The cities of Brandon and Flowood are hoping to start the trend in Rankin county of banning e-cigarettes and vaping for minors. They're too late.

Minors are already prohibited from buying such products meaning the new ordinances will have little effect on the legality of vaping in Rankin county.

According to a story from WLBT, this began as a discussion among municipalities in Rankin county, along with the Sheriff's Department. Other cities are expected that follow suit.

Elected officials across the country are beside themselves in the push to outlaw vaping.

Unfortunately, America has a terrible record of accomplishment when it comes to government prohibitions. After all, the prohibition on teens purchasing e-cigarettes or vaping products is so ineffective, we don't even realize it's already the law.

Sales of e-cigarettes have been prohibited to those under 18 since 2016, so minors are already turning to the black-market. That should be our first clue that bans don’t work. Because the black market is the problem, as it usually is.

So far, the overwhelming evidence is the deaths and illnesses related to vaping were the result of black-market substances, such as vitamin E. We don't exactly know all of the details but these are not the products adults are legally purchasing today.

Indeed, prohibitions only tend to illicit more dangerous options.

During alcohol prohibition, individuals made their own liquor that was often much more dangerous than what you could legally buy prior to prohibition. Today, many people roll their own cigarettes in locales that have absurdly high taxes. Again, these are often more dangerous as you can get more nicotine by leaving out a filter.

And when it comes to vaping, teens can turn to YouTube for do-it-yourself videos on raising nicotine levels. This won’t change because of a new ordinance. Just like it didn't change because of a federal law.

While well intentioned, all this ordinance and other bans will do is increase lawlessness.

A new tax credit designed to help children being raised in the state’s foster care system and passed this session has reached its cap for business donations, but individuals still have time to take advantage before the year ends.

The way the Children’s Promise Tax Credit works is businesses and individuals donate to eligible organizations that help children. Then they fill out a form and send it to the state’s Department of Revenue.

For businesses, the credit is a dollar for dollar up to 50 percent of its state tax liability.

Individual taxpayers can receive a dollar for dollar credit up to $1,000 of their liability. Those without a liability have five years to apply the credit before it expires.

House Bill 1613 passed nearly unopposed in the legislature this session and went in effect on July 1.

There is a $5 million cap for corporate donations that was reached soon after the credit went into effect. Individuals wanting to participate have a $3 million cap.

Sean Milner is the executive director of the Baptist Children’s Village, which receives 37 percent of its funding from individual donations, but none from state or federal funds. He said he’s had a hard time explaining the new tax to donors for an unusual reason.

“The law is so good that people are having a hard time understanding it. Not because it’s difficult to understand, but quite honestly it makes too much sense and people aren’t used to things coming out of the legislature that make this much sense,” Milner said. “The idea that you can give your money to someone who’s serving the state’s needs as opposed to having to pay taxes, that’s difficult for people to understand.”

According to the state Department of Revenue, $2,751,042.18 of the individual credit has yet to be allocated.

Milner says that the number of allocated credits doesn’t show how much of an impact the credit has had on his donors. He said that most of his donors, who are individuals giving between $25 and $100, aren’t itemizing and won’t be taking advantage of the credit’s advantages.

He said when his organization sent out a letter with directions on how to utilize the new credit to existing donors, the checks continued to flow in despite most not taking advantage of the program.

“Everybody is so generous in Mississippi. They give money and expect nothing in return,” Milner said. “They don’t report this or keep the receipt to put on their taxes for some kind of receipt. It’s a great law and it’s taking a little while for people to catch on.”

Erin Kate Goode is the executive director of the Jackson-based Center for Pregnancy Choices Metro Area. She said donations to her organization, which uses a licensed medical clinic to educate pregnant women about their choices including adoption and parenting, have been three times as much as the same time last year.

While she has a donor that is matching gifts during that time, she says the tax credit is definitely helping.

“The gifts have been a higher level than they were last year,” Goode said. “It (the credit) frees people up to give more.”

