July 6 marked two years since the Mississippi Public Service Commission issued an order that called for a settlement in the battle over the controversial Kemper Project clean coal power plant, known now as Plant Ratcliffe.

In February 2018, the PSC unanimously approved a settlement that reduced the amount of capital costs the company could collect from ratepayers and mandated that Mississippi Power run the Kemper Project on natural gas only, something the company had done since August 2014.

Mississippi Power’s 187,000 ratepayers on the Coast will only pay about $1 billion of the plant’s capital costs, avoiding double-digit rate hikes to pay for the multi-billion plant.

If Mississippi Power could’ve gotten the plant commercially operational — even for a few days — and the PSC approved of the utility’s spending, ratepayers would’ve had to pay more than $3 billion rather than Southern Company stockholders.

The plant was supposed to cost $2.4 billion, but the cost ballooned by 212.5 percent to $7.5 billion.

Kemper was enabled by friendly regulators and a legislature that passed two bills, including one that allowed the company to collect the plant’s costs from ratepayers before it came online and another that gave the company the authority to charge ratepayers for a $1 billion bond to help finance the plant.

Kemper Project explained

Kemper was a 582-megawatt plant designed to convert the second-lowest grade of coal, lignite, into a natural gas-like substance called synthesis gas to fuel its electricity-generating turbines. The two gasifiers turned the high-moisture lignite into 1,750 degree syngas and presented the biggest technical hurdle that ultimately couldn’t be overcome.

The chemical plant component of Kemper that was most important to its environmental promises was its carbon capture system. This system was supposed to remove 65 percent of the carbon dioxide from the gas stream for sale to oil exploration firms to inject into old oil wells.

Other byproducts, such as ammonia and sulfuric acid, were to be sold to off-site companies as another revenue generator to offset the plant’s massive costs.

The announcement by Mississippi Power on June 28, 2018 that it was ceasing its attempts to get the plant’s two gasifiers and assorted equipment operational was the beginning of the end of the Kemper saga. The company spent billions of dollars and three years to get Kemper’s gasifiers working as a steady-state generating unit.

An accident in October 2016 nearly resulted in a catastrophic explosion when hot syngas filled an area of the Kemper plant that wasn’t built for 1,750 degree temperatures. If the gasifiers had been working at operational pressure, there likely would’ve been a fatal explosion.

Consequences for Southern Company, the parent firm of Mississippi Power that build the $7.38 billion plant are still in play. In May, the company said in a filing with the U.S. Securities and Exchange Commission that it’s under investigation by the Civil Division of the U.S. Department of Justice due to Kemper.

The lignite mine that was supposed to supply the plant with fuel is now closed and the company said in a recent SEC filing that it hasn’t decided the fate of the 30-plus mile carbon dioxide pipeline.

Taxpayers picking up the tab

Mississippi Power ratepayers weren’t alone in paying for Kemper. Taxpayers were also on the tab as well.

The utility was set to receive $133 million in IRS investment tax breaks from building the plant. The company couldn't make the original start date of May 2014 required by the tax breaks and had to return them.

Another set of IRS tax breaks, this one for $279 million, had to be returned after the plant missed an April 2016 deadline.

The utility also received $245 million from the U.S. Department of Energy under a now-defunct grant program for coal power plants that were supposed to be more environmentally friendly.

Some history

The administration of then-President George W. Bush in 2004 began the Clean Coal Power Initiative, giving grants for research into cleaner electrical generation using coal. The $2 billion, 10-year program was designed to demonstrate cleaner alternatives to traditional coal-fired power plants.

Southern Company announced in December 2006 that it’d build a new coal gasification power plant company that was supposed to cost $1.8 billion and be completed in 2013. Earlier that year, Mississippi Power asked the PSC to approve its need for more generation capacity.

Southern wasn’t going to finance this experimental project entirely with investor dollars.

One of the recipients of the DOE grant program was to be an integrated gasification plant added to the Stanton Energy Center near Orlando in a partnership with Southern Company and the Orlando Utilities Commission. The 285-megawatt plant was canceled in 2007, only two months after groundbreaking, as the company blamed an “uncertain regulatory environment.”

