Most Mississippians want a law ensuring free speech on college campuses throughout the state.

According to new polling from Mason-Dixon Polling & Strategy, 83 percent of Mississippi voters support a law that “would protect speech for all college students, even if others disagree with their point of view.”

“The last place on earth we should expect to see free speech weakened is on a college campus,” said Jon Pritchett, President and CEO of Mississippi Center for Public Policy. “Part of an essential education in the West includes learning to tolerate speech with which you may disagree. And it is clear that most Mississippians agree.”

This law has broad public support in every corner of the state. Seventy-eight percent of Democrats, 88 percent of Republicans, and 80 percent of independents support the law.

Legislation protecting free speech has been introduced in both the Senate and the House. Senate Bill 2495 has been introduced by Sen. Angela Hill (R-Picayune) and is awaiting action in the Universities and Colleges committee. Rep. Stacey Wilkes (R-Picayune) has introduced House Bill 1562, which has been referred to the House Universities and Colleges committee. These bills reflect current First Amendment case law and will protect Mississippi institutions from needless litigation.

The bills must pass out of committee by Tuesday, February 5, to stay alive.

To date, governors in 10 states – both Republicans and Democrats – have signed similar campus free speech legislation. This includes two of Mississippi’s neighbors, Louisiana and Tennessee. As of last year, legislation had been introduced in another 15 states.

Campus free speech bills are popular with voters because of the growing number of colleges and universities that have lost sight of freedom of speech for all students. Many university policies that hinder free speech are unconstitutional. These include the creation of “free speech zones” and “free speech corners,” which limit speech to certain areas on campus, as well as vague policies that require university permission for meetings and demonstrations that meet legal standards of reasonability.

Full poll results can be found here.

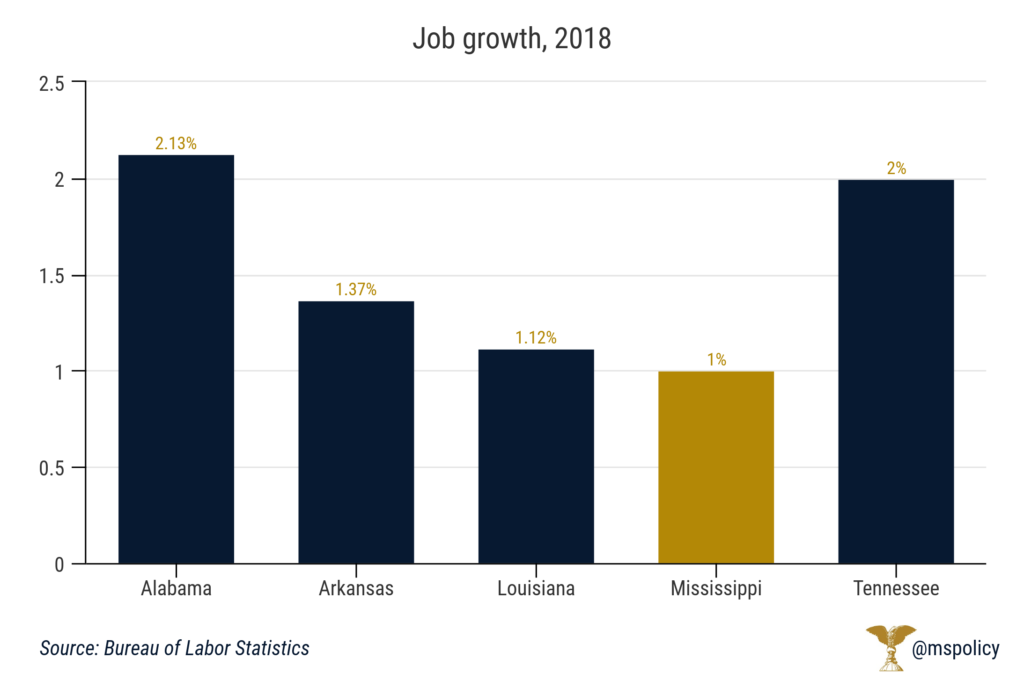

Mississippi had a job growth of 1 percent last year.

