In this episode of Unlicensed, MCPP's Jon Pritchett sat down with National Review Institute scholar Andy McCarthy to talk about his book Ball of Collusion, impeachment, the Deep State, and more.

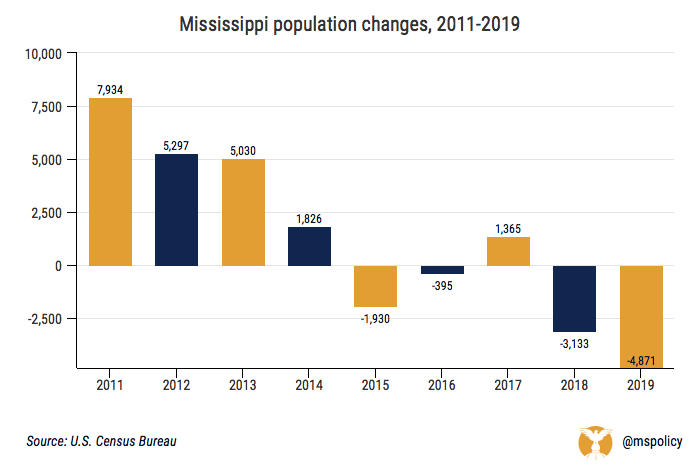

Mississippi suffered its fourth population decline over the past five years in 2019.

According to new estimates from the U.S. Census Bureau, the state’s population declined by 4,871, the sixth highest total in the country. Mississippi and neighboring Louisiana, which saw a decrease of 10,896 residents, are the only states in the south to lose population over the past year. This is a continuing trend.

But what’s happening in Mississippi is an outlier in the South, save for the Pelican State.

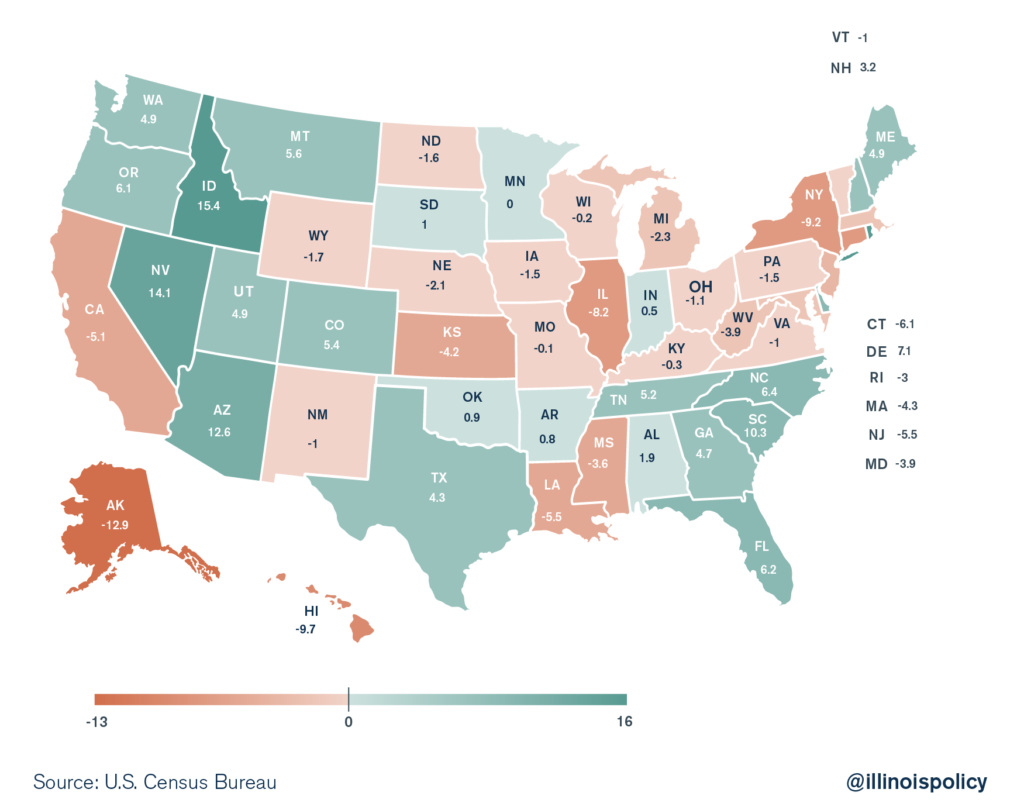

A look at the map of domestic migration, which measures where Americans are moving over the past year, shows a picture of the haves and the have-nots when it comes to population growth.

