Low unemployment rates, high labor force participation rates, positive employment and labor force changes, and increasing wages define the strong small metro areas in this country.

There are a total of 324 metro areas with less than 1 million people. There are three in Mississippi: Gulfport, Hattiesburg, and Jackson. The Wall Street Journal recently ranked those areas to determine the hottest and coldest markets in the country.

The top markets were as varied and diverse as the country, though it certainly helps to be in the Southeast or the interior West.

Some may roll their eyes at three of the top seven small markets benefiting from today’s oil boom. Odessa, Texas, of Friday Night Lights fame, came in at number five with Lake Charles, Louisiana at number seven. And the number one small metro area? Midland, Texas. Midland has an unemployment rate of 2.3 percent, labor force participation rate of 77.1 percent, a 9 percent employment change, and a 7.4 percent labor force change. Barbers can even make $180,000 a year in the oil boom town. Certainty times are good.

But, the hottest markets extend far beyond oil. The top five markets also include locales such as Greeley, Colorado, Provo, Utah, and Columbus, Indiana. Other growing markets in the Southeast include College Station, Texas, Gainesville, Georgia, and Huntsville, Alabama.

We are in what may be the hottest job market of our lives. The economy has added jobs for 100 consecutive months (though the 20,000 jobs created in February came in low). Unemployment is at its lowest level in 49 years. Both low-skill and high-skill jobs are in-demand and, as a result, salaries are growing.

Yet that isn’t everywhere. Including a large segment of Mississippi.

Mississippi’s three metro areas are, unfortunately, more likely to be on the back half of this list.

Hattiesburg, home to the University of Southern Mississippi and William & Carey University, had the best showing at 154. The unemployment rate is 4.1 percent with a 59.8 percent labor force participation rate. The employment change is 1.5 percent and the labor force change is 0.9 percent.

The state’s capitol city wasn’t far behind at 173. The Jackson metropolitan area has an unemployment rate of 4 percent, with a 61.9 percent labor force participation rate. Employment grew by 1.3 percent and the labor force grew by 0.7 percent.

While Hattiesburg and Jackson were slightly better than stagnant, the Gulfport metro area fared much worse. Among the 324 metro areas, it came in at 282. The unemployment rate is around the state average at 4.8 percent, while the labor force participation rate is 54.1 percent. Employment grew by just 0.2 percent and the labor force contracted, decreasing by 0.4 percent. This made Gulfport one of 93 markets to see their labor force get smaller over the past year.

In Mississippi, growth is largely relegated to pockets, not metro areas.

Oxford and Lafayette county have a booming economy and a low unemployment rate thanks in large part to Ole Miss, but it generally doesn’t extend beyond the county line.

There’s a similar story in officially designated metro areas. In the three-country Hattiesburg metro area, Forrest county has an unemployment rate of 4.7 percent, which is in line with the state average. Lamar county, it’s western neighbor, has one of the lowest unemployment rates in the state at 3.9 percent. Meanwhile, Perry county, which is east of Hattiesburg, has a 6.5 percent unemployment rate.

In the Jackson metro area, unemployment rates range from 3.7 percent in Rankin county to 6.5 percent in Copiah county.

This, of course, isn’t that different than what much of the smaller markets in America are experiencing.

The Mississippi legislature wrapped up the 2019 session last week a few days early, but still managed to pass 366 out of the 2,876 bills that were introduced.

Some of the bills advanced the cause of economic freedom and personal liberty. Some didn’t.

Here’s everything of interest that was submitted this year, some that passed and others that died in the process:

Good bills that passed

House Bill 1205 will prohibit state agencies from requesting or releasing donor information on charitable groups organized under section 501 of federal tax law. The bill, sponsored by state Rep. Jerry Turner (R-Baldwyn), was amended in the Senate to include all organizations covered section 501 of federal tax law. The governor signed the bill on March 28.

HB 1352 is sponsored by state Rep. Jason White (R-West) and is known as the Criminal Justice Reform Act. The bill will clear obstacles for the formerly incarcerated to find work, prevents driver’s license suspensions for controlled substance violations and unpaid legal fees and fines and updates drug court laws to allow for additional types of what are known as problem solving courts.

The bill went to conference on March 27 and the two chambers voted to adopt the conference report the next day. The bill only awaits the governor’s signature to become law.

SB 2781, known as Mississippi Fresh Start Act, is sponsored by state Sen. John Polk (R-Hattiesburg). This bill will eliminate the practice of “good character” or “moral turpitude” clauses from occupational licensing regulations, which prohibit ex-felons from receiving an occupational license and starting a new post-incarceration career.