Milner said another advantage of the credit is that it creates a partnership between childcare agencies, the business community, and general public and that the benefits from that relationship has yet to be seen.

Bob Anderson is a CPC donor and a board member and says that he hopes that people don’t get lost in applying for the tax credit, which he says is not difficult.

“The pot of money for it (the tax credit) is largely there this year, but I think in the future, it’s going to go a lot quicker,” Anderson said. “This credit is a great way to direct money to these organizations that directly help children. A lot of government organizations have a lot of overhead, but the CPC and organizations like them are very streamlined, very efficient. I used to joke they could cut a nickel in half and make 20 cents out of it.

The DOR will accept applications from businesses starting January 1 by email for the credit for 2020.

In 2015, the Drug Enforcement Agency raided Miladis Salgado’s home on a false tip that her estranged husband was dealing drugs. In the end, the federal government used civil forfeiture to take $15,000 from Salgado, a large portion of her life savings.

Salgado knew she had done nothing wrong. So she fought back. And won.

But Salgado needed an attorney. She hired an attorney on contingency, and after two long years, the court was about to rule in her favor. That’s when the federal government folded. They admitted there was no evidence of a crime and agreed to return her money.

But in doing so, they refused to pay her attorneys’ fee. Salgado petitioned the judge for the fees, but that request was denied because the government returned her money before a ruling, which would have triggered the government to pay those fees.

That would leave Salgado with about $10,000 of her $15,000 the government took. The other $5,000 would go toward her attorney. Meaning, even though Salgado did nothing wrong and the government illegally took her property, she will still lose $5,000 just for fighting for her property that was rightly hers.

The Institute for Justice brought Salgado’s petition for attorney fees to the U.S. Supreme Court. The Mississippi Justice Institute, along with other public interest law firms, filed an amici curiae (friends of the court) brief in support of Salgado.

“The government spent years trying to take Salgado’s cash,” the amici firms wrote. “It embarked on the all-too-common attrition-by-litigation strategy. Salgado was forced to bear the literal expense of defending against the government’s actions. Even though the government eventually dismissed its case and returned the cash, Salgado wound up with less money than she had before the DEA’s raid.”

The petition revolves around a profound question: When the government dismisses a forfeiture case it has spent years litigating, did the property owner from whom the property was taken ‘substantially prevail’ under federal law?

What is the high road and why do we need to take it to freedom?

At the Mississippi Center for Public Policy, our duty is to pave the way so citizens are free to choose their own version of flourishing — unencumbered by government’s barriers and burdens. We believe the best way to get every Mississippian on the high road to freedom is to first hold government to its constitutionally limited role so that free market ideas and mechanisms are robust and so that private institutions can blossom.

That was the inspiration behind the High Road to Freedom, MCPP’s new policy guide with more than 100 policy recommendations on 28 of the most pressing issues in our state. Each topic is backed by rationale, data, ideas, and principles and can be put into action.

Click here to download and read The High Road to Freedom.

It is our goal that this will serve as a policy guide over the next four years. We will continue to have luncheons that highlight individual issues and run op-eds in newspapers through the state. And when the legislature returns in a couple weeks, we will regularly turn to this book to outline our position on an issue and the reasoning behind it.

There has never been a question about where we stand or what we believe will be the right policy. This just makes it clear for everyone.

Finally, we didn’t do this because we love policy, but rather because we love people. When we love people, we want them to have every opportunity to raise their eyes to the wonders of what is possible and to be willing to endeavor to live the life they have imagined for themselves and for their loved ones.

You can check out the High Road to Freedom here.

As many prepare to hit the roads to travel for the Christmas holidays, Mississippians will be paying less than most at the pump.

According to the daily updated data from AAA, Mississippians are paying $2.21 per gallon. Missouri is slightly less at $2.206 per gallon. Mississippi’s four neighbors range from $2.23 in Louisiana to $2.30 in Tennessee.

Residents of Simpson county are paying the least for gasoline at $2.08 per gallon. Residents of Alcorn, Desoto, Hancock, Harrison Jones, Marion, Prentiss, Stone, Tate, Warren, and Yazoo are all paying $2.15 or less per gallon.

