Two Mississippi Department of Transportation public affairs employees were indicted by a Hinds county grand jury this week on embezzlement charges over gift cards.

Jarrod Ravencraft, 49, was indicted on one count of embezzlement for using $10,000 worth of gift cards owned by MDOT and utilizing them for his own use from June 2017 until March 2018.

He was hired as MDOT’s Public Affairs director in 2013 and left the agency in July 2018.

Selena Sandifer, 40, was indicted on one count of embezzlement on September 10 for converting $1,000 of gift cards in December 2015 to her own use. Sandifer was a deputy director in the public affairs division and was hired in 2013.

The two could face up to 20 years in prison apiece if convicted.

The gift cards were to be distributed to Mississippi public schools to reward teachers who completed an MDOT safety education program known as the Transportation Safety Education Program that gave grants to schools.

Participating middle and high schools were required to use at least two transportation safety lesson plans, host several safety events at their schools and participate in training online. The school was also to have at least 60 percent of their students sign the Safe Driver Pledge on the MDOT website.

The safety program covers seat belt use, child safety seats, impaired and distracted driving, speeding, road dangers, safe pedestrian, and biking practices and school safety.

Schools could sign up for the program to receive MDOT funds and up to five teachers or administrators at each participating school could receive a safety leader award, with the Walmart gift cards as a reward.

MDOT has a budget of $1.105 billion in fiscal 2020, with most of it ($559 million) coming from federal funds. The rest comes from the state’s 18.7 cent per gallon tax on gasoline.

Black-market vaping products that have foreign substances added to them can be very dangerous. That’s obvious. But the calls for bans on vaping devices and why people are becoming sick are two different things. Unfortunately, they are being lumped together.

We know there has been an outbreak of sorts related to vaping. According to a Center for Disease Control and Prevention report, 530 people have been hospitalized with what is now known as Vaping Associated Pulmonary Illness, or VAPI. Three cases have been reported in Mississippi. Nine deaths have been reported nationally.

This has led to the initial reaction that we have seen among some officials who have called for a ban on vaping devices, or at least the flavored products that most users prefer. Unilaterally, governors in New York and Michigan have done just that.

Democratic gubernatorial candidate Jim Hood has also called for a ban on vaping devices. His Republican opponent, Tate Reeves, has taken a more nuanced approach.

But the illnesses and deaths do not appear to be from products sold legally at vape shops.

A study in the New England Journal of Medicine found 84 percent of those hospitalized in Illinois and Wisconsin reported using vaping or e-cigarette devices to consume substances purchased illegally on the black market.

Typical black-market substances include THC, the active ingredient in marijuana, cannabis wax and oil, and Vitamin E.

In a release earlier this month, the FDA noted a similar finding, stating, “Many of the samples tested by the states or by the FDA as part of this ongoing investigation have been identified as vaping products containing tetrahydrocannabinol (or THC, a psychoactive component of the marijuana plant) and further, most of those samples with THC tested also contained significant amounts of Vitamin E acetate.”

They, rightfully, warned consumers to avoid black-market vaping products and to not add any substances to the products purchased in stores.

As the early reports show, black-market products are already the problem. If we proceed to outlaw vaping or e-cigarettes, it will only create a larger black market. And likely more illnesses and deaths.

The Hemp Cultivation Task Force held their second meeting this week as they heard from agriculture experts and law enforcement about potential ramifications of hemp legalization in Mississippi.

Next year, the legislature will be able to act upon any recommendations or findings, or perhaps draw their own conclusions. But whatever they decide, we won’t be blazing any trails with hemp.

In fact, since the last task force meeting in July, the tiny number of states where hemp remains illegal became smaller. In July, Ohio Gov. Mike DeWine signed legislation legalizing the production of hemp in the Buckeye State. This follows the states of Georgia, Louisiana, and Texas legalizing industrial hemp earlier this year.

