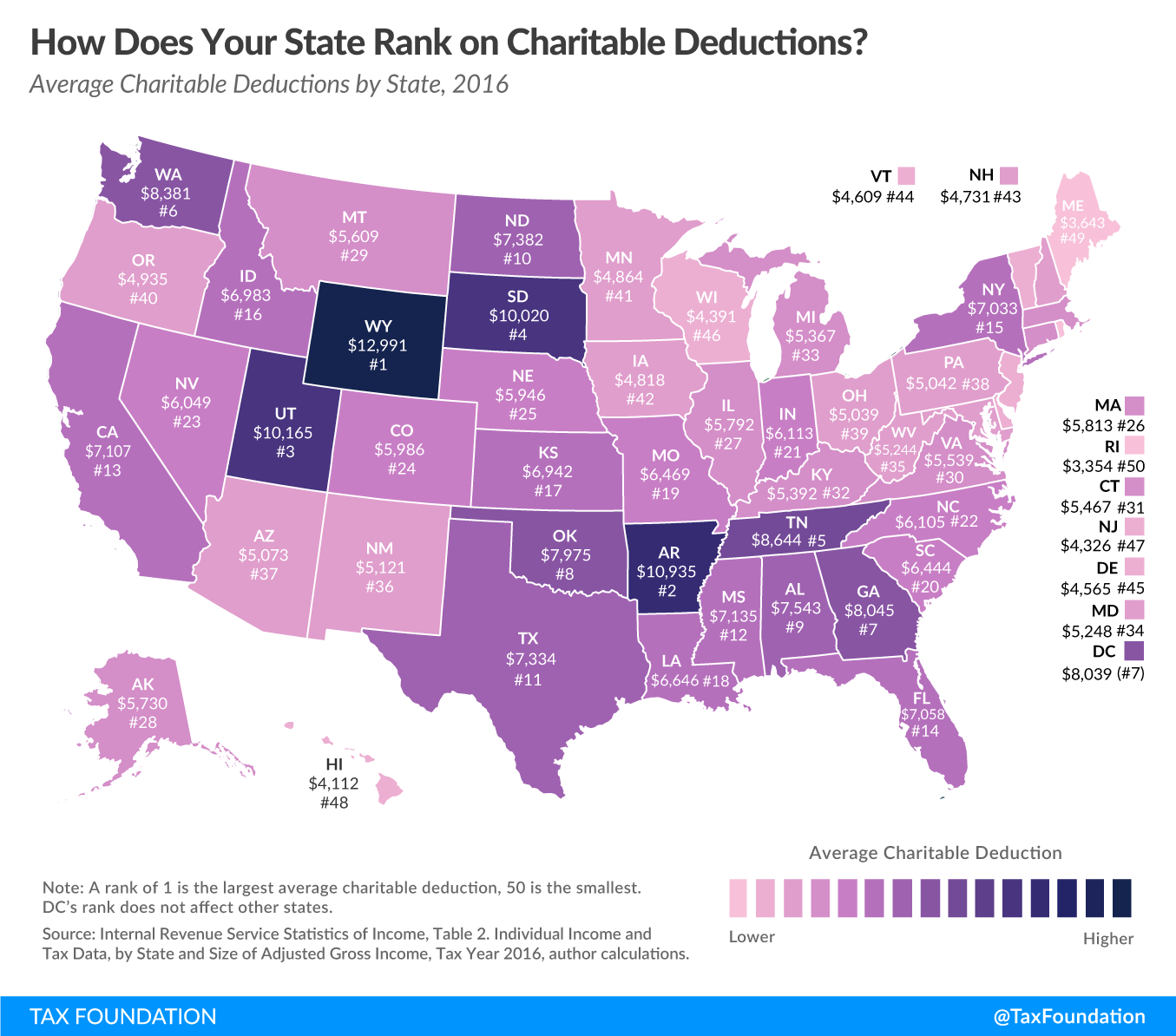

As many prepare for end-of-year charitable contributions, data from the Internal Revenue Service continues to show Mississippi as one of the most charitable states in the country.

According to the IRS, some 250,000 Mississippians took an itemized deduction for charitable giving last year. The average deduction in the Magnolia State was $7,135. This is the 12th highest average in the country.

