The Mississippi Senate passed a bill intended to promote school safety Tuesday and bypassed some key reform bills, setting up a busy calendar on the deadline.

Wednesday is the final day for general (non-revenue bills) to pass out of the other chamber.

The Senate declined to take up House Bill 1352, the criminal justice reform package and HB 1268 which would change procedures governing constitutional challenges to local ordinances. Both bills maintain their places on the calendar.

HB 1205 was also bypassed by the Senate. It would prohibit state agencies from releasing or requesting donor information from 501(c) non-profit organizations. And HB 702, which would expand cottage food operations in the state, was also passed.

In the morning session, the Senate passed a bill, HB 1283 that is intended to address school safety. The bill would require school districts to develop and conduct an active shooter drill within the first 60 days of the start of each semester.

It would also establish a monitoring center connected with federal data systems with three regional analysts monitoring social media for threats.

The bill would also create a pilot program for six school districts with a curriculum for children in kindergarten through fifth grade with “skills for managing stress and anxiety.” The pilot plan would be federally funded.

It would also mandate that all school district employees receive refresher training on mental health and suicide prevention every two years.

The Mississippi Office of Homeland Security would also develop a curriculum to train and certify threat assessment officers, which would be required to conduct an annual inspection and threat assessment of each school in the state. They’d be required to inspect surveillance equipment and floorplans.

Teachers and administrators would also be trained in conducting what the bill calls behavioral health screenings for students.

The Mississippi Department of Education will develop and implement a statewide media campaign based on the concept of “see something, say something.”

The school safety bill will return to the House for concurrence, since it was amended in the other chamber. If the House concurs with the changes made to the bill, it’ll be headed to Gov. Phil Bryant.

If not, the bill will go to a conference committee to smooth out the differences.

The Senate also passed a bill, HB 977, that would allow out-of-state, licensed physicians the ability provide treatment to players and coaches at sporting events.

An amendment similar to several dead bills that would’ve allowed licensed medical professionals to practice in the state for charity failed on a voice vote. The amendment was authored by state Sen. Angela Hill (R-Picayune) and failed on a voice vote.

As a conservative woman, I consider campus free speech and free association protections to be vitally important.

In my experience, conservative women are more likely to have their ideas attacked and silenced on many campuses. Maybe it’s because we believe in taking responsibility for our actions. Maybe it’s because we don’t blame the so-called misogynistic patriarchy for all our problems. Maybe it’s because we refuse to believe there is a glass ceiling limiting our opportunities or maybe it’s because we know we don’t have to keep the victim card in our back pockets “just in case.” Whatever the reason, conservative women can sometimes find themselves with a target on their back.

Consider the case of former Secretary of State Condoleezza Rice. A few years ago, Rice was invited to Rutgers University to deliver a commencement address. The campus outcry was so divisive that Rice eventually declined to speak.

Two years later while delivering a commencement address at the same school, then president Barack Obama reminded the students and faculty of Rutgers that they should embrace debate and discussion. “Don’t feel like you got to shut your ears off because you’re too fragile and somebody might offend your sensibilities,” counseled Obama. “Go at them if they’re not making any sense. Use your logic and reason and words.” The Rutgers population could have used that message a couple years earlier.

Discouraging free speech and association

Far too often, college campuses are not places where students are encouraged to use logic, reason and words to dialogue about a controversial issue. As a conservative woman in college, I personally encountered an environment that discouraged political free speech and association.

As a freshman, I realized that there was a need for an organization where students could meet and discuss different ideas. So, I started a student conservative women’s organization to do just that. To start, I needed a faculty sponsor. My potential sponsor, though, had concerns of backlash from other faculty members. She was also worried about how her employer – the administration of the college – would treat her for sponsoring a conservative political group. This woman loved her job. She was a good professor. She was a great advisor. It’s terrible she had to consider the future stability of her job before she could sponsor a campus club that shared her own opinions and beliefs.

As it turns out, her concerns were real. The university did not appreciate our group’s constitution. The administration was scared. They were scared of causing any sort of friction among students. And they were scared that some students might be offended. After much back and forth, I finally persuaded the Student Life administrators to allow our group to be formed, thus creating an empowering place where conservative women could assemble, meet, and share our ideas.

It’s concerning to me that my own college campus was so nervous about legitimate debate on important topics that my own group almost didn’t even get started, which, in a way, would have silenced my own voice. Whatever happened to the constitutional right to free association?

