In this episode of Unlicensed, we talk about Mark Zuckerberg's recent speech in defense of free speech in the midst of political attacks by many who want to be the next president of the United States. And we spend a few minutes talking about the early days of Facebook.

Over the past year, a steady stream of op-eds have appeared in the Daily Leader and other media outlets promoting either Medicaid expansion or something called Medicaid reform.

These terms are not being accurately used, creating a false dichotomy for the uninformed reader. In order to have a balanced dialogue about both Medicaid expansion and Medicaid “reform,” we should begin by defining what is meant by both.

Medicaid is a joint federal-state health insurance program mostly controlled by the federal government. Most important, federal law determines the baseline for eligibility. States, however, are somewhat free to add additional coverage populations and services. The Affordable Care Act (“Obamacare”) attempted to force every state to expand Medicaid coverage to include able-bodied childless adults earning up to 138 percent of the federal poverty level.

The Supreme Court nullified this expansion as unconstitutionally coercive in a 2012 decision, NFIB v. Sebelius. Thereafter, states were free to decide for themselves whether to expand Medicaid to able-bodied childless adults. To date, 14 states, including Mississippi, have declined to expand Medicaid.

When policymakers debate “Medicaid expansion,” they are properly considering whether to expand Medicaid to able-bodied childless adults earning up to 138 percent of the federal poverty level. For some reason, the ACA deemed this population as most worthy of coverage, offering a 90 percent funding match. No other population is eligible for this match – not children, not the disabled, not the elderly.

Medicaid “reform” is a little bit harder to define. Some on the Left want to “reform” and “expand” Medicaid by creating a “Medicaid for All” program. Some on the Right would “reform” Medicaid by eliminating it altogether. In all fairness, neither the complete expansion nor the complete contraction of a program is a “reform.” In common parlance, a “re-form” implies the preservation of the form of the existing thing, even if that thing undergoes an extensive overhaul.

Seen in this light, it is clear that – contrary to a recent op-ed, “A conservative vote for Jim Hood” – allowing Mississippi hospitals to act as another managed care provider is not a reform. This is not to comment one way or another on whether the “Mississippi True” plan is sound or not.

It is simply to let people know that adding another managed care provider to the Medicaid insurance marketplace is a lot like adding another fast food provider to Brookhaven’s current offerings. Whether its McDonald’s or Burger King or Taco Bell, they pretty much all do the same thing and aren’t going to bring about a “reform” of anyone’s eating habits.

The second usage of the phrase “Medicaid reform” refers to a plan promoted by the hospitals called Mississippi Cares, which includes the hospital-run managed care plan. This plan would be based on a program signed into law by Mike Pence when he was governor of Indiana.

Over the past few years, the “[insert state] Cares” plan has made the rounds in Republican states. Another recent op-ed – “Medicaid reform needed in Mississippi” – tells us that what Tate Reeves calls Medicaid “expansion” is actually what the hospital association calls Medicaid “reform.”

In fact, the Healthy Indiana Plan (HIP 2.0) is both an expansion and a reform, albeit a very mild reform. Five years in, HIP 2.0 is showing the limits of what states can accomplish by tinkering around the edges of Medicaid. To begin with, Indiana’s Medicaid work requirement is being challenged in court, as are similar requirements in other states. Second, the copays are quite low, albeit higher than traditional Medicaid.

For these and other reasons, the plan is not paying for itself. In 2014, Pence’s office explicitly promised that “HIP 2.0 will not raise taxes and will be fully funded through Indiana’s existing cigarette tax revenue and Hospital Assessment Fee program, in addition to federal Medicaid funding.”

Yet, in 2019, Indiana increased taxes on several fronts in order to help pay for higher than anticipated Medicaid costs. Indiana lawmakers also came very close to tripling the cigarette tax because, as the Indiana Hospital Association now readily admits, “The hospitals’ share [of HIP 2.0] is increasing at an unsustainable rate, and increasing the cigarette tax can help provide necessary relief to hospitals.”

Perhaps worst of all, Indiana’s health care costs for employer-based insurance plans are so high that out-of-state companies have adopted the mantra of “ABI: Anywhere But Indiana.” As a January 2019 report demonstrates, not even millions in profits from Medicaid expansion is preventing hospitals from shifting costs to consumers with private insurance.

