The Mississippi Center for Public Policy hosted 12-time All-American swimmer Riley Gaines at River Hills Club of Jackson on Thursday to promote a Women’s Bill of Rights in Mississippi.

Gaines was on her way to winning a national title at the NCAA swimming championship in 2022 when she tied with a female-identifying, transgender athlete who previously lived as a man.

In an effort to spread awareness of fairness and keep women in women’s sports, Gaines travels the country promoting women’s rights. She has gained popularity through her willingness to speak out against injustice and a large following on TikTok.

With the help of the Independent Women’s Forum, Gaines has been an avid proponent of a “Women’s Bill of Rights,” a growing phenomenon across the country. This bill codifies the definition of a woman and protects single-sex spaces.

This legislation, titled “The Title IX Preservation Act,” was introduced during the 2023 Legislative session, with versions from Rep. Jill Ford and Sen. Angela Hill, but sadly died in committee. Mississippi Center for Public Policy is hopeful for its reintroduction in the 2024 Legislative Session and will be advocating heavily for this bill’s passage.

“Mississippi was one of the first states to ensure there were women-only sports. So, Mississippi was ahead of the curve there, which is phenomenal, but what good is that bill if we can’t define the term ‘woman?’” Gaines said. “It’s crucial that we’re able to do so to protect women, not just in sports, but in any law that mentions the term ‘woman.’”

Gaines was also joined Thursday by Independent Women’s Forum policy analyst Mandy Gunasekara. Gunasekara, who previously served for the Trump Administration as the U.S. Environmental Protection Agency Chief of Staff, said she wants to ensure her home state is moving forward, not backward in protecting the rights of women.

Nearly 100 individuals attended the event, getting to visit with Gaines and Gunasekara afterward.

Click here to watch an interview of Riley Gaines with MCPP CEO & President Douglas Carswell.

MCPP will be hosting several other speakers in the coming weeks and months, including former Secretary of Education Betsy DeVos on March 23 and fossil fuel analyst Alex Epstein on April 18.

Ever since the 2010 Affordable Care Act, states have been able to enroll low-income Americans in Medicaid using federal subsidies. So far, 39 states have signed up to expand Medicaid this way. Mississippi is one of 11 states that hasn’t. Should we?

The debate over Medicaid expansion in Mississippi is a perfect example of what happens when politics becomes polarized. The argument generates heat rather than light. Advocates on either side stopped listening to each other long ago.

Those opposed to Medicaid expansion refer to it as ‘Obamacare’ as though simply associating the idea with the 44th President was reason enough to reject it.

Advocates for more Medicaid often imply that those on the other side harbor some sort of moral flaw. Governor Tate Reeves has been remarkably consistent in opposing more government throughout his career. This has not prevented various critics from implying that his rejection of Medicaid expansion is cynical or opportunistic.

What most Mississippians, I suspect, really want to know is whether more Medicaid will lead to better health care.

Medicaid has already been expanding in Mississippi, even without our state formally opting into the provisions of the Affordable Care Act (ACA). Between 2014 and 2023, Medicaid spending in Mississippi rose almost 40 percent. This year, Medicaid spending will total an estimated $7.2 billion. There are currently about 880,000 Mississippians on Medicaid, a 22 percent increase over the past three years.

Expanding Medicaid further under the provisions of the ACA would mean enrolling every low-income adult (those on less than $20,120 pa) on Medicaid. This would place an estimated 300,000 more people on Medicaid in Mississippi, meaning over 1.1 million Mississippians were signed up for Medicaid.

“And about time too!” some might say. “If 300,000 more people qualified for Medicaid, we would see a dramatic fall in the number of uninsured, meaning more people accessing better health care”. But would they?

Advocates for expansion have yet to show that increasing the number of Medicaid claimants by a third would itself mean improved access to health care. Might not enrolling over a quarter of a million more Mississippians on Medicaid just make it harder for those on Medicaid to get the health care they need? It’s not as if the 880,000 current Medicaid recipients are getting optimal outcomes, is it?

Those wanting to expand Medicaid often cite the state of our cash-strapped rural hospitals in support. More Medicaid patients, they tell us, would save these hospitals from closure. Are we certain of that?

We already know that rural hospitals lose approximately 12 cents on the dollar for every Medicaid patient that they treat. How would increasing the number of loss-making Medicaid patients save them? Rather than insult those that raise this point, or accuse them of dishonesty, those wanting to add 300,000 more people to Medicaid ought to address these points.

On the opposing side, I have yet to hear a slam-dunk explanation as to why Mississippi should reject a scheme that would see Washington DC shoulder 90 percent of the costs.

“Ha! Just wait until that federal subsidy dries up! The cost of all this extra Medicaid will end up being paid for out-of-state taxes” some have said to me. Really?

Federal subsidies might only cover 50 – 78 percent of the cost of earlier Medicaid enrollees, but I am not aware of any state currently having to pay more than 10 percent of the costs of expansion under the ACA. Were that to change, to be fair, it would have massive consequences for tax rates in our state seeing as Medicaid in Mississippi costs in excess of $7 billion. It would mean goodbye income tax elimination and hello tax hikes – forever.

Those opposed to federal subsidies for Medicaid might be more convincing if they had opposed subsidies for all those other boondoggles down the decades.

