In this edition of Unlicensed, the MCPP team talks about the results from Tuesday’s primary election.

Tate Reeves narrowly missed a majority and will meet Bill Waller in the gubernatorial runoff. Lynn Fitch and Andy Taggart will be in the runoff for the Republican nominee for Attorney General. Meanwhile, Michael Watson and David McRae advance. And there were some upsets in the legislature.

What should we look for in the runoff and in the general election?

Lt. Gov. Tate Reeves led the Republican ticket for governor but narrowly missed the majority needed to avoid a runoff. In the three-way race, Reeves won 49 percent of the vote, followed by former Supreme Court Justice Bill Waller at 33 percent and State Rep. Robert Foster at 18 percent.

Reeves and Waller will meet in a runoff on August 27. The winner will face Attorney General Jim Hood who cruised to the Democratic nomination in a field of eight candidates. Hood is largely seen as the most competitive Democratic nominee for governor since Ronnie Musgrove lost his re-election bid to Haley Barbour in 2003.

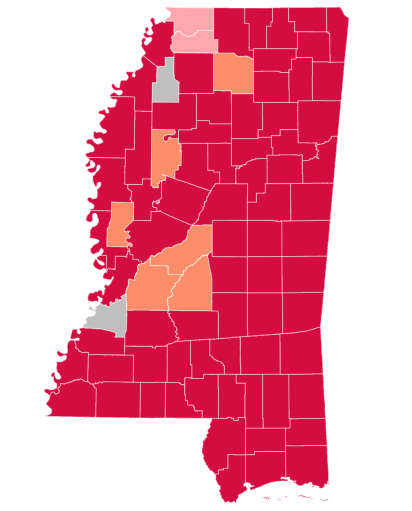

Among large Republican counties, Reeves cleaned up in South Mississippi. He won an outright majority in the lower six counties, including big numbers in population centers of Hancock (60 percent), Harrison (60 percent), and Jackson counties (65 percent). He won in the Pine Belt, east Mississippi counties such as Lauderdale and Lowndes, and Northeast Mississippi. Many of those counties were voting in the Republican primary in large numbers for the first time. With 97 percent of precincts reporting, Reeves won at least a plurality in 72 of the 80 counties that had reported numbers.

Republican gubernatorial breakdown by county

Reeves led most counties in the state, while Waller's base was centered around the Jackson area.

Waller’s strength was in the metro area. He easily won Madison (62 percent) and Hinds (59 percent) counties, but also won a plurality in Rankin county, Reeves home county. Those three counties gave Waller about one-third of his total vote. Foster, who is from Hernando, won Desoto and Tate counties.

For those looking just at numbers, 2019 will be the year Republican primary voters finally outpaced Democratic primary voters despite the GOP holding the governor’s mansion for 24 of the past 28 years.

In the race for Attorney General, Treasurer Lynn Fitch led the field and she will face Attorney Andy Taggart in the runoff. Taggart narrowly defeated State Rep. Mark Baker for the second spot. Baker won his home county of Rankin plus a few other smaller counties, Tagart won Hinds, Madison, and Yazoo counties. Fitch won the rest of the state.

State Sen. Michael Watson defeated Public Service Commissioner Sam Britton 53-47 for the GOP nod for Secretary of State. And David McCrae will be the Republican nominee for Treasurer, defeating State Sen. Buck Clarke 62-38.

In the State House, five liberty-minded Republicans defeated their primary opponents. This includes Reps. Joel Bomgar, Dana Criswell, Dan Eubanks, Ashley Henley, and Steve Hopkins. Notably, Bomgar and Hopkins both had opponents who had been endorsed by Gov. Phil Bryant but that wasn't enough to put them across the finish line.

And there looks to be a couple significant shakeups among the Republican leadership. Speaker Pro Temp Greg Snowden appears to have been defeated by Billy Adams Calvert and House Ways and Means Chairman Jeff Smith is trailing Dana McLean in his bid to return to Jackson.

