President Donald Trump made the recently-passed criminal justice reform one of the big components of his State of the Union speech Tuesday night.

Two of his guests in the Capitol gallery for the speech were Alice Johnson and Matthew Charles, both former offenders helped by his signature of the FIRST Step Act into law in December, one of the biggest bipartisan criminal justice reform initiatives passed in decades.

“This legislation reformed sentencing laws that have wrongly and disproportionately harmed the African American community,” Trump said in his speech. “The FIRST STEP Act gives non-violent offenders the chance to reenter society as productive, law-abiding citizens. Now states across the country are following our lead.

“America is a nation that believes in redemption.”

Thanks to Gov. Phil Bryant and the legislature, Mississippi has been a national leader on the issue since the passage of House Bill 585 in 2014 and has a chance to continue this movement in the right direction with legislation that’s still active in the state legislature.

Senate Bill 2791 and HB 1352 were both approved by the respective judicial committees in their originating chambers before Tuesday’s deadline.

SB 2791 would mandate evidence-based solutions to reduce incarceration and eliminate obstacles for ex-offenders to find work. It would also give courts the ability to reduce post-incarceration supervision, which can last up to five years under present law. This would allow probation officers to give more supervision to violent and habitual offenders.

The Reentry and Employability Act is sponsored by state Sen. Juan Barnett (D-Heidelberg).

State Rep. Jason White (R-West) sponsored the Criminal Justice Reform Act, which would clear obstacles for the formerly incarcerated to find work such as preventing occupational licensing boards from barring licenses to ex-offenders who’ve served their debt to society.

These “good faith clauses” have resulted in two former ex-offenders being denied licenses.

HB 1352 would also end the requirement that an offender’s driver’s license be suspended for a controlled substance violation that wasn’t related to the operation of a motor vehicle.

It would also change the name of drug courts to “intervention” courts and create a fund to help finance programs that would reduce recidivism.

