Combatting Welfare Fraud in Mississippi with Commonsense Reforms

A bill (HB 1090) before the Miss. Senate implements a number of best practices aimed at combatting welfare fraud. The bill would save the state an estimated $40 million [1] annually by verifying eligibility for Medicaid and SNAP/food stamps. The bill also creates oversight procedures – like tracking where EBT (food stamp) and TANF cards are used – to discourage fraud.

Medicaid Fraud

The U.S. Government Accountability Office (GAO) warned again this year, as it has for the past 14 years, that Medicaid is a “high-risk” program owing to “vulnerabilities to fraud, waste, abuse, and mismanagement.” An estimated $60 billion in Medicaid expenditures are thought to be lost to fraud each year. Likewise, according to the National Conference of State Legislatures, “Fraud and abuse in Medicaid cost states billions of dollars every year, diverting funds that could otherwise be used for legitimate health care services.”

There are basically two types of Medicaid fraud: provider fraud and enrollee fraud. While the federal government apparently has no mechanism in place to accurately track fraudulent Medicaid spending, its Centers for Medicare & Medicaid Services estimates that “eligibility errors” account for the majority of payment “errors.”

This suggests that the majority of Medicaid fraud is generated by ineligible recipients. Such recipients are generally misreporting identity, residency, citizenship status and/or income. Identify theft, for example, is rampant in Medicaid. Arkansas recently audited its Medicaid rolls and found 20,000 enrollees with “high-risk” identities, many of them using stolen or falsified Social Security numbers. Illinois conducted a similar review and found 14,000 dead people on Medicaid.

Under federal law, the Miss. Division of Medicaid is supposed to verify eligibility on an annual basis. States have the option of relying on “self-attestation” for eligibility and cross checking this information against a federal database (PARIS) that is supposed to verify Social Security number usage.

In 2016, the PARIS database flagged only 2.4 percent of Mississippi Medicaid recipients as having a Social Security number used by someone in another state. By contrast, other states are finding an average fraud rate of 10 percent after implementing the reforms mandated by HB 1090. These states are using private-sector databases to quickly and inexpensively verify ongoing eligibility.

HB 1090 would require the Division of Medicaid to enter into a competitively bid contract to hire a vendor to monitor ongoing Medicaid and SNAP/food stamp eligibility. The vendor would only be paid out of the savings generated by catching fraud. The vendor would not be able to actually remove anyone from Medicaid or any other welfare program, but would only flag suspicious information, leaving it up to Miss. Medicaid to investigate and handle the removal of verified cases of fraud.

States that have implemented similar monitoring systems have seen a return on their investment of well over 10 to 1. Illinois, for instance, is saving almost $400 million annually. Pennsylvania saved $710 million in 18 months. Minnesota estimates annual savings of $307 million.

At least 11 other states are currently running or have recently run some form of enhanced welfare verification audit: Alaska, Arkansas, Illinois, Kansas, Maine, Massachusetts, Minnesota, Missouri, Pennsylvania, Rhode Island, and Wyoming.

Welfare Fraud & Abuse

The eligibility verification system created by HB 1090 would apply to all Mississippi welfare programs administered by the Division of Medicaid and the Department of Human Services (DHS), including SNAP/food stamps and TANF. Food stamp fraud in Mississippi is a serious problem, if only judging from the many cases of fraud reported in the media. According to a 2012 report in the Daily Journal, “In the last fiscal year alone, 1,705 people were disqualified from Mississippi’s Supplemental Nutrition Assistance Program – SNAP – for making false claims and bilking the program out of more than $2.7 million.” These 1,705 cases of fraud represent 0.2 percent of total enrollment. The actual fraud rate is likely much higher.

“The application process for SNAP is based on an ‘honor system,’ trusting the applicants truthfully submit their income and number of dependents,” acknowledges DHS fraud investigator Ken Palmer. In particular, DHS has found that a number of recipients do not report income, causing “the client to get taxpayers’ dollars that they were not entitled to.”

While DHS’s efforts at catching fraud are appreciated, the department is relying on a “pay-and-chase” model that enables fraudsters to remain on the rolls indefinitely, until and unless they are actually caught. Using existing technology to review welfare eligibility on a quarterly basis would speed up the process of eliminating fraud, saving the state money and sending the message that fraudsters shouldn’t target Mississippi.

