This column appeared in the Clarion Ledger on September 2, 2018.

During the recently concluded special session, lawmakers passed a $1 billion infrastructure bill, created a lottery, and distributed BP settlement money throughout the state.

House Speaker Pro Temp Greg Snowden (R-Meridian) and Sen. Hob Bryan (D-Amory) offered their take on the five-day session at Monday’s Stennis-Capitol Press Luncheon in Jackson.

“I believe this is five of the most productive days I’ve experienced,” Snowden said.

Snowden reviewed the three bills at length, calling House Bill 1, the infrastructure bill, essentially a House bill. It will divert money from new bonds, internet sales tax revenue from the 7 percent online sales tax, a new annual tax ($75 to $150 annually) on hybrid and electric vehicles, and sports betting revenue.

Snowden brought up the fact that two United States Supreme Court rulings paved the way for the internet sales tax and sports betting revenue, arguing it was not something they could have done during the regular session.

“We passed three major pieces of legislation,” Snowden added. “You might disagree with them but you can’t say we didn’t get it done. Everyone knew it had to happen, just didn’t know how. And this was a bicameral success. Both bodies worked together for the good of the state. It will be transformative for one or two generations.”

And Snowden noted the bipartisan support.

“Even the lottery wasn’t partisan,” Snowden said.

Bryan had a slightly less optimistic perspective

“Every bad idea imaginable all squared into one session,” is how Bryan began his time at the podium. “The lottery will always be a bad idea. It is not right for the government to run a numbers racket. It preys on the poor, especially poor who are most susceptible.”

Bryan then raised the point of their being little meaningful discussion or debate on the lottery. Under the lottery bill that passed, a five-member board appointed by the governor will oversee a private corporation to run the lottery. The initial bill removed the lottery board from state public records and open meetings laws. The House added open meetings provisions after passing the Senate, but Bryan still didn’t like the idea of a private entity running the lottery. He went so far as to raise the potential for conflicts of interest between the lottery board and private corporations.

“There was so much going on but never time to focus on this huge entity that will have lots of money outside of government controls,” Bryan said. “Some of us tried to slow things down but we were unable.”

Snowden, who voted against the lottery each time it was before the House, said he opposes the lottery because it doesn’t make “good economic sense.” But he added it was better for a private corporation to be running it than the state.

And he noted, “I think it’s fair to say Mississippians wanted a lottery.”

Bryan also mentioned that the infrastructure funding is essentially diverting money from the general fund to cover the new transportation funds.

“This is not an improvement for our state,” Bryan said. “The notion that we’ve done anything to help road maintenance just ain’t so.” He added that this was a short-term solution, noting loss of revenue from multiple tax cuts and government incentives for private companies are taking money from the general fund.

Snowden defended the health of the economy and the budget.

“The health of the economy is not the same thing as revenue in state coffers,” Snowded added. “You don’t judge the health of the economy by how your general fund is doing. We’ve been responsible fiscally and will continue to be.”

Calling for a more limited government is not just a conservative talking point, it is a principle that encourages freedom and prosperity. And it’s backed up by scientific data.

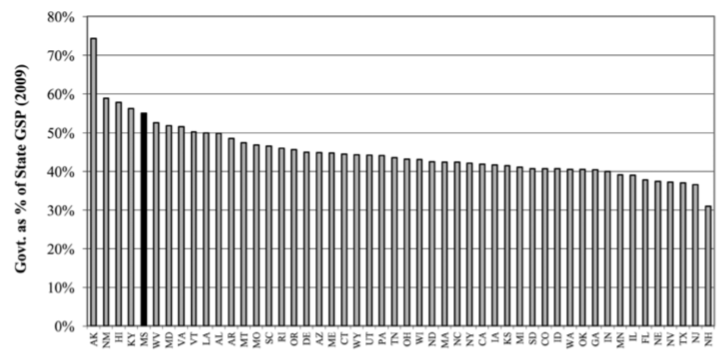

There are eight states where government controls more than half of the economy. Mississippi is one of them.

According to the Fraser Institute, government spending- federal, state, and local- accounts for 55 percent of the economy in Mississippi (as outlined in Promoting Prosperity in Mississippi). This leaves less than half of the state’s economic resources for the private sector. New Hampshire is the freest state, with just 31 percent of the economy controlled by the government. Live Free or Die indeed.