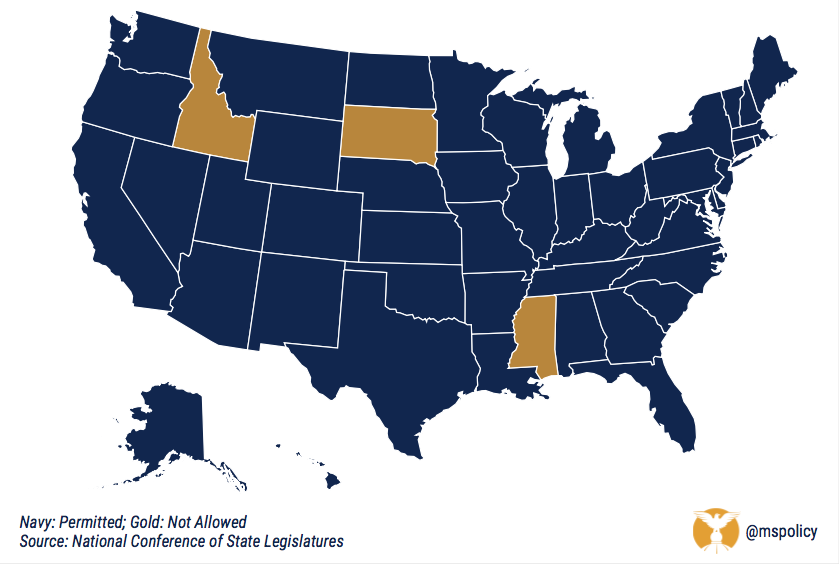

The states where hemp production remains illegal: Idaho, Mississippi, and South Dakota. And it remains illegal in South Dakota only because Gov. Kristi Noem vetoed a bill that would have made production legal.

States where the cultivation of hemp is legal

We have seen a massive move toward hemp legalization at the state level after the 2018 Farm Bill expanded the cultivation of hemp. Previously, federal law did not differentiate hemp from other cannabis plants, even though you can’t get high from hemp. Because of this, it was essentially made illegal. But we did have pilot programs or limited purpose small-scale program for hemp, largely for research.

Now, hemp cultivation is much broader, with the Farm Bill allowing the transfer of hemp across state lines, with no restrictions on the sale, transport, or possession of hemp-derived products. There are still limitations, but most states have taken the opportunity to find new markets for those who would like to cultivate hemp. Just not Mississippi.

So as a task force brings in experts to debate the merits of hemp in Mississippi and listens to opponents in law enforcement make claims about how they would be unable to differentiate between hemp and marijuana, the rest of the state can look on as hemp is now legal for 99 percent of the country. And we can wonder why something so easy can be so difficult for Mississippi.

The Mississippi Hemp Cultivation Task Force met for the second time Wednesday, with subcommittees offering their reports on what the ramifications of hemp cultivation would be for Mississippi.

Agricultural experts said that markets for hemp — which is derived from strains of the cannabis sativa plant with low amounts of the psychoactive substance in marijuana known as THC — are new in the United States and that cultivation would present lots of unknowns for farmers. Legal hemp would have a THC content of 3 percent or less.

Law enforcement officials complain that they can’t tell the difference between hemp and marijuana and would need more funds.

Mississippi is one of only three states where hemp cultivation is illegal. The other 47 states have legalized it for commercial, research, or pilot programs.

The U.S. Department of Agriculture will present regulations governing hemp cultivation nationally within the next couple of months after the 2018 U.S. Farm Bill authorized the growing and sale of hemp.

Hemp can be cultivated for its fiber, which can be used in insulation, rope, textiles, and other products. The seeds are also a good source of protein and can be eaten by humans or used for animal feed. The flowers of the plant can be used for cannabidiol, or CBD oil production that has benefits still being studied by scientists, including those at the University of Mississippi Medical Center.

Larry Walker is the director of the National Center for Natural Products Research at the University of Mississippi. He pointed to Kentucky, which was one of the early adopters of a pilot hemp cultivation program, as having advantages since hemp cultivation is very similar to a cash crop already grown in the Bluegrass State, tobacco.

Kentucky has issued about 110 processor licenses in 2019 and the industry is expected to create about 900 full-time jobs.