According to preliminary data from the Bureau of Labor Statistics, Mississippi added about 11,000 jobs last year. But while Mississippi did experience an increase in job growth, the state lagged behind every neighboring state.

Of the four neighboring states, Alabama had the strongest job growth at 2.13. Tennessee was next at 2 percent, followed by 1.37 percent in Arkansas, and 1.1 percent in Louisiana.

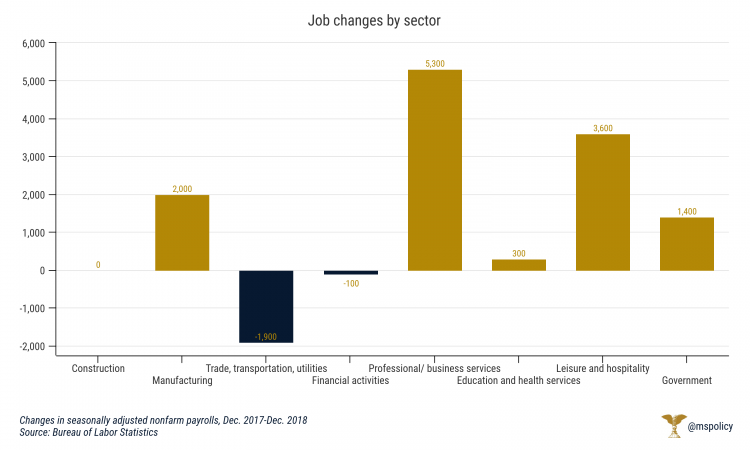

Of the 11,000 jobs Mississippi added last year, about 1,400 were in government. Professional and business services had the strongest growth (5,300), followed by leisure and hospitality (3,600), and manufacturing (2,000).

Education and health services added a modest 300 jobs and construction did not any jobs. Financial activities had a loss of jobs (-100) as did trade, transportation, and utilities (-1,900).

Mississippi’s unemployment rate, which is historically among the highest in the country, sits at 4.7 percent. It’s down slightly from 4.8 percent last December, but still higher than the national average of 3.9.

What can Mississippi do better?

Mississippi has the fifth largest government share of state economic activity, and that is due to state and local spending, not federal funds. While there is a large contingent who would want to see the government spend more, it would actually be pretty difficult.

When the government grows, the state has increased ownership and the private sector shrinks. And economic freedom, which is based on free markets and voluntary exchange, individual liberty, and personal responsibility, wanes.

According to the most recent Fraser Institute Economic Freedom of North America report, which measures government spending, taxes, and labor market freedom, Mississippi was ranked 45th among the 50 states. Similarly, Cato Institute’s Freedom in the Fifty States, which measures economic and personal freedom, placed Mississippi 40th in their most recent rankings.

What is the correlation between economic freedom and prosperity? The freer states are more prosperous, have higher per capita incomes, more entrepreneurial activity, and lower poverty rates. We have the model. We need to just look at what similar states have done for economic growth. And it is important to know the difference between the reality of economic growth and the practice of economic development; those can be very different things.

Government incentives, often in the name of economic development and being ‘business-friendly,’ attempt to lure businesses to the state through financial benefits, such as site preparation, infrastructure, job training, or special tax breaks. The only reason these incentives are necessary is because of higher taxes or policies that burden businesses.

Instead of special incentives for a few, Mississippi should work to provide a favorable climate for every business. And let the market decide where a business locates or expands. An economic development officer can sell low taxes and low regulatory burdens to a company looking for a great location like Mississippi. What’s more, the data shows us that such policies allow existing businesses already in our state to expand and grow from a small employer to a large employer without getting any incentives from the taxpayers. That’s economic growth.

Being business friendly isn’t based on who can seek the most favors, it is based on how free your state is.

To their credit, state leaders have attempted to improve the economic climate of Mississippi, most notably through tax and regulatory reform. In 2017, the legislature adopted a new law that will require all new licensing regulations to be approved before they take effect, ensuring new attempts to stifle competition will be reviewed before they are finalized.

