When Javier Milei burst onto the scene as a presidential candidate in Argentina in 2023, brandishing a chainsaw, many dismissed him as unhinged. His radical libertarian platform was presented by the media as evidence of Argentina’s tragicomic decline.

Argentina was poorer in 2023 than it had been two decades earlier. That year, the economy contracted sharply, inflation spiraled, and public finances remained in disarray, propped up by repeated IMF bailouts.

A hundred top economists signed a letter warning Argentina against electing Milei. When Argentinians promptly elected him president, the experts all agreed that we should pity the Argentines for their folly.

But then of course Milei was crazy enough to actually do in office what he said he was going to do.

He slashed government, shutting down entire departments and reducing spending, leading to Argentina’s first budget surplus in over a decade in 2024. He cautiously began cutting taxes.

Milei eliminated exchange rate controls, rental market restrictions, and burdensome licensing requirements that once stifled the economy. The entrenched Peronist system of political graft is being dismantled.

As a result, living standards are rising rapidly, economic output is growing, and inward investment is surging. Young Argentines are no longer fleeing the country—instead, they’re returning home.

In other words, Argentina is doing what Mississippi has been doing; cutting taxes, removing restrictions, encouraging inwards investment – and seeing a surge in growth as a consequence.

Mississippi’s conservative leaders might not normally brandish chainsaws, but when it comes to implementing free market reforms, they have been as effective as Argentina’s Milei.

Mississippi started to implement bold tax reforms from 2022, reducing the state income tax to a flat 4 percent. This year we passed a law to phase out the income tax altogether.

In 2021, Mississippi passed the Universal Recognition of Occupational Licenses Act, a significant step towards labor market deregulation in an “at will” employment state.

The Magnolia state side-stepped most of the renewable energy nonsense that pumped up energy costs elsewhere. Today, Mississippi has some of the most affordable electricity in the country.

These are the reasons there has been a flood of inward investment into Mississippi. It’s why Mississippi is seeing a manufacturing boom.

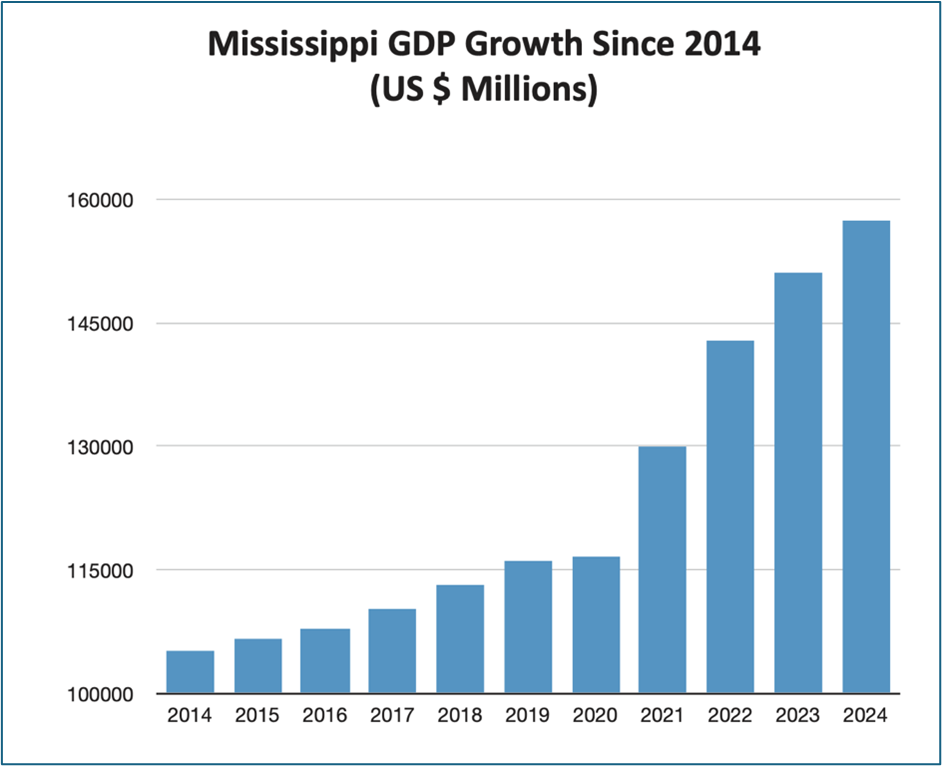

Mississippi’s free market reforms explain why there has been more economic growth in our state in the past five years than there was over the previous fifteen years combined.