Ten seizures worth $68,634 by the Hinds County Sheriff’s Office and listed in the state’s civil asset forfeiture database have no associated paperwork, according to an analysis of records by the Mississippi Center for Public Policy.

The Sheriff’s Office said that incident reports were only available for eight of the 18 forfeiture cases listed in the first 18 months on the civil asset forfeiture database. They said the other records were missing.

The eight incident reports provided by the sheriff’s office can be found here. Seven of them match up to records in the forfeiture database.

One of them has the same case number as one in the database, but the dates and facts of the case differ from the one listed online.

This case from March 28, 2018 involved the seizure of a 2009 BMW 750iL luxury car worth $10,000, but the incident report provided to MCPP listed a driving under the influence case with a different arrestee from March 3, 2018 that involved no seizure of property and a 2017 Chevrolet Malibu.

These are the cases without associated incident reports:

- This case from May 5, 2018 where the Sheriff’s Office seized $710 in cash and a Glock pistol worth $550. The notice of intent to forfeit says the seized property was found in close proximity to ecstasy and marijuana.

- A Volvo commercial truck ($10,000 value) and a Great Dane refrigerated truck ($15,000) were seized on June 27, 2018. No drugs were listed on notice of intent.

- This case from May 17, 2018 resulted in the seizure of a 1998 Honda Accord ($1,000 value) and $1,201 in cash. No drugs were listed in the notice of intent.

- The sheriff’s office seized $6,131 in cash, according to the notice of intent, on July 16, 2018. The NOI said marijuana was in close proximity to the seized cash.

- On August 31, 2017, the sheriff’s office seized $1,431 in cash. No drugs were listed on the notice to forfeit.

- The database lists a seizure from October 10, 2017 when $3,863 was seized. Marijuana was reported as the drug in proximity to the cash.

- The sheriff’s office reported a seizure from October 12, 2017 of $5,000 in cash, a $500 safe and a 12-gauge shotgun worth $200. Marijuana was listed as the drug in proximity to the seized items, but the forfeiture was later contested and no final decision is listed in the database.

- On January 10, 2018, deputies seized $10,520 in cash, citing the presence of marijuana as the justification for the seizure.

- On February 1, 2018, $1,040 in cash and a 20-gauge shotgun worth $100 were seized due to proximity to marijuana.

- This case from February 28, 2018 resulted in the seizure of $1,488 in cash. No drugs were listed on the notice of intent.

A new report from the non-profit Institute for Justice on the federal equitable sharing program finds that civil asset forfeiture does not deter crime and does not reduce drug use, the two most common refrains from proponents of civil asset forfeiture. At the same time, forfeiture activity increases as local economies suffer.

A 1 percentage point increase in local unemployment — a standard proxy for fiscal stress — is associated with a statistically significant 9 percentage point increase in seizures of property for forfeiture.

Mississippi has begun to make a move to scale back civil forfeiture. In 2017, the legislature let administrative forfeiture die when the law authorizing the program was not renewed.

Previously, administrative forfeiture allowed agents of the state to take property valued under $20,000 and forfeit it by merely obtaining a warrant and providing the individual with a notice. In order to get the property back, an individual was required to file a petition in court within 30 days and incur legal fees in order to contest the forfeiture and recover such assets.

The state is still allowed to seize and keep property through civil forfeiture, a process that requires the state to go before a judge for an adjudication of whether the property should be forfeited, even if the owner does not file suit.

And much like the federal program has not translated into less crime or drug use, the program in Mississippi has generally not led to big drug busts. In fact, if you remove one large bust from the equation, the average value of forfeited property is only $5,422 over the past 18 months. Less than 10 seizures statewide amounted to more than $60,000. One-third were for less than $1,000. A similar story is evident among Hinds County seizures.

The Office of State Auditor released its annual exceptions report this week. The auditor’s office staff recovered more than $1.5 million in fiscal 2019 and issued 64 demands for more than $4.6 million.