The top five charitable states were Wyoming ($12,991), Arkansas ($10,935), Utah ($10,165), South Dakota ($10,020), and Tennessee ($8,644).

Along with two of Mississippi’s neighbors coming in the top five nationally, Alabama placed ninth at $7,543 per contribution and Louisiana was 18th at $6,646 per contribution.

The five least charitable states were Rhode Island ($3,354), Maine ($3,643), Hawaii ($4,112), New Jersey ($4,326), and Wisconsin ($4,391).

As a note, this isn’t necessarily total amount of giving, but the total amount that eligible taxpayers deducted on their income taxes in 2016. A donation that was made but not reported on tax filings would not be counted in this report.

And as the standard deduction will be increased because of the Tax Cuts and Jobs Act that passed last year, it is assumed that far fewer individuals and families will itemize their deductions this year. That will impact tax filings, but what effect it has on actual charitable giving remains to be seen.

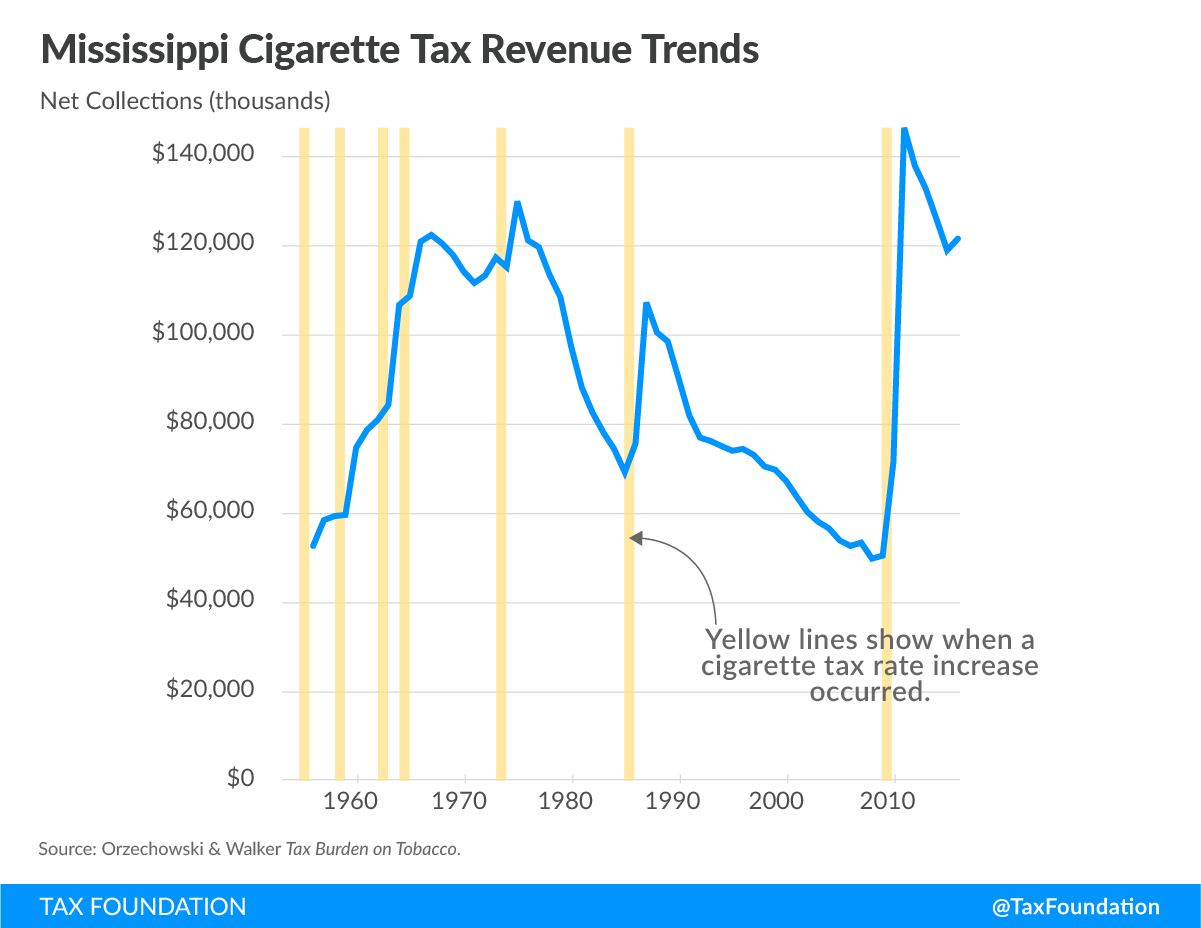

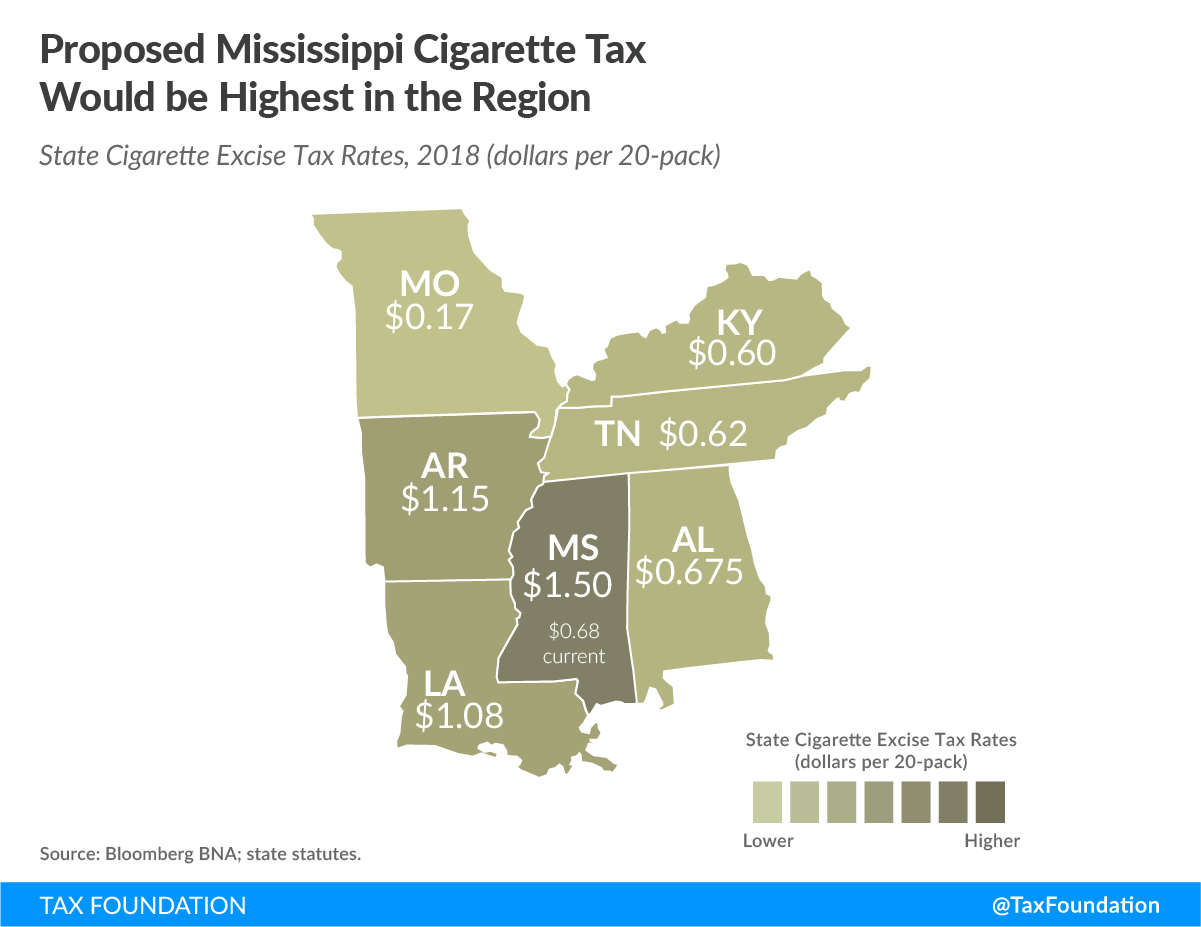

Cigarette taxes are one of the easiest taxes to raise. It is a tax on an unsympathetic, and shrinking, demographic.

