A pharmaceutical company that is closing a Mississippi drug plant received money from taxpayers for another facility in the state.

AmerisourceBergen will be shuttering its Cleveland PharMEDium plant, laying off 140 workers, but the Pennsylvania-based company received $1,150,000 from several Mississippi Development Authority programs to move a distribution center to Olive Branch, where the $48 million facility employs 129 workers.

The DeSoto facility received $600,000 from the Development Infrastructure Program, which builds and repairs publicly-owned infrastructure, such as roads, for new and expanding businesses. If AmerisourceBergen were to miss its job creation goals, the company would have to repay the grant.

Under the DIP program, companies aren’t required to make an investment commitment.

AmerisourceBergen received $500,000 in grants from the Mississippi ACE Fund, which like the DIP program, can be clawed back if the company doesn’t meet job creation goals. The MDA calls this fund a “deal-closing fund” and this money can be used to relocate equipment, provide employee training or building improvements.

AmerisourceBergen also received $50,000 for training under the Workforce Training Fund in 2017.

AmerisourceBergen is also participating in the Advantage Jobs Incentive Program that provides a rebate of 90 percent of Mississippi payroll taxes withheld to qualified employers for 10 years.

The Cleveland plant was part of a 2015 acquisition by AmerisourceBergen of Illinois-based PharMEDium for $2.575 billion. The transition hasn’t been the smoothest for the parent company.

The company said in a first quarter filing with the U.S. Securities and Exchange Commission that it likely won’t restart production this year at its Memphis PharMEDium facility where it laid off 225 workers in January.

Both the Memphis and Cleveland plants are compounding facilities that mix drugs in syringes and intravenous bags for sale to hospitals, which see cost savings from not having to do them in-house.

PharMEDium also has facilities in Dayton, New Jersey and Sugar Land, Texas.

Production at Memphis was suspended by AmerisourceBergen in December 2017 after an inspection by the U.S. Food and Drug Administration found issues with sterility with syringes made at the facility. The company said in its SEC filings it is enacting corrective measures to fix the problem.

The company issued a voluntary recall in December 2017 on some of its products because of a lack of assurance in their sterility.

The company received a grand jury subpoena from the U.S. Attorney’s Office for the Western District of Tennessee in November 2017 for documents about lab testing of a certain type of syringe made at the facility.