In addition to proactively verifying eligibility, HB 1090 reigns in welfare abuse by eliminating several loopholes used by the Obama administration to gut landmark welfare-to-work reforms signed by President Bill Clinton in 1996.

Federal law, for example, requires most working-age (18 to 50) able-bodied, childless adults to cycle off of food stamps after 3 months unless they are working, training or volunteering for at least 20 hours a week. Under a “waiver” offered by the Obama administration, Mississippi dropped this requirement from 2009 to 2016. The state has similar waivers that have eliminated income and asset tests for food stamps. These are still in place.

Kansas is another state that reinstituted the able-bodied adult work requirement, but then tracked 41,000 former recipients to analyze the results. Half obtained employment almost immediately, and almost two-thirds were working within a year. Incomes rose by an average of 127 percent a year, with many finding permanent well-paying jobs in a variety of industries. Other quality-of-life measures, like marriage rates, also increased.

HB 1090 would require legislative permission for Mississippi to again waive food stamp work requirements. The legislature would also have to statutorily authorize any waivers eliminating income and asset standards.

Other states have found good reason to implement the reforms in HB 1090. Michigan discovered it had thousands of lottery winners on welfare. “I feel that it’s OK because I have no income, and I have bills to pay,” admitted one million-dollar winner. “I have two houses.”

Since Michigan, like Mississippi, does not have an asset standard, even multimillion-dollar winners could legally remain on food stamps until public outrage forced a change in law. In Ohio, the millionaire son of an Iranian prince was found to be receiving both food stamps and Medicaid. The man reportedly held $4.2 million in a Swiss bank account, lived in an 8,000 square foot home and had a BMW and Lexus parked in his four-car garage. In his defense, the fraudster claimed, “It was our right to apply [for food stamps] and I applied. If you don’t like the system, change it.” Ohio’s welfare programs, not unlike Mississippi’s, waive asset standards. “I answered every question asked by benefit workers,” claimed the man.

Along with restoring federal welfare-to-work reforms, HB 1090 would provide state policymakers with additional information as to how the state’s welfare benefits are being utilized. Among other things, the bill would track out-of-state welfare usage. When Maine ran such a check, they found $3.5 million worth of transactions in Florida, including hundreds of thousands of dollars in withdrawals from ATMs near Walt Disney World. In turn, when Florida ran such a check, they found 3,500 of their food stamp recipients were also receiving food stamps in at least one other nearby state, including Mississippi. The bill would also codify and expand the list of prohibited ATM (TANF) transactions at liquor stores, casinos and strip clubs to include spas, nail salons and similar locations.

Note 1: A fiscal note from the Department of Human Services, prepared by The Stephen Group, estimates annual savings from Medicaid verification of $6.9 million in General Fund savings and $6.2 million in federal savings from the SNAP/TANF reforms. (Mississippi pays about 25 percent of the cost of Medicaid while the federal government pays about 75 percent. The federal government pays the full share of SNAP/TANF costs, though the state is responsible for administrative costs.) The Stephen Group report assumes a fraud rate of 1 percent for Medicaid managed care; 1 percent for SNAP; and 2 percent for Medicaid long-term care. Other states that have conducted similar reviews have identified much higher fraud rates, depending on the nature of the audit: Illinois (34 percent); Arkansas (ranges between 3, 12 and 24 percent); Minnesota (17 percent). Based on the experience of other states, we anticipate an average eligibility fraud rate of 10 percent of total enrollment, which would be roughly 72,000 cases based on FY2016 average monthly enrollment of 728,704 (excludes CHIP). Not every enrollee costs the same, but annual spending per enrollee in Mississippi is $5,913: the range being $18,592 for the most expensive enrollees to $2,403 for the least expensive. If we use the very conservative estimate of $3,000 per year in enrollee costs (much less than The Stephen Group assumes), we arrive at the following: $3,000 x 72,000 cases divided by 6 months = $108 million. Based on our current FMAP, this translates into $27 million in savings for a half year. If the audit is run twice in a twelve-month period, this number will double to $54 million. Hence, we conservatively assume savings ranging from $27 million to $54 million, the average of which is $40 million. To be clear, the savings other states are seeing is not only from a one-time review of their rolls, but from constant monitoring. We recommend a quarterly audit, resulting in even greater savings. We also estimate there will be some administrative savings as non-eligible individuals drop off of the SNAP/TANF rolls. The Stephen Group report estimates the enhanced eligibility and other reforms will cost about $3 million annually, but expects federal funding to cover as much as two-thirds of this amount. Assuming the cost is even as high as $2 million annually, this would result in a return on investment of 20 to 1.