Experiences with a similar plant constructed in 2002 by Tampa Electric likely didn’t help solidify the case for another coal gasification plant in the Sunshine State.

Then-Gov. Haley Barbour used his considerable influence and longstanding relationship with Southern (his lobbying firm, Barbour, Griffith and Rogers was the utility giant’s long-term lobbyist in Washington) to get approval by the Department of Energy in May 2008 to move the project money from Florida to Mississippi.

The legislature passed Senate Bill 2793 in the 2008 legislative session — commonly known as the Baseload Act — allowing utilities in the state to start charging customers for power plants before they generated a single kilowatt of electricity and Barbour signed the bill into law.

The Mississippi PSC approved MPC’s need for more generation capacity in November 2009, with the plant’s capital costs for ratepayers capped at $2.88 billion. Mississippi Power petitioned the PSC to increase the spending cap to $3.2 billion in March 2010, while two months later, construction begins at the site in Kemper County north of Meridian.

The PSC issued the plant’s first certificate of need and necessity, which authorized the plant’s construction. A lawsuit by the Sierra Club and other groups was successful in throwing out the authorization after a state Supreme Court decision in June 2010 that sent the matter back to the PSC.

In April 2012, the PSC approved a new certificate in a meeting that lasted less than a minute and capped the project’s costs that could be charged to ratepayers. A few weeks later, Mississippi Power announced a $488 million cost increase, which brought Kemper’s cost to $2.88 billion.

In 2013, the legislature passed a bill that allowed the company to issue a 20-year bond up to $1 billion payable by its ratepayers. Gov. Phil Bryant later signed House Bill 1134 into law.

The bond approved in 2013, known as a special purpose entity, was designed to provide up to $1 billion to offset increasing costs on the Kemper Project.

Mississippi Power received an 18 percent rate increase — 15 percent in 2013 and 3 percent in 2014 — approved by the Public Service Commission before the plant came online. The increase was later overturned by a state Supreme Court order in a lawsuit brought by Hattiesburg businessman Thomas Blanton.

Motorists in Mississippi pay less to fill up their tanks than those in any other state in the union despite an upward climb in prices over the past month.

As of Monday, the average price of regular gasoline in Mississippi is $2.40. This ranges from a low of $2.32 in Stone county to a high of $2.68 in Adams county.

The average price per gallon was $2.34 a week ago and $2.28 a month ago. This is part of a national trend, as gas prices have risen by about 10 cents over the past three weeks. And manyanticipate Tropical Storm Barry could cause another spike in gas prices.

There is a wide range of gas prices throughout the country, with motorists in the South paying the least.

Lowest gas prices in the country

| State | Price per gallon |

| Mississippi | $2.40 |

| Alabama | $2.42 |

| Louisiana | $2.43 |

| Arkansas | $2.43 |

| South Carolina | $2.48 |

| Oklahoma | $2.50 |

| Texas | $2.50 |

California motorists are paying $3.74 per gallon, the most in the country. Some areas of the Golden State are paying more than $4.00 per gallon, numbers not seen in Mississippi since 2008.

Because Mississippians enjoy a low price at the pump, many – including both Democrats and Republicans running for governor – have called to raise the state’s gas tax, with the belief that it will be less painful. Some advocate for adjusting the tax to inflation annually, thereby preventing legislators from ever having to vote for a tax hike again while ensuring regular increases.

All this would do is simply redirect money from the private sector to government. A government that already controls 55 percent of the state’s economy.

Taxpayers currently spend over $1 billion annually on the work of the Mississippi Department of Transportation. Some might want more, but the biggest problems with Mississippi roads are not state-maintained roads. Of the 479 bridges that are currently closed, only 11 are state controlled – and they are all being replaced. The rest are maintained by cities and counties.

