Lt. Gov. Tate Reeves outlined his plans for the 2019 legislative session, mixed in with a pitch to be the state’s next governor, at the Stennis Capitol Press Forum Monday.

Reeves touted the state’s progress in K-12 education, historically low unemployment rate and increasing tax revenues while vowing that he will never, as governor, support the expansion of Medicaid, which he called Obamacare.

He also supported increasing pay for both teachers and state workers in this year’s session and promised that despite increasing revenues, most state agencies will receive the same level of funding as last year’s budget.

“For the next three months, my focus will be to finish the job I was elected to do, leading the state Senate and passing good, conservative policy,” Reeves said. “I’m proud of my record over the past seven years, because I’ve done what I promised voters I would do. Cutting taxes and finding efficiencies in state government.

“I’m not afraid to say no to my friends and I have no plans to change just because this is an election year.”

As for the state’s improving financial condition, he cited the most recent tax revenue report from the Department of Revenue. The report shows that collections for the fiscal year so far are $90.4 million or 3.52 percent over the sine die estimates. The biggest increases are in the use tax (7 percent tax that is now assessed on internet sales) which was 20.17 percent and nearly 14.98 percent increase in corporate income tax revenue.

The state’s unemployment rate was 4.7 percent in December, which still lags behind the national rate of 3.7 percent.

The two-term lieutenant governor and former state treasurer also decried the decision by the governing board of the Public Employees' Retirement System of Mississippi from 15.75 percent of payroll to 17.4 percent.

“The request by Public Employees' Retirement System will be funded in its entirety,” Reeves said. “Even though I am disappointed that the board broke years of precedence and made a significant request for an increase before they received the annual actuary report this year.”

Reeves said the extra taxpayer money for employer contributions to PERS could add up to between $75 million to $80 million. Taxpayers could also be paying more at the municipal and county level, as local government contributions could add up to $25 million or more.

As for the issue of a decreasing population in Mississippi, Reeves blamed the lack of a large urban area with the kind of amenities desired by millennials and the large number of out-of-state students attending the state’s two largest universities. The University of Mississippi had 41.7 percent of its enrollment from out of state, while 35 percent at Mississippi State University hail from outside the state.

Reeves did get in a shot at one of the gubernatorial candidates on the Democrat side, Attorney General Jim Hood.

“The political enemy of 2019 are the liberal ideas of (U.S. House Speaker) Nancy Pelosi, (Senate Minority Leader) Chuck Schumer and (state Attorney General) Jim Hood,” Reeves said, linking Hood rhetorically with two national Democrats with little popularity in the state.

Former Heisman Trophy winning quarterback Tim Tebow was able to play football for his local public school in Florida while being homeschooled.

Tebow, the Heisman winner, two-time national champion, and first round draft pick, made international news most recently when he proposed to Demi-Leigh Nel-Peters, a former Miss Universe.

Florida is one of about three dozen states that allow homeschool students to play sports for their local high school. Some states have enacted this policy through legislation. In other instances, state high school athletic associations have put this policy in place. The Alabama High School Athletic Association recently made such a change.

Though the policies may vary, the intention is similar: just because you are homeschooled does not mean you can’t play sports for your local high school that your taxes are funding.

Every neighboring state permits homeschool students to play high school sports. Mississippi stands out as the only state that does not.

Over the past several years, including this year already, various bills have been introduced in the legislature to make this change. Only once has such a bill made it out of committee and it was killed on the Senate floor thanks in large part to an odd coalition of opponents that included the Home School Legal Defense Association (HSLDA). HSLDA normally take a neutral position on “Tebow bills,” but believed that particular legislation threatened the academic freedom of all homeschoolers.

Homeschoolers in Mississippi enjoy a high level of academic freedom. Something that upsets many people in both parties. In an effort to preserve what homeschoolers have already “won” in Mississippi, it doesn’t look like any changes will be made to the homeschooling code sections any time soon.

At least not until a Tim Tebow comes on the scene in Mississippi.