Indiana’s experience with Medicaid expansion is the same as every other state’s: expensive and of arguable value for anyone but the hospitals. There is no reason to expect different results for Mississippi, even if expansion is cloaked in a veneer of “reform.”

This column appeared in the Daily Leader on October 20, 2019.

Those hoping to have the opportunity to cultivate hemp in Mississippi are keeping a close eye on the Hemp Cultivation Task Force.

The task force was created by the legislature earlier this year and will provide their findings on hemp in Mississippi prior to the 2020 legislative session. The group has held two public meetings, with a third scheduled for late November.

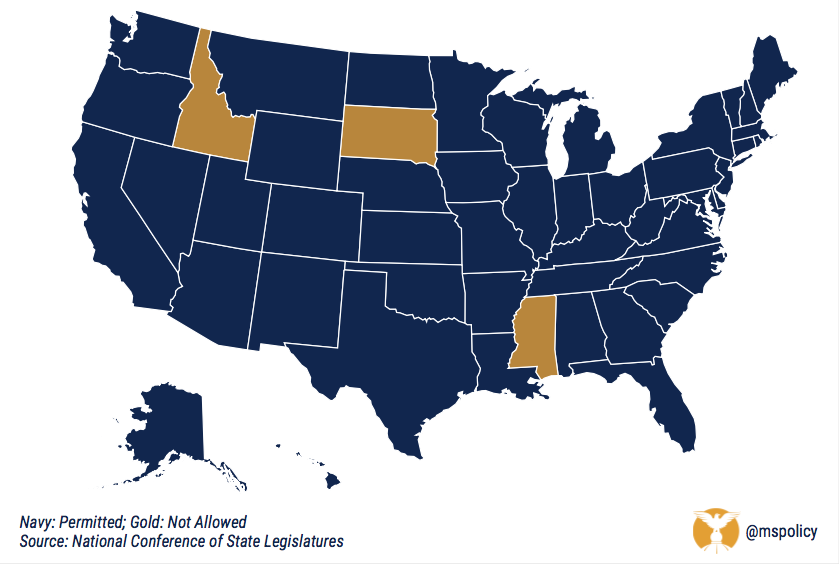

Since the time the legislature passed on legalizing hemp in Mississippi earlier this year, a number of states have chosen to move forward. We’re at the point where virtually every state – 47 total – have ok’d hemp cultivation. That doesn’t mean they are necessarily harvesting hemp right now. Just that they have begun the process.

Today, Mississippi, South Dakota, and Idaho are the holdouts.

States where hemp is legal

We don’t know what the task force will recommend. But no one should be surprised to see the deliberate process continue.

While farmers might want the state to legalize hemp, the tone of the task force hasn’t necessarily been positive. And the legislature can still do their own thing, though it might be odd to create a task force and then do something beyond what they recommend. But it’s possible.

Keep in mind that the House is already on record of removing hemp from the controlled substance list in Mississippi thanks to a floor amendment from Rep. Dana Criswell (R-Olive Branch). Attempts to make the change in committee had previously been killed, and obviously the House language was watered down to a task force when it hit the Senate a month later.

Meanwhile, South Dakota and Idaho are both preparing to act next year.

The South Dakota legislature legalized hemp last year, only to have it vetoed by Gov. Kristi Noem. They also have a Hemp Study Committee and are working on legislation for 2020. Same story in Idaho. Republican leaders have promised farmers they will be able to grow hemp next year.

So we shall see.

For now, the question is who will be the 48th state to legalize hemp? And will any state still make hemp illegal by the end of 2020?

Mississippi has more than 117,000 regulations on the books. It would take the average person 13 weeks to wade through the 9 million words of administrative code on record.

This data is from the Mercatus Center at George Mason University. They have been combing through the data on regulations among the 50 states. For various reasons they were only able to get results from 46 states, but it does provide a picture of what everyone is doing.

So what do we know?

Virtually every state has a regulatory problem. The average state has 131,000 regulations, putting Mississippi slightly below the average. But the bigger you are, the more regulated you are.

The most regulated state is California, which would come as a surprise to very few people. It has nearly 400,000 regulations. The other states in the top five are New York, Illinois, Ohio, and Texas.