The bill died for a time in the Senate on March 28, when the first conference report was rejected by the Senate. However, a motion to reconsider kept the bill alive and it was recommitted for further conference. The resulting second compromise was accepted by both chambers on the session’s final day and now the bill awaits Bryant’s signature.

SB 2901, known as the Landowner Protection Act, will exempt property owners and their employees from civil liability if a third party injures someone else on their property.

The bill is sponsored by state Sen. Josh Harkins (R-Flowood). The versionsigned by the governor on March 29 allows civil litigation against property owners due to negligence based on the condition of the property or activities on the property where an injury took place. This was a major point of contention during debate over the bill.

HB 1613, also known as the Children’s Promise Act would allow an income tax for voluntary cash contributions by businesses to eligible charitable organizations that help children. The credit would increase the cap on individual tax credits from $1 million to $3 million.

The bill awaits the governor’s signature.

Senate Concurrent Resolution 596 makes Mississippi the 15th state to call for a Convention of the States authorized under Article V of the U.S. Constitution. The resolution was approved by the Senate and passed the House on March 27. Since it’s a resolution and not a bill, it doesn’t require the governor’s signature.

For a Convention of the States to occur, 34 state legislatures would have to pass similar resolutions.

The good bills that died too young

HB 1268 would’ve clarified state law regarding constitutional challenges to local ordinances. With local circuit courts acting as both the appellate body for appeals on specific decisions (such as bid disputes) and the court of original jurisdiction, there’s been confusion among judges regarding the law that governs challenges of local decisions, which are required within 10 days.

City and county attorneys have used this 10-day requirement on decisions to get new constitutional challenges — which are new lawsuits and not appeals — thrown out of circuit courts. This law would’ve added language that would prevent application of the 10-day requirement to constitutional challenges.

The bill was sponsored by state Rep. Dana Criswell (R-Southaven) and passed the House by a 116-2 margin. It was passed out of the Senate Judiciary A Committee, but never made it to the Senate floor for a vote and died on the calendar.

SB 2693 would’ve pre-empted local regulation of short-term vacation rentals, such as Airbnb, and was sponsored by state Sen. Angela Burks Hill (R-Picayune). It died in committee.

HB 85 would’ve required a warrant for law enforcement agencies to use cell site simulator devices except to prevent loss of life or injury. It was authored by state Rep. Steve Hopkins (R-Southaven) and died in committee without a vote for the third consecutive year.

SB 2675 would’ve reauthorized the Education Scholarship Account program until 2024 and was sponsored by retiring state Sen. Gray Tollison (R-Oxford). The bill passed the Senate on a party-line vote, but died in the House Education Committee on deadline without a vote.

Now the program will have to be reauthorized in the next session or face extinction as the authorizing law expires on July 1, 2020.

HB 702 would’ve allowed cottage food operators to increase their maximum sales to $35,000 and advertise their products on the web. It passed the House with ease, but died in the Senate without any committee consideration.

Direct wine sales– The Mississippi legislature still refuses to allow residents to buy wine at either a grocery store (allowed in most states such as neighbors Alabama and Louisiana) or receive direct shipments at home. With the death of SB 2183 and HB 708 early in the session, we’ll have to wait until 2020’s session to possibly get a change in this regulatory hurdle. Both died without committee consideration.

Charitable health care– One would think in a poor, rural state as short of physicians as Mississippi, legislators would want to allow out-of-state, licensed healthcare providers such as physicians, nurses, optometrists and dentists to practice for a non-profit in Mississippi on a charitable basis.

Nope. Both HB 1491 and SB 2248 died in committee without a peep thanks to the lobbying power of the state’s medical establishment.

No Tim Tebows in Mississippi– Another year and the legislature still won’t allow home-schooled students to participate in extracurricular activities, such as athletics, in their respective school districts. HB 118 and SB 2912 died without a committee vote.

Thankfully dead

HB 1104 would’ve reenacted the controversial practice of administrative forfeiture. Last year, the legislature allowed the expiration of the law that authorized administrative forfeiture — which gave law enforcement agencies the ability to seize property valued at less than $20,000 with only a notice to the property owner.

The bill died in committee when support waned among lawmakers for bringing back the practice.

SB 2542, authored by state Sen. Brice Wiggins (R-Pascagoula), would’ve appropriated $4,696,500 toward bringing Amtrak service to the Mississippi Gulf Coast that was ended when Hurricane Katrina made landfall in August 2005. The bill never made it out of committee.

HB 1573 and SB 2563 were cigarette tax increases which were sponsored by state Rep. Jeff Smith (R-Columbus) and state Sen. Wiggins respectively. HB 1573 would’ve increased the tax on a pack of cigarettes to $1.68, while SB 2563 would’ve hiked the per-pack levy to $2.18. Neither bill made it out of committee.