This ranking gave Mississippi the fifth largest government, behind Alaska, New Mexico, Hawaii, and Kentucky. Looking at our neighbors, government controlled between 47-50 percent of the economies in Alabama, Arkansas, and Louisiana. It is 43 percent in Tennessee.

For those that might blame federal spending, if we look at just state and local spending, Mississippi would actually move up to the fourth highest share of government control. So the federal government isn’t to blame.

Government is growing in Mississippi

Interestingly, it has not always been this way. Throughout the 1990s, government control of the economy in Mississippi ranged from about 40-45 percent.

It sat at around 45 percent at the turn of the century. And has been trending in the wrong direction since that time.

Does this matter?

Mississippi has an outsized government. It is larger than our peers. But do we need it? After all, Mississippi is a poor state and largely rural.

Regardless of the size of the state, it is problematic when resources must be dedicated to political favor seeking and lobbying rather than private sector activities. The shift is from entrepreneurship and toward lobbying. That may benefit an individual or a single company, but it does not benefit the economy.

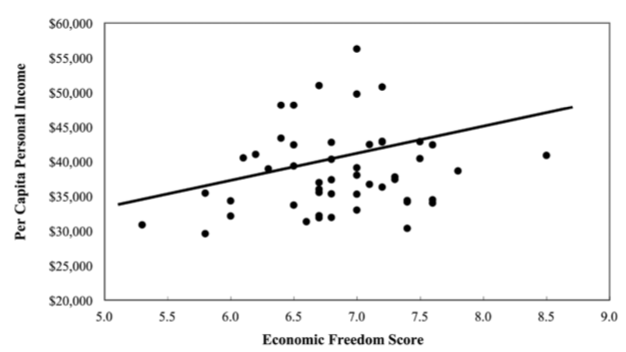

And we have data to show the correlation between economic freedom, which includes personal choice, voluntary exchange, free enterprise, and property rights, and prosperity.

When looking at the Economic Freedom of North America index and per capita income, we see a direct and clear trend. The freer the state, the greater the income.

Those who live in states with the highest per capita income live in the freest states. The poorest states rely on the government. It is not by accident.

People vote with their feet

Beyond the data and freedom indexes from the likes of Fraser, Cato, or Heritage, can you make the argument that people like the high regulation, union friendly status of states like California or New York? After all, Manhattan and San Francisco (minus the used needles and feces on the streets) are highly desirable places to live. And as a result, their cost-of-living is among the highest in the country.

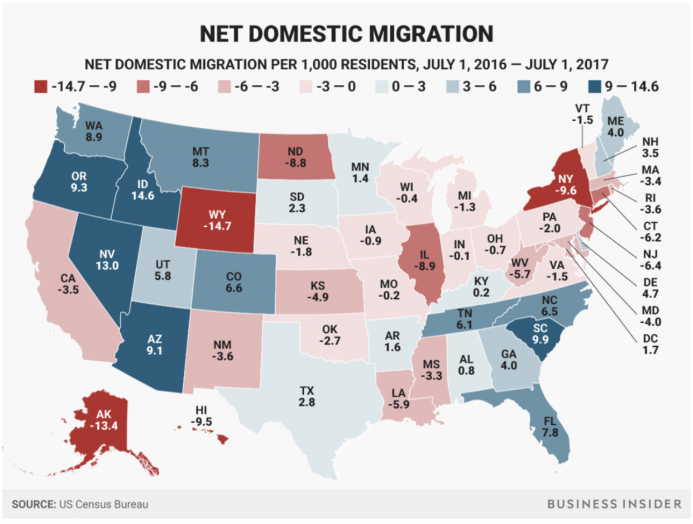

And while those locations might be desirable, net migration tells a different story. We can throw out the data, the policy wonks, and the studies and we still have this graphic.

We are free to live where we’d like in this country. And people are moving to the states that do well on the various measures of economic freedom. As a result, they are moving out of states that do not.

Do people intentionally look at these reports and determine that is where they are going to live? No, probably not. Rather, they are moving to the states with opportunity, with growth, and where the cost-of-living is reasonable. (Hint: states with less burdensome regulations.)