A proposal floated by a Mississippi coalition to increase the state’s cigarette excise tax by 221 percent — to $2.18 per pack — would result in a huge increase in tax evasion and avoidance, according to a recent statistical analysis.

If the increase is adopted, Mississippi will find itself surrounded by lower-taxed states, which will encourage cross-border shopping by individuals and large scale smuggling, too, among other undesirable consequences.

It was anecdotal evidence about cigarette tax evasion and avoidance, or “smuggling,” that led one of the authors (LaFaive) and two of his colleagues to estimate the degree to which cigarettes are smuggled between states, as well as from Mexico and to Canada. They estimate that through 2016, Mississippi’s smuggling rate was a mild 4 percent.

The estimate is built around their statistical model, which measures the difference between smoking rates published by the federal government for each state and legal paid sales. There are often yawning gaps between the two — the amount of cigarettes that should be smoked based on sales and the amount of smoking that actually occurs — and that difference is probably explained by smuggling.

The model can be used to make “what-if” estimates based on proposed changes in tax rates. At an excise tax of $2.18 per pack, smuggling would leap from 4 percent to 35 percent of the total market. That is, of all the cigarettes consumed in Mississippi after such a tax hike, 35 of every 100 cigarettes would be smuggled. The model also reports that 21 percent of all consumption would be a function of “casual” smuggling. Casual smuggling is represented by individuals who typically buy lower-taxed smokes elsewhere for personal consumption.

The degree of casual tax avoidance or evasion makes sense when you consider that Mississippi, at $2.18 per pack, would be surrounded by lower taxed states Tennessee (62 cents); Alabama (67.5 cents); Louisiana ($1.08); and Arkansas ($1.15). Consider too, that Missouri, which imposes a tax of just 17 cents — the lowest in the country — is only a short drive through Arkansas.

When tax rates vary substantially across state borders, that gives people an incentive to shop elsewhere for their smokes and for larger, organized crime cells to engage in large, long-haul smuggling operations.

For example, New York State imposes a state excise tax of $4.35 per pack, and New York City tacks on an additional $1.50. Nearby Virginia — a five-hour drive — imposes a tax of only 30 cents. It is this difference that consumers seek to save (and smugglers try to profit from) by acquiring lower priced, often illegal cigarettes. In New York, inbound trafficking is rampant and news stories about it are easy to find.

Just last November, the New York state attorney general announced a 242-count indictment involving 17 cigarette smugglers who moved over 18 million untaxed smokes into the Empire State. That’s just one cell and one bust. There have been many others. This is something Magnolia State lawmakers should consider before taking up legislation that could make Mississippi’s smuggling look more like a New York racket.

Moreover, smuggling is not the only consequence of high cigarette taxes. Others include brazen theft of cigarettes from retailers and wholesalers, shipment hijackings, violence against people and police, cases of murder-for-hire, accidental deaths involving police pursuits and public employee corruption.

All of the risks associated with higher cigarette excise taxes could be worthwhile if they led to far more people kicking the habit. Research shows, however, that as much as 85 percent of the after-tax change in legal paid sales is a function of tax avoidance and not quitting. Cigarette sales may drop dramatically, but it does not follow that smoking rates do.

None of this should suggest that either of us wish to encourage smoking. Neither of us are smokers and we would discourage others from starting. But the data shows us that there are far more effective ways — including tobacco alternatives, non-combustion substitutes, and innovative harm-reduction products — to reduce smoking than raising taxes.

The evidence from around the country and elsewhere tells us that relatively high cigarette excise tax rates can produce every sort of mischief, including undermining the very health goals such taxes were adopted to address.

This editorial was co-authored by Michael LaFaive. He is senior director of fiscal policy for the Mackinac Center for Public Policy and author of “Prohibition by Price: Cigarette Taxes and Unintended Consequences,” a chapter in the book, “For Your Own Good.”

