The Mississippi Center for Public Policy teamed up with the Heritage Foundation to host a packed lunch with Senator Roger Wicker and leading foreign policy strategist, Michael Pillsbury.

Drawing from his bestselling book about China, “The Hundred Year Marathon”, Michael Pillsbury explained just how easy it is for China to gain access to top-secret American defense plans.

Pillsbury explained how under President Nixon and Henry Kissinger, America initially took a pro-China approach, seeking to engage and assist what was then the world’s most populous country.

China, Pillsbury suggested, has learned our strategy all too well and is able to take advantage of it. Even today, America’s administrative state continues to assist China is ways that are not always in America’s best interest.

Pillsbury went on to suggest that America should adopt a Reagan-era approach of achieving peace through strength, building up our military capability in the hope that we never need to use it.

China, some believe, has made plans to invade Taiwan within the next few years. America needs to prepare for every eventuality.

Wicker went on to emphasize the importance of the US navy and the need to ensure the navy had sufficient strength and capabilities.

Taiwan, both Wicker and Pillsbury agreed, should be strengthened in a way that resembles the defense of a porcupine. While not a proactive threat to anyone, a porcupine’s needles ensure than anything that attacks it risks incurring serious pain. Taiwan, they suggested, can be strengthened to a point where China would reconsider making any move on the island state.

The U.S. Supreme Court just finished its term, and the left could not be angrier. Gun rights were upheld when the Court ruled that the government does not get to decide why people can carry guns, religious freedom endured when the Court ruled that a coach has the right to privately pray on the football field, and the ability to protect the right to life was returned to the states when Roe v. Wade was overturned.

Now, House Democrats have introduced legislation to expand the Court to create a liberal majority. Congresswoman Alexandria Ocasio-Cortez called the Supreme Court “illegitimate.” The call is growing louder to completely abolish the Supreme Court in its entirety. As also shown by the push to abolish the electoral college and the Senate filibuster, when the left does not get its way, its solution is to change the rules to ensure that they do next time.

However, there is a way to be pro-abortion and anti-Roe or anti-gun but agree with the Court’s pro-second amendment ruling. In fact, some of the justices of the Supreme Court might have just given the states the green light to enact laws with which they personally do not agree. All opinions on abortion, guns, prayer, or any other political issue are irrelevant in deciding a case. What matters is constitutionality.

Is Mississippi’s abortion ban after 15 weeks constitutional? The Supreme Court ruled that it is in part because the Constitution never mentions abortion. It ruled that New York’s gun law, which required that gun owners prove their reasoning for owning guns, was unconstitutional in part because the Constitution clearly enumerates and protects the right to keep and bear arms. The same can be said about prayer.

Article I of the Constitution gives the legislature the ability to make laws. Because the left cannot sell the public on their radical ideas, they rely on unelected jurists to carry out their agenda for them. That is how the three liberal justices routinely rule. However, Article III of the Constitution lays out clearly that the Supreme Court is meant to interpret the law, not make the law. As then-Judge Amy Coney Barrett said, “It’s never appropriate for a judge to impose that judge’s personal convictions, whether they derive from faith or anywhere else, on the law.”

Along with the federal government, the scope of the Supreme Court has grown too big. It issues national decrees, barring states from making their own laws based on inferred rights found nowhere in the Constitution, such as abortion. In Marbury v. Madison, Chief Justice John Marshall ruled that the Court has the power to strike down unconstitutional laws, which is called judicial review. This power, when used correctly, safeguards states’ and citizens’ rights from a tyrannical government. When misused, however, it bypasses people and their votes to create de facto legislation. Thankfully, the Court is just now beginning to undue faulty precedent and return power to elected lawmakers and localities.

If you disagree with a law that does not specifically contradict the Constitution, do not depend on the Supreme Court to make it go away. Instead, vote for whomever most closely reflects your values to the legislative branch of government, the ones who make the law.

When running for President in 2020, then-candidate Joe Biden promised to “defeat the NRA” by banning assault weapons and enacting other radical gun control measures. After recent mass shootings in Buffalo, New York, and Uvalde, Texas, President Biden signed gun control legislation into law, but did he deliver on his campaign promises?

The latest ‘red flag’ law being debated in Washington increases mental health funding, closes the so-called “boyfriend loophole,” which aims to prevent unmarried domestic abusers from acquiring guns, and most controversially, incentivizes states to adopt “red flag laws.”

Red flag laws allow citizens to go to court to seek an order permitting law enforcement to seize the weapons of a person who has exhibited behavior indicating they might be a threat to themselves or others. Conservatives, wary of big government abuse and overreach, say red flag laws could be used to target people over political beliefs. For example, someone’s leftist ex-girlfriend could pursue a court order against them for posting a picture with guns or sharing a “dangerous” opinion on social media, and if one judge deems it appropriate, those guns could be taken away for some period of time.

Yes, this new law is another step in the left’s march toward stronger gun control laws, but it does not ban assault weapons or deliver any other major progressive “wins” that President Biden promised. Biden admitted this himself, saying that “this bill doesn’t do everything I want.” Other members of the President’s parties have made even more extreme gun control promises than Biden. Texas Governor Candidate Beto O’Rourke, who has lost two elections within the last four years, famously said “hell, yes” in response to whether certain guns should be taken away by law-abiding gun owners. New York Governor Kathy Hochul said that she is prepared to enact gun control so extreme that her state will “go back to muskets.”