Ugly bills that passed

HB 1612 will authorize municipalities to create special improvement assessment districts that will be authorized to levy up to 6 mills of property tax (the amount per $1,000 of assessed value of the property) to fund parks, sidewalks, streets, planting, lighting, fountains, security enhancements and even private security services. The tax will require the approval of 60 percent of property owners in the district.

The bill is sponsored by state Rep. Mark Baker (R-Brandon). The Senate amended the bill so it only applies to Jackson (cities with a population of 150,000 or more) and Bryant signed the bill on March 29.

SB 2603 will reauthorize motion picture and television production incentives for non-resident employees that expired in 2017. The bill, as originally written, capped incentives to out-of-state production companies at $10 million. This was reduced in conference to $5 million and it was signed by the governor on March 28.

HB 1283 is better known as the “Mississippi School Safety Act of 2019.” Controversially, it will require school districts to develop and conduct an active shooter drill within the first 60 days of the start of each semester.

It would also establish a monitoring center connected with federal data systems with three regional analysts monitoring social media for threats.

The bill would also create a pilot program for six school districts with a curriculum for children in kindergarten through fifth grade with “skills for managing stress and anxiety.” The pilot plan would be federally funded.

The governor signed the bill on March 29.

House Bill 366 allowed the state’s rural, non-profit electric power associations to start broadband networks. The bill zipped through the legislative process with uncanny speed, going from the House Public Utilities Committee to governor’s signature in 16 days.

Since the EPAs will require some sort of capital — likely sourced through grants or loans from the federal government — to start up broadband networks, the bill went into effect after Bryant signed it on January 30.

There was also a failed bill that would’ve provided state taxpayer funds to help start up these service providers, which will have to be managed separately from the EPA’s electric services. With startup cash likely in short supply from the free market, expect the EPAs to descend on the state Capitol, hat in hand, next January asking for grants and loans to serve rural customers.

Officials at the University of Iowa have recently challenged a small group of Christians, students of the university, for supposedly threatening the university’s human rights policy.

The group, called Business Leaders in Christ, were accused of violating university policy by not allowing a gay student to serve as vice president of their group. Members of the group stated that allowing a gay student to serve as vice president of their group would conflict with their core beliefs – the belief that marriage is rightfully intended for one man and one woman.

The court ruled in favor of Business Leaders in Christ and determined that the University of Iowa could not strip them of their rights.

This case demonstrated the sad reality of religious discrimination in America and specifically, religious discrimination on college campuses. Few of us have heard or seen any media coverage of this case. It brings to light the fact that religious discrimination, in America and on college campuses, extends far past what our mainstream media chooses to report.

The University of Iowa attempted to “de-recognize” a Christian group of students for pledging allegiance to their own faith and upholding their own ideals. The violation of rights and targeted discrimination in this act were significant. Yet coverage of the incident has been sparse.

We live in an age in which we worship at an altar of tolerance but the media remains markedly deaf to a case that involved acute intolerance and discrimination based upon one’s religious beliefs. Why? It is vital that we ponder the answer to this question.

Had this been a case of discrimination involving people and events serving the purposes of the left more adequately, would our newsfeed have provided us with more details? Had the rights of an openly Christian group not been upheld in a court of law, would we have heard more?

The lack of media coverage and the hypocritical nature of the discrimination are alarming. The officials who de-recognized the group claimed that they did so based the university’s human rights policy. Yet, where were the rights of the members of Business Leaders in Christ? Where were their natural rights to choose a leader who upheld the core tenants of their common faith?

Even as school officials claimed that the Christian group was practicing intolerance, the university simultaneously infringed on religious freedom and practiced their own brand of intolerance.

The implications of this incident are far-reaching. How we choose a college could be one implication. The way Christians are perceived by the world is yet another.

I am fortunate enough to pursue my chosen field of study at a Christian university. It is a university where I am free to express my faith in all areas of my life. Yet, one should not have to attend a Christian school, as a Christian, to obtain the rights of religious expression. The process of choosing a college should be largely based on how well a student thinks a particularly university can prepare a prospective student for entry into his or her chosen profession.

If the “everything is political” era now extends to college, however, it may become necessary for a Christian student to consider the factor of freedom of speech and religious expression when choosing a school.

The issue of religious discrimination on college campuses, safeguarded by the media’s neglect, seem to be deliberate and systematic. It is slowly teaching the world to be distrustful of Christian expression of faith. It consistently and quietly encourages and magnifies harmful stigmas and generalizations attached to Christianity.

For instance, during what little media coverage there was of this issue, reporters never mentioned if the gay student was denied participation in the group altogether or if the student was merely denied a leadership role.

The recent Iowa court case is just one example of countless others that highlight how Christians are discriminated against on college campuses. The examples are big and small – from paper grading scandals to Christian student group expulsion.