Enrolling more people on Medicaid might reduce the number of uninsured people on paper. I doubt it will lead to the improved outcomes proponents of Medicaid expansion expect.

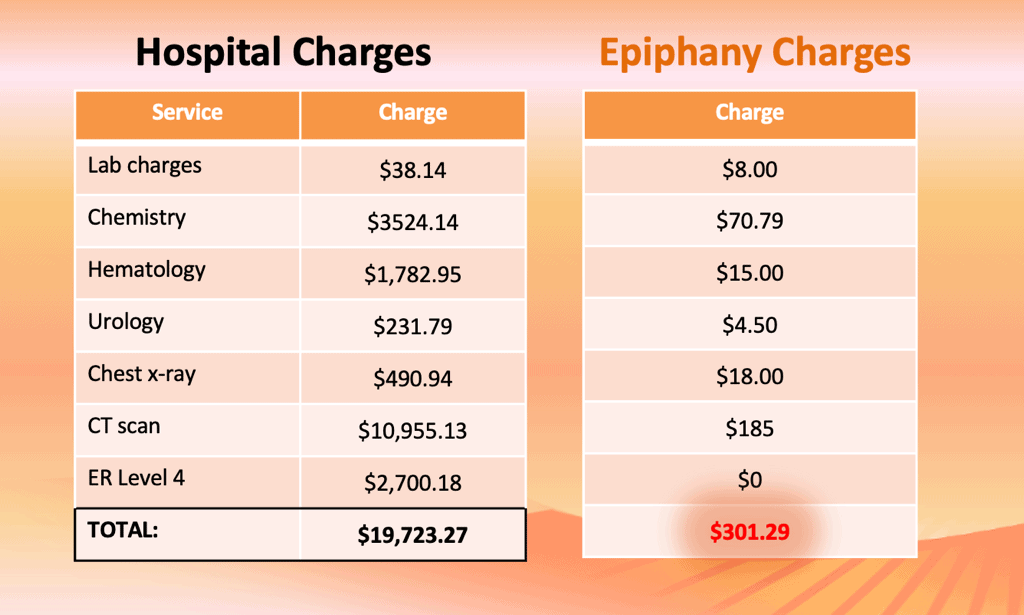

A few days ago, the brilliant Florida physician, Dr. Lee Gross, was in Jackson talking about a different way of providing affordable health care. Dr. Gross’ model does not involve insurance, socialized or otherwise. Instead, Dr. Gross’ patients, many of whom are on low incomes, pay a monthly subscription of $80 ($30 per child). In return, they get unlimited primary health care treatment.

How is Dr. Gross able to make this work as a viable business? Precisely because he does not deal with insurance companies. According to Dr. Gross, it is the interaction between insurers and providers that pushes up costs for physicians and patients – and which helps explain why America has some of the highest healthcare costs in the world.

Simply offering to deal with providers on a cash basis allows Dr. Gross’ medical practice to secure substantial discounts (for example a 95 percent discount for an MRI scan), which he passes on to patients making his subscription model viable. Here is a list of some of the cost reductions Dr. Gross is able to routinely secure for his patients.

Subscription-based primary care provision works in Florida because there is a competitive market in services – and is growing rapidly. Florida does not have the restrictive laws that we have here in Mississippi that intentionally limit the number of providers.

If policymakers in Mississippi really want to ensure better health outcomes, they should remove the myriad of protectionist laws. No amount of federal subsidy will improve outcomes as long as they remain.

Douglas Carswell is the President & CEO of the Mississippi Center for Public Policy.

In the early days of the internet, a law was passed that has had a critical role in enabling it to evolve. Long before many of today’s social media titans even existed, Section 230 of the 1996 Communications Decency Act made it clear that internet companies are not liable for content posted on their sites by third parties.

It is hard to imagine what the internet would look like today without this key protection. If social media sites were liable for what people posted, they would out of necessity need to police what was said.

“Policing what people post is exactly what social media sites already do” say some critics of Section 230. Frustrated at the apparently anti-conservative biases of certain sites, a number of conservatives advocate for an end to Section 230.

Social media companies like Facebook, they argue, are in effect editorializing content when they use algorithms to control what we read. If they are going to editorialize like a newspaper, why not make them liable like a newspaper for what appears on their platform?

Conservative critics of Section 230 have been joined by those on the left who believe that social media sites should do much more to tackle ‘misinformation’. They actively want to oblige tech companies to control what we read and see.

This week the Supreme Court is hearing evidence in a case that could have profound implications on the future of Section 230. In Gonzalez Vs Google, the argument is being made that Google is liable for how the search engine firm’s algorithms present their results.

Think of how many items are uploaded onto the internet every day. The internet would be unusable without being able to order and organize. It is hard to see how we would be able to use the internet without relying on companies like Google to do this for us.

Even the most basic system of ordering content, by date order or alphabetically, means having some sort of algorithm. It seems absurd to me to make a search engine liable for how its algorithm operates.

I worry that if a search engine like Google is made more liable for what it shows me every time I use it, we would soon find all kinds of unintended consequences. Far from searching gazillions of sources, I imagine that the search engine would seek to limit what they search to a pool of approved sources.