“Tobacco growers can do a lot of things as far as planting and processing that are very similar with hemp,” Walker said. “They’ve had great success, but some of the numbers there are quite inflated.”

Wes Burger is the associate director of the Forest and Wildlife Research Center at Mississippi State University. He said hemp has the potential to be a competitive crop in the state’s agricultural mix, but that isn’t a silver bullet or a path to prosperity.

He also said there will need to be markets set up for hemp and seed testing to find varieties that would grow best in Mississippi’s climate and soils. He also said there are no legal herbicides or pesticides for hemp cultivation, which could make it problematic. Also, the thick fibrous nature of the stems that makes for strong products also can damage agricultural equipment such as combines.

According to Burger, there are three types of cultivation. Many farmers grow hemp for the seeds and those type of farms will favor plants with some spacing between them. Fiber farmers will want their plants to grow closely together and be taller with fewer stems to maximize the amount of fiber harvested. Those wanting to grow plants for CBD production would grow them like vegetables such as cucumbers and the plants would be short and bushy.

John Dowdy, who is the director of the Mississippi Bureau of Narcotics, said that hemp cultivation would add problems for law enforcement since it requires a laboratory to determine whether the THC content crosses the 3 percent threshold.

He said that those costs could add up to $500,000 per year for the Department of Public Safety and that the DPS is already overwhelmed trying to stop Mexican heroin and methamphetamines and Chinese fentanyl.

The final meeting of the Hemp Cultivation Task Force is November 20 and the group will finalize their recommendations to the legislature, which is due in December.

The Mississippi Center for Public Policy continues to perform an analysis of the data from the civil asset forfeiture database and the results continue to raise more questions than they answer.

The law — which created the database — has been in effect for two years now and there have been 476 seizures as of September 20 (there were 315 by January), with a total value of $4,294,535.

The average seizure has increased slightly from $7,490 per seizure in the initial analysis done in January in the database’s first 18 months online to $7,952.

While that sounds like a substantial increase, there are several outliers that skew the numbers. Ten of the seizures were of $100,000 or more and the sum of those added up to $2,042,206 or 47 percent of all seizures. Those 10 seizures had an average value of $204,220, but only represented 2.1 percent of all seizures.

The highest dollar seizure remains the bust of several vape shops for selling spice (synthetic cannabinoids) by the Mississippi Bureau of Narcotics. MBN seized $644,421 in cash in Rankin County on August 5, 2018.

Removing the seizures of $100,000 or more lowers the average to $4,837. The average of the seizures with a total value of less than $50,000 was $4,274 and represented 96.6 percent of all seizures.

The vast majority of seizures, 399 according to the database, were less than $10,000, representing 83.8 percent of all seizures. Even smaller were 161 seizures for less than $1,000 or 33.8 percent of the total.

| Value of forfeited property | Percentage of all forfeitures |

| >$100,000 | 2.1% |

| >$50,000 | 3.4% |

| <$10,000 | 83.3% |

| <1,000 | 33.8% |

What was seized is also instructive. Most seizures (376 out of 476) involved currency and those averaged about $9,662. There were also 264 weapons seized, worth an average of $357 per firearm.

There were 89 vehicles seized, with an average value of $5,727.

Among the more unusual items included an Xbox One video game system (the department valued it at $129) that was forfeited to the DeSoto County Sheriff’s Department on June 10. Agents found 14 grams of marijuana, 100 THC-infused vape cartridges and some edibles at the home of the Xbox’s owner, who also lost a 2014 Ford Mustang to forfeiture.

A collectible $5 bill from 1963 (valued at $100 according to the Yalobusha County Sheriff’s Department) was seized on May 6 along with $10,314 in cash in a drug bust that included methamphetamine, marijuana, ecstasy, alprazolam, carisoprodol and hydrocodone. The forfeiture was contested in court.

There were also four televisions that were also forfeited.

The picture the database paints is incomplete, since the law requires only law enforcement agencies to list the description and value of the item seized, a copy of the notice to intent to forfeit, any petitions by property owners to contest the forfeiture and any judge’s order that would include those that cover final disposition of the seized property.