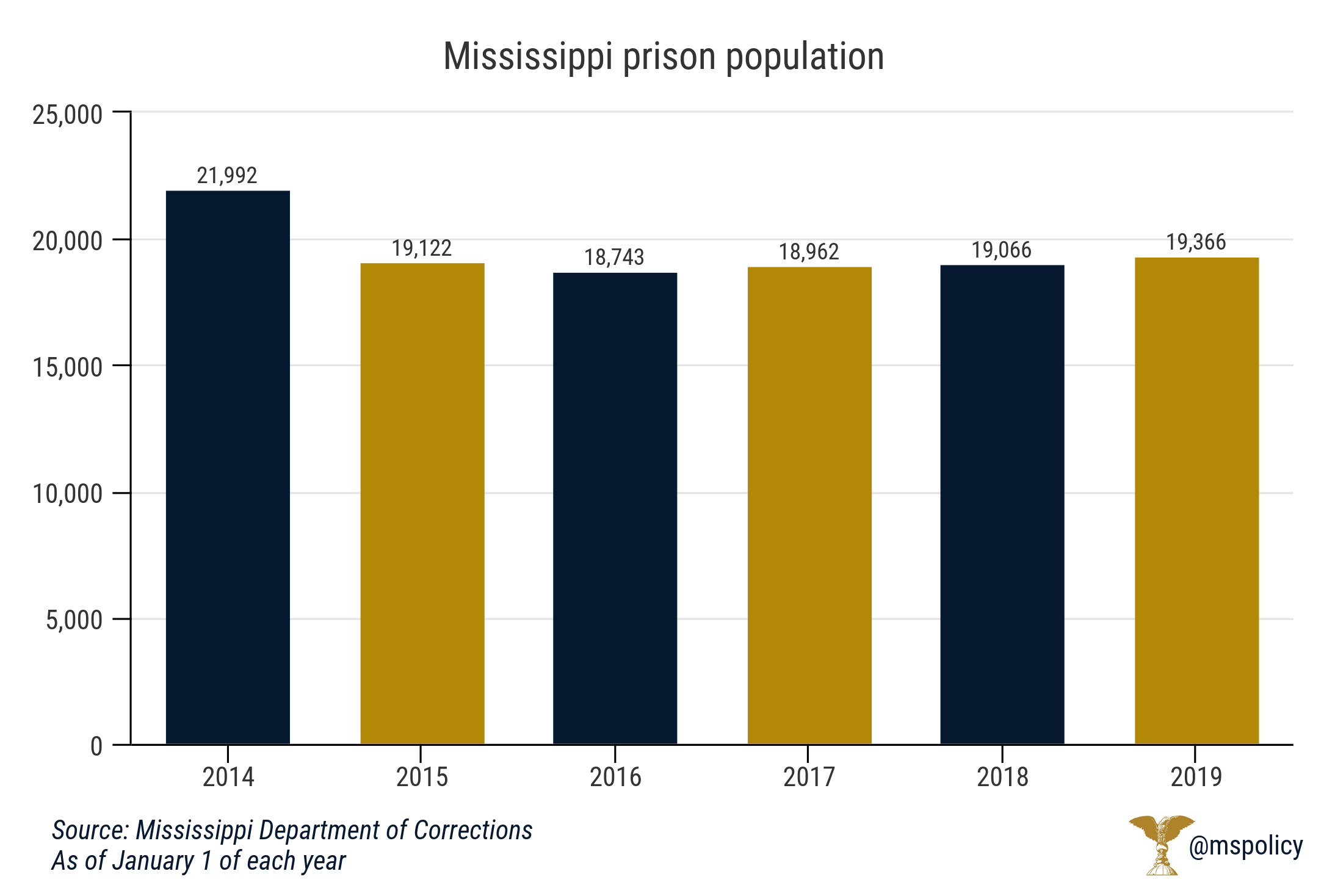

Since the passage of HB 585 in 2014, Mississippi’s prison population has declined from 21,992 inmates on January 1, 2014 to 19,366 on January 1, 2019. That’s a decrease of 11.94 percent.

After bottoming out in 2016, the number of state prisoners has been a slow uptick (3.23 percent) and further reforms could help. Those numbers are still lower (20,988 inmates) than the Pew Trusts predicted for the state’s prison population.

Last year, Gov. Bryant signed another round of criminal justice reforms, HB 387, into law that created a “safety valve” option that allows judges discretion in applying mandatory minimum sentences for repeat offenders and prohibited incarceration due to the inability to pay a fine or fee among other reforms.

These reforms have reduced the number of non-violent offenders in state prisons and given judges more leeway in sentencing when it comes to mandatory minimum sentences for repeat offenders.

Also, the state has outlawed jailing those due to an inability to pay a fine or fee.

At a time when most states are cutting back or eliminating film incentives, Mississippi is pressing forward.

Yesterday, both the House and Senate adopted separate legislation that would reinstate the nonresident payroll portion of the incentives program. This would allow for a 25 percent rebate on payroll paid to cast and crew members who are not Mississippi residents.

It was repealed in 2017, when the Senate did not consider renewing it. It is a different story this year.

If the expired incentive is brought back, it would put Mississippi in the position of expanding film incentives program while other states are putting on the breaks. In the past decade, the number of states with such a program has declined from a peak of 44 to 31 (as of last year).

Why are states moving away from film incentives? The answer is simple; the math doesn’t add up.

A 2015 PEER report shows taxpayers receive just 49 cents for every dollar invested in the program. That means that for every dollar the state gives to production companies, we see just 49 cents in return.

If you’re a proponent of these incentives and you’re looking for a bright side, we are actually “doing better” than many other states. This includes our neighbors in Louisiana, who recover only 14 cents on the dollar. They also have one of the most generous programs in the country; it was unlimited until lawmakers capped it a couple years ago. (Other reports show the Pelican State recovering 23 cents on the dollar, but either way it’s a terrible investment.)

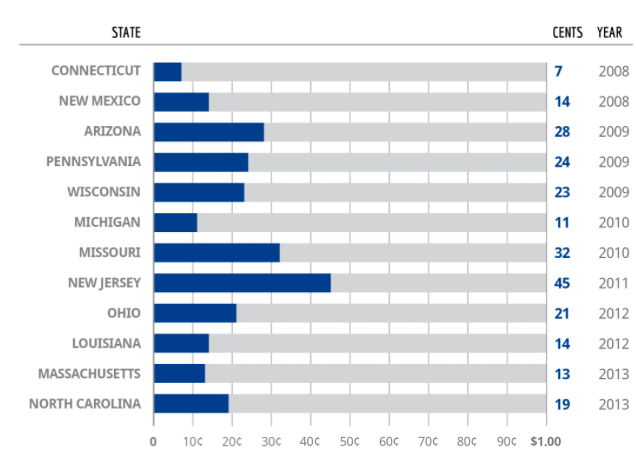

Beyond Mississippi and Louisiana, film incentives are proving to be a poor investment throughout the country. Numerous studies have been conducted on film incentives. Each of them has produced sobering results for those worried about taxpayer protection. Here is a review of the return per tax dollar given, from 2008 through 2013. In these third-party studies, covering 12 different states, there was no program that returned even 50 cents on the dollar.