And the Taxpayer Pay Raise Act in 2016 will eliminate the 3 percent income tax bracket, allow self-employed individuals to deduct half of their federal self-employment taxes, and remove the franchise tax on property and capital when fully implemented. Even though Mississippi’s overall tax burden is still above the national average, this will move Mississippi closer to a flatter income tax and make our business climate more competitive.

These reforms weren’t easy, but showed forward thinking to align us closer with neighboring states. Making the case for spending more money on your favorite government program is not what is needed to prosper. We need to think much bigger than that. If we want to do better than the bottom ten in categories like per capita income, it starts with doing better in categories like business friendliness, regulatory practices, and tax rates.

Thanks to a recent change in federal regulations for short-term health insurance policies, Mississippians could have a chance to purchase cheaper policies.

In August, the U.S. Department of Health and Human Services issued a rule that extended the duration of short-term plans from three months to 12, with renewals that could stretch them out for up to three years. The policy went into effect in October.

According to HHS data, the monthly premium for a short-term policy in the fourth quarter of 2016 was $124, compared with $393 for an unsubsidized individual market plan.

Mississippi Insurance Commissioner Mike Chaney said these policies fill what he called a “doughnut hole” in the market place, where they are between jobs and do not have the ability to pay the high cost of temporary health insurance, known as COBRA (Consolidated Omnibus Budget Reconciliation Act of 1985).

He said a few thousand Mississippians at the most would be buying these policies, but having their availability means they have a chance to buy affordable health insurance that was previously unavailable. He also said several insurance companies are already offering the policies in the Magnolia State.

“It fills a very needy void in the market,” Chaney said. “It gives the consumer another choice. You need to be certain your doctor will accept the policies and they need to be certain to what will and won’t be paid. We’ve not had any complaints on them.”

These policies also could be utilized by seniors not eligible for Medicare and young adults who have aged out from their parents’ plans.

According to a report by the Foundation for Government Accountability, yearly premiums for health insurance have skyrocketed from an average of $2,800 in 2013 to $6,000 in 2017 and more than 30 million remain uninsured. The report also says that 56 percent of counties in the U.S. had only one insurer to choose from in the individual market.

The rule change will help 2.5 million gain health insurance, according to the FGA.

Mississippi is one of 17 states with no restrictions in state law that would limit the plans.

These short-term plans are much cheaper for consumers, but lack some of the mandated coverages that are part of the policies sold under the exchanges set up by the Affordable Care Act, also known as Obamacare. This means these plans can be better tailor-fit to a consumer’s need than the several sizes fit-all types offered by the exchanges.

A network of cameras that could track people throughout a city 24 hours a day is open for misuse and misidentification.

A man is shopping with his family during the holidays at a crowded mall when a law enforcement team swoops in to arrest him, wrongly, as a wanted child predator. News of the arrest quickly passes through Twitter and becomes front page news.

A sheriff is concerned about a NAACP chapter that is critical of her. She begins to track members and have them arrested.

An innocent man is on trial for murder. The most important evidence is an incorrect facial recognition match between him and a video of the perpetrator caught on a home video camera. The match serves to shift the burden to the incorrectly identified man to prove he is not the person in the video.

These things will happen with facial recognition technology. The question is how often.

Sunday, January 13 brought two brutal murders in Jackson. One a slaying of a preacher as he entered his church. The other a shooting in a Wal-Mart parking lot at a busy time when families are present.

The two murders are continuations of a very worrisome trend in which Jackson’s murder rate is increasing when the rates in nearby cities are decreasing. They are part of a murder rate that is the highest Jackson has seen in over 20 years. The city had 92 homicides in 1994 and 1995, and 84 in 2018. But Jackson also had roughly 190,000 citizens in the mid-1990s, and today, after hemorrhaging citizens for decades, stands at approximately 166,865. We are killing more with less.

Mayor Chokwe Lumumba addressed the public after these Sunday murders. One of the crime-fighting methods he announced the city would pursue is a “Real Time Crime Center” that “will give us eyes into our community, so we can hopefully stop crime before it happens because we’re watching the city 24 hours a day, seven days a week.” The center would rely on facial recognition technology used through a network of cameras that could track people throughout the city.

