The chicken was good, but what drove many through the doors of one of America’s most popular fast-food joints was the values the brand stood for.

It wasn’t just fried poultry; it was a large restaurant chain that unabashedly stood with their Christian foundation. They singlehandedly changed the game of fast food simply by introducing a bit of kindness to the process. And now, they’ve abandoned that foundation by relenting to the demands of the faith-hating progressive mob.

The CEO of Chick-Fil-A announced that they would cut their donations to two organizations after a range of LGBT protests. Now, who were these hate-filled, evil organizations, so clearly bent on darkness that all support had to be cut? They were the Salvation Army and the Fellowship of Christian Athletes. What kind of a world do we live in when the Salvation Army, which serves 25 million people around the globe annually, is treated as some despicable hate group?

The record ought to be set straight on these two groups. For those who don’t know, the Salvation Army was founded by William Booth to provide ministry and support to thieves, prostitutes, gamblers, and others who were often not accepted in traditional churches. The Fellowship of Christian Athletes provides support to tens of thousands of athletes and coaches around the world, binding them together in a community of faith.

Today, The Salvation Army helps to cure hunger, support those in poverty, fight human trafficking, support veterans, house the homeless, help disaster survivors, support the elderly, and end domestic abuse. They treat and support all people equally regardless of color, race, or creed.

And yet, today some despise them because they hold traditional Christian views. It is these very views which built the organization that has deeply impacted millions of lives, it is these very views that laid the foundation of love upon which so many could feel the courage and compassion to sacrifice for others, it these very views which have guided and shaped countless men and women around the globe.

Chick-Fil-A’s succumbing to the demands of the mob sets a horrifying precedent. If one of the largest companies in the world can be forced to reject the Salvation Army, then what hope does any small Christian business have?

Make no mistake, the Salvation Army will not be the last victim of the left’s relentless war against those of faith. If our modern cancel culture demands that even they be sacrificed on the progressive altar, then the mob will not relent until every religious-based foundation, mosque, hospital, synagogue, charity, and church closes its doors.

They would rather dismiss all the good that these organizations do on a global scale than see them hold an opposing idea.

After Chick-Fil-A relented from its support of one of the largest global charitable organizations, LGBT protesters demanded that the company start donating directly to LGBT causes as a sort of penance within the church of the socially woke. It won’t end there, the goal line of the progressive movement shifts ever leftward, constantly demanding more as though it were some ravenous beast. Perhaps Chick-Fil-A should rethink their strategy.

Any fan and patron of Chick-Fil-A likely knows the restaurant well. When one walks in, they will undoubtedly be greeted by a sign showcasing the chain’s humble roots in a small town store, founded by Truett Cathy. The plaque typically boasts that he did not invent chicken, but he did invent the chicken sandwich.

Today, I can only imagine Truett Cathy is rolling over in his grave on account of the betrayal by today’s company leadership and their decision to bow before the false god of potential profits.

A report released today by state Auditor Shad White’s office says taxpayers spend more on administrative costs for K-12 education than most of the other southern states.

Mississippi spent 28.74 percent of its K-12 expenditures ($4.2 billion annually with local, state, and federal funds included) on expenses outside the classroom, with only Oklahoma, the District of Columbia and Texas being higher.

Outside the classroom spending is divided into two subcategories of general and school administration and these costs include spending on salaries and benefits for administrators such as superintendents, principals and their staffs, district board expenses, operations and maintenance, legal services, and non-student travel.

According to the report, Mississippi spent 9.38 percent of its education budget in 2016on general and school administration spending, second only in the South to the District of Columbia (15.27 percent). Florida spent the least as a percentage of its budget (6.41 percent).

If Mississippi spent as much of its K-12 budget on classroom-related costs as the state that keeps the highest percentage of its budget in the classroom, Maryland, there would be $250 million available to spend on everything from teacher pay raises to supplies.

According to the report, Mississippi spent an average of 8.87 percent of its K-12 expenditures on general and school administrative spending from 2006 to 2016.

Conversely, the average percentage spent in the classroom by Mississippi taxpayers was third-lowest among the 16 states, which averaged 71.26 percent of their appropriations for K-12.

Mississippi spent 71.26 percent of its expenditures in the classroom, a drop from 2006 when classroom expenses added up to 72.29 of all spending on K-12.

The Office of State Auditor recommends that districts evaluate methods by which they can streamline or cut outside-the-classroom spending. White’s office also recommended that the MDE lessen its regulatory burden on districts to cut down on administrative costs due to compliance with mandates.

Lottery tickets will go on sale next week in Mississippi a short 15 months after the legislature legalized a state lottery in the 2018 special session.