The report outlines funds from misappropriations by government officials from either violations of the law or accounting errors. The 64 demands issued by the auditor’s office were 24 more than last year.

"The Office of the State Auditor continues to serve as a watchdog organization to ensure that tax dollars are protected," said Auditor Shad White. "We pledge to perform our jobs with integrity, honesty and a commitment to excellence. We continue to protect the public’s trust through evaluations of accounting practices and aggressive investigations of alleged wrongdoing."

Taxpayers are owed more than $13.5 million in unpaid civil demand letters by governmental officials issued by auditor’s office.

If the official doesn’t pay the requested amount, the auditor can take the case to a local district attorney or the Attorney General’s office for prosecution. Public officials are required to have a surety bond to protect taxpayers and the auditor’s office can recover part of the demand from the bonding firm.

The report also details previous cases dealt with by the auditor’s office and the disposition of funds. The auditor’s office can issue demand letters to government officials responsible for misappropriated funds after an investigation concludes.

Among the cases the auditor’s office pursued in fiscal 2019 include:

- Town of Bay Springs— Former city clerk Randy James received a demand letter for $325,561 and the bond company has repaid $60,000, leaving a balance of $265,561.

- Town of Coldwater— Former town clerk George Nangah was served a demand for $302,973 on January 17 and signed a plea deal for one count of wire fraud in the U.S. District Court for the Northern District of Mississippi on April 29. No payment has been received and state charges are still pending.

- Town Creek Water Board — The auditor’s office issued demands to eight board members totaling $523,032. James Robinson ($85,877), Jim Bucy ($88,100), Jim Long ($11,797), the late John Morgan Jr. ($103,040), Kenneth Oswalt ($95,625), Luther Oswalt ($23,565), Michael Pannell ($90,810) and Teresa Winters ($24,323) received demands and no payments have been received.

- Holmes County Board of Supervisors— Supervisor Eddie Carthan was issued a demand for $184,184 on April 17 and no payments have been received.

- Warren County Tax Assessor’s Office — Former bookkeeper Paula Hunt was indicted for embezzlement and issued a demand for $165,329. No payments have been received.

- Humphreys County — Chancery Clerk Lawrence Browder was issued a demand in 2014 for $143,306 for exceeding the fee cap($90,000 according to state law). On January 10, he was indicted on count of fraudulent statements and representations and the auditor’s office issued a demand letter for $279,764 on January 14. No payment has been received.

- Oloh Volunteer Fire Department — Former secretary Jessica Delancey was issued a demand for $100,294. The bond company paid $50,000 and a balance remains of $50,294.

- Wayne County Sheriff’s Department — Sheriff Joseph Ashley was sent a demand for $53,554 and no payment has been received.

- Mississippi Board of Animal Health— Former director of accounting Chris Smith was served a demand for $33,892. Payment was issued by the bond company for $25,000, leaving a balance of $8,892.

- City of Moss Point — Utility supervisor Kenya Bowens and Lakeshia Benton were both indicted on single counts of embezzlement. On January 11, Benton was issued a demand of $4,218, while Bowens received one for $26,350 and both were paid by the bond company.

- City of Pascagoula — Former city manager Robert Huffman was issued a demand on May 31 for $6,819, which has been paid.

- Mississippi Attorney General’s Office— Former investigator Kelly Edgar was issued a demand for $6,188 on January 8 and payment was received in full.

- Harrison County School District— Former bookkeeper Rita Franke was issued a demand for misappropriation of funds on April 30 for $4,990 and no payments yet received.

- Mississippi Department of Health — Former environmentalist Willie Anderson was indicted on single counts of embezzlement and fraud on January 24. He was served a demand for $2,009 and no payments have been received.

As a new school year approaches for children, some 15,000-20,000 Mississippians won’t be settling into a traditional public or private school classroom.