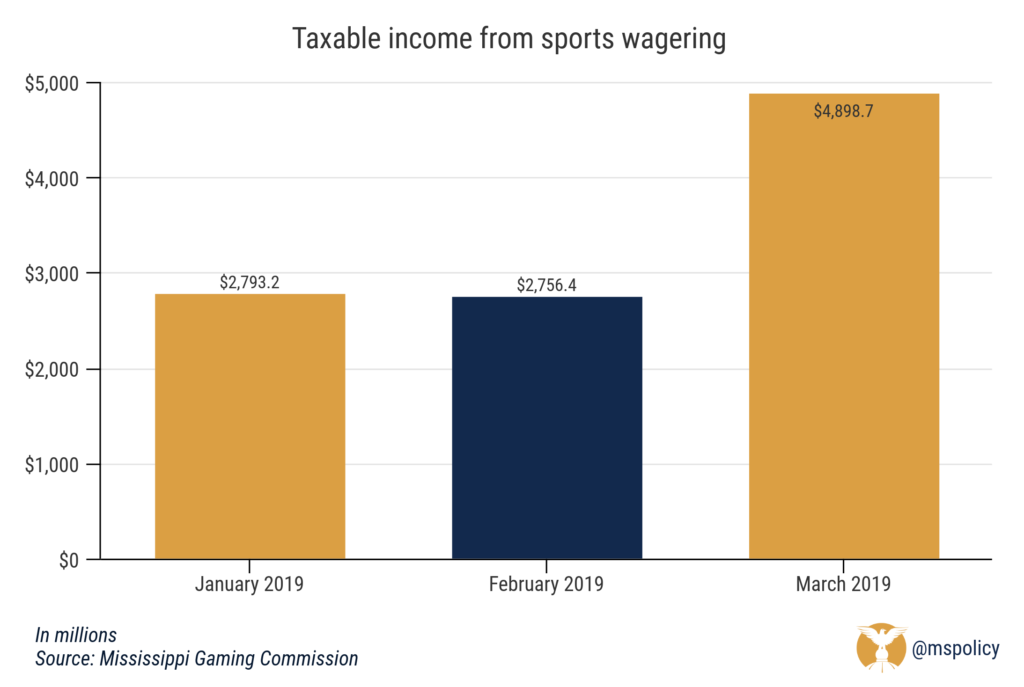

The NCAA Tournament provided a big boost to Mississippi casinos in March as revenues from sports gambling nearly doubled February during an otherwise quiet time of the year.

In March, total taxable revenue was $4.9 million versus $2.8 million in February.

But while Mississippi was the first state in the Southeastern Conference blueprint to have legalized sports gambling after the Supreme Court overturned the federal ban, more players are entering the field and making it easier to wager on sports.

To place a bet on sports in Mississippi, you have to do it at a casino. That may be attractive for a destination event such as the Super Bowl or a major boxing match, but it’s likely not going to happen for an average basketball or baseball wager on a Tuesday night. That person will continue to use an illegal, offshore website, which costs the state revenue it would otherwise receive.

Meanwhile to the north, Tennessee is on the cusp of legalizing online sports gambling. While the Volunteer State does not have casinos, those interested in betting on a sporting event will be able to do so from their smartphone or computer. Obviously making it much easier, and more convenient to place a bet.

This would likely have the biggest impact on the already declining revenue of Tunica casinos. Another casino is closing this summer, leaving the county with just six remaining casinos, a far cry from the boom of the 1990s when those six were the only casino destinations for hundreds of miles. Gaming payrolls peaked at 13,000 in Tunica in 2001, but they are down to less than 5,000 today.

Today, it’s much easier to find a casino near your house, including one in West Memphis, Arkansas.

So while the Mississippi legislature had the vision to approve sports gambling when it was still illegal, pending the Supreme Court decision that gave authority back to the states, the limitations on where the consumer can bet will likely hurt the state as sports gambling becomes more common place across the country.

Gov. Phil Bryant has changed his mind on film incentives after signing into law earlier this month a bill that brought back some subsidies that expired in 2017.

Senate Bill 2603 allows Mississippi-based motion picture production companies to receive up to $5 million for payroll and fringe benefits paid to out of state, non-resident employees. The bill, as originally written, would’ve provided to out-of-state production companies up to $10 million for payroll and fringe benefits for out of state employees.

This was reduced in conference to $5 million and restricted to production companies that have been certified by the Mississippi Development Authority to have filed income taxes in the state in the past three years and filmed at least two motion pictures in the state in the past 10 years.

The law went into effect immediately and there isn’t a repealer, which means there’s no expiration date on the incentives.

The bill signing marked a major shift in Bryant’s opinion on the motion picture production subsidies, which are being curtailed or eliminated in several other states.

The governor urged the legislature in his FY2018 budget recommendation to allow the Motion Picture Incentive Rebate Program to expire, citing a 2015 report by the Joint Legislative Committee on Performance Evaluation and Expenditure (PEER) as one of the reasons.

“While I support the jobs and attention that films bring to Mississippi, taxpayers should no longer subsidize the motion picture industry at a loss,” Bryant said in his budget recommendation. “The motion picture incentive rebate has cost approximately $25 million since 2011.

“Allowing the motion picture incentive rebate to expire could save a similar amount over the next five years.”

