Gov. Phil Bryant is ending the last two months of his time in the governor’s mansion with approval ratings that are among the highest in the country.

According to Morning Consult’s gubernatorial approval rankings from the third quarter of 2019, Bryant has a 55 percent approval rating compared to just 26 percent of voters who disapprove, a positive spread of 29 points.

The 55-26 rating is good for 14th highest overall. The main difference is the majority of the governor’s ahead of Bryant have been in office for one full term or less. Bryant, of course, is wrapping up his eighth and final year.

In his two elections, Bryant set modern day high marks for Republican gubernatorial candidates. He won 61 percent of the vote against then-Hattiesburg Mayor Johnny DuPree in 2011, while winning 66 percent in 2015 against Robert Gray, a truck driver who was the surprise Democrat nominee four years ago.

About the survey

On a daily basis, Morning Consult surveys over 5,000 registered voters across the United States. Morning Consult conducted 533,985 surveys with registered U.S. voters from July 1 through September 30, 2019, to determine the Q3 2019 Governor Rankings.

The margins of error vary by state and party. You can see the margin of error for each governor here.

In each poll, Americans indicated whether they approve or disapprove of the job performance of their governor. For each question, they could answer strongly approve, somewhat approve, somewhat disapprove, strongly disapprove, or don’t know / no opinion.

Morning Consult obtained population parameters for registered voters from the November 2012 Current Population Survey.

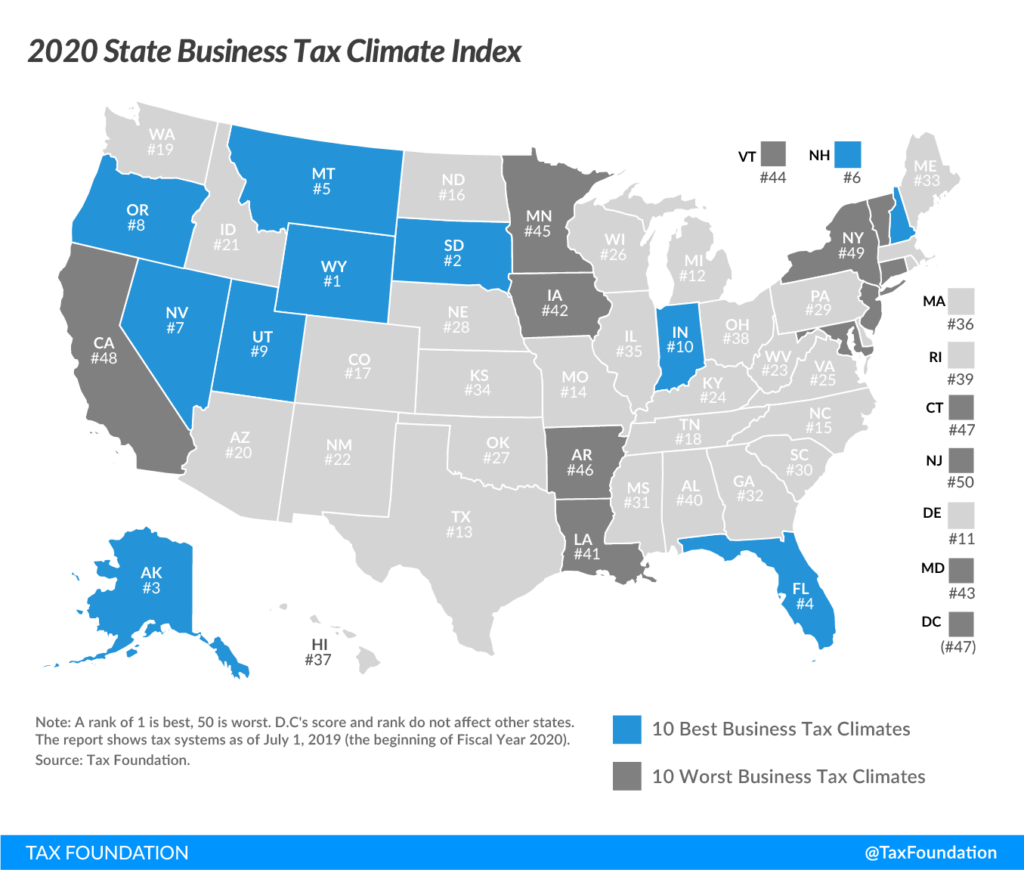

Mississippi’s tax climate dipped slightly last year as it remains in the both half nationally.

