This column appeared in The Daily Signal on August 31, 2018.

During the recently concluded special session, lawmakers passed a $1 billion infrastructure bill, created a lottery, and distributed BP settlement money throughout the state.

House Speaker Pro Temp Greg Snowden (R-Meridian) and Sen. Hob Bryan (D-Amory) offered their take on the five-day session at Monday’s Stennis-Capitol Press Luncheon in Jackson.

“I believe this is five of the most productive days I’ve experienced,” Snowden said.

Snowden reviewed the three bills at length, calling House Bill 1, the infrastructure bill, essentially a House bill. It will divert money from new bonds, internet sales tax revenue from the 7 percent online sales tax, a new annual tax ($75 to $150 annually) on hybrid and electric vehicles, and sports betting revenue.

Snowden brought up the fact that two United States Supreme Court rulings paved the way for the internet sales tax and sports betting revenue, arguing it was not something they could have done during the regular session.

“We passed three major pieces of legislation,” Snowden added. “You might disagree with them but you can’t say we didn’t get it done. Everyone knew it had to happen, just didn’t know how. And this was a bicameral success. Both bodies worked together for the good of the state. It will be transformative for one or two generations.”

And Snowden noted the bipartisan support.

“Even the lottery wasn’t partisan,” Snowden said.

Bryan had a slightly less optimistic perspective

“Every bad idea imaginable all squared into one session,” is how Bryan began his time at the podium. “The lottery will always be a bad idea. It is not right for the government to run a numbers racket. It preys on the poor, especially poor who are most susceptible.”

Bryan then raised the point of their being little meaningful discussion or debate on the lottery. Under the lottery bill that passed, a five-member board appointed by the governor will oversee a private corporation to run the lottery. The initial bill removed the lottery board from state public records and open meetings laws. The House added open meetings provisions after passing the Senate, but Bryan still didn’t like the idea of a private entity running the lottery. He went so far as to raise the potential for conflicts of interest between the lottery board and private corporations.

“There was so much going on but never time to focus on this huge entity that will have lots of money outside of government controls,” Bryan said. “Some of us tried to slow things down but we were unable.”

Snowden, who voted against the lottery each time it was before the House, said he opposes the lottery because it doesn’t make “good economic sense.” But he added it was better for a private corporation to be running it than the state.

And he noted, “I think it’s fair to say Mississippians wanted a lottery.”

Bryan also mentioned that the infrastructure funding is essentially diverting money from the general fund to cover the new transportation funds.

“This is not an improvement for our state,” Bryan said. “The notion that we’ve done anything to help road maintenance just ain’t so.” He added that this was a short-term solution, noting loss of revenue from multiple tax cuts and government incentives for private companies are taking money from the general fund.

Snowden defended the health of the economy and the budget.

“The health of the economy is not the same thing as revenue in state coffers,” Snowded added. “You don’t judge the health of the economy by how your general fund is doing. We’ve been responsible fiscally and will continue to be.”

Calling for a more limited government is not just a conservative talking point, it is a principle that encourages freedom and prosperity. And it’s backed up by scientific data.

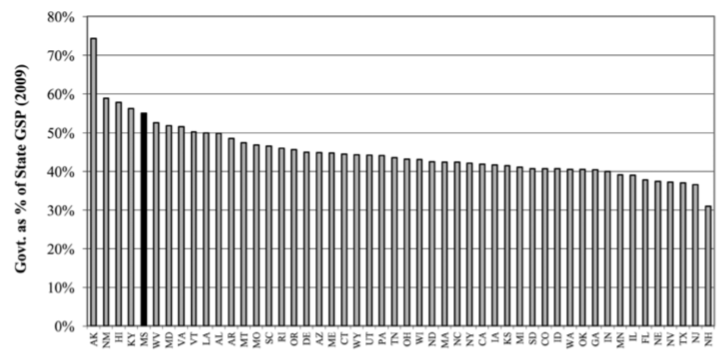

There are eight states where government controls more than half of the economy. Mississippi is one of them.

According to the Fraser Institute, government spending- federal, state, and local- accounts for 55 percent of the economy in Mississippi (as outlined in Promoting Prosperity in Mississippi). This leaves less than half of the state’s economic resources for the private sector. New Hampshire is the freest state, with just 31 percent of the economy controlled by the government. Live Free or Die indeed.