|

Mississippi’s Internet Sales Tax: The explosion of online retail sales has fostered a debate about whether and how to collect taxes on those purchases from companies that are not currently required to collect them. During the 2017 legislative session, the Mississippi House of Representatives passed a bill regarding this issue. That bill, HB 480, died in the Senate Finance Committee, but the issue itself is not going away. The Mississippi Department of Revenue (DOR) has proposed a regulation very similar to the legislation. A major difference between the regulation and the legislation is that HB 480 would have directed that the taxes collected by certain out-of-state sellers be spent on road and bridge repair. Although there are many aspects to this debate, this paper is intended to explain only a few of the policy matters involved. It does not seek to take a side, but to impartially explain the pertinent facts. For the most part, we will deal with things as they are, not as they should or should not be.

Is this a new tax? Is it a tax increase? The answer to both questions is no, at least as applied to the tax itself. The process to collect the tax will be taxing – logistically, financially, and emotionally – especially for small businesses. But the use tax on the purchase itself is neither a new tax nor a tax increase. Here’s why. For every item you buy right now that is subject to sales or use tax, you are the one who owes the tax. It would have perhaps been more accurate to call it a “purchase tax” than a “sales tax.” The tax is not on the business from which you purchased the item. The tax is assessed on the item itself, and you as the purchaser owe the tax. In order to make it easier to identify and collect the tax, the state requires sellers (retail stores, for instance) to collect it for you. That’s why it’s not included in the price of the product but is identified as a separate item on your receipt. (In contrast, businesses include the cost of their own taxes, such as income or property taxes, in the underlying price of the product, not as a separate item on the receipt.) Consider this analogy. You owe tax on your income. In order to increase compliance, the state requires your employer to withhold money from your paycheck and send it to DOR. That’s not a tax on your employer. You are the one who owes the tax. If your employer doesn’t withhold enough, you still owe the full tax on your income, and you are required to remit it when you file your tax return. In the same way, if a retailer – in-state or out-of-state – collects an adequate amount of sales or use tax for you, you owe nothing more. But if the retailer does not collect it, you still owe it. Whether you have noticed or not, or whether you have answered it truthfully or not, your Mississippi tax return asks you to identify the amount of purchases you made from out-of-state companies for which you did not pay sales or use tax. You are supposed to pay 7% of that amount to the state. Apparently, not many people do that. If you buy an item in another state and the seller charges you sales tax in that state, you can deduct that amount from the use tax you would otherwise owe to the state of Mississippi. The very important exception to this: you cannot deduct sales or use taxes paid in another state on most motorized vehicles (cars, trucks, motorcycles, boats, etc.) whose first use will be in Mississippi. In other words, if you buy one of those items in another state, and it has not been used before, you will owe the full use tax in Mississippi even if you paid sales tax in the state where you bought it.

To summarize: the tax on purchases from out-of-state sellers is a tax that is owed now; it is not a new tax, and it is not a tax increase. If the tax is already owed, what’s the problem with requiring sellers to collect it? If that’s the case, has Congress shown any interest in allowing it? Since Congress has not acted, what governs internet tax collection?

If Congress does eventually pass a bill, what safeguards are likely to be approved for small businesses to deal with the complexity?