Until 1695, anyone in England with a printing press needed a license for it. Only those that published things that the powerful approved of could legally operate one. I worry that we are about to recreate a world in which there are in effect licenses for having a digital printing press. Only social media companies that operate in an approved manner will be viable. Those that post on them will need approval too. The internet will have less diversity of thought and more uniformity. We will all be poorer.

Mississippi’s legislature has focused a lot on Jackson this session.

A bill that could have helped create more Charter Schools died in committee. Another seeking to give voters the power to recall elected officials never made it. Lawmakers apparently did not have time to consider a Parents’ Bill of Rights or reforms that might improve health care in our state either.

But what they did manage to do was find plenty of time to consider how to fix the state of our state capital.

With Jackson’s water supply reliably unreliable, Senator David Parker introduced a bill that establishes a new regional water authority, run by a board appointed by city and state leaders. Then there was legislation introduced to give the Capitol police in Jackson jurisdiction across the whole city, rather than over a few blocks downtown. Legal measures were also approved to create a court system for the newly extended policing area.

"Good," I hear you say. "Jackson’s a mess and time spent trying to fix these things is time well spent."

Our capital certainly has one of the highest homicide rates per person in America. Last year, 133 people were murdered in the city. Anything that provides us with more effective law enforcement and a better system of public prosecution deserves support.

Then there are the persistent problems with Jackson’s water supply. As someone that works downtown, I can confirm that the sludge that flows from the faucets is the same sepia color as before. Anything that means a city of 150,000 people might at least have reliable running water has to be a good thing, right?

For years, of course, the mainstream media attacked Mississippi’s leaders for not concerning themselves with what was going on in Jackson. Remember when Jackson’s water troubles hit the national headlines last year? There was no shortage of commentators on hand to inform the rest of America that it was all down to the failure of state officials for not getting involved. Donna Ladd even suggested to NBC News that the lack of running water in the city was "a direct legacy of white-supremacist thinking at the state level." Really.

Now that state officials are actively seeking to fix some of the state capital’s problems, of course, the mainstream media throws out precisely the same kind of accusations. CNN recently informed us that creating a functioning court system for the city "smacks of a modern-day Jim Crow regime."

Attacked when they do. Attacked when they don’t. I have a great deal of sympathy for state officials who get vilified for leadership failings that are 100 percent made in Jackson.

That said, conservatives should think carefully before stepping in with state power to try to fix local-level incompetence. Why?

Each time that the state government steps in, what they are doing is fixing specific problems caused by municipal failure. They aren’t addressing the underlying causes of that failure, which is a lack of accountability. Stepping in to do what city officials cannot or will not do might even make the accountability problem worse.

Thirty years ago back in my native Britain, Margaret Thatcher faced a similar problem. Although elected Prime Minister with a large majority, in certain parts of the country local government was in the hands of those that were known as the 'looney Left.' The 'looney Left' were often so incompetent they could not run a bath.

Eventually, Mrs. Thatcher felt she had to intervene, taking steps to prevent the 'looney Left' from destroying the cities that they ran. Her interventions might have improved things in the short term, but they caused a long-term strategic problem for conservatives.

First, it put back to the day when people in those badly run areas had to face the consequences of how they voted. If anything, people knew that they could carry on voting the way they did safely in the knowledge that the central government would intervene before anything got out of hand.

Second, it played into the hands of local politicians whose whole schtick was to foster grievances, as opposed to run things competently. Having an outside authority step in to take responsibility not only lets the grievance-mongers off the hook. It gives them a whole new set of real or imagined grievances to complain about, assisted by a media only too willing to amplify those grievances. (See the media coverage after Governor Reeves restored Jackson’s water supply for details).

Third, conservatives who see state intervention as the solution to Jackson’s multiple municipal failings ought to ask themselves how far they might be willing to go. If new state structures are the answer to the city’s water problems, why not create a similar system to oversee the airport? If we now have a new court system, why not a new structure to run the city’s failing schools?

No conservative would want the federal government to step in and run our state. We should be cautious about having the state government intrude too far into municipal affairs either.

I don’t know who gets to hold President Biden’s cell phone these days, but whoever runs his Twitter account has been hyperactive.

The past few days have seen a blizzard of tweets attacking all the Left’s usual targets from Republicans and business to their old favorite 'trickle-down economics.'

So, what exactly is this ‘trickle-down economics’ that Joe Biden has been attacking? According to the Left, ‘trickle-down economics’ is a shorthand explanation of the way that conservatives run things. It involves massive tax cuts for the rich with a little bit allowed to ‘trickle down’ to everyone else.

This is a grotesque misrepresentation of what conservatives stand for. In over 30 years in the policy wonk world, I have not once heard a conservative use the term 'trickle-down economics' to describe their strategy.

The term itself was invented by the Left in the 1930s to misrepresent Cal Coolidge’s economic strategy. Neither then, nor now, do conservatives believe that the way to make poor people richer is to make rich people even richer.

Conservatives believe in cutting taxes across the board to the benefit of everyone – which is why in states like Mississippi, conservatives have been so proactive in cutting income taxes for the broad mass of working people.

This has not stopped the Left from repeatedly using the term to mischaracterize what conservatives actually stand for. It is a form of misinformation, up there alongside various other conspiracy theories. Indeed, one should regard people who make excitable claims about ‘trickle-down economics’ in much the same way that one might regard people who make excitable claims about QAnon or microchips in the water.