Democrats control both chambers of Congress and the presidency, but they still cannot deliver on their anti-second amendment crusade. As their political capital diminishes, their promises become increasingly vague, from an assault weapon ban to “common sense gun reform” to simply “doing something.” This catch-all phrase is designed to create the façade that something truly special has happened thanks to the President’s leadership when, in reality, that is nowhere near the truth.

Meanwhile, the Supreme Court has struck down a New York law that required citizens to show “proper cause” to get a concealed carry gun license. According to the left, the right to bear arms is dependent on if the anti-gun government thinks the specific reasoning for doing so is good enough. Thankfully, the Supreme Court can recognize an unconstitutional infringement when it sees one. For the past thirty years or more, the anti-gun lobby has promised a lot. But they don’t have an awful lot to show for it.

“Too many boards and commissions in our state have far too much power to decide public policy."

“Drain the swamp!” How often have we heard this phrase bandied about by politicians seeking to signal that they are on our side?

Those that we send to Washington often refer to DC as “the swamp”, a place full of federal bureaucrats making public policy with little reference to the public. But what about the swamp closer to home?

Before complaining about the federal fat cat agencies in Washington, we ought to acknowledge that there are plenty of self-serving bureaucrats right there in Mississippi.

A new report, “Drain the Swamp – the administrative state in Mississippi,” published by the Mississippi Center for Public Policy shows that Mississippi’s bureaucrats are out of control. Of the 222 agencies and boards that we reviewed, we found that only a tiny minority are headed by a directly elected official. Of those that are appointed, the state Senate confirms only a small minority.

The administrative state in Mississippi is able to make public policy and spend public money with too little accountability to the public.

Of course, there are plenty of departments and boards that are essential to effective public administration. But Mississippi has dozens of agencies and boards that we could probably do without. I have no doubt that plenty of good people work for the Auctioneer Commission or the Board of Physical Therapists. But other states seem to cope without such entities. Might Mississippi be able to manage without an Interior Design Advisory Committee?

When Ronald Reagan launched his presidential campaign at the Neshoba County Fair in 1980, he famously observed how “When you create a government bureaucracy, no matter how well-intentioned it is, almost instantly its primary priority becomes the preservation of the bureaucracy.”

The Gipper was absolutely right back then, and the problem has grown much worse since.

Too many boards and commissions in our state have far too much power to decide public policy. Often this is the fault of the legislature that has delegated to these agencies broad powers. But it is also, as Reagan understood, in the nature of bureaucracy to expand unless it is kept in check.

Our report makes a number of suggestions to make more of Mississippi’s public officials better accountable to the public. We propose reining in the wide discretion that the legislature has foolishly granted officials. We suggest sunset provisions to ensure that bureaucracy does not continue to expand long after it has served its initial purpose. Our report considers giving the legislature more effective oversight over the bureaucracy and how it spends public money. We even suggest that it might be time to eliminate some agencies altogether.

Many of these agencies and commissions have become a source of patronage. They are run in the interests of vested interests. Instead of economic freedom, they have spawned a cartel economic system in our state, in which someone’s permission is always needed to do something.

The key to achieving economic prosperity in Mississippi is to overturn this cartel economic system and eliminate our home-grown version of the administrative state. Our report shows how.

The report can be accessed on our website, mspolicy.org.

This editorial, written by the Mississippi Center for Public Policy CEO & President Douglas Carswell, was featured in Y'all Politics on May 31.