The FORUM Act

It’s also concerning to me that, even here in Mississippi, attacks are made on campus free speech. However, there are some who are combating this, like Rep. Stacey Wilkes who introduced The FORUM Act this legislative session. Though it did not become law this year, the protections Rep. Wilkes is championing, such as the right to free speech and free association on Mississippi college campuses, are incredibly important. FORUM is designed to protect the lawful, constitutional expression of students and the campus community, provide recourse should those rights be inhibited, and to make the university accountable for protecting those rights.

As a Missouri native, I know firsthand the problems that can occur when college campuses do not have clear policies to protect the free speech and free association rights of all students. Three years after I established my conservative women’s club, months of protests at the University of Missouri showed just how necessary legislation like the FORUM Act is and what can happen when colleges and universities do not have a clear plan to follow that would protect the campus community’s right to speech.

The University of Missouri

At one such protest, a professor taking part in the demonstration demanded the use of force to keep student journalists from documenting the protestors, violating the media’s First Amendment protection to do so. It took four months and intense pressure from the media and the public before she was fired from her position at Mizzou. Following this incident, campus police threatened the Mizzou community announcing that the university’s Office of Student Conduct would take “disciplinary action” against students who had reportedly engaged in any “hurtful speech.” The email sent out with the announcement stated that though the language was not criminal, they wanted such incidents reported and that the Office of Student Conduct could take disciplinary action if the individuals were identified as students.

Four months prior to all of this, in July, Missouri became the second state in the nation to pass the Campus Free Expression Act (Senate Bill 93). The legislation’s purpose was to protect campus media coverage and counter protests, as well as regular protests anywhere on university property. Essentially, the bill eliminated campus free-speech zones. In this case, obviously, protestors were taking full advantage of that freedom. Which is good, and this was a good first step. However, had the Missouri legislature gone further, passing something like the FORUM Act, most of what happened at Mizzou could have been avoided, or dealt with in a more appropriate way.

What FORUM would do is bring back a campus culture in which people get accustomed to hearing points of views different than their own. From there, they would learn to respond in a respectful and civil manner. This is the exact opposite of what Mizzou did. Instead, they tried to suppress the speech of others in their attempt to appease the protestors. Once all the drama cleared, Mizzou realized where they went wrong in prolonging the protests and began taking steps to recover. This included adopting a policy statement committing the university to free speech principles.

Justice Oliver Wendell Holmes is credited with writing that, “The protection of a people’s right to hear is of particular importance on college campuses, where students’ intellectual development is dependent on the ‘free trade in ideas.’” Ultimately, it is dedication to these principles that we should all share – whether conservative or liberal, or female or male.

Everyone will benefit from campus free speech and free association protections, especially the students our university systems are supposed to serve.

The legislature is very close to reinstating a provision in the film incentives program that died two years ago. And, in doing so, continuing and expanding a program that we know is losing taxpayer dollars.

Senate Bill 2603 has passed the Senate, and, last week, the House, with only minor changes that will need to be resolved before a bill is sent to Gov. Phil Bryant for his signature.

Mississippi currently has two incentives on the books. One is the Mississippi Investment Rebate, which offers a 25 percent rebate on purchases from state vendors and companies. The other is the Resident Payroll Rebate, which offers a 30 percent cash rebate on payroll paid to resident cast and crew members.

Previously, Mississippi had a non-resident payroll portion of the incentives program. This allows for a 25 percent rebate on payroll paid to cast and crew members who are not Mississippi residents. It expired two years ago, and the Senate has refused to consider it after passing the House twice.

It’s a different story this year.

A terrible return on investment of taxpayer dollars

A 2015 PEER report shows taxpayers receive just 49 cents for every dollar invested in the program. That means that for every dollar the state gives to production companies, we see just 49 cents in return. If you or I were receiving that return on our personal investments, we would fire our financial advisor. Of course, no one spends his or her own money as carefully as the person to whom that money belongs.

For those looking at a bright side, we are actually “doing better” than many other states. This includes our neighbors in Louisiana, who recover only 14 cents on the dollar. They also have one of the most generous programs in the country; it was unlimited until lawmakers capped it a couple years ago. (Other reports show the Pelican State recovering 23 cents on the dollar, but either way it’s a terrible investment.)