Are those safeguards in the proposed DOR regulation? If the U.S. Supreme Court has said states cannot require out-of-state businesses with no physical presence in-state to collect these taxes, why would DOR attempt to do so anyway? For the legislature, the apparent motivation behind HB 480 was to increase the amount of money being directed toward road and bridge repair, by allocating to that purpose the amount of use taxes collected and remitted by out-of-state sellers. Of that amount, 70% would have gone to the state Department of Transportation for state-maintained roads and bridges, and 30% to cities and counties for local road and bridge repair. Normally, the use tax goes into the General Fund, which is the primary source from which the legislature appropriates funds to schools, Medicaid, prisons, etc. Road and bridge funding comes primarily from the tax on gasoline and other fuels, generally referred to as the “gas tax.” Other Common Questions Those who would answer “no” say it is wrong to place the tax-collection burden on out-of-state sellers because the sellers don’t use water and sewer infrastructure, or fire and police protection, or other benefits provided by local and state government to brick-and-mortar establishments. They also say buyers generally choose to purchase online more for convenience than price, so the 7% difference would not change the purchasers’ buying decisions. In addition, they say sales tax collections have not declined despite the rise in online sales. I noticed Amazon is now charging me 7% on the items I buy from them. If they aren’t required to collect tax on their sales to Mississippians, why are they doing so? Do we know whether Amazon is receiving any special benefits as a result of their agreeing to collect a use tax? March 1, 2017

|

(JACKSON, MISS—FEBRUARY 17) – Today, the Mississippi Justice Institute (MJI) filed a complaint with the Mississippi Ethics Commission following a refusal by the Department of Revenue (DOR) to make available public documents related to a voluntary agreement between that agency and the online retailer Amazon. The agreement, as first disclosed in public statements by Department of Revenue officials, appears to provide for Amazon to collect use tax from online purchases from Mississippians and remit those taxes to DOR. DOR officials have publicly spoken of negotiations between the agency and Amazon.

“Mississippi law requires government transparency and accountability. As taxpayers, the public should be allowed to know the details of our state agencies’ agreements and contracts with outside entities – in this case a billion dollar corporation collecting taxes on behalf of the state. These details are particularly important because they involve an issue with current active legislative debate and recently completed but not yet enacted rulemaking by the Department of Revenue. The state is making policy on this issue without revealing public information which could inform the citizens,” said Mike Hurst, director of MJI.

Hurst continued, “The Department of Revenue denied our open records request citing confidentiality of required tax records. But the agreement isn’t a required tax record because this is a voluntary agreement. Under existing U.S. Supreme Court precedent, the Department of Revenue cannot require an out-of-state company with no physical presence in Mississippi to pay a use tax. There is no exemption to Mississippi’s transparency laws which allows the Department of Revenue to deny review of these public records, so we have appealed their refusal to the Ethics Commission,”

Hurst noted several questions the information requested might answer.

- Has the state agency obligated taxpayers to any agreement?

- Did DOR agree with Amazon that, in exchange for voluntarily collecting these use taxes for DOR, DOR would promulgate regulations attempting to codify the application of use taxes to other out-of-state companies?

- Did DOR structure the agreement at Amazon’s request to give Amazon a competitive advantage over competitors?

- Did DOR agree to give Amazon some kind of benefit for voluntarily coming forward and agreeing to collect use taxes for DOR? If so, what are the details of that contract between a state agency and a collection company?

- Did DOR agree to shield third-party sellers on Amazon’s platform from collecting use tax?

You can read MJI's record request here; the DOR's refusal here, and MJI's complaint to the Ethics Commission here.

The Mississippi Justice Institute represents Mississippians whose state or federal Constitutional rights have been threatened or violated by government actions. It is the legal division of the Mississippi Center for Public Policy. To learn more about MJI, visit www.msjustice.org.

--30--

|

|

|

![]()

|

|

Legislative Update - February 6, 2017

This Thursday is the deadline for the House and Senate to pass bills that were approved by their own committees. The exception to that are bills that take your money and spend your money, otherwise known as Appropriations and Revenue bills. That deadline comes later this month.

Although bills died that would have made blue the official state color, classified venomous snakes as inherently dangerous to humans, required contracts to be written in large print, require a "probable cause" hearing for legislators who are arrested, and require school districts to serve low-fat meals and snacks to students diagnosed as overweight, there are still plenty of bills still alive.

Out of 2,300 bills that were introduced to change or create state laws (called “general bills”), 91% of them died in committee, leaving 429 to consider. Many of those are duplicate or similar bills in the House and Senate, and many are to simply extend current laws that would otherwise expire this year.

Below are significant bills that are still alive. If you click on the bill number, it will take you to the legislature’s status page for that bill, where you can read the original and current versions, and if it has been voted on in the full House or Senate, you can see who voted for or against it.