Large swaths of the Northeast and Midwest show a declining population, while the interior west, west coast (save for California), and the Southeast saw population gains. Substantial gains in some states.

Domestic migration growth rate in 2019

Mississippi had a negative domestic migration rate of 3.6, meaning for every 100 residents that moved to Mississippi last year, 103.6 left, according to analysis of Census numbers from the Illinois Policy Institute. Louisiana had a negative rate of 5.5. Every other southern state, south of Virginia, had positive numbers. Some smaller like 0.8 in Arkansas, some larger like 10.3 in South Carolina.

So people aren’t leaving the South, or running for liberal policy (see California, Illinois, and New York), they are just leaving Mississippi.

Mississippi over the past decade

While Mississippi’s population grew by about 20,000 during the first four years of this decade, there has been a sharp reversal dating back to 2015, save for a small positive uptick in 2017. The declines have been particularly noticeable over the past two years, losing more than 3,000 residents in 2018 and nearly 5,000 last year.

Mississippi’s population growth over the past decade was only 45th best. Even Louisiana, who has been on the negative side of things recently, had growth of about 2.5 percent last decade (compared to being slightly above zero in Mississippi).

Tennessee had the 17th highest growth in the country, while Alabama and Arkansas were middle of the pack.

Reversing the trend

We can look at Mississippi and say things like, “we don’t have any cool large cities today that people want to move to.” But honestly, were Salt Lake City or Raleigh or Nashville that cool 30 years ago? They certainly looked and performed much differently than they do today.

People moved to those places because of opportunity. And there are policies the state can adopt that would put Mississippi ahead of the curve when it comes to national policy and positioning the state to be competitive nationwide.

For starters, Mississippi needs to move away from a desire to overregulate commerce and embolden government bureaucrats. Mississippi has more than 117,000 regulations that cut across every sector of the economy. A successful model to stem this growing tide would be a one-in, two-out policy where for every new regulation that is adopted, two have to be removed. If a regulatory policy is so important, let’s make the government prove it.

The Trump administration adopted a similar executive order in 2017, and the numbers show we are actually seeing decreases greater than two-to-one, and these are not insignificant regulatory reductions.

This could be particularly beneficial in healthcare and tech policy. No department regulates more than the Department of Health, but our goal should be a push toward free market healthcare reforms that encourage choice and competition. In tech policy, the state has the opportunity to be one of the first states to essentially open the door for innovation, rather than one where entrepreneurs need to seek permission from the state. If Mississippi wants to get in the technology world, and we are convinced this is essential, a permissionless innovation policy in healthcare would be a big step in the right direction. In his recent article in the Mississippi Business Journal, Auditor Shad White pointed out the opportunity to focus on creating high margin businesses and jobs with a focus on healthcare tech innovation.

We should also not require people to receive permission from the state to work when they do move here. Open the door to productive citizens by allowing for universal recognition of licensing, following the path paved by Arizona. If you have been licensed in one state, that license should be good in Mississippi. Again, we could be ahead of the curve.

At the same time, our occupational licensing regime should be reviewed. Today, 19 percent of Mississippians need a license to work. It was 5 percent in the 1950s. While there are some occupations where a license is obviously prudent, we’ve expanded into far too many occupations.

This serves to lower competition and increase costs for consumers, while not providing those consumers with a better product. Occupational licensing is an example of how Mississippi misses the opportunity to grow her economy by acting in defensive ways to protect the slices of our economic pie for the well-connected when the reality is we could create a much bigger economic pie if we encouraged more creative disruption, competition, and risk-taking.