Rather, they will be classified as homeschoolers, though that definition ranges from those who are part of co-ops to those who take classes online to those who follow standard curriculum at home to those who take a more unschooled approach. Or maybe it’s a little of all that and more.

While the numbers are just estimates without a formal registration process, we have seen homeschooling jump quite significantly – both in Mississippi and nationwide. According to federal data, the number of homeschoolers more than doubled over the first decade over the 21st century.

And there is no reason to believe those numbers are doing anything but growing.

After all, it’s easier than ever to homeschool, and to be as engaged (or not) as you would like. Thanks to the power of the Internet, and social media in general, a group of moms (or dads) can easily organize a trip, whether it’s to a museum, zoo, water park, etc., as a group without any formal organization. It’s easier than ever to meet with other homeschool families, to share ideas, or to exchange books and curriculum. Or to just get encouragement from local families.

Reasons families give for homeschooling

| Reason | Important percent |

| Concern about the environment of other schools | 91% |

| To provide moral instruction | 77% |

| Dissatisfaction with other schools | 74% |

| To provide religious instruction | 64% |

| Nontraditional approach to child’s education | 44% |

| Child has special needs | 16% |

Source: National Center for Education Statistics

And Mississippi makes it easy to homeschool, as they should. Families just have to file an annual certificate of enrollment with your local attendance officer by September 15. Beyond that, there are no regulations concerning curriculum or testing, nor do you need to provide any additional information to the local school district.

Still, that hasn’t stopped school districts in Mississippi from trying.

Last year, Greenville Public School District Deputy Superintendent Glenn Dedeaux said the district is “legally responsible to ensure every child of educating age receives an adequate education” and he warned that not all homeschool curricula “are approved by the Mississippi Department of Education to meet the necessary standards.” Dedeaux also implied that homeschoolers must take subject matter tests to graduate. Not true.

We also have the story of a Mississippi mom who was arrested on truancy charges. Her child had previously been enrolled in public school, but she chose to homeschool him because of health reasons. She decided to begin homeschooling the following year, but was arrested before the September 15 deadline to file her notice to homeschool.

And school districts in general have taken it upon themselves to require more than a notice to homeschool at time. The Natchez-Adams School District tried to demand homeschoolers provide receipts for curriculum purchases. They likely aren’t the only district who has asked for information parents aren’t required to provide.

Our guess is as homeschooling continues to grow in popularity, we will continue to see school districts overstep their authority. And the state might be interested in enacting new regulations as well.

We can hope they won’t.

If you went to the Nehsoba County Fair in hopes of hearing candidates for the top offices in the state preach fiscal conservatism or ideas to shrink the size of government, you came away disappointed.

Numerous candidates – both Democrats and Republicans – spent the bulk of their time, as they have spent most of their campaigns, singing from the big government hymnal. And if they get their way next year, we could be looking at a much larger government, a larger budget, and higher taxes for all.

The most common bi-partisan item was the need to expand Medicaid, though we have also been told there is a “Republican” way of moving more people to government insurance. We like to cite Indiana. After all, Vice President Mike Pence, the Indiana governor at the time, worked on a deal with the Obama administration known as HIP 2.0. In reality, the program is little different than every other state that has expanded Medicaid. Costs have gone up, few – if any – people are contributing, and virtually no one has been dis-enrolled.

We’ve been told that we should do this because it’s “free money” from the feds. Regardless of a personal disdain for using the word “free” when it comes to healthcare or whatever else politicians are giving out, we know this would come at a cost to state taxpayers. There is still no such thing as a free lunch.

Estimates generally put the additional cost at roughly $200 million per year. But as other states have shown, Medicaid expansion estimates generally balloon, leading to greater costs to the state.

Maybe that’s why the Mississippi Republican Party passed a resolution in 2013 opposing Medicaid expansion and supporting the GOP’s attempts to resist expansion. Times have changed I suppose.