IMPORTANT NOTE: Listing of the bills below should NOT be taken as our endorsement of them. To the contrary, there are some horrible bills that somehow made it out of committees with generally conservative majorities.

Accountability and Transparency |

|

| HB 396 | Prohibit elected state officials from visibly or audibly participating in the making of state funded advertising. Awaits House Floor. |

| HB 479 | Prohibit personal use of campaign contributions and revise law to require detailed reporting. Passed House 104-12. |

| HB 555 | Require approval by Outside Counsel Oversight Commission for Attorney General to bring certain suits. Passed House 63-58 after initially failing 58-60. |

| HB 812 | Revise regulations regarding Civil Asset Forfeiture. Passed House 118-3. |

| HB 938 | Prohibit state agencies from purchasing motor vehicles for one year. Passed House 115-5. |

| HB 974 | Remove most civil service protections for employees in several agencies by exempting those agencies from the Personnel Board rules, regulations and procedures for three years. Passed House 62-58. |

| HB1109 | Provide standards for state agencies to follow regarding Requests for Proposals (RFPs). Awaits House Floor. |

| HB1112 | Agency Accountability Review Act of 2017. Require legislature's watchdog, the PEER committee, to regularly evaluate state agencies' effectiveness and efficiency, including whether they are achieving ther goals. Awaits House Floor. |

| HB1127 | Revise Open Meetings Act to require minutes to be posted on public bodies' websites within certain time after the meeting. Awaits House Floor. |

| HB1296 | Financial Transparency in Education Act - require school districts to post their revenue and expenditures online in a searchable format. Awaits House Floor. |

| HB1330 | Abolish certain boards and commissions that have not met in more than a year. Awaits House Floor. |

| SB2567 | Mississippi Health Agency Reorganization Act of 2017 - give governor the power to appoint the executive directors of several agencies, including the Health Department and the Mental Health Department, among others. Awaits Senate Floor. |

| SB2572 | Abolish certain boards and commissions that have not met in more than a year. Passed Senate 51-0. |

| SB2632 | Prohibit state agencies from using state funds to hire contract lobbyists. Awaits Senate Floor. |

| SB2634 | Transfer BP Settlement Funds into Gulf Coast New Restoration Reserve Fund. Awaits Senate Floor. |

| SB2642 | Require state agencies to report to the Legislative Budget Office any "Maintenance of Effort" agreements or "Memoranda of Understanding" between the agency and the federal government. Passed Senate 51-0. |

| SB2645 | Impose moratorium on the acquisition of State vehicles. Passed Senate 51-0. |

| SB2689 | Prohibit personal use of campaign funds. Awaits Senate Floor. |

| SB2846 | Provide standards for state agencies to follow regarding Requests for Proposals (RFPs). Awaits Senate Floor. |

Business |

|

| HB 883 | Authorize natural gas public utilities that are rate-regulated to undertake economic development activities. Passed House 119-0 |

| HB 928 | Allow Qualified Small Employer Health Reimbursement Arrangements to allow empoyers to provide health insurance while limiting its cost. Passed House 117-2. |

| HB1076 | Allow counties and cities in high-poverty or high-unemployment areas to exempt an area within their jurisdiction to exempt businesses from certain regulations, in an effort to draw investment into these communities. Awaits House Floor. |

| HB1322 | Authorize small craft breweries to sell light wine or beer they produce on the premises of the brewery. Passed House 94-23. |

| SB2542 | Authorize natural gas public utilities that are rate-regulated to undertake economic development activities. Passed Senate 51-0 |

| Crime and Courts | |

| HB 645 | Increase penalties for capital and first-degree murder committed against police officers. It differs from the Senate version in that it does not place this under the "hate crimes" statute. Awaits House Floor. |

| HB 805 | Allow challenges to MS laws to be filed in any county circuit court, not only in Hinds County (which is the current requirement). The Chief Justice of teh MS Supreme Court would then appoint a judge to hear the arguments in whatever location he or she chooses. Awaits House Floor. |

| HB1033 | Remove the automatic action of sending criminals to prison if they miss a payment on their fines; prohibit suspending driver licenses for crimes that do not involve driving. Awaits House Floor. |

| HB1039 | Creats severe penalties and prevents due process for alleged sexual assault perpetrators on college campuses. Awaits House Floor. |