The Tax Foundation placed Mississippi 31st overall for taxes, including corporate, individual, sales, property, and unemployment insurance taxes. The only neighboring state to do better was Tennessee. Alabama, Louisiana, and Arkansas were rated 40, 41, and 46 respectively.

Wyoming was again the top-rated state, followed by South Dakota, Alaska, Florida, and Montana. The bottom five states, beginning with number 50, were New Jersey, New York, California, Washington, D.C., and Connecticut.

According to the Tax Foundation, the top states share a few similarities.

“The absence of a major tax is a common factor among many of the top 10 states,” according to the report. “Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate income tax, the individual income tax, or the sales tax. Wyoming, Nevada, and South Dakota have no corporate or individual income tax (though Nevada imposes gross receipts taxes); Alaska has no individual income or state-level sales tax; Florida has no individual income tax; and New Hampshire, Montana, and Oregon have no sales tax.”

Mississippi dropped a spot from last year. The state received its best marks for unemployment taxes (5th best) and corporate taxes (10th best). The corporate tax component measures impacts of states’ major taxes on business activities, both corporate income and gross receipts taxes. The unemployment insurance tax component measures the impact of state UI tax attributes, from schedules to charging methods, on businesses.

Mississippi’s worst tax categories were property and sales. It would be a good idea to lower our business tax burden on land, buildings, equipment, and inventory.

Mississippi has begun phasing out its capital stock tax, following an exemption added in 2018 with the first-rate reduction, from 2.5 to 2.25 mills, in 2019. The tax will slowly phase out through 2028, but the modest rate reduction is not enough to move the needle on Index rankings.

Voters in the Leland School District rejected a bond measure in September when it failed to receive the necessary 60 percent of the vote for approval. The Leland School Board has set December 10 for a re-vote.

The price of the bond to taxpayers will decrease from $8.75 million to $6.9 million, according to the Leland Progress.

While some have used this to decry the crumbling facilities or complain about state funding, one major issue should be addressed before moving to others: The district had 776 students last year.

That’s the size of a high school, or maybe one school, but you shouldn’t be expected to run and finance a school district of that size in a poor part of the state with little infrastructure.

Because as some talk about the challenges the district faces, this school district spends among the most per student in the state. According to the last audit of the district, it spent $13,523 per student. The state provides about 57 percent of funding for the district.

The cost per student and the state’s share of funding is considerably more than districts like Madison, Clinton, or Rankin.

It’s also considerably more than tuition at nearby private schools: Washington School is $6,792 for high school, it’s $5,395 (for Catholic students) and $6,395 (for non-Catholic students) at St. Joseph Catholic School, $5,775 at Indianola Academy, and $5,600 at Greenville Christian School. And I am guessing they don’t have problems with leaking roofs or air conditioning despite being about half the price.

Washington county’s population is about 46,000. It was over 72,000 in 1980. But it’s still home to four school districts. The Greenville School District is the largest with about 5,000 students. But you then have Western Line School District, with 1,851 students, the tiny Hollandale School District, with 581 students, and Leland.

Washington county school districts

| District | Students | Cost per student |

| Greenville School District | 4,955 | $9,367 |

| Hollandale School District | 581 | $12,740 |

| Leland School District | 776 | $13,523 |

| Western Line School District | 1,851 | $10,641 |

Over the past eight years, the state legislature has adopted 10 separate consolidation bills impacting 21 different school districts. By 2021, the state will have 13 fewer school districts than in 2014.