Ronald Reagan was attacked for ‘trickle-down economics’ in the 1980s, despite doing more than almost any other President to reduce the tax burden on those with the lowest incomes. That did not stop Bill Clinton, who was able to run a budget surplus thanks to Reagan’s tax cuts the previous decade, from also using the term in the 1990s.

How should the right respond? Keep cutting taxes for everyone.

The Left is always going to use the myth of 'trickle-down economics' to attack conservatives. The past century or so shows that they will relentlessly misrepresent – especially when there’s an election looming.

But the ‘trickle down’ attack only ever gains traction when we stop cutting taxes (See President Bush the Elder’s one-term career for details). Keep on cutting.

An education revolution is underway across America.

Last week, Sarah Huckabee Sanders, the newly elected governor of Arkansas, announced a plan to introduce universal school choice. By 2025, every family in Arkansas will be given an Education Freedom Account for each child. This will allow moms and dads to enroll their kids in whatever school is most appropriate for their family – be it “public, private, parochial, or homeschool”.

The month before, Utah and Iowa passed laws that will allow something similar. Texas, Florida and Wyoming are not far behind. Arizona and West Virginia have already implemented school choice.

It has been half a century since Milton Friedman, the great conservative thinker, first advocated a system of universal school choice. But over the intervening years, not a great deal actually happened.

Some states made a few incremental steps toward greater school choice. Our own state of Mississippi, for example, passed a law to allow children with special needs to have greater control over their share of the education budget.

At the same time, starting in the 1990s, several states in the midwest created what became known as charter schools. Phenomenally successful, these government-funded schools operate independently from the state school system and extended education choices to many families that would not otherwise have had any.

The reality is that until two years ago, no state in America had a comprehensive system of school choice. In a couple of years, it is likely that at least 10 of the 50 states will. What changed?

For decades, school choice has been the conservative movement’s Holy Grail, something much sought after, but seldom ever seen – until now. Why are we suddenly seeing the success of the school choice movement?

COVID lockdowns played a part. When schools were shut down, often for extended periods of time, parents found themselves asking questions about what and how their children were being taught. The culture of deference to expert educators dissolved. Dissatisfaction grew. Suddenly there was a large pool of parents wanting something different.

At the same time, leaders in several states have woken up to the way that they can build a coalition around parental empowerment. Gov. Ron De Santis in Florida, for example, is phenomenally popular. He was re-elected winning 62 of Florida’s 67 counties. Giving school choice to moms and dads from every background in the state has won him support from voters of every background across the state.

Nor should we overlook the role of state-based think tanks who have been patiently making the case for change. It is no coincidence that there is a handful of highly effective free-market think tanks advocating for change in states such as West Virginia, Arizona and Texas.

Perhaps the most revealing thing about the school choice revolution as it unfolds is that those opposed to school choice seem to be a lot weaker than was once assumed. For decades the lack of progress toward school choice was down to the powerful vested interests that opposed giving parents control over their tax dollars.

It turns out those vested interests who believe that the primary purpose of the state’s education system is to provide the payroll are not as strong as was assumed. Sure, they huff and they puff and complain about giving parents more power. But it seems that there are more moms and dads that want change.

So why aren’t we seeing any momentum toward school choice in Mississippi? If Arkansas’ governor can announce a program for universal school choice, why can’t we?

At times it seems as if the forces of ‘do nothing’ inertia in Mississippi are stronger than ever. During the current legislative session, for example, even fairly modest proposals that might have made it a bit easier to open more charter schools (Mississippi only has eight) were killed off in committee.

The key is leadership. Arkansas looks set to get school choice because instead of kowtowing to the vested interests, Gov. Huckabee Sanders is reaching over their heads and appealing directly to families.

It turns out that allowing every family the freedom to make choices about their kids’ education that currently only a few wealthy folks can make is pretty popular. I suspect it is only a matter of time before someone makes that discovery on our side of the river.

It wasn’t Liz Truss’s failure to make big changes we should worry about. It was her inability to deliver even the most modest pro-market reforms after a decade in high office that ought to alarm us.

As Prime Minister for six weeks, Truss tried and failed reduce Britain’s tax burden to about the level it was under Gordon Brown.

As a cabinet minister for ten years, Truss – a mother as well as a free marketeer – tried to reduce the costs of childcare by reducing red tape. Her efforts to change legally mandated child/carer ratios, despite mountains of evidence it could be done safely, were persistently thwarted.

If even someone who served as Minister for Child Care, Minister for Women, Chief Secretary to the Treasury, Lord Chancellor, Foreign Secretary and Prime Minister, cannot manage minor regulatory changes regarding childcare, what hope is there for free marketeers?

The reality is that free markets are in headlong retreat around the world, not just in Britain. After decades of greater trade liberalisation, a new form of protectionism is emerging.

The United States is in the process of ‘re-shoring’ global supply chains, using subsidies and tariffs to ensure the domestic production of everything from microchips to electric cars. The European Union, too, under the guise of going green is seeking to make herself less dependent on Asian imports. China, admitted to the World Trade Organisation nearly 20 years ago in the hope that she might become more amenable to free trade, is aggressively mercantile.