This ranking gave Mississippi the fifth largest government, behind Alaska, New Mexico, Hawaii, and Kentucky. Looking at our neighbors, government controlled between 47-50 percent of the economies in Alabama, Arkansas, and Louisiana. It is 43 percent in Tennessee.

For those that might blame federal spending, if we look at just state and local spending, Mississippi would actually move up to the fourth highest share of government control. So the federal government isn’t to blame.

Government is growing in Mississippi

Interestingly, it has not always been this way. Throughout the 1990s, government control of the economy in Mississippi ranged from about 40-45 percent.

It sat at around 45 percent at the turn of the century. And has been trending in the wrong direction since that time.

Does this matter?

Mississippi has an outsized government. It is larger than our peers. But do we need it? After all, Mississippi is a poor state and largely rural.

Regardless of the size of the state, it is problematic when resources must be dedicated to political favor seeking and lobbying rather than private sector activities. The shift is from entrepreneurship and toward lobbying. That may benefit an individual or a single company, but it does not benefit the economy.

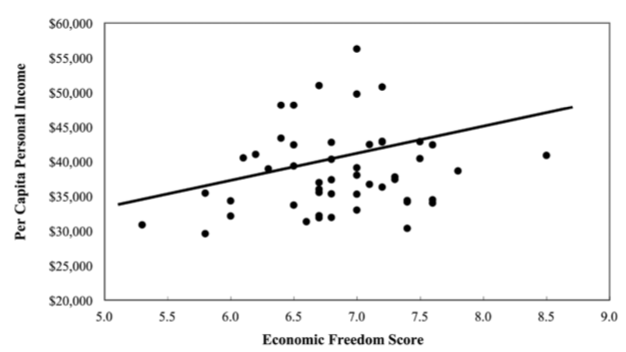

And we have data to show the correlation between economic freedom, which includes personal choice, voluntary exchange, free enterprise, and property rights, and prosperity.

When looking at the Economic Freedom of North America index and per capita income, we see a direct and clear trend. The freer the state, the greater the income.

Those who live in states with the highest per capita income live in the freest states. The poorest states rely on the government. It is not by accident.

People vote with their feet

Beyond the data and freedom indexes from the likes of Fraser, Cato, or Heritage, can you make the argument that people like the high regulation, union friendly status of states like California or New York? After all, Manhattan and San Francisco (minus the used needles and feces on the streets) are highly desirable places to live. And as a result, their cost-of-living is among the highest in the country.

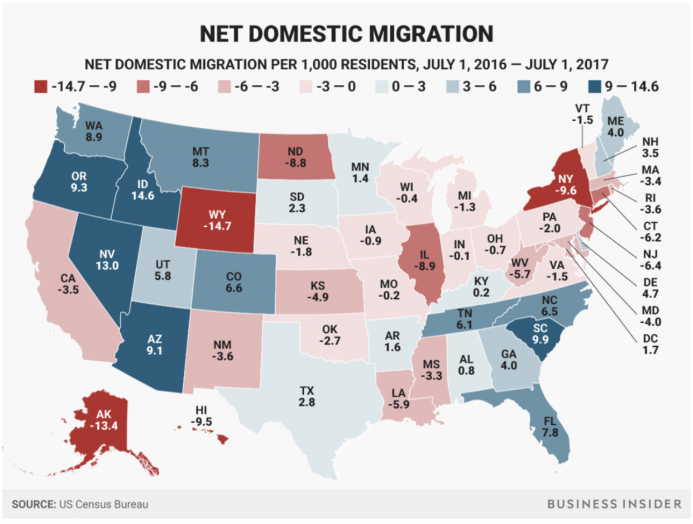

And while those locations might be desirable, net migration tells a different story. We can throw out the data, the policy wonks, and the studies and we still have this graphic.

We are free to live where we’d like in this country. And people are moving to the states that do well on the various measures of economic freedom. As a result, they are moving out of states that do not.

Do people intentionally look at these reports and determine that is where they are going to live? No, probably not. Rather, they are moving to the states with opportunity, with growth, and where the cost-of-living is reasonable. (Hint: states with less burdensome regulations.)

