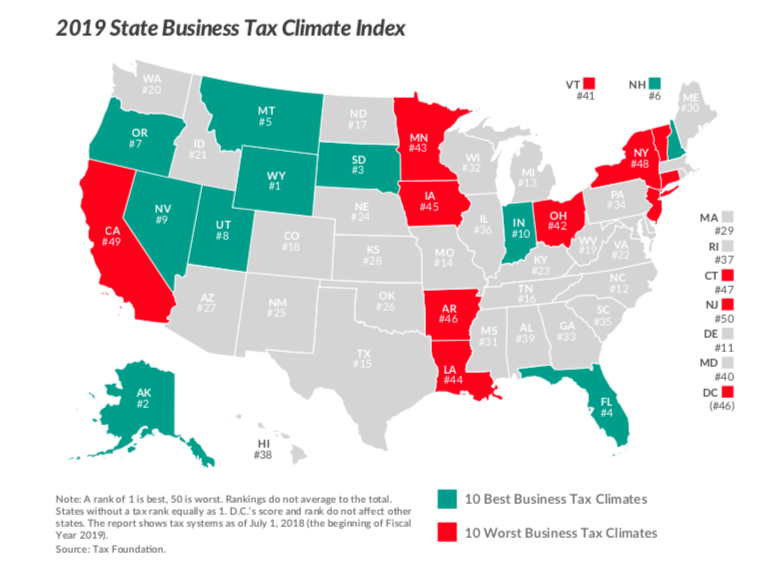

Mississippi’s business tax climate rating dropped slightly over the past year.

The Tax Foundation’s “State Business Tax Climate Index” grades each state on the burden of their corporate taxes, individual income taxes, sales taxes, property taxes, and unemployment insurance taxes. Fewer policy areas are as important as tax policy when it comes to economic growth.

The five highest rated states were Wyoming, Alaska, South Dakota, Florida, and Montana, while the five worst states in terms of business tax climate were New Jersey, California, New York, Connecticut, and Arkansas.

Mississippi’s ranking isn’t that much different from where it has been the past four years, ranging from a high of 29 (in 2016 and last year) to a low of 31 (this year). In 2017, the state ranked 30th. Still, Mississippi did drop slightly from the previous year.

This change, however, isn’t due to negative action taken by the state but simply because other states had passed Mississippi. One of those was Kentucky, the biggest gainer nationwide. They moved up 16 spots from 39th to 23rd after a series of tax reforms in the Bluegrass State.

Compared to our neighbors, Tennessee is doing the best by far. The income-tax-free state was rated 16th. Mississippi, however, bested our three other border states: Alabama (39), Louisiana (44), and Arkansas (46). That is good, but not anything to necessarily celebrate as it says more about their poor-performance.

Looking within the different tax categories, Mississippi did best with respect to unemployment insurance taxes (5) and corporate taxes (15). In fact, the corporate taxes topped all neighboring states, including Tennessee. However, Mississippi’s rankings for individual taxes (27), sales taxes (35), and property taxes (36) held the state back.

Generally speaking, the states with the best business tax climate are also the states that having a growing economy and a growing population.

A school district in Mississippi appears to have backtracked from comments that appeared in a recent article detailing the district’s new proposed policy for homeschool students.

According to the Delta Democrat Times, Greenville Public School District Deputy Superintendent Glenn Dedeaux said the district is “legally responsible to ensure every child of educating age receives an adequate education” and he warned that not all homeschool curricula “are approved by the Mississippi Department of Education to meet the necessary standards.”

Dedeaux also implied that homeschoolers must take subject matter tests to graduate.

Regardless of what you may or may not think about homeschooling, these comments run counter to Mississippi law. Indeed, Mississippi has one of the most parent-friendly homeschool laws in the country.

Mississippi code specifically says:

[I]t is not the intention of this section to impair the primary right and the obligation of the parent . . . to choose the proper education and training” for their child, “and nothing in this section shall ever be construed to grant, by implication or otherwise, to the State of Mississippi . . . any right or authority to control, manage, supervise or make any suggestion as to the control, management or supervision” of the private education of children. Further, “this section shall never be construed so as to grant, by implication or otherwise, any right or authority to any state agency or other entity to control, manage, supervise, provide for or affect the operation, management, program, curriculum, admissions policy or discipline of any such school or home instruction program.