South Dakota, Alaska, Montana, Idaho, and North Dakota are the least regulated. South Dakota had just 44,000 regulatory restrictions. Idaho, who is in the middle of a population boom, is the largest state among that group with about 1.7 million residents.

Why do we care?

Regulatory growth has a detrimental effect on economic growth. We now have a history of empirical data on the relationship between regulations and economic growth. A 2013 study in the Journal of Economic Growth estimates that federal regulations have slowed the U.S. growth rate by 2 percentage points a year, going back to 1949.

A recent study by the Mercatus Center estimates that federal regulations have slowed growth by 0.8 percent since 1980. If we had imposed a cap on regulations in 1980, the economy would be $4 trillion larger, or about $13,000 per person. Real numbers, and real money, indeed.

On the international side, researchers at the World Bank have estimated that countries with a lighter regulatory touch grow 2.3 percentage points faster than countries with the most burdensome regulations. And yet another study, this published by the Quarterly Journal of Economics, found that heavy regulation leads to more corruption, larger unofficial economies, and less competition, with no improvement in public or private goods.

Mississippi’s regulatory burden, by agency

| Agency | Regulations |

| Department of Health | 20,248 |

| Department of Human Services | 12,530 |

| State Boards, Commission, and Examiners | 10,204 |

| Department of Environmental Quality | 9,158 |

| Department of Mental Health | 6,006 |

There are actions a state can take to free their citizens of this burden. One of the most common reforms is the one-in-two-out rule where every time a new regulation is added to the books, two must be removed by that agency or department. Similarly, sunset provisions require the legislature to determine whether a regulation is necessary and if it should remain.

Currently, regulations are written in the code and stay on the books in perpetuity. That isn’t good.

Simply because Mississippi is closer to the middle (rather than being among the worst) does not mean the state should be comfortable with our regulatory burden. In a state in need of economic growth, rather, we should find a way to remove unnecessary barriers and inhibitors.

Taxpayers are providing the funding for a seminar this week in Hattiesburg that features an education professor who co-wrote a book with Bill Ayers, the controversial Weather Underground radical leader and education professor.

According to Mississippi Department of Education spokeswoman Patrice Guilfoyle, Crystal Laura will be paid $5,000, plus travel costs, from federal funds. Laura will be one of the keynote speakers at Transforming Schools: Meeting the Needs of All Learners workshop that started Tuesday and ends Wednesday in Hattiesburg.

Laura, who is an assistant professor of educational leadership at Chicago State University, cowrote You Can’t Fire the Bad Ones! And 18 Other Myths about Teachers, Teachers Unions and Public Education with Ayers in 2018 and has written other books, including Being Bad: My Baby Brother and the School-to-Prison Pipeline in 2014.

The event is designed for educators from districts identified by MDE as at-risk and require more professional development, additional funding, and other assistance.

This program is part of the Every Student Succeeds Act that was signed into law by President Obama in 2015.

The event was sponsored by the MDE and the Mississippi State University Research and Curriculum Unit.

Laura’s seminar was to instruct seminar participants on the “equitable literacy skills required for Mississippi educators to better support the learning needs of vulnerable and/or minority students.” This would help educators attending the seminar “build their capacity to provide equitable and culturally responsive teaching.”

The other keynote speaker is Robert Jackson, a former NFL player and former teacher in the Indianapolis Public Schools. His session dealt with strategies for educating black and Latino males.

Ayers is a retired University of Illinois at Chicago professor and was the former leader of the Weather Underground. This leftwing domestic terror organization from the late 1960s and early 1970s performed bombings of the U.S. Capitol and the Pentagon in addition to other targets in New York and Chicago.

Thanks to illegal tactics by Federal Bureau of Investigation agents during its investigation into Weather Underground activities, a federal grand jury declined to indict Ayers and other group members over the bombings and other illegal activities.

According to an examination of data from the Mississippi Center for Public Policy, Lawrence County had the highest two-year per capita average of fines and forfeitures in the state at $55.57.

Those numbers have a large caveat, skewed by $1.28 million in fines and forfeitures in 2016 after the sheriff’s department there earned $103,057 in fines and forfeitures in 2017.