Here is the net migration between 2016 and 2017 among the five freest and five least free states, according to the Economic Freedom of North America index.

| State | Freedom Index Ranking | Net Migration |

| New Hampshire | 1 | 3.5 |

| Texas | 2 | 2.8 |

| Florida | 3 | 7.8 |

| South Dakota | 4 | 2.3 |

| Tennessee | 5 | 6.1 |

| Hawaii | 45 (tie) | -9.5 |

| Mississippi | 45 (tie) | -3.3 |

| New Mexico | 47 (tie) | -3.6 |

| West Virginia | 47 (tie) | -5.7 |

| California | 49 | -3.5 |

| New York | 50 | -9.6 |

The numbers speak for themselves. If we want to increase prosperity and attract new residents to the state, it starts with enacting policies that encourage and promote the principles of economic freedom.

In this edition of Freedom Minute, we talk about the start of the NFL season, declining ratings and revenue, Nike, Colin Kaepernick, and culture.

This past session, Mississippi joined a number of other states in reforming civil asset forfeiture laws.

Lawmakers allowed the administrative forfeiture provision to sunset, meaning the previous law ceased to be in effect at the end of June. In response, Mississippi Center for Public Policy and the Mississippi Justice Institute joined with Empower Mississippi and national conservative organizations in thanking the legislative leadership for ending administrative forfeiture in the state.

Administrative forfeiture allows agents of the state to take property valued under $20,000 and forfeit it by merely providing the individual with a notice. An individual would then have to file a petition in court to appeal. This had the net result of requiring the individual to pay an often-large legal bill to get his or her property back. This, naturally, has an outsized negative effect on low-income households.

Asset forfeiture reforms

Until 2017, Mississippi was the wild west of sorts when it came to civil asset forfeiture. In 2015, the Mississippi Bureau of Narcotics, along with local police departments, seized nearly $4 million in cash.

They seized amounts as low as $75. They seized trucks, cars, ATVs, riding lawnmowers, utility trailers, and 18-wheelers; an arsenal of assorted handguns, shotguns, and rifles; cell phones, cameras, laptops, tablets, turntables, and flat screen TVs; boat motors, weed eaters, and power drills; and one comic book collection, according to a report from Reason.

And that does not include numbers from police departments that work independently of the Bureau of Narcotics. Until 2017, they didn’t track or publish asset forfeiture data.

Moreover, family members, especially parents, often have their cars or other property seized for the alleged crimes of their children. This happens even though the parents are not connected to the illegal activity. For example, in 2015, the Desoto County Sheriff's Department agreed to return a 2006 Chevy Trailblazer owned by the mother of the petitioner, Jesse Smith, in exchange for $1,650.

In 2017, the legislature provided needed reforms. Now, seizing agencies must obtain a search warrant issued by a judge within 72 hours of seizing property. And all forfeitures are posted on a publicly accessible website. Repealing administrative forfeiture is another important step.

Voters oppose civil forfeiture

Polling shows a large cross-section of Mississippi voters oppose the practice of civil asset forfeiture.

According to a poll from 2016, 88 percent of voters oppose civil forfeiture, including 89 percent of Republican voters. Every category of Mississippi voter identified in the poll — by race, age, sex, political party and district — is against police taking property from people not convicted of a crime.

By reforming the civil forfeiture system, Mississippi is adopting policies that are in-line with voters in the state and reforms that other states have enacted.

A new report shows taxpayer funded film incentives continue to perform poorly nationwide.

The report, Calling Cut on Film Incentives, was recently released by the Beacon Center of Tennessee and focuses on the poor investment for taxpayers in the Volunteer State. While there has never been an official ROI calculation from the state of Tennessee, the report looked at three key points:

- 40 percent of the subsidized projects made less at the box office then they received in subsidies

- Several of the subsidized projects only spent a small share of their budget in state

- Many programs hold the state, i.e. taxpayers, hostage and threaten to move if they do not receive additional subsidies, similar to sports teams and corporations