Government has also been getting bigger. We tend to think of America as a land of limited government. In reality, there has been a remarkable expansion in the size of the state in the past decade or so. From 1990 to 2020, total government spending in the United States averaged around 25 per cent of GDP. By 2021, government spending as a percentage of GDP hit 42 per cent, the sort of level one might expect to see in Europe.

European governments, meanwhile, have reached the size one would expect to see in a socialist society. Government spending now accounts for over half of all output in France, Germany, the UK, Italy, Belgium and Sweden. The state in supposedly free market western countries is now larger than in communist China, where government spending as a percentage of output has risen from less than a fifth 20 years ago to a third today.

This is partly a consequence of Covid. All that ‘locking down’ made the world more authoritarian, normalising the idea that a small group of official ‘experts’ might decide what was right for the rest of us. As governments frantically scrabbled for protective equipment and vaccines their instincts become more protectionist. And, of course, government spending soared to cope with the apparent emergency, yet somehow remains high despite alarm about the virus subsiding.

But Covid, which emerged in 2019, cannot explain why public officials in Britain were introducing price controls in the energy market long before. Nor can it account for the tendency for public officials on either side of the Atlantic to, for example, tax soda drinks or regulate the level of salt in food.

Before anyone had heard of Covid, in 2008 western governments nationalised banks that overexposed themselves to bad loans. A decade or more before then, central bankers had redefined their role from being lenders of last resort to engineers of economic growth using massive monetary manipulation.

Covid accelerated a trend towards more top down government which was already there.

When Liz Truss complains that she had been undermined by a public policy ‘establishment’, she wasn’t being a crazy conspiracy theorist. Many of those that make public policy in Britain, America and Europe hold a world view deeply ill-disposed towards the free market. Why?

It’s not that the people that make policy making for a living set out to be anti market. Their déformation professionnelle merely reflects the way that universities have been churning out social science graduates imbued with a corrupted kind of empiricism.

The sort of folk that run the policy making bureaucracy in Britain, America and Europe have been taught to hold various theories and then make observations in search of facts to fit the theory. This they call ‘evidence-based’ policy making (and who could argue with that, right?).

Seeking out observations to fit the theory – whether setting tax rates, trying to change the trajectory of an epidemic or regulate childcare – produces a flawed set of assumptions. It is a form of reasoning that the physicist and philosopher David Deutsch calls ‘inductivism’. No matter how much emphasis inductivists place on ‘the data’ or on modelling, it also gives rise to an excessive belief in the ability of policy makers to engineer particular outcomes. Who is a mere minister to presume to know better?

Inductivist reasoning has given rise to technocratic managerialism, almost irrespective of who or what the voters vote for.

But here’s the odd thing. This retreat from free market thinking happened at a time when there have never been more organisations dedicated to defending it. Much of academia might be hostile to free market ideas, but free market think tanks have never been more active or better funded than right now.

Here in the United States, Washington DC is full of think tanks, brimming with brilliant people and ideas. A network of state-based think tanks exists, advocating for the free market from my own Mississippi to Maine, from California to Carolina.

Across the Atlantic, London is home to a number of world class think tanks. Thanks to the efforts of the late Linda Whetstone, a network of free market organisations now straddles much of the globe, too.

All that advocacy infrastructure we free marketeers have put in place has not arrested the expansion of the state. We need to ask why.

Defending the free market is difficult. The way that the free market works is counter intuitive. The notion, for example, that we might depend largely on foreigners to feed us can be unsettling. That self-sufficiency might actually increase the risk of food shortages seems contrary to common sense.

It is easy for a politician to get a round of applause for promising to fix prices. The secondary effects of their price fixing are often harder to discern. Each time the state intervenes, the benefits of that intervention are usually concentrated, but the costs dispersed.

No one is born with these insights. They are not innately understood but must be learned. Instead of learning them, young people are taught to see the world in a way that leaves little sympathy for the notion that human affairs might best be left to organic design.

Young Europeans and Americans have had it drummed into them that the world faces an impending climate emergency, necessitating massive state intervention. Implicit in climate change catastrophism is a profound pessimism, the sense that the world is getting worse. If you believe that the world is getting worse, you are much more receptive to the idea that things should be reordered by top down design.

‘Woke’ ideas, too, have gone from university campuses into mainstream society. Old-school Marxists divided the world by class – capitalist oppressor versus oppressed workers. ‘Woke’ ideology should be thought of as a form of neo-Marxism, one that divides the world not by class, but in terms of race and gender – race oppressors versus oppressed.

Now entrenched in the corporate and public sectors, these ideas purport to explain how the world works by co-opting each of us into a hierarchy of victimhood and guilt. Unequal outcomes, according to this leftist narrative, are caused by the injustices of ‘the system’, rather than any differences in behaviour (so-called ‘systemic’ accounts for unequal outcomes ironically deny agency to precisely those supposedly oppressed people the left claims to champion).

However absurd we might believe this to be, this narrative does at least offer young minds an overarching view as to how the world works. Where is our counter narrative?

We were too busy focused on the minutiae of tax reform as a new left-wing narrative went mainstream. No wonder only 40 per cent of American’s aged 18 to 29, according to research by Pew, have a positive view of capitalism.

There is nothing wrong with reforming taxes. My own think tank, the Mississippi Center for Public Policy successfully led efforts to reduce our state income tax. My point is that if we are to win the war of ideas, we need to convince people about the moral merits of the market, too.