In the metro area, gas is $2.18 per gallon in Rankin county, $2.20 in Madison county, and $2.22 in Hinds county.

Californians are paying the most among the continental U.S., at $3.62 per gallon. Two counties in the state are posting averages of over $4.00 per gallon.

A significant amount of attention was dedicated to Mississippi’s gas tax during the 2019 elections, with an emphasis on raising it from candidates in both parties.

In the Republican gubernatorial primary, former Supreme Court Justice Bill Waller supported a gas tax increase as did Democrat Attorney General Jim Hood. Gov.-elect Tate Reeves, who defeated Waller in the primary and Hood in the general election, opposed a gas tax increase on his way to victory.

Still, there are others in powerful positions who have voiced support for at least some type of gas tax increase. And the numerous transportation related associations are not likely to give up their continual efforts to raise taxes.

But does a high gas tax correspond with a highly rated highyway system?

Not necessarily, according to an analysis that compared gasoline taxes by state and rankings from the Reason Foundation’s recently released annual Highway Report.

None of the top 10 states scored for highway efficiency and cost effectiveness were among the top 10 in the amount of gasoline tax levied on consumers. The top 10 states averaged 25.25 cents in taxes per gallon, just slightly above 24.85 cent per gallon nationwide average from the American Petroleum Institute.

Mississippi has the third lowest gasoline tax nationally (18.79 cents per gallon) and yet its highway efficiency and cost effectiveness was ranked 25th by Reason.

Out of the five states with the lowest gasoline taxes, only Alaska (49th overall) and Oklahoma (41st overall) were near the bottom.

Conversely, none of the states with the highest gasoline tax scored higher than Mississippi in the overall score, the best being Illinois at 28th. The Land of Lincoln hits motorists with a 54.98 cent tax on every gallon of gasoline.

California has the nation’s highest gasoline tax at 61.20 cents per gallon, yet it only ranked 43rd overall in the Reason Foundation report. Pennsylvania (35th in the report) has the next highest gasoline tax nationally at 58.7 cents per gallon.

Missouri was ranked third overall and its gasoline tax (17.42 cents per gallon) is the lowest in the country, yet its rural interstate pavement condition was 17th best and it also scored highly for capital and bridge disbursements per mile (second) despite having the seventh-largest state-controlled highway system nationally.

Mississippi was ranked 25th by the Reason Foundation overall, with its score bolstered by high marks for high maintenance disbursements per mile and low urban congestion.

While the Mississippi legislature has opted against raising the gas tax, the Mississippi Infrastructure Modernization Act of 2018 will send 35 percent of use tax revenues by next year to cities and counties to assist with infrastructure.

The bill will additionally authorize $300 million in borrowing, with $250 million for the Mississippi Department of Transportation and $50 million for local infrastructure not administered by MDOT.

The other part of the package was the creation of a lottery, which started selling tickets just a couple weeks ago. The first $80 million in tax revenue annually will go to the state highway fund until 2028 and the rest will be put into the Education Enhancement Fund. Just the highway fund portion alone could add up to $720 million.

State gasoline taxes are levied in addition to the federal tax of 18.4 cents, which hasn’t been increased since 1993.

Many people like to ring in the new year with fireworks. And in Mississippi, it is easier than many other places to buy and use fireworks.

You have probably noticed temporary firework stands set up near your house in the past couple weeks and that is because Mississippi has a defined selling period. Retailers can sell fireworks during the two busiest seasons; the current period from December 5 through January 2 and from June 15 through July 5. And what retailers can sell and you can purchase is largely wide open.

But while state law provides for much freedom, many municipalities limit the use of fireworks in their city limits. Though not exhaustive, here is the rundown of whether fireworks are legal or illegal in Mississippi cities.

Fireworks are legal in the following cities:

Bay St. Louis, Horn Lake, Jackson (as of 2011), Natchez, Nettleton, Waveland.