| SB2302 | "Ban the Box" & expunction: Prohibit employers from asking on employment applications about criminal convictions. They may ask that in interviews, but cannot preemptively ask. This and other provisions of the bill are part of the recommendatinos of the "Re-Entry Council" made up of judges, attorneys, and others seeking to enable former offenders to gain employment and thus reduce the likelihood of commiting another crime. Awaits Senate Floor. |

| SB2469 | "Blue, Red, and Med Lives Matter": Places violent offenses against law enforcement officers, firefighters and emergency medical personnel under the "hate crimes" law. Passed Senate 37-13. |

| SB2710 | Prohibit sanctuary cities and require local cooperation with federal immigration control. Awaits Senate Floor. |

| SB2842 | Authorize mental health court intervention programs. Passed Senate 51-0. |

| SB2907 | Criminalize the posting or other sharing of explicit photos or videos without the subject's consent. Awaits Senate Floor. |

Education |

|

| HB 32 | Require appointment (rather than election) of school superintendents in the event of vacancy in elected office before January 1, 2019, when all superintendents must be appointed. Passed House 113-4 and Senate 49-2. Signed into law by the Governor. |

| HB 263 | Require school districts to adopt policies to notify parents of alleged bullying incidents involving their children. Also broadens the definition of bullying to include words or actions that "exploit an imbalance of power" between the perpetrator and the victim. Awaits House Floor. |

| HB 267 | Elect all school boards during statewide general election or presidential election for four-year term. Awaits House Floor. |

| HB 293 | Reduce the number of days in a scholastic year from 180 to 170. Awaits House Floor. |

| HB 312 | Authorize inclusion of hunter safety education program in school curriculum. Awaits House Floor. |

| HB 433 | Require citizenship exam as part of U.S. History or American Government courses. Awaits House Floor. |

| HB 442 | Revise the qualifications for school superintendents to allow someone with a master's degree, or a bachelors degree if he or she has at least 10 years of management experience, to be appointed as a superintendent. The latter is only an option where all members of the school board that appoints the superintendent are elected. Awaits House Floor. |

| HB 503 | Direct the State Board of Education to incorporate cursive writing into elementary education curriculum. Awaits House Floor. |

| HB 544 | Authorize the State Dept of Education to issue Nontraditional Route Standard Licenses to certain teachers and administrators with advanced degrees. Awaits House Floor. |

| HB 866 | Limit the number of days a student may be required to take standardized assessments: State-required tests no more than 3 days; for district tests, no more than 20. Awaits House Floor. |

| HB 875 | Revise the process of state school accreditation in failing school districts through a process of district transformation. Awaits House Floor. |

| HB 905 | Require uniform accounting system for all school districts to address local, state and federal funds. Also, transfer audit powers from State Auditor to the State Department of Education. Awaits House Floor. |

| HB1036 | Expand eligibility for the MS Dyslexia Therapy Scholarship to 12th grade (it's now 6th), as would HB1046, but also expand the universe of schools at which the scholarship may be used. Also requires a school district to test a student for dyslexia if a parent requests it. Awaits House Floor. |

| HB1046 | Expand eligibility for the MS Dyslexia Therapy Scholarship to 12th grade (it's now 6th). Awaits House Floor. |

| HB1050 | Allow unspent funds from a special-needs education scholarship account to remain in the account to be used the following school year. Awaits House Floor. |

| HB1224 | Exempt school districts with "A" and "B" accountability ratings from certain duties. Awaits House Floor. |

| HB1227 | Discontinue MS Statewide Teacher Appraisal Rubric (M-STAR) and require local districts to adopt teacher evaluation system. Awaits House Floor. |

| HB1294 | Revise education funding formula. So far, this bill simply includes the current law with no changes, in order to have all the necessary "code sections" necessary once they decide what to propose. Awaits House Floor. |

| SB2036 | Sets all school board elections to be held in November general elections beginning in 2019. Awaits Senate Floor. |

| SB2042 | Establish Early Childhood Services Interagency Coordinating Council. Considered on Senate Floor but was sent back to committee, which effectively killed it. |

| SB2273 | Direct the State Board of Education to incorporate cursive writing into elementary education curriculum. Awaits Senate Floor. |

| SB2328 | Increase minimum GPA to qualify for the MS Resident Tuition Assistance Grant Program (M-TAG). Awaits Senate Floor. |