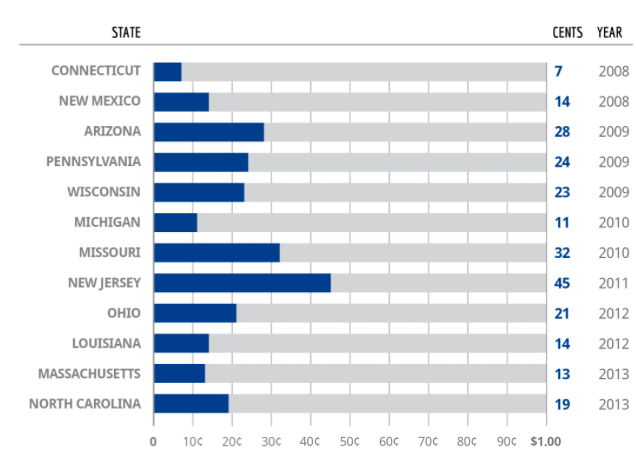

Beyond Mississippi and Louisiana, film incentives are a poor investment throughout the country. Numerous studies have been conducted on film incentives. All sobering for those worried about taxpayer protection. Here is a review of the return per tax dollar given, from 2008 through 2013. In these third-party studies, covering 12 different states, there was not a program that returned even 50 cents on the dollar.

Source: John Locke Foundation

Since this chart was published, studies on similar programs in Florida, Virginia, and West Virginia have shown similar results. No program had a positive ROI.

We have to do it if other people are

One of the commonly prescribed reasons for why need film incentives is it’s “good” for the state to have movies filmed here. As is often the case in government, we focus on the inputs. How many films are made here? What movie star was in Mississippi? That is nice, but the focus should be on outcomes.

The other common argument is that other states are doing it. Throughout the country, producers hold states hostage and threaten to move without incentives. Producers in Mississippi have raised the same point. Again, that is not good reason to essentially throw taxpayer money away.

Simply because another state is wasting money does not mean Mississippi should join them, or continue this practice.

In a comprehensive list of state film production incentives compiled by the National Conference of State Legislatures (NCSL), we see states that do not have incentives for producers but offer tax breaks to everyone, without partiality. For example:

Alaska: No film incentive program. Effective July 1, 2015, the film production incentive program was repealed. Alaska has no state sales or income tax.

Delaware: No film incentive program. However, the state does not levy a sales tax.

Florida: This program sunset on June 30, 2016. It has not been renewed. The state does not levy a state income tax.

New Hampshire: No film incentive program. The state has no sales and use, or broad base personal income taxes.

South Dakota: No film incentive program. There is no corporate or personal income tax in South Dakota.

Our goal should be for Mississippi to have the most competitive business climate in the country. The tax breaks that a few chosen industries or companies receive should be made available to all. When we do that we will remove the need for taxpayer funded incentives.

There has been a movement underway around the nation and in Mississippi to reform our criminal justice system.

The movement has gained momentum due to our mass incarceration problem in the U.S. — a reality where our prison population has grown roughly seven-fold since the 1970s and left us with highest incarceration rate in the world.

By way of comparison that helps visualize the extent of the problem, the U.S. incarcerates 655 per 100,000 people of any age, while Turkmenistan incarcerates 583, Cuba 510, Rwanda 434, Russia 415 and Brazil 324, according to data maintained by the Institute for Criminal Policy Research at the University of London.

In a nation with the highest incarceration rate in the world, Mississippi has the third highest rate as a state.

If you are hearing these types of statistics for the first time and are very surprised, you are not alone. Most are very surprised. And as you might suspect, our unique incarceration habit is a very expensive one. It is a budget-busting endeavor that is eating an ever-increasing percentage of state budgets around the nation, and it is doing so at the expense of other worthwhile and necessary public investments.

Perhaps this is one reason why even in this divisive political era, the reform movement has drawn supporters from across the political spectrum.

The Mississippi Legislature has been one such supporter, and more than that, it has been a leader on this issue nationally. In recent years it has passed two criminal justice reform measures, H.B. 585 (2014) and H.B. 387 (2018), and it is currently considering H.B. 1352, another reform measure. H.B. 1352 seeks to make it easier for people who have paid their debt to society to re-enter the workforce by removing barriers to employment. These barriers occur in various ways that are not directly or indirectly tied to fighting crime or reducing recidivism, such as through the denial of occupational licenses and the loss of driving privileges for offenses that are not related to driving.