It is an emerging crisis of a violation of our rights as Americans and it is a crisis largely ignored by mainstream media.

Mississippi teachers make less than their counterparts nationally in the 50 states and the District of Columbia, but when Mississippi’s low cost of living is taken into account, the state’s rank jumps to 35th nationally.

The John Locke Foundation performed an analysis using data from the National Education Association and adjusting the salaries using cost of living indices from the Council for Community & Economic Research (C2ER).

The same process can be applied to salaries taking into account the new $1,500 raise passed by the legislature. Mississippi is still the nation’s lowest average salary ($47,074) when 3 percent salary increases are given to the other states.

The state’s average-paid teacher ($45,574) will receive a 3.29 percent bump from the pay hike, which will cost taxpayers more than $58 million annually.

With the data adjusted for the cost of living ($54,929 in Mississippi), the post-pay hike average teacher salary jumps to 34th, ahead of states such as New Hampshire, Montana, New Mexico and Virginia.

In the Southeast, the adjusted salaries rankings put Mississippi ahead of South Carolina ($52,802.71) and Florida ($50,401.26), but behind Georgia ($64,529.73), Tennessee ($59,514.44), Arkansas ($59,445.21), North Carolina ($59,142.82), Alabama ($58,474.08), and Louisiana ($56,037.06).

If Mississippi’s average teacher salary was increased to $50,132 (10 percent increase), the state’s ranking would increase to 17th nationally ($58,497 with cost of living adjustment) and it would be the second-highest among Southeastern states behind Georgia (ranked 9th with an adjusted annual salary of $62,650).

The average teacher salary nationally is $63,635.46 when adjusted for cost of living.

Mississippi has the lowest cost of living nationally, while Hawaii, District of Columbia, California, New York and Massachusetts are highest nationally, according to the C2ER.

The House and Senate approved the conference report on Senate Bill 2770 on Thursday. The raise started as $1,000 raise phased in over two years and was increased in conference. Attempts to recommit the bill by Democrats in both chambers failed on largely party-line votes.

Some have called the $1,500 raise a “betrayal,” a “joke” and a “slap in the face.”

This is the third teacher pay hike since 2000. The legislature passed a $337 million plan in 2000 that was phased in over six years.

In 2014, the legislature passed a two-year plan that increased teacher pay $1,500 in the first year and $1,000 in the second year, costing taxpayers an additional $100 million.

Teachers in Mississippi receive annual raises after their first three years on the job and also receive pay hikes for earning higher certifications. A teacher in the lowest certification level starts at $34,390, increasing to $39,108 for the highest certification level.

A teacher with 20 years of experience will earn $43,300, while the highest classification nets $53,400. This is before local supplements, which can be several thousand dollars more per year in certain school districts.

According to the Bureau of Labor Statistics, the average weekly salary in Mississippi is $752 or $39,104 annually.

While the Jackson City Council considers an ordinance which could drastically limit Airbnb and other short-term rental properties in the area, Jan Serpente continues to maintain and prepare her cottage in anticipation of her next guests.

She first learned of Airbnb about two years ago, when her youngest son, Sam, suggested she and her husband rent out their recently fixed-up wash house in their backyard. “One year he said, ‘mom, why don’t you rent this out?’” Within the first 24 hours that the space was listed on the Airbnb site, she had her first visitor scheduled. Two years later, she has welcomed and hosted over 200 guests in the Jackson area.

“I think people want to experience their travel, and this gives them an experience,” Jan says.

Jan and her husband moved to Jackson from the Coast after Katrina. Most of the guests she and her husband have hosted are either traveling from Memphis to New Orleans or from Dallas to the beach. A drive, Jan says, that is too long to cover in one day. However, she has also hosted visitors from Cambridge, England; New York; and locals looking for a weekend retreat.

For those visiting the area, Jan leaves out a list of places of interest, restaurant suggestions, and places to explore. Jan and her husband themselves have traveled a bit, though not extensively. Their last stay in a hotel ended when a lawnmower smashed into their room causing them to swear off hotels completely. She says that when someone visits a town, they generally want the local experience of that town. Which is what they get with an Airbnb. With Airbnb, we can give our customers that local town experience.

In Jan’s opinion, Airbnb’s growing popularity comes from a few factors; the comfort level an Airbnb space provides can offer an alternative to a national hotel chain, it generally costs less than a hotel, and an Airbnb can add to a traveler’s experience in ways most hotels just can’t.

Especially important to Jan is the comfort of her guests. She bakes fresh bread every day and makes sure to leave some in the cottage to welcome the guests when they arrive. She also leaves snacks like fruit and instant grits.