A similar story in Mississippi

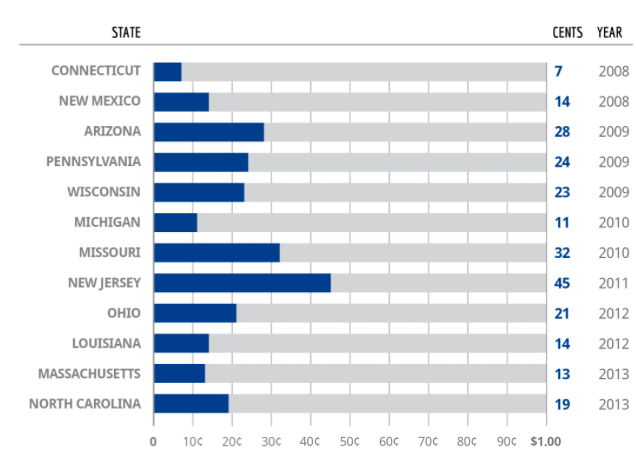

Mississippi has a similar experience with film incentives. A 2015 PEER report shows taxpayers receive just 49 cents for every dollar invested in the incentives. For those looking at a bright side, we are actually “doing better” than many other states.

This includes our neighbors in Louisiana, who recover only 14 cents on the dollar. They also have one of the most generous programs in the country; it was unlimited until lawmakers capped it a couple years ago. (Other reports show the Pelican State recovering 23 cents on the dollar, either way a terrible investment.)

Good for production, not the economy

Beyond Mississippi, Tennessee, and Louisiana, film incentives are universally a poor investment throughout the country. Numerous studies have been conducted on film incentives. All sobering for those worried about taxpayers. Here is a review of the return per tax dollar given, from 2008 through 2013. In these third-party studies, covering 12 different states, there was not a program that returned 50 cents on the dollar (never mind actually made money).

Source: John Locke Foundation

Since this chart was published, studies on similar programs in Florida, Virginia, and West Virginia have shown similar results. No program had a positive ROI.

If an individual was investing their own money, they would never make any of these deals. But is has been said, and proven, many times that no one spends their own money more carefully than that person.

A move in the right direction

Mississippi lawmakers have begun to scale back on the “handouts to Hollywood.” Last year, lawmakers chose not to extend the non-resident payroll portion of the incentives program. This previously allowed for a rebate on payroll paid to cast and crew members who are not Mississippi residents.

But we still have two incentives on the books. One is the Mississippi Investment Rebate, which offers a 25 percent rebate on purchases from state vendors and companies. The other is the Resident Payroll Rebate, which offers a 30 percent cash rebate on payroll paid to resident cast and crew members.

And old habits die hard. The House voted to bring back the incentives this past session. The bill didn't make it through the Senate and that incentive is still dead.

Mississippi is moving in the right direction and they are joined by other states. While all but six states had film incentives a decade ago, the number is now up to 19. Mississippi can be number 20 by removing the incentives currently on the books.

Just because other people are doing it

One of the common prescribed reasons for why need film incentives is because it’s “good” for the state to have movies filmed here. As is often the case in government, we focus on the inputs. How many films are made here? What movie star was in Mississippi? That is nice, but the focus should be on outcomes.

The other common argument is that other states are doing it. That is the point the Beacon Center made about producers holding the state hostage and threatening to move. Producers in Mississippi have raised the same point. And I am sure they have in every other state where film incentives are threatened.

However, simply because another state is wasting money does not mean Mississippi should join them.

Corporate welfare is never a good idea. It’s an even worse idea when you know we are losing money and you want to continue with or resurrect such a program. Our goal should be to have the most competitive business climate in the country. The tax breaks that a few chosen industries or companies receive should be made available to all. When we do that we will remove the need for taxpayer funded incentives.

Tiger Woods is taking heat from the media for just wanting to play golf and not taking their bait.

USA Today columnist Christine Brennan was highly critical of Tiger Woods earlier this week for his refusal to weigh in on the politics of the day.

Brennan, along with several reporters at Tiger’s press conference following a recent tournament, seemed upset because he would not opine on the subject of Donald Trump and race relations, particularly “as a man of color.”

It’s as if every athlete now has an obligation to share personal views on every subject.

The constitutional right to free speech gives Tiger the right to say nothing at all. Perhaps he has a different view or a less popular one. Perhaps he voted for Trump. Maybe he didn’t vote at all. Regardless, he is not required to provide his views on politics or society.