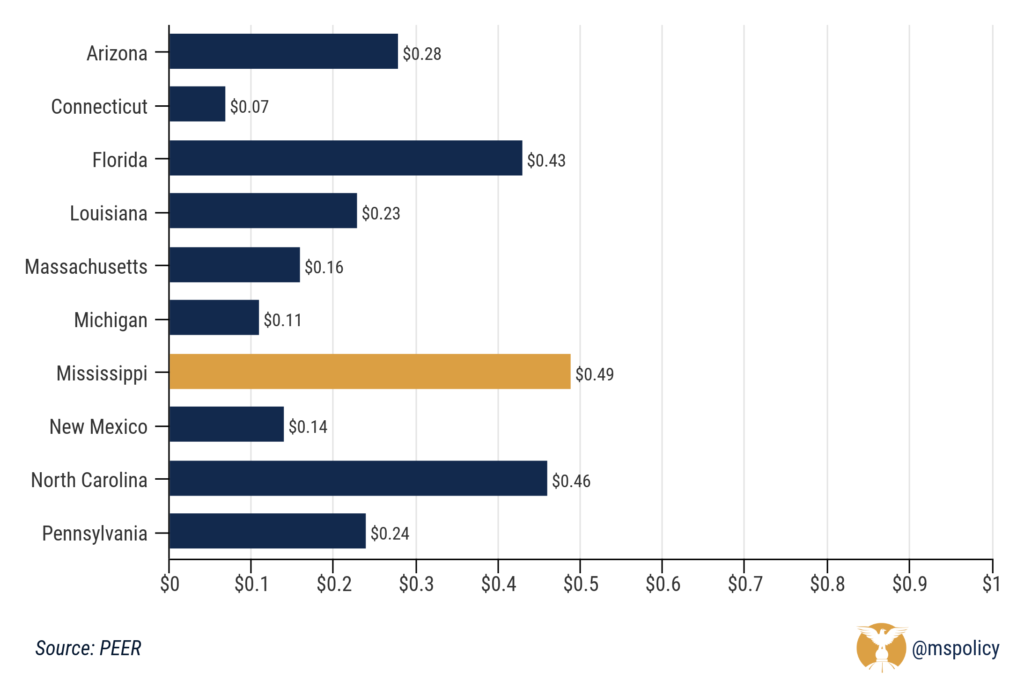

The study showed that the state lost 51 cents on every dollar invested in the program since the program’s enactment in 2004.

Since 2009, according to the National Conference of State Legislatures, 13 states have ended their incentive programs.

There’s plenty of evidence that’s pointing policymakers toward eliminating these subsidies. Indeed, Mississippi’s failure to make a profit on film incentives isn’t surprising. Nor is it out of the ordinary. It’s in line with every other report on incentives, as shown in the graphic below. Film production companies win and taxpayers lose.

A 2016 study by Michael Thom — an assistant professor at the University of Southern California Price School of Public Policy — found that motion picture incentive programs had little to no effect on the economies of the states with the incentives.

Sales and lodging tax waivers had no effect on four different economic indicators, while transferable tax credits — such as the ones in Louisiana — had a small, sustained effect on industry employment levels but no effect on wages.

Refundable tax credits had no employment effect and only a temporary effect on wages.

Mississippi has cash rebate program on eligible expenditures and payroll and provides sales and use tax reductions on eligible purchases and rentals. Rebates are capped at $10 million and the annual rebates provided are capped at $20 million. At least 20 percent of production crew of an eligible production must be Mississippi residents.

Did you know that Mississippi has a law on the books that allows licensing boards to suspend or revoke your professional license if you default on your student loans?

Well, until June 30 at least. This year, as part of a larger occupational license reform bill that will make it easier for ex-offenders to receive a license, the legislature adopted new language that will prohibit the state from pulling your license just because you couldn’t make a payment on your student loans.

The old law, and others like it, were meant to limit defaults and to keep borrowers from choosing not to pay back their loans. A “tough love” law, if you will. The U.S. Department of Education even previously urged states to “deny professional licenses to defaulters until they take steps to repayment.”

Mississippi certainly wasn’t alone. Prior to the repeal, the Magnolia State was one of 15 states - both red and blue - that had such a law in place. But the repeal movement has been steadily growing, with five other states scrapping their laws in the last two years.

The reasons for the sudden changes of heart are obvious. Some 44 million Americans owe a collective $1.5 trillion in student loan debt nationwide, with 8.5 million federal borrowers in default as of last year. At a time when more and more individuals are saddled with student loan debt, it makes little sense to attack their ability to earn a living in their professional field. The fastest way, and for most people the only way, to pay off debt is to generate monthly income above the basic cost of living.