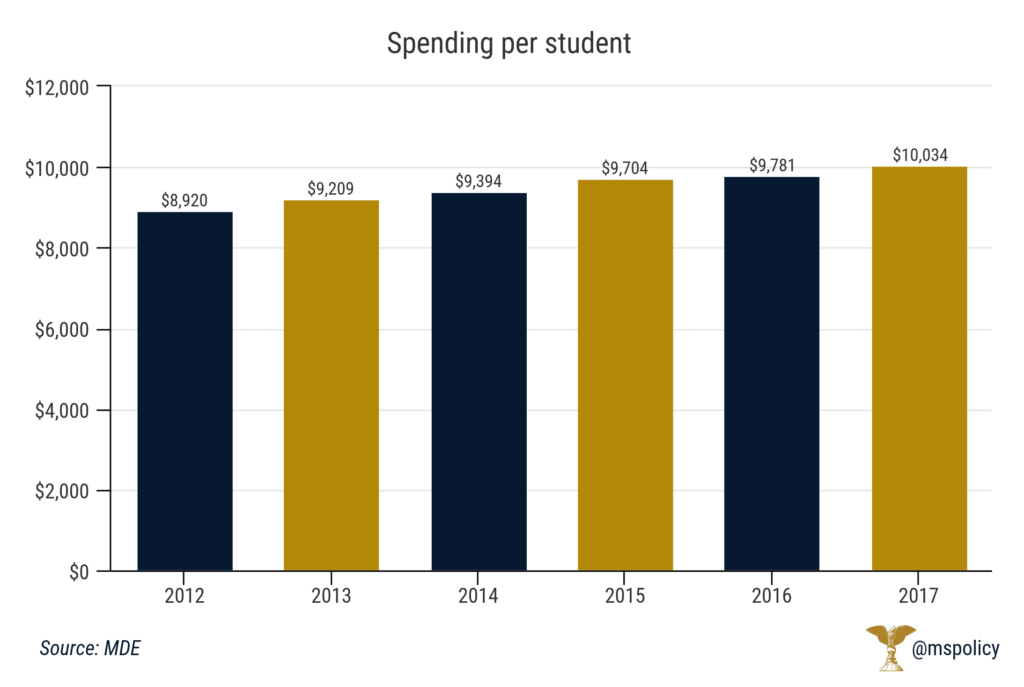

The state of Mississippi eclipsed spending $10,000 per student last year.

According to the 2017-2018 Superintendent’s Annual Report, released Thursday, the state spent $10,034 per student, on average. This amount was based on average daily attendance, which was 439,599 students last year.

This marks the sixth straight year that the average expenditure per student has increased. In 2012, the state was spending $8,920 per student. It increased to $9,209 in 2013, $9,394 in 2014, $9,704 in 2015, and $9,781 last year.

On a district-by-district basis, spending per student fluctuated from a high of over $21,000 per student in the Montgomery County School District to a low of $7,800 in the Lincoln County School District. The Kemper County School District, Amite County School District, Moss Point School District, and Lumberton School District rounded out the top five.

Eighty-six districts spent more than $10,000 per student, and 24 spent more than $12,000 per student.

National figures on what each state is spending tend to vary widely depending on the source. The U.S. Census, which tracks public education finances, showed a national average of $11,762 during the 2016 fiscal year. However, the same data had Mississippi spending just $8,702, almost $1,000 less than what the state reported.

Simultaneous to the increase in per-student-expenditure, the average daily attendance has also decreased each year. While that number was just under 440,000 this year, it was 461,000 in 2012. This represents a drop of more than 4.5 percent. Enrollment numbers decreased again for the 2018-2019 school year, and, presuming education funding is not reduced, the per- student-average will only continue to increase.

Mississippi law enforcement agencies need little justification to seize property or even cash from owners under state law.

All law enforcement has to do is connect property to a crime to seize it, and can use proceeds from it to supplement their budgets. Those whose property is seized have to prove in a civil court their property was not involved with a crime or the proceeds of a crime.