That certainly has the ring of Orwell’s 1984.

It is unclear if the mayor is serious about the city pursuing this technology, or whether his comments were more of an off-the-cuff variety that did not reflect an intentional and definitive policy direction. Understandably, the mayor would like to reassure the public that his administration is serious about the issue of violent crime.

However, facial recognition technology has the potential for misidentification and abuse. Both are obvious problems. If the city is serious about pursuing this technology, the problems associated with it must be addressed and the public needs to be fully engaged in the process – something that is not occurring around the nation as private companies are quietly attempting to sell these technologies to law enforcement agencies.

Early tests of the technology as it exists today (and it is constantly evolving) reveal significant misidentification issues. The ACLU Foundation of Northern California recently tested Amazon’s Rekognition software using its default settings. This mirrors how the technology is used by a sheriff’s department in Oregon. It compared every member of Congress with 25,000 mugshots, and falsely matched 28 members of Congress with mugshot images.

The test also revealed, as have other tests, that facial recognition technology is more likely to misidentify people of color. This is one of the reasons Brian Brackeen, who is CEO of the facial recognition firm Kairos and also is black, has been fighting against the use of the technology by law enforcement.

Abuse is harder to measure since the technology is not used in many places. We know from history that bad actors will periodically be in positions of power when the technology could be abused. We know that China is introducing the technology at a rapid pace and regularly reminds its citizens that the technology will make it virtually impossible to evade the state.

With these potential troubles in mind, it is perhaps time to hit the pause button and fully discuss this technology before using it. A technology’s availability, even its use by the private sector, does not mean it is something the government should use.

And this doesn’t address a more fundamental point. If Jackson wants to be serious about fighting crime, perhaps it should focus first on the easier-to-reach basics it is missing, like prosecuting cases in a timely manner, before reaching for Orwellian sounding technologies that promise magical abilities with great risks to civil liberties.

This column appeared in the Northside Sun on January 31, 2019.

In Harmelin v. Michigan, Justice Antonin Scalia pointed to the special danger inherent in governments using economic fines for punishment. Unlike other forms of punishment that cost the government money, fines are a revenue source. That source can act as gasoline that propels the government in search of prosecutions for fines in areas where previously it never would have searched.

Because of that, to use Justice Scalia’s words, “it makes sense to scrutinize governmental action more closely when the State stands to benefit.”

This concern and others are at play in Timbs v. Indiana, a case presently pending before the United States Supreme Court. Mr. Timbs is arguing the Excessive Fines Clause of the Eighth Amendment to the United States Constitution applies to the states. He is challenging Indiana’s civil forfeiture of his $42,000 Land Rover following an attempted small quantity drug sale. The value of the Land Rover is nearly four times the maximum criminal fine he could receive for his criminal conviction.

This case is part of a larger debate that is occurring nationwide over the use of civil asset forfeiture proceedings to seize private property. Civil asset forfeiture proceedings, also called civil in rem forfeiture proceedings, permit the government to seize property that it alleges is connected to criminal activity.

There is usually no state-level requirement that there be a conviction in the underlying criminal matter in order for the government to seize the property. A difficulty lies in the fact this is done in a civil proceeding, not a criminal one, with its lesser burden of proof, i.e., preponderance of the evidence. Sometimes it is not even done in a civil proceeding but in an administrative hearing with even less protections for the property owner.

There are other problems. These include innocent persons who have their property tied up in forfeiture proceedings and taken by the state, either permanently or for long periods of time, because unbeknownst to them someone such as a family member used their car for an illegal purpose.

The Excessive Fines Clause already applies to civil asset forfeiture proceedings instituted by the federal government. The question in Timbs is whether it applies to these same proceedings brought by the states.

The Supreme Court has already ruled that most provisions of the Bill of Rights apply to the states through the Fourteenth Amendment, which bars states from depriving persons of “life, liberty, or property without due process of law.” This process of applying the first 10 Amendments to the states through the Fourteenth Amendment is referred to as “incorporation.”

