|

MCPP Champions Important Foster Care Reform

New law provides a dollar-for-dollar tax break that will help transform foster care in Mississippi

|

|

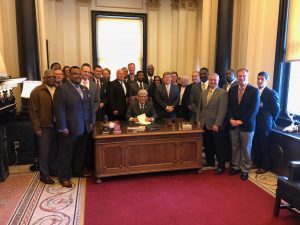

| (JACKSON) - A new law (HB 1566) signed by Mississippi Governor Phil Bryant provides a $1,000, dollar-for-dollar tax credit for donations to organizations that serve children and families in crisis. The Mississippi Center for Public Policy (MCPP), along with the governor’s Faith Advisory Council, championed the law. It will enable nonprofits across the state to expand their outreach to children in foster care, disabled children, and families in poverty.

Ron Matis, chairman of the Mississippi Faith Advisory Council, praised state lawmakers for supporting 1566: “Thanks to the visionary leadership of Governor Bryant, Lt. Gov. Tate Reeves, and Speaker Philip Gunn, Mississippi is leading the way in empowering the private sector to work alongside government to create a better future for our children in foster care. I am thankful that the Faith Advisory Council, in only its first year of existence, was able to work with lawmakers to launch this new initiative.”

The Mississippi Faith Advisory Council was created in 2017 to bring together diverse faith leaders around the state to help address the systemic problems of poverty and family breakdown in Mississippi.

Dr. Jameson Taylor, vice president of MCPP and vice chair of the Mississippi Faith Advisory Council, said: “This law is a game changer for Mississippi nonprofits. Based on a similar program in Arizona, we believe this law will generate millions of dollars in new services. Tax breaks like these can increase donations by as much as 5 to 1. That means that for every dollar contributed, the return will be $5 in new and additional services. I can’t imagine a better way to leverage a tax cut for the hardworking families of Mississippi.”

The new law creates a $1,000 tax credit for married couples filing jointly (or $500 for individual filers) who donate to organizations that assist children who are either already in foster care or at high risk of going into the state’s foster care system. A similar $800 credit ($400 individual filers) is available for taxpayers who donate to organizations that serve children with a disability or that serve low-income families. The law also doubles the existing $2,500 tax credit for adoptions to $5,000.

According to Faith Council Chairman Matis: “This law provides a tax cut for people who want to do something about the foster care crisis in our state. Not everyone can adopt a child in foster care, but everyone can give a small donation. By encouraging non-itemizers to give, this law will help build up the nonprofit sector in Mississippi.”

Concluded Dr. Taylor: “Mississippi is the second state in the country to pass this innovative approach to helping children in foster care and families in need. Diverse organizations across the state will benefit, including GoodWill Industries, Salvation Army, and Catholic Charities. Most important, this tax credit will provide new tools and resources to the children and families of Mississippi to help them achieve a better life.”

Dr. Taylor may be contacted for media interviews at [email protected] or by calling 601-969-1300.

###

|

|

Getting it Right for Mississippi Families and Employers:

MCPP Proud to Support Criminal Justice Reform Law

The Mississippi Center for Public Policy (MCPP) is putting families first by encouraging efforts to get young men and fathers back to work. Last year, we made tremendous strides toward this goal by passing gold-standard welfare-to-work reforms. Mississippi’s progress in this area, in part, inspired President Trump to issue an executive order yesterday promoting welfare-to-work standards for federal entitlement programs.

We are also working to strengthen and reunify families by supporting criminal justice reforms that help ex-offenders obtain and keep jobs. One such package of reforms, HB 387, was signed into law today by Gov. Phil Bryant.

Dr. Jameson Taylor attends bill signing of HB 387

HB 387 builds on the successful model of criminal justice reform passed in 2014 by the Mississippi legislature. Owing to these reforms, according to analysis by The Pew Charitable Trusts, Mississippi has benefitted from:

- A more than 10 percent decline in our prison population.

- A renewed focus on violent offenders, who now occupy 63 percent of prison beds, as opposed to 56 percent previously.

- A 5 percent decline in the property crime rate, along with a historically low violent crime rate.

HB 387 reduces red tape that sometimes prevents former inmates from getting and keeping jobs. For example, the law requires parole officers to accommodate parolees' work schedules. HB 387 also requires a one-time census of county jails so lawmakers can better understand how to deal with this population.

HB 387 was sponsored by Rep. Andy Gipson (now Commissioner of Agriculture and Commerce), assisted by Rep. Joel Bomgar and others. The legislation was also supported by a broad coalition of organizations (see letters below), such as Right on Crime, Prison Fellowship, and the Mississippi Faith Advisory Council. In particular, Americans for Prosperity played an important role in supporting HB 387. MCPP was happy to help with their efforts. Please join us in celebrating this victory and applauding Gov. Phil Bryant for supporting smart and effective criminal justice reform.