Mississippians will be able to purchase scratch-off tickets beginning on November 25 at one of more than 1,200 retailers statewide. Power Ball and Mega Millions tickets, the multi-state games known for big payouts that have at times surpassed $1 billion, will go on sale later in 2020.

But you need to be older in Mississippi than most other states to purchase lottery tickets. The minimum age is 21. Arizona, Iowa, and Louisiana are the only other states that require you to be 21 to buy tickets. You have to be 19 in Nebraska. Every other state sets 18 as the age minimum.

That includes Arkansas and Tennessee. Mississippi’s other neighbor, Alabama, is one five states that do not have a state lottery.

The bulk of lottery profits in Mississippi – the first $80 million – will be directed toward infrastructure projects. Additional money will go toward education, which is traditionally the primary funding recipient from most lotteries.

Mississippi took a long and windy road toward a lottery

In 1992, voters in Mississippi cleared the way for a lottery by amending the state constitution to allow for a lottery, but there was little interest from the legislature over the next two plus decades. Especially with the creation of casinos along the Coast and Mississippi River and the revenue that gaming promised.

But that changed in 2018. For years, stories regularly ran of Mississippians crossing state lines to purchase lottery tickets as jackpots crept up. Popular support appeared to be on the side of a lottery. Many Republicans were outspoken in their support. And Gov. Phil Bryant came out in favor of a lottery and it became a solution for more transportation funding. And in August of last year, the legislature legalized a lottery in Mississippi.

But even that wasn’t easy. The House initially voted against the lottery conference report in a bipartisan vote of 61 opposed and 53 in favor. Legislators got another stab at it and it passed the House 58 to 54 on the second vote. It was an odd-looking board with the speaker and speaker pro tempore voting against it, but in the end the bill was adopted.

And Mississippians will soon be buying lottery tickets. If they’re 21.

Lottery tickets will go on sale next week in Mississippi a short 15 months after the legislature legalized a state lottery in the 2018 special session.

Mississippians will be able to purchase scratch-off tickets beginning on November 25 at one of more than 1,200 retailers statewide. Power Ball and Mega Millions tickets, the multi-state games known for big payouts that have at times surpassed $1 billion, will go on sale later in 2020.

But you need to be older in Mississippi than most other states to purchase lottery tickets. The minimum age is 21. Arizona, Iowa, and Louisiana are the only other states that require you to be 21 to buy tickets. You have to be 19 in Nebraska. Every other state sets 18 as the age minimum.

That includes Arkansas and Tennessee. Mississippi’s other neighbor, Alabama, is one five states that do not have a state lottery.

The bulk of lottery profits in Mississippi – the first $80 million – will be directed toward infrastructure projects. Additional money will go toward education, which is traditionally the primary funding recipient from most lotteries.

Mississippi took a long and windy road toward a lottery

In 1992, voters in Mississippi cleared the way for a lottery by amending the state constitution to allow for a lottery, but there was little interest from the legislature over the next two plus decades. Especially with the creation of casinos along the Coast and Mississippi River and the revenue that gaming promised.

But that changed in 2018. For years, stories regularly ran of Mississippians crossing state lines to purchase lottery tickets as jackpots crept up. Popular support appeared to be on the side of a lottery. Many Republicans were outspoken in their support. And Gov. Phil Bryant came out in favor of a lottery and it became a solution for more transportation funding. And in August of last year, the legislature legalized a lottery in Mississippi.

But even that wasn’t easy. The House initially voted against the lottery conference report in a bipartisan vote of 61 opposed and 53 in favor. Legislators got another stab at it and it passed the House 58 to 54 on the second vote. It was an odd-looking board with the speaker and speaker pro tempore voting against it, but in the end the bill was adopted.

And Mississippians will soon be buying lottery tickets. If they’re 21.

In this episode of Unlicensed, we talk about the latest controversy at Ole Miss after the journalism school cancelled a conservative speaker, why our reliance on federal funds is not a good thing, and how the Popeyes chicken sandwich compares to Chick-fil-A.

Enrollment is down at Ole Miss for the third consecutive year according to new data from the Institutions of Higher Learning.

The University of Mississippi, including the University Medical Center, has a fall 2019 enrollment of 22,273. It’s still (barely) the largest university in the state, but it is down 817 students from last year, or about a 3.5 percent drop. Enrollment was down 2.2 percent last year.

Overall, enrollment at the eight state universities is down 1.6 percent, with 77,896 students, compared to 79,193 students last year. Two years ago, enrollment stood at 81,378.

Mississippi State University, the second largest university in the state, had a gain of 252 students. State now has 22,226 students. They had the greatest gain in terms of the number of students, but Mississippi University for Women enjoyed the highest percentage increase at 3.8.