Here is the net migration between 2016 and 2017 among the five freest and five least free states, according to the Economic Freedom of North America index.

| State | Freedom Index Ranking | Net Migration |

| New Hampshire | 1 | 3.5 |

| Texas | 2 | 2.8 |

| Florida | 3 | 7.8 |

| South Dakota | 4 | 2.3 |

| Tennessee | 5 | 6.1 |

| Hawaii | 45 (tie) | -9.5 |

| Mississippi | 45 (tie) | -3.3 |

| New Mexico | 47 (tie) | -3.6 |

| West Virginia | 47 (tie) | -5.7 |

| California | 49 | -3.5 |

| New York | 50 | -9.6 |

The numbers speak for themselves. If we want to increase prosperity and attract new residents to the state, it starts with enacting policies that encourage and promote the principles of economic freedom.

This past session, Mississippi joined a number of other states in reforming civil asset forfeiture laws.

Lawmakers allowed the administrative forfeiture provision to sunset, meaning the previous law ceased to be in effect at the end of June. In response, Mississippi Center for Public Policy and the Mississippi Justice Institute joined with Empower Mississippi and national conservative organizations in thanking the legislative leadership for ending administrative forfeiture in the state.

Administrative forfeiture allows agents of the state to take property valued under $20,000 and forfeit it by merely providing the individual with a notice. An individual would then have to file a petition in court to appeal. This had the net result of requiring the individual to pay an often-large legal bill to get his or her property back. This, naturally, has an outsized negative effect on low-income households.

Asset forfeiture reforms

Until 2017, Mississippi was the wild west of sorts when it came to civil asset forfeiture. In 2015, the Mississippi Bureau of Narcotics, along with local police departments, seized nearly $4 million in cash.

They seized amounts as low as $75. They seized trucks, cars, ATVs, riding lawnmowers, utility trailers, and 18-wheelers; an arsenal of assorted handguns, shotguns, and rifles; cell phones, cameras, laptops, tablets, turntables, and flat screen TVs; boat motors, weed eaters, and power drills; and one comic book collection, according to a report from Reason.

And that does not include numbers from police departments that work independently of the Bureau of Narcotics. Until 2017, they didn’t track or publish asset forfeiture data.

Moreover, family members, especially parents, often have their cars or other property seized for the alleged crimes of their children. This happens even though the parents are not connected to the illegal activity. For example, in 2015, the Desoto County Sheriff's Department agreed to return a 2006 Chevy Trailblazer owned by the mother of the petitioner, Jesse Smith, in exchange for $1,650.

In 2017, the legislature provided needed reforms. Now, seizing agencies must obtain a search warrant issued by a judge within 72 hours of seizing property. And all forfeitures are posted on a publicly accessible website. Repealing administrative forfeiture is another important step.

Voters oppose civil forfeiture

Polling shows a large cross-section of Mississippi voters oppose the practice of civil asset forfeiture.

According to a poll from 2016, 88 percent of voters oppose civil forfeiture, including 89 percent of Republican voters. Every category of Mississippi voter identified in the poll — by race, age, sex, political party and district — is against police taking property from people not convicted of a crime.

By reforming the civil forfeiture system, Mississippi is adopting policies that are in-line with voters in the state and reforms that other states have enacted.

A new report shows taxpayer funded film incentives continue to perform poorly nationwide.

The report, Calling Cut on Film Incentives, was recently released by the Beacon Center of Tennessee and focuses on the poor investment for taxpayers in the Volunteer State. While there has never been an official ROI calculation from the state of Tennessee, the report looked at three key points:

- 40 percent of the subsidized projects made less at the box office then they received in subsidies

- Several of the subsidized projects only spent a small share of their budget in state

- Many programs hold the state, i.e. taxpayers, hostage and threaten to move if they do not receive additional subsidies, similar to sports teams and corporations