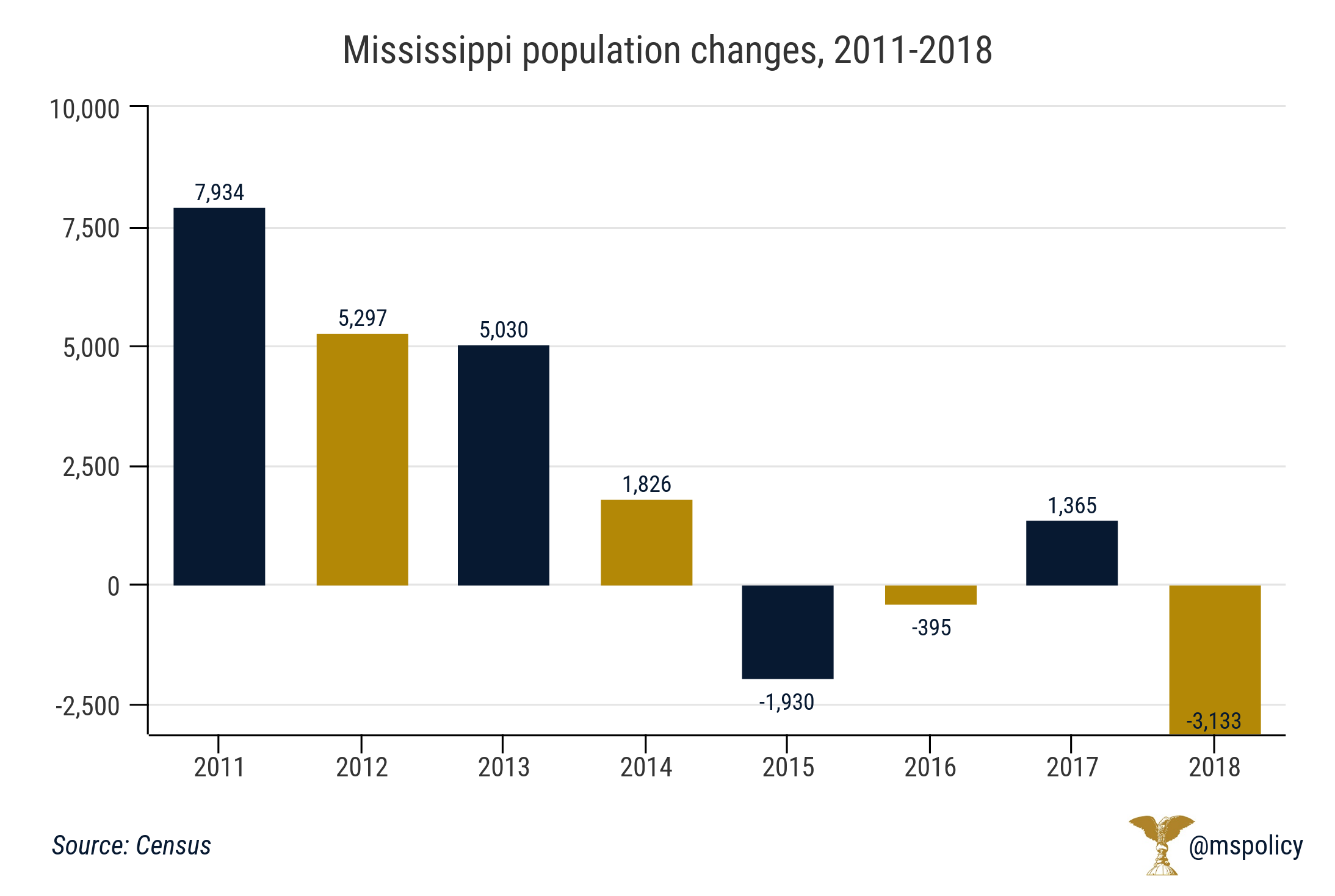

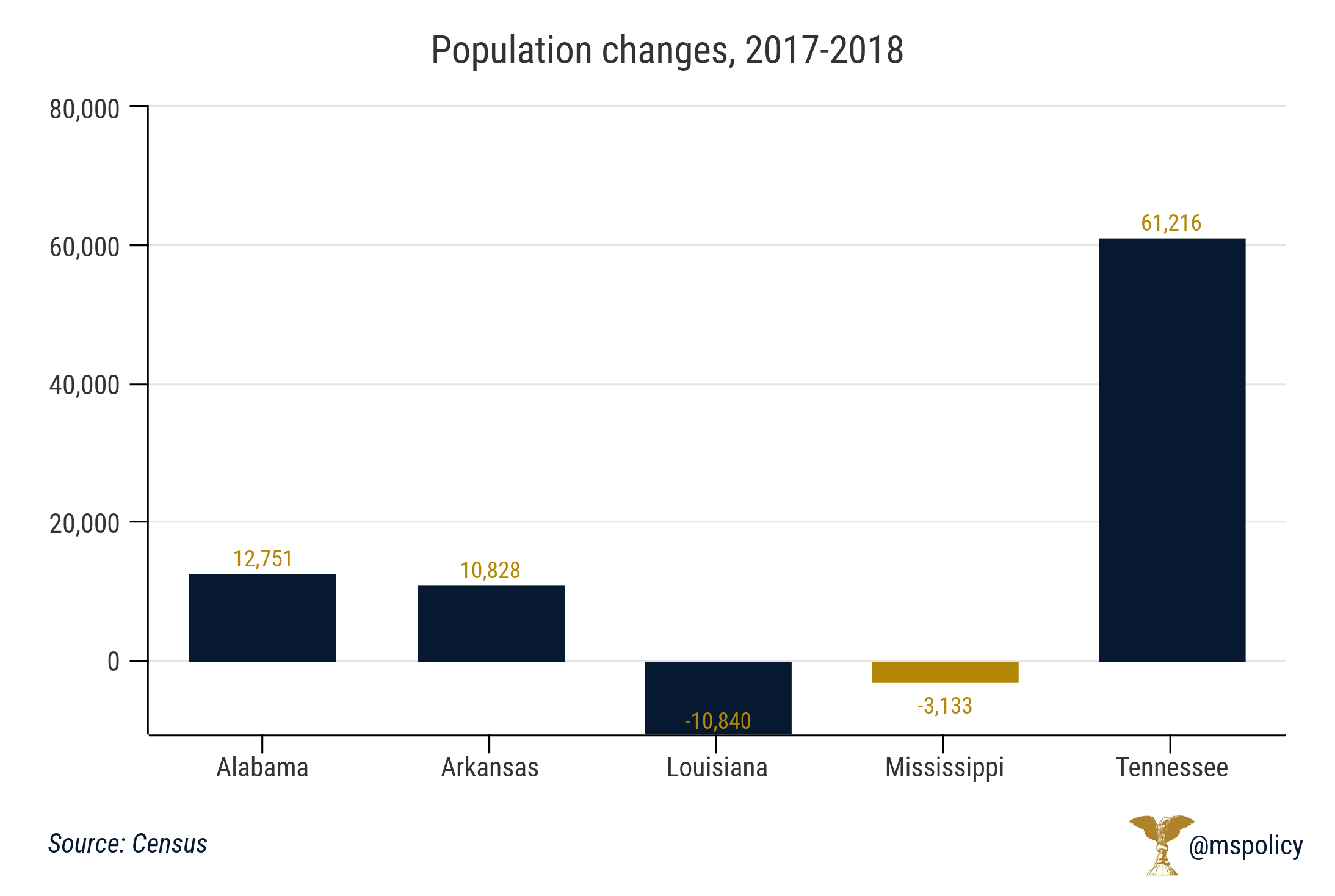

Mississippi and Louisiana both experienced population declines over the previous year, standing out among neighboring states and most of the South.