Free market reforms explain why we had one of the fastest growing states in America at the end of last year. In 2025, Mississippi’s per capita GDP is projected to surpass Germany’s.

Just like Argentina, Mississippi still has all those condescending ‘experts’ to contend with. The same sort of people who dismissed the idea that free market Argentina might flourish, still won’t accept that Mississippi is shaping up to be one of America’s new economic success stories.

I’ve experienced first-hand supposedly rational, educated individuals flatly refusing to accept the evidence that Mississippi is flourishing. Why? To acknowledge that a southern, conservative - and now increasingly free market - state was flourishing would undermine their progressive world view.

Perhaps that is just another reason we should all want Mississippi to keep growing.

Speaking to my friends at Smith County Republicans the other day, someone asked me what I most loved about moving to Mississippi from London.

There are so many things I love about the Magnolia state, the more I thought about it, the longer my answer grew. I thought I’d list a few of my favorite things about life in Mississippi.

1. Southern Civility. Yes, it’s a bit of a cliché, but as an outsider I can confirm it’s the truth; Mississippi folk are the friendliest people on the planet. Southern charm makes being here such a joy.

2. Mississippi BOOM! Since I arrived almost five years ago, economic output in the state is up about a third. There’s been a massive injection of inward investment. You can feel the growth. Coming from the other side of the Atlantic, it's uplifting to live in a place that is on the up.

3. Income tax on the way out. Mississippi is on the way to eliminating the income tax entirely, like Florida, Tennessee and Texas. It is great to live in a society where taxes go down and public officials can’t expect to keep taking more.

4. Space. With 3 million people spread out over 48,000 square miles, Mississippi has lots of space. There’s a great big outdoors. Our state might not have mega cities the size of Atlanta or Chicago, but having seen the boarded up offices and shops in Chicago, I wonder if modern technology means that being more spread out is actually the way to go.

5. Stunning small towns. Too often downtown America feels abandoned, people and businesses having moved to the suburbs. One of the delights Mississippi has to offer are towns that are actually prospering. Downtown Oxford, Starkville and Natchez, for example, are full of shops and restaurants – and thriving.

6. Universities. Our family is at the stage where we’re starting to think about college options. There are so many great choices in this part of the world. Sending your kid to a southern university reduces the chance they’ll become a communist – which is why, I suspect, we are seeing such a surge in applications from outsiders wanting to study in this state.

7. High school football. The football season is about to begin and when it does, the highlight of my week will be watching Friday night football. It is a festival of everything Americana…..

8. College football. The next best thing is college football. Sure, we don’t have an NFL team, but I genuinely prefer watching SEC teams play.

9. The weather. Some folk complain about Mississippi’s heat and humidity. Coming from London where one would sometimes seldom see the sun, I love the climate here. The sun in our state is up bright and early (almost) every day. Glorious.

10. Gardening. I love gardening, and it seems you can grow almost anything here. Sweet peas. Hibiscus. This year I’ve had a bumper crop of grapes and even starting to get some mulberries.

If living in America means you’ve won first prize in the lottery of life, being in Mississippi means you got the bonus ball!

Mississippi is shedding its image as an economic laggard. Over the past five years, the state’s economic output has grown more than it did over the previous fifteen years combined.

According to the U.S. Bureau of Economic Analysis, Mississippi posted the second-fastest per capita GDP growth and fifth-fastest personal income growth among all states in Q4 2024. Billions in capital investment have flowed in.

This growth is happening across the state—from the Gulf Coast and Pine Belt to DeSoto County, the Jackson metro area, and the university hubs of Oxford and Starkville.

Mississippi whoooooosh!

Mississippi’s recent growth is no accident. It is down to good public policy. Since 2022, Mississippi has implemented transformative tax cuts, reduced the state income tax and lowered the grocery sales tax and easing business inventory taxes. A 2021 law streamlining occupational licensing reduced barriers for workers and entrepreneurs, with the Mississippi Secretary of State reporting a 12% increase in new business registrations in 2023 alone.

Energy in our state is affordable, Mississippi electricity rates averaging 13.43 cents per kilowatt-Hour, helping draw in energy-intensive industries, including two major data centers in Madison and Rankin counties. To top it all, Mississippi’s public universities are fueling growth, and around Oxford and Starkville, entrepreneurial ecosystems are thriving.

But to maintain this momentum, our state needs to abandon policymaking as usual and embrace bold reform. That’s why the Mississippi Center for Public Policy (MCPP) has just launched The Mississippi Miracle? Bold Reforms for Growth.