If Mississippi is to grow its economy, it will require not only keeping our best and brightest but also attracting others to come to the Magnolia State. Places like Tennessee, Georgia, and the Carolinas did not lose their Southern identities by encouraging newcomers. The economic engines in those states grow because of the quality of the entrepreneurs, capitalists, scientists, and productive people. Not that long ago, Charlotte and Meridian were exactly the same size. Economies are dynamic and once they get momentum, amazing things can happen. There is also the probability that a growing economy will have a “boomerang effect” – bringing back people born and educated here who left to pursue greater opportunities.

There’s no rule that Mississippi has to lose population. Alabama, with whom we share much in common, had a domestic migration growth of 1.9 last year. States like Tennessee, Georgia, and Florida may have done better, but we are not automatically immune to the success of our neighbors.

Finally, Mississippi needs to shed its abundant reliance on government and the public sector. Whether for public assistance, grants, contracts, jobs, or specific tax breaks, the citizens and companies in Mississippi are too dependent on state government. And the state is too dependent on the federal government. We have the third highest level of economic dependence on federal grants-in-aid in the nation (43%) and the fourth highest level of our economy driven by the public sector in the country (55%). Politicians, state agency directors, and government bureaucrats cannot create the economic growth we need. They can, however, work together with our various representatives and create an environment that allows and encourages private economic activities. Ultimately, with such an environment, it will be the entrepreneurs, business owners, productive workers, creative disruptors, capitalists, managers, and consumers who deliver the economic growth we all seek.

As the state auditor appropriately ended his article in the Mississippi Business Journal, the time to act is now.

The Mobile City Council delayed a decision on whether to provide $3 million in taxpayer funds to restart passenger service between the city and New Orleans.

According to a story on Al.com, council members were set to vote on the possible outlay on December 31, but learned that the deadline for local matching funds for a federal railroad grant was extended from January 6 to February 5.

The council will wait until its January 26 meeting before deciding to commit to providing the taxpayer money, which would be provided over the first three years the twice-daily Amtrak trains would be in operation.

The Federal Railroad Administration not only extended the deadline for local matches for its Restoration and Enhancement Grant program, but increased the amount of available funds by an additional $1.9 million to $26.3 million.

Alabama leaders, most notably Gov. Kay Ivey, have balked about providing funds to restore the service that was ended in 2005 before Hurricane Katrina made landfall on the Gulf Coast.

Mississippi has already promised $15 million and Louisiana will provide $10 million to match more than $33 million in federal grants to upgrade the trackage and other infrastructure.

The three states would have to outlay more than $3.3 million apiece over the first three years of operation to keep the service running.

In addition to the possible money from Mobile for operations, either the state of Alabama or another government in the state would need to provide $2.2 million for capital improvements to the CSX-owned trackage between Mobile and the Mississippi state line.

The Southern Rail Commission is an Interstate Rail Compact created in 1982 by Congress and consists of commissioners appointed by governors from Alabama, Louisiana, and Mississippi. The group is lobbying Alabama leaders to provide taxpayer funds for the project, including $2.5 million for a branch line to connect the CSX tracks to a possible new train station planned for Mobile’s downtown airport at the Brookley Aeroplex.

A plan to shift all air travel from the Mobile Regional Airport west of the city to Brookley is already in progress and city leaders are game to making it a multimodal travel hub. One airline, Frontier, is already offering service from a temporary terminal at the airport just minutes from Interstate 10 and downtown.

A 2015 Amtrak study says that a twice-daily train between Mobile and New Orleans would draw 38,400 riders annually. Similar routes have existed from 1984 to 1985 and 1996 to 1997, but both were put on a permanent siding as the three states declined to provide more taxpayer funds.

A similar passenger train, the Hoosier Line, received $3 million annually from Indiana taxpayers to provide four days per week service between Indianapolis and Chicago. Indiana Gov. Eric Holcomb sliced the money from his proposed two-year budget that was approved in April after ridership fell 18 percent from 33,930 rides in fiscal 2014 to 28,876 in fiscal 2018.

The Federal Rail Administration — under the Consolidated Rail Infrastructure and Safety Improvements Program (CRISI) — is providing up to $32,995,516 in taxpayer funds for improving crossings, bridges, sidings and other infrastructure along the route. Some of this money could also be used by Mobile for a new train station.

These funds would also pay for preliminary engineering and federal environmental reviews needed for another project of the SRC, passenger service between Baton Rouge and New Orleans.