Louisiana had the fourth highest population loss, in terms of real numbers, at 10,840. Mississippi’s population declined by 3,133. While Mississippi has now seen a population loss in three of the past four years, this was the biggest decline since the official 2010 Census.

The 2018 population estimate is 2,986,530. Mississippi experienced a short population increase of more than 20,000 residents during the first half of the decade, but the population is now down more than 4,000 people since 2014.

Among other neighboring states, over the past year, the population in Alabama increased by 12,751, in Arkansas it increased by 10,828, and it increased by 61,216 in Tennessee.

Tennessee’s population boom isn’t a surprise, or anything new. The state has added more than 400,000 residents since the 2010 Census.

And it’s part of a migration trend. People are leaving progressive income tax states and moving to income tax free states. Over the past year, 339,396 Americans moved to no income tax states, including Tennessee. And 292,947 left progressive income tax states.

Mississippians have among the highest tax burdens

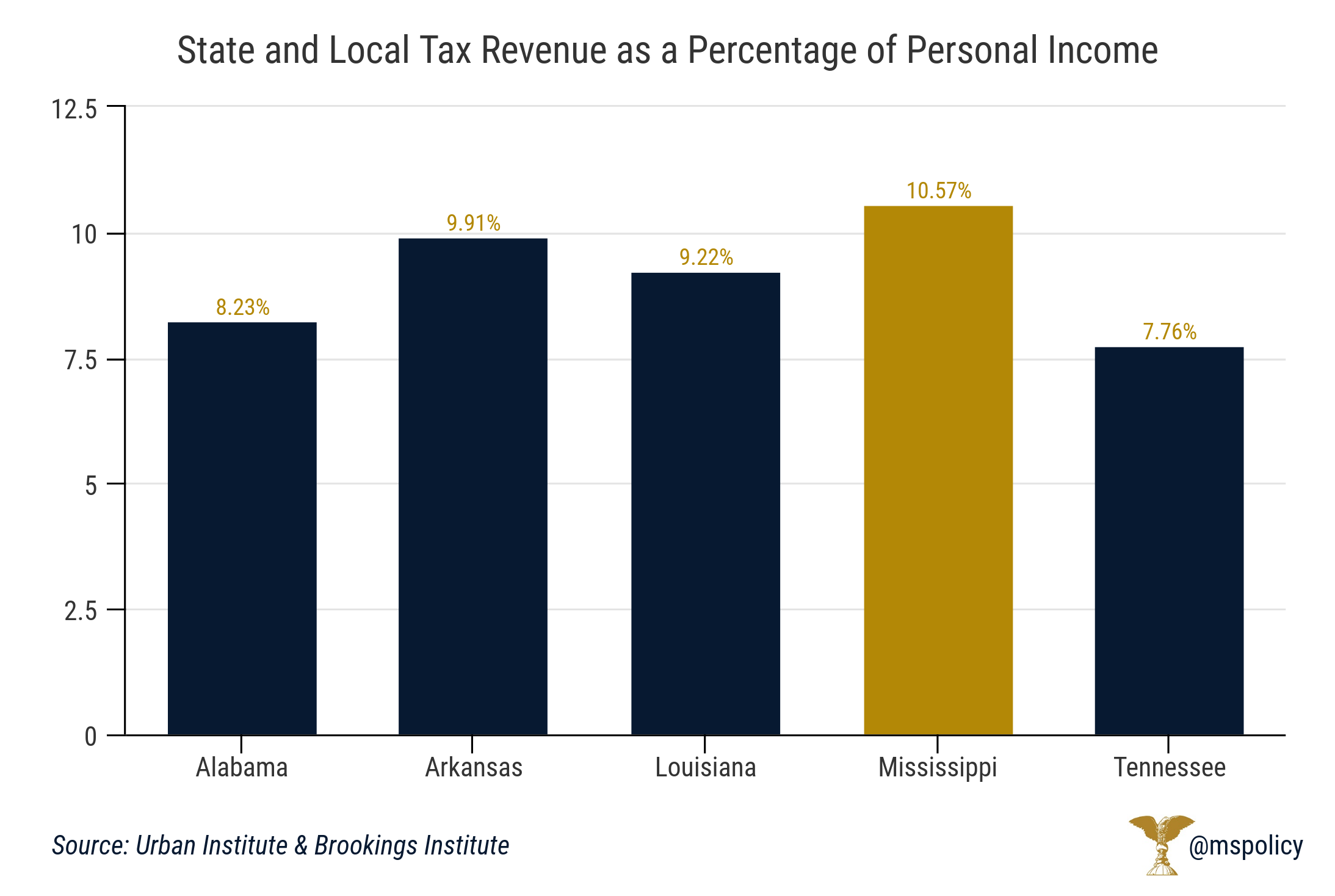

As Census data shows, Mississippi’s tax burden is hurting the state. As a percentage of personal income, Mississippians have a state and local tax revenue rate of 10.57 percent. The national average is 10.08 and the Southeast average is 8.57.

Among neighboring states, Alabama has a rate of 8.23, Arkansas is 9.91, Louisiana is 9.22, and the income-tax free state of Tennessee is 7.76. This means Tennessee runs their government for about 25 percent cheaper than Mississippi. Mississippi is the only state in the Southeast, save for West Virginia, over 10 percent. The Mountaineer state is the highest in the region at 11.23.