Source: John Locke Foundation

Since this chart was published, studies on similar programs in Florida, Virginia, and West Virginia have shown similar results. No program had a positive ROI.

Having a movie filmed in your state is a nice trophy, as is having a movie star dining at a local restaurant. But when it comes to our tax dollars, the burden on the state should be to demonstrate how those dollars are being wisely invested.

Other states appear to be focused on results of film incentives. Mississippi, however, appears to be ignoring the data and heading in the opposite direction.

Tuesday was the first big deadline in the Mississippi Legislature for bills to make it out of committee and plenty of bills died without making it to the floor.

The next deadline is February 14, the last day that general (non-revenue) bills can be passed by the originating chamber.

Here are the some of the bills that survived and others that died:

Still alive

Senate Bill 2791 and House Bill 1352 are two criminal justice reform measures that have made it out of committee. SB 2791 would mandate evidence-based solutions to reduce incarceration and eliminate obstacles for ex-offenders to find work. The Reentry and Employability Act is sponsored by state Sen. Juan Barnett (D-Heidelberg).

State Rep. Jason White (R-West) sponsored the Criminal Justice Reform Act, which would clear obstacles for the formerly incarcerated to find work.

HB 337 and SB 2901 are bills that would exempt property owners and their employees from civil liability if a third party injures someone else on their property. The House version was sponsored by state Rep. White, while the Senate version was sponsored by state Sen. Josh Harkins (R-Flowood).

HB 623 would exempt school districts with A and B accountability ratings from the Mississippi Department of Education from certain mandates, including grade reporting and annual auditing of the district’s official discipline plan and code of student conduct. Under this bill, any licensed teacher employed at one of these districts would be exempt from continuing education requirements as a condition of their license renewal.

HB 702 would allow cottage food operators to increase their maximum sales to $35,000 and advertise their products on the web. The bill, sponsored by state Rep. Casey Eure (R-Saucier), has been passed by the House and has already been transmitted to the Senate.

HB 1128 would reauthorize motion picture and television production incentives for out-of-state firms that expired in 2017. The bill is sponsored by state Rep. Jeff Smith (R-Columbus).

HB 1204 and SB 2759 would allow a municipality or county to execute the winning bid in a sealed bidding process if a judge hasn’t ruled on a protection request for bids within 90 days. The House version is sponsored by state Rep. Jerry Turner (R-Baldwyn) and the Senate version is sponsored by state Sen. John Polk (R-Hattiesburg).

HB 1268 would clarify some confusion in the law regarding time limitations for constitutional litigation brought by those whose rights have been threatened by government action. This would protect and advance constitutional rights in Mississippi. It was introduced by Rep. Dana Criswell (R-Olive Branch).

SB 2675 would reauthorize the Education Scholarship Account program until 2024 and was sponsored by state Sen. Gray Tollison (R-Oxford).

Dead

HB 19 would’ve required bond counsel to be selected through competitive requests for proposal process and was sponsored by state Rep. David Baria (D-Bay St. Louis).

HB 31 would’ve eliminated the requirement for a supervising physician for nurse practitioners with 3,600 or more hours in clinical practice and was sponsored by state Rep. Jay Hughes (D-Oxford).

HB 85 would’ve required a warrant for law enforcement agencies to use cell site simulator devices except to prevent loss of life or injury. It was authored by state Rep. Steve Hopkins (R-Southaven).

HB 173 would limit the salaries of the State Superintendent of Public Education, the Commissioner of Higher Education and the Executive Director of the Mississippi Community College Board to a pay scale of 150 percent of the governor’s salary, and was sponsored by state Rep. Bill Shirley (R-Quitman).

HB 118 and SB 2912 would’ve allowed homeschooled students to participate in extracurricular activities. At present, Mississippi law prevents homeschooled students from participating in extracurricular activities, such as athletics, in their respective school districts. A similar bill in the Senate by state Sen. Michael Watson (R-Pascagoula) also died without a floor vote.