There are no requirements that law enforcement agencies list the type of drug that was involved with the seizure, the circumstances of the seizure or whether charges were filed in connection with the seizure.

Some law enforcement agencies, including the North Mississippi Narcotics Unit, include the related incident report that provides maximum transparency with the drug type and quantity, circumstances of the arrest, charges (if any) and the location.

Others provide this information, such as the DeSoto County Sheriff’s Department, in the notice to forfeit.

Mississippi lost 3,500 private sector jobs last month, while government added 1,100, reversing recent trends in both directions.

According to the latest data from the Bureau of Labor Statistics, preliminary numbers show Mississippi’s nonfarm payrolls declined from 1,171,100 in July to 1,168,700 last month. That still represents an increase of 15,000 jobs over the previous 12 months.

But the most glaring numbers from the report were the gains and losses by industry sector. Government, which accounts for nearly 21 percent of all jobs in Mississippi, added 1,100 jobs in August. Total government employment in the state now sits at 242,800. It was 240,900 a year ago.

Industry sector changes in Mississippi over past month, July to August 2019

| Sector | Payroll changes |

| Construction | -900 |

| Education and health services | -1,000 |

| Financial activities | +300 |

| Government | +1,100 |

| Leisure and hospitality | -1,500 |

| Manufacturing | -700 |

| Professional and business services | -800 |

| Trade, transportation, and utilities | +1,100 |

| Total | -2,400 |

Not everyone had a bad August. Each of our neighboring states added jobs last month. Alabama added 2,900 jobs, Arkansas added 2,300, Louisiana added 4,800, and Tennessee added 900.

For Louisiana, August was a turnaround in the state. They had previously lost nearly 4,000 jobs over the past year. They are now slightly on the positive side in terms of jobs created.

Payroll changes over the past 12 months among neighboring states

| State | Jobs change since Aug. 2018 | Job change % |

| Alabama | +41,800 | 2.05% |

| Arkansas | +15,600 | 1.3% |

| Louisiana | +1,000 | 0.05% |

| Mississippi | +15,000 | 1.3% |

| Tennessee | +45,900 | 1.5% |

Mississippi’s numbers over the past year aren’t terrible, but they certainly need to be better for long-term economic growth. To do this, we can look at other states and what the path to sustained economic prosperity looks like.

Many will claim this will come from the government. But all government can do is redistribute wealth from one person to another as it chooses, whether that’s a social welfare program or a corporate welfare one. Government only moves money around. It doesn’t create new wealth or build a bigger pie.

Only the private sector can do that. Individual initiative is the most powerful economic engine we have. Wealth is generated when individuals risk their own resources in hopes of meeting a need in the lives of other people or businesses, and do so in a manner that earns them a profit. That need might take the form of a new product, a more efficient service, or fresh, capital needed by a business to start or expand its operations.

It’s very easy, and very tempting, for any government official to give out tax dollars, get their picture taken, and talk about how much they are doing for you and me because of that new government initiative.

You don’t get a shovel for reducing regulations, freeing up the healthcare industry, or reforming occupational licensing. But the most helpful thing an elected official can do is be serious about pursuing policies that will make it easier for free enterprise. We’ve seen the results of our elected officials trying to manipulate, organize, and orchestrate the economy.

At the end of the day, to generate sustainable, long-term growth, the only option is to grow the private sector through lower taxes and a lighter regulatory burden. It doesn’t make for a sexy campaign slogan and many people who work in government or depend on government for jobs and contracts won’t like to hear it.

What does that look like?

There are numerous policy ideas lawmakers can and should consider to positively change the economic trajectory of the state.

1. Reform scope-of-practice and certificate of need laws to provide more access and competition in healthcare.

2. Eliminate overburdensome occupational licensing regimes that often only serve to keep entrepreneurs out of a specific industry or field of work.

3. Reduce our state’s regulatory burden that makes it more difficult and more expensive to operate a business in the state.

America has a poor record of accomplishment when it comes to blanket government prohibitions, yet that doesn’t mean lawmakers will use history as a guide in future decisions. The latest example: vaping.