During oral argument in Timbs this past November, the Justices sounded skeptical of Indiana’s arguments that the Excessive Fines Clause did not apply to the states. Justice Neil Gorsuch, an appointee of President Donald Trump, interjected at the beginning of Indiana counsel’s argument to express exasperation at Indiana’s argument that the Clause should not incorporated against the states: “most of the incorporation cases took place in like the 1940s. And here we are in 2018 still litigating incorporation of the Bill of Rights. Really? Come on, General.”

Fellow Trump appointee Justice Brett Kavanaugh likewise seemed perplexed: “Isn’t it just too late in the day to argue that any of the Bill of Rights is not incorporated?”

Justice Gorsuch appeared to go so far as to suggest that if the Clause does apply, Indiana would also lose the case on the merits of whether the seizing of the Land Rover was in fact excessive.

Two federal circuits and 14 state high courts have already held that the Excessive Fines Clause applies to the states. Questions from Justices Gorsuch and Kavanaugh and others suggest the Supreme Court may soon follow suit and affirm those courts took the correct path.

Interestingly, only four state courts have held that the Clause is not applicable to state actions. Mississippi is one of them.

Some may wonder how far a government might go in its justifications of civil asset forfeiture and arguments that it is not excessive. Some may further wonder whether opponents of the process are a bit too paranoid of potential abuses of power.

In response to those possible sentiments, look no further than Indiana counsel’s argument before the Supreme Court - he argued that it would not be excessive for the government to seize an automobile for the driver exceeding the speed limit by five miles per hour.

As Justice Scalia noted, when profit is a motive there is special reason to scrutinize the exercise of government power. The use of civil asset forfeiture proceedings has increased significantly in modern times as a fundraising source for local governments and law enforcement agencies.

This is problematic, and Eighth Amendment protections are needed to protect against what Chief Justice John Roberts termed “the terrifying force of the criminal justice system.”

There are many things we can do to lift up all children. And we don't need to sacrifice our own children to make that happen.

In a recent NBC Think article, author Noah Berlatsky reflected on Mississippi State University (MSU) Assistant Professor Margaret Hagerman’s new book “White Kids: Growing Up with Privilege in a Racially Divided America.” Berlatsky opens with the conflicting pride he felt when his child lobbied his private secondary school to recognize Columbus Day as Native People’s Day because the school should not celebrate “white imperialism.” (His son’s effort was successful.)

Ignore for a moment that Columbus Day is a celebration of human achievement, global trade, and multiculturalism that has been celebrated for more than a century, including in multiple Latin American, non-white countries. Ignore also that instead of educating the student on the rich tradition of this holiday, the school wasted time accommodating an uninformed child’s protest about a holiday he clearly doesn’t understand.

Held up to any scrutiny, this situation is absurd, but not more absurd than Berlatsky’s reflections on it. Berlatsky is conflicted because, while he is proud of his child’s “anti-racist activism,” he feels shame for his white privilege affording his child an education at an expensive private school where school administrators take such activism seriously. In his view, this exemplifies the much larger problem of structural racism. He then explores the MSU professor’s book.

How About Help the Needy Instead of Hurting Children?

One of the many lazy assertions in this book is that even anti-racist white parents “actively reproduce inequality” by not spending enough time discussing racism with their children and by giving their children books whose characters happen to be white. There is no end to the left’s shaming of people who have done nothing more than teach their kids to be good people to the best of their ability.

Berlatsky has done nothing wrong, and unlike Hagerman suggests, Noah has not actively reproduced racism. On the contrary, his son obviously demonstrated his awareness and opposition of racism at a young age. In an attempt to appease his ideological possession, Noah brainstorms over possible lifestyles choices that might mitigate his child’s privilege footprint.

He pulls from Hagerman’s book: “Everyone is trying to do the best for their kid,” she says. “But I actually think that there are times when maybe the best interest of your own kid isn’t actually the best choice. Ultimately, being a good citizen sometimes conflicts with being good parents. And sometimes maybe parents should decide to be good citizens over being good parents.”

Berlatsky mulls over a few examples of this. “That could mean voting to raise taxes so to better fund public schools. Maybe in our case it should have meant choosing a public school rather than a private one.”