And far too many of those localities are simply not keeping up with their roads and bridges and that is evidenced by what they spend. For example, Hinds County has spent an average of only 6.48 percent of its annual expenditures in the last three years on roads and bridges. It has 44 bridges closed, according to the Office of State Aid Roads. Neighboring Rankin and Madison counties spent 31 and 22 percent on roads and bridges, respectively.

Increasing the gas tax would not help local governments as those taxes go to the state and the Department of Transportation.

As we often see in government, the first reaction is a tax increase. But we know there are often far better solutions, like prioritizing your current funding. That is something local government could – and should – work on.

The nation’s largest teachers union has adopted a new policy affirming a fundamental right to abortion, while rejecting the idea that student learning should be a priority of the union.

At their recent convention, the National Education Association, of which the Mississippi Association of Educators is an affiliate, affirmed a new business item that reads:

“The NEA will include an assertion of our defense of a person’s right to control their own body, especially for women, youth, and sexually marginalized people. The NEA vigorously opposes all attacks on the right to choose and stands on the fundamental right to abortion under Roe v. Wade.”

This is a sharp change from prior years when they attempted to walk more of a middle ground, saying they support “reproduction freedom,” not abortion, while bragging about not spending money in regards to pro-abortion legal services.

As we have seen with the left, abortion has moved from “safe, legal, and rare,” to legal until the moment of birth and funded by taxpayers. And if you disagree with that you are evil, anti-woman, and essentially support violence against women.

But the bigger question is, is it necessary for the NEA, or its affiliates, to take a position on abortion? NEA is certainly a left-wing organization, that has never been in doubt. But, what does abortion have to do with education or teachers?

One might presume a rejected item that calls for a renewed emphasis on quality education would be more in line with the NEA. That read:

“The National Education Association will re-dedicate itself to the pursuit of increased student learning in every public school in America by putting a renewed emphasis on quality education. NEA will make student learning the priority of the Association. NEA will not waiver in its commitment to student learning by adopting the following lens through which we will assess every NEA program and initiative: How does the proposed action promote the development of students as lifelong reflective learners?”

But, alas, the union rejected those ideas.

According to the most recent data available from the union, the NEA has just 4,561 members in Mississippi, compared to over 54,000 in Alabama. The numbers in Mississippi show a 5 percent drop in the past five years.

Mississippi Center for Public Policy has joined a diverse coalition in publishing a set of seven principles to guide conversation about amending Section 230 of the Communications Decency Act of 1996.

The coalition includes civil society organizations, academics, and other Internet law experts.

In its current form, the law holds those who create content online responsible for the content they create, while protecting online intermediaries from liability for content generated by third parties, except in specific circumstances.

Maintaining that fundamental arrangement is vital. As the principles statement declares: “We value the balance between freely exchanging ideas, fostering innovation, and limiting harmful speech. Because this is an exceptionally delicate balance, Section 230 reform poses a substantial risk of failing to address policymakers’ concerns and harming the Internet overall.”

As civil society organizations, academics, and other experts who study the regulation of user- generated content, we value the balance between freely exchanging ideas, fostering innovation, and limiting harmful speech.

The seven principles are:

- Content creators bear primary responsibility for their speech and actions.

- Any new intermediary liability law must not target constitutionally protected speech.

- The law shouldn’t discourage Internet services from moderating content.

- Section 230 does not, and should not, require “neutrality.”

- We need a uniform national legal standard.

- We must continue to promote innovation on the Internet.

- Section 230 should apply equally across a broad spectrum of online services.

Read the full letter here.

A stud welding company will be receiving funding from state taxpayers, plus other tax incentives, to relocate a facility from Illinois to Clarksdale.

Image Industries will relocate to the former Metso facility in Clarksdale, where it will manufacture threaded weld studs, shear connectors, concrete anchors, hydraulic weld ports and cable management studs.

According to Mississippi Development Authority spokesperson Tammy Craft, the state will provide:

- $300,000 grant for relocating equipment.

- $500,000 grant for building renovations.

The company is expected to invest $3 million and create 50 jobs. From 2012 to 2017, taxpayers have spent $678 million in just MDA grants alone from 2012 to 2017.