Mississippi’s percentage has gone up steadily over the past few years. From 2010-2012, it ranged from 9.84 to 9.88. But this trend has, unfortunately, been going in the wrong direction.

The battle to preserve our natural rights of life, liberty and property is as arduous today as it was 242 years ago, when George Washington and his men made a daring defense.

Though we don’t fight our would-be rulers with muskets and bayonets today, we remain in a war to defend our constitutional rights from those who would continue to challenge them.

Our weapons today are different but our commitment to win must be no less earnest.

Our founders understood the high purpose and necessity of such a defense. They knew the opportunity of a constitutional republic was won by their generation but that it would also require an ever-vigilant citizenry to defend it from well-meaning but power-seeking governments, generation after generation.

As active and engaged citizens, we have a role as defenders of the blessings of liberty for all Mississippians. Whether a lawyer representing an entrepreneur who is prevented from starting a business by unnecessary and burdensome regulations, a policy advocate working with members of the legislature to push for limited government, a community activist working to ensure equality under the law, or an ordinary citizen writing an Op-Ed for the local newspaper, we’re all defending our shared blessings of liberty.

These blessings were not granted to us by government; they are natural to each of us as individuals. And none of us can be denied these blessings or given any modifier that makes our blessings preferable or subordinate to any others’.

As we celebrate the eternal blessings of the Christmas Season with family and friends, let’s take the time to think about that incredible crossing on Christmas night, 1776. When the hopes of independence lay in the balance, our country’s first president planned and executed the bold attack on the British.

George Washington led famished, cold, tired men across the Delaware in the darkness as rain turned to sleet and then to snow, and the winds blew without relief. The American colonists prevailed in that fight at Trenton and eventually, thanks to a spirit that would not be subdued, our independence was won.

With that enduring spirit in mind this Christmas season, we should take the time to recognize how rich our blessings are and how worthy of a robust defense is liberty.

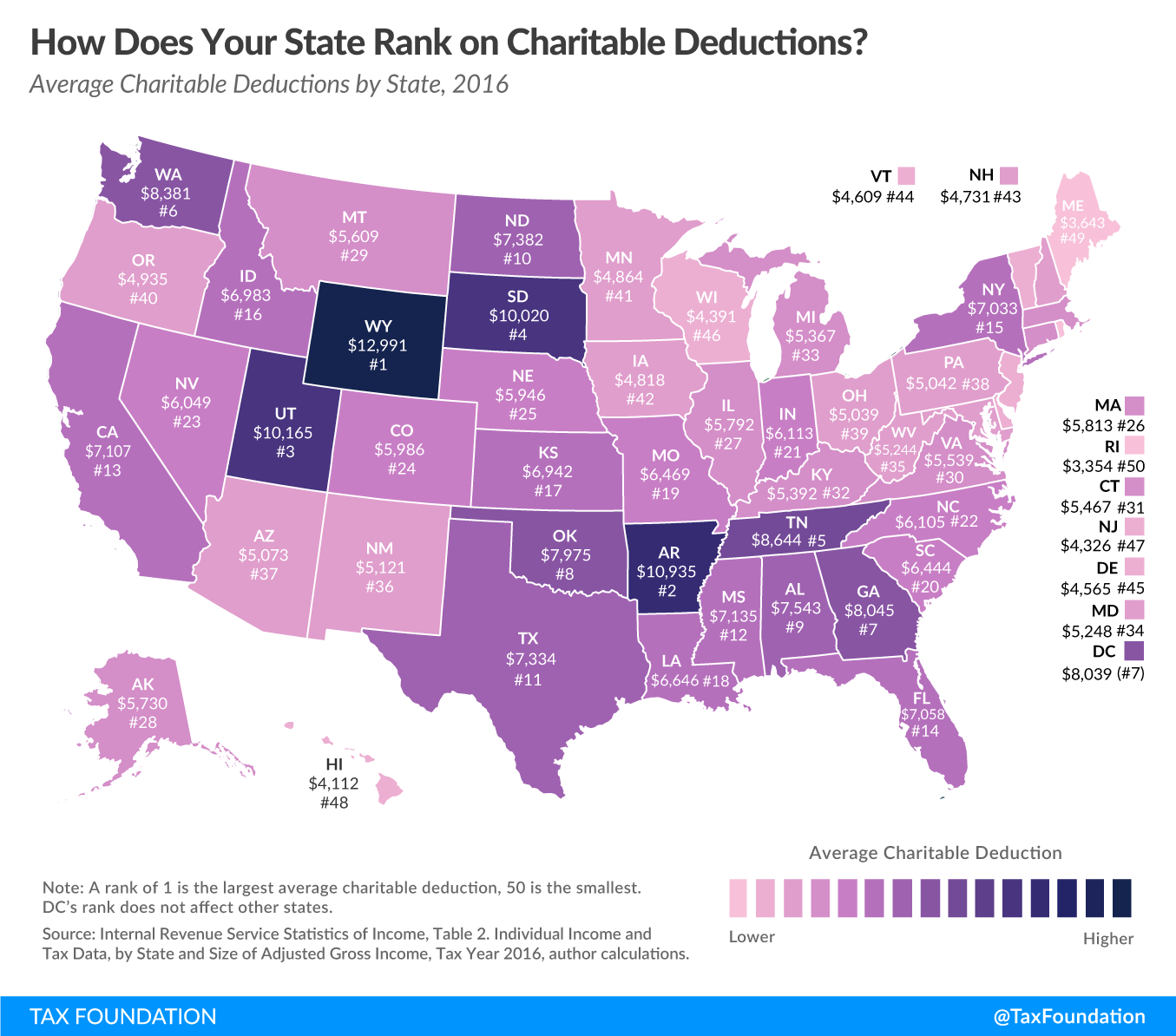

As many prepare for end-of-year charitable contributions, data from the Internal Revenue Service continues to show Mississippi as one of the most charitable states in the country.