Our paper details practical steps to sustain and accelerate this momentum:

- Empower Parents Through School Choice: Let families use state funds for public, private, or homeschooling options to drive competition and elevate education standards.

- Refocus Higher Education: Cut administrative bloat, prioritize workforce-relevant programs, and redirect resources from low-value courses to practical, job-focused education.

- Rein in Public Spending: Cap budget growth to population growth plus inflation to ensure fiscal discipline and curb waste.

- Cut Red Tape: Eliminate outdated regulations, repeal Certificate of Need laws, and create a business-friendly environment to spur innovation.

- Reform Public Procurement: Mandate transparent, competitive bidding with regular audits to prevent cronyism and maximize taxpayer value.

- Promote Welfare-to-Work: Emphasize work requirements, job training, and time-limited benefits to foster self-sufficiency and reduce program costs.

These reforms are practical policies that lawmakers can implement to improve lives across Mississippi.

To explore them in detail, visit mspolicy.org under “Publications” or email me at [email protected] for a direct link.

MCPP has a small, but highly productive team. We punch above our weight, producing policy proposals that become law, and helping set the agenda at the Capitol. We are able to do all this because we have the input of so many people across our state. Please read our proposals and share your thoughts—I want to hear what you think.

For decades, Mississippi exported people. Young people in particular tended to leave our state for places like Atlanta, Nashville, Huntsville and Austin.

I believe the tide is starting to turn. I often hear anecdotes of young people moving back to Mississippi. The data suggests that growth in our state is creating opportunities and drawing more people to move here .

Have a read of our report and help us build on this momentum.

Some groundbreaking news for Mississippi! With the passage of the One Big Beautiful Bill, a federal tax credit is due to transform the school choice landscape in our state. This new tax credit enables individual donors to fund scholarships for local Mississippi families, who will now be able to select the schools that best suit their children.

Donors will be able to redirect funds they would have paid to the IRS, receiving a dollar-for-dollar tax credit that reduces their tax liability by the amount donated, up to $1,700 per taxpayer (as outlined in the Senate version).

In other words, local money that would otherwise have been given to the government, instead stays in Mississippi, to provide scholarships for K-12 education, including private schools, charters, homeschooling, and more. I estimate that up to $116 million could be available statewide, potentially funding approximately 18,000 scholarships each year at $6,500 each.

The impact could be profound. Imagine 18,000 students, previously limited by circumstance, gaining access to schools of their choice. Eligible households—those earning up to 300% of the area’s median income (covering most Mississippi families)—could escape underperforming schools, unlocking better opportunities for their children. This transforms opportunities for thousands of families.

Moreover, this tax credit introduces competition, compelling public, private, and charter schools to elevate standards and innovate. With 18,000 students seeking private education options, any lingering resistance from certain private providers is likely to fade. Already excellent schools, like The Redeemer’s School in Jackson, will thrive and expand, I suspect.

For years, efforts to expand school choice in Mississippi have faced obstruction from entrenched interests. MCPP has led the fight for school choice in this state for several years, and I can tell you that this federal tax credit now changes the game. With over $100 million annually fueling school choice, the tide will turn, and Mississippi is finally aligning with neighboring states that prioritize parent power.

Anti school choice liberals in our state, many of whom spent years supporting anti school choice campaigners and media groups while sending their own kids to private schools, will despair. They should. Mississippi lawmakers are at last taking school choice seriously. We are starting to see a sustained effort to give families in our state the sort of choices families have in all of our neighboring states.

This new federal tax credit is a massive step in the right direction. It is about to mainstream the idea of school choice in our state in a big way.

FOR IMMEDIATE RELEASE

(Jackson, MS) Mississippi Center for Public Policy Named Finalist for National Bob Williams Award

The Mississippi Center for Public Policy (MCPP) has been selected as a finalist for the prestigious Bob Williams Award for Outstanding Policy Achievement in the “Biggest Home State Win” category.

This national recognition, awarded by the State Policy Network, honors MCPP’s pivotal role in successfully advocating for the elimination of Mississippi’s income tax.

“We are deeply honored to be named a finalist for this distinguished award, jointly with Empower Mississippi,” said Douglas Carswell, President and CEO of MCPP. “Our team led the charge for income tax reduction and eventual elimination through innovative tax triggers, and it’s incredibly rewarding to see our vision become law with the passage of HB1.”

The incremental reduction of the income tax, which started a couple of years ago, is already driving economic growth, attracting significant investment, and enhancing Mississippi’s competitiveness.

“This reform is a major victory for every Mississippi taxpayer,” Carswell added.