In New York, Gov. Andrew Cuomo has issued an executive order banning e-cigarettes. Michigan residents will have a similar ban in a couple weeks courtesy of executive action. And in Mississippi, Democratic gubernatorial candidate Jim Hood has called for a ban on vaping devices after reports that a woman’s death in Monroe county may have been linked to vaping.

According to a Center for Disease Control and Prevention report, 530 people have been hospitalized with what is now known as Vaping Associated Pulmonary Illness, or VAPI. Three cases have been reported in Mississippi. Sadly, nine deaths have been reported nationally.

Therefore, we are told we must ban vaping and e-cigarettes. This would just be another example of unintended consequences due to the need to “do something” rather than looking at the entirety of the situation.

First, the potential bans ignore the fact that e-cigarettes have proven to help tobacco smokers quit. Since 2007, these products have helped an estimated three million Americans quit smoking and a recent study published in the New England Journal of Medicine found that e-cigarettes and vaping devices were “twice as effective as nicotine replacement at helping smokers quit.”

The Royal College of Physicians proclaimed in 2016, “in the interests of public health it is important to promote the use of e-cigarettes, NRT (Nicotine Replacement Therapy), and other non-tobacco nicotine products as widely as possible as a substitute for smoking in the UK.” We can presume that would apply in the United States as well.

And there is a cost savings benefit from current smokers switching to the replacement devices. A 2017 study by R Street Institute found that taxpayers could save $2.8 billion in Medicaid costs per one percent of enrollees over 25 years if users switched from combustible cigarettes.

A ban also ignores the question of where current users, particularly the teen vapers lawmakers are particularly interested in saving, would turn. After all, teen vaping is surging.

Yet, sales of e-cigarettes have been prohibited to those under 18 since 2016, so minors are already turning to the black-market. That should be our first clue that bans don’t work. Because the black market is the problem, as it usually is. So far, the overwhelming evidence is the deaths and illnesses related to vaping were the result of black-market substances, such as THC, the active ingredient in marijuana, cannabis wax and oil, and bootlegged cartridges using vitamin E. Not the products adults are legally purchasing today.

So, because teens, who are already prohibited from purchasing these products, have resorted to the black market, we must ban adults from being able to purchase these products, at least when it comes to the fruit and candy flavors that most prefer (whether we are talking about teens or adults trying to kick the cigarette habit). This will only lead to a larger black market, and more illnesses, and more deaths. All the things those in favor of banning the products seemingly are trying to prevent. Or maybe it will just push more users back to tobacco products, which, coincidently, are at an all-time low among minors.

We’ve played the prohibition game before. It doesn’t end well. During alcohol prohibition, individuals made their own liquor that was often much more dangerous than what you could legally buy prior to prohibition. Today, many people roll their own cigarettes in locales that have absurdly high taxes. Again, these are often more dangerous as you can get more nicotine by leaving out a filter.

And when it comes to vaping, teens can turn to YouTube for do-it-yourself videos on raising nicotine levels. This won’t change if and when any of these proposals to regulate or eliminate vaping or e-cigarettes becomes law.

The bans won’t provide an alternative to current cigarette smokers, nor will they stop teens from vaping. Instead, they will only increase lawlessness. Hopefully policymakers will review the full situation before making hasty decisions that sound good to their political ears.

All three of Mississippi’s charter schools improved their grades in the Mississippi Department of Education’s annual accountability grades released Tuesday.

The grades evaluate how school districts and individual schools are performing from year to year and 70 percent of districts were rated as a C or higher.

Reimagine Prep has gone up a letter grade in the last three accountability scores, going from a C last year to this year’s B. Smilow Prep improved from a D to a C and Midtown Public Charter School went from an F to a D.

There were other improvements with public schools. The number of schools that are considered failing (with a D or F grade) dropped from 37.6 percent in 2016 to 26.2 percent in the latest batch. The number of failing districts fell from 50 last year to 42 in this year’s scores.

The state Board of Education has to approve the accountability scores at its meeting today.

Last year, 28 districts improved their grades. This year, the numbers were even better, as 46 districts bumped up a letter grade. At the individual school level, 258 of the state’s 877 public schools improved by a letter grade from last year.