A similar story in Mississippi

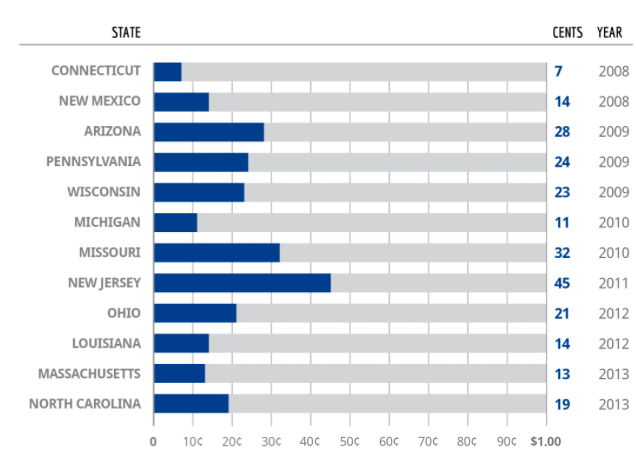

Mississippi has a similar experience with film incentives. A 2015 PEER report shows taxpayers receive just 49 cents for every dollar invested in the incentives. For those looking at a bright side, we are actually “doing better” than many other states.

This includes our neighbors in Louisiana, who recover only 14 cents on the dollar. They also have one of the most generous programs in the country; it was unlimited until lawmakers capped it a couple years ago. (Other reports show the Pelican State recovering 23 cents on the dollar, either way a terrible investment.)

Good for production, not the economy

Beyond Mississippi, Tennessee, and Louisiana, film incentives are universally a poor investment throughout the country. Numerous studies have been conducted on film incentives. All sobering for those worried about taxpayers. Here is a review of the return per tax dollar given, from 2008 through 2013. In these third-party studies, covering 12 different states, there was not a program that returned 50 cents on the dollar (never mind actually made money).

Source: John Locke Foundation

Since this chart was published, studies on similar programs in Florida, Virginia, and West Virginia have shown similar results. No program had a positive ROI.

If an individual was investing their own money, they would never make any of these deals. But is has been said, and proven, many times that no one spends their own money more carefully than that person.

A move in the right direction

Mississippi lawmakers have begun to scale back on the “handouts to Hollywood.” Last year, lawmakers chose not to extend the non-resident payroll portion of the incentives program. This previously allowed for a rebate on payroll paid to cast and crew members who are not Mississippi residents.

But we still have two incentives on the books. One is the Mississippi Investment Rebate, which offers a 25 percent rebate on purchases from state vendors and companies. The other is the Resident Payroll Rebate, which offers a 30 percent cash rebate on payroll paid to resident cast and crew members.

And old habits die hard. The House voted to bring back the incentives this past session. The bill didn't make it through the Senate and that incentive is still dead.

Mississippi is moving in the right direction and they are joined by other states. While all but six states had film incentives a decade ago, the number is now up to 19. Mississippi can be number 20 by removing the incentives currently on the books.

Just because other people are doing it

One of the common prescribed reasons for why need film incentives is because it’s “good” for the state to have movies filmed here. As is often the case in government, we focus on the inputs. How many films are made here? What movie star was in Mississippi? That is nice, but the focus should be on outcomes.

The other common argument is that other states are doing it. That is the point the Beacon Center made about producers holding the state hostage and threatening to move. Producers in Mississippi have raised the same point. And I am sure they have in every other state where film incentives are threatened.

However, simply because another state is wasting money does not mean Mississippi should join them.

Corporate welfare is never a good idea. It’s an even worse idea when you know we are losing money and you want to continue with or resurrect such a program. Our goal should be to have the most competitive business climate in the country. The tax breaks that a few chosen industries or companies receive should be made available to all. When we do that we will remove the need for taxpayer funded incentives.

New York Gov. Andrew Cuomo is in hot water after saying that America “was never that great.” Cuomo is furiously trying to walk back this remark because all reasonable Americans understand that our country, while still struggling to live up to its ideals, has always been the greatest country known to the world. Politicians who do not understand this basic truth should plan to keep their day jobs.

But what made America so great?

When the Declaration of Independence was adopted on July 4, 1776, America was a fledgling experiment in self-government, which the rest of the world expected to fail miserably. All of the wealth and power was in the Old World, with its palaces, empires and powdered wig-wearing aristocrats. America was considered the boondocks, full of log cabins and fur cap-wearing farmers, trappers and frontiersmen.

A few years later, America had fielded a Continental Army that defeated the largest military power in world history and had become the freest and most prosperous country in the world.