While no school had a bigger drop in terms of actual numbers than Ole Miss, Mississippi Valley State University had the largest drop percentage wise. They are down 6 percent. Alcorn State University also had a significant drop, 3.7 percent.

| University | Fall 2018 enrollment | Fall 2019 enrollment | Number change | Percent change |

| Alcorn State | 3,658 | 3,523 | -135 | -3.7% |

| Delta State | 3,716 | 3,761 | 45 | 1.2% |

| Jackson State | 7,250 | 7,020 | -230 | -3.2% |

| Miss. State | 21,974 | 22,226 | 252 | 1.1% |

| MUW | 2,711 | 2,813 | 102 | 3.8% |

| MVSU | 2,285 | 2,147 | -138 | -6% |

| Ole Miss | 23,090 | 22,273 | -817 | -3.5% |

| Southern Miss | 14,509 | 14,133 | -376 | -2.6% |

Southern Miss, which is down 376 students over the past year, remains the third largest university in the state. Valley remains the smallest at 2,147 students.

Mississippi is no longer the state most dependent on federal aid as a percentage of its budget.

The only reason the Magnolia State went down in the rankings is because three other states vastly increased their dependence, not because lawmakers in Mississippi were able to wean the state off federal aid.

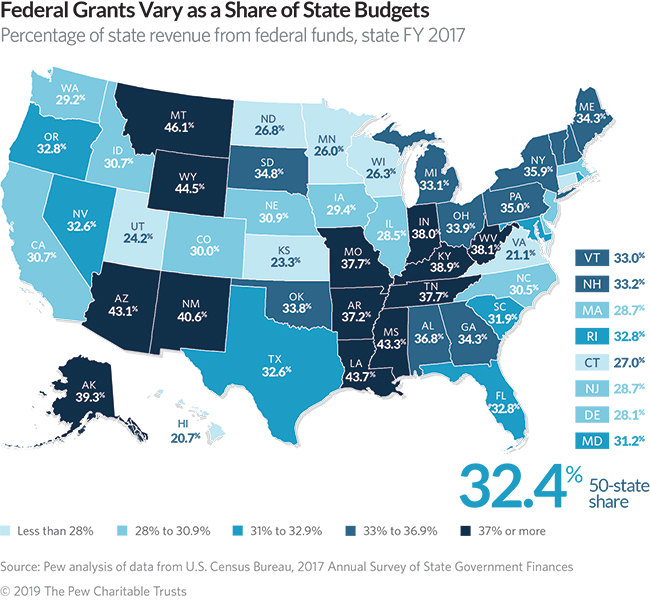

The recent analysis from The Pew Charitable Trusts reveals that, on average, nearly one third of state revenue came from the federal government in 2017, a near 50-year high. Federal grants helped states pay for healthcare, social services, education, transportation, and other infrastructure.

In the last four years on average, 44.38 percent of Mississippi’s budget came from federal funds.

Montana was the leader in federal funds, with 46.1 percent of its revenues coming from that source. Wyoming (44.5 percent) was second, Louisiana (43.7) was third and Arizona (43.1 percent) was fifth.

Only two of those states — Mississippi and Wyoming — have not expanded Medicaid under the so-called Affordable Care Act (also known as Obamacare) to able-bodied, working adults.

Hawaii (20.7 percent), Virginia (21.1) and Kansas (23.3) had the lowest shares of their revenue coming from federal funds.

On average, the share of state budgets nationally that came from federal funds added up to 32.4 percent.

Mississippi was one of seven states were federal funds were the largest revenue source, outstripping state tax revenues. The others included Alaska, Arizona, Louisiana, Montana, New Mexico, and Wyoming.

Federal funds represent about 45 percent of Mississippi’s total budget

| Year | Federal Funds | Total funds | Percentage |

| 2020 | $9,381,841,075 | $21,082,964,275 | 44.5 |

| 2019 | $9,372,443,748 | $20,855,445,148 | 44.9 |

| 2018 | $9,109,854,566 | $20,538,282,858 | 44.4 |

| 2017 | $ 9,129,408,882 | $20,905,097,426 | 43.7 |

In the fiscal 2020 budget, 44.5 percent of Mississippi’s revenues ($9.38 billion out of $21 billion) came from federal funds. In fiscal 2019, 44.9 percent of the state’s revenues ($9.37 billion out of $20.86 billion) originated from federal funds.

According to the analysis, 26 states had declines in their share of revenues coming from federal dollars. The trend, however, was that federal funds as a percentage of state budgets were at the fourth-highest level according to Pew data going back to 1961.

In 2017, federal dollars accounted for $639 billion of the $1.97 trillion in revenue collected by state governments.

Religion, Speech, Press, Assembly, Petition. These are the constitutional rights engraved on the entrance to the Overby Center for Southern Politics and Journalism.