Woods has said that to expect him to have a say on everything having to do with blackness in America because his father was black is disrespectful to his Asian mother. Because his mother is Asian, is Tiger compelled to weigh in on trade relations and Harvard’s admission policies?

Maybe Tiger just wants to talk about golf. Maybe golf fans just want hear him discuss golf. Rather than criticize Tiger for refusing to weigh in on political matters, he should be thanked for having the discipline and the good sense to let everyone enjoy the sports they like.

The USGA, PGA, LPGA, and their fans appear to understand golf is a sport, not a political weapon. Why doesn’t the rest of the sports world?If we are in the mood for political commentary, we can switch the channel to any number of networks that dedicate 24 hours every day to the subject.

It seems the governing bodies of golf understand something fundamental: The sports industry relies on fans, spectators, viewers, and players. Without attendees and viewers, the business models fall apart. Like any healthy business, the customer is at the center.

The NBA and NCAA’s boycott of North Carolina over the transgender bathroom bill and the NFL’s handling of the national anthem issue are recent examples of leagues alienating fans by involving themselves in politics.

With this is mind, why would a sports league attempt to use its sport as a weapon for politics? Sports fans come from all political persuasions. Why jeopardize your relationship with the customer over political issues?

We’ve been asking that question of ESPN, NBA, NFL, NCAA, and other sports organizations of late. Using the resources of a sports organization or the resources of a media company to advance an agenda seems a flawed strategy, and there is data emerging to support this.

In nearly every measured television market, center right-viewers are leaving ESPN. Deep Root, a TV data service, analyzed 43 markets across the US and compared 2015 audiences with 2016 audiences. In 36 of the 43 markets, ESPN viewership had become more liberal—between 5 percent and 27 percent more liberalin 2016 than in 2015.

In other words, center-right viewers left the network.

Those of us who want our sports delivered free of political commentary salute Tiger Woods and the sport of golf. Now please have a talk with your organizational cohorts at the NFL, NBA, and NCAA. We sports consumers/fans would like to have our sports back.

Sports have always been a common denominator in our culture. Regardless of race, age, sex, education, or political affiliation, sport is a unifier. That needs to be respected.

With all of the balkanization that exists in the other parts of our lives, let’s leave sports alone. We’ve already surrendered higher education, arts, music, media, and filmmaking to progressives. They can’t have sports, too.

New York Gov. Andrew Cuomo is in hot water after saying that America “was never that great.” Cuomo is furiously trying to walk back this remark because all reasonable Americans understand that our country, while still struggling to live up to its ideals, has always been the greatest country known to the world. Politicians who do not understand this basic truth should plan to keep their day jobs.

But what made America so great?

When the Declaration of Independence was adopted on July 4, 1776, America was a fledgling experiment in self-government, which the rest of the world expected to fail miserably. All of the wealth and power was in the Old World, with its palaces, empires and powdered wig-wearing aristocrats. America was considered the boondocks, full of log cabins and fur cap-wearing farmers, trappers and frontiersmen.

A few years later, America had fielded a Continental Army that defeated the largest military power in world history and had become the freest and most prosperous country in the world.

A limited government and an empowered citizenry

America became great because the Constitution limited the power of government and empowered individuals to lead their lives as they saw fit. The framers of the Constitution did not know what America would look like 230 years in the future, but they knew they were tired of being subject to the whims of a king. They carefully constructed a government that had just enough power to impose civil order, protect citizens from foreign invaders and secure individual rights to life, liberty and the pursuit of happiness, but not enough power to violate those rights itself. To achieve this, the framers confined the powers of the federal government to those specifically listed in the Constitution and divided that power among three branches of government.

The framers also took a belt-and-suspenders approach to protecting the rights of the people. They added a Bill of Rights to the Constitution to ensure that certain important rights were never violated, even though the framers themselves said that the Constitution had not granted the federal government the power to violate those rights to begin with. Additional amendments were later added to the Constitution to extend its protection of rights to all people, regardless of race or gender, and to keep state and local governments from violating the people’s rights.

If you don’t recognize this strictly limited government, you would be forgiven. Today, politicians say they can do just about anything they want, except what is explicitly forbidden by the Bill of Rights, and even that is up for debate. When asked where the Constitution authorized a proposed law, one congressman admitted, “I don’t worry about the Constitution on this, to be honest.”