In place of catastrophism, we should begin by showing that we live in an elevated age. Almost everyone alive today enjoys a vastly better existence than they would have had in any previous period in human history – thanks to the free market.

For most of our existence as a species, there wasn’t much in the way of markets. People produced most of what they consumed for themselves – which accounts for why there was so little to consume, and people remained poor. But then along came the modern market economy, which emerged first in Holland and then England in the sixteenth and seventeenth centuries.

Instead of the normal subsistence existence, the Dutch and the English began to buy and sell to get what they needed. This system of free market exchange meant they could eat food they had not grown, build houses with timber they did not fell, and cloth themselves with textiles they had not woven. As a result, living standards in early modern Holland and England began to soar, accompanied by a dramatic rise in life expectancy.

Over the intervening 300 years, this system of free market exchange has grown to become ever more complex, encompassing an ever larger portion of humankind. Wherever the free market system took hold – Europe or America, Asia, South America or Africa – people began to live wealthier and healthier lives.

This process of market-driven progress that began three or four hundred years ago accelerated in the past half century. As a result, most people alive today are at least twice as rich as their grandparents. In China and parts of Asia, average incomes are many multiple of what they were in the 1950s. Life expectancy has increased, too, with particularly pronounced improvements in Africa and Asia in recent decades.

As the free-market system expanded, it saw ever more specialisation and exchange. The effect of this has been to make technology – from search engines and iPhones to air travel and solar panelling – which was once the preserve of the rich available to billions.

Instead of oppressor versus the oppressed, the modern market economy has made us interdependent, each of us partners in a web of mutual prosperity.

It’s an exhilarating story that needs to be told. To stand a chance against the left’s advancing narrative, we must be more that analytically right. We can only win if we are able to explain how the world around us works.

So how might we popularise this counter narrative? How do we take ideas found in books such as Matt Ridley’s The Rational Optimist or Daniel Hannan’s Inventing Freedom, and make them part of the popular conversation? Frederick Hayek popularised the role that intellectuals played advancing socialism. How do we today popularise our critique of over confident elites attempting to engineer outcomes they cannot possibly control?

A generation ago, Milton Friedman realised that it was not enough for him to write a book, Free to Choose, which made the moral case for the free market. He also had to present them to people in a format that they would absorb. The result was a ten-part TV series. Aired on most major US networks, Friedman’s presentation changed how millions of Americans saw the world.

Some in the free-market movement have made a good job of doing something similar using the new media. PragerU, Reason and FEE (the Foundation for Economic Education) have produced content that articulates free market concepts that are watched by millions around the world.

For several decades, Rush Limbaugh used radio to present a conservative analysis of current affairs to millions of Americans. Today, a new generation of commentators has emerged achieving with the new media what Rush using radio. Joe Rogan, Ben Shapiro, Dave Rubin and Dennis Prager have each acquired audiences of millions. In Britain, assorted YouTubers have achieved something similar.

But is there not a danger that these new media pundits are speaking to an audience that already agrees with them? Such is the fragmentary nature of the modern media market, there is little prospect of reaching beyond those that already subscribe to their world view the way that Rush Limbaugh’s ubiquitous broadcasts were able to.

How can we reach beyond those that already agree with us?

It is not a coincidence that some of the most effective advocates of conservative viewpoints today are not politicians or policy wonks, but those that started out as stand-up comedians. Joe Rogan and Dave Rubin in America, Konstantin Kisin, Dominic Frisby and Andrew Doyle in Britain all started out on the comedy stage, making wry observations about the world around them.

Satire and subversive humour, more than policy papers, are going to be critical weapons in the drive to undermine progressive ideology. As conservatives adapt to using new media, I suspect we will see broader output. Moving on from the simple talk show genre we get today, we will see documentaries and mockumentaries. (Think of the fun a genuine satirist would have with Harry and Meghan, or Greta Thunberg.) Someday soon I suspect it might be possible to watch a drama that isn’t a subtle – or not so subtle – lecture on identarian ideology.

Politics and policy lies downstream from culture. If we engage far more broadly than with mere policy genres, we stand a much better chance of winning policy fights.

One reason this has not already happened is that Big Tech tends to be ultra-progressive and inclined to censor a world view that conflicts with their own. During the Covid panic, for example, many of those that even questioned the efficacy of state mandated lockdowns were censored. Can anyone really imagine YouTube allowing mockumentaries that skewered leftist orthodoxies?

Free marketeers need to ensure their ideas are heard, but the way to achieve this is not to demand state regulation of Big Tech. Giving the state oversight over Big Tech’s output might simply entrench its anti-free market slant.

When social media platforms manipulate what viewers see they pay a price. As Mark Zuckerberg seemed to admit in a recent interview with Joe Rogan, if the algorithms give us what they want, rather than what we want, we tune out – and the social media platforms lose market share. See Facebook’s audience data and share price for details.

Big Tech censors are engaged in a counter reformation. However vigorously they might suppress what they don’t approve of, they will not be able to stop the subversion of the leftist elite’s ideology.

Our greatest cause for optimism is America. Yes, federal spending has risen, and many states have raised taxes and smothered themselves in regulations. But many southern states have moved in the opposite direction, eliminating red tape and cutting taxes. Some have eliminated state income tax altogether.