And voters approve a tax increase in Mississippi, as they do in virtually every poll taken on the issue regardless of the state.

Yet, that doesn’t mean raising cigarette taxes to cover budget shortfalls is good public policy. Quite the opposite, excise taxes on cigarettes are one of the least stable parts of a state budget and will likely only leave lawmakers looking for other solutions in a few years.

As taxes on cigarettes are constantly being raised, we have a great deal of data on this subject. What we experience is an immediate bump in revenue, followed by a falloff in collection in future years. This happened the previous three times cigarette taxes have been raised in Mississippi; 1973, 1985, and 2009.

As you can see, the state noticed an immediate uptick followed by a decrease. Today, the state is collecting the same tax revenue (adjusted for inflation) on cigarettes as it was in 1975. This, despite the fact that taxes have increased by 518 percent during this time period.

A second thing happens when a state adopts the highest cigarette tax rates in their region: people look elsewhere for cigarettes. The proposed $1.50 increase (to $2.18) that some are pursuing would place Mississippi’s tax rate at least 90 percent higher than Arkansas and Louisiana and more than 200 percent above that in Tennessee and Alabama. And as a result, even less revenue is collected.

Cigarette usage has been declining since the 1960s and that trend is not slowing, even if Mississippi is above the national average. If the goal of health advocates is to see that number reach zero, it will happen because of continued education, not taxes.

Cigarette taxes are easy. But the comprehensive tax reform that Mississippi needs is far more complex. The state has one of the highest total tax rates as a percentage of personal income in the Southeast. While Mississippi’s local and state tax revenue rate is 10.57 percent, the four neighboring states range from 7.76 percent to 9.91 percent.

And unfortunately for Mississippi, Americans, and their wealth, are moving to low tax states. So what can we do in Mississippi? We can follow the lead of high-growth, low-tax states in the Southeast that have lower taxes, lighter licensure and regulatory burdens, and a smaller government.

Public school enrollment continues to decline in Mississippi, with 2018 being the seventh consecutive year that less students are enrolled than they were the year before.

According to the latest numbers from the Mississippi Department of Education, 470,668 students are enrolled in public schools. This includes both district and charter school students. If the 1,641 students in charters are removed, the number dips slightly to 469,027.

In 2012, total enrollment was 492,847. And there was no competition from charters at the time. This represents a drop of about 4.5 percent over the past seven years.

What is causing the decline?

The state population has declined over the previous couple years. But if we go back to 2012, the population compared to today is largely stagnant. And maybe even a little higher today depending on 2018 Census estimates. And Census data doesn’t show a major change in the ages of the population so we have roughly the same number of children ages 5-18 today that we had in 2012.

So, it is not due to outmigration. And we see that even when we look at specific districts. While Rankin county isn’t growing at the pace it was over the prior two decades, the county has grown about 4.5 percent since 2012. Yet, enrollment in the Rankin County School District has dropped slightly from 19,448 to 19,206 this year. This is a drop of a little over 1 percent. Not huge, but not the numbers you would expect in a growing suburb.

When you look at enrollment among younger students, the numbers though are more staggering. Kindergarten enrollment has gone from 1,569 in 2012 to 1,365 today, a drop of 10 percent. Enrollment in first grade has decreased from 1,611 in 2012 to 1,438 this year, a decrease of almost 11 percent.

What about areas of the state that are losing population? That certainly includes the city of Jackson. Jackson Public Schools have seen the greatest decline in terms of real numbers. And they are the district most impacted by parents having a choice in their child’s education through charter schools.

In 2012, 29,738 students were enrolled in JPS. Today, they are under 24,000 students. This represents a drop of 20 percent, far greater than the 5 percent decline among the city’s population during this time. And the decline is 32 percent among kingergartners. The Hinds County School District, though much smaller, saw a 10 percent drop in students from 6,267 in 2012 to 5,619 today.

Also in the Jackson metro area, both Clinton and Madison county posted enrollment gains over the past seven years. Clinton grew from 4,756 to 5,310, a 12 percent gain. Madison grew by 6 percent, from 12,507 to 13,302.