In 2015, the county had fine and forfeiture revenues of $98,961 and $116,664 in 2014.

Tiny Issaquena County (population 1,308) was second, with a running two-year average over 2016 and 2015 of $36.10 in revenue from fines and forfeitures. The county received $45,468 in 2015 from fines and forfeitures and $48,971 in 2016.

In 2016, fines and forfeitures represented 1.06 percent of Issaquena County’s revenues ($4,583,342) and 1.02 percent of revenues ($4,423,202) in 2015.

The county with the largest population in the top five, Simpson, averaged $26.23 per each one of its 26,758 residents for fines and forfeitures for third place. In 2017, fines and forfeitures ($642,093) accounted for 7.84 percent of the county’s revenues. In 2016, fines and forfeitures ($697,283) represented 5.36 percent of the county’s $ 13,006,437 in revenues.

According to a 2018 audit by state Auditor Shad White’s office, the Simpson County Sheriff’s Office didn’t maintain documentation for purchase of information and evidence (PIPE) funds and didn’t deposit funds within one business day into the county’s bank accounts. The county said in its response to the report that it had corrected both deficiencies.

Fourth was Jefferson County, with a two-year average of $182,409 in fine and forfeiture revenues or $25.67 per resident. Fifth was Franklin County, with a two year average of $182,409 and a per capita figure of $25.38.

The auditor’s office conducts audits, either directly or via an accounting firms, of the state’s 82 counties periodically. Listed under each county’s revenues was a category for fines and forfeitures, which can include traffic and other fines and forfeitures. Most of the data was from the fiscal years 2017 and 2016.

The auditor’s office had data from those years for most counties, but 23 did not and data from 2016 and 2015 was substituted.

The average statewide for the state’s counties was $21.16 in fines and forfeiture revenue per resident and counties averaged $428,743 per year in revenue.

Sixteen Mississippi cities earned at least $1 million in fines and forfeitures and the average for residents in cities and towns was $32.54.

Sheriffs are prohibited by law in Mississippi from using radar for traffic enforcement, so it can be surmised that most of the fines and forfeitures listed in the county audits by the Office of the State Auditor are likely seizures.

| County | Population | 2017 fines and forfeitures | Per capita | 2016 fines and forfeitures | Per capita | Two-year forfeiture average | Per capita average |

| Lawrence | 12,455 | $ 103,057 | $ 8.27 | $ 1,281,190 | $ 102.87 | $ 692,124 | $ 55.57 |

| Issaquena* | 1,308 | $ 45,468 | $ 34.76 | $ 48,971 | $ 37.44 | $ 47,220 | $ 36.10 |

| Simpson | 26,758 | $ 706,546 | $ 26.41 | $ 697,283 | $ 26.06 | $ 701,915 | $ 26.23 |

| Jefferson | 7,106 | $ 254,787 | $ 35.86 | $ 110,030 | $ 15.48 | $ 182,409 | $ 25.67 |

| Franklin | 7,788 | $ 190,843 | $ 24.50 | $ 204,434 | $ 26.25 | $ 197,639 | $ 25.38 |

| Jones | 68,461 | $ 1,189,335 | $ 17.37 | $ 2,085,672 | $ 30.47 | $ 1,637,504 | $ 23.92 |

| Montgomery | 10,023 | $ 241,087 | $ 24.05 | $ 233,427 | $ 23.29 | $ 237,257 | $ 23.67 |

| Amite | 12,326 | $ 290,246 | $ 23.55 | $ 248,354 | $ 20.15 | $ 269,300 | $ 21.85 |

| Tunica | 9,944 | $ 193,928 | $ 19.50 | $ 238,460 | $ 23.98 | $ 216,194 | $ 21.74 |

| Lamar | 62,447 | $ 1,249,443 | $ 20.01 | $ 1,452,579 | $ 23.26 | $ 1,351,011 | $ 21.63 |

*Data from 2016 and 2015

The Mississippi Justice Institute and members of Sidewalk Advocates for Life – Jackson, Mississippi announced a challenge to Jackson’s new prohibition on counseling and other free speech outside the state’s only abortion facility today.