The federal grants that would be provided to enact Amtrak service are meant to get the service operating. The first year, the grants would provide 80 percent of the operating costs, declining to 60 percent in the second year and dwindle to 40 percent in the third.

Scores on the ACT test for both Mississippi high school juniors and seniors decreased from last year, according to data released by the Mississippi Department of Education.

The average composite scores for Mississippi juniors who took the test declined from 17.8 in 2018 to 17.6 in 2019, while the percentage of juniors who met the minimum for all four benchmarks (English, mathematics, reading and science) remained at 9 percent.

Mississippi is one of 15 states that administers the ACT to all of its high school graduates. Mississippi seniors scored an average of 18.1, down slightly from last year’s 18.3.

In 2018, 38 percent of juniors in Mississippi met the standard for English. In 2019, that number increased slightly to 39 percent. Also up was reading (up one point to 24 percent of juniors meeting the standard) and a three-point improvement in science (18 percent of juniors met the standard).

Only 15 percent of 2019 juniors met the standard for math, down from 18 percent in 2018.

Out of the 29,817 juniors that took the test in 2019 in Mississippi, only 2,683 met the standards in all four areas, which is a good indicator of the readiness to take on college-level work. Last year, it was 2,812 out of 31,254 juniors statewide.

Only Nevada (17.9 composite average) scored worse than Mississippi among the states that administer the test to 80 percent or more of its graduates.

Only 46 percent of Mississippi seniors met the standard for English (tied with Hawaii for third lowest), 29 percent met the benchmark for reading (second from the bottom), 20 percent met the math standard (worst among the 80 percent testing states) and 19 percent met the standard for science, tied for last with Nevada.

One interesting trend is how juniors in A-rated and F-rated districts compared. Of the 31 A-rated districts in Mississippi, 12 had their composite scores dip in 2019 from 2018. Ten of those were 0.5 points or more.

The Oxford School District had the biggest drop among the A-rated districts, sliding from 22 in 2018 to 20.9 in 2019.

The biggest increase was the Lafayette County School District, whose ACT score composites went up from 18.2 to 19.5.

Of the 19 F-rated districts, only seven had gains from 2018 to 2019. Two districts, had losses of a point or more. The Humphreys County School District had the biggest drop, sliding from a composite of 15 in 2018 to 13.9 in 2019.

A former student at Jones County Junior College is suing the school for infringing on his free speech rights. And the U.S. Department of Justice is coming to his defense.

Michael Brown, who is now a student at the University of Southern Mississippi, was stopped twice by campus police for trying to inform students about the political club he was involved with, Young Americans for Liberty, without prior authorization from the school’s administration, according to the complaint filed by the Foundation for Individual Rights in Education.

Brown was stopped by campus officials early last year about an inflatable beach ball, known as a “free speech ball,” upon which students could write messages of their choice and again in the spring for polling students about marijuana legalization.

An administrator told YAL that they weren’t permitted on campus since they hadn’t sought permission from the college.

According to Brown, he and another student held up a sign polling students on marijuana. Campus police took him and another student to their office after telling a friend, who wasn’t a student, to leave. Campus officers later escorted the friend off campus.

The DOJ has now issued what is known as a statement of interest.

The DOJ statement compared the school’s regulations regarding public speech from their handbook to the tyrannical state of Oceania in George Orwell’s “1984.” The statement also says the college has an obligation to comply with the First Amendment.

The current regulations require at least three days’ notice to administrators before “gathering for any purpose.” The student handbook also puts even more restrictions on college-connected student organizations, which must schedule their events through the vice president of student affairs. The school administration also reserves the right, according to the handbook, to not schedule a speaker or an activity.

The statement says that these restrictions operate as a prior restraint on student speech and contain no exception for individuals or small groups, and grant school officials unbridled discretion to determine about what students may speak.

The DOJ urges JCJC to revisit and revise its speech policies. In May, FIRE wrote a letter to Jones Count Junior College President Jesse Smith offering to help the community college bring its policies into compliance with the First Amendment. The school didn’t respond to the letter.

This, however, is not the first – or even the most recent – instance of college campuses in Mississippi restricting free speech.