“It just makes me happy,” Jan added. “I’ve always liked visitors. I like to make them cozy beds, I like to make good food. So, it’s kind of a spiritual experience that you’re taking care of strangers. You want them to be comfortable, safe, happy. You want it to be a good experience for them.”

By adding to guests’ traveling experience, Jan gets an experience of her own. She describes Airbnb hosting as a way of seeing the world from the comfort of her own home. An experience she loves to share with her granddaughter, who often accompanies her in welcoming guests.

How does a potential renter know if they will be staying in a nice house? Airbnb uses a peer-to-peer review system. If an Airbnb is not up to standards, guests can complain or leave a bad rating. When customers rate a host poorly, that host is likely taken off the Airbnb site completely and kicked out of the system. If a host wants his or her location to stay up on the site, they must provide the best experience possible. This puts the power in the hands of the users and guests who stay at these Airbnb locations, rather than in the hands of government.

We want to keep this power in the hands of the costumers rather than forcing local restrictions on hosts, as various cities in Mississippi, including Jackson, are either attempting to do or have already done.

In Jan’s opinion, the city of Jackson should be doing things to promote Airbnb in Jackson.

“I think we’re doing the city of Jackson a favor,” Jan said. “We’re fabulous ambassadors. Visitors come here for a stay and I want it to be nice for them.”

Considering Jan’s level of constant guests, she is sure that this is what people want. And she enjoys putting on a good face for Jackson. Since moving here over a decade ago, Jan and her husband have considered if they wanted to stay in Jackson on several occasions. Ultimately, there is a lot about Jackson they are both proud of and they want to share that pride with others. Airbnb has given them a way to use their property to do exactly that.

“You kinda want to share that with other people, it’s easy to be here.”