A limited government and an empowered citizenry

America became great because the Constitution limited the power of government and empowered individuals to lead their lives as they saw fit. The framers of the Constitution did not know what America would look like 230 years in the future, but they knew they were tired of being subject to the whims of a king. They carefully constructed a government that had just enough power to impose civil order, protect citizens from foreign invaders and secure individual rights to life, liberty and the pursuit of happiness, but not enough power to violate those rights itself. To achieve this, the framers confined the powers of the federal government to those specifically listed in the Constitution and divided that power among three branches of government.

The framers also took a belt-and-suspenders approach to protecting the rights of the people. They added a Bill of Rights to the Constitution to ensure that certain important rights were never violated, even though the framers themselves said that the Constitution had not granted the federal government the power to violate those rights to begin with. Additional amendments were later added to the Constitution to extend its protection of rights to all people, regardless of race or gender, and to keep state and local governments from violating the people’s rights.

If you don’t recognize this strictly limited government, you would be forgiven. Today, politicians say they can do just about anything they want, except what is explicitly forbidden by the Bill of Rights, and even that is up for debate. When asked where the Constitution authorized a proposed law, one congressman admitted, “I don’t worry about the Constitution on this, to be honest.”

Every detail of our lives is subjected to government rules

The rest of Congress appears to feel the same way. The Federal Register, which contains all proposed and final regulations issued by federal agencies, has published over 3.2 million pages. If it were printed and stacked, it would be taller than the Washington Monument. This does not take into account all the laws passed by Congress or by state and local governments.

Because of all these rules, the cost of doing business in America is staggering, and startups and small businesses are at a competitive disadvantage to big businesses that can easily afford it. Those large companies can also afford to pay lobbyists to convince lawmakers to pass even more laws that keep new competitors at bay. All the while, countless Americans are prevented from pursuing their version of the American dream.

Where did we go wrong?

The framers envisioned the judiciary as the guardians of individual rights. But over time, the courts have become more interested in picking and choosing which rights to protect or neglect. In the process, they have invented government powers that do not exist. The result is that our government is far more powerful than the founders ever intended.

You may have heard the term “activist judges.” We certainly don’t need those, but we do need an engaged judiciary that takes seriously its role in the system of checks and balances so carefully designed by the framers.

The good news is that we can all play a part in restoring the American vision. Courts will only take our constitutional rights seriously if we do. We need citizens who are willing to stand up for their rights and attorneys who are willing to advocate for those people, simply because it is the right thing to do. At the Mississippi Justice Institute, we have made that our mission.

The first – and hopefully last – special session of 2018 is now over.

The Legislature passed three bills: a $200 million infrastructure bill; a lottery bill; and a bill to distribute BP settlement money throughout the state. We reviewed the infrastructure bill earlier in the week, and it has been signed into law by the governor.

The lottery bill did not pass without drama. In fact, the most interesting part of session was that it almost did not pass at all. On Monday night, the House stunned many observers by rejecting the lottery conference report. After “sleeping on it,” several members changed their vote the next morning. The initial vote on the conference report was 53 for and 61 against. The do-over vote was 58 for and 54 against. Up until the end of the special session members who had voted “No” during the do-over were switching their vote to “Yes.”

Mississippi's path to a lottery

Once Gov. Phil Bryant came out in favor of the lottery, lawmakers began to feel it was inevitable. Long gone are the days when Gov. Ray Mabus (D) lost his re-election bid partly because of his support for the lottery. As Jake McGraw over at Rethink Mississippi details, the lottery was unconstitutional in Mississippi between 1868 and 1992. (Public opinion about lotteries seems to ebb and flow as ebbs and flows the controversy and corruption lotteries tend to facilitate.)

In 1992, voters cleared the way by amending the state constitution to allow for a lottery, but it took another 26 years before the lottery actually became law in Mississippi. One might wonder at this delay, but there is something to be said – said by James Madison, in fact – that public opinion often benefits from guidance, refinement – and delay. This refinement – owing to the divided form of government we all enjoy – is what distinguishes representative democracy from the tumult of purely majoritarian rule.

Mississippi becomes the 45th state to legalize the lottery, and our citizens will presumably no longer be crossing the state line to buy tickets in Louisiana, Arkansas and Tennessee. This phenomenon – that people are buying lottery tickets in other states – was one of the primary motivations to pass a lottery here. It is interesting, however, that the two states immune to this argument – Alaska and Hawaii – do not have lotteries. Just maybe these folks believe it’s bad policy.