In addition to addressing work-related issues, H.B. 1352 also addresses mental health issues, which along with addiction issues affect our criminal justice system. These issues often go unaddressed in prison. For addiction issues, drug courts have proven to be an effective tool. H.B. 1352 builds on drug court successes by allowing these courts to also offer treatments to those with mental health issues.

The cost implications are huge. Mississippi spends over $300 million annually in a cash-strapped state to support an overly large prison system. Funds are scarce to non-existent to dedicate towards measures that would reduce crime in the first place. H.B. 1352 would create a dedicated fund to ensure that cost-savings from reforms are invested in programs that are aimed at reducing crime and making communities safer.

Criminal justice reform is an issue that garners bipartisan support because of shared goals — safer communities, fewer people in prison, more people leading productive lives, and cost savings from unnecessary overincarceration. Over 95 percent of the people currently incarcerated in our prisons will be re-entering our communities at some point. A current reality is that approximately a third of those persons will reenter prison within three years. The reasons for this can range from the commission of a new crime to violations of a parole condition. We can change this equation to some degree by ensuring that when people leave our prisons, they can go to work. H.B. 1352 will help do that.

It is difficult to combat the realities of recidivism. There is no sense in making this battle more difficult by making it harder for the recently released to find employment through the imposition of unnecessary barriers. It is imperative that we eliminate these barriers, such as the denial of occupational licensing, that make it harder for people to find work and more likely to turn to crime.

Our current incarceration system is not effective. We should be smart on crime and adopt evidence-based solutions that actually make our communities safer – policies that have demonstrated success through the numbers, not simply emotion-based actions that provide only chest beating points. A smarter approach involves offering the dignity of work to people who have made mistakes and focuses incarceration efforts on those who truly pose a threat to public safety. This, in turn, will create safer communities for the people of our state. That’s something we can all agree on.

This editorial appeared in the Clarion Ledger on March 12, 2019.

As Mississippi enacts a law that will allow its electric cooperatives to offer broadband service to customers, one of the state’s lawmakers also suggested the Magnolia State should follow the lead of Kentucky and issue bonds to build out statewide fiber infrastructure.

Mississippi Wired, anyone?

Despite the fact that the Bluegrass State’s Kentucky Wired is massively overbudget and way behind schedule, Mississippi state Rep. Robert Johnson (D-Natchez) oddly pointed to Kentucky’s plan as one to emulate.

Gov. Phil Bryant recently signed into law the Mississippi Broadband Enabling Act, which sailed through the 2019 legislative session.

After that bill became law, only a handful of cooperatives indicated they are ready to move forward on high-speed internet. So Johnson told Mississippi Today he’d support a state plan to issue bonds and incur debt to build out fiber in Mississippi. The state would then lease the fiber to private providers to extend the “last mile” to customers.

“It is that important to the state,” Johnson said.

Michael Callahan, CEO of the Electric Cooperative of Mississippi, said cooperatives will soon meet with consultants to research acquiring federal funds (read: taxpayer money) to aid in the broadband effort.

Brent Skorup, senior research fellow at the Mercatus Center, cautions against the wholesale model espoused by Johnson. He pointed both to UTOPIA in Provo, Utah, a financially-troubled project purchased by Google Fiber for $1 in 2013, and Kentucky Wired, which is quickly turning into a boondoggle for that state.

“It’s only public-private in the most narrow sense,” he told the Taxpayers Protection Alliance Foundation. “Taxpayers are on the hook for that project.”

Kentucky Wired was originally supposed to be up and running this year, but recent reports indicate only 1,000 of the 3,000 miles of the statewide fiber infrastructure are complete.

Kentucky State Auditor Mike Harmon released a scathing report on the project last year, calling the plan a “bait-and-switch on the taxpayers.” Kentucky residents could be on the hook for as much as $1.5 billion after state officials switched the financing of the project primarily from the private side to the public side to take advantage of tax-exempt bonds by creating the nonprofit Kentucky Wired Infrastructure Company. But a combination of project delays and expected revenues drying up are sinking any chance taxpayers have of recouping their unexpected investment.

As for cooperative broadband, Skorup said the “devil is in the details.”

He points out that such cooperatives are historically heavily subsidized by the federal government, which could hurt the business case for private providers in those areas looking to offer service.

“That could scare off unsubsidized companies in rural areas,” Skorup said.