| SB2398 | Revise the qualifications for school superintendents, but differently from HB442. This bill would require at least 6 years of classroom or administrative experience, at least 3 of which must have been as a principal of a school rated A or B or a school that improved at least a letter grade. However, the State Board of Education may approve rules that allow someone without direct experience to be a superintendent. Passed Senate 34-17. |

| SB2431 | Authorize the State Board of Education to place failing school districts into "District Transformation Status." Awaits Senate Floor. |

| SB2459 | Expands compulsory school age from the current 6-17 to the ages of 5-18. Awaits Senate Floor. |

| SB2461 | Require school district consolidation in Perry County. Passed Senate 33-18. |

| SB2463 | Require school district consolidation in Chickasaw County. Passed Senate 35-16. |

| SB2607 | Revise education funding formula. So far, this bill simply includes the current law with no changes, in order to have all the necessary "code sections" necessary once they decide what to propose. Awaits Senate Floor. |

Elections |

|

| HB 228 | Authorize pre-election day voting. Passed House 113-8. |

| HB 373 | Allow first-time voters to register online. Awaits House Floor. |

| HB 467 | An almost-300 page bill to revise election laws. Awaits House Floor. |

| SB2468 | An almost-300 page bill to revise election laws. Awaits Senate Floor. |

Family |

|

| HB 853 | Revise Power of Attorney to authorize parents to delegate care and custody of a child. Awaits House Floor. |

| HB1210 | Require Youth Court to provide redacted copy of child's record to child's parent/guardian upon request of the parent/guardian. Awaits House Floor. |

| HB1298 | Create MS Advisory Council on Faith-based Initiatives. Awaits House Floor. |

| HB1451 | Increase fee for marriage certificates from $10 to $20, and for processing marriage license applications, from $20 to $30. House voted 70-47, but it needed 71 votes. It was later reconsidered and approved 84-29. |

| SB2311 | Create MS Achieving a Better Life Experience (ABLE) Act, to provide accounts for individuals with disabilities. Awaits Senate Floor. |

| SB2342 | Termination of parental rights - technical corrections. Passed Senate 48-1. |

| SB2483 | Divorce - add 2-year separation as a ground for. Awaits Senate Floor. |

| SB2520 | Require Youth Court to provide redacted copy of child's record to child's parent/guardian upon request of the parent/guardian. Passed Senate 51-0. |

| SB2514 | Create MS Advisory Council on Faith-based Initiatives. Awaits Senate Floor. |

| SB2680 | Clarify alternative of relative care for abused and neglected children. Awaits Senate Floor. |

| SB2695 | Sheriff or police chief to notify parent or guardian of minor released after arrest. Awaits Senate Floor. |

| SB2703 | Divorce - add domestic violence as a ground for. Awaits Senate Floor. |

| SB2704 | Increase marriage license processing fee from $20 to $50. Awaits Senate Floor. |

Health |

|

| HB 318 | Authorize grants to rural hospitals to help them stay alive or adjust to new opportunities. Passed House 113-8. |

| HB 909 | Require State Health Plan to cover annual pap smears and PSA tests. Awaits House Floor. |

| HB 926 | Allow the University of MS Medical Center to form Health Care Collaboratives - joint ventures that are exempt from antitrust laws, to the extent possible, as well as the Open Meetings and Public Records Acts. Awaits House Floor. |

| SB2214 | Allow acupuncturists to provide care without a referral from a physician if they have been practicing in MS for at least 5 years. Awaits Senate Floor. |

| SB2511 | Provide for the licensing of Naturopathic medicine practitioners. Awaits Senate Floor. |

| SB2610 | Clarify the allowable use of Cannabidiol in research of seizures and other medical conditions. Awaits Senate Floor. |