Every detail of our lives is subjected to government rules

The rest of Congress appears to feel the same way. The Federal Register, which contains all proposed and final regulations issued by federal agencies, has published over 3.2 million pages. If it were printed and stacked, it would be taller than the Washington Monument. This does not take into account all the laws passed by Congress or by state and local governments.

Because of all these rules, the cost of doing business in America is staggering, and startups and small businesses are at a competitive disadvantage to big businesses that can easily afford it. Those large companies can also afford to pay lobbyists to convince lawmakers to pass even more laws that keep new competitors at bay. All the while, countless Americans are prevented from pursuing their version of the American dream.

Where did we go wrong?

The framers envisioned the judiciary as the guardians of individual rights. But over time, the courts have become more interested in picking and choosing which rights to protect or neglect. In the process, they have invented government powers that do not exist. The result is that our government is far more powerful than the founders ever intended.

You may have heard the term “activist judges.” We certainly don’t need those, but we do need an engaged judiciary that takes seriously its role in the system of checks and balances so carefully designed by the framers.

The good news is that we can all play a part in restoring the American vision. Courts will only take our constitutional rights seriously if we do. We need citizens who are willing to stand up for their rights and attorneys who are willing to advocate for those people, simply because it is the right thing to do. At the Mississippi Justice Institute, we have made that our mission.

This column appeared in the Clarion Ledger on September 2, 2018.

The first – and hopefully last – special session of 2018 is now over.

The Legislature passed three bills: a $200 million infrastructure bill; a lottery bill; and a bill to distribute BP settlement money throughout the state. We reviewed the infrastructure bill earlier in the week, and it has been signed into law by the governor.

The lottery bill did not pass without drama. In fact, the most interesting part of session was that it almost did not pass at all. On Monday night, the House stunned many observers by rejecting the lottery conference report. After “sleeping on it,” several members changed their vote the next morning. The initial vote on the conference report was 53 for and 61 against. The do-over vote was 58 for and 54 against. Up until the end of the special session members who had voted “No” during the do-over were switching their vote to “Yes.”

Mississippi's path to a lottery

Once Gov. Phil Bryant came out in favor of the lottery, lawmakers began to feel it was inevitable. Long gone are the days when Gov. Ray Mabus (D) lost his re-election bid partly because of his support for the lottery. As Jake McGraw over at Rethink Mississippi details, the lottery was unconstitutional in Mississippi between 1868 and 1992. (Public opinion about lotteries seems to ebb and flow as ebbs and flows the controversy and corruption lotteries tend to facilitate.)

In 1992, voters cleared the way by amending the state constitution to allow for a lottery, but it took another 26 years before the lottery actually became law in Mississippi. One might wonder at this delay, but there is something to be said – said by James Madison, in fact – that public opinion often benefits from guidance, refinement – and delay. This refinement – owing to the divided form of government we all enjoy – is what distinguishes representative democracy from the tumult of purely majoritarian rule.

Mississippi becomes the 45th state to legalize the lottery, and our citizens will presumably no longer be crossing the state line to buy tickets in Louisiana, Arkansas and Tennessee. This phenomenon – that people are buying lottery tickets in other states – was one of the primary motivations to pass a lottery here. It is interesting, however, that the two states immune to this argument – Alaska and Hawaii – do not have lotteries. Just maybe these folks believe it’s bad policy.

BP money

Before going home on Wednesday, lawmakers were also forced to decide how to distribute $750 million in BP settlement funds – gotten from the 2010 Deepwater Horizon oil spill. Bickering over how to divvy up the windfall has preoccupied the Legislature for at least the past two sessions. The Senate bill proposed sending 75 percent of the money to the coast and 25 percent to the rest of the state. The House agreed, fending off several amendments and letting everyone go home Wednesday afternoon. Legislative leadership clearly wanted to avoid sending the bill to conference, where it would have become even more of a “Christmas tree.”

It has been reported that the 75 percent in settlement money will go to six counties: Hancock, Harrison, Jackson, Pearl River, Stone and George. The bill does not exactly say this. Rather, it stipulates the money will be used for programs and projects in the Gulf Coast region “as defined in the federal RESTORE Act, or twenty-five miles from the northern boundaries of the three coastal counties.” ... So which is it? The RESTORE Act’s definition of the “Gulf Coast region” goes well beyond six counties. Which definition governs how the money is to be used? The language is a bit confusing (but I ain’t a lawyer, only a Ph.D.). This confusion could spawn more squabbling – if not a lawsuit or two.