The new ordinance bans individuals who are near health facilities from approaching within eight feet of any person without consent, for the purpose of engaging in various forms of speech such as counseling or education or distributing leaflets; bans people from congregating or demonstrating within fifteen feet of the abortion facility, and bans any amplified sound.

Violations of the ordinance could result in fines of up to $1,000 and 90 days in jail.

“Our clients are engaging in quintessential free speech, and they are doing so peacefully and respectfully,” said Aaron Rice, Director of the Mississippi Justice Institute. “They care deeply for the unborn and feel morally led to offer life-affirming alternatives to people entering an abortion facility. Jackson’s new ordinance is an attempt to silence our clients’ speech, and we are proud to stand with them and defend their rights.

“Regardless of what anyone thinks of our clients’ views, we all should recognize that they have the right to hold those views. And just as importantly, they have the right to express those views, and to try to convince others to adopt their views. That is the very meaning of a free society.”

In the past five years, Sidewalk Advocates for Life has trained thousands of volunteers to go to abortion facilities to simply offer loving, life-affirming alternatives to abortion. In that time, nearly 7,000 women and families have freely chosen the help provided and given life to their children.

“Women regularly accept our offer to help in the midst of an unexpected pregnancy, said Pam Miller, Co-Leader of Sidewalk Advocates for Life – Mississippi.“In fact, in partnership with other peaceful community members, more women than ever -- at least 30 this year alone -- have opted to take advantage of the free, alternative resources the Jackson community provides. We are committed to connecting women with the loving, life-affirming assistance they deserve, and we will continue to serve the women of Mississippi in a peaceful and law-abiding way.”

The lawsuit was filed in Hinds County Circuit Court. A copy of the complaint can be found here.

Many Americans around the country will not attend school or work today, and that is because, upon that day, we celebrate the life and accomplishments of Christopher Columbus, founder of the New World.

Unfortunately, many in our society, have now chosen not to recognize the name of this important holiday. In fact, many now claim this day in the name of Indigenous People. Such moral grandstanding dismisses the important historical and cultural significance of Columbus Day to millions of Catholics and Italians around the nation.

Rejection of Columbus Day is a disgrace and highlights modern progressives’ weak-willed insistence on placating the voices of mobs.

Much has been said about Columbus himself, but in this piece, I would like to discuss the origins of this day which we celebrate and its meaning for so many Americans. Columbus Day was unofficially celebrated in many cities and states as early as the 18th century but took on larger importance for many immigrant communities later on.

In 1792, New York commemorated the 300th anniversary of Columbus’ landing. Many Italians and Catholics organized annual religious events to honor the explorer. On the 400th anniversary of the landing, President Benjamin Harrison encouraged people to “so far as possible, cease from toil and devote themselves to such exercises as may best express honor to the discoverer and their appreciation of the great achievements of the four completed centuries of American life.”

Ultimately, it was in 1937, due to lobbying by the Knights of Columbus, that President Franklin Roosevelt declared Columbus Day a Federal Holiday.

Today, some oppose the legacy of Columbus and thus reject this holiday. Interestingly, those who stand against the day actually rest on a long tradition of opposition. Almost immediately from its founding, the day was opposed by many due to deeply ingrained biases against the Catholic faith and its followers.

For many decades in our nation, much of the country felt that one could not be Catholic and be a true American. Catholics were seen as Papists who held the Church as having greater authority than the president and American institutions, and thus many believed that Catholics could not be productive members of society. In public life, Catholics were demonized and belittled.

This deep-seated disgust for Catholics reared its ugly head consistently in public life. It can be seen in the vitriolic attacks against Al Smith, the first Catholic presidential candidate. Yet, it can also be traced all the way through John F. Kennedy’s presidential run, as he was frequently questioned and distrusted by many on account of his Catholic faith.

Furthermore, biases against Catholics served to further promote deep racism and resentment against Irish and Italian immigrants. For those who came to the United States seeking a better life, many found that they were not entirely welcomed by their new home both due to their faith and race.

Columbus Day became a central rallying point for Catholics. Christopher Columbus was viewed by many Americans as an initial founder of the nation, whose brave exploits ultimately led to the capacity for our great American nation to be established. Catholics seized upon this appreciation for the man and held up Columbus as a shining example that one could in fact be both Catholic, and a proud American.