The company will also participate in the Growth and Prosperity Program, which is designed to encourage economic growth in impoverished parts of the state. To qualify for the program, a county must have an unemployment rate that is 200 percent of the state’s annual unemployment rate or have 30 percent or more of its population below the federal poverty line.

This program allows a participating entity that relocates or expands in a GAP-qualified area to receive:

- A full exemption on all state income and franchise taxes related to the new location.

- A full sales and use tax exemption on all equipment and machinery purchased during initial construction. This exemption lasts from the project inception until three months after startup.

- A property tax exemption for taxes levied on land, buildings, equipment and some inventory at a facility in a GAP area. The exemption doesn’t include school taxes or the portion of the ad valorem taxes that pay for fire and police protection.

These incentives can last for up to 10 years after authorization. The GAP-eligible counties are Adams, Bolivar, Claiborne, Coahoma, Holmes, Humphreys, Issaquena, Jefferson, Leflore, Noxubee, Oktibbeha, Quitman, Sharkey, Sunflower, Tallahatchie, Tunica, Washington and Yazoo.

There are also areas of Adams, Amite, Attala, Franklin and Lowndes counties that are also part of the GAP program.

| Company | Employees | Cost per job |

| Krone | 45 | $182,777 |

| Amazon | 850 | $14,470 |

| Enviva | 90 | $188,888 |

| Image Industries | 50 | $36,0000 |

| Kohler | 250 | $11,600 |

A planned Enviva wood pellet mill cleared a big regulatory hurdle, as the Mississippi Department of Environmental Quality approved its air pollution permit at its meeting Tuesday.

The permit board’s unanimous decision came after a contentious May public hearing in Lucedale and a comment period that was extended from the required 30 days to 61 days by MDEQ officials.

The plant, which could be the largest wood pellet plant in the nation, is designed to manufacture 1,420,500 oven-dried tons of wood pellets, which can be used to fuel overseas power plants, such as in Great Britain.

Maryland-based Enviva has seven mills in the Southeast and one of those mills is in Amory, acquired in August 2010.

When MDEQ staff was asked about complaints from dust emissions produced by the Amory facility, they said there had been some complaints over dust. The Amory plant was originally built by CKS Energy in 2007 and acquired by Enviva in 2010.

They also said the new Lucedale facility would have better emissions control equipment to mitigate the 250 possible tons per year of volatile organic compounds, particulates of less than 10 microns in diameter and smaller particles of less than 2.5 microns in diameter.

Two of the audience members spoke about the pellet plant. Frank Figures, a local resident and opponent of the plant, says that the plant will be allowed to be periodically bypass its emissions controls.

MDEQ said the plant would be allowed to do that 50 hours annually for plant startup/shutdown operations.

Former Lucedale mayor Doug Lee said he supported the plant and thought it’d be a positive for George County.

The North Carolina Department of Environmental Quality and Enviva reached a settlement this year in a lawsuit filed by the Southern Environmental Law Center and Environmental Integrity Project to add more pollution controls and reduce emissions by 95 percent from Enviva’s wood pellet plant in Richmond County, North Carolina.

Enviva and Mississippi officials announced in January that the company — which makes wood pellets that fuel overseas power plants — will build a $140 million pellet mill and a $60 million loading terminal at the port in Pascagoula.

Enviva is expected to hire 90 employees in Lucedale, with 300 loggers and truckers possibly finding work supplying logs to the company.

Mississippi taxpayers will be providing $4 million in grant funds, with $1.4 million for a water well and a water tank, while the other $2.5 million is for other infrastructure needs and site working. George County will provide $13 million in property tax breaks over the next 10 years.

All of those incentives, if realized, could add up to $17 million or about $188,888 per job.

These wood pellets are made from low-grade wood fiber unsuitable for lumber because of small size, defects, disease or pest infestation; parts of trees that can’t be processed into lumber and chips, sawdust and other residue.