One case that exemplified this policy occurred at Jackson’s Medgar Wiley Evers International Airport on February 20, 2017. Ashley Tami Renee Phillips was trying to catch a flight when a Transportation Security Administration officer detected $30,000 in cash that was in three bundles in her checked luggage. In the request for forfeiture, the Jackson Airport Police Department alleged that the cash was concealed in clothing in her checked luggage.

The Department brought in a drug dog and the animal alerted to the presence of narcotics on the currency, giving the police the justification to seize it. This despite a study that says that nearly 80 percent of U.S. currency is contaminated by cocaine residue.

Phillips hired a local attorney and contested the seizure, denying that the money was concealed in the clothing in her luggage.

The airport police and Phillips finally reached a settlement that allowed law enforcement to keep $5,000 of the money, with the rest returned to Phillips and her attorney. In most cases, however, it is not worth it to challenge a seizure. Attorney and filing fees often make it cost prohibitive for the value of the seized property.

When a Mississippi law enforcement agency makes a seizure, it has to send a notification, usually by letter, to the property owner that details what was seized and informing them they have 30 days to contest the forfeiture in civil court. If the owner doesn’t contest the forfeiture, the ownership of the property or cash automatically goes to the agency that made the seizure.

Law enforcement agencies can retain 80 percent of the proceeds from any seizure if only one agency was investigating and 100 percent if more than one agency was involved. The remaining 20 percent, if one agency was involved, is shared with the local district attorney’s office or the Mississippi Bureau of Narcotics who help file the seizure paperwork with the judge.

In the case of the airport seizure, the Madison and Rankin County District Attorney’s office that filed the request on behalf of the police would receive 20 percent of the $5,000.

Last year, the Mississippi legislature allowed the expiration of the law that authorized administrative forfeiture — which allowed law enforcement agencies to seize property valued at less than $20,000 with only a notice to the property owner.

But even after the law was repealed, agencies continue to seize property under administrative forfeiture. In September, the Mississippi Justice Institute, the legal arm of the Mississippi Center for Public Policy, sent a letter to MBN advising the agency of the change in the law after it became apparent that the property seizures continued. Later that month, MBN sent notices allowing retrieval of improperly seized property.

Two years prior, Gov. Phil Bryant signed into law a bill that created a civil asset forfeiture database that is maintained by the MBN. The law also required law enforcement agencies to report some, but not all, data on their seizures. Previously, there was no reporting requirements on which assets were seized.

It also outlawed the practice of law enforcement agencies hiring outside counsel to pursue civil asset forfeiture claims, as it requires them to use either local district attorneys or MBN to handle all legal work on forfeitures.

Maintaining diversity departments at Mississippi State University and the University of Mississippi are hitting taxpayers in the wallet.

According to records obtained by the Mississippi Center for Public Policy, the University of Mississippi spent $1,249,868 of its 2018-2019 budget on diversity related operations, which include the Division of Diversity and Community Engagement, Center for Inclusion and Cross Cultural Engagement and the McLean Institute for Public Service and Community Engagement.

Mississippi State University spent $803,756 on diversity-related activities that include the Institutional Diversity and Inclusion Division and the Holmes Cultural Diversity Center.

As a percentage of their total budgets ($681 million for Ole Miss and $364 million for Mississippi State), Ole Miss and Mississippi State are both outspending the University of Michigan on diversity-related activities. Michigan was the flashpoint for two landmark U.S. Supreme Court cases involving race-based admissions policies.

The Ann Arbor-based school has a budget of more than $3 billion and spent more than $2 million on its diversity agenda with 12 employees. In 2014, the U.S. Supreme Court upheld a Michigan ballot initiative that prevented race-based admissions at the state’s institutions of higher education with a 6-2 decision in Schuette v. Coalition to Defend Affirmative Action.

The ballot initiative was in response to the 2003 U.S. Supreme Court decision, Grutter v. Bollinger, that upheld affirmative action admission policies at Michigan and other universities.

The University of Alabama has six full-time employees dedicated solely to two diversity-related organizations, the Diversity Equity and Inclusion office and the Women and Gender Resource Center. The Tuscaloosa-based institution had a budget of $2.14 billion in 2017.