Several states have unfunded liabilities that can only be fixed with major reforms. Unfortunately, politicians find it easier to ignore the problem.

Unfunded public-pension liabilities are not a fun subject, and most politicians do all they can to avoid it. Nobody wants to be the sober one in a room full of drunks — but the party can’t go on forever, and eventually someone will have to clean up the mess.

According to a comprehensive survey by the American Legislative Exchange Council (ALEC) of 280 state-administered public-pension plans, the unfunded liabilities of state-administered pensions now exceed $6 trillion. The number increased by $433 billion in the last twelve months. An April report from Pew Charitable Trusts shows that state-pension debt has increased for 15 consecutive years. While this growing gap is a major concern for current public-sector employees and retirees, it should also worry the rest of us.

As the costs of providing current pension benefits begin to weigh on city and state budgets, other public services are getting crowded out. This is putting pressure on many pension-plan managers to seek greater returns by buying riskier assets. Decades of underfunding adds to the pressure, as governments scramble to meet unrealistic return targets and pay out promised benefits at a level the private sector moved away from decades ago. This all points to the growing possibility that many states will need to raise taxes to keep the party going. But without major pension reform, we may soon see the day when taxpayers in fiscally responsible states are asked to bail out those states that just couldn’t, or wouldn’t, stop partying.

A few examples of what some of the party favors look like will help explain why the clean-up phase will be so infuriating. The retired head of the Oregon Health & Science University takes home a pension of $76,111 — each month! Fifty-eight percent of police and firefighters in Scranton, Pa., are on disability pensions; the average retirement age of a Scranton police officer is just under 45 years old. In Nevada, the average full-career state worker will receive more than $1.3 million in lifetime pension benefits. In five states (California, West Virginia, Oregon, Texas, and New Mexico), a retiree can receive an annual pension income that exceeds his last yearly salary.

In Mississippi, the unfunded pension picture is not a pretty one. We have total unfunded liabilities of over $80 billion. On a per capita basis, that means each Mississippian is responsible for roughly $27,000 of the debt. We only have 24 percent of these promises currently funded. But this issue affects states of all sizes and politics, and from all regions.

The states with the largest per capita debt are somewhat surprising: Alaska, Connecticut, Ohio, Illinois, and New Mexico. So are the states with the smallest per capita share of debt: Tennessee, Indiana, Nebraska, Wisconsin, and North Carolina.

However, perhaps the most important measure for a state’s pension health is its funding ratio. This is the percentage of the total pension obligations that is currently funded. The states that are the least funded to meet obligations include Connecticut (20 percent), Kentucky (21 percent), Illinois (23 percent), Mississippi (24 percent), and New Jersey (26 percent). In other words, Connecticut has saved $1 for every $5 of known debt obligation it has for current and future state system retirees. The states in the best shape: Wisconsin (62 percent funded), South Dakota (48 percent), New York (46 percent), Tennessee (46 percent), and North Carolina (45 percent).

What do the data tell us? For starters, note the strong correlation between states that have managed their pension programs responsibly and states with pro-growth economic policies that favor free-market solutions over government ones. Note that each of the five states with the highest funding levels are also states that rely less on the government to sustain their economies. In none of these states does government control more than 45 percent of the economy, which puts these states in the top half of that measure.

On the other end of the spectrum, 57 percent of Kentucky’s economy is controlled by government, while the public sector controls 55 percent of Mississippi’s economy. Obviously, states such as New Jersey and Illinois suffer from powerful public-employee unions that resist any attempts to adjust spending, renegotiate bad contracts, or move new employees to 401(k)-type retirement accounts that require self-financing of retirement programs (as with the tens of millions of workers in the private sector). But even in states without public-sector unions, such as Mississippi, lawmakers have been hesitant to make necessary changes.

The party is over. This is an easy math problem that, unlike the financial crisis from ten years ago, everyone can see coming. Let’s turn the lights on in state capitols and city halls everywhere and get the cleanup started.

This column appeared in National Review on August 29, 2018.