This Isn’t Only Stupid, But Evil

It’s incoherent, at best, to imply that worse parents make better citizens. While white liberals ponder the various ways they should have neglected their kids to appease “oppressed groups,” I and many other millennials reject this ideological disease.

I am a young, half-white mother and wife who has seen the expansion of the radical left politically correct culture since I was in elementary school. When Gillette is lecturing you about how to behave, you know things have gone too far. The only result of this decades-long Marxist campaign is more outrage at good people.

According to many on the left, I am supposed to teach my son of the repressive nature of his existence as he develops. I am to tell him at every turn to sacrifice himself to others for the transgression of being himself. This thinking is not only intellectually pitiful, but also profoundly evil.

How About Some More Constructive Responses

The smallest minority is the individual. I reject the notion that my son’s value is determined by his skin color, sex, or life circumstance. I look forward to teaching my son about self-discovery. I want to see him develop his talents and learn to appreciate the talents of his peers. I want him to feel the joy of hard work and achievement, and to admire the qualities of others in a society that appreciates individuals.

If we raise our children to appreciate individualism, then we will end all the various flavors of collectivism, from racism to white privilege. Teaching our children about the horrors of imperialism, slavery, and racism is critical. However, there is no greater good to be gained by sacrificing the quality of my child’s education or economic circumstance.

To maximize the quality of each child’s path to quality education, economic prosperity, and social well-being, I propose a few different policy points. School choice, not mandated-by-ZIP code education, will give children the propensity to thrive. Rather than blame individuals who move to a highly rated school district or make them feel guilty for choosing to send their child to a private school, open the door to more students to do the same.

Eliminating barriers to economic progress, such as excessive licensing, will create a world of jobs for entrepreneurs, especially low-income entrepreneurs. While licensing was once limited to areas that most believe deserve licensing, such as medical professionals, lawyers, and teachers, this practice has greatly expanded over the past five decades.

In my home state of Mississippi, approximately 19 percent of workers need a license to earn a living. This includes everything from a shampooer, who must receive 1,500 clock hours of education, to a fire alarm installer, who must pay more than $1,000 in fees to become licensed. In total, there are 66 low- to middle-income occupations that are licensed in Mississippi. Similar stories exist is every state, yet the outcomes are the same: higher cost for consumers and less opportunity for entrepreneurs.

Finally, promoting, or at the very least not discouraging, marriage will lead to more intact families and the benefits that surround it. The success sequence––graduate from high school, obtain employment, and get married before having children––has long been debated, but it is undeniable from numerous points of view that following these (not so simple) steps will put an individual, and a family, on the path to prosperity.

This, of course, will require a cultural response, similar to anti-smoking campaigns, as much as a government response. Unfortunately, too few people seem interested in taking up the cause of marriage, despite it being the leading cause of inequality in American children’s lives.

I want what is best for my son, and I will do what it takes to make that happen, no matter the political trends. And that is the best thing we can do for a better society.

This column appeared in The Federalist on January 30, 2019.

The quest by Rep. Mark Baker (R-Brandon) to reauthorize administrative forfeiture in Mississippi is gaining national attention. And not necessarily for the right reasons.

Last week, a coalition of numerous conservative organizations, in Mississippi and nationally, including Mississippi Center for Public Policy, Mississippi Justice Institute, American Conservative Union, Empower Mississippi, FreedomWorks, Institute for Justice, and Right of Crime sent a letter to Gov. Phil Bryant, Lt. Gov. Tate Reeves, and Speaker Philip Gunn asking them to oppose the reauthorization.

“Conservatives rightly understand that private property rights are the bedrock of a free society, and the bar must be high for a government to seize property from its citizens and transfer ownership to the state through forfeiture litigation,” the letter reads. “Civil forfeiture is controversial because it often means innocent people losing their property to the state in processes that are complex and divorced from the prosecution of the crime that was the basis for the initial seizure.”

One of the preeminent Constitutional scholars in the country has also weighed in.