Louisiana State University has nine full-time employees whose role is dedicated to diversity-related issues. LSU had a budget of $1.018 billion in 2018.

Ole Miss spent 95.8 percent of its diversity-related budget ($1,249,868) on personnel-related costs. That adds up to $1,197,080 in 2018-19 for eight full-time employees with more budgeted for part-time student workers.

That figure could also increase with four unfilled positions, two of which (assistant vice chancellors for diversity and community engagement) pay $120,000 apiece per year.

What are the objectives of the various diversity departments on college campuses?

Former Ole Miss Chancellor Jeffrey Vitter called diversity “a hallmark of education” and said that it “enriches the environment and experiences of all our campus constituents.”

In the diversity plan at Ole Miss, the university wants to increase the enrollment and graduation rate of minorities, hire more minorities in administrative, faculty and staff positions, change the curriculum to one that “enhances multicultural awareness and understanding,” and increase the use of minority vendors by the university.

Mississippi State has 11 full-time employees and more money budgeted for part-time student workers whose job descriptions are based on increasing campus diversity. Personnel-related costs absorb 82.2 percent of the diversity program’s budget at State.

MSU’s diversity plan is similar, with goals to increase diversity in both enrollment and among administration, faculty and staff along with providing more contracts to minority vendors.

Diversity is a lucrative career, especially at Ole Miss. The university pays Katrina Caldwell, the Vice Chancellor for Diversity and Community Engagement, $205,000 per year. She received a $5,000 raise in 2018 after being hired from Northern Illinois University.

According to her bio on the university website, Caldwell’s duties include “leadership and coordination of UM’s efforts to create and supervise a diverse, inclusive and welcoming environment for all members of the community.”

Are taxpayers seeing a benefit for this spending? Not according to a paper from the National Bureau of Economic Research that shows that having a diversity staff doesn’t translate to an increase in the hiring of “underserved” racial and minority groups.

The paper, authored by Baylor University economists Steven Bradley, James Garven, Wilson Law and James West, took a look at data from U.S. universities from 2001 to 2016 that hired an executive level chief diversity officer and whether the diversity of their faculty and administrative hires increased as a result.

The four didn’t find any significant evidence that hiring a diversity officer results in more hiring of minority faculties and administrators and that the pool of diverse Ph.D. candidates is limited as many often accept employment outside the academy.

According to their research, two thirds of all U.S. universities have a chief diversity officer on staff.

A Mississippi Senate appropriations subcommittee hearing on Department of Public Safety funding Wednesday morphed into a discussion of excessive wait times for driver’s license renewal.

State Sen. Brice Wiggins (R-Pascagoula) criticized the DPS, represented by Commissioner Marshall Fisher, for having four-hour plus wait times for driver’s license renewals.

“The issue is simple things could be done,” Wiggins said. “Four hour wait times are flat-out unacceptable for the citizens of Mississippi. Something has to change. I’ve heard of people coming in to say they just need to change their address and they’re told come back in six hours.”

Wiggins also said that he’d support more appropriations for DPS to help reduce wait times and suggested a phone, but also said it was more than just about money. He said that the department should enact a phone-based or online appointment system to lower wait times.

Fisher told Wiggins and the subcommittee that the examiners, who make around $21,000 annually, need a pay hike. He also said he’d like to have more of the driver’s license services online.

Fisher has asked the subcommittee for a $48.75 million increase in his agency’s budget that would include a new trooper school, more officers for the Mississippi Bureau of Narcotics, and more medical examiners for the state crime lab. This increase would also cover added employer contributions to the state’s defined benefit pension system.

Fisher also asked for his agency to be released from the purview of the Mississippi Personnel Board and the Employee Appeals Board. Under state law, a bill would have to be drafted to provide DPS with an exception.

During his briefing, Fisher said the number of state troopers is critically low and the agency needs 60 more troopers. According to his numbers, there are 488 troopers on the force at present, but of those, 160 have enough service time to retire this year.

