This is an excerpt from Governing By Principle, MCPP’s ten principles to guide public policy.

- A more than 10 percent decline in our prison population.

- A renewed focus on violent offenders, who now occupy 63 percent of prison beds, as opposed to 56 percent previously.

- A 5 percent decline in the property crime rate, along with a historically low violent crime rate.

|

|

|

|

|

When government tries to keep people from failing, it actually can encourage people to take risks they are not equipped to handle. A government safety net changes the way industries behave, just as it changes the way individuals behave. If government is likely to bail them out, there is less need for responsible, efficient operations, or decisions based on market demand.

Government-designed advantages, such as subsidies or tax preferences for one or a few businesses, is sometimes known as “corporate welfare,” and it can have just as detrimental an impact on the free market as government regulation. Some companies or individuals, or perhaps a particular industry might benefit, but competition is hindered, and the taxpayers are left footing the bill. History has shown that government usually does not do well in predicting successful ventures. More importantly, it should not use taxpayers’ money to speculate on business ventures.

It might be appropriate to provide roads, water and sewer systems, and other infrastructure for a project that shows promise, as measured (among other things) by the private capital which has been invested or committed to it.

But money should not be taken from taxpayers and given to a private company to subsidize its business. To do so forces a taxpayer to invest in a company involuntarily, which violates the foundation of a free market - a voluntary exchange. It also distorts the market, because economic investment is based on the power of government, not on the demand of the market. Competitors cannot compete fairly with government-subsidized companies.

The power of eminent domain should not be used by the government to take property from one individual or company and give it to another private entity. To do so violates the right to sell private property without coercion. This particular use of eminent domain has the effect of making government the ultimate owner of all property, as it can take a person's land simply because those in power want someone else to have it.

Abraham Lincoln said, “You cannot strengthen the weak by weakening the strong. You cannot help the wage earner by pulling down the wage payer…You cannot build character and courage by taking away man’s initiative and independence.”

Simply put, markets work better than mandates and corporate welfare. Government officials who realize the need to let the free market work will govern with humility and restraint.

This is an excerpt from Governing By Principle, MCPP's ten principles to guide public policy.

Individual initiative is an infinitely more powerful economic force than government action. Wealth is generated when individuals risk their own resources in hopes of meeting a need in the lives of other people or businesses, and do so in a manner that earns them a profit. That need might be a hammer or food, or it could be capital needed by a business to start or expand its operations.

The government doesn’t have anything to give that it didn’t take from someone else. In other words, government cannot create wealth; it can only take wealth from people and redistribute it to others. This redistribution of wealth might be to an individual through a welfare-type program, or to a business with which the government has a contract, or to government employees. That’s not to say people can’t get wealthy from government programs, but it is not new wealth; it is wealth that was generated by someone else, and the government took it from them. This is not a negativestatement, implying that it is never appropriate for government to tax the people; it is simply a statement of fact. How much wealth the government should take and how it uses that wealth are subject to debate, but the simple fact is that government does not create wealth.

In some ways, it is understandable that people would think first how the government would be a good source for building wealth in a community or state. It’s easier to grasp the concept of expanding a government service or agency than it is to comprehend how the private sector could piece together a cohesive economy. And yet, it’s that wonderful mystery of private sector initiative that has made ours the most productive and resilient economy the world has ever known!

With few exceptions, the areas of our state and country where government has spent trillions (yes, with a T) to “help” the poor by transferring wealth to them from other people, are still mired in poverty. For the good those programs might do in helping with short-term needs, they have helped create a pattern of generational poverty, where creativity is stifled and hopelessness prevails.

Instead of transferring wealth, government’s role in the economy should be to protect the freedom of individuals to generate wealth for themselves.

Numerous examples throughout history can be cited of nations that attempted to force equality of wealth through government efforts. The former Soviet Union is one of the most notable, a nation with vast resources, an enormous population, yet a failed economy because it was directed by the government. Current-day Russia has experienced economic problems, not because it moved to a supposedly “free” market system, but primarily because it did not provide the property rights protections necessary for a truly free market. This kept the power in the hands of officials with strong connections to the government, allowing them to take advantage of the people just as they had under Communist rule. (Related to that, the Russian people were not sufficiently informed how a free market system is supposed to work and how they could apply their new-found freedom.)