Another common issue is cross-subsidization between power and broadband divisions, which has been observed in cities that decided to offer high-speed internet and didn’t find the business as easy as anticipated. The Mississippi bill, however, stamps that issue out by not allowing cooperatives to use electricity revenue to prop up the internet.

Skorup said electric cooperatives’ common monopoly on utility poles in rural areas is a concern. Private providers must negotiate rates for usage of those poles for their own fiber.

“I would start to worry that this would give [cooperatives] the incentive to raise the cost of access for other broadband providers,” he said.

Despite his “yea” vote on the bill, Johnson is one of a consortium of attorneys that is suing seven Mississippi electric cooperatives, claiming in the suit that those nonprofit entities aren’t returning excess revenue to their member customers.

Cities and counties could collect certain debts by garnishing state income tax refunds if a bill passed by the Mississippi legislature becomes law.

House Bill 991 would allow local governments to collect any debt or fine that’s at least $50. Different debts could also be combined to satisfy the debt threshold of $50.

The bill passed the House 86-28 back in February and it cleared the Senate by a 30-14 margin last week. It is now headed to Gov. Phil Bryant’s desk for signature.

The legislation was pushed by the Mississippi Municipal League, which said on its Facebook page that it would help reconcile thousands of unpaid municipal court fines in cities and towns throughout the state.

Under the bill, cities and counties would contact the Mississippi Department of Revenue and submit the debt owed it for collection. The local government, or a member organization on its behalf, would send written notice of the intent to the debtor to garnish part or all of their refund.

In addition to the debt, a 25 percent collection assistance fee would also be assessed.

The debtor would have 30 days to contest the garnishment and receive a hearing in front of the government. Appeals of these decisions would be made to the county circuit court.

HB 991 doesn’t explicitly mention county-owned rural hospitals, of which there are 19 in the state, but doesn’t exclude debts paid to them either.

Already, the DOR can garnish state income tax refunds to recover:

- Unpaid child support.

- Federal taxes or fees owed.

- Unpaid student loans (state government loans only).

- Community college unpaid fees or other debts.

The bill was sponsored by state Rep. Jeff Smith (R-Columbus).

It made it out of the Senate Finance Committee the day before Tuesday’s deadline for general bills to make it out of committee in the opposite chamber.

Last year, there were a pair of billsthat were very similar to this year’s HB 991 for counties and municipalities and all died in committee without making it to the floor.

Two other bills regarding the garnishment of state income tax refunds for the collection of debts were also drafted.

Senate Bill 2194was signed into law and allows community colleges to get the DOR to garnish state income tax refunds for the repayment of unpaid fees or other debts.

Another bill, SB 2608, would’ve allowed public and private non-profit hospitals to do the same thing, but died on the calendar after making it out of the Senate Finance Committee.

A bill that could protect the donor lists of non-profit organizations passed a key hurdle Monday.

House Bill 1205 would prohibit state agencies from requesting or releasing donor information on charitable groups organized under section 501 of federal tax law. The bill passed out of the Senate Accountability, Efficiency, Transparency and is now on the Senate calendar.

The deadline for passage is Wednesday.

The bill, which is sponsored by state Rep. Jerry Turner (R-Baldwyn), was originally written to include all of the different 501(c) designations. The bill was amended in the Senate AET Committee for the bill’s protections to only include 501(c)(3) organizations.

If the bill is passed by the Senate, the new version will have to be accepted by the House or else the differences will have to be settled in conference.

According to federal law, 501(c)(3) groups have to disclose their donor lists to the IRS, which are not disclosed on publicly available tax filings. These organizations are eligible to receive tax-deductible contributions, but can’t engage in direct political activity.

The bill is needed as progressives nationally have made it their goal to expose the donors to political organizations they deem hostile to their interests. If these lists are made available, these donors can be left open to threats, harassment or possibly other consequences.

The Pelosi-run U.S. House will likely pass House Resolution 1, known as the “For the People Act of 2019” Friday.

The rather inaptly named bill would have federal financing of elections in the form of six to one matching funds for donations up to $200 for candidates who reject large donations, would require states to implement mandatory voter registration, restore voting rights nationwide to ex-felons and place greater federal oversight over elections, which have traditionally been the responsibility of the states by limiting state regulations on voting by mail and voter roll purges.

It would also make Election Day a federal employment holiday.

