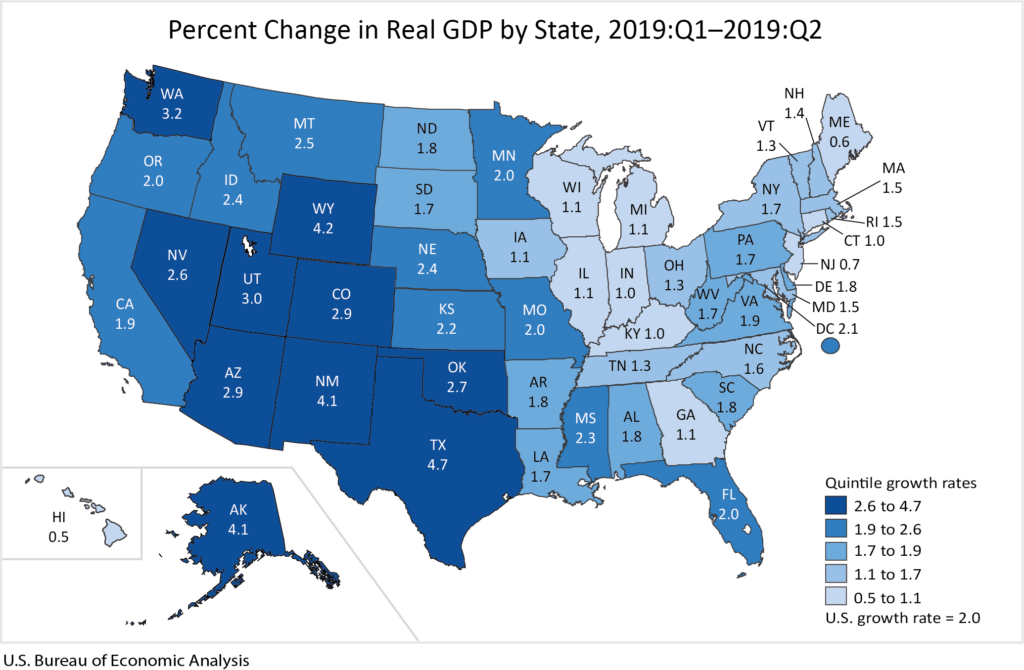

Mississippi’s real gross domestic product outpaced the national and Southeastern average for the second quarter of 2019.

Mississippi’s GDP grew by 2.3 percent compared to the first quarter of the year. This was part of a national trend that saw growth among all 50 states. The national average was 2 percent and the Southeast average, which does not include Texas, was 1.7 percent. Texas posted the strongest numbers in the country at 4.7 percent.

Professional, scientific, and technical services and real estate were two of the leading contributors to the GDP growth. Mississippi’s numbers, however, were below others in both sectors. Mining, which helped many western states see big gains, increased by 23.5 percent nationally.

A look inside Mississippi’s numbers reveals noticeable positives for the state, and areas that need improvement.

- Mississippi outpaced the Southeastern average in agriculture (and related industries), utilities, construction, durable goods manufacturing, retail, and finance.

- Mississippi trailed the Southeastern average in real estate and professional, scientific, and technical services.

- While wholesale trade was down nationally, Mississippi saw smaller loses than Southeastern and national numbers.

- Mississippi had the 3rd highest growth in government, behind only Maryland and New Mexico.

- Mississippi’s percentage of the U.S. GDP has been 0.6 percent for the last six quarters.

Percentage change in GDP, Southeast states

Mississippi led every Southeastern state in change of GDP. Florida was the only other Southeastern state above 2 percent. Kentucky had the lowest change, with a growth rate of 1 percent.

| State | Change | Rank |

| Alabama | 1.8 | 26 |

| Arkansas | 1.8 | 25 |

| Florida | 2.0 | 17 |

| Georgia | 1.1 | 44 |

| Kentucky | 1.0 | 46 |

| Louisiana | 1.7 | 29 |

| Mississippi | 2.3 | 14 |

| North Carolina | 1.6 | 32 |

| South Carolina | 1.8 | 23 |

| Tennessee | 1.3 | 38 |

| Virginia | 1.9 | 21 |

| West Virginia | 1.7 | 27 |

In the first quarter of 2019, Mississippi’s GDP grew by 1 percent compared to the Southeastern average of 2.6 percent.

Taxpayers will pay $300,000 to bring a distribution center for auto parts retailer O’Reilly Auto Parts to Horn Lake in Desoto County in north Mississippi.