According to the IRS, some 250,000 Mississippians took an itemized deduction for charitable giving last year. The average deduction in the Magnolia State was $7,135. This is the 12th highest average in the country.

The top five charitable states were Wyoming ($12,991), Arkansas ($10,935), Utah ($10,165), South Dakota ($10,020), and Tennessee ($8,644).

Along with two of Mississippi’s neighbors coming in the top five nationally, Alabama placed ninth at $7,543 per contribution and Louisiana was 18th at $6,646 per contribution.

The five least charitable states were Rhode Island ($3,354), Maine ($3,643), Hawaii ($4,112), New Jersey ($4,326), and Wisconsin ($4,391).

As a note, this isn’t necessarily total amount of giving, but the total amount that eligible taxpayers deducted on their income taxes in 2016. A donation that was made but not reported on tax filings would not be counted in this report.

And as the standard deduction will be increased because of the Tax Cuts and Jobs Act that passed last year, it is assumed that far fewer individuals and families will itemize their deductions this year. That will impact tax filings, but what effect it has on actual charitable giving remains to be seen.

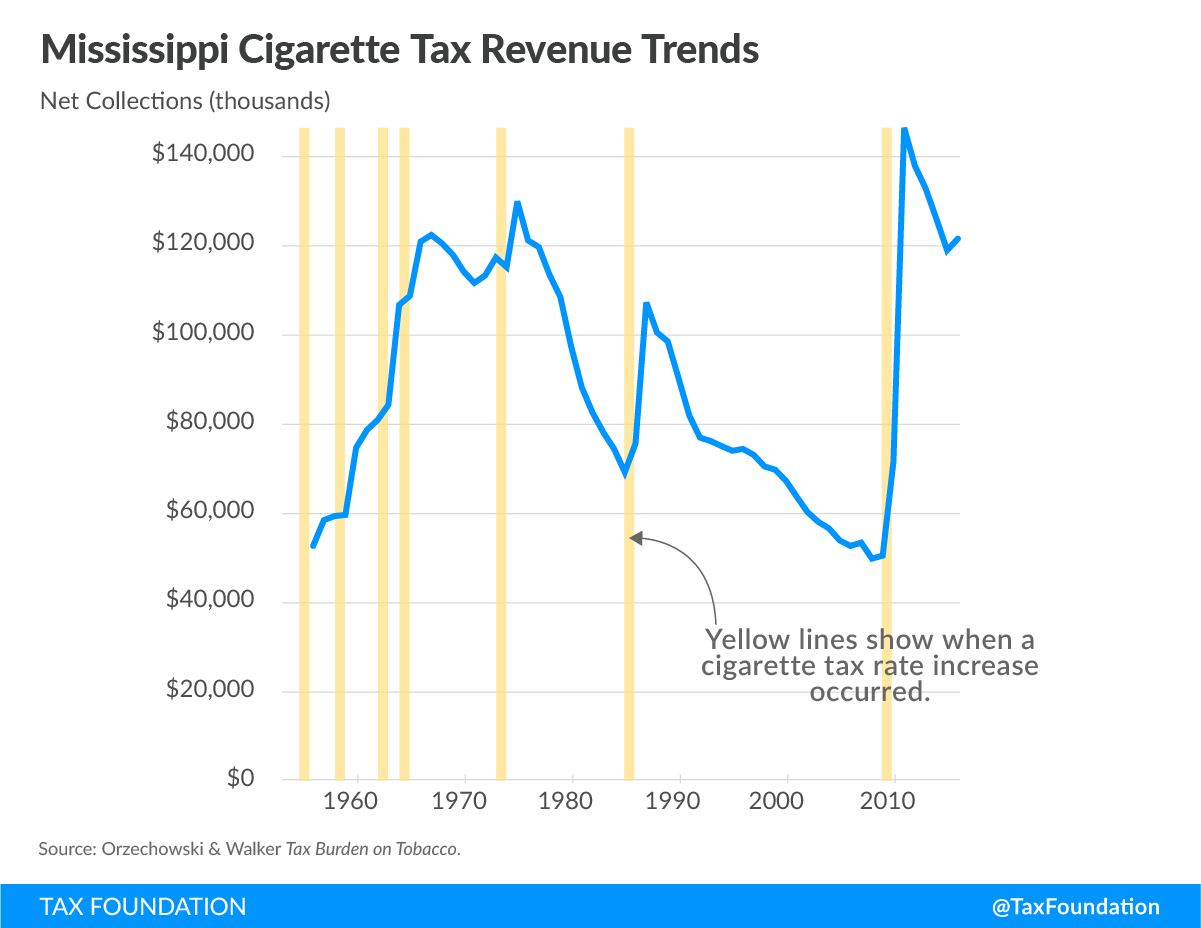

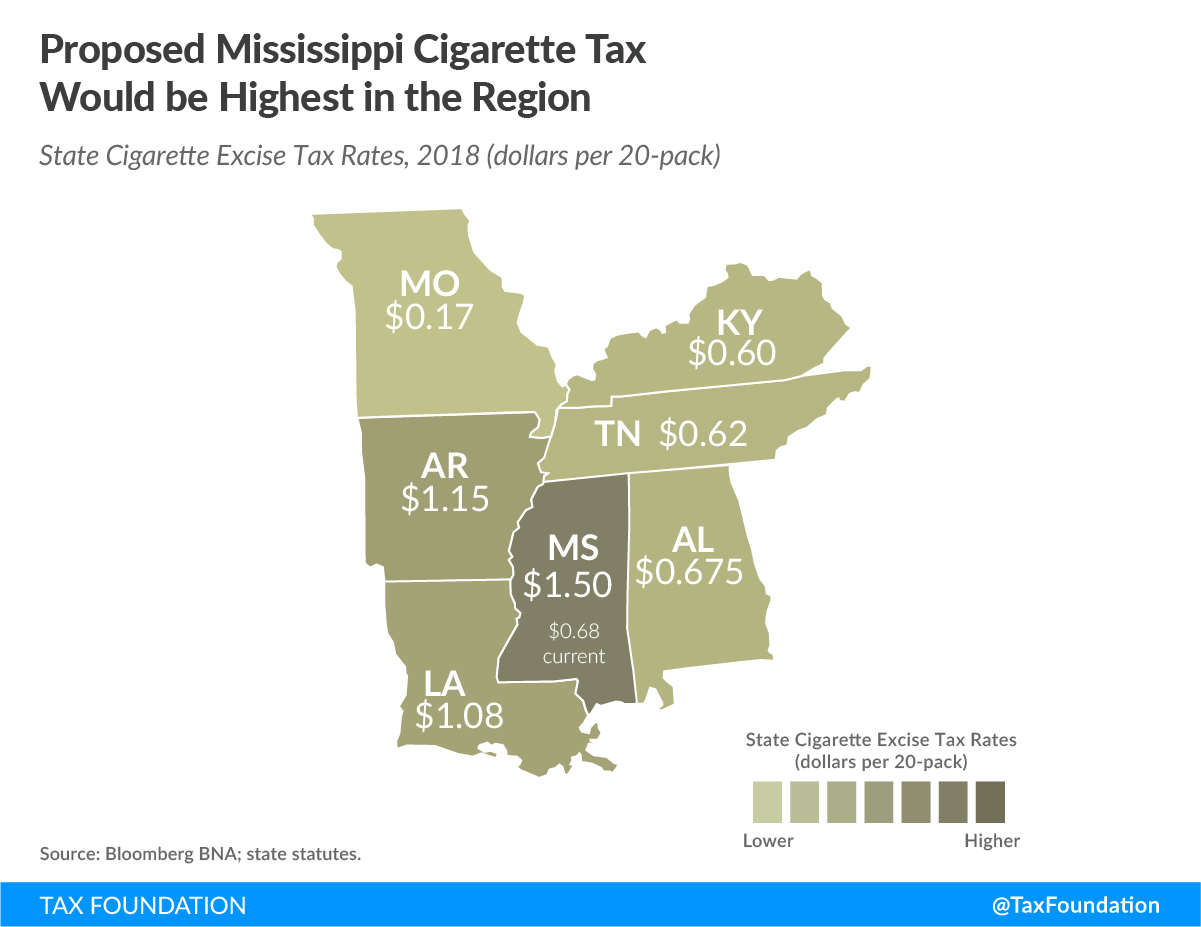

Cigarette taxes are one of the easiest taxes to raise. It is a tax on an unsympathetic, and shrinking, demographic.

And voters approve a tax increase in Mississippi, as they do in virtually every poll taken on the issue regardless of the state.

Yet, that doesn’t mean raising cigarette taxes to cover budget shortfalls is good public policy. Quite the opposite, excise taxes on cigarettes are one of the least stable parts of a state budget and will likely only leave lawmakers looking for other solutions in a few years.