State law authorizes a force of 650 troopers.

Fifty seven troopers were added to the force after a trooper school graduated last year, while up to 54 in the present class could join the force on May 1.

According to the U.S. Department of Justice statistics, the national average is 20 troopers per 100,000 residents. Using Fisher’s numbers on troopers, the state has 17 per 100,000 residents.

Fisher also said the autopsy workload for the state’s two medical examiners is too high and that the Medical Examiner’s Office needs seven additional personnel, including two new examiners. He said the two examiners performed 1,250 autopsies last year, which is far more than 250 per examiner recommended by the National Association of Medical Examiners.

School district consolidation in Mississippi can offer both efficiency and savings to taxpayers. It is also one of the trickiest, and most sensitive issues, to local residents, and local lawmakers.

Over the past five years, the state legislature has led on the issue with 10 separate consolidation bills impacting 21 different school districts. By 2021, the state will have 13 fewer school districts than in 2014.

The formula behind the consolidation has largely been to merge two, or in some cases three, districts that are in the same county and are both failing, or, at best, struggling. The consolidations have included:

- Consolidating North Bolivar School District and Mound Bayou School District into the North Bolivar Consolidated School District (2014);

- Consolidating Benoit School District, West Bolivar School District, and Shaw School District into the West Bolivar School District (2014);

- Consolidating Sunflower County School District, Drew School District, and Indianola School District into the Sunflower County Consolidated School District (2014);

- Consolidating Oktibbeha County School District and Starkville School District into the Starkville Oktibbeha Consolidated School District (2015);

- Consolidating the Clay County School District and West Point School District into the West Point Consolidated School District (2015);

- Consolidating the Winona School District and the Montgomery County School District into the Winona Montgomery Consolidated School District (2018);

- Consolidating the Durant School District and the Holmes County School District into the Holmes County Consolidated School District (2018);

- Consolidating the Greenwood School District and the Leflore County School District into the Greenwood Leflore School District (2019);

- Dissolving the Lumberton School District into the Lamar County School District (2019);

- Consolidating Chickasaw County School District and Houston School District into the Chickasaw County School District (2021).

Still, school districts in Mississippi serve a lower number of students, on average, than every other state in the Southeast, save for Arkansas. What does that mean? We are spending money on additional salaries, pensions, benefits, buildings, etc. that other states are not. This means less money in the classrooms.

Mississippi’s school districts are inefficient compared to other Southern states

| State | Total enrollment | Total school districts | Students per district |

| Florida | 2,721,459 | 67 | 40,619 |

| North Carolina | 1,443,163 | 115 | 12,549 |

| Virginia | 1,279,544 | 135 | 9,478 |

| Georgia | 1,744,240 | 199 | 8,765 |

| South Carolina | 718,322 | 82 | 8,760 |

| Tennessee | 960,704 | 142 | 6,766 |

| Louisiana | 720,458 | 126 | 5,718 |

| Alabama | 733,951 | 136 | 5,397 |

| West Virginia | 281,439 | 55 | 5,117 |

| Kentucky | 685,176 | 173 | 3,961 |

| Mississippi | 492,279 | 151* | 3,260 |

| Arkansas | 475,782 | 254 | 1,873 |

Source: National Education Association, “Rankings & Estimates 2014-2015”

The average district size among the 12 states was 9,467, almost three times the size of the average district in Mississippi. For Mississippi to be in line with that average, the state would need to see a reduction to 52 school districts, eliminating almost two-thirds of the districts in the state.

Florida is the biggest outlier in this group. Removing the Sunshine State from the mix would drop the average district size to 6,513. Even doing that, Mississippi would still need to drop to 75 districts to be at the average. That is a reduction of almost 50 percent.

Among neighboring states, if school districts in Mississippi were to serve the same number of students as school districts in Alabama, Mississippi would need to experience a reduction to 91 districts. To mirror Louisiana, Mississippi would need a reduction to 86 districts. And to match the same number of students per district as Tennessee, Mississippi would need a reduction to 73 districts. Either of these changes would represent a decrease of 40 to 50 percent of the districts in the state.