This fall, the Overby Center for Southern Journalism and Politics at Ole Miss rescinded an invitation of Elisha Krauss, a conservative commentator, days before she was scheduled to appear. The event was hosted by Young America’s Foundation. The Center is housed in the same building as the School of Journalism and New Media but is a separate organization.

The Overby Center claimed they do not allow ideological speakers, yet with a 2019 lineup that included a former Democratic candidate for the U.S. Senate and partisan journalists from the New York Times and Washington Post (among others), the definition of “ideological” seems to fluctuate based on how much you may agree with certain speech.

Krauss is certainly someone who has a conservative background, but also someone who has spent considerable time in the larger world of journalism. Someone who would have been a good balance to many of the other speakers allowed to convey their thoughts and ideas at the Overby Center.

Fortunately, the story in Oxford ended on a positive note. The administration invited Krauss back. And she gave a well-received speech, naturally, regarding free speech on college campuses.

But whether it’s a junior college or the oldest public university in the state, we shouldn’t be having these fights in Mississippi. Free speech should be welcomed and encouraged on every college campus in the state, regardless of whether you like the speech or not. And it shouldn’t take a lawsuit or an administrator overriding one or two decision makers.

To date, 14 states, including every state that borders Mississippi, have passed legislation to protect campus free speech and ensure different voices can be heard. The Magnolia State has the opportunity to join this growing trend in 2020.

Occupational licensing is usually sold as a necessity to protect the health and welfare of our citizens. It is a sign of quality that can only be achieved through an official license from the government. When in reality it is nothing more than a protectionist game that limits competition and raises cost for everyone.

In the 1950s, just five percent of workers in America needed a license to work. And these are in occupations most commonly associated with licensing — medical professionals, teachers, or lawyers. But since that time, the number of occupations that require a license has exploded.

Today, about 19 percent of Mississippians are in an occupation that requires a license. And this is particularly troubling in low and middle-income occupations. Mississippi currently licenses 66 of 102 lower-income occupations, as identified by Institute for Justice.

On average, licensing for low and middle-income occupations in Mississippi requires an individual to complete 160 days of training, to pass two exams, and to pay $330 in fees. Those numbers will vary depending on the industry. For example, a shampooer must receive 1,500 clock hours of education. A fire alarm installer must pay over $1,000 in fees.

The net result is a decrease in the number of people who can work. A study from the National Bureau of Economic Research found that occupational licensing reduces labor supply by 17 to 27 percent.

In Mississippi, the Institute for Justice estimates that licensing has cost the state 13,000 jobs. That represents two Nissan plants that could be created by reducing our licensing burden, and it wouldn’t require a dime in taxpayer incentives.

The limited consumer choice then leads to higher prices for that consumer, resulting in a hidden tax every Mississippians pays.

Occupational licensing leads to a decrease in the number of people working and an increase in costs to everyone. But is it a public good?

The empirical evidence that exists shows that is not the case. As the Obama administration said in a 2015 report, “Most research does not find that licensing improves quality or public health and safety.” The consumer is paying more without getting better results.

Instead of government licensing, there are voluntary or non-regulatory options that help entrepreneurs start and run businesses while providing the maximum options for consumers.

Key Facts

- 19 percent of workers in Mississippi need a license to work.

- Mississippi requires individuals in low and middle-income occupations to complete 160 days of training, to pass two exams, and to pay $330 in fees, on average.

- Mississippi has lost 13,000 jobs because of occupational licensing and the state has suffered an economic value loss of $37 million, according to a report from Institute for Justice.

- Mississippians pay a hidden tax of $800 every year because of licensing, according to a report from Heritage Foundation.

- In 2004, Mississippi freed hair braiders of irrelevant licensing requirements. Today, there are 2,600 hair braiders earning a living in the state.

- In 2019, Mississippi adopted the Fresh Start Act, which will help ex-offenders earn a living by prohibiting occupational licensing boards from using rules and policies to create blanket bans on ex-offenders.

Licensing Alternatives

Market competition is the least restrictive option. Without government-imposed restrictions, consumers have the widest assortment of choices, thereby giving businesses the strongest incentives to maintain a reputation for high-quality services. When service providers are free to compete, consumers can decide who provides the best services, thereby weeding out those that do not.