To homeschool in Mississippi, a family must file a certificate of enrollment with the school attendance officer where the family resides. They must do this by September 15. Beyond that, parents have the freedom to make their own education decisions for their children.

While there is not official data on the number of homeschoolers in Mississippi, estimates put it at around 17,000 students statewide. If homeschoolers were a single district, they would be the fourth largest district in the state.

Dan Beasley, an attorney with the Home School Legal Defense Association, reached out to Dedeaux. Dedeaux said he was misquoted in the original article. And, to his credit, he understands he has no authority over which program a homeschool family selects.

Mississippi families who choose to homeschool their children should not be susceptible to illegal attempts by school districts to regulate their education.

A government boycott of a company for an exercise of free speech would be a flagrant violation of the First Amendment.

Chick-fil-A has been heavily criticized for its reputation as a supporter of traditional marriage. The company’s CEO has made public comments in support of traditional marriage, and the company has donated money to organizations that opposed same-sex marriage before the Supreme Court ruled on the issue.

While it is Chick-Fil-A’s constitutional right to engage in free speech, liberal government officials around the country could not stand it. When Chick-Fil-A attempted to re-open a franchise at the Denver International Airport, the city council saw its opportunity for retribution.

Councilman Paul Lopez called his opposition to allowing the chain at the airport “really, truly a moral issue on the city.” “We can do better than this brand in Denver at our airport, in my estimation,” another member Jolon Clark said.

The problem was that Chick-Fil-A’s speech was protected by the First Amendment, which meant the government could not punish the company in retaliation for its speech. The Denver officials had made it abundantly clear that their opposition to allowing Chick-Fil-A into the airport was due to their personal objection to Chick-Fil-A’s speech. Because of this, the city was ultimately forced to allow the chain into the airport.

You don’t have to be a constitutional scholar to understand that this exclusion would have been a violation of the First Amendment. It doesn’t even pass the smell test. If something like this happened in Mississippi, many citizens would be outraged. Rightfully so.

But this is happening in Mississippi right now, just not to Chick-Fil-A. Instead, Nike has drawn the ire of the Mississippi Department of Public Safety (MDPS) for its new ad campaign featuring former NFL quarterback Colin Kaepernick, who is widely known for sparking a protest movement in professional sports where players kneel during the national anthem.

The MDPS commissioner recently announced to the Associated Press that MDPS will no longer purchase training equipment from Nike.

Like the Denver officials, the MDPS commissioner made clear that his decision to initiate a government boycott was based on his personal objection to the speech made by Nike, saying: “As commissioner of the Department of Public Safety, I will not support vendors who do not support law enforcement and our military.”

The commissioner’s views are understandable and well-intentioned. He is a Navy veteran and a long serving law enforcement officer. He appears to feel strongly about this issue.

As a proud American myself, and as a fellow military veteran who lost a leg in Iraq, I would not personally choose the national anthem as a venue for protest as Kaepernick has, or to highlight this act as Nike has. However, I fought to protect their right to do just that without fear of government retribution, and I am always heartened to see citizens actually exercising that right.

Moreover, the Mississippi Center for Public Policy, of which the Mississippi Justice Institute is a division, has clearly communicated, on several occasions, its opposition to using the national anthem as a venue to protest at sporting events.

But this issue is not about the commissioner’s views or my views on Nike’s speech, or the identity politics which would elevate our views above those of others based on our status as veterans. It is about the Constitution that we have both sworn to protect.

A government boycott of Nike is simply unconstitutional.

Here is the tricky thing about the Constitution: it works both ways. If you stand by and watch its protections erode while your adversaries’ rights are under assault, you can’t be shocked when its protections are not there for you when the tables are turned. If you don’t want a government boycott of Tim Tebow’s kneeling, you can’t defend a government boycott of Colin Kaepernick’s kneeling.