“Mississippi legislators should think hard before reinstating the controversial and questionable practice of administrative (sometimes called “civil”) forfeiture,” Ilya Shapiro, Senior Fellow at MCPP and the Director of the Robert A. Levy Center for Constitutional Studies at the Cato Institute, said. “This is a practice that allows state agents to seize property they allege to have been involved in a crime without so much as a court order. And since these are considered civil actions, property owners get few of the protections typically enjoyed by criminal defendants.

“In many past forfeiture cases, property was stripped away without any conviction, and sometimes without charges being filed at all—and then people had to petition the court and pay exorbitant legal fees to get their stuff back. Administrative forfeiture is simply at odds with basic American principles of fairness, justice, and due process. Reinstating it in Mississippi would be a step backwards, especially when many other states are reforming their laws to bolster property rights, not undermine them.”

In 2017, Mississippi became the 19th state in the country to make reforms to civil asset forfeiture in the past half-decade when the state mandated a searchable forfeiture database. That number is now up to 29 states.

If House Bill 1104 becomes law, this would be a rare instance where a state is actually walking back from reforms.

Film incentives are one of the few programs that are largely popular among legislators regardless of party, while they universally provide a poor return on investment for taxpayers.

There was a time when most states had some kind of incentives for the film industry, but that trend has quickly changed. While 44 states had incentives a decade ago, today just 31 do. Others, like Mississippi, have quietly scaled back their program.

For the past two sessions, the Senate has killed attempts from lawmakers in the House to extend the non-resident payroll portion of the incentives program. This previously allowed for a 25 percent rebate on payroll paid to cast and crew members who are not Mississippi residents.

Two incentives remain on the books. One is the Mississippi Investment Rebate, which offers a 25 percent rebate on purchases from state vendors and companies. The other is the Resident Payroll Rebate, which offers a 30 percent cash rebate on payroll paid to resident cast and crew members.

House Bill 1128 would bring back the non-resident rebate. Lawmakers should proceed with caution.

A terrible return on investment of taxpayer dollars

A 2015 PEER report shows taxpayers receive just 49 cents for every dollar invested in the program. That means that for every dollar the state gives to production companies, we see just 49 cents in return. If you or I were receiving that return on our personal investments, we would fire our financial advisor. Of course, no one spends his or her own money as carefully as the person to whom that money belongs.

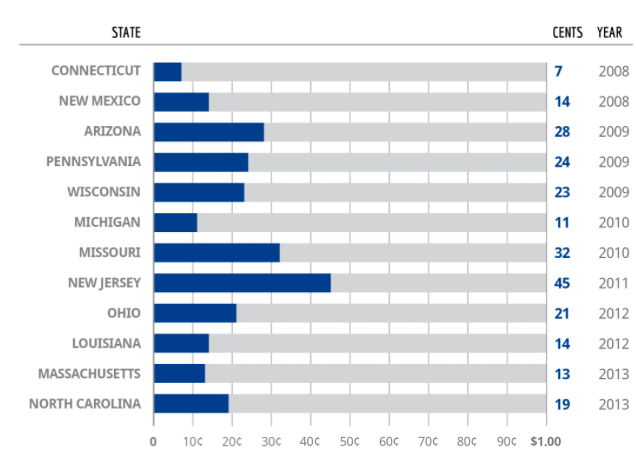

For those looking at a bright side, we are actually “doing better” than many other states. This includes our neighbors in Louisiana, who recover only 14 cents on the dollar. They also have one of the most generous programs in the country; it was unlimited until lawmakers capped it a couple years ago. (Other reports show the Pelican State recovering 23 cents on the dollar, but either way it’s a terrible investment.)

Beyond Mississippi and Louisiana, film incentives are a poor investment throughout the country. Numerous studies have been conducted on film incentives. All sobering for those worried about taxpayer protection. Here is a review of the return per tax dollar given, from 2008 through 2013. In these third-party studies, covering 12 different states, there was not a program that returned even 50 cents on the dollar.

Source: John Locke Foundation

Since this chart was published, studies on similar programs in Florida, Virginia, and West Virginia have shown similar results. No program had a positive ROI.