Quality service self-disclosure is another term for customer satisfaction. There are numerous common sites people can leave reviews such as Yelp, Google, Facebook, specific industry sites, etc. Finding out which location is providing a good customer experience is easier than ever, providing users with more complete options.

Voluntary, third-party certification allows the provider to voluntarily receive and maintain certification from a non-government organization. One of the most common examples is the National Institute

for Automotive Service Excellence (ASE) designation for auto mechanics. No mechanic is required to receive this certification, but it sends a signal to the consumer that the location with that designation is committed to quality service. And the consumer can decide whether that is important.

Voluntary bonding and insurance is the final voluntary option. By being bonded and insured, providers are showing their concern for quality to customers at the risk to their own bottom line — whether that’s through the potential for increased premiums or loss of collateral.

These are less restrictive options that do not involve the government. But there are still government- controlled options that are less intrusive than licensure.

Two legal options are private causes of action, which give consumers the right to bring lawsuits against service providers who are at fault, and deceptive trade practice acts, which allow consumers to sue businesses for practices that are deceptive or unfair.

The government can also mandate inspections as they do in a number of fields, most notably the food- service industry. It could be applied in occupations that also require licensing, such as the construction field and barbers and cosmetologists. This allows those who are trained in a field to spot potential hazards, while being less burdensome than licensure.

The state may choose to require registration, as they do with hair braiders. Hair braiders previously needed to take hundreds of hours of irrelevant cosmetology classes. Now they register with the state and pay a small fee. This discourages “fly-by-night” providers, while still only creating a small barrier for providers.

All of these options have one theme in common: They are better than government mandated licensure and prevent entrepreneurs from having to take state mandated classes, pay hundreds (or thousands) of dollars in classes, and take time out of their life to receive permission from the state to earn a living.

Instead, the state can protect consumers, while relying on a small government approach that promotes competition and consumer choice. This is what will encourage economic growth.

Following Arizona

Earlier this year, Arizona became the first state in the nation to provide licensing reciprocity to newcomers to the Grand Canyon State, a state that has had a steady stream of inmigration dating back a couple decades.

Right now, if you move to Mississippi, you are required to essentially start from scratch if you want a license in the field you have already been trained. Even if you’ve been mastering that work for two plus decades. But not in Arizona anymore.

What Arizona did, and a couple other states have since followed, is roll out the red carpet to new residents moving to the state and telling people they can work here without an extra unnecessary hurdle. If you got your license in Mississippi, that’s good enough for Arizona.

Mississippi should follow this model, especially in the early days before every state has done this, and make the business climate more enticing to all.

The battle to preserve our natural rights of life, liberty, and property is as arduous today as it was 243 years ago, when George Washington and his men made a daring defense.

Though we do not fight our would-be rulers with muskets and bayonets today, we remain in a war to defend our constitutional rights from those who would continue to challenge them. Our weapons today are different but our commitment to win must be no less earnest.

Our founders understood the high purpose and necessity of such a defense. They knew the opportunity of a constitutional republic was won by their generation but that it would also require an ever-vigilant citizenry to defend it from well-meaning but power-seeking governments, generation after generation.

As active and engaged citizens, we have a role as defenders of the blessings of liberty for all Mississippians. Whether a lawyer representing an entrepreneur who is prevented from starting a business by unnecessary and burdensome regulations, a policy advocate working with members of the legislature to push for limited government, a community activist working to ensure equality under the law, or an ordinary citizen writing an op-ed for the local newspaper, we’re all defending our shared blessings of liberty.

Government did not grant these blessings to us; they are natural to each of us as individuals. And none of us can be denied these blessings or given any modifier that makes our blessings preferable or subordinate to any others.

As we celebrate the eternal blessings of the Christmas season with family and friends, let us take the time to think about that incredible crossing on Christmas night, 1776.

When the hopes of independence lay in the balance, our country’s first president planned and executed the bold attack on the British. George Washington led famished, cold, tired men across the Delaware in the darkness as rain turned to sleet and then to snow, and the winds blew without relief.