HB 1113, SB 2825 and SB 2826 were all bills that would’ve changed the state’s Education Scholarship Account program. HB 1113 was sponsored by state Rep. Becky Currie (R-Brookhaven) and would’ve revised the eligible expenses under the program, eliminated the lottery for selecting eligible students for the program from the wait list and established an appeals process.

SB 2825 would’ve added ESA funding to the Mississippi Adequate Education Program, the funding formula for K-12 education and was sponsored by state Sen. Chris Caughman (R-Mendenhall).

SB 2826 was sponsored by state Sen. Videt Carmichael (R-Meridian) and would’ve also eliminated the lottery method for selecting eligible students for the ESA program from the wait list, required the Mississippi Department of Education to enact an accountability program and established an appeals process.

HB 1491 and SB 2248 would’ve allowed out-of-state, licensed healthcare providers such as doctors, nurses, optometrists and dentists to practice for a non-profit in Mississippi on a charitable basis. The Senate bill was sponsored by state Sen. Angela Burks Hill (R-Picayune), while the House version was sponsored by state Rep. Shane Aguirre (R-Tupelo).

SB 2693 would’ve pre-empted local regulation of short-term vacation rentals, such as Airbnb, and was sponsored by state Sen. Hill.

HB 625 and SB 2767 would’ve allowed the farming of agricultural hemp in the state. The U.S. Congress passed a farm bill in December that authorized states to start growing the plant, which can be made into thousands of products such as clothing, paper, shampoos and even insulation.

The House version was sponsored by state Rep. Joel Bomgar (R-Madison) and the Senate version was sponsored by state Sen. Willie Simmons (D-Cleveland).

SB 2183 and HB 708 would’ve allowed direct sales and shipments of wine to state residents. The Senate version was authored by state Sen. Bob Dearing (D-Natchez), while the House version was sponsored by state Rep. Charles Busby (R-Pascagoula).

On the last day for bills to make it out of committee, the House Judiciary A Committee passed several measures on to the full House.

One that didn’t make it was House Bill 1104, which would’ve reenacted administrative forfeiture for property worth less than $20,000. Barring another meeting of the committee, the bill will die without being considered by the full House.

The biggest controversy came on House Bill 337, the Landowner Protection Act. This bill would exempt property owners and their employees from civil liability if a third party injures someone else on their property.

Committee Chairman and state Rep. Mark Baker (R-Brandon) cited the 10 murders in 19 days in Jackson as one of the reasons for the bill.

“There are a lot of groups with interest in this,” Baker said. “This bill is not about dealing with slip and falls at the grocery store. At some point, you can’t keep foisting that problem (crime) on owners of property.

“At some point, if the Jackson Police Department can’t do anything about, why are we going to put this on someone else?”

State Rep. Edward Blackmon Jr. (D-Canton), who is affiliated with the Mississippi Trial Lawyers Association, railed against the bill.

“This is a Jackson, Mississippi bill that will affect the entire state and reverses years of established law in our courts,” Blackmon said.

The committee later approved the bill over Blackmon’s strenuous objections and it will now be taken by the full House.

A companion bill in the Senate, Senate Bill 2901, has already been approved by the Business and Financial Institutions Committee.

Among the other bills that made it out of the House Judiciary A Committee:

- HB 777 would change existing law on notaries public. Also known as the Revised Mississippi Law on Notarial Acts.

- HB 819, also known as the Uniform Athlete Agents Act, would require several disclosures be made between an agent and a potential client that is a student-athlete. It would also require agents to report of all expenses incurred in the recruiting of student-athletes.

- HB 1149 would require all courts in the state to utilize the Mississippi Electronic Courts System, which puts court documents online.

- HB 1268 would revise the standard of constitutionality on an appeal from judgment by a county or municipal authority.

- HB 1285, also known as the GAP (Guard and Protect vulnerable children and adults) Act, would revise state law on guardianships and conservatorships.

The next deadline will be February 14 for original floor action on bills from their own chamber.

A bill that would have reauthorized administrative forfeiture in Mississippi appears to have died on the calendar.

House Bill 1104, which was authored by Rep. Mark Baker (R-Brandon), did not come up in a Judiciary A committee meeting this morning as lawmakers were busy moving legislation before the deadline for committees to report on legislation.