BP money

Before going home on Wednesday, lawmakers were also forced to decide how to distribute $750 million in BP settlement funds – gotten from the 2010 Deepwater Horizon oil spill. Bickering over how to divvy up the windfall has preoccupied the Legislature for at least the past two sessions. The Senate bill proposed sending 75 percent of the money to the coast and 25 percent to the rest of the state. The House agreed, fending off several amendments and letting everyone go home Wednesday afternoon. Legislative leadership clearly wanted to avoid sending the bill to conference, where it would have become even more of a “Christmas tree.”

It has been reported that the 75 percent in settlement money will go to six counties: Hancock, Harrison, Jackson, Pearl River, Stone and George. The bill does not exactly say this. Rather, it stipulates the money will be used for programs and projects in the Gulf Coast region “as defined in the federal RESTORE Act, or twenty-five miles from the northern boundaries of the three coastal counties.” ... So which is it? The RESTORE Act’s definition of the “Gulf Coast region” goes well beyond six counties. Which definition governs how the money is to be used? The language is a bit confusing (but I ain’t a lawyer, only a Ph.D.). This confusion could spawn more squabbling – if not a lawsuit or two.

Several years ago, former New York City Mayor Michael Bloomberg made headlines when he attempted to ban soft drinks over 16 ounces. After several years of legal challenges, New York City exhausted their appeals and people in the city were free to drink from a 17 ounce cup.

Despite that setback, the nanny state is alive and well, particularly in large metropolitan cities and coastal states. But take heart, these rules and regulations are for your own good. At least that is what we often hear.

Lawmakers are particularly concerned that you don’t know how to parent, especially when it comes to educating your child. While many states, Mississippi included, have parent-friendly homeschool laws, others make it a little more difficult to educate your own child in your own house.

In Pennsylvania, you must meet educational qualifications to homeschool, file a notarized affidavit, which includes evidence of immunization and an outline of proposed objectives by subject area, meet the required number of days or hours of instruction, including the required subjects, maintain a portfolio, which includes work samples and standardized testing, and then have your child evaluated each year with a certification that must be submitted to the local school superintendent.

Before children reach school age, we have seen parents seek out new options for preschool, including cooperatives. Here, parents volunteer in the classroom and help run the school, helping to lower the costs of a traditional preschool. Now that this is working well for families, Virginia is looking to require 30 hours of training for parents before they help with activities such as sweeping the floors and passing out snacks.

After all, are those snacks healthy?

The government is here to help you decide

The city of Baltimore recently banned restaurants from including soft drinks or other sugary drinks on kids’ menus. Now, milk, 100 percent fruit juices, water, and flavored or sparkling water without added sweeteners are what the city of Baltimore will allow you to purchase. Not to be outdone, California is now interested in protecting your children from your bad parenting. A proposed law will require restaurants to serve only water or flavored milk to children, sorry fruit juices.

But don’t ask for a straw with your milk or water when you are in California. Numerous municipalities have enacted bans, but Santa Barbara is taking the war on straws to the next level. In the coastal city, outlaws who use straws can be fined up to $1,000 and sent to prison for six months. To be fair, cutting down on waste in a good thing. But let’s not pat ourselves on the back for making up some statistics you received from a nine-year old and then passing laws that will do absolutely nothing for the environment.

Just make sure that milk isn’t raw. Nineteen states, including Mississippi, ban the sale of raw milk, though Mississippi does allow the sale of raw goat milk. But California takes it a step further. They actually deploy “food confiscation teams” to raid the homes of people who purchased bootleg milk. And don’t think about calling nondairy milk, milk.

Regulating competition in the name of consumer protection

The Food and Drug Administration is considering regulatory action that will prohibit almond milk and soy milk from calling their products milk. All because you and I are unaware that Almond milk does not come from a cow. This move is being cheered by the dairy industry, which is looking to use political favor to stifle competition. Sound familiar?

This is what we have seen from the taxi industry in response to Uber and Lyft or the hotel industry in response to Airbnb. Incumbents seek protection from government when a disruptor enters their industry, rather than making changes in products or services in the free-market. They do this because the allocation of resources towards government has worked in far too many places – thus encouraging unnecessary and often silly rules and regulations.