Petal was the highest scoring school district statewide, with Ocean Springs, Clinton, Oxford and Madison County rounding out the top five.

Thirty one districts received the top grade of A, up from 18 in last year’s grades, and nine of those earned an A rating for the first time. There were 35 districts that earned B grades and 35 more with grades of C. Last year, 42 districts earned B grades and 37 finished with C grades.

After three years of F grades that almost resulted in a state takeover, the Jackson Public School district improved to a D. All of the JPS high schools received a failing grade and only 22 out of the district’s 56 schools received a passing score.

Since 2011, when the MDE switched to a letter grade system for accountability scores, the JPS has scored no better than a D.

The accountability grades are partially based on the performance of students and the annual progress made on the Mississippi Academic Assessment Program tests for English language arts and mathematics, which are administered annually to students in the third through eighth grades and in high school.

Also figured into the accountability grades are the four-year graduation rate, student performance on biology, U.S. history and ACT tests, and student participation and performance in advanced coursework such as Advanced Placement.

According to an economist, Mississippi is one of the top states nationwide for health care openness and access, but improvements could be made.

Robert Graboyes is an economist who is a senior research fellow with the free market-oriented Mercatus Institute at George Mason University and specializes in the economics of health care.

The Healthcare Openness and Access Project (HOAP) is a 2018 study that Graboyes co-authored with Dr. Darcy Bryan and the Dartmouth Institute for Health Policy’s Jared Rhoads. It ranks the states on the flexibility and discretion that patients and providers have in managing health and healthcare.

Mississippi finished just outside the top 10 among the best states and the District of Columbia at 11th overall, better than Louisiana (12th), Alabama (20th), Tennessee (34th) and Arkansas (37th). Wyoming was ranked best, while New Jersey was the worst.

Where Mississippi fell short in the index was on pharmaceutical access, which measures the difficulty of obtaining certain classes of drugs, including experimental ones. The Magnolia State ranked 41st. The state also was ranked 44th for the number of taxes on healthcare services and devices.

“Mississippi's actually ahead of the curve on telemedicine, as it should be because it’s the perfect state for that,” Graboyes said.

He said the state’s regulation of medical practice is one of the nation’s least restrictive.

Graboyes said that two ways the state can improve its healthcare access is to allow nurse practitioners to practice without the supervision of a physician and to end the state’s certificate of need regime.

Certificate of need laws are designed to restrict competition among medical facilities and require that the building of a hospital or even the procurement of some specialized diagnostic equipment be approved by the state Board of Health.

“It’s hard to find a virtue to it (CONs),” Graboyes said. “It skews resources. Anything that blocks the supply of quality care, whether it be difficult medical licensing or restrictions or requirements such as a nurse practitioner who can’t hang his or her own shingle, is not productive.

“You have a couple of counties here that have no doctors and you could get a nurse practitioner or two in there who can do an awful lot that a doctor can.”

Graboyes said that one of the ways that healthcare access can improve and costs can fall nationwide in the future is for the industry to end the Progressive-era practice of eschewing business techniques for the healthcare industry.

He said the 1910 Flexner report, which eliminated proprietary schools and centralized teaching standards at medical schools, is where the concept of medicine as not a business but a social instrument.

He said the logic of having the healthcare industry run by doctors is the same as having the airlines being run by pilots.

“Of course medicine is a business,” Graboyes said. “It’s life and death, but so are a lot of other things. Where medicine differs from other professions is there is this terrible intimacy. The corporate practice of medicine isolated the medical field from business practices.”

He used an example of how surgical patients can remember the name of their doctor and his qualification, yet those who traveled on an airplane were unaware of the pilot’s name and how many hours he’d flown in his career.

Graboyes cites the example of a hospital chain in India which performs heart bypass operations at a fraction of the cost such a surgery would be in the United States. That surgery would cost $100,000 in the U.S., but in India, the surgery only costs $1,000.

Not only is the surgery in India cheaper, it gets results, Graboyes said, that are equal or even better than those in the U.S. or Europe.