We have to do it if other people are

One of the commonly prescribed reasons for why need film incentives is it’s “good” for the state to have movies filmed here. As is often the case in government, we focus on the inputs. How many films are made here? What movie star was in Mississippi? That is nice, but the focus should be on outcomes.

The other common argument is that other states are doing it. Throughout the country, producers hold states hostage and threaten to move without incentives. Producers in Mississippi have raised the same point. Again, that is not good reason to essentially throw taxpayer money away.

Simply because another state is wasting money does not mean Mississippi should join them, or continue this practice.

In a comprehensive list of state film production incentives compiled by the National Conference of State Legislatures (NCSL), we see states that do not have incentives for producers but offer tax breaks to everyone, without partiality. For example:

Alaska: No film incentive program. Effective July 1, 2015, the film production incentive program was repealed. Alaska has no state sales or income tax.

Delaware: No film incentive program. However, the state does not levy a sales tax.

Florida: This program sunset on June 30, 2016. It has not been renewed. The state does not levy a state income tax.

New Hampshire: No film incentive program. The state has no sales and use, or broad base personal income taxes.

South Dakota: No film incentive program. There is no corporate or personal income tax in South Dakota.

Our goal should be for Mississippi to have the most competitive business climate in the country. The tax breaks that a few chosen industries or companies receive should be made available to all.

When we do that we will remove the need for taxpayer funded incentives.

When Mississippi law enforcement agencies want to keep property they have seized from a property owner, they now have to prove to a judge that the property is connected to crime.

In a deeper analysis by the Mississippi Center for Public Policy of the state’s asset forfeiture database, 135 of 315 seizures listed in the first 18 months of the database had neither proximity to drugs or distribution of paraphernalia or funds directly traceable to the drug trade. That means 42.9 percent of all forfeitures were considered to be catch-all violations of the state’s Controlled Substances Act without any of the above justifications.

Right now, the state only has civil asset forfeiture which requires judicial oversight, but that could change.

House Bill 1104 is authored by state Rep. Mark Baker (R-Brandon) and it would bring back administrative forfeiture that expired on July 1. This type of forfeiture was for property valued at $20,000 or less and required only a notification to the property owner without any judicial oversight.

The bill will likely make it to the House floor out of the committee Baker chairs, the Judiciary A Committee.

Gov. Phil Bryant has already tweeted his support for the bill, saying that he is “standing with law enforcement.” He said if the bill makes it to his desk, he’ll sign it.

There are procedures provided under the law for forfeiture.

One of those procedures is that, when an agency seizes a vehicle, cash, a weapon or other property, they have to provide the property owner a Notice of Intent to forfeit that property. Most law enforcement agencies use a boilerplate form with six boxes that give a general reason for the forfeiture.

Without doing public record requests for specific incident reports from the law enforcement agencies, these NOIs provide the best view of the justification underlying most forfeitures.

The boxes on the standard forfeiture form include:

- Vehicle is subject to forfeiture under the state law since it was used to transport or facilitate the transport, sale, receipt, possession or concealment of controlled substances or property. The database has 54 vehicles that were forfeited under this provision.

- Money was found in close proximity to forfeitable substances.

- Money was found in close proximity to forfeitable drug manufacturing or distribution paraphernalia.

- Money was found in proximity to forfeitable records of the importation, manufacture or distribution of controlled substances.

- Deadly weapon or money is was used or intended for use in violation of state law.

- Said property subject to forfeiture since it was used or intended for use in violation of state law.

- Money or property being forfeitable since it was the proceeds or derived from proceeds traceable to exchange in violation of the state law.

According to the analysis, 180 of all seizures or 57.14 percent at least had one box checked that included proximity to drugs or distribution paraphernalia or funds directly traceable to the drug trade.

As for the breakdown:

- There were 148 or 46.9 percent of the 315 forfeitures that were in direct proximity to drugs.

- Only 72 forfeitures or 22.8 percent had directly traceable drug proceeds.

- There were 51 seizures or 16.19 percent involving proximity to paraphernalia for distribution.

- Only 27 seizures, or 8.5 percent, had all three: proximity to drugs, distribution paraphernalia and traceable funds.