The American colonists prevailed in that fight at Trenton and eventually, thanks to a spirit that would not be subdued, our independence was won.

With that enduring spirit in mind this Christmas season, we should take the time to recognize how rich our blessings are and how worthy of a robust defense is liberty.

Those who wish to have wine or liquor in their homes on Christmas Day in Mississippi need to make sure they purchased their alcohol by closing time on Christmas Eve.

All alcohol that is greater than 5 percent alcohol by weight is illegal to be sold on Christmas Day. This essentially means beer and light wine can be sold in grocery stores, while liquor stores can not sell any of their goods.

Mississippi is one of 21 states with such a restriction in place. Nine states have a total ban on retail alcohol sales on Christmas. The same restriction was in place for Thanksgiving in Mississippi.

Alcohol restrictions, though probably not as silly as this, have long been a part of Mississippi’s history.

Our modern laws governing the control of alcohol are anything but that, and continue a long tradition of excess government control.

We have over empowered individual counties to define their own laws, and in so doing have created a chaotic state of regulation, difficult to understand by the average residential citizen, let alone internal and external businesses hoping to sell.

Furthermore, the state has retained an egregious amount of control of the distribution process. Mississippi has decided that, rather than allow private businesses to control the market, it will run a large warehouse in the central part of the state which will have a complete monopoly over the distribution of all spirits and wines.

As the Department of Revenue states on its own site, “the ABC imports, stores, and sells 2,850,000 cases of spirits and wines annually from its 211,000 square foot warehouse located in South Madison County Industrial Park.”

This warehouse consistently operates at capacity, and government leaders are considering a $35 million expansion. Perhaps our politicians ought to consider giving the free market a chance?

There is no reason that our government should be so deeply involved in controlling the distribution for a product. They hike up prices by a tremendous rate, limit access to the product, and determine which brands are allowed to sell in the state, leaving businesses in the dark and unable to control their own wares.

Private businesses are barred from distributing alcohol in Mississippi. While UberEats, DoorDash, and GrubHub have created thousands of jobs in other states through their delivery systems, our legislative leaders have shut down this opportunity for individuals to order alcohol with their delivery.

And while a variety of companies sell and ship wine, whiskey, and other alcoholic beverages around the country, our legislative leaders have determined that we shouldn’t have this freedom of access.

If you were shopping for a Christmas gift this year, you might find yourself looking at a wine basket, such as those at Wine & Country. However, upon checkout you will be met with the embarrassing notification that your state is one of only three in the entire nation that completely bars the shipment of any wines.

The excess regulation has made Mississippi last in the nation for craft beer development. For comparison, craft brewers currently produce $150 per capita in Mississippi, while they produce $650 per capita in Vermont. Imagine the difference such an industry could make in our state. This is thousands of tangible new jobs which are being discouraged from coming into existence by our government.

Existing policies have led Mississippi to have the largest shadow economy in the nation (referring to the exchange of products that are not taxed or recorded) at 9.54 percent of GDP. Moonshine is either produced or is available in every single county, which many link to the strict regulation of the alcohol industry. Our egregious taxation of alcohol products displayed here by the Department of Revenue has encouraged many companies such as Costco and Trader Joes to avoid opening locations in the state due to the lack of revenue potential on alcoholic products.

Prohibition is alive and well in Mississippi. Our government has decided we apparently can’t be trusted to make basic purchasing decisions for ourselves, so they must control what alcoholic drinks we’re allowed to have access to, how we’re allowed to receive these drinks, and from whom we’re allowed to purchase these drinks.

Be not fooled by the government “do gooders” who proclaim that they carry out policies like this for our own protection. Too many of our political leaders refuse to give freedom a chance, and instead have decided that they know better than we do when it comes to running our lives.

The fact is that while Mississippi prides itself on having a relatively low income tax, it finds dozens of other ways to tax and control its citizens.

Companies are discouraged from entering into business in the state because we have established covert taxes which discourage entrepreneurial risk taking.

Mississippi controls, regulates, and taxes alcohol worse than New York or California, so imagine what other discrete ways it is shutting down job opportunities and discouraging new business.