In contrast, the former Soviet bloc nations that have been most successful economically since the fall of the Soviet Union are those that have provided a dependable system of justice, a low (usually flat) tax on its citizens, and a limited regulatory system. This allows entrepreneurs to know the rules of the game and explore their opportunities with relative certainty that their rights will be

protected, and that they will have few unnecessary burdens placed on them by the government.

Financially speaking, free people are not equal, and equal people are not free. If 100 people were made equally wealthy today, they would no longer be equal by tomorrow. Some would spend, some would give, and some would save, making their wealth “unequal” once again.

The greatness of the free-enterprise system is found in the equality of opportunity, not equality of outcome. Why should anyone strive for excellence when there is no incentive to produce a better product or offer a better service? Economic opportunity—the chance to make a profit and build wealth—encourages innovation and competition. This, in turn, benefits the whole economy, not just the entrepreneur, because it results in improved products and services. As one entrepreneur gains success, others might be drawn to compete, resulting in even better products and services, or equal quality at a lower price. In the end, consumers benefit from a healthy, competitive free-market system—where true wealth is created.

Government officials who understand that government cannot create wealth but can clear the way entrepreneurs to do so will govern with humility and restraint.

|

|

Transportation Network Companies (TNCs), like Uber and Lyft, entered the mainstream transportation services market in 2012 and 2013.

TNCs use smartphones to connect passengers with drivers and manage the exchange, reducing the transaction cost in multiple ways, thereby vastly expanding the potential market for transportation services. The emergence of TNCs motivated taxi special interest groups around the United States to try to use local governmental authority to protect their industry from this new competition. In response, Uber and Lyft lobbied state legislators to preempt local regulation of TNCs.

Mississippi enacted HB 1381 into law in 2016, creating a statewide regulatory standard for TNCs and preempting municipalities from enacting their own taxes, licenses, and regulations on TNC operations. This overruled Jackson, Mississippi, which had just passed an ordinance licensing and regulating TNCs, and other cities which had disallowed operations.

Taxi regulations are commonly enacted at the municipal level and are quite literally the textbook definition of how anticompetitive regulations harm customers. They are a perfect example of local policy historically creating barriers to entry (through limits on taxicab licenses), price controls (through maximum and minimum legal fares), and mandated business practices (requiring specific costly equipment and service standards). Because the transportation service industry is rife with regulatory capture that violates generality and free exchange, starting from a blank slate is the only way that policymakers can hope to enact appropriate reform.

The largest problem facing transportation service markets is the anonymity between the driver and passenger. This anonymity in the past has created a public safety problem due to drivers extorting higher fares from passengers or else using the seclusion of a taxi ride to assault them. Similarly, though less emphasized, drivers are at the mercy of criminally-minded passengers, with the result that taxi drivers face the highest on-the-job murder rate for any profession in the U.S.

Laws created in the interest of public safety are an appropriate function of local government. However, many times special interest groups use the guise of public safety to argue for regulations that protect them from competition. For example, although mandating that taxicabs have bulletproof partitions between the driver and passenger would protect the driver from thieves, they are a costly piece of equipment that can create a barrier to entry for entrepreneurs. Furthermore, many other taxi regulations have explicitly limited entry by new drivers or companies, as well as creating price controls and business practice mandates that have nothing to do with public safety. In short, there are many clear violations of the principles of generality and free exchange.

Because most taxi regulations violate generality and free exchange, there is good reason to believe that municipal-level TNC regulations would have the same effect. Thus, Mississippi appears to have acted correctly in preempting local regulation of TNCs. In fact, the argument could be made that Mississippi did not go far enough and should have preempted local regulation of taxis and limousines as well, following Michigan’s example.

This is an excerpt from Local Governments Run Amok? A Guide for State Officials Considering Local Preemption by Michael D. Farren and Adam A. Milsap. It was published in Promoting Prosperity in Mississippi.

Victory for charter schools in Mississippi

Mississippi Justice Institute and other defendants protect constitutionality of charter schools according to trial court

(JACKSON) – Hinds County Chancery Judge Dewayne Thomas ruled today in the lawsuit challenging the constitutionality of charters schools in Mississippi. Judge Thomas ruled in favor of the charter schools and their parents, and against the Southern Poverty Law Center.