Coalition letter supporting HB 387

Coalition letter supporting HB 387

(Click to read full letter)

Coalition letter supporting criminal justice reforms

(Click to read full letter)

|

Mississippi Center for Public Policy Names New CEO

|

Jon L. Pritchett Named MCPP’s Next Leader

|

|

|

|

(JACKSON) – The Board of Directors of the Mississippi Center for Public Policy (MCPP) has named Jon L. Pritchett as its new President and CEO. Pritchett is a native of North Carolina and comes to MCPP from the Tar Heel state’s John Locke Foundation, one of the nation’s oldest and most respected free-market, public policy think tanks, where he was Senior Vice President. Pritchett replaces MCPP's longtime president, Forest Thigpen. (JACKSON) – The Board of Directors of the Mississippi Center for Public Policy (MCPP) has named Jon L. Pritchett as its new President and CEO. Pritchett is a native of North Carolina and comes to MCPP from the Tar Heel state’s John Locke Foundation, one of the nation’s oldest and most respected free-market, public policy think tanks, where he was Senior Vice President. Pritchett replaces MCPP's longtime president, Forest Thigpen.

Before working in public policy, Pritchett spent nearly three decades in the private sector in a variety of leadership positions. Among other executive roles, which included investment banking, public relations, and sports marketing, Pritchett was CEO of AstroTurf USA.

MCPP Board Chairman, Mike Dawkins said, “Jon Pritchett understands that the purpose of a free-market think tank is to guide policy, not based on political party affiliation, but based on principle. Jon will have a broad appeal to Mississippians across ideological lines. He communicates well with people with whom he may not agree because he respects their perspectives, while still holding to principles that will create a better place for all Mississippians. He challenges the mindset that a 'conservative' lacks compassion for the economically disadvantaged. Jon has succeeded as a business person and as an emerging leader in the free-market movement. Our board believes we have found an outstanding leader to guide MCPP.”

“Jon Pritchett is the consummate professional,” remarked John Locke Foundation Board Member, Theodore Hicks. “He loves liberty and is willing to fight for her, but always as a well-articulated, gentleman. Our loss is Mississippi’s gain. With Jon at the helm of MCPP, there’s no doubt that freedom in Mississippi will expand,” added Hicks.

When asked why she thought Pritchett was the right person to lead MCPP, MCPP Board Member, Gloria Walker responded, “We are beyond delighted that Jon and his family are moving to Jackson. We welcome the experience, passion, and energy that he brings to the position of President and CEO, because these skills are necessary for us to be successful in our mission to increase transparency at all levels of government. We look forward to working with Jon and are confident that he will bring a respect for traditional values that many Mississippians hold so dear. MCPP is very much alive and ready to start a new chapter.”

Pritchett will join the organization at the beginning of April. According to Pritchett, his immediate goals are focused on communications and fundraising. “The excellent work of MCPP and its talented staff is not as well-known across the state of Mississippi as it should be. Mississippians need to know about the vital work MCPP and the Mississippi Justice Institute do to fight the enemies of liberty, to enhance freedom, to limit government, to ensure choice and competition, and to promote the foundational principles of a thriving society, including individual responsibility and strong traditional families. And this work cannot be done in a robust and meaningful way without raising funds from individuals, foundations, and businesses,” said Pritchett. Unlike most 501(c)3 non-profit organizations, the Mississippi Center for Public Policy takes no money from government sources at the local, state or federal level. Pritchett continued, “I’m honored to have the opportunity to work with our staff and board to build onto the substantial foundation developed over 25 years by Forest Thigpen."

Jon is no stranger to Mississippi. When Jon was CEO of AstroTurf USA, Mississippi native Archie Manning served as AstroTurf''s spokesperson. Manning remarked, “I’ve known Jon since 2007, when I became involved with AstroTurf. He’s a strong leader, and I’m excited for Mississippi and for Jon.”

In addition to his role as a leader, manager, and fundraiser, Pritchett also writes op-eds on a variety of public policy issues, including corporate social activism, business regulations, culture wars, the business of sports, and leadership. His work has been published in the Wall Street Journal, Forbes, The Federalist, and Washington Examiner, among others. He has appeared on the Fox Business Network, the YES Network, and on the BBC. Pritchett also co-hosts a weekly podcast called Head Locke, which is a unique look at current news, culture, sports, business, and public policy.