Additionally, the districts in Mississippi are largely unbalanced. Half of all public school students in the state attend school in one of just 28 school districts. Yet, 63 districts have less than 2,000 students and educate just 16 percent of students.

There is not a magic size for a district. There are poor performing large districts, starting with Jackson Public Schools, just as there are high-performing small districts. But this inefficient distribution of students, which results in excessive bureaucracy, costs taxpayers money and prevents dollars from making it to the classroom.

While there is overwhelming local pressure to oppose consolidation, the legislature should continue with the process of reducing the number of school districts in Mississippi.

* This data was released before Mississippi began consolidating school districts, but the drop in the number of districts isn’t great enough to change these statistics.

It has often been said that government does not create jobs, it merely creates the environment that encourages, or in some cases, discourages, job growth. When it comes to occupational licensing, the emphasis is on discouraging job growth.

Because of these often burdensome laws, Mississippians are forced to spend time and money to receive permission from the government before they can earn a living.

While licensing was once limited to areas that most believe deserve licensing, such as medical professionals, lawyers, and teachers, this practice has greatly expanded over the past five decades. Today, approximately 19 percent of Mississippians need a license to work. This includes everything from a shampooer, who must receive 1,500 clock hours of education, to a fire alarm installer, who must pay over $1,000 in fees. All totaled, there are 66 low-to-middle income occupations that are licensed in Mississippi.

What is the reasoning behind new licensing? The public argument is generally centered around the belief that we must do this in the name of consumer safety to protect individual citizens. But the reality is often something less altruistic. Mainly, these occupational associations are more interested in building a moat around their industry with the help of government. The harder it is for someone to enter an industry, the less competition and consumer choice the industry incumbents face.

This may artificially raise the wages of industry practitioners by raising the prices of goods and services that require such licenses, but it does so at a cost. Consumer choices are limited and consumer costs are increased. And the added cost is not insignificant. Mississippians pay a hidden tax of more than $800 each year due to onerous occupational licensure requirements, according to a 2016 report from the Heritage Foundation.

In 2018, the Mississippi legislature, with little discussion and few dissenting votes, passed a bill to make it more difficult to become a real estate broker. The proposed law sought to increase the time it would take to become a broker, going from the current one year to three years. Fortunately, Gov. Phil Bryant vetoed the legislation.

Who were the individuals supporting such legislation? Was it the Coalition of Mississippians Against Inexperienced Brokers? A group of citizens negatively impacted by brokers who had just one year of experience? No, it was, naturally, the Realtors Association.

But the bigger problem isn’t just one specific association pushing the legislature to limit competition, it is the cost of all unnecessary and burdensome regulations on Mississippi’s economy.

According to a recent report from the Institute for Justice, Mississippi has lost 13,000 jobs because of occupational licensing and the state has suffered an economic value loss of $37 million. To put that into perspective, just by legislative action to rollback unnecessary licenses, we can create two Nissan plants…without spending a dime of taxpayer dollars.

Instead of relying on government, these are the actions that will encourage and promote economic growth in Mississippi. If that is our goal, we need to trust in the benefits of the free market and a “lighter touch” from government and occupational licensing regimes and we need to return to a belief in individual responsibility.

This can be achieved in a number of ways. For example, voluntary certification offers an avenue for reform. This already occurs in many industries and allows private third-parties to set standards for individuals to voluntary subscribe as one level of quality assurance.

One of the more widely recognized private certifications is the Automotive Service Excellence (ASE) certification for mechanics. You can open a garage tomorrow with – or without – the ASE certification and customers may or may not care.

But that decision is left to the entrepreneur and the customer, not to the government or the industry lobbyist or the board of licensure. We can do this with any number of professions currently licensed by the state. If we really want more jobs and fewer people dependent on government, it starts by creating an environment that encourages work; not one that encourages the creation of hurdles and obstacles.

This column appeared in the Daily Leader on January 4, 2018.