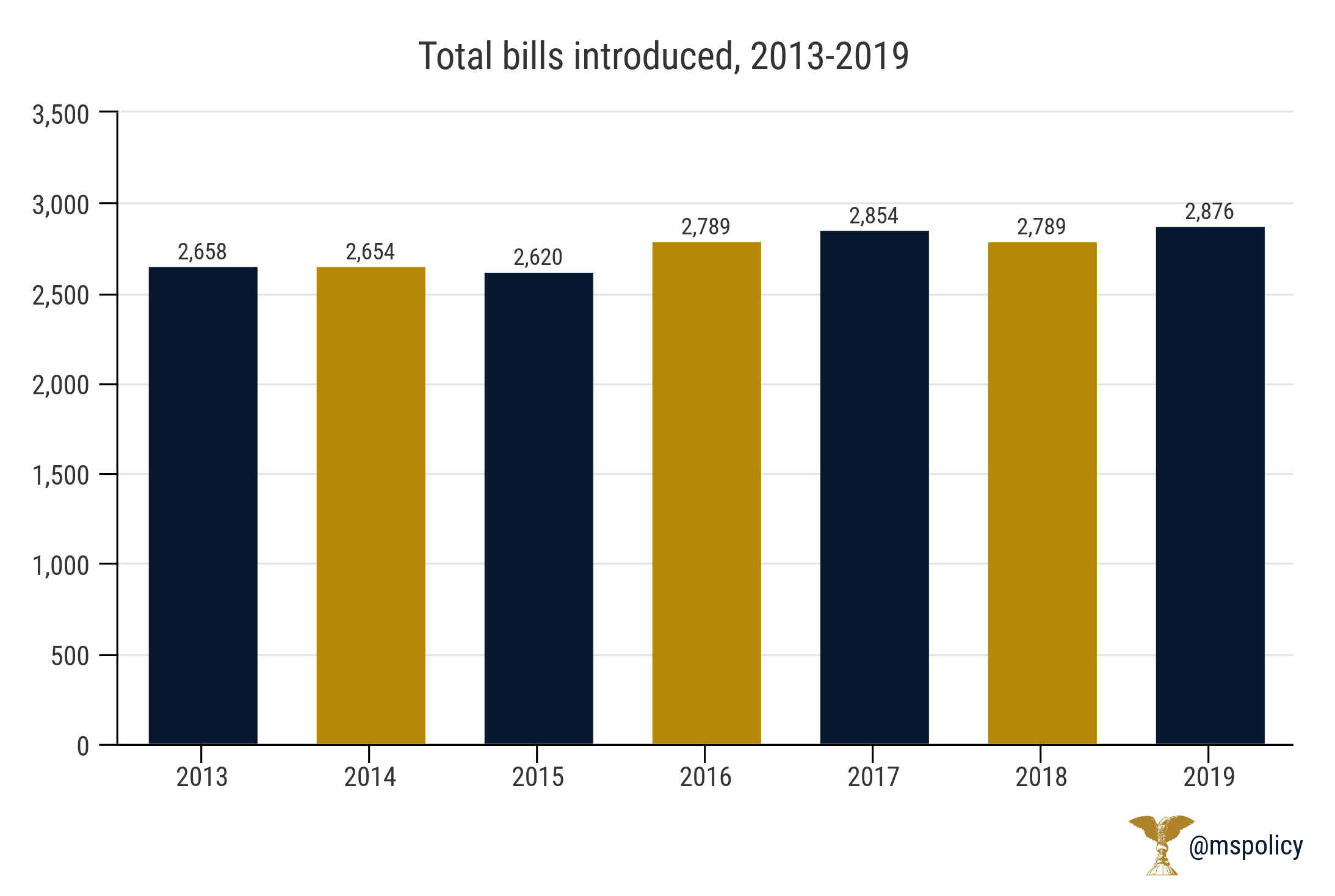

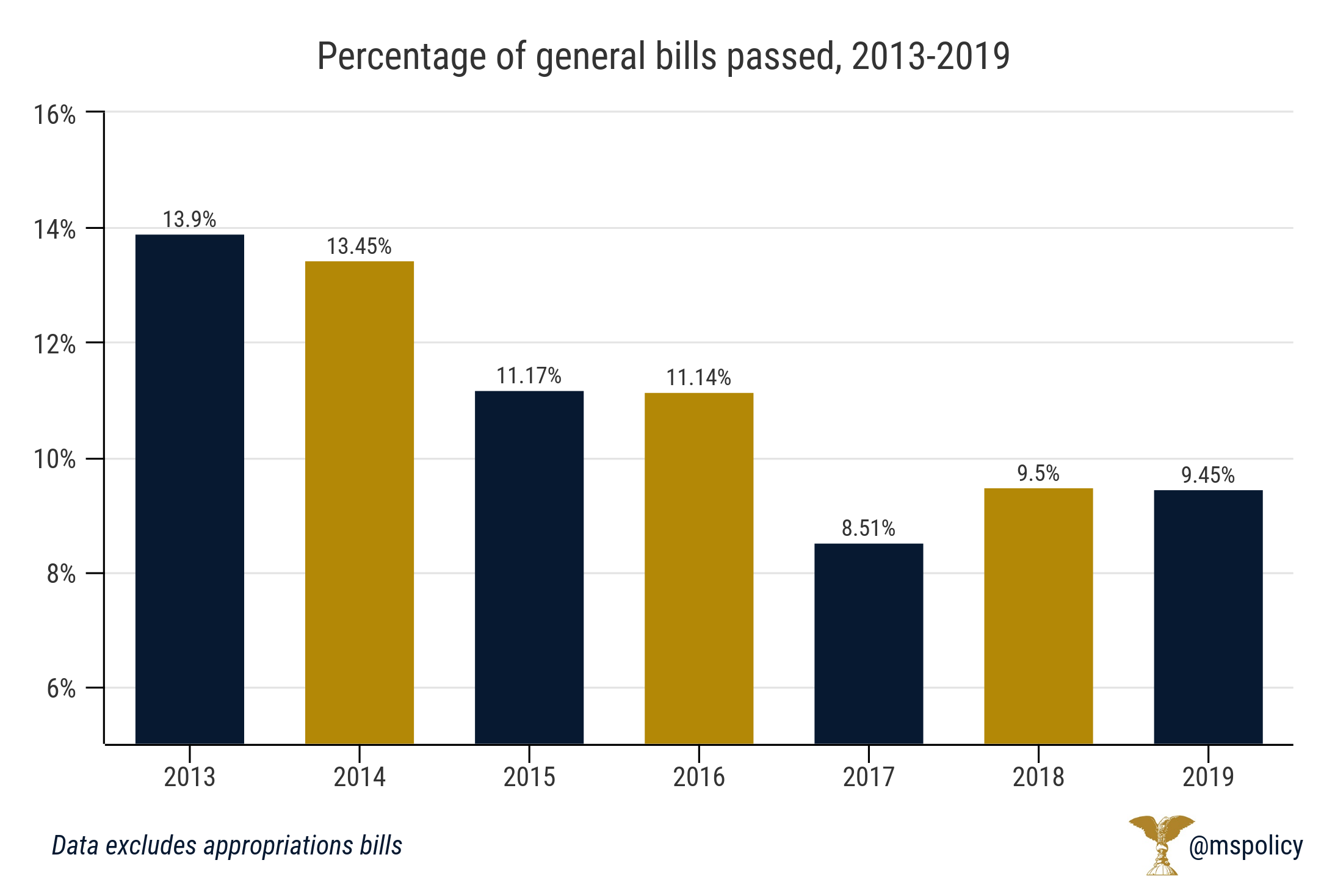

Mississippi legislators drafted plenty of bills this year, but very few became law.