Baker told WLBT’s Courtney Ann Jackson that there wasn’t support for the bill in the Republican caucus.

All bills that do not make it out of committee today are dead for 2019, unless the governor calls a special session or supporters find a way to amend a bill that is still alive.

Last session, the legislature let administrative forfeiture die when the law authorizing the program was not renewed. Previously, administrative forfeiture allowed agents of the state to take property valued under $20,000 and forfeit it by merely obtaining a warrant and providing the individual with a notice. In order to get the property back, an individual was required to file a petition in court within 30 days and incur legal fees in order to contest the forfeiture and recover such assets.

For these reasons, administrative forfeiture was viewed as a particularly pernicious policy that placed lower-income property owners in the difficult situation of deciding whether to pay a legal bill that could exceed the value of the forfeited assets in order to get their property back if they were not involved in a drug-related crime.

The state is still allowed to seize and keep property through civil forfeiture, a process that requires the state to go before a judge for an adjudication of whether the property should be forfeited, even if the owner does not file suit. Additionally, this has no impact on the state’s ability to seize property through criminal forfeiture.

A new report shows a sharp decline in the state government workforce over the past 15 years.

According to the Office of the State Auditor, the number of state government employees has decreased by more than 5,200 dating back to 2004. The bulk of the reduction, about 4,500 employees, is from the past nine years.

“While there have been reductions-in-force (RIFs) actions at some state agencies—The Office of the State Auditor underwent two such RIFs in the last decade—most of the reductions have been through attrition and voluntary separations, which include resignations and retirement,” the report notes. “In fact, in FY 2018, 65% of those who left state government left through resignations, and 13% of those who left state government retired.

“Aside from reduction by attrition, the State has likely also been able to reduce the workforce through increased use of technology and automated services. For instance, automating certain processes using kiosks or online services may eliminate unnecessary positions.”

As a result, the ratio of citizens to state employees has improved from 94:1 in 2010 to 108:1 today. The puts Mississippi ahead of Arkansas (50:1) and Louisiana (66:1), but behind Alabama (158:1) and Tennessee (167:1) in terms of efficiency.

Right now in Mississippi, the sale of raw cow’s milk for human consumption is prohibited, but a bill in the Mississippi legislature could change that.

The Mississippi On-Farm Sales and Food Freedom Act, authored by state Rep. Dan Eubanks (R-Walls) would allow intrastate sales of agricultural products directly from the producer to consumers and would prevent local governments from restricting those sales.

The bill would also mandate a “buyers beware” label for these goods that would warn of health risks from consuming raw, unprocessed agricultural products.

The bill is up against a deadline, as Tuesday is the deadline for bills to pass out of committee.

According to Eubanks, Mississippians are spending $8.5 billion a year on food and most of that is imported from out of state.

“Ninety percent of our food we import and we’re an ag state,” Eubanks said. “The irony is we’ll commit billions in taxpayer money on incentives and bond issues to bring in economic development and you might get 500, 1,000 jobs.

“All we’ve got to do is make a little change to our law, wouldn’t cost us a dime. If we started buying five percent more locally grown, you’re talking $400 million plus that would stay in our state. If it stays in our state, it would create jobs.”

He says that passage of this bill would allow the birth of a cottage farm industry in the state and help small farms grow into larger operations.

He also says that it’s absurd that the state sells cigarettes with a disclaimer on each box about their health effects, but won’t allow its citizens to buy raw milk. Also, it’s legal in the state for consumers to buy raw goat’s milk.

“We put such an impediment in the way of people trying to live healthier,” Eubanks said. “We’re the unhealthiest state in the country. We consume so much processed, artificial foods and we need to eat more whole, natural foods and yet we want to put a road block in the way to helping further that for some communities.”

As for neighboring states, Alabama and Louisiana prohibit all sales of raw milk for human consumption while Arkansas allows the on-farm sale of up to 500 gallons of raw milk. Tennessee only allows raw milk to be obtained through what is known as a “cow share agreement” where an individual or a group pay a farmer for boarding and milking a cow that they own.

Nationally, 13 states allow sale of raw milk in stores while 17 states allow sales only on the farm where it was produced.

New York made headlines recently for passing legislation that will legalize abortion to the moment of birth.

The New York state Senate voted 38-24 in favor of the “Reproductive Health Act” last week. This bill has passed the state Senate before but has failed to pass the Assembly in past years. This time, the Assembly passed RHA 92-47.