Mississippi’s defined benefit pension fund’s fiscal position worsened after worse than average investment income in 2019 and changes to the way the staff forecasts its future finances, according to the fund’s annual report released on Wednesday.

The Public Employees’ Retirement System of Mississippi — which serves most state, county and municipal employees — now has an unfunded liability of more than $17.6 billion. Last year, it was $16.9 billion.

PERS’ actuarial staff lowered the plan’s future inflation assumption and the amount of salary increases for contributing member, which helped the unfunded liabilities increase by nearly a billion dollars.

The plan’s funding ratio, which is defined as the share of future obligations covered by current assets, shrank from 61.8 percent in 2018 to 60.9 percent, just a tick below 2017 (61 percent). While the plan’s obligations won’t be due all at once, the funding ratio presents a good view of the plan’s financial health.

The general fund tax revenue for the entire proposed state budget for fiscal 2021 is $5.85 billion. Filling PERS’ present unfunded liability would take three years of that revenue.

PERS funding ratio 1998-2019

| 1998 | 2002 | 2006 | 2010 | 2014 | 2018 | 2019 |

| 85% | 83.4% | 73.5% | 64.2% | 61% | 61.8% | 60.9% |

The reason for the worsening financial situation is two-fold: Less money coming in from the plan’s investments and more benefits paid out to an ever-increasing number of retirees.

PERS earned $1.701 billion or a 6.64 percent rate of return on the plan’s investments, after earning $2.385 billion or a 9.48 percent rate of return in 2018.

The plan’s annual average expectation is 7.75 percent return from its investments.

The number of retirees increased from 104,973 to 107,844, a difference of 2,871. The number of active members largely held steady, decreasing just slightly from 150,687 in 2018 to 150,651 in 2019. The ratio of active employees to retirees remained at 1.4 for the second consecutive year.

Benefits paid by PERS to retirees increased by $138 million over last year to $2.7 billion, an increase of 5.3 percent from 2018.

With more retirees and more paid out in benefits than last year, the amount paid as a cost of living adjustment to PERS retirees increased again.

Last year, the plan paid $650 million in COLA to beneficiaries. This year, that amount grew 7.6 percent to nearly $700 million.

As a percentage of benefits paid, the COLA grew from 24.9 percent of benefits paid in 2018 to 25.4 this year.

PERS provides a cost of living adjustment that amounts to three percent of the annual retirement allowance for each full fiscal year of retirement until the retired member reaches age 60.

From that point, the three percent rate is compounded for each fiscal year. Since many retirees and beneficiaries choose to receive it as a lump sum at the end of the year, the benefit is known as the 13th check.

PERS unfunded liabilities (in billions)

| 2009 | 2010 | 2012 | 2014 | 2016 | 2018 | 2019 |

| $9.99 | $11.26 | $14.5 | $14.45 | $16.81 | $16.94 | $17.6 |

PERS actuaries forecast that the plan’s funding ratio — provided that the plan’s investments average 7.75 percent over the next 28 years — will be up to 83.2 percent funded by 2047.

If the plan’s finances average 6.25 percent rate of return, the plan would dip below 50 percent on its funding ratio by 2034 and bottom out slightly above 25 percent by 2049.

Change is possible

The dire situation does not need to continue.

Lawmakers should freeze the program’s overly generous COLA for three years or more. Then either tie it to the Consumer Price Index, which has recorded a rate of inflation of 2.18 percent since 1999 or go back to the old way of computing the COLA as 2.5 percent of the original benefit.

One alternate solution is mimic South Dakota’s approach to its COLA. This state indexes its COLA to the CPI and to the plan’s funding ratio — which is defined as the share of future obligations covered by current assets.

South Dakota has a minimum COLA rate of 2.1, when plan funding level is below 80 percent and a maximum of 3.1 percent when the plan is funded above 100 percent.

New hires should be transferred to a 401k plan that would increase employee contribution rates and allow them to have more control and portability over their money.

By Increasing the employee contribution rate (which now is 9 percent), this would better balance contributions by taxpayers, which have increased eight times since 1990 versus only twice for employees. Only the legislature can authorize an employee contribution increase for PERS and haven’t done so since 2009.

The state retirement system does not need to be unfunded. But it will require action.