Despite the largest number of total bills presented in the last six years, the percentage of them that became law (12.66 percent) was the second lowest in the same span.

There were 2,876 bills — 127 more than the six-year average of 2,749 — that were drafted in this year’s session, which ended Friday. With 104 of them being appropriations bills — which fund state agencies and make up the budget — that left 2,772 general bills.

Only 260 general bills were passed by both chambers in the legislature and either have been signed or are awaiting the signature of Gov. Phil Bryant. That’s a rate of 9.45 percent for those keeping score at home.

Most bills signed into law by Bryant will go into effect on July 1, the first day of the new fiscal year.

The average in the last six years has been 11.01 percent for general bills and 14.38 percent for all bills.

Comparing the session with last year, 9.5 percent of all general bills and 12.87 percent of all bills in that session became law.

While the number of bills dropped has gone up in the last four years, the number that survive the process in the legislature to make it to the governor’s desk has shrunk every years since 2016.

The highest percentage session was 2013, when 17.27 of all bills and 13.9 percent of all general bills became law. That session had 2,658 total bills and 2,554 general ones.

The chances that this year’s bills passed by the legislature are signed by the governor are good. This session, Bryant vetoed only three out of 366 bills after averaging four vetoes per session the last three years.

Here are the bills Bryant vetoed in this year’s session:

- Senate Bill 2669 would’ve extended the repeal date on the Mississippi Development Authority’s Local Governments Capital Improvements Revolving Loan Fund. His veto message said another bill he signed, House Bill 713, reauthorized the program, thus eliminating the need for SB 2669.

- HB 576 would’ve allowed the State Superintendent of Education to send a representative in their stead to the State and School Employees Health Insurance Management Board. The governor said in his veto message that it would create an undesirable situation and precedent regarding the composition of the board.

- HB 666 would’ve increased the minimum age for the commitment of youthful offenders to the state training school from age 10 to age 12. Bryant’s veto message said the bill would prevent Youth Court judges from placing violent offenders ages 10 and 11 in either the state school or secured detention.

| Session year | Total bills | Appropriations | General | All bills passed by both chambers | General bills passed by both chambers | % of total bills passed | % of general bills passed |

| 2019 | 2,876 | 104 | 2,772 | 366 | 262 | 12.73% | 9.45% |

| 2018 | 2,789 | 104 | 2,685 | 359 | 255 | 12.87% | 9.50% |

| 2017 | 2,854 | 104 | 2,750 | 338 | 234 | 11.84% | 8.51% |

| 2016 | 2,789 | 104 | 2,685 | 403 | 299 | 14.45% | 11.14% |

| 2015 | 2,620 | 104 | 2,516 | 385 | 281 | 14.69% | 11.17% |

| 2014 | 2,654 | 104 | 2,550 | 447 | 343 | 16.84% | 13.45% |

| 2013 | 2,658 | 104 | 2,554 | 459 | 355 | 17.27% | 13.90% |

| Averages | 2,749 | 2,645 | 394 | 290 | 14.39% | 11.02% |

Before the Mississippi legislature left town Friday as the session came to a close, it added $371 million in debt in the form of a large bond bill and several other bond bills for various projects.

Senate Bill 3065 adds up to about $207 million in additional spending that includes $85 million in borrowing for projects for the state’s universities, $25 million in projects at community colleges and $63 million for restoration of historic buildings statewide.

The House and Senate both signed off the compromise on Thursday and the bill needs only Gov. Phil Bryant’s signature to become law.

In a stunning admission while presenting the bill’s conference report, state Rep. Jeff Smith (R-Columbus) said that many of the projects were for “trying to help members that are going to have tough races.”

“We had some big-ticket items and this was the most for the IHL (Institutes for Higher Learning) that we’ve ever had,” said Smith, who is the chairman of the House Ways and Means Committee. “Overall, this bill smells good.”

The “Christmas tree” bond bill isn’t the only bit of largesse being put on the taxpayers’ credit card.

There was also $86 million in projects for the Mississippi Development Authority, $12.5 million to help with the construction of the Mississippi Center for Medically Fragile Children, $7.94 million for the Water Pollution Control Revolving Fund and $3.5 million for improvements at Lauderdale County’s industrial park. All were signed into law by Bryant this week.

Bryant also signed House Bill 983 into law on Thursday. This law will give Huntington Ingalls Industries $45 million from state bonds.

The bill says the funds are for capital improvements, investments and upgrades for the shipyard, part of a three-year deal to help Huntington Ingalls.