Regulation |

|

| HB 539 | Require seat belts for all passengers. Awaits House Floor. |

| HB 967 | Regulate and tax fantasy sports games in the same way the state regulates and taxes casinos. Awaits House Floor. |

| HB1076 | Allow counties and cities in high-poverty or high-unemployment areas to exempt an area within their jurisdiction to exempt businesses from certain regulations, in an effort to draw investment into these communities. Awaits House Floor. |

| HB1216 | Direct agencies to report on laws and regulations that were put in place as a result of Obamacare, and the impact of those laws and regulations. Awaits House Floor. |

| HB1265 | Require all state agency rules to be repealed after certain time unless the agency readopts them through the normal public-comment process. Awaits House Floor. |

| HB1425 | Require occupational licensing boards, if they are controlled by people who are in the industry they regulate - to submit their proposed regulations and enforcement actions to the governor before they are finalized. This is in response to a US Supreme Court ruling regarding executive power that is exercised independent of a governor, if the boards are controlled "active market participants." Awaits House Floor. |

| SB2896 | Regulate and tax fantasy sports games in the same way the state regulates and taxes casinos. Awaits Senate Floor. |

Tax |

|

| HB 131 | Authorize the Department of Revenue to compromise and settle certain tax liabilities. Passed House 119-0. |

| HB 480 | Require out-of-state sellers who do not have a presence in MS to collect "use tax" (similar to sales tax) on purchases made by Mississippi residents. Any money collected from this requirement would be used for road and bridge repair, with 70% going to the state department of transportation and 30% going to local governments. Originally passed House 77-40. A normally-routine procedural vote to send it on to the Senate failed, leaving the bill in limbo for the moment. |

| HB 687 | Allow public community and junior colleges to collect a debt by obtaining from the Dept of Revenue a set off against a debtor's state tax refund. Because of where it appears in the MS Code, it would also allow community and junior college officials to obtain the state and federal tax returns of the debtor. Passed House 104-14. |

| HB 699 | Authorize the Dept of Revenue to disclose certain taxpayer information to law enforcement entities. Brought up on House Floor but debate has been suspended on it. |

| HB 711 | Extend authority of Dept of Revenue to approve applications for certain "rebates" given to Hollywood and other producers under the MS Motion Picture Incentive Act. Passed House 107-15. |

| HB 804 | Require MS Gaming Commission to establish a lottery. Awaits House Floor. |

Welfare |

|

| HB1090 | Requires Medicaid to contract with a company to identify dead people and non-Mississippi residents who are on the Medicad rolls, among other provisions to combat fraud in welfare programs. Awaits House Floor. |

| HB1186 | Require Medicaid to apply for waivers from Federal requirements in order to conduct pilot projects to best meet needs and control costs. Awaits House Floor. |

| SB2330 | Requires Medicaid to contract with a company to identify dead people and non-Mississippi residents who are on the Medicad rolls. Awaits Senate Floor. |

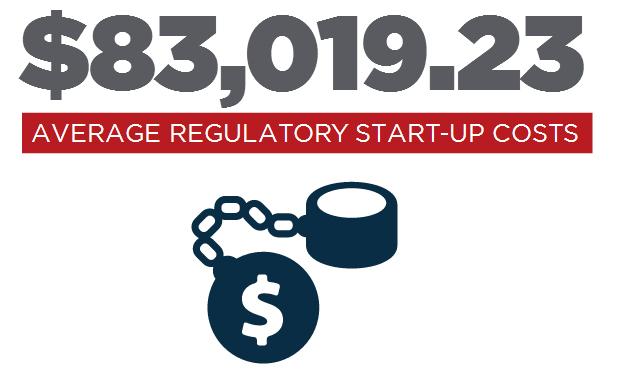

Regulatory reform is cutting red tape in North Carolina and it can work in Mississippi, too. So says Joe Sanders of the John Locke Foundation in a

Regulatory reform is cutting red tape in North Carolina and it can work in Mississippi, too. So says Joe Sanders of the John Locke Foundation in a  By passing a phase-out of Mississippi's franchise tax, Mississippi Lieutenant Governor Tate Reeves and Speaker of the House Philip Gunn this month received the 2016 Outstanding Achievement in State Tax Reform by the Tax Foundation.

By passing a phase-out of Mississippi's franchise tax, Mississippi Lieutenant Governor Tate Reeves and Speaker of the House Philip Gunn this month received the 2016 Outstanding Achievement in State Tax Reform by the Tax Foundation.

Mississippi Department of Education (MDE) is seeking feedback on revisions to the College and Career-Ready Standards for Science. MDE has created

Mississippi Department of Education (MDE) is seeking feedback on revisions to the College and Career-Ready Standards for Science. MDE has created