When young people lose their income, they lose their ability to pay back loans in any meaningful way. At that point, borrowers are stuck in an endless cycle with no way out and few good options. Such individuals are likely to take on credit card debt or other forms of debt just to stay afloat. Continuing this process keeps a debtor spinning like a hamster in a wheel.

As the student loan crisis is growing, more Americans than ever, and more Mississippians, also need a license to obtain employment. We would call it ironic if it wasn’t so dumb and cruel.

Nearly one-in-five Mississippians need a license to work. This is a change from under five percent just a few decades prior. That is because while licensure was once limited to occupations such as medical professionals, lawyers, or teachers, it now extends to everything from an auctioneer to a shampooer. All totaled, Mississippi licenses 66 lower income occupations.

Naturally, those lower income occupations are more likely to default on student loans.

Consider cosmetologists, who are licensed in all 50 states. In Mississippi, you must clock 1,500 hours, which is more-or-less in line with other states. And you need all this for a job that has a median national wage of $25,000 per year. Not surprisingly, cosmetologists had a national default rate of over 17 percent in 2012, significantly higher than the national average. If a cosmetologist defaults, and he/she loses his/her license, what should they then do? The same could be asked of any licensed professional.

In the long run, we need to reform occupational licensing to make it easier for people to earn a living without spending a year or two in the classroom, often accruing debt. Many of the occupational licenses the state requires are onerous and serve little purpose but to protect established interests. Most occupational licenses can be replaced with less restrictive alternatives such as certification, bonding, insurance, inspections, or registration.

In the meantime, preventing licensing boards from attacking licenses because of student loan default is a good first step toward liberty and toward encouraging a defaulter to take the personal responsibility to pay off debts by exercising their right to earn a living in Mississippi.

This column appeared in the Vicksburg Post on April 24, 2019.

The Mississippi cultural retail attraction program died in the Mississippi legislature in 2014, when the authorizing law expired without passage of an extension. Despite this end, one last holdout project is still alive and could receive more than $96 million from the program.

The Galleria received its third extension from the Mississippi Development Authority in July that moves the deadline for the start of construction to 2022. That’s nine years after the project was authorized in 2013 and eight years after the program ended.

The Gulf Coast Galleria is being developed by Coast developer Bob Mandal and Rise Partners of Chattanooga — which took over for original partner CBL Properties — at a site located at the junction of Interstates 10 and 110, which connects the primary artery with downtown Biloxi and the beaches at its terminus at U.S. 90.

There is some activity at the site, which has now been cleared. Two car dealerships owned by Mandal face I-10 and the city of D’Iberville has expanded D’Iberville Boulevard, which runs through the heart of the site before crossing I-10.

The project was authorized on December 19, 2013 by the MDA, with a minimum required investment of $50 million and an estimate of a $320 million capital investment by the developers.

The developers received their first extension from the MDA on December 17, 2015 that gave them a 60-day extension.

The second was on January 11, 2016 that gave the developers until December 19, 2019 to begin construction.

The latest one was approved by the MDA on July 27, 2018 and it expires on December 19, 2022.

Under the cultural retail attraction program, Mississippi returns 80 percent of the sales tax revenue to the developer until the total reaches 30 percent of construction costs. Each retail project in the program must offer either $1 million worth of state-related art, historic markers or audio-visual equipment, or host space for the MDA for 10 years for tourism promotion purposes.

There are two other projects that are receiving money under the program.

The $113 million DeSoto MidSouth Tourism Project LLC, which built the Tanger Outlets Southaven, has earned $6,972,588 of a possible $33,990,000 as of October 2018.

The Outlets of Mississippi in Pearl could receive up to $24 million on an $80 million investment.

There were other projects covered under the cultural retail attraction project that didn’t pan out, including one on property owned by the Jackson Municipal Airport Authority in Rankin County. It was approved for a rebate of $48.8 million for a $162.5 million investment.

The Mississippi legislature passed Senate Bill 2463 in 2013, expanding the existing sales tax rebate program to include cultural retail attractions. A bill to reauthorize the program died in the 2014 legislative session after the MDA approved more than $150 million in possible rebates.