As taxes on cigarettes are constantly being raised, we have a great deal of data on this subject. What we experience is an immediate bump in revenue, followed by a falloff in collection in future years. This happened the previous three times cigarette taxes have been raised in Mississippi; 1973, 1985, and 2009.

As you can see, the state noticed an immediate uptick followed by a decrease. Today, the state is collecting the same tax revenue (adjusted for inflation) on cigarettes as it was in 1975. This, despite the fact that taxes have increased by 518 percent during this time period.

A second thing happens when a state adopts the highest cigarette tax rates in their region: people look elsewhere for cigarettes. The proposed $1.50 increase (to $2.18) that some are pursuing would place Mississippi’s tax rate at least 90 percent higher than Arkansas and Louisiana and more than 200 percent above that in Tennessee and Alabama. And as a result, even less revenue is collected.

Cigarette usage has been declining since the 1960s and that trend is not slowing, even if Mississippi is above the national average. If the goal of health advocates is to see that number reach zero, it will happen because of continued education, not taxes.

Cigarette taxes are easy. But the comprehensive tax reform that Mississippi needs is far more complex. The state has one of the highest total tax rates as a percentage of personal income in the Southeast. While Mississippi’s local and state tax revenue rate is 10.57 percent, the four neighboring states range from 7.76 percent to 9.91 percent.

And unfortunately for Mississippi, Americans, and their wealth, are moving to low tax states. So what can we do in Mississippi? We can follow the lead of high-growth, low-tax states in the Southeast that have lower taxes, lighter licensure and regulatory burdens, and a smaller government.