A government boycott in retaliation for corporate speech also ignores Mississippi law establishing bidding requirements for most public purchases. We have those laws for a reason.

Lastly, conducting a government boycott is simply not the proper role of government. A public official boycotting vendors with certain views implies that taxpayer money is their money, to reward or punish whom they see fit based on their own personal beliefs. Many Mississippians may agree strongly with the vendor’s message, and other Mississippians may oppose it. The government should not use public funds to attempt to speak for all taxpaying Mississippians on matters of public discourse.

If a public official wants to personally boycott a company in response to its speech, they are free to do that and the First Amendment protects that right for them. But when acting in their official capacity using taxpayer money, neither the Constitution, nor Mississippi law, nor a healthy respect for the opinions of their fellow Mississippians allow for such personal indulgences.

The Mississippi Justice Institute has requested the commissioner to rescind his government boycott. We trust he will uphold our Constitution.

This column appeared in the Clarion Ledger on September 28, 2018.

In this edition of Freedom Minute, we talk about why a government boycott based upon a personal objection to speech made by a company is unconstitutional.

The Mississippi Justice Institute, the legal arm of the Mississippi Center for Public Policy, sent a letter today to the Mississippi Department of Public Safety concerning the Department’s proposed boycott of Nike.

MJI outlined that a government boycott based upon a personal objection to speech made by a company is unconstitutional. This is the case whether it is the government boycott of Chick-Fil-A in Denver or Nike in Mississippi.

“A government boycott of a company for an exercise of free speech would be a flagrant violation of the First Amendment,” Aaron Rice, Director of the Mississippi Justice Institute, said. “For example, in Bd. of Cty. Comm'rs, Wabaunsee Cty., Kan. v. Umbehr, 518 U.S. 668 (1996), the U.S. Supreme Court held that the First Amendment protects independent contractors from the termination of at-will government contracts in retaliation for their exercise of the freedom of speech. In a similar case, the Court in Rutan v. Republican Party of Illinois, 497 U.S. 62 (1990) held that politically based refusals to hire are just as unconstitutional as politically based dismissals of employees. What is clear from these cases is that the government cannot use taxpayer money to punish speech, either by canceling existing financial arrangements or by refusing to enter into future business relationships.”

In the past, MCPP has clearly communicated its view that using the national anthem as a venue for protest at sporting events is not appropriate and the NFL has clearly suffered from the consumer backlash. However, there is a difference between consumers exercising rights based on personally-held views and the government attempting to do it on behalf of all citizens.

“As a proud American, and as a fellow military veteran who lost a leg in Iraq, I would not personally choose the national anthem as a venue for protest as Colin Kaepernick has, or to highlight this act as Nike has,” Rice added. “However, I fought to protect their right to do just that without fear of government retribution, and I am always heartened to see citizens actually exercising that right - even when I may disagree with their viewpoint.

“MCPP and MJI are private organizations with the objective, among other things, of holding government accountable to its proper role as defined by the Constitution. To look the other way simply because we may disagree with the speech in question would be to fail in fulfilling this objective.”

Read the letter here: https://mspolicy.org/wp-content/uploads/2018/09/Open-Letter-to-MDPS-Commissioner-9.27.18.pdf

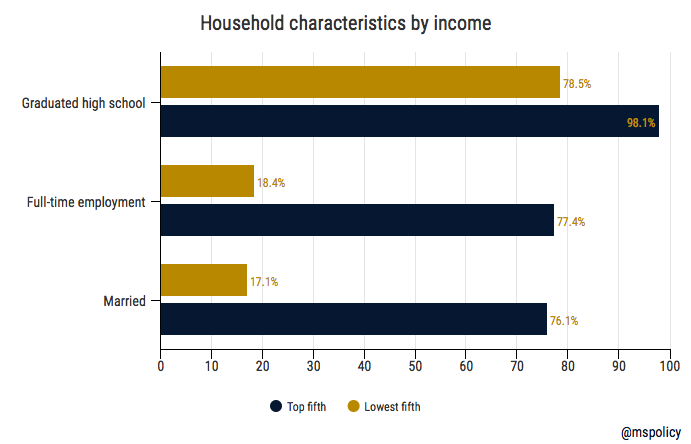

There is income inequality in America, but it is dictated by individual choices. Just three life choices can define if one will be trapped in a life of poverty or if they will be on a path to prosperity.