With several projects still approved for the incentive program, there were several attempts by state Sen. David Blount (D-Jackson) to put the final nail in the cultural retail attraction program’s coffin.

He filed a bill in 2016 to kill cultural retail projects that weren’t complete by July 1 of that year. It failed in committee. He tried again with an amendment to another bill, which increased the amount of the historic structure tax credit, to accomplish the same task. It passed the Senate, but was eliminated in conference.

The Mississippi legislature passed Senate Bill 2463 in 2013, expanding the existing sales tax rebate program to include “cultural retail attractions.” A bill to reauthorize the program died in the 2014 legislative session after the MDA approved more than $150 million in rebates.

Gov. Phil Bryant has signed the Fresh Start Act, protecting the 14th Amendment right of ex-offenders to obtain gainful employment.

Senate Bill 2781, authored by Sen. John Polk (R-Hattiesburg) and Mark Baker (R-Brandon), prohibits occupational licensing boards from using bureaucratic rules to prevent ex-offenders from working. The law requires occupational licensing boards to eliminate blanket bans and “good character” clauses used to block qualified and rehabilitated individuals from working in their chosen profession.

“Both federal and state courts clearly affirm that occupational licensing boards must provide an objective and legitimate reason to deny an ex-offender a license to work,” said Dr. Jameson Taylor, Vice President for Policy at Mississippi Center for Public Policy. “According to the Mississippi Supreme Court, the freedom to engage in a profession is a ‘God-given, constitutional liberty.’ Mississippi licensing boards need to clean up their rules so they don’t run afoul of the Equal Protection Clause of the 14th Amendment. Fresh Start requires them to do so while leaving every licensing board free to set high standards for their specific profession.”

Under the Fresh Start Act, licensing boards must adopt a “clear and convincing standard of proof” in determining whether a criminal conviction is cause to deny a license. This includes the nature and seriousness of the crime, the passage of time since the conviction, the relationship of the crime to the responsibilities of the position and evidence of rehabilitation. The law also creates a preapproval process that allows ex-offenders to determine if they may obtain a particular license before undertaking the time and expense of training, education and testing. In addition, the law protects licensed individuals who fall behind on their student loans from losing their occupational license.

“We have thousands of open positions available in Mississippi,” said Taylor. “We need skilled labor. We also have one of the highest ex-offender populations in the country. We shouldn’t let red tape prevent people from pursuing their dreams and supporting their families.”

According to a study published by Arizona State University, states with heavier occupational licensing burdens have much higher 3-year recidivism rates. More than 10 states have codified the protections contained in Fresh Start, including Tennessee and Georgia.

“Fresh Start leaves every occupational licensing board free to protect consumer health and safety by maintaining rigorous standards for licensure,” concluded Taylor. “But it also directs licensing boards to follow the Constitution by outlining legitimate reasons to deny someone a license. In the past, broad licensing restrictions have been used to keep “certain kinds of people” from working. Thanks to the leadership of Gov. Phil Bryant, Lt. Gov. Tate Reeves and Speaker Philip Gunn, Mississippi is cutting red tape so that people who want to work can obtain good-paying jobs.”