Furthermore, Italians especially revered the great explorer as a testament to how their people had contributed richly to American life, and that they ought to be accepted fully into society.

Columbus Day represents what is best about America. The day symbolizes that ultimate goal of immigrants for integration into society, and our constant historical challenge to better meet the full definition of the rights promised to Americans in the Constitution, and the ideas promoted by our traditions.

Celebrating Columbus Day does not mean white-washing history. One can recognize the ills of Columbus’ actions, however, it is necessary to place his work within the context of the moment and the moral structures of the time.

It should never be forgotten how the day has empowered millions of Catholics and immigrants to make the claim that they, too, are proud Americans. Those who have done so should be ashamed of themselves for striking this day from their calendars. Rather than attempting to intellectually challenge our communities with a proper historical analysis of Columbus’ work as well as the origins of the day which celebrates him, they took the easy path and simply cast the day aside.

Well, as an individual with family origins in both the Italian and Native American communities, and as a proud Catholic, I am deeply disheartened to see so many willing to dismiss history and tradition in order to appease the mobs of trending opinion who readily decry that which they oppose, without the slightest bit of contextual understanding for history.

Neither Republican gubernatorial nominee Lt. Governor Tate Reeves nor his Democratic opponent Attorney General Jim Hood offered their endorsement for the medial marijuana ballot initiative that will be before voters next fall.

The Medical Marijuana 2020 campaign recently turned in over 100,000 certified signatures in their attempt to make Mississippi the 34th state in the country to legalize medical marijuana.

Hood didn’t say how he’d vote, rather offering a vague response that he will leave it to the medial professionals to make judgments on medical marijuana.

“I did two terms as District Attorney, 16 years as Attorney General,” Hood said. “I’ve been a drug warrior for all those years, and it hadn’t worked. Medical marijuana is something that should be left up to the doctors in the medical profession. I’ve seen a few studies that it may help people get off opioids, I just don’t want it to get in the hands of kids. That’s why I’ve been raising cane about vaping…I think it’s up to the medical profession to make those decisions on the value of medical marijuana.”

Reeves made comments similar to the GOP debate this summer, where he said he was opposed to the initiative, but would respect the will of the voters if the initiative passed.

“As a father of three girls, I’m going to vote against the amendment that’s on the ballot next year,” Reeves said. “If I am elected governor and the people of Mississippi decide to vote a different way than I do then I’m going to uphold the will of the people.”

If Mississippians approve the initiative, it will be part of an ongoing trend, particularly in Republican states. Last year, voters in Missouri, Oklahoma, and Utah approved ballot initiatives to legalize medical marijuana. Two years prior, voters in Arkansas, Florida, and North Dakota did the same thing.

What would medical marijuana look like in Mississippi?

If the ballot initiative is approved by voters in November, marijuana would be legal for those with a debilitating medical condition and would have to be authorized by a physician and receive it from a licensed treatment center.

Some of these conditions include:

- Cancer

- Epilepsy and other seizure-related ailments

- Huntington’s disease

- Multiple sclerosis

- Post-traumatic stress disorder

- HIV

- AIDS

- Chronic pain

- ALS

- Glaucoma

- Chrohn’s disease

- Sickle cell anemia

- Autism with aggressive or self-harming behavior

- Spinal cord injuries

If a physician concludes that a person suffers from a debilitating medical condition and that the use of medical marijuana may mitigate the symptoms or effects of the condition, the physician may certify the person to use medical marijuana by issuing a form as prescribed by the Mississippi Board of Health. The issuance of this form is defined in the proposal as a “physician certification” and is valid for 12 months, unless the physician specifies a shorter period of time.

That individual then becomes a qualified patient. After they do this, they present the physician certification to the Mississippi Department of Health and are issued a medical marijuana identification card. The ID card allows the patient to obtain medical marijuana from a licensed and regulated treatment center and protects the patient from civil and/or criminal sanctions in the event the patient is confronted by law enforcement officers. “Shopping” among multiple treatment centers is prevented through the use of a real-time database and online access system maintained by the Mississippi Department of Health.

The Mississippi Department of Health would regulate the cultivation of marijuana, processing, and being made available to patients. There would also be limits on how much marijuana a patient could obtain.