Mississippi Justice Institute (MJI) Director Shadrack White, who represents the parents of charter school students, said, “This is a critical victory for the parents and their children who attend charter schools in Mississippi. Judge Thomas saw that the constitution does not trap my clients in their traditional public schools when public charter schools provide a better option. These parents know what’s best for their children.”

The charter lawsuit turned on whether the Mississippi Constitution allowed funding from state and local governments to be spent at charter schools. “Our case was simple,” said White. “My clients pay taxes, so they should have the right to take that money to a public charter school if that is a better option for their children. These schools are making their lives better. The plaintiffs in this case, however, had an extreme argument: that the funding for charter schools, agricultural schools, some alternative schools, and other types of non-traditional public schools should be barred.”

“As this case marches forward, I am going to continue thinking about all the good that charter schools have done for my clients, like Gladys Overton and her daughter Drew,” said White. “When we started this case, Gladys told us that, in her old school, Drew experienced nonstop bullying and a difficult classroom environment. Drew moved to ReImagine Prep, a charter school in Jackson, and today she is thriving. She was the most improved student in her class last year and, like every other student at ReImagine, is learning computer coding skills to prepare her for the workforce.”

“Students like Drew are who we fight for,” added White.

####

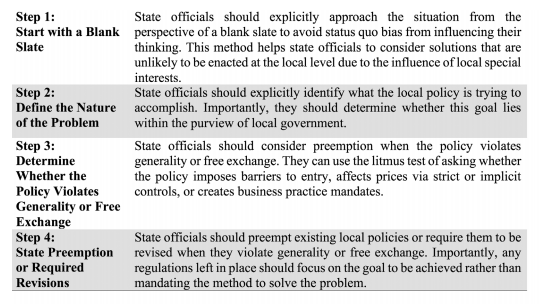

In order to maximize economic growth, and the higher quality of life that comes with it, state policymakers should consider preempting local policy in situations where it violates generality or free exchange. The framework discussed below can help guide officials’ decisions on whether to preempt.

The first step is to start with a blank slate. State officials should explicitly approach the situation from the perspective of a blank slate to avoid status quo bias from influencing their thinking. This is important because the economy and society are constantly changing due to new entrepreneurial discoveries or shifting social preferences. Regulations are often an implicit attempt on the behalf of special interest groups to freeze the current state of the world in place, intrinsically limiting the potential for economic growth. Starting from a blank slate makes it more likely that state officials will consider solutions that are unlikely to be enacted at the local level due to the influence of local special interests.

The second step is to define the nature of the problem. State officials should explicitly identify what the local policy is trying to accomplish. Importantly, they should determine whether this goal lies within the purview of local government. If it does not, then there may be reason for the state to preempt the policy. Alternately, the problem might be better addressed by entrepreneurs because social problems often create profit opportunities for those who can solve them. Lastly, in some cases ex post solutions via the courts are a more effective and less intrusive way of addressing a situation that might or might not cause future problems.

Step three is to determine whether the policy violates generality or free exchange. State officials can use the litmus test of asking whether the policy imposes barriers to entry, affects prices via strict or implicit controls, or creates business practice mandates. However, local policies can violate these principles in other ways than these three main avenues, so state officials should be alert to any policy which appears to go outside the guardrails of generality and free exchange.

The final step is to decide to preempt or require revisions. State officials should preempt existing local policies or require them to be revised when they violate generality or free exchange. In cases where policies would inherently violate generality or free exchange, as in the case of strict price controls, state officials should proactively preempt them. For example, Mississippi precluded municipalities from implementing rent control in 1985. State officials should also consider proactive preemption when there is good historical evidence that local policy tends to violate these principles. Taxi regulations are an example of this because their history is rife with examples of regulatory capture and subsequent anticompetitive regulations.

Importantly, any regulations at the local or state level should focus on the goal to be achieved rather than mandating the method to solve the problem. This allows for innovation in compliance and encourages entrepreneurs to find better and lower cost means of satisfying the regulation, leading to greater economic growth.

Framework to guide local preemption

This is an excerpt from Local Governments Run Amok? A Guide for State Officials Considering Local Preemption by Michael D. Farren and Adam A. Milsap. It was published in Promoting Prosperity in Mississippi.