And then there are the needs to spend more on roads and bridges. Ignoring the hundreds of millions of dollars the legislature appropriated in a special session last year or the fact that most of the troubled roads and bridges are locally controlled, there seems to be a never-ending desire to raise gas taxes. “Lots of other states are doing it so we should as well,” say the proponents. According to most of candidates at Neshoba, “It’s the only thing we can do”

Again, support for higher taxes was bi-partisan. It appears very few candidates have learned the art of saying “no.”

The truth is Mississippi doesn’t have a problem with failing to spend government funds. Said more accurately, our government officials have not been stingy when it comes to spending taxpayer money on all sorts of programs. On a per capita basis, we have one of the largest governments in the country. We have a larger government workforce than most. Government controls 55 percent of our state’s GDP. How much higher can that go? When you understand these facts, it makes the pleas for more government “investment” ring hollow.

Despite this evidence, most candidates running for the top offices in the state don’t think government is large enough.

To the dismay of numerous business groups, the Mississippi legislature opted, once again, not to raise gas taxes in the state this year.

Mississippi continues to have the third lowest gas tax in the country, at 18.4 cents per gallon (cpg), which is identical to the federal gas tax motorists also pay. Only Alaska (14.66 cpg) and Missouri (17.42 cpg) have lower gas taxes.

On July 1, motorists in 14 states saw their gas taxes raised, either through new taxes approved by the legislature or due to automated increases. Tennessee is in the final stage of a phased in 6 cent per gallon increase, which included a 1 cent per gallon increase this year.

Illinois drivers saw the biggest jump – as their taxes went up 19 cents per gallon. Those who purchase gas in California, Connecticut, Indiana, Maryland, Michigan, Montana, Nebraska, Ohio, Rhode Island, South Carolina, Vermont, and parts of Virginia also experienced increases in gas taxes.

Gas taxes among neighboring states

| State | Gas tax | National ranking |

| Alabama | 21.21 cpg | 41 |

| Arkansas | 21.8 cpg | 40 |

| Louisiana | 20.01 cpg | 43 |

| Mississippi | 18.4 cpg | 48 |

| Tennessee | 27.4 cpg | 30 |

As a result of the low taxes and other factors that help Mississippians pay the least per gallon in the country, many – not just the business community, but both Democrats and Republicans running for governor – have called to raise the state’s gas tax, with the belief that it will be less painful and that the state desperately needs it. Some advocate for adjusting the tax to inflation annually, thereby preventing legislators from ever having to vote for a tax hike again while ensuring regular increases.

Simply because your taxes happen to be lower than other states does not mean you should raise them to match those states. That is bad policy. Besides, all this would do is simply redirect money from the private sector to government. A government that already controls 55 percent of the state’s economy.

Taxpayers currently spend over $1 billion annually on the work of the Mississippi Department of Transportation. Some might want more, but the biggest problems with Mississippi roads are not state-maintained roads. Of the 479 bridges that are currently closed, only 11 are state controlled – and they are all being replaced. The rest are maintained by cities and counties.

And far too many of those localities are simply not keeping up with their roads and bridges and that is evidenced by what they spend. For example, Hinds County has spent an average of only 6.48 percent of its annual expenditures in the last three years on roads and bridges. It has 44 bridges closed, according to the Office of State Aid Roads. Neighboring Rankin and Madison counties spent 31 and 22 percent on roads and bridges, respectively.

Increasing the gas tax would not help local governments as those taxes go to the state and the Department of Transportation.

As we often see in government, the first reaction is a tax increase. Before we start looking for more sources to fund infrastructure, we should do everything in our power to ensure taxpayer monies are carefully expended and that suppliers and contractors are producing the most value possible for the dollars they receive. And all of it should be open and transparent.

Our government officials should be negotiating hard with incumbent contract holders on price and inviting competition at every step to ensure maximum bang for the buck.

And if we don’t have enough competition amongst existing contractors or those suppliers don’t have enough capacity to handle the work without charging more, we should open up the competition by inviting others to enter the bidding.

These dollars belong to the taxpayers and they should be respected as such.