The Lucedale plant will mill, dry and pellet the wood in a press, using natural polymers in the wood called lignin to act as a natural glue.

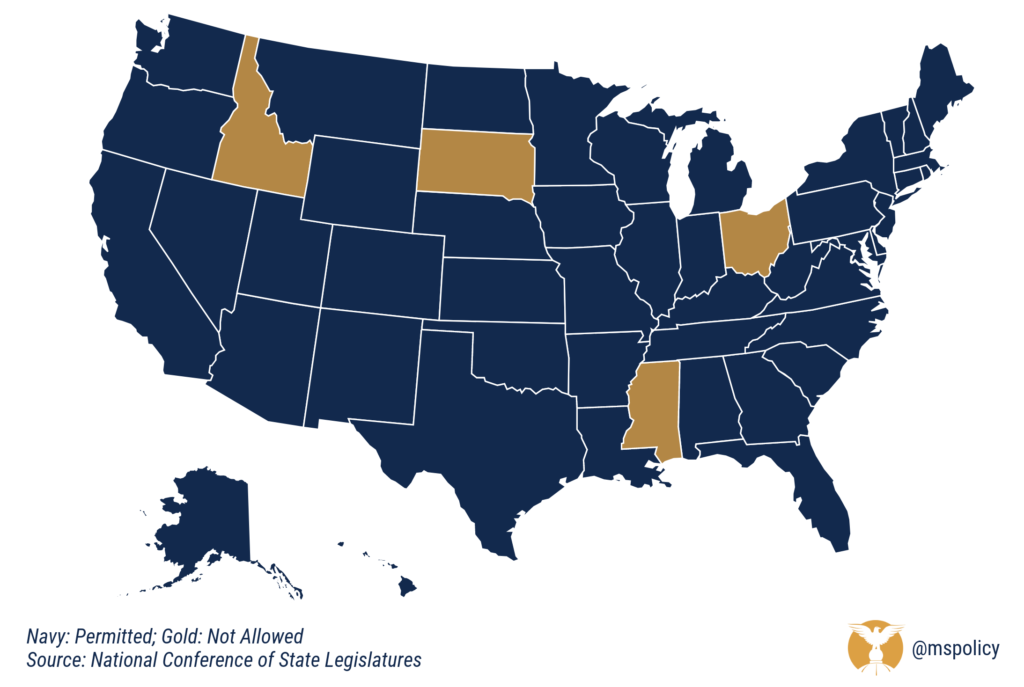

As the Hemp Cultivation Task Force kicks off their work, Mississippi now finds itself on an island as the only state in the Southeast where the cultivation of hemp is illegal.

This year, Georgia, Louisiana, and Texas joined the ranks of states legalizing industrial hemp. As states continue to move in that direction, Mississippi is sitting with just Idaho, Ohio, and South Dakota among the only states in the nation where hemp remains illegal.

The South Dakota legislature Ok’d hemp legalization earlier this year, but it was vetoed by Gov. Kristi Noem.

Cultivation of hemp for commercial, research, or pilot programs

We have seen a massive move toward hemp legalization at the state level after the 2018 Farm Bill expanded the cultivation of hemp. Previously, federal law did not differentiate hemp from other cannabis plants, even though you can’t get high from hemp. Because of this, it was essentially made illegal. But we did have pilot programs or limited purpose small-scale program for hemp, largely for research.

Now, hemp cultivation is much broader, with the Farm Bill allowing the transfer of hemp across state lines, with no restrictions on the sale, transport, or possession of hemp-derived products. There are still limitations, but most states have taken the opportunity to find new markets for those who would like to cultivate hemp.

The message from Marshall Fisher, the commissioner of the Department of Public Safety, at yesterday’s first meeting of the task force was that we can’t do this. It’s not regulated enough, there is a link between hemp and fentanyl, and we will see more people being buried if we move in this direction. And law enforcement can’t tell the difference between hemp and cannabis.

We don’t know what the task force will recommend. It includes both supporters and opponents. And of course, the legislature – who will be tasked with acting on any recommendations – will be different next year.