The worst part of the legislation — known as the DISCLOSE and Stand By Every Ad acts — are even being criticized by the American Civil Liberties Union. These acts would require the disclosure of the identity of donors who contribute $50,000 or more by political non-profit groups and also govern revelation of donors for issue-based political ads.

The ACLU and other groups claim this runs counter to First Amendment protections governing free speech.

State Rep. Mark Baker (R-Brandon), a co-sponsor who presented the bill on the House floor, said the ultimate goal of U.S. House Speaker Nancy Pelosi and others on the left is to destroy the donor base of the conservative movement and make the entire country like California, where Republicans are a marginalized minority with little electoral or political power.

“They want to destroy groups like the NRA, the U.S. Chamber of Commerce and the pro-life movement,” Baker said. “They have already successfully carried out this game plan in California.

“Mississippi has a chance to strike back and take a stand to protect donor privacy rights. That’s why I am championing legislation to protect the right of every person in Mississippi to give to the charity or cause of their choice.”

Passing HB 1205 would take the issue of donor privacy, at the state level, out of the purview of the courts.

A 1959 decision by the U.S. Supreme Court, NAACP v. Alabama, would’ve appeared to protect the right to privacy for members of an organization, since they might be exposed to economic and social sanctions.

In September, the U.S. Ninth Circuit of Appeals overturned a 2016 verdict in a case pitting California Attorney General Xavier Becarra against Americans for Prosperity that said that 501(c)(3) non-profits didn’t have to reveal their donor lists to the California AG’s office.

The IRS recently changed its regulations in July to remove donor lists from the publicly-available tax forms for 501(c)(4) and 501(c)(6) organizations. Changing the rules for 501(c)(3) organizations would require action by Congress.

In 1925, a group of mothers came together, committed to commemorating their sons who had tragically been lost in the blood bath that was World War I. To this end, they organized the community, fundraised, and erected the “Peace Cross” in Bladensburg, Maryland with the assistance of the, non-religious, American Legion.

Today, nearly 95 years later, some are claiming that this cross cannot remain on public land, as it represents an establishment of religion by the state. On February 27, the U.S. Supreme Court heard the case of The American Legion v. The American Humanist Association. The Court will soon release its important decision, which may set a precedent for the future existence of memorials around the United States.

It is worth noting that the land and statue were initially owned and cared for by the American Legion, before being taken over by the state. Since 1961, the state of Maryland has cared for the statue and land. Thus, the interpretation of the Establishment Clause pushed forward by the American Humanist Association is ahistorical and fails to account for the precedent of Supreme Court cases, which have previously granted the continued existence of similar memorials. This includes Thomas Van Orden v. Rick Perry. First, the state did not originally erect the memorial, and second, the intention of the memorializers was to put up a symbol of peace, in the way they best knew, and so they turned to the cross.

The American conception of the First Amendment does not necessitate societal freedom from religion, but rather freedom of religion. What makes America unique is that, unlike many European societies, the United States has consistently reestablished not only the freedom to private conscience, but the freedom of public expression of one’s faith.

In this guarantee, our Constitution ensures that the American people are allowed to publicly display their religious beliefs. The mothers of Bladensburg and the American Legion practiced this public expression in their establishment of this monument to the 49 fallen soldiers. And in entrusting this monument to the state, did not intend for the state to make a public establishment of the Christian religion, but rather intended for the enduring memorialization of America’s involvement in World War I, and the citizens that it lost in that war.

The implications of this case are significant, and will have a wide ranging impact on the state of memorialization and religious expression in the United States.

Where will the line will be drawn in regards to monuments and memorials if the Supreme Court takes the side of the Humanist Association? If one takes a walk through Arlington National Cemetery, a number of monuments will be seen that bear the shape of crosses, and the Star of David. All around the country there are crosses that adorn battlefields and town squares. Will all these be torn down?

Far from state establishment of religion, these markers commemorate those who have given their lives for this country, citizens who gave all in defense of the rights and liberties every American should retain.

How confused is a citizenry that insists the memorials of yesterday must be torn from the ground and uprooted?

If nothing else, we ought to respect the dead, and especially those who served the nation in combat and died in battle, enough to commemorate them in the way chosen by the families of the fallen. That is a fundamental American liberty, the right of religious freedom, and it is enshrined in our Constitution. Let’s hope the U.S. Supreme Court does not let The American Humanist Association put that asunder.