Winners and losers

Outside of the Jackson metro area, we saw enrollment trends largely mirror migration trends.

Desoto County long ago passed JPS as the largest school district in the state and it continues to grow though the pace has slowed some. Today, enrollment stands at 34,392, a 5 percent gain from 2012.

Harrison County, the fourth largest school district in the state, has grown by 7 percent, from 14,037 to 15,010. The Harrison County School District is one of five districts in the county. Biloxi and Gulfport also posted gains, of 17 and 8 percent respectively.

In Jackson County, the Jackson County School District dropped 3 percent, from 9,518 to 9,209. Similarly, the Pascagoula-Gautier School District experienced a 1 percent decline, from 6,902 to 6,866. However, Ocean Springs grew by 6 percent, from 5,590 to 5,936 students.

Lamar county became the sixth district in the state to pass 10,000 students this year. The district has grown by 13 percent over the past seven years, from 9,404 to 10,624. Also in the Pine Belt, Hattiesburg had a drop of 14 percent, falling from 4,608 students in 2012 to 3,953.

The school district which saw the greatest percentage decline, among the 30 largest districts in the state, was Greenville, which saw a 22 percent drop. The district dropped from 5,714 students to 4,480. Jackson and Columbus both lost 20 percent of their student enrollment, followed by Meridian’s 16 percent loss.

Certainly, some of the decline is due to outmigration. But there appears to be more to the story. The state does not track private school enrollment or the number of children who are homeschooled, but the number of children leaving district schools is greater than the number of children leaving the state.

School district enrollment change, 2012-2018

| School District | 2012 Enrollment | 2018 Enrollment | Change |

| Biloxi | 5,347 | 6,243 | 17% |

| Clinton | 4,756 | 5,310 | 12% |

| Columbus | 4,593 | 3,654 | -20% |

| Desoto County | 32,759 | 34,392 | 5% |

| Greenville | 5,714 | 4,480 | -22% |

| Gulfport | 6,013 | 6,487 | 8% |

| Hancock County | 4,436 | 4,416 | 0% |

| Harrison County | 14,037 | 15,010 | 7% |

| Hattiesburg | 4,608 | 3,953 | -14% |

| Hinds County | 6,267 | 5,619 | -10% |

| Jackson County | 9,518 | 9,209 | -3% |

| Jackson | 29,738 | 23,935 | -20% |

| Jones County | 8,534 | 8,701 | 2% |

| Lamar County | 9,404 | 10,624 | 13% |

| Lauderdale County | 6,778 | 6,283 | -7% |

| Lee County | 7,177 | 6,902 | -4% |

| Lowndes County | 5,071 | 5,452 | 8% |

| Madison County | 12,507 | 13,302 | 6% |

| Meridian | 6,209 | 5,232 | -16% |

| Ocean Springs | 5,590 | 5,936 | 6% |

| Oxford | 3,944 | 4,323 | 10% |

| Pascagoula | 6,902 | 6,866 | -1% |

| Pearl | 3,954 | 4,257 | 8% |

| Rankin County | 19,448 | 19,206 | -1% |

| South Panola | 4,602 | 4,324 | -6% |

| Tupelo | 7,523 | 6,994 | -7% |

| Vicksburg | 8,714 | 7,775 | -11% |

The United Campus Workers union has officially chartered a chapter on the campus at Ole Miss.

In a story reported by The Daily Mississippian and covered by Y’all Politics, this will be the local chapter of UCW. UCW is under the larger Communications Workers of American umbrella. UCW claims 1,800 members across 16 campuses in the state of Tennessee, where the union originated. It is also organized in Georgia, and this is its first entrance into Mississippi.

But this isn’t a traditional union in the sense that the union and management negotiate pay, benefits, hours, etc. There wasn’t a majority vote by a specified bargaining unit for this union to represent employees.

In addition to being a right-to-work state, public employees have no collective bargaining rights in the state of Mississippi. State employees are simply free to join voluntary unions and this is similar. UCW appears to be more of an association of like-minded faculty and staff.