Washington county has yet to be part of that mix. Local residents may love their local school districts. Local legislators will continue to fight as hard as they can. And a bond, if successful, will be funded by those local residents.

However, at the end of the day, the school district gets the majority of its money from the state, meaning taxpayers throughout the state, not just Leland residents. And taxpayers have a right to know if their money is being spent wisely. A consistently underperforming school district with 776 kids that spends over $13,000 per student? I don’t know if that should be considered wise, especially when there are other options.

Mississippi’s school districts are inefficient compared to other Southern states

The issue isn’t just Leland. School districts in Mississippi serve a lower number of students, on average, than every other state in the Southeast, save for Arkansas. What does that mean? We are spending money on additional salaries, pensions, benefits, buildings, etc. that other states are not. This means less money in the classrooms.

| State | Total enrollment | Total school districts | Students per district |

| Florida | 2,721,459 | 67 | 40,619 |

| North Carolina | 1,443,163 | 115 | 12,549 |

| Virginia | 1,279,544 | 135 | 9,478 |

| Georgia | 1,744,240 | 199 | 8,765 |

| South Carolina | 718,322 | 82 | 8,760 |

| Tennessee | 960,704 | 142 | 6,766 |

| Louisiana | 720,458 | 126 | 5,718 |

| Alabama | 733,951 | 136 | 5,397 |

| West Virginia | 281,439 | 55 | 5,117 |

| Kentucky | 685,176 | 173 | 3,961 |

| Mississippi | 492,279 | 151* | 3,260 |

| Arkansas | 475,782 | 254 | 1,873 |

Source: National Education Association, “Rankings & Estimates 2014-2015”

The average district size among the 12 states was 9,467, almost three times the size of the average district in Mississippi. For Mississippi to be in line with that average, the state would need to see a reduction to 52 school districts, eliminating almost two-thirds of the districts in the state.

Florida is the biggest outlier in this group. Removing the Sunshine State from the mix would drop the average district size to 6,513. Even doing that, Mississippi would still need to drop to 75 districts to be at the average. That is a reduction of almost 50 percent.

Among neighboring states, if school districts in Mississippi were to serve the same number of students as school districts in Alabama, Mississippi would need to experience a reduction to 91 districts. To mirror Louisiana, Mississippi would need a reduction to 86 districts. And to match the same number of students per district as Tennessee, Mississippi would need a reduction to 73 districts. Either of these changes would represent a decrease of 40 to 50 percent of the districts in the state.

Additionally, the districts in Mississippi are largely unbalanced. Half of all public school students in the state attend school in one of just 28 school districts. Yet, 63 districts have less than 2,000 students and educate just 16 percent of students.

There is not a magic size for a district. There are poor performing large districts, starting with Jackson Public Schools, just as there are high-performing small districts. But this inefficient distribution of students, which results in excessive bureaucracy, costs taxpayers money and prevents dollars from making it to the classroom.

While there is overwhelming local pressure to oppose consolidation, the legislature should continue with the process of protecting taxpayer dollars and reducing the number of school districts in Mississippi.

As children in Mississippi and around the country prepare for a night of trick-or-treating, they may unknowingly run afoul with local laws.

These aren’t laws restricting criminal actions often associated with Halloween mischief, such as egging a house or smashing pumpkins that belong to someone else. Rather, these are restrictions on who can trick-or-treat, how late they can be out, and what they can or can’t wear.

A story on Roanoke, Virginia’s trick-or-treating laws went viral last year. In Roanoke, no one over 12 is allowed to trick-or-treat. Not only is it illegal, it is a misdemeanor punishable by up to six months in jail.

While the potential jail time might not apply, the city of Meridian also prohibits those over 12 from asking for candy. “It shall be unlawful for any person to appear on the streets, highways, public homes, private homes, or public places in the city to make trick or treat visitations; except, that this section shall not apply to children 12 years old and under on Halloween night,” the ordinance reads. And you have to be inside by 8 p.m.