According to Mississippi Development Authority spokesperson Tammy Craft, the agency will provide a $250,000 grant for workforce training and a $50,000 grant for equipment installation.

The company will refit a 580,000-square foot warehouse purchased in February at the DeSoto 55 Logistics Center and will create 380 job. Horn Lake will also provide property tax exemptions.

O’Reilly Auto Parts is moving its distribution center, one of the 27 it has nationally, from Little Rock, Arkansas to Horn Lake. Missouri-based O’Reilly Auto Parts has 5,000 stores in 47 states and will convert the former Little Rock distribution center into what it callsa super hub store.

In a news release, MDA executive director Glenn McCullough Jr. said that Mississippi’s location in the center of the Southeast provides strategic advantages for the company.

Gov. Phil Bryant said the announcement marks 1,300 state-assisted jobs that have been created via various projects in Desoto County.

These projects include:

- Medline Industries, which will bring 450 jobs to Southaven in DeSoto County and will receive $3.8 million from state taxpayers to build a medical supply distribution center.

- German agricultural equipment company Krone, which moved its headquarters and 45 jobs across the state line from Memphis to Olive Branch, will receive $7.3 million in property and inventory tax breaks in addition to a $250,000 equipment relocation grant. The company could also receive some income tax rebates that could add up to $675,000 annually over the next decade.

From 2012 to 2017, taxpayers have spent $678 million in just MDA grants alone from 2012 to 2017.

Select incentives for a few may generate headlines or photo-ops, but it does not generate sustained economic growth.

Economic development policy really means the state picking the winners and losers by employing direct subsidies and tax breaks to attract or promote specific businesses or industries. An authentic effort to grow our economy would not focus on giving targeted companies the assistance and resources without providing those to all companies and industries.

It is not fair to the current companies in Mississippi, who built their businesses without government help, to find themselves competing with companies subsidized by taxpayers. For too long, Mississippi has followed a policy that supposes “economic development” can be a meaningful driver of economic well-being in the state. It cannot. That policy is a losing one.

The evidence produced from analysis points convincingly to the conclusion that these targeted incentives do not produce long-term benefits in excess of their costs. In many cases, the cost-per-job is extraordinarily high. While some high-profile companies and their political allies may be better off, non-beneficiary companies may lose workers or experience wage increases, or both, and the state’s economic activity as a whole slows.

When political favor seeking is emphasized like this, it thwarts the private sector and tips the scales in favor of those companies and individuals with access to political relationships. It sends a message to the private sector that it should not focus on consumer-oriented actions, like product/service innovation or marketing, and focus resources instead on lobbying, legal representation, and elections. That’s not a recipe for sustained economic growth.

And we should also acknowledge the opportunity costs of corporate welfare. By eliminating corporate welfare, Mississippi, and every state in the nation with income taxes, could reduce their personal and corporate income taxes for everyone. Or, the money that is sent to select industries could instead be used for infrastructure, healthcare, education, law enforcement, or other basic functions of government.

Rather than increase the hand of government in our economy, we should trust the “invisible hand” of the marketplace and the proven incentive of profit and loss for the allocation of resources.

A report by a legislative watchdog says the Tunica County Board of Supervisors needs reforms to its procedures to ensure that it doesn’t engage in deficit spending and complies with state law on various issues.

The Joint Legislative Committee on Performance Evaluation and Expenditure Review (PEER Committee) issued the report in light of budgetary concerns that included:

- A $4.3 million deficit from October 1, 2012 to August 31, 2019.

- The county’s general fund had a negative balance of $4.9 million and the report says the county was using its road fund to pay expenses in contravention of state law.

- In April 2018, the board transferred $5 million to the general fund from its road funds, a practice also contrary to state law. An opinion from the attorney general informed the board that the transfer wasn’t permissible, but the board didn’t authorize repayment of the $5 million to the road fund until PEER began its investigation.

- The county assessed a nine-mill property tax for the road fund in 2015 and overtaxed county residents by $5.5 million from 2015 to 2017 because it was inaccurate in its projection of future road maintenance and construction expenditures.

- Minutes of the board’s meetings didn’t always specify why the body went into executive session as required by law.

- In fiscal 2014, the county was forced by a court order to refund $190,000 to one taxpayer after being in non-compliance with state law on the issuance of tax levies.

Tunica County revenues declined because of declining gaming fee expenses, falling 26 percent between 2013 and 2018. The county received 62 percent of its revenues during the same span from gaming fees.

The county has six casinos, down from a high of nine in 2014.