The winner will be determined by a vote of those attending the State Policy Network’s 33rd Annual Meeting in New Orleans in late August.

MCPP has a proven track record of transforming policy ideas into impactful legislation. In addition to income tax elimination, recent successes include school funding reform, red tape reduction, labor market reforms, and legislation to tackle DEI ideology.

For media inquiries, please reach out to Anika Page, [email protected].

When I first moved to Mississippi, one or two of my friends back in England raised their eyebrows. “Mississippi!” the expression of their faces seemed to say. Like many people who’ve never had the good fortune to live in this state, when they hear the word “Mississippi”, they think of the river, or a riverboat or cotton field, perhaps.

Maybe it’s time for such folk to think again. Mississippi has real economic momentum.

Our state is the second-fastest growing economy nationwide. In 2024, Mississippi’s real GDP grew by an impressive 4.2%, ranking second in the U.S. and adding $1.27 billion to our economy. We have also seen some remarkable income growth, ranking fifth nationally for per-capita personal income growth in Q3 2024. A record flow of inward investment is coming into our state, while a record $14 billion a year of exports in goods goes out of our state abroad.

For as long as anyone can remember, young people have been leaving Mississippi. Not anymore. SEC colleges have become fashionable, in part perhaps because they are less ‘woke’ than public universities elsewhere. The number of students at Ole Miss and Mississippi State has risen sharply over the past five years.

Soon after I started at the Mississippi Center for Public Policy, a think tanker from another state told me in jest that when they looked at any set of indices about their state, they would say “Thank goodness for Mississippi”. Apparently, our reliably poor performance meant their state would always escape being bottom of the class. That joke doesn’t work anymore.

Mississippi just led the way in passing legislation to eliminate the income tax. We’re the first state to have managed that since oil-rich Alaska in 1980. Other states are now using Mississippi tax reforms as the model to follow.

Our state pioneered labor market reforms to occupational licensing that have helped drive growth. Mississippi has shown other states how to do it.

If you want low cost energy, Mississippi gives you a pretty good guide as to how to do it, too. The average residential rate in our state is 14 ¢/kWh, among the lowest in America, and about a third of what it costs in California. A decade or so ago, Mississippi led the way insisting that children be taught to read using phonics. This accounts for our relative (if not so much absolute) improvement in reading scores. Your support helps fuel this Mississippi success.

Our state might be showing the way, but we also have a lot to learn from other states, particularly when it comes to school choice. Families in Tennessee, Arkansas and Alabama are now able to apply to get control over their child’s share of the state education budget. There’s a lot more we need to do to get rid of red tape. Mississippi just passed the most conservative budget in years, and we need to keep control over public spending in our state.

Each day when I wake up, I’m not just grateful to be in America. I’m delighted to be in Mississippi.

Immigration is the most critical issue facing America. In recent weeks, ICE has been busy. There have been lots of raids and approximately 800 daily arrests of illegal immigrants nationwide. The administration wants one million deportations this year. In Los Angeles, this crackdown triggered protests that turned violent. President Trump has now sent National Guard troops and even a small number of Marines to enforce the law. Leftwing agitators in other cities seem to be gearing up for more protests.

I’m not sure that siding with violent protesters waving foreign flags is going to win the left mainstream support. Indeed, some of the images from Los Angeles will only alienate middle America. Polls now show 65% support for mass deportations. As Stephen Miller, Trump’s chief of staff, wryly observed, such protests could boost the President’s approval rating past 60%.

For years, immigration rules have simply not been enforced. As an immigrant to America that came in via a laborious and costly process, it annoys me that other people can come in by simply ignoring the rules - and the authorities turned a blind eye.

It is vital that Trump wins the fight to be able to remove those that come into America illegally. If you don’t have borders, you won’t have a country. Don’t just take my word for it. Look at what is happening on the other side of the Atlantic. Today, only around a third of school children in London are English. Sweden is projected to be 30 percent Muslim by 2050. Austria and Germany 20 percent and Britain almost 18 percent.

Today not a single nation in the Western hemisphere has a total fertility rate above replacement level – not even Haiti. Birth rates everywhere from Mexico to Chile have nosedived.

What this means is that if America fails to control her borders and remove those that come here illegally, you may not get the immigration you think you’re going to get. You could end up with a very different sort of America. What if the melting pot won’t melt? What if cultural convergence becomes cultural divergence? America needs an immigration policy that works for America’s long term interests and is enforced accordingly. I fear that unless Trump wins this fight, no one is going to bother enforcing immigration law again. If that happens, the consequences would be catastrophic.