As the traditional business clusters centered around New York, Chicago and California have faltered, states run along more free-market lines have flourished. From Texas to Tennessee and Florida, a ‘new South’ has emerged. It is already the most populous part of America, pulling in not only people but capital and innovation.

Free market Southern states are not only a rebuke to the more statist states. Their success provides a model to follow once they have exhausted the alternatives in states like Oregon and Illinois.

After the Soviet system fell apart 30 years ago, it became fashionable to believe that the world was converging in the same direction. Free markets, based on universal values, were going to become ubiquitous, and nation states and their peculiarities less important.

The free market system did indeed embrace the world to such an extent we even called the process ‘globalisation’. But in reality, it might have been better understood as a process of benign ‘Americanisation’.

Nation states did not cease to be unimportant in the new global order. Quite the contrary, one nation state in particular – the United States – underpinned it. The idea that the world is converging towards universal values is an illusion.

China under Xi seems to have pivoted away from the pro-market policies established under Deng, resuscitating a fondness for micromanagement. Turkey, too, is not run by those looking to emulate the West, but by those who speak of restoring Ottoman glory.

We often unthinkingly include continental Europe as part of ‘the West’. Wasn’t it the case that much of Europe was incorporated into a system of free markets and limited government by Anglo American force of arms 80 years ago? Does the European Union today, a multinational agglomeration of people, presided over by a remote elite owe more to an Anglo-American tradition or a Habsburg one?

Among the opinion forming classes in American and Britain, however, the delusion of universal values has taken hold. Both are presided over by those who see nation states, including their own, as mere geographic spaces, occupied by interchangeable people bound by little besides economic activity.

This cultural relativism – a belief that all cultures are equally capable of producing Shakespeare or vaccines or free markets or, for that matter, genocide – is the foundational fallacy of the modern left. Cultural relativism has spawned a deep antipathy not only to the free market, but challenges the very legitimacy of the Anglo-American nation states.

Rather than marvel at how a small island off the northwest coast of Europe began a series of innovations that was to lift herself – and eventually the whole world – out of poverty, Britain’s achievement, we are told, was made at the expense of others. Instead of celebrating the ascent of America, we are invited to regard the United States as a nation ‘founded by slave-owners on stolen land’.

If we really want to defend the free market our priority must be to tell the story of (Anglo) American exceptionalism.

That 13 ramshackle British colonies might rise up to become the greatest Republic in history is extraordinary. That they might have done so by proclaiming the principle that each of us are created equal, in possession of the right to ‘life, liberty and the pursuit of happiness’ makes the United States not just a material achievement, but a revolutionary moral achievement, too.

America is the first great power in human history that has used her strength not to subjugate people and create an empire, but to set people free and demand the dissolution of empires. Three times she has used her might to save the free world, first from German militarism, then from the Nazis and most recently from Soviet communism.

For all her imperfections, there is no other nation on the planet that people of every creed, colour and culture would rather call home than the United States.

America’s story is the story of freedom, a tale of how free individuals and free markets, not technocratic elites, produced the greatest society to have ever existed. If we want to defend free markets, it is time to tell it.

Douglas Carswell is the President & CEO of the Mississippi Center for Public Policy. He was a member of the British Parliament and co-founded the official Brexit campaign. He lives in Jackson, Mississippi.

This article was originally published in The Spectator.

Mississippi legislators missed the opportunity to repeal the CON laws and prevent the dangers they cause for Mississippians.

By any measure, America is experiencing a substance use crisis. In 2021, deaths from overdoses reached an estimated 107,622 people across the United States, with roughly another 140,000 deaths due to excessive alcohol use. Unfortunately, Mississippi has not been spared from this epidemic. In 2021 alone, 491 people died from opioid overdoses, and over 2,500 people required Narcan to be revived after an overdose.

Numerous factors contribute to a person’s substance abuse, and it can be very difficult for them to realize or be convinced by their loved ones that they need professional help to get sober and get their life back on track. However, as the substance use crisis continues to get worse, facilities that provide treatment are hamstrung by antiquated regulations that prevent them from scaling up their ability to care for patients in need.

In nearly every industry or sector of the economy, when there is an increased demand for a business’s goods or services the relevant companies will simply scale, either by expanding their current operations or building new locations altogether. However, thanks to Mississippi’s Certificate of Need laws, the health care industry is prevented from scaling up as needed.

And when that happens, it’s patients — the very people these laws were supposed to help — who suffer.

Our state’s CON law requires that facilities that provide rehabilitation care must receive regulatory permission to expand or establish new locations or even just to add additional beds at inpatient facilities. This process takes months and can cost up to $25,000.

Additionally, this process includes a provision to allow “affected persons” to request a public hearing to argue against granting the Certificate of Need. “Affected persons” includes health care organizations that already provide a similar service or have indicated to the state that it plans to offer similar services in the future.

This provision is ostensibly to ensure that there is adequate care and to keep medical costs down, but, in reality, it provides a way for competing health care providers to try and limit their competition. We would think it odd if Mcdonald's had to secure permission from Burger King to open a new location, yet for some reason this is considered a good idea when it comes to health care.