For years conservatives, and some liberals, have been advocating for what has been labeled the success sequence. On the surface it’s relatively simple, and there are some variations, but it generally looks like this: Graduate from high school, obtain employment, get married, and then have children only after you are married.

More people than ever are graduating from high school, though that may also be due to a decreasing of standards. Job prospects vary depending on the economy of the day, and where you live, but right now jobs are plentiful. But as we know, it is the second half of the equation – getting married and waiting until you are married to have children – that appears to be a little more difficult. And with dire results.

In the 1960s, as our country embarked on the Great Society and implemented social welfare programs in the name of combating poverty, out-of-wedlock births stood at less than 5 percent nationwide. That percentage had remained stagnant going back to the 1920s. But since the 1960s, it has spiked to over 40 percent.

In Mississippi, the latest numbers show 53.2 percent of children born in the state are to unwed mothers. Though that is slightly better than the 54 percent mark in 2014.

Why does this matter?

Well, here is what the data shows.

Of the lowest fifth earners in our country, those with an income range of up to $24,638:

- 21.5 percent did not receive a high school diploma.

- 18.4 percent of householders worked full-time. 68.5 percent did not work.

- 17.1 percent are married couple families compared to 82.9 percent who are either single-parent families or single.

Of the top fifth, those who earn more than $126,855:

- 1.9 percent did not receive a high school diploma.

- 77.4 percent of householders worked full-time.

- 76.1 percent are married couples compared to 23.9 percent who are either single-parent families or single.

Many things in life can dictate one’s income. Fortunately, when it comes to graduating high school, working, and getting married before children, each individual can control what path he or she takes.

Americans for Tax Reform today led a coalition of 58 conservative groups and activists, including the Mississippi Center for Public Policy, in support of the Tax Reform 2.0 legislation set to be voted on by the House of Representatives later this week.

This proposal is split into three pieces of legislation: H.R. 6760, the Protecting Family and Small Business Tax Cuts Act, H.R. 6757, the Family Savings Act, and H.R. 6756, the American Innovation Act.

Most importantly, Tax Reform 2.0 strengthens the gains made by the Tax Cuts and Jobs Act last year by making individual and small business tax cuts permanent. This tax reduction could not be made permanent when TCJA passed because of a combination of liberal obstructionism, arcane Senate rules, and an unwillingness to reduce out-of-control federal spending.

The legislation also updates retirement, education, and family savings accounts and promotes innovation and entrepreneurship for small businesses.

The full letter can be found here.

This press release is from the Americans for Tax Reform.