The use of fireworks are banned in the following cities:

Aberdeen, Amory, Biloxi, Columbus, Corinth, D’Iberville, Diamondhead, Fulton, Hattiesburg, Hernando, Laurel, Long Beach, Meridian, Moss Point, Ocean Springs, Olive Branch, Oxford, Pascagoula, Pass Christian, Petal, Poplarville, Ridgeland, Southaven, Starkville, Tupelo, Vicksburg, West Point.

Disclosure: These regulations are based on recent news stories. Check with local authorities for most updated ordinance.

The default appears to be illegal, while it is largely legal in unincorporated portions of the counties.

One of the most common refrains from limiting fireworks is safety concerns and injuries caused by fireworks. But a 2017 report from the U.S. Consumer Safety Commission says “there is not a statistically significant trend in estimated emergency department-treated, fireworks-related injuries from 2002 to 2017.”

Rest assured, you are more likely to get injured from the new toy your son or daughter got for Christmas then from fireworks-related injuries.

Noise is the other big complaint concerning fireworks, particularly after a certain time. Of course, municipal noise ordinances can and already do police that issue.

So as you celebrate a new year, make sure you don’t run afoul with government regulators that have taken it upon themselves to limit your freedoms.

The cost of going by rail to New Orleans from Mobile will likely be prohibitive for most tourists, according to analysis by the Mississippi Center for Public Policy.

Even the best-case scenario for a train trip and rides to two tourist areas — Jackson Square and Uptown — would cost 65.8 percent more than driving by car, which includes parking near Jackson Square.

Our hypothetical trip, either by rail or by car, would involve our family of four visiting the area around Jackson Square — where the Aquarium of the Americas, the beignets and coffee of the Café Du Monde, the St. Louis Cathedral and the Louisiana State Museum Cabildo are within easy walking distance — and the Audubon Zoo in Uptown.

Just round-trip train tickets would cost a family of four at least $144 (if the one-way ticket was $18 per person) or as much as $288 (if the ticket was on the high end of estimates at $30 per person one way).

Adding in rides from Uber (during non-peak hours) to get to some attractions from the train station in the New Orleans Central Business District and the cost balloons to $189.87 (low end of train ticket estimates) to as much as $333.87 at the top end.

The best-selling car in Alabama and Mississippi is the Nissan Altima, which has a 16-gallon gas tank and gets 39 miles per gallon on the highway. With regular gasoline costing $2.14 per gallon in Mobile, a tank of gas would cost $34.24.

Parking at Harrah’s New Orleans casino parking garage is $5 per hour. Assuming a three-hour excursion to Jackson Square would cost $15.

Parking at the Audubon Zoo is free. The total by car adds up to $49.24. Using the standard federal mileage reimbursement rate still is cheaper than rail at $83.52.

Regardless of whether tourists decide to go by rail or if by car, taxpayers will be heavily subsidizing the $65.9 million project.

Mississippi has already committed about $15 million in state taxpayer money to the project, with Louisiana adding $10 million. Alabama is balking on whether to provide its share of the matching funds.

The Federal Rail Administration — under the Consolidated Rail Infrastructure and Safety Improvements Program (CRISI) — is providing up to $32,995,516 in taxpayer funds for improving crossings, bridges, sidings and other infrastructure along the route and adding a railroad station in Mobile.

A 2015 Amtrak study predicted that 38,400 passengers would utilize restored rail service, which was ended in 2005 before Hurricane Katrina made landfall, across the Gulf Coast.

It would also operate, according to the study, at a loss of $4 million that would have to be covered by subsidies from state and local governments.

The idea that the state can keep your property through forfeiture when you have not been convicted of a crime does not sit well with many people. And it doesn’t even do what its supporters like to promote.

The basis of civil asset forfeiture is formed around the idea that your property can be connected to a crime and forfeited to the state, whether you have been convicted of that crime or not. Supporters will often talk about the need to use civil asset forfeiture to deter large drug operations that may cross Interstates 10 or 20. But is that really happening in large numbers?