It’s not the first time for Huntington Ingalls receiving money from state taxpayers, as the state has borrowed $307 million for Ingalls improvements since 2004. The company was awarded $9.8 billion in new contracts in 2018 and was just given a $1.48 billion contract Tuesday for the 14thSan Antonio class amphibious dock ship for the Navy.

Huntington Ingalls Industries received $45 million from taxpayers in 2018, $45 million in 2017, $45 million in 2016, $20 million in 2015, $56 million in 2008, $56 million in 2005 and $40 million in 2004.

The company leases the land for its Pascagoula shipyard from the state and is exempt from property taxes. It is one of south Mississippi’s largest employers, with 11,000 workers.

In addition to the San Antonioclass, Huntington Ingalls’ Pascagoula yard builds Arleigh Burkeclass destroyers, Americaclass amphibious warfare ships and the Legend class national security cutter for the U.S. Coast Guard.

The state already owes more than $4.441 billion in bond debt and legislators appropriated more than $285 million for debt service for fiscal 2020, which begins on July 1.

The legislature will also borrow $300 million for infrastructure needs under a deal reached in the 2018 special session.

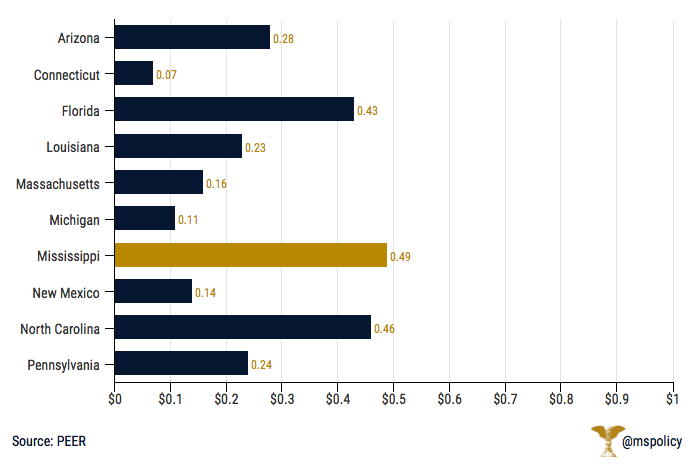

The House and Senate have adopted the conference report to expand Mississippi’s film incentives program despite evidence that the program loses taxpayers money. It is on its way to Gov. Phil Bryant.

Those concerns were largely swept aside by proponents who either argued that the report from PEER was incomplete, inaccurate, or that there are other benefits that we can’t necessarily measure.

The 2015 report from PEER shows taxpayers receive just 49 cents for every dollar invested in the program. That means that for every dollar the state gives to production companies, we see just 49 cents in return for the general fund.

But Senate Bill 2603, which passed with few dissenting votes, will bring back the non-resident payroll portion of the incentives program. This allows for a 25 percent rebate on payroll paid to cast and crew members who are not Mississippi residents. It expired in 2017 and the Senate had refused to consider it. Until this year. Though the companies now have to be Mississippi-based production companies.

Two other incentive programs remained on the books. One is the Mississippi Investment Rebate, which offers a 25 percent rebate on purchases from state vendors and companies. The other is the Resident Payroll Rebate, which offers a 30 percent cash rebate on payroll paid to resident cast and crew members.

For those who question the PEER report, they are missing one key data point. All the studies on film incentives, and the body of research is significant, have painted a similar picture. We are not sitting on an island with some crazy, unsubstantiated report. As the PEER report outlined, no one is receiving more than 50 cents on every dollar put in the program.

This is why many of those states have scaled back or eliminated their programs. In 2009, all but six states offered some type of incentives for movie producers. As of 2018, just 31 states still have programs on the books. So, while other states are cutting back, Mississippi lawmakers appear interested in pressing forward.

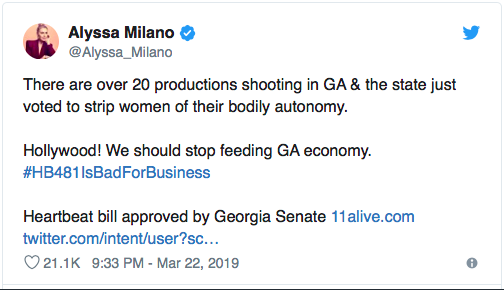

And there is another point to be considered. Do we want Hollywood to think they control our state? That is certainly the emerging situation in Georgia, a state that has a massive film incentives program. Consider this recent tweet from actress Alyssa Milano:

Just last week, Gov. Phil Bryant signed a heartbeat bill into law. Or this commentary from director Rob Reiner concerning North Carolina’s bathroom bill a number of years ago:

When you incentive Hollywood to come to your state, they believe they can and should set policy for your state. If you dare to disagree with their value system, the script they follow is to economically boycott the hand that feeds them. We’ve seen this movie before. It’s not worth the price of admission.