Throughout the country, towns like Belville, Illinois, Bishopville, South Carolina, and Boonsboro, Maryland have similar age limits.

Meridian also restricts anyone over 12 from wearing a mask or any other disguise, unless they get a permission slip from the mayor or chief of police. Dublin, Georgia and Walnut Creek, California have similar mask restrictions.

The rest of your costume may also be illegal in some locales. In Alabama, it’s illegal to dress up as a minister, priest, nun, or any other member of clergy. Violators can be slapped with a $500 fine and a year in jail.

In a recent move that received national attention, the Kemper County Board of Supervisors approved a measure in 2016 that made it illegal for anyone to appear in public in a clown costume or clown makeup for Halloween that year. The ordinance expired the day after Halloween. That ordinance carried a fine of $150 for outlaws who wore clown costumes.

The conventional wisdom is that these ordinances aren’t enforced. Police aren’t asking boys who are starting to show signs of facial hair for identification to check their age. Chances are no one is spending 365 days in a county jail in Alabama for impersonating a priest or rabbi.

Which, of course, leads to the next question: Why have such laws? We already have laws on the books to restrict actual criminal activity. We don’t need additional laws that are confusing and do little but potentially ruin a fun night for millions of children.

We simply have too many laws in this country. It should not be government’s responsibility to regulate the behavior of children on a Halloween night running through the neighborhood in pursuit of treats. That responsibility belongs to the parents, just like it should on every other night of the year.

In this episode of Unlicensed, we talk about the MJI lawsuit against the city of Jackson over a new ordinance that will ban protestors near an abortion clinic. Should the government be allowed to outlaw speech they don't like?

All 122 seats in the state House of Representatives will be on the ballot in November, with Republicans looking to expand their current two-thirds majority.

With Rep. Nick Bain of Corinth switching parties before he qualified for re-election earlier this year, Republicans now hold 75 seats in the House. (It’s technically 74 with a vacancy in a Republican held seat.) The number of Democrats also dipped when Reps. Angela Cockerham of Magnolia and Steve Holland of Plantersville opted to run as independents, forgoing potentially challenging Democratic primaries.

Here is what we know

Heading to November, Republicans nearly have a majority just in terms of the number of seats Democrats failed to field a candidate. There are 55 seats with no Democratic candidate. There are 42 seats with no Republican opponent. Translation: There are very few competitive seats on the ballot.

Here are the remaining races with both an R and a D:

| District | Republican | Democrat | Notes |

| 3 | Tracy Arnold (i) | Janis Patterson | |

| 7 | Steve Hopkins (i) | Theresa Isom | |

| 10 | Brady Williamson | Bobby Dailey | Republican held open seat |

| 12 | Clay Deweese | Tiffany Kilpatrick | Democrat held open seat |

| 13 | Steve Massengill (i) | Pam Denham | |

| 15 | Mac Huddleston (i) | Pat Montgomery | |

| 17 | Shane Aguirre (i) | Cathy Grace | |

| 22 | Thomas Futral | Jon Lancaster | Democrat held open seat |

| 25 | Dan Eubanks (i) | Harold Harris | |

| 28 | Jerry Darnell | Matt Williams | Republican held open seat |

| 40 | Ashley Henley (i) | Hester McCray | |

| 53 | Vince Mangold (i) | Rita Goss | |

| 56 | Philip Gunn (i) | Vicki Slater | |

| 64 | Bill Denny (i) | Shanda Yates | |

| 68 | Jon Pond | Zakiya Summers | Democrat held open seat |

| 74 | Lee Yancey | Jason McCarty | Republican held open seat |

| 75 | Vance Cox | Tom Miles (i) | |

| 78 | Randy Rushing (i) | Joe Bradford | |

| 90 | Noah Sanford (i) | L. R. Easterling | |

| 97 | Sam Mims (i) | Ben Thompson | |

| 102 | Missy McGee (i) | Brandon Rue | |

| 105 | Dale Goodin | Matthew Daves | Republican held open seat |

| 115 | Randall Patterson (i) | Felix Gines | |

| 117 | Kevin Felsher | Inez Kelleher | Republican held open seat |

| 122 | Brent Anderson | Wendy McDonald | Democrat held open seat |

After winning by two points in 2015, Rep, David Baria (D-Bay St. Louis) opted against a run at a third term in the House this year giving Republicans their pickup best opportunity. District 12, despite being in Oxford, is still a slight Republican district. With Rep. Jay Hughes (D-Oxford) running for higher office, this is another potential opening, though certainly more challenging.

The only other competitive Democrat seat is District 75, currently held by Rep. Tom Miles (D-Forest). It’s a Republican-leaning district, but Miles has done just fine at the ballot box. He defeated Vance Cox, who he is facing again this year, 63-37 in 2015.

Democrats are challenging a dozen or so Republican incumbents, yet the territory isn’t that great. Every district held by Republicans is a “Republican” district based on a partisan voting patterns. District 40 may be shifting away from Republicans, but Rep. Ashley Henley (R-Southaven) did win 69 percent of the vote in 2015. District 102 certainly entices Democrats, yet Rep. Missy McGee won nearly 68 percent in a 2017 special election – in a district Democrats targeted and spent money on.

Regardless of where Democrats look, they will need to win in districts where statewide and national Republicans generally win 60 plus percent of the vote. Can Cathy Grace defeat Rep. Shane Aguirre in Tupelo? Can Shanda Yates topple Rep. Bill Denny in Northeast Jackson? Perhaps, but the numbers aren’t on their side.

Because right now, if you want to defeat a Republican incumbent, your best chance to do so is in the Republican primary.

Independent’s Day

We may see two independents elected for the first time in nearly two decades, though both Holland and Cockerham took divergent paths to their current efforts.

Holland is facing a challenge from Rickey Thompson, a former Lee County Justice Court Judge, who was removed from the court four years ago for various judicial misconduct violations. Thompson, who is black, made this a racial issue, as did his supporters. Holland, who was first elected in 1983, choose to avoid a Democratic primary that is overwhelmingly black.

Cockerham was one of two Democrats to land a committee chair four years ago and is in line for another powerful spot if she returns. Her willingness to side with Republicans has put her at odds with the Democratic leadership, and she is in an overwhelmingly Democratic district. She escaped a primary four years ago despite her close relationship with the Speaker. She was unable to do so again, so she decided to run as an independent.

Best case scenario

For Democrats, you need a net 15 seat pickup for the majority. That’s not happening so you really have to be happy with a couple seats and knocking the Republicans out of their “supermajority” status.

For Republicans, you need 7 seats for 82, which would be a two-thirds majority. That's likely impossible, this year, or ever, just based on the districts, so you want to see your incumbents win and pick up District 122, and then knocking off Miles and picking up District 12 would be a bonus.

The Mississippi Association of Educators, one of the state’s teachers unions, has made various endorsements of statewide and legislative candidates.

They endorsed Jim Hood, Jay Hughes, Johnny Dupree, and Jennifer Riley-Collins; the Democratic nominees for governor, lieutenant governor, secretary of state, and attorney general.

They made numerous legislative endorsements earlier this year. Here is a review of endorsements among those who have general election opponents.

| District | Candidate | Party |

| SD5 | Steve Eaton | Democrat |

| SD9 | Kevin Frye | Democrat |

| SD10 | Andre DeBerry | Democrat |

| HD3 | Janis Patterson | Democrat |

| HD12 | Tiffany Kilpatrick | Democrat |

| HD15 | Pat Montgomery | Democrat |

| HD22 | Jon Lancaster | Democrat |

| HD28 | Jerry Darnell | Republican |

| HD64 | Shanda Yates | Democrat |

| HD75 | Tom Miles | Democrat |

| HD122 | Wendy McDonald | Democrat |

MAE is relatively small in Mississippi, with less than 5,000 members and no collective bargaining rights. But they are part of the larger National Education Association, who is no stranger to delving into virtually every left-wing political issue.