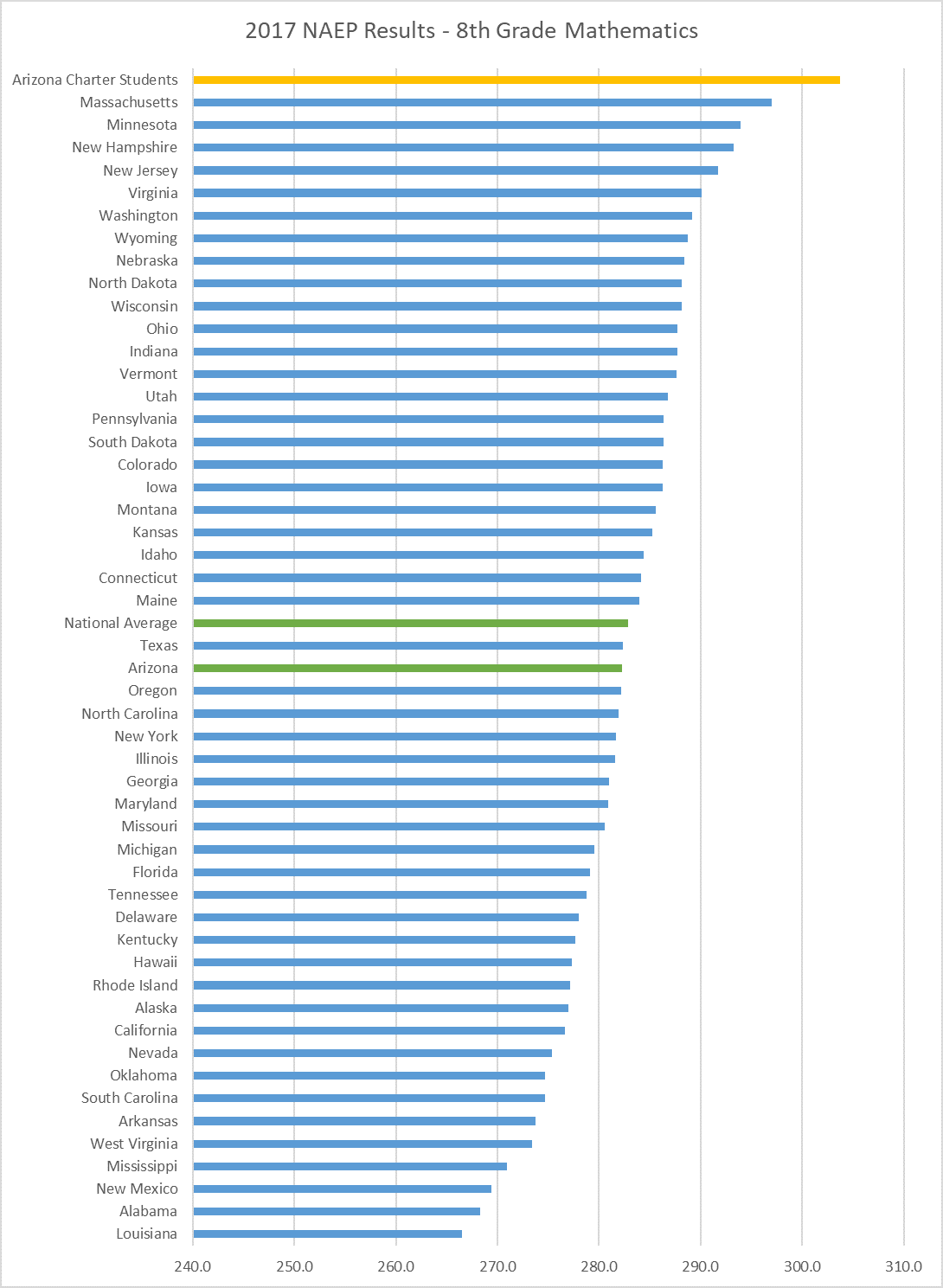

Dubbed the "wild west" of charter schooling by detractors, Arizona is showing that a model that provides parents with numerous choices, and bottom-up autonomy, works.

Two years ago, the National Association of Charter School Authorizers (NASCA) gave Mississippi the eighth highest score on their policy analysis of state charter laws. At the same time, Arizona came in at just 18th.

In the eyes of organizations like NASCA and others, states like Arizona do not have the necessary regulations in place concerning key issues like renewal standards, academic performance, or a default closure provision. And they don’t perform authorizer evaluations.

Mississippi took a different approach and developed a “model” charter law that was based on best practices from NASCA and similar organizations. But as we have seen, charters have been slow to open in Mississippi. Not because of lack of interest among operators or parents, but because of the process of authorizing charter schools in Mississippi.

This year, 16 different operators proposed opening a total of 17 schools across the state.The prior two years, 18 operators filed similar letters of intent to begin the charter school application process. Yet just five schools are currently opened for this school year, with one more coming in 2019.

Arizona, on the other hand, has approximately 600 schools serving north of 185,000 students. That accounts for about 20 percent of public school enrollment in the state. Deemed the “wild west” by detractors, over the past five years some 200 schools have opened with about 100 closing. Those numbers aren’t because of a law, either for better or for worse. But because parents in Arizona now recognize that they are empowered to choose the right school for their child.