According to our analysis at Mississippi Center for Public Policy of the civil asset forfeiture database, only 12 percent of seizures have occurred along an interstate route over the past two years and the average seizure is valued at a little over $7,900.

While that is a relatively low number to begin with, there are several outliers that skew the numbers up. Ten of the seizures are of $100,000 or more and the sum of those adds up to a little over $2 million or 47 percent of all seizures. Those 10 seizures have an average value of $204,220, but only represent 2.1 percent of all seizures.

Removing the seizures of $100,000 or more lowers the average to $4,837. The average of the seizures with a total value of less than $50,000 is $4,274 and represents 97 percent of all seizures.

The vast majority of seizures are valued at less than $10,000, representing 84 percent of all seizures. Even smaller were 161 seizures for less than $1,000 or 34 percent of the total.

Cars and weapons remain the most popular items to be seized, but we also had video game consoles, televisions, and a collectible $5 bill.

The state has begun to slowly move in the right direction when it comes to civil asset forfeiture. A few years ago, the state mandated that all forfeitures be posted on a central database. This is the only reason we have a view into Mississippi’s civil asset forfeiture world.

And then in 2018, the legislature let administrative forfeiture die when the law authorizing the program was not renewed. Previously, administrative forfeiture allowed agents of the state to take property valued under $20,000 and forfeit it by merely obtaining a warrant and providing the individual with a notice.

A massive offensive was launched earlier this year to reinstate administrative forfeiture. Fortunately, those efforts were unsuccessful in the legislature.

Still, the bar remains low for forfeiting property. The state is still allowed to seize and keep property through civil forfeiture, a process that requires the state to go before a judge for an adjudication of whether the property should be forfeited, even if the owner does not file suit.

In reality, the cost to recover property, meaning attorney fees and court fees, is often higher than the value of the property forfeited, leaving little incentive to attempt to get your property back.

Seeing the unfairness in such a system, many states have begun to go further in protecting fundamental property and due-process rights. To date, 18 states require a criminal conviction to forfeit most or all types of property. And three states – Nebraska, New Mexico, and North Carolina – have abolished civil forfeiture entirely.

That is the direction in which Mississippi should continue to move. Criminals should not be allowed to keep their ill-gotten gains, but it should require a criminal conviction before the state can keep that property.

Because, save for a few outliers, rather than busting drug kingpins, law enforcement is more likely seizing iPhones, guns, or small amounts of cash.

The truth is that we don’t have to choose between supporting law enforcement or safeguarding civil liberties. We can protect our communities and our Constitutional rights.

This column appeared in the Meridian Star on December 12, 2019.