What is next?

And while we can’t have straws or sugary drinks, at least we still have balloons. For now. The anti-balloon movement appears ready to build on the anti-straw movement and do away with the common practice of releasing balloons. Even though, as the AP admitted, balloons are a “very small part of environmental pollution.”

Thirty-two years ago President Ronald Reagan said, “The nine most terrifying words in the English language are: I'm from the Government, and I'm here to help.” Over the years and decades, we have seen our government continue to grow, giving government regulators more power every day. And as we do that, we continue to lose just a little bit more of our freedoms and liberties.

Be very cautious next time you hear a politician sell you on a promise that what he or she is doing is for your own good.

This column appeared in the Clinton Courier on August 29, 2018.

The House of Representatives changed course on Tuesday, voting in favor of a state lottery. They did this less than 24 hours after rejecting the lottery conference report. Five Republicans and three Democrats switched from a "No" vote to a "Yes" vote. Two Democrats and one Republicans switched from a "Yes" vote to a "No" vote.

With approval from the House, the lottery is on its way to Gov. Phil Bryant for his signature.

This is a historic day in Mississippi. Lawmakers rose to the occasion and passed the last part of a sustainable infrastructure funding mechanism that will also provide additional money for public education.

— Phil Bryant (@PhilBryantMS) August 28, 2018

The Mississippi Infrastructure Modernization Act

In addition to creating a state lottery, lawmakers also created the Mississippi Infrastructure Modernization Act.

This new law provides more than $1 billion in infrastructure funding over the next five years. The legislation is the result of two years of negotiation and compromise between the House and Senate, seeking to find a fiscally responsible way to provide sustainable and reliable roads funding.

Here are the details on the Mississippi Infrastructure Modernization Act:

- Provides $200 million annually for roads and bridges. Funding will reach $1.1 billion over five years. This money will come from $300 million in new bonds/debt, internet sales tax revenue from the 7 percent online sales tax, a new annual tax ($75 to $150 annually) on hybrid and electric vehicles, and sports betting revenue.

- Of note, raising the gas tax was never part of this package.

Problems with initial bill

The initial lottery bill also left much to be desired, exempting the new lottery board from state public records and open meetings laws. The House addressed this problem by adding transparency language. A House amendment to leave the door open to video gaming also slowed the bill down. This change was opposed by casino operators as well as the faith community, which had thus far voiced muted opposition to the lottery.

A decades-old debate, Mississippi will become the 45th state to enact a lottery. A lottery board, appointed by the governor, will also serve as the board of the Mississippi Lottery Corporation. It would act as a private corporation domiciled in Mississippi. The lottery is expected to generate about $80 million in annual revenue, with 35 percent of total proceeds going to the state. The remaining 65 percent will go toward administrative costs/paying vendors and prize payouts.

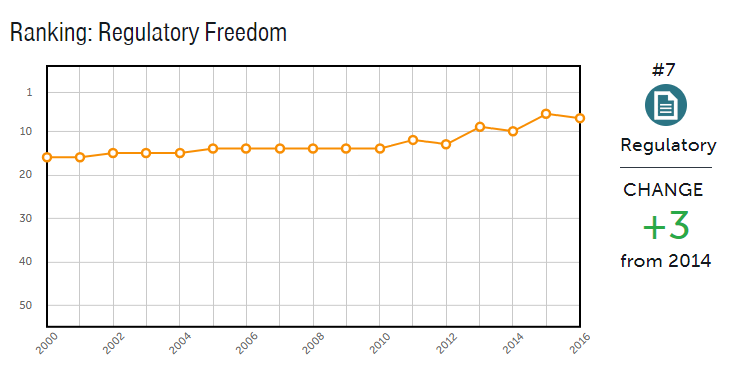

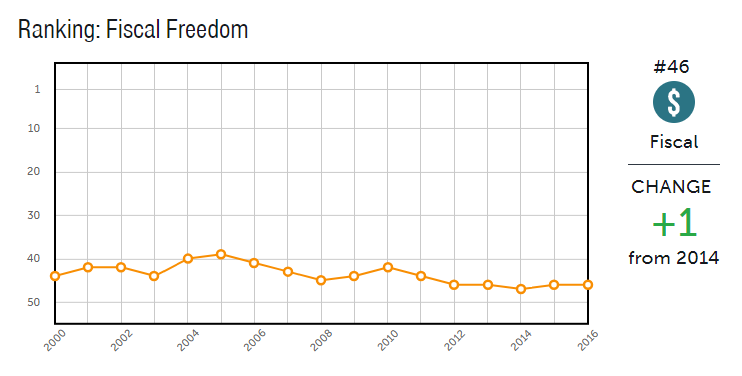

A new report from a libertarian think tank shows personal and economic freedom is growing in Mississippi though we are still in the bottom 20 percent.