Administrative attempts to shut down a public school, regardless of how poor it is doing on test scores or other measures we commonly look at, is not an easy task. You are usually met with a fierce opposition of loyal parents and potentially lawsuits as well. For the most part, Arizona parents have moved beyond that.

Arizona parents don't wait for a school to get better

They move on. It is parents who are now closing poor performing schools, not the government. Of those schools that closed, they were open on average just four years (even with a 15 year reauthorization window) and had only 62 students their final year. Without government intervention, parents were able to determine what wasn’t working.

We shy away from using words like “market” when it comes to education, but that is exactly what is happening. After all, parents have the ability to make a choice.

So it’s a different model, but how is it working? After all, our focus should be outcomes and not intention.

A review of the most recent NAEP scores among Arizona’s charter students helps to answer that question.

- 8th grade math was ranked first in the nation (the state rank was 25th)

- 8th grade reading ranked second in the nation, behind just Massachusetts (the state rank was 35th)

- 4th grade math was ranked 16th in the nation (the state was ranked 41st)

- 4th grade reading was ranked 16th in the nation (the state was ranked 42nd)

Beyond the overall numbers, perhaps more newsworthy, Arizona charter schools have also boosted the largest gains in the country over the past eight years among all four tests. No state showed more progress in terms of points gain between 2009 and 2017 (when Arizona charter schools are compared to the 50 individual states).

- 8th grade math had a +30 change in scale score

- 8th grade reading had a +20 change in scale score

- 4th grade math had a +11 change in scale score

- 4th grade reading had a +11 change in scale score

A couple other important points to make. While Arizona’s 8th grade students are competing with a traditional top-performing state like Massachusetts, the similarities stop there. Arizona is educating a high-minority population while Massachusetts (and similar states) are largely white. At the same time, Arizona spends about half of what Massachusetts spends per student.

Today, 84 percent of zip codes in Arizona have a charter school, the highest percentage in the country. Mississippi’s new to the charter game so it’s not a fair comparison. But that number is a rounding error in the state.

By making options available in large numbers, also known as supply, and giving power to choose to parents, also known as demand, we see a successful bottom-up accountability system.

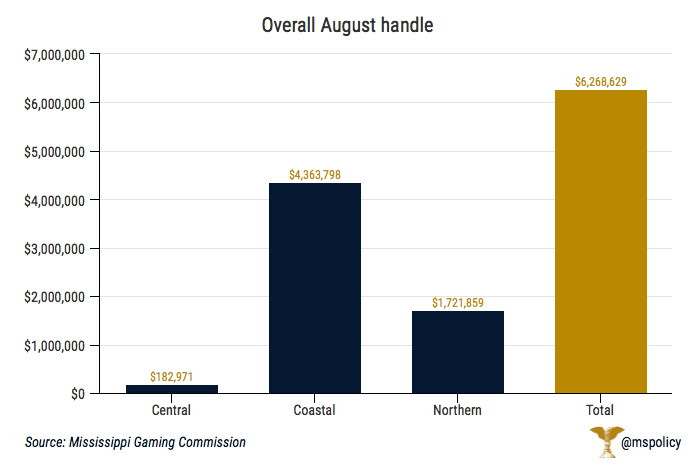

Revenue from the first month of sports betting in Mississippi indicates a positive start for the Magnolia State.

In 2017, the legislature paved the way for sports betting should the Supreme Court overturn the restrictions on such activities, which they did this year. That allowed Mississippi to be one of the first states outside of Nevada to offer sports betting.

Through the month of August, an otherwise quiet month of the year before football season begins, casinos took in nearly $6.3 million in sports betting. This translates to more than $644,000 in revenue for casinos and $77,000 in taxes for the state.

Two other important points show greater promise.

First, just 11 of the state’s 28 casinos participated in the opening month of sports betting, with many opening in the middle or end of the month.

Additionally, Mississippi casinos took in nearly $3.5 million in just the first three days of September, more than half of the handle from August. The difference? The start of college football and the NFL.

Most expect these numbers to only climb in the weeks ahead.