The data is overwhelmingly clear that despite whatever good intentions lie behind these CON laws, they simply serve to reduce access to care and make it more expensive. A study by the University of Washington’s School of Public Health and Community Medicine compared and contrasted results in states with and without CON laws and found that they are “not an effective mechanism for controlling overall health care spending” and that they had in some cases actually limited the supply of care. Before their total repeal in Pennsylvania, CON laws had limited the supply of alcohol and chemical dependency beds.

Recent reports have confirmed these results. A multitude of research has found that states with CON laws have higher costs and less access to treatment, beds, and medical equipment.

Substance use is a crisis, and there is no time to waste in months of bureaucratic paper shuffling to improve access to treatment.

Unfortunately, Mississippi legislators missed the opportunity to repeal the CON laws that are preventing Mississippians who are struggling with substance use from being able to access the care that they need. House Bill 10 was introduced at the beginning of this legislative session and would have amended the relevant laws to remove chemical dependency services and facilities from CON regulations. It failed in committee by vote last week.

Passing House Bill 10 would have ensured more access to care, lower prices, and shorter wait times for people struggling with substance use by allowing Mississippi health care facilities to expand their ability to treat them without months of bureaucratic hoop-jumping that in the end only leads to higher costs and worse health outcomes.

This bill would have been a win-win-win that would have saved health care providers months of bureaucratic headache, allowed people with a substance abuse problem to access quality care at lower prices, and saved taxpayers money by reducing the negative consequences that stem from untreated substance abuse.

Americans for Prosperity Mississippi will continue to educate the public about the dangers of Certificate of Need laws and encourage legislators to pass H.B. 10 next year to ensure that Mississippians in crisis can access the care they need.

Submitted by Starla Brown. She is the State Director of Americans for Prosperity, an allied organization of the Mississippi Center for Public Policy.

Why do some firms go ‘woke’?

Disney recently got embroiled in a row about transgender identity in kindergartens. Why would anyone think that that was a good idea for a family-friendly business?

A couple of years before then, Gillette ran a campaign about ‘toxic masculinity’. What made a company that sells shaving products to millions of men think that was a smart move? (It wasn’t. Gillette dropped the campaign and was reported to have undergone a massive write-down).

Yesterday, I read that the CEO of BP was planning to dial back investments in wind and solar to focus more on oil and gas. How did a company called British “Petroleum”, I wondered, get into a position where it was being defensive about petroleum production in the first place?

Corporate executives make decisions for all sorts of reasons. We just don’t know the full story behind what happened at any of these firms. But what we do know is that a growing number of people fear that big businesses are coming under pressure from investment funds to make decisions that are not purely based on maximizing returns.

Over the past few years so-called Environmental, Social & Governance investing – or ESG – has become an established orthodoxy on Wall Street. Big investment firms have devised various metrics by which they measure corporate performance that is not necessarily related primarily to profitability.

What, they demand to know, is the business in which they are investing doing to promote diversity? How is the board looking to combat climate change? Is the business inclusive enough?

If large investment firms make their investments conditional upon meeting these kinds of metrics, those that run the business will do what they can to comply. I worry that pressure from ESG investors has made a lot of corporate America ‘woke’.

“So what?” you might well say. “It’s not your money, Carswell. It’s up to these investment funds to invest any way they want. If they insist on things that don’t make commercial sense, that’s their business.”

In a free market, we should not be in the business of telling those that own capital how they might invest it. The trouble is that the ESG investment firms on Wall Street don’t generally own the capital. They merely manage it.

Some of the large public investment funds on Wall Street might act as if they own the funds they allocate. In reality and in law, they are merely entrusted to manage other people’s money.

Investment managers have what is known as a fiduciary duty to those that invest in their funds – be they small retail investors or a large pension fund. A key part of that fiduciary duty is to aim to maximize returns for their investors.

When the high-flying CEO of a large Wall Street investment fund, hot off the plane from Davos, decides to disinvest in oil and gas in order to save the planet, are they fulfilling their obligation to maximize returns? Or, in pursuit of what is essentially a political agenda, are these large money managers, forgetting their fiduciary responsibilities?

We should have no problem with an investment firm wanting to invest any way it wants – provided they make it clear to their own investors if and when they are not aiming to maximize returns.

To try to tackle this problem in the US Congress, Rep. Bryan Steil has introduced the ‘Putting Investors First Act’. This is a sensible solution that every conservative ought to be able to support at a federal level. But what should conservatives seek to do to address this issue at a state level?

Here in Mississippi, state Senator Chad McMahan’s bill (SB 2849) is a great local solution. His bill clarifies the fiduciary duty of Mississippi’s Public Employees’ Retirement System board, making sure that the board sticks to maximizing returns and ensuring the safety of investments. It is encouraging to see his bill make progress through the Mississippi Senate.

I believe this is a good, conservative approach. An additional guardrail for PERS will help ensure the safety of money invested on behalf of our teachers, law enforcement officers and other public servants.

What possible justification is there for not wanting to ensure that those that run a state’s Public Employee Retirement System maximize returns? A bill that puts investors first and maximizes returns seems like an ideal solution.

Mississippi lawmakers have an opportunity to tackle ‘woke’ corporations, and ensure against government interference in the free market and attempts to pressurize corporations into implementing a ‘woke’ agenda. Let’s hope they take it.