Mississippi seems to be doing rather well. Our economy is growing, and according to data from the U.S. Bureau of Economic Analysis, Mississippi was one of the fastest growing states in the last quarter of 2024. Personal incomes are rising faster than inflation.

Our state is heading in the right direction because we’ve got some key policies right. Taxes, notably the state income tax, have been lowered, with eventual income tax elimination in sight. Rules on occupational licensing have been reformed, making our labor market more flexible.

Our state government has (by and large) kept public spending under control, meaning we have a budget surplus. We don’t yet have meaningful school choice. But every child in the public school system does now have a personalized budget, making it harder for the education bureaucracy to squander resources and easier for the dollars to follow the child.

Every one of these wins was achieved because a handful of people were prepared to put their neck on the line and fight for it. Each time they were opposed by vested interests and, frankly, by the go-along-to-get-along apathy of some who ought to have known better.

We’re only on the road to income tax elimination because principled conservatives were bold. Previous Speaker Philip Gunn overcame opposition to lower income tax to a flat 4 percent. Current Speaker Jason White outmaneuvered the forces of inertia facing him to secure legislation that will mean eventual elimination. Governor Tate Reeves made the case for it consistently.

At every stage, the Governor and two Speakers were attacked for their stance, notably in various leftist-sponsored media outlets. Sometimes by those that now claim credit for the tax cut. Mississippi’s legislature has just passed one of the most conservative budgets in years only because the House leadership refused to do business-as-usual. They insisted on a proper budget setting process – and if you remember, were repeatedly lambasted for it.

Efforts to ensure every child has a personalized education budget were often fiercely resisted by folk that now claim it was their idea all along. That’s politics, you might say. And it’s how change happens. A new consensus comes about not because everyone gets together for kumbaya, but because good ideas take on and defeat the bad.

Mississippi is on the up, but there are so many more reforms we need to ensure we’re no longer 50th out of 50. We are now surrounded by states that have school choice. Red tape in our state is restricting growth. Despite an impressive recent improvement, far too many working age adults in our state aren’t working.

It’s not naïve optimism that will deliver school choice or red tape reduction, but robust, unflinching advocacy. It’s time to turn up the volume.

At the end of May, Mississippi lawmakers returned for a Special Session to finalize the state’s budget after failing to reach an agreement during the regular session. The result? A more conservative budget.

For years, Mississippi’s budgets were decided behind closed doors over a single weekend during the session. Speaker Jason White and the House changed that by demanding an open, public process.

Speaker White’s commitment to transparency paid off. When Governor Tate Reeves called the Special Session, he urged fiscal restraint. This matters because Mississippi’s general fund has grown far faster than inflation since 2020.

Lawmakers listened, passing a $7.1 billion budget — a modest increase from last year and one of the most fiscally responsible in recent years. The big spend items are $3.3 billion, for education, $1.4 billion for Transportation and $431 million (up from $407 million) to try to improve our dysfunctional prison system.

Speaker Jason White was right all along. When lawmakers decide the budget in public through a proper process, they are more careful with our money. Sunlight truly is the best disinfectant.

One subplot to the budget saga merits attention. Some Senate members made a misguided attempt to cut basic funding for the State Auditor’s department, hindering its ability to function. This echoed attempts by leftist politicians in Washington, D.C., to block DOGE from auditing federal funds.

Every conservative in Mississippi should applaud the House for standing firm and restoring the State Auditor’s funding. The Auditor can continue investigating misuse of public funds. (Why would any politician scheme to block the Auditor from scrutinizing tax dollar spending? Did they really think they could do so and not look ridiculous? If Homer Simpson did political strategy, I doubt he’d make that mistake. It is political positioning 1.0.) Restraining public spending matters in Mississippi for several reasons.

First, all those efforts to pass a law to eliminate the state income tax over the coming year will amount to little unless we continue to maintain a budget surplus. The budget passed will maintain a modest surplus and sets a precedent that puts us on the road to actual income tax elimination.

Second, if Mississippi’s economy keeps growing at a rate of 3-4 percent a year, and the budget only grows by 1-2 percent a year, the size of the private sector will grow relative to the overall economy. This is the only way to lift Mississippi over the next generation from being one of the poorest states in the Union to being one of the richest.

Perhaps the most significant thing about this year’s budget is not just that it is fiscally restrained. It was decided openly and transparently. The days when billion-dollar decisions could be made by a handful of good ole boys at the Capitol in private are coming to an end.

A new generation of leaders is emerging in our state who not only support pro-growth policies. They aren’t willing to keep doing politics like its 1960-something.