At their recent convention, NAE affirmed a new business item that reads:

“The NEA will include an assertion of our defense of a person’s right to control their own body, especially for women, youth, and sexually marginalized people. The NEA vigorously opposes all attacks on the right to choose and stands on the fundamental right to abortion under Roe v. Wade.”

This is a sharp change from prior years when they attempted to walk more of a middle ground on abotion, saying they support “reproduction freedom,” not abortion, while bragging about not spending money in regards to pro-abortion legal services.

As we have seen with the left, abortion has moved from “safe, legal, and rare,” to legal until the moment of birth and funded by taxpayers. And if you disagree with that you are evil, anti-woman, and essentially support violence against women.

But the bigger question is, is it necessary for the NEA, or its affiliates, to take a position on abortion? NEA is certainly a left-wing organization, that has never been in doubt. But, what does abortion have to do with education or teachers?

One might presume a rejected item that calls for a renewed emphasis on quality education would be more in line with the NEA. That read:

“The National Education Association will re-dedicate itself to the pursuit of increased student learning in every public school in America by putting a renewed emphasis on quality education. NEA will make student learning the priority of the Association. NEA will not waiver in its commitment to student learning by adopting the following lens through which we will assess every NEA program and initiative: How does the proposed action promote the development of students as lifelong reflective learners?”

But, alas, the union rejected those ideas.

All 52 seats in the state Senate are on the ballot in November, though there will be very few seats that are actually competitive. Republicans currently hold a 32-20 majority in the chamber.

The fact that so little attention has been given to the Senate, or the House, is probably a good indication that Democrats will be hard-pressed to make any gains and may actually lose a couple seats if things break in the GOP’s favor on election day.

Here is what we know

Democrats have 13 seats where they are running without a Republican opponent. Republicans have 23 seats where there is not a Democratic candidate. So that’s our base.

Here are the remaining races with both an R and a D:

| District | Republican | Democrat | Notes |

| 2 | David Parker (i) | Lee Jackson | Safe Republican seat |

| 3 | Kathy Chism | Tim Tucker | Republican held open seat |

| 5 | Daniel Sparks | Steve Eaton | Democrat held open seat |

| 8 | Ben Suber | Kegan Coleman | Democrat held open seat |

| 9 | Nicole Boyd | Kevin Frye | Republican held open seat |

| 10 | Neil Whaley (i) | Andre DeBerry | |

| 13 | B.C. Hammond | Sarita Simmons | Safe Democrat seat |

| 17 | Chuck Younger (i) | DeWanna Belton | Safe Republican seat |

| 19 | Kevin Blackwell | Dianne Black | Safe Republican seat |

| 22 | Hayes Dent | Joseph Thomas | Republican held open seat |

| 25 | Walter Michel (i) | Earl Scales | Safe Republican seat |

| 31 | Tyler McCaughn | Mike Marlow | Republican held open seat |

| 34 | Steven Wade | Juan Barnett (i) | Safe Democrat seat |

| 37 | Melanie Sojourner | William Godfrey | Democrat held open seat |

| 40 | Angela Hill (i) | Thomas Lehr | Safe Republican seat |

| 48 | Mike Thompson | Gary Fredericks | Democrat held open seat |

What seats are competitive?

Republicans are defending open seats in Districts 3, 9, 22, and 31. Districts 3 and 31 are overwhelmingly Republican and would constitute a major upset if Democrats were to pick up either. District 9 is a Republican leaning district, though anything around Oxford might make you nervous if you are a Republican.

But the other open seat Republicans are defending is the newly redrawn District 22, courtesy of a federal lawsuit. Lawmakers adopted a new district, which increased the black voting-age population from 51 to 58 percent, giving Democrats a much greater chance of picking up this seat. (And their best chance overall.) The Fifth Circuit Court of Appeals upheld the implementation of the district.