The report says there are also problems with the way the county spends taxpayer funds.

The board has an arrangement with the North Delta Regional Housing Authority on a program to build and rehabilitate homes in the county for the elderly and handicapped, but had no signed contract either between the NDRHA and the county.

The county later moved all administrative and operational responsibilities for the program to the non-profit Tunica County Housing Inc. in 2014.

The board voted to appropriate $1.6 million from county taxpayers to the organization, with no supporting documentation on how the funds were expended or whether any work. The Tunica County Housing Inc., which was involved in the program, spent 41 percent of its budget ($681,000) provided by taxpayers on administrative costs.

The Better Business Bureau and the Charities Review Council both agree that administrative costs shouldn’t exceed 35 percent for a grant-issuing organization.

The county’s attorney, John Keith Perry Jr., blasted the report in his response letter that PEER includes from examined agency or subdivision.

He said that county officials only had two “small windows of four hours” to review and respond to the PEER report, less than what had been given to other agencies in the past. He also accused PEER of being focused on “a few hot-button issues of a political nature.”

He also said the county reserves the right to do a more thorough response when allowed to study the full and final report.

A minor controversy erupted at Ole Miss last night when news began to spread that the Overby Center for Southern Journalism and Politics had rescinded the invitation of Elisha Krauss. The administration then fired back saying this was a unilateral decision and welcomed Krauss to campus.

Krauss is a conservative commentator, writer, and podcaster. She is a host and contributor at Ben Shapiro’s Daily Wire. Krauss previously hosted a morning show in Los Angeles with Shapiro for four years and produced the syndicated Sean Hannity Radio Show for seven years. She has also worked with Truth Revolt, PragerU, and ran a congressional campaign. She certainly has a conservative background, but also someone who has spent considerable time in the larger world of journalism.

The event was hosted by Young America’s Foundation.

According to the Overby Center, they do not allow “ideological” speakers at the Overby Center. Without passing judgments, you can review their spring 2019 schedule and decide for yourself if you find any of those speakers to be ideological.

My guess is if there is someone you agree with, they are not ideological. If you don’t agree, they are definitely ideological. That is how our brains work. And why we shouldn’t have arbitrary rules, particularly unwritten rules.

But it’s more than just that. Why is a school that has journalism in its name rejecting any speaker based on ideology, even if it is true that they have also turned down liberals? Shouldn’t this be the one place, at a minimum, where free speech is encouraged and debate is welcomed? Is this not what we are teaching young journalism students?

Shouldn’t we want as many different opinions as we can find, even if we disagree with what the speaker is saying? Would that not be better for everyone?

We can go on forever about why we must defend free speech, something that has gone out of fashion with a large segment of our society. But when you do that, you also no longer have to make personal judgments on who is or isn’t ideological.

At the end of the day, Ole Miss made the right call in overruling the decision of a few. It just should have never come to that.

Note: The original story said the Ole Miss School of Journalism and New Media cancelled the event when it was the Overby Center.

Officials from a pro-abortion group working with the Mississippi state Department of Health offered to give county health clinics a free iPad for encouraging participation by pregnant women in a study, who also received a participation gift.

Provide Inc. is a Cambridge, Massachusetts-based pro-abortion group that was brought in by former State Health Officer Dr. Mary Currier in June 2017 to get the state in compliance with mandates regarding Title X, a federal family planning program that provided the state with more than $10 million over the past two years.

These Title X mandates included options counseling, which included abortion, for pregnant women using services at county clinics.

The Provide survey was intended to gather data for MDH and the pro-abortion group on services received, quality of option counseling (which included abortion) and demographics. The survey began on April 19, 2018 and was closed on June 20 after a federal court decision.

The study was conducted on iPads exclusively loaded with the survey materials and provided to 14 clinics statewide. The goal was for Provide and MDH to survey 400 pregnant women. The clinics would get to permanently keep their iPad if they got an 85 percent completion rate.

According to the last data from the emails obtained by the Mississippi Center for Public Policy, 345 women completed the survey.

The pregnant women received a $15 gift card to Target for participating in the survey on the iPad. If they agreed to do an interview with a Provide staffer two weeks later, they received a $40 gift card.

According to an email, Provide intended to use the data to further its training program, while the MDH’s goal was to determine if Provide training helped with options counseling for pregnant women. The survey was aimed at adult, English-speaking pregnant women, with non-English speakers and minors excluded.

On April 25, State Health Officer Dr. Thomas Dobbs told his employees to “remove all educational material samples left by the group Provide.” He later said that some of the materials were seen at a local county health department and that they weren’t approved for use at MDH.