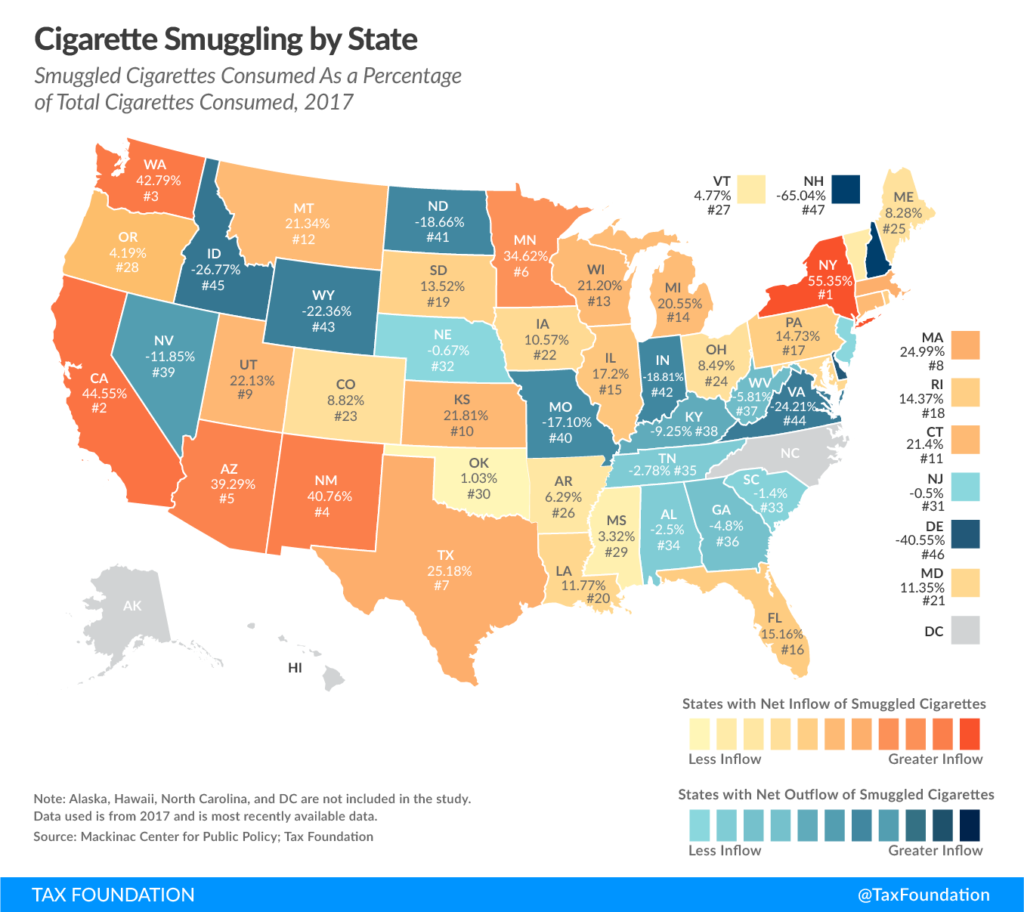

Mississippi has a small inflow of cigarettes that are smuggled from other states. A decade earlier, prior to raising taxes on cigarettes, the state has a small outflow.

That is according to a new analysis on cigarette smuggling from the Tax Foundation.

Cigarette taxes are one of the easier targets for lawmakers looking for additional revenue as you combine a large network of health advocates pushing for the tax and a shrinking, unsympathetic demographic of smokers.

That is why cigarette taxes have routinely been floated in the legislature since the last increase in 2009. Even though we know the unintended consequences, particularly with a massive hike such as the 221 percent increase that was unsuccessful last year.

Mississippi has a mild inflow of smuggled cigarettes at 3.32 percent, according to a new analysis from the Mackinac Center for Public Policy and the Tax Foundation. That means for every 100 cigarettes that are consumed in Mississippi, three are smuggled from other states. That is 29th highest in the country.

Mississippi is surrounded by states to the north and east that have lower (though slightly lower in some cases) taxes, including Alabama, Georgia, Kentucky, Missouri, and Tennessee. Each of those states actually have a positive rate of outbound smuggling, ranging from 2.5 percent in Alabama to 17.1 percent in Missouri.

In a review of cigarette smuggling in 2006, prior to the most recent tax hike, Mississippi had a small outbound rate of 1.7 percent.

The estimate is built around a statistical model which measures the difference between smoking rates published by the federal government for each state and legal paid sales. There are often yawning gaps between the two — the amount of cigarettes that should be smoked based on sales and the amount of smoking that actually occurs — and that difference is probably explained by smuggling.

The model can be used to make “what-if” estimates based on proposed changes in tax rates, as compiled by the Mackinac Center last year. At an excise tax of $2.18 per pack, as proposed in 2019, smuggling would leap from the current rate to 35 percent of the total market. That is, of all the cigarettes consumed in Mississippi after such a tax hike, 35 of every 100 cigarettes would be smuggled.

The model also reports that 21 percent of all consumption would be a function of “casual” smuggling. Casual smuggling is represented by individuals who typically buy lower-taxed smokes elsewhere for personal consumption.

The evidence from around the country and elsewhere tells us that relatively high cigarette excise tax rates can produce every sort of mischief, including undermining the very health goals such taxes were adopted to address.