Cato Institute’s Freedom in the Fifty States tracks freedom based on fiscal policy, regulatory policy, and personal freedom. Mississippi came in at 40th overall, a five spot jump from 2014, though still lower than our peak of 32 in the early-2000s.

So what are we doing well?

Our regulatory policy is in the top 10, and is moving in the right direction. Two years ago, lawmakers adopted a new law that will require all new licensing regulations to be approved before they take effect, ensuring new attempts to stifle competition will be reviewed before they are finalized.

On land use freedom, health insurance freedom, labor market freedom, lawsuit freedom, and occupational freedom, which all encompass our regulatory policy, Mississippi is in the top half of all states in each category.

Where can we improve?

That was the good. But when it comes to fiscal policy, we have much room for growth. And it appears we are only moving backwards.

Fiscal policy includes state and local taxation, government consumption, investment, employment, and debt. Essentially, how much are you being taxed and how much of our economic activity is controlled by government?

“Mississippians’ overall tax burden is a bit above average nationally at 9.9 percent, but local taxes are quite low. This fiscal centralization goes along with a lack of choice among local government (less than 0.4 per 100 square miles). Debt is much lower than average, but government employment and consumption are far higher than average. State and local employment is 17.7 percent of private sector employment,” the report notes.

Policy recommendations? Reduce spending on health and hospitals, where we are the third most liberal spending state, and on education and public welfare, where we spend well more than the national average as a share of the economy. Make government smaller, and reduce state taxes.

Two years ago the legislature eliminated the 3 percent income tax bracket, permitted self-employed individuals to deduct half of their federal self-employment taxes, and removed the franchise tax on property and capital when fully implemented. That will help our future rankings.

And while fiscal freedom has been going in the wrong direction, we are on the right course in personal freedom, largely due to the criminal justice reforms lawmakers have begun to make. We currently came in 34th. To move in to the top half, we need to continue on the right path with those reforms.

How are our neighbors doing?

Among our four border states, we were the only state below 31st overall. Alabama, Louisiana, and Arkansas were rated 28th, 30th, and 31st respectively. The outlier- in a good way- was Tennessee at 7th.

| State | Overall | Fiscal | Regulatory | Personal |

| Mississippi | 40 | 46 | 7 | 34 |

| Alabama | 28 | 19 | 23 | 49 |

| Arkansas | 31 | 33 | 14 | 47 |

| Louisiana | 30 | 22 | 32 | 30 |

| Tennessee | 7 | 3 | 10 | 45 |

As we mentioned, regulatory policy is our strength and Mississippi’s 7th place ranking topped all neighboring states, including Tennessee. Personal freedom was a wash, only Louisiana enjoyed a rating higher than our 34th.

It comes back to fiscal policy. Arkansas is ranked 33rd, Louisiana is 22nd, Alabama is 19th. Tennessee? 3rd. So what are they doing? “The Volunteer State lacks an income tax, and both state and local tax collections fall below the national average. We show state-level taxes falling from 5.1 percent of adjusted personal income in FY 2007 to 4.3 percent in FY 2014 and then back up to 4.5 percent in FY 2017. Local taxes have also fallen a bit since 2006, from about 3.7 to 3.3 percent of income. State and local debt is low, at 17.2 percent of income, and so is government consumption and investment, at 9.7 percent of income. Government employment is only 10.7 percent of private employment, a big drop since 2010 as the job market has recovered,” the report mentions.

Over the past several years, Mississippi has made improvements in several areas. Only five states made greater gains over the past four years. Still, 40th isn’t where we want to hang our hat. By moving our fiscal policies closer to our neighbors, we will begin to enjoy a freer, and more prosperous, state.