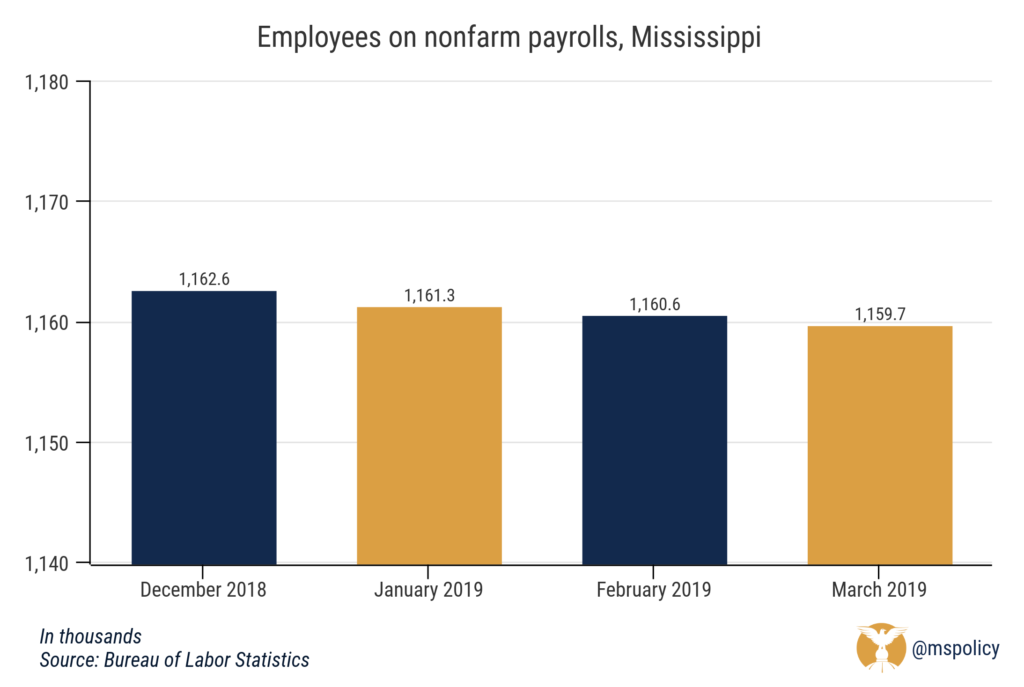

Payrolls in Mississippi dipped in the first quarter of 2019 as the state lost 2,900 jobs from December 2018 through March 2019.

In December, nonfarm payrolls in Mississippi reached 1,162,600. But after three months of decreases, payrolls were down to 1,159,700 in March. Preliminary estimates from February initially showed a slight increase to 1,161,900, but those numbers were revised down to 1,160,600.

This is a reversal of 2018 when Mississippi added about 11,000 jobs for a modest job growth rate of one percent.

Over the past month, Mississippi saw employment gains in construction (+500), financial activities (+100), and leisure and hospitality (+100). However, the state experienced reductions in manufacturing (-500), trade, transportation, and utilities (-400), professional and business services (-400), education and health services (-100), and government (-100).

What is happening nationwide?

Nationally, the country has added around 540,000 jobs over the first three months of the year. Mississippi’s job growth rate of -0.25 percent came in 44th among the 50 states. Among Mississippi’s neighbors, Alabama was the top performer, growing at a rate of 0.47 percent.

| State | Job growth rate | National ranking |

| Alabama | .47% | 17 |

| Arkansas | .28% | 26 |

| Louisiana | .12% | 35 |

| Mississippi | -.25% | 44 |

| Tennessee | .22% | 30 |

For Mississippi’s neighbor to the east, this is a continuing trend of strong numbers. In 2018, Alabama had a job growth rate of 2.13 percent.

Idaho had the greatest percentage change in employment during the first quarter at 1.19 percent, followed by West Virginia (1.05%), North Carolina (.91%), Oregon (.90%), and Maine (.78%).

What can Mississippi do better?

Mississippi has the fourth largest government share of state economic activity, and that is due to state and local spending, not federal funds. While there is a large contingent who would want to see the government spend more, it would actually be pretty difficult.

When the government grows, the state has increased ownership and the private sector shrinks. And economic freedom, which is based on free markets and voluntary exchange, individual liberty, and personal responsibility, wanes.

According to the most recent Fraser Institute Economic Freedom of North America report, which measures government spending, taxes, and labor market freedom, Mississippi was ranked 45th among the 50 states. Similarly, Cato Institute’s Freedom in the Fifty States, which measures economic and personal freedom, placed Mississippi 40th in their most recent rankings.

What is the correlation between economic freedom and prosperity? The freer states are more prosperous, have higher per capita incomes, more entrepreneurial activity, and lower poverty rates. We have the model. Similar states have experienced economic growth by adopting freedom-based policies. And it is important to know the difference between the reality of economic growth and the practice of economic development; those can be very different things. There is a role for corporate recruitment and economic development, but that can’t be the main driver of sustainable economic growth.