In Tennessee, UCW’s work has largely been centered on social and economic justice issues, which includes lobbying the legislature for pay raises or expanded health insurance while fighting privatization of campus services and pension reform. Essentially, it is a left-of-center, grassroots organization.

Finding liberal professors at Ole Miss to join UCW shouldn’t be that difficult.

Two of the early proponents and members of the union are Jessica Wilkerson, assistant professor of Southern Studies and history, and James Thomas, assistant professor of sociology and anthropology.

Wilkerson was recently a guest speaker at a Students Against Social Injustice rally where protestors demanded the university remove the Confederate statue on campus and implement speech codes for students.

Thomas, as many will recall, recently received national attention when he tweeted that protestors should harass Republicans in public, including the time-worn traditions of sticking fingers in salads and redistributing appetizers.

UCW reports it has more than 50 members registered at Ole Miss.

Delta State University no longer has policies in place that stifle campus free speech.

Recently, Mississippi Center for Public Policy, National Review, and College Fix raised questions about DSU’s student regulations that read, “words, behavior, and/or actions which inflict mental or emotional distress on others and/or disrupt the educational environment at Delta State University” could possibly “subject violators to appropriate disciplinary action, including suspension and expulsion.”

As a result of this policy, the university received a speech code rating of red from the Foundation for Individual Rights in Education.

According to Rick Munroe, Vice President for University Advancement and External Relations at DSU, the university rescinded the policy in February 2017. However, the old policy inadvertently remained on the website. But the recent attention prompted the university to update the website with the new policy.

The new policy, which largely follows state and national laws, now lists offenses against persons as, “physical abuse, verbal abuse, threats, intimidation, harassment, sexual contact without permission, coercion and other conduct which threatens or endangers the health or safety of any person.”

Gone is the far more troubling, and open for interpretation, mental or emotional distress language. This could have been interpreted as a violation of a students’ rights to free speech or as a “speech code.”

This is the direction in which all universities should be moving. Free speech and intellectual debate should be encouraged on college campuses. Diverse opinions should not just be tolerated, they should be welcomed and encouraged. Students must have the right to express themselves freely, no matter how popular or unpopular such expressions may be.

Let’s hope other colleges and universities follow Delta State’s lead. And make it explicitly clear that college campuses are the last place on earth that should stifle free speech.

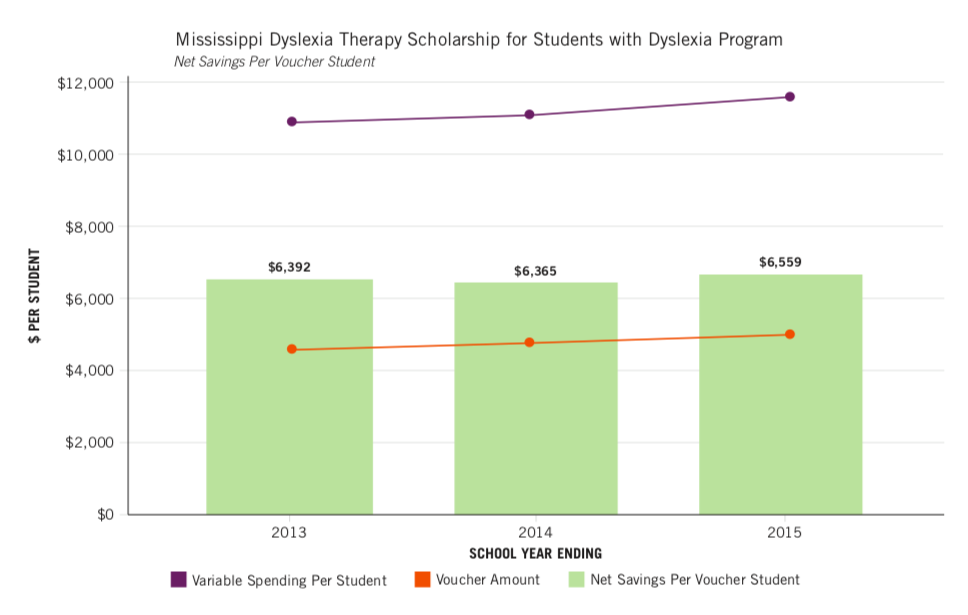

Mississippi’s Dyslexia Scholarship program provides hope to families whose children are not receiving the support they need in their assigned, district schools. And at the same time, it saves taxpayer dollars.