He gave instructions that all Provide materials were to be removed by May 1 and that any found were to be reported.

One of his subordinates told him and other officials that Provide held training in Jackson and that some of those employees at the training were provided some materials on site as resources.

On May 6, a 16-year-old pregnant girl completed the survey in Rankin County and received a gift card. Provide removed her information from the survey and the clinic received additional training in eligibility screening.

State officials, most notably Marilyn Johnson, who is the MDH’s director of Family Planning and Title V Maternal Child Health, were in constant contact with Provide employees during the study period providing updates on study participant numbers.

There are several reminders to the participating clinics that Provide materials were not approved by the MDH. Other emails requested the charging of iPads. One clinic director was asked if she was refusing to participate in survey and Provide employees wondered if someone else at the clinic could do it instead.

MDH received $4,522,634 in fiscal 2019, $5,520,200 in fiscal 2020 and will likely receive $4,100,000 in fiscal 2021 from the Title X grant program.

According to its 2018 IRS Form 990 tax form, Provide “focuses on making sustainable improvements to abortion access where it is needed most in rural communities in the South and Midwest.”

The group said in the 990 that it held training sessions at 630 health and social service sites in states where “women seeking abortion face particularly high barriers to accessing care.” The organization also said that its goal was to increase “trainees’ intention to provide referral for abortion by 69 percent.”

The states listed, in addition to Mississippi, included Alabama, Colorado, Florida, Illinois, Kentucky, Louisiana, North Carolina, Nebraska, New York, Ohio, Oklahoma and Tennessee.

The 9th Circuit of the U.S. Court of Appeals issued a stay on the injunctions on the Trump administration rule, allowing it to go into effect, while it considers the merits of the legal challenges. Oral arguments in the case were held on September 23.

Planned Parenthood has pulled out of the Title X program as a result of the new rule.

Today’s technology has helped usher in what is commonly referred to as the sharing economy. This is a broad term we use for an economic system where services are provided in exchange for a fee, via a third-party facilitator.

The most common examples of the sharing economy are ridesharing and homesharing apps, such as Uber, Lyft, Airbnb, or HomeAway. On the surface, escorting people around town in a car or renting out a spare bedroom aren’t exactly technologically advanced ideas.

It is the digital platforms or apps that have centralized the process and provided a certain level of comfort as a virtual middleman that has led to the explosion we are witnessing.

We see this in many other areas of our life as well. Peer-to-peer websites or apps, whether it’s Yelp, Facebook, Google reviews, and others, do a better job of providing feedback to potential customers than any government inspector.

Sure, government grades restaurants, but most people make their decisions on where to eat based on feedback from past customers. If an establishment was dirty, you’d read about it there, rather than from a government grade.

A common example of a profession that depends on positive feedback is home bakers, who are part of the rapidly growing cottage food industry. In deference to the incumbents who have paid a regulatory price, Mississippi limits what you can sell, where you can sell it, and how much you can make before you bow to the government and seek permission.

While many have attempted to warn us of the dangers of cookies or brownies baked at home in a non-government approved kitchen, we can find high-quality food via reviews from happy (or unhappy) customers.

Once again, we’ve always had word of mouth reviews among friends, but technology has helped bring that to the masses, elevated peer reviews, and forced businesses to bring greater attention to customer satisfaction.

In fact, if you suffer from repeated negative reviews, you will no longer be able to rent your house on Airbnb, nor will you be able to drive for Uber.

All of this is occurring naturally, rather than with the help of government. The response from those whose industry has been interrupted is not surprising. But it is unfortunate how government has attempted to intervene in the free market in too many instances.

When Uber first made its way to Mississippi, the reaction from many localities was to enact strict regulations. After all, the taxis had spent years building their industry cartel working alongside government. Now, you had a group doing it without government’s blessing.

One of the most egregious examples of an overzealous government was in Oxford, a college town who has a greater need for this service than most. They coordinated with the local taxi companies on regulations that effectively banned ridesharing options.

Today, Uber and Lyft operate freely in Mississippi thanks to the legislature pre-empting municipalities and opening ridesharing statewide. It is clear that the legislature’s work is not done in supporting consumers and entrepreneurs in the face of local government interference.

A map of current Airbnb rentals is a good indicator of places people want to visit. One might assume those governments would want to welcome visitors, but we have seen Gulfport and Biloxi take adverse actions, with Starkville considering new regulations that would limit the number of nights you could rent your house and enforce a residency requirement.