Government incentives, often in the name of economic development and being ‘business-friendly,’ attempt to recruit businesses to the state through financial benefits, such as site preparation, infrastructure, job training, or special tax breaks. In most cases, the reason incentives are necessary is because of higher taxes or policies that burden businesses. In some cases, incentives are necessary because corporations take advantage of a highly competitive economic development and play the states against one another. There is a better way for us to play this game.

Instead of special incentives for a few, Mississippi should work to provide a favorable climate for every business. Let the market decide where a business locates or expands. An economic development officer can sell low taxes and low regulatory burdens to a company looking for a great location like Mississippi. What’s more, the data shows us that such policies allow existing businesses, already in our state, to expand and grow from a small employer to a large employer without getting any incentives from the taxpayers. Those are the best jobs. That’s sustainable economic growth.

To their credit, state leaders have attempted to improve the economic climate of Mississippi, most notably through tax and regulatory reform. In 2017, the legislature adopted a new law that will require all new licensing regulations to be approved before they take effect, ensuring new attempts to stifle competition will be reviewed before they are finalized.

And the Taxpayer Pay Raise Act in 2016 will eliminate the three percent income tax bracket, allow self-employed individuals to deduct half of their federal self-employment taxes, and remove the franchise tax on property and capital when fully implemented. Even though Mississippi’s overall tax burden is still above the national average, this will move Mississippi closer to a flatter income tax and make our business climate more competitive.

These reforms weren’t easy, but showed forward thinking to align us closer with neighboring states. Making the case for spending more money on your favorite government program is not a path to prosperity. We need to think much bigger and much smarter. If we want to do better than the bottom ten in categories like per capita income, it starts with doing better in categories like business friendliness, regulatory practices, entrepreneurial environment, private capital encouragement, and tax rates.

Tying annual increases of K-12 education spending to the price of consumer goods for urban consumers, depending on which measure is used, could become very expensive for taxpayers.

Increasing K-12 education spending commensurate with the 18 percent cumulative rate of inflation suggested by public education advocates would’ve added up to $1.042 billion in additional spending between 2007 and 2017. These figures include federal, state and local revenue.

Synchronizing increases in K-12 spending to the Consumer Price Index from the U.S. Bureau of Labor Statistics (21.9 percent cumulative rate of inflation) would’ve hit taxpayers with $1.228 billion in additional spending during that time.

The Consumer Price Index measures the average change, over time, in prices paid by urban consumers for various goods and services, including food, beverages, health care, insurance, housing, and energy.

That includes electricity rates and gasoline prices.

Mississippi, according to data from the U.S. Census Bureau, has 51.2 percent of its total population living in rural areas.

The furor over inflation and whether K-12 spending needed to be more closely tied to it came out of a report issued by state Auditor Shad White’s office.

The report by the auditor’s office showed that the growth in K-12 spending on administrative and other non-classroom costs from 2007 to 2017 outpaced the increase in the amount spent in the classroom.

According to the report, administrative costs increased 17.67 percent during the decade, while instruction costs increased 10.56 percent.

The amount of money being spent overall (federal, state and local) on K-12 education in Mississippi increased 12.89 percent from 2007, when it was $4.9 billion, to 2017, when it was up to $5.5 billion.

This inflationary data might not be applicable to government spending on K-12 education, except in a few cases.

According to BLS data, the annual rate of increase for food and beverage prices for urban customers averaged 2.3 percent.

Diesel is needed to fuel school buses and national retail prices, according to data from the U.S. Energy Information Administration, averaged $3.17 per gallon due to five years of prices of $3.80 and higher in the South.

Diesel prices from 2013 to 2017 decreased from $3.92 to $2.65, a drop of 32.39 percent.

White’s report isn’t the first time that alarms have been sounded over increasing administrative costs.

The Joint Committee for Performance Evaluation and Expenditure Review (PEER) released a report in 2015 that showed spending from 2005 to 2015 on instruction decreased by 3.2 percent while that spent on administration increased by 13 percent.

According to data from the state’s Legislative Budget Office, federal and state taxpayers have spent about $3.426 billion on average in the last four years for K-12 education, which averages about 16.3 percent of the state’s total budget when all revenues (general fund, special funds and federal funds) are considered.

These figures don’t include local property taxes and other revenue, such as 16th section land lease income.