During the first three years of the program, from 2013 through 2015, it saved taxpayers $1.4 million, or about $6,500 for every child that received the scholarship. This is according to a new study from EdChoice. In 2013, the savings totaled $204,536, in 2014, the savings increased to $458,296, and in 2015, the savings were up to $780,497.

In 2012, the Dyslexia Scholarship became Mississippi’s first private school choice program, providing a scholarship to students with dyslexia equal to the base student costs of educating a child in Mississippi. For the first three years, that ranged from $4,400 to $4,700.

Source: EdChoice

This program is wildly popular among participants, growing from 32 in 2013 to 237 today. Still, there are major limitations to the program that have prevented it from reaching all that it was designed for. To participate, a private school must be accredited by the state. Therefore, the numerous private schools that provide dyslexia therapy services, but are instead accredited by other associations, are not allowed to participate.

On numerous occasions, parts of families have been uprooted so their children could attend a school like the 3-D School in Petal while another member of the family stays home to work.

Two years ago, the legislature debated, and the Senate passed, a bill that would have expanded the program to all accredited private schools who meet the dyslexia therapy qualifications. But the House chose to go with a much narrower expansion, and many families still remain in the dark when it comes to receiving the services their children need.

Today, abortions are occurring less often in America than they have at any time since the Supreme Court legalized abortion in all 50 states in 1973.

Laws on legal abortion vary from state to state, with Mississippi setting the limit to abortion at 20 weeks gestation. The state’s ban on abortions after 15 weeks has come to a pause as it fights its battle in the courts.

Despite the temporary setback, recent Center for Disease Control reports on abortion rates have brought good news to those on the pro-life side of this issue.

The CDC’s 2015 report indicates a downward trend in abortions since their climax in the 1980s. In 2015, the United States experienced 638,169 abortions. This is a two percent drop from 2014 data. In Mississippi, abortion percentages reflect this trend.

Hinds County, home to the only abortion clinic in the state, ranked first in abortion rates. But, it saw a drop from 23.2 percent to 20.7 percent of pregnancies ending in abortion. Still, one in seven pregnancies ending in abortion in Hinds, Rankin, and Madison counties is nothing to celebrate.

However, it is worth investigating what is causing this downward trend—especially if we want it to continue. One correlation is the rising number of pregnancy centers.

Charlotte Lozier Institute’s 2018 Pregnancy Center Report showed that an estimated two million people received free services at pregnancy centers this year. These pregnancy centers operate as private nonprofits and ministries with an estimated 67,400 volunteers including 7,500 licensed medical professionals. And they have saved American taxpayers an estimated $161 million.

Nationally, the National Institute of Family and Life Advocates had a huge 2018 Supreme Court victory that saved the longevity of these centers from state legislatures who would rather see them shut down. In Mississippi, we can claim over 40 pregnancy centers and clinics. The largest pregnancy medical clinic in the state is The Center for Pregnancy Choices-Metro Area, with two locations in Jackson. These pregnancy centers offer pregnancy tests, sonograms, supplies, referrals for adoption and medical needs, counseling, and parenting classes as some of their services.

The pro-abortion lobby frequently targets pregnancy centers that save taxpayers millions and offer compassionate, free services to women facing unplanned pregnancies. “Fake Clinic” is the branded name given to pregnancy centers by the pro-abortion community. In our state’s capitol, “Fake Clinic” signs and fliers have littered our streets with the hope of swaying women against attending their appointments with The CPC. Instead, patient numbers have increased at metro area clinics. And ninety-four percent of patients leave reporting full satisfaction from their visit. Not one patient has reported a poor experience on exiting surveys.

One wonders if a government agency ever received such phenomenal reviews.

The numbers speak volumes. The free market is handling the subject of unplanned pregnancies far better than any government agency. The private donors, volunteers, and pregnancy center employees of Mississippi are driving solutions to end abortion in our state.

Anja Baker is a Contributing Fellow for Mississippi Center for Public Policy.