Public school enrollment continues to decline in Mississippi, with 2018 being the seventh consecutive year that less students are enrolled than they were the year before.

According to the latest numbers from the Mississippi Department of Education, 470,668 students are enrolled in public schools. This includes both district and charter school students. If the 1,641 students in charters are removed, the number dips slightly to 469,027.

In 2012, total enrollment was 492,847. And there was no competition from charters at the time. This represents a drop of about 4.5 percent over the past seven years.

What is causing the decline?

The state population has declined over the previous couple years. But if we go back to 2012, the population compared to today is largely stagnant. And maybe even a little higher today depending on 2018 Census estimates. And Census data doesn’t show a major change in the ages of the population so we have roughly the same number of children ages 5-18 today that we had in 2012.

So, it is not due to outmigration. And we see that even when we look at specific districts. While Rankin county isn’t growing at the pace it was over the prior two decades, the county has grown about 4.5 percent since 2012. Yet, enrollment in the Rankin County School District has dropped slightly from 19,448 to 19,206 this year. This is a drop of a little over 1 percent. Not huge, but not the numbers you would expect in a growing suburb.

When you look at enrollment among younger students, the numbers though are more staggering. Kindergarten enrollment has gone from 1,569 in 2012 to 1,365 today, a drop of 10 percent. Enrollment in first grade has decreased from 1,611 in 2012 to 1,438 this year, a decrease of almost 11 percent.

What about areas of the state that are losing population? That certainly includes the city of Jackson. Jackson Public Schools have seen the greatest decline in terms of real numbers. And they are the district most impacted by parents having a choice in their child’s education through charter schools.

In 2012, 29,738 students were enrolled in JPS. Today, they are under 24,000 students. This represents a drop of 20 percent, far greater than the 5 percent decline among the city’s population during this time. And the decline is 32 percent among kingergartners. The Hinds County School District, though much smaller, saw a 10 percent drop in students from 6,267 in 2012 to 5,619 today.

Also in the Jackson metro area, both Clinton and Madison county posted enrollment gains over the past seven years. Clinton grew from 4,756 to 5,310, a 12 percent gain. Madison grew by 6 percent, from 12,507 to 13,302.

Winners and losers

Outside of the Jackson metro area, we saw enrollment trends largely mirror migration trends.

Desoto County long ago passed JPS as the largest school district in the state and it continues to grow though the pace has slowed some. Today, enrollment stands at 34,392, a 5 percent gain from 2012.

Harrison County, the fourth largest school district in the state, has grown by 7 percent, from 14,037 to 15,010. The Harrison County School District is one of five districts in the county. Biloxi and Gulfport also posted gains, of 17 and 8 percent respectively.

In Jackson County, the Jackson County School District dropped 3 percent, from 9,518 to 9,209. Similarly, the Pascagoula-Gautier School District experienced a 1 percent decline, from 6,902 to 6,866. However, Ocean Springs grew by 6 percent, from 5,590 to 5,936 students.

Lamar county became the sixth district in the state to pass 10,000 students this year. The district has grown by 13 percent over the past seven years, from 9,404 to 10,624. Also in the Pine Belt, Hattiesburg had a drop of 14 percent, falling from 4,608 students in 2012 to 3,953.

The school district which saw the greatest percentage decline, among the 30 largest districts in the state, was Greenville, which saw a 22 percent drop. The district dropped from 5,714 students to 4,480. Jackson and Columbus both lost 20 percent of their student enrollment, followed by Meridian’s 16 percent loss.

Certainly, some of the decline is due to outmigration. But there appears to be more to the story. The state does not track private school enrollment or the number of children who are homeschooled, but the number of children leaving district schools is greater than the number of children leaving the state.

School district enrollment change, 2012-2018

| School District | 2012 Enrollment | 2018 Enrollment | Change |

| Biloxi | 5,347 | 6,243 | 17% |

| Clinton | 4,756 | 5,310 | 12% |

| Columbus | 4,593 | 3,654 | -20% |

| Desoto County | 32,759 | 34,392 | 5% |

| Greenville | 5,714 | 4,480 | -22% |

| Gulfport | 6,013 | 6,487 | 8% |

| Hancock County | 4,436 | 4,416 | 0% |

| Harrison County | 14,037 | 15,010 | 7% |

| Hattiesburg | 4,608 | 3,953 | -14% |

| Hinds County | 6,267 | 5,619 | -10% |

| Jackson County | 9,518 | 9,209 | -3% |

| Jackson | 29,738 | 23,935 | -20% |

| Jones County | 8,534 | 8,701 | 2% |

| Lamar County | 9,404 | 10,624 | 13% |

| Lauderdale County | 6,778 | 6,283 | -7% |

| Lee County | 7,177 | 6,902 | -4% |

| Lowndes County | 5,071 | 5,452 | 8% |

| Madison County | 12,507 | 13,302 | 6% |

| Meridian | 6,209 | 5,232 | -16% |

| Ocean Springs | 5,590 | 5,936 | 6% |

| Oxford | 3,944 | 4,323 | 10% |

| Pascagoula | 6,902 | 6,866 | -1% |

| Pearl | 3,954 | 4,257 | 8% |

| Rankin County | 19,448 | 19,206 | -1% |

| South Panola | 4,602 | 4,324 | -6% |

| Tupelo | 7,523 | 6,994 | -7% |

| Vicksburg | 8,714 | 7,775 | -11% |