In District 10, Sen. Neil Whaley will have his first general election battle with an R next to his name. He won a non-partisan special election in 2017 in a district that is slight lean for Republicans, at best. It was previously held by a Democrat.

Democrats are defending open seats in Districts 5, 8, 37, and 48. District 48 is open because Gary Fredericks defeated longtime incumbent Deborah Dawkins by almost 20 points in the primary. Dawkins had never won more than 53 percent of the vote and the opening gives Republicans a clear path in a seat they have long targeted, only to come up short. And while it doesn’t always translate, the district had about 4,500 votes in the GOP primary compared to 3,600 voting in the Democratic primary. It’s the most Democratic Senate seat on the Coast, but still leans Republican.

District 5 is an overwhelmingly Republican seat that is historically Democrat, a once-common trend that is now almost extinct. The difference is that this year many of the local officials switched to the Republican Party. While not quite as Republican, Districts 8 and 37 also lean GOP.

Best case scenario?

For Republicans, District 22 may be lost, but all other open seats and all incumbents hold. You then pick up the four Democrat-held open seats, giving Republicans a gain of three seats for the night and a 35-17 advantage, which is a two-thirds majority.

Republicans are teetering on the edge of capacity in the Senate. That would likely do it.

For Democrats, you split the four Democrat-held open seats and pick up Districts 9, 10 and 22 from Republicans. That would give the Democrats a gain of one seat on the night, though they’d still be deep in the minority.

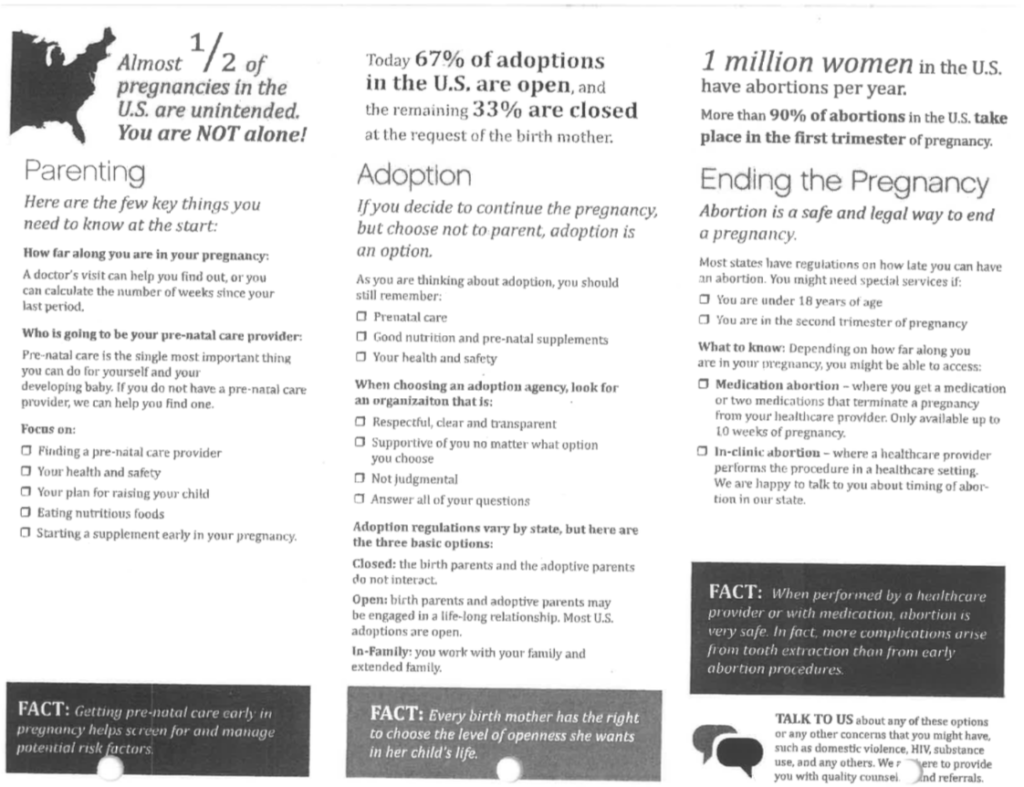

The Mississippi Department of Health worked with a pro-abortion group to distribute literature and helped the non-profit perform a voluntary study on pregnant women at 14 county health clinics around the state.