Meaning, you can’t buy a house and rent it out, something relatively common in a college town with SEC football. The net result would be fewer options for visitors.

The incumbent companies will complain that the playing field isn’t level with the new technologies. If that’s the case, we should regulate down, rather than up. We should make it easier for everyone to do business safely. Yes, it should be easy to rent out your house. Just like it should be easy to open a new hotel.

All of these new technologies are inherently positive. They are positive for the entrepreneur, who may need supplemental income and flexibility with their job so they can pursue an education and/or care for family. Regulating up and making it harder for these services to exist will hurt the people who need jobs the most. And they are a positive for the consumer who now has new options in what they can choose.

This is voluntary exchange and we should be encouraging it.

This column appeared in the Clarion Ledger on November 7, 2019.

Voters in Simpson county on Tuesday approved a referendum that will legalize alcohol sales countywide.

According to unofficial reports, 61 percent of voters supported the referendum, meaning Simpson county will soon become a ‘wet’ county.

Mississippi has a hodge-podge of liquor laws as the 1966 law that repealed prohibition provided for local control over alcohol sales. According to PEER, Mississippi has 31 dry counties, with three additional counties that are partially dry. However, most of those counties have some have localities that have either wet municipalities or resort area status, allowing the legal sale of alcohol.

Throughout Mississippi, there has been a strong move in that direction among dry counties as their numbers continue to dwindle.

Proponents of the referendum in Simpson county submitted the necessary 1,500 certified voter signatures for the referendum this past August. Previous efforts had stalled due to lack of signatures.

Dipa Bhattarai is suing the state so she can have the right to earn a living eyebrow threading without having to take hundreds of hours of irrelevant classes. She's not the only one having to jump through unreasonable hoops. Mississippi is one of the least economically free states according to an annual study by the Fraser Institute.

The Fraser Institute released its Economic Freedom of North America 2019 report Thursday and Mississippi was ranked 42nd with a score of 5.3 out of 10, ahead of only Kentucky, California, New Mexico, Oregon, Vermont, Alaska, West Virginia, and New York.

The study measures economic freedom in terms of three categories: government spending, taxes, and regulations and uses data from 2017, the most recent year data was available for all jurisdictions.

Mississippi ranked 44thin government spending, 36th in taxes and 40thin labor market freedom.

According to data from the Bureau of Labor Statistics, 20.5 percent of those employed in the state in work for a division of government, be it federal, state or local.

This figure outstrips manufacturing, retail, and food services.

The non-partisan Tax Foundation rated Mississippi 31stin its annual Business Tax Climate Index, with the state having the 10thlowest corporate tax rate while having a mid-pack (27th) individual income tax rate. The state’s sales tax was 34th highest in the nation while the property tax rate was 37thworst.

According to the Mercatus Center at George Mason University, the state’s regulations contain 117,558 restrictions and 9.3 million words. It’d take an individual 518 hours (or about 13 weeks) to read the state’s administrative code.

New Hampshire and Florida were the top two states in the Fraser Institutereport, which also uses the same metrics to measure economic freedom in states in Mexico and Canadian provinces.

Mississippi was ranked as one of the “Least Free” among the states by the Fraser Institute’s annual report, a place it has been all but two years since 1998. Mississippi’s 42nd ranking was the same as last year, when Mississippi scored a 5.2 out of 10.

Mississippi’s neighbors are doing much better in the rankings, as Alabama was ranked 35th(5.8 total score out of 10), Arkansas 32nd (6.0), Louisiana was ranked 26th (6.3) and Tennessee was third in the study (7.6).

The study was authored by Southern Methodist University economist Dean Stansel; Caminos de la Libertad head of research Jose Torra and Fred McMahon, who is the resident fellow as the Dr. Michael A. Walker Chair in Economic Freedom at the Fraser Institute.

The Fraser Institute, a Canada-based free market group, has conducted the Economic Freedom of the Worldreport for the last 30 years. The primary conclusion of the reports was that “economic freedom is positively correlated with per-capita income, economic growth, greater life expectancy, lower child mortality, the development of democratic institutions, civil and political freedoms, and other desirable social and economic outcomes.”

In the most-free states and provinces in North America, the average per capita income in 2017 was 9.2 percent above the national average compared to 3.4 percent below the national average in the least-free jurisdictions.

The trend line for economic freedom in the U.S. isn’t positive, according to Fraser Instituteresearch.

From 2003 to 2017, the average score for U.S. states in the all-government index fell from 8.23 to 7.92.