Press and social media have been in outraged battles over the passage of this state legislation. The implications of this law have shaken up the entire nation.

In Mississippi, it has triggered an influx of volunteer applications and donations to pregnancy help centers from appalled Mississippians across the state.

The cleverly named “Reproductive Health Care Act” is horrific and unconscionable.

This law has five major consequences that should incite fear and disgust in us all:

- It legalizes abortion past 24 weeks until the moment of birth;

- It decriminalizes the death of any preborn child, meaning the murder of a pregnant woman cannot be ruled a double homicide;

- RHA legally makes abortion a “fundamental right” according to state law;

- It oddly allows licensed health practitioners who are not abortion doctors to commit abortions; and

- By declaring abortion a “right,” it follows the extreme left’s trend of implementing state laws that will uphold the abortion industry in the event that the Supreme Court overturns Roe vs. Wade.

Most level-headed Americans are appalled at these changes to the New York penal code. Sadly, abortion has only been limited in the third trimester in 43 of our 50 states prior to this legislative session.

What took America over the edge was New York Gov. Andrew Cuomo calling for the entire state to celebrate following his signing of the bill into law. He called for One World Trade Center and other landmarks to be lit in pink, exalting the decision.

Cuomo, who is Catholic, maintains his support of the law despite pending talks of his excommunication from the Catholic Church for violating fundamental beliefs of his own faith. In defense of his unjustifiable actions, he stated, “I’m not here to represent a religion.”

Any decent human can understand the humanity of a child in the third trimester no matter race, religion, or creed.

In an attempt to one-up Cuomo, Virginia Gov. Ralph Northam advocated that post-birth abortions ought to be allowed in his state. He voiced support of a bill in his state allowing abortion up to the moment of birth even if the baby was born alive by accident.

A baby born alive would be “kept comfortable” and only “resuscitated if that’s what the mother and the family desired.” If a mother did not want the child born alive, that baby would be left to die a slow and painful death at a medical facility with medical professionals present.

Fortunately, that bill was defeated in committee.

In our state, Mississippi Center for Public Policy advocated a bill last year that banned abortion after 15 weeks gestation. It was halted 30 minutes after Gov. Phil Bryant signed it into legislation by a temporary block. In November, activist District Judge Carlton Reeves blocked the law. Mississippi has not given up Bryant’s dream of making Mississippi the “safest place for an unborn child in America.” The 5th U.S Circuit Court of Appeals will be next to hear the case.

As the law stands, abortion is legal up to 20 weeks gestation in Mississippi.

Mississippi is listed as one of four “trigger law states” that will almost immediately ban abortion if the 1973 decision of Roe vs. Wade is reversed. The abortion lobby is working creatively to prevent states from limiting or banning abortion at any level.

Mississippi may be in far better shape than states like New York or Virginia, but we must remain vigilant in defending our state’s right to rule in defense of preborn children.

Someone has to stand for the life of the preborn while the left crowns the “right to choose” as more valuable than life itself.

All too often, ex-offenders are released from prison and unable to land a job because of licensing restrictions. The “Mississippi Fresh Start Act” would provide a second chance.

Introduced by Rep. Mark Baker (R-Brandon), House Bill 1284, which has cleared the Judiciary A Committee and is headed to the full House, would prohibit occupational licensing boards from using rules and policies to create blanket bans that prevent ex-offenders from working.

A companion bill, Senate Bill 2781, has been introduced in the Senate by Sen. John Polk (R-Hattiesburg). It has cleared the Accountability, Efficiency, and Transparency Committee, but a reverse-repealer was added in committee.

Under the proposed legislation, licensing authorities would no longer be able to use vague terms like “moral turpitude” or “good character” to deny a license.

Rather, they must use a “clear and convincing standard of proof” in determining whether a criminal conviction is cause to be denied a license. This includes nature and seriousness of the crime, passage of time since the conviction, relationship of the crime to the responsibilities of the occupation, and evidence of rehabilitation on the part of the individual.

An individual may request a determination from the licensing authority on whether their criminal record will be disqualifying. If an individual is denied, the board must state the grounds and reasons for the denial. The individual would then have the right to a hearing to challenge the decision, with the burden of proof on the licensing authority.

If this legislation passes, it would provide hope for ex-offenders who want to turn their lives around and learn a trade so that they can better support themselves and their families.