In an August 9 letter requested by state Sen. Angela Hill (R-Picayune) to the legislature’s watchdog, known as the Joint Legislative Committee on Performance Evaluation and Expenditure Review or PEER Committee, the Mississippi Department of Health detailed its relationship with the non-profit Provide, a pro-abortion group.

According to Guidestar, a non-partisan charity monitoring group, Provide’s mission is ensuring access to safe abortion for all women in the United States.

Provide was involved to assist the MDH with compliance with the requirements of a $286 million federal family planning program called Title X. In June 2017, the U.S. Department of Health and Human Services conducted a site visit and found the state not in compliance with requirements for options counseling, which included abortion.

According to the letter, Provide gave training to MDH employees in late 2017 and early 2018 to facilitate implementation of a corrective action plan. There were no contracts between state officials and Provide, according to an examination of the state contract database.

In addition to training, Provide was approved by the Institutional Review Board to issue several iPads loaded with a voluntary client survey to several county health clinics statewide. The survey was intended to gather data on services received, quality of option counseling (which included abortion) and demographics.

In an August 9 letter to the PEER Committee, MDH claimed that no publication or information from Provide was used to counsel patients.

That response contradicts one email from MDH.

In one email sent on April 25, State Health Officer Dr. Thomas Dobbs said that he had ordered the Provide educational materials from county health clinics removed months ago. He also said several complaints had been received about some clinics still having the material on hand. He ordered them to have the materials removed by May 1.

According to its 2018 IRS Form 990 tax form, Provide is a Cambridge, Massachusetts-based 501 (c)(3) group that “focuses on making sustainable improvements to abortion access where it is needed most in rural communities in the South and Midwest.”

The group said in the 990 that it held training sessions at 630 health and social service sites in states where “women seeking abortion face particularly high barriers to accessing care.” The organization also said that its goal was to increase “trainees’ intention to provide referral for abortion by 69 percent.”

The states listed, in addition to Mississippi, included Alabama, Colorado, Florida, Illinois, Kentucky, Louisiana, North Carolina, Nebraska, New York, Ohio, Oklahoma, and Tennessee.

Provide’s involvement with the MDH was ended because of a rule change in the Title X program by the Trump administration. The new rule which prohibited grant money going to programs where abortions are performed.

On June 20, the 9th Circuit of the U.S. Court of Appeals granted the Department of Health and Human Services’ request for a stay on several injunctions issued by district courts in three states that temporarily halted the Trump administration’s new rule. MDH stopped the study the same day.

The entire 9thCircuit is taking up the case and oral arguments were held on September 23, with a decision likely forthcoming.

MDH/Provide timeline

- June 2017 – After a site visit by the U.S. Department of Health and Human Services, the state is found not to be in compliance with Title X regulations regarding option counseling (including abortions).

- Last quarter of 2017 and first quarter of 2018 – Pro-abortion group Provide helps train state officials and county health department workers in options counseling.

- April 19, 2018 – Study conducted by Provide on options counseling administered voluntarily to pregnant women using services at several county health clinics begins.

- February 2019 – The Trump administration issues a new Title X rule that prohibits the provision of grant money to abortion providers.

- April 25, 2019 – Dr. Dobbs instructs MDH employees to not hand out Provide educational materials since they aren’t state-approved.

- June 20, 2019 – The state ends the Provide study after a decision by the 9thCircuit of the U.S. Court of Appeals keeps the Trump Title X rules in effect.