Read Jon Pritchett's Bio HERE

Download Jon Pritchett's Head shot HERE

####

The Mississippi Center for Public Policy (MCPP) is an independent, non-profit, public policy organization based in Jackson, MS. MCPP works to promote and protect the concepts of free markets, limited government, and strong traditional families. |

|

Mississippi Center for Public Policy Applauds

Governor Bryant for Signing 15-Week Pro-Life Bill

The Gestational Age Act (HB 1510) will make abortion safer

and rarer in Mississippi while preserving abortion access.

|

|

Ron Matis, Gov. Phil Bryant and MCPP VP for Policy Dr. Jameson Taylor

| (JACKSON) – The Mississippi Center for Public Policy (MCPP) applauds Governor Phil Bryant for signing the Gestational Age Act (HB 1510), which will make abortion safer and rarer in Mississippi while preserving abortion access. MCPP played a key role in drafting the law and educating lawmakers about why women in Mississippi will benefit from this legislation. MCPP acting president Dr. Jameson Taylor comments on the bill becoming law:

“Right now, we are seeing a dialogue among the states on abortion policy. States, along with the Supreme Court, have rejected the rigid framework of Roe v. Wade and are acknowledging the sensibility of reasonable restrictions on abortion aimed at protecting maternal health and the life of the unborn. Public opinion agrees, and a majority of voters support commonsense laws that would make abortion safer and rarer.

“The state of Mississippi has an obligation to make abortion as safe as possible. Thanks to the leadership of Lt. Gov. Tate Reeves and Speaker Philip Gunn, this legislation accomplishes that goal. Late-term abortions that occur after the first trimester are very dangerous to the mother’s health. Many doctors, also, don’t want to perform them. This regulation strikes a reasonable balance in favor of protecting maternal health.”

Continues Dr. Taylor:

“U.S. abortion policy is very radical. Most of the world, more than 90 percent of countries, limits abortion after the first trimester. Mississippi is recognizing the international medical and scientific consensus on this issue. We believe this law should be a model for the rest of the country because it’s the same standard used by the rest of the world.

“3-D and 4-D ultrasounds are showing mothers all over the world that their unborn child has a beating heart and can move, hear, taste, see, and feel pain. Even pro-abortion apologists acknowledge that every abortion is a tragedy and that the unborn child has a human form. This law is aimed at making abortion safer and rarer.”

Sixteen states have enforceable limits on abortion at 20-weeks. Mississippi’s own 20-week law has not been challenged in court. To learn more, read our recent brief, “Pro-Life Bill Strikes the Right Balance.”

Dr. Taylor may be contacted for media interviews at [email protected] or by calling 601-969-1300.

####

|

|

Pro-Life Bill Strikes Right Balance

|

|

|

The Mississippi Center for Public Policy is proudly pro-woman and pro-life. Our vision for Mississippi is simple: to be the best state in America to raise a family, run a business and enjoy the blessings of a good life. As part of that vision, we want Mississippi to have the best health care system in America. We also want Mississippi to have the best economy in America. And we want to be the best at protecting basic human rights, including the right to life.

That is why we strongly support HB 1510, the 15-week Abortion Limit bill. This legislation strikes the right balance for Mississippi by protecting the health of the woman considering abortion and by protecting the life of the unborn. In doing so, this commonsense bill protects women from serious and significant risks and protects the life of the unborn child with a beating heart who can move, hear, taste, see, and feel pain.

Consider these facts:

HB 1510 protects women …

- HB 1510 will increase the safety of abortions for the mother by limiting elective abortions to 15-weeks. It will also preserve the legality of abortion where it is necessary to preserve the life of the mother.

- According to the pro-abortion Guttmacher Institute (Planned Parenthood’s think tank), the risk of a mother dying from an abortion increases more than 2,100 percent between 8-weeks and 18-weeks of pregnancy. Maternal mortality increases by 38 percent with every week after 8-weeks gestation.

HB 1510 does not impose an undue burden …

- Nationwide, approximately 95 percent of abortions occur during the first 15-weeks. According to the Centers for Disease Control and Prevention (CDC), just 1.1 percent of abortions in Mississippi take place after the fifteenth week.

- The medical and scientific consensus around the world is that abortion after the first trimester is an unsafe option that should be limited. 92 percent of countries limit abortion after the first trimester.

- The United States is one of only four nations that permit abortion-on-demand throughout all 9 months of pregnancy. Any democracy that values life should not have abortion laws that align with North Korea and China.

- Recent national polling (January 2018) indicates the vast majority (76 percent) of voters support commonsense laws regarding abortion, with a limit after the first trimester being one of the preferred options.

HB 1510 is constitutional …

Planned Parenthood relies on old case law from Roe v. Wade (1973) to claim that states can’t regulate pre-viability abortions. This is old law based on old science. A recent Supreme Court decision, Gonzales v. Carhart (2007), upholds the legality of limiting abortion, even in cases of pre-viability:

- “The Act does apply both pre-viability and post-viability because, by common understanding and scientific terminology, a fetus is a living organism while within the womb, whether or not it is viable outside the womb.”

- “Casey rejected both Roe’s rigid trimester