But, if we have questions on whether or not hemp leads to chaos in the streets, we can just look to 46 other states.

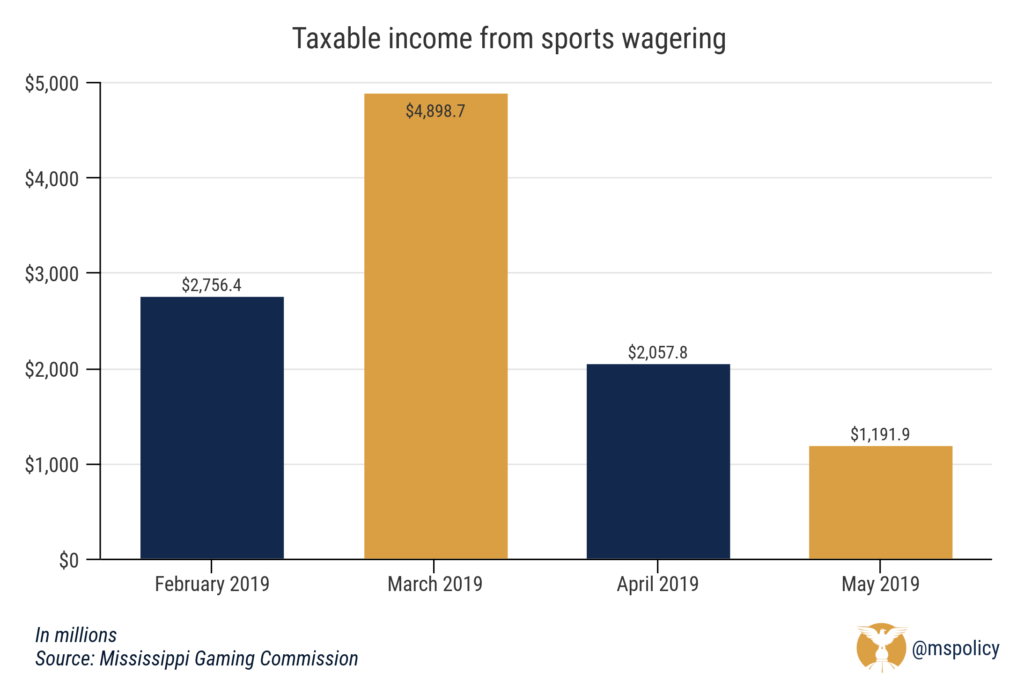

Revenue from sports betting continues to decline in Mississippi as the slow season for betting continues a couple months before football resumes.

Taxable revenue for the month of May totaled just under $1.2 million, down from around $2 million in April. In March, revenues were just under $4.9 million, a far outlier from recent trends, thanks to the college basketball tournament. January and February hovered between $2.7 and $2.8 million.

The biggest win for Mississippi’s casino-only sports betting industry, however, was Louisiana’s inability to pass their own legislation which would have legalized sports betting in Pelican State casinos and race tracks. The proposed legislation would have required local referendums in each parish, but it died on the last day of the session.

Lawmakers will not meet again until next March.

Other neighboring states

In Arkansas, sports betting became legal last week. Last November, voters approved a ballot initiative legalizing sports betting and the Oaklawn Racing Casino Resort in Hot Springs, is the first to welcome betters. While the timeline is still to be determined, a casino closer to home, Southland Gaming & Racing in West Memphis, is expected to begin collecting wagers soon. Competition has swallowed a lot of the revenue Mississippi once experienced, and this would likely add further pains to Tunica area sports betting operations.

Tennessee could also add to those pains, but they have some work to do. The state passed an online-only sports betting bill earlier this year, but it has many issues – requiring sportsbooks to buy official league data to settle in-play wagers, a very expensive entry point and high taxes, and a ban on prop bets in NCAA games. Much work remains before the Volunteer State is taking bids.

Legislation was introduced in Alabama this year, but it did not move and most consider sports betting a long-shot with our neighbors to the east.