This is a rather ironic inscription for a building which just last week prohibited Daily Wire contributor Elisha Krauss from speaking on behalf of a University chapter of Young America’s Foundation.

Blocking the event days before it was scheduled, the School of Journalism and New Media cited an unlisted regulation that prohibited “partisan” figures from speaking at the center.

Following an outcry by conservative student activists and an intervention by Chancellor Glenn Boyce to overrule the initial decision, Krauss will be making her debut on the Ole Miss campus tonight; this time at the newly renovated Student Union.

While the idea that censoring a career journalist who once served as a senior producer to The Sean Hannity Show and a co-host to the Ben Shapiro Show may feel antithetical to the mission of a journalism school; if you were to understand the current political climate at Ole Miss this would all seem as right as rain.

These days at Ole Miss, the academic class is evangelical in their pursuit of progressive values; seeking to censor, harass, and nullify the opinions of those students who still carry with them main street values.

While Boyce deserves credit for reversing the decision of the journalism school, there still is work to be done in promoting free speech on campus as well as addressing institutional biases in departments.

Maybe that will all start with Krauss reminding Ole Miss the meaning of those five words inscribed on the walls of the Overby Center.

The cost to win Mississippi’s governor mansion can get expensive when a competitive Democrat is on the top of the ticket.

Tuesday’s election won by Republican Lt. Gov. Tate Reeves over the state’s lone remaining Democrat in statewide elected office, Attorney General Jim Hood, was the second most costly in state history after the 2003 race.

Then-Gov. Ronnie Musgrove was defeated by Gov. Haley Barbour in an election that cost a combined $18 million.

The final tally for 2019 added up to about $16 million, with Reeves spending $10.8 million and Hood spending about $5.2 million. This was more than the last two gubernatorial races combined.

Hood’s spending added to about $13.43 per each of his 402,080 votes (46.6 percent), while Reeves spent $24.01 for each of his 449,746 votes (52.1 percent).

Those vote tallies are eerily similar to 2003, when Barbour defeated Musgrove 52.59 percent to 45.81 percent. Barbour had 470,404 votes against Musgrove’s 409,787 total. Turnout was higher in 2003 by 31,878 votes.

Hood had the best performance, both percentage-wise and numbers wise, in the last four cycles for a Democrat in a statewide race.

The closest in percentage was John Eaves, who lost to the incumbent Barbour with 42.1 percent of the vote in 2007. Eaves received 313,232 votes out of 744,039 cast.

Hood did better than predicted by several pre-election polls and won largely-Republican Madison county by 445 votes, swept all of the Delta counties and was competitive in GOP stronghold Desoto county with 37.7 percent of the vote (13,919 votes).

In the hotly contested U.S. Senate runoff in 2018, Mike Espy earned 40.9 percent of the 42,884 votes cast in Desoto county.

Comparisons are difficult between statewide and national elections, but the possible ceiling for Democrats in Mississippi can be extrapolated from the 2008 and 2012 presidential elections won by Barack Obama with high statewide turnout. He earned 43 percent (554,641) of the 1,289,865 votes cast statewide in 2008 and 43.79 percent in 2012 (562,949 out of 1,285,584 total).

Speaking of Desoto county, Obama received 30.51 percent in 2008 in (19,627 votes) and 32.79 percent in 2012 (21,575 votes).

The U.S. Senate race in 2018 had the second-best Democrat showing statewide in the 2000s. Espy received 420,819 votes or 46.4 percent in the runoff won by Sen. Cindy Hyde-Smith.

One of places where the 2019 election was won for Reeves was in northeast Mississippi. The eight most northeastern counties went decisively for the lieutenant governor after voting heavily for Hood in his elections as attorney general. The Gulf Coast was also a place where Reeves racked up big numbers, as he received 64.1 percent of all votes there.

Gov. Phil Bryant’s path to the governor’s mansion after two terms of Barbour was easier than Reeves (or Barbour).

In 2011, Bryant beat former Hattiesburg mayor Johnny DuPree in the general election 61 percent to 39 percent. DuPree spent $1.197 million in the race and received 348,617 votes. That adds up $3.43 per vote for the Democrat.

Bryant spent $5.58 million in the race and earned 544,851 votes. His spending amounted to about $10.24 per vote.

The 2015 election was one of the cheapest in recent memory. Bryant faced an unknown Democrat, truck driver Robert Gray. Gray, whose CB handle was the “Silent Knight,” spent a mere pittance on his campaign. His $4,835 in campaign spending added up to two cents per each of the 231,643 votes cast for him in the general election or 32.3 percent of votes cast.

Bryant spent $2.74 million on his race or about $5.74 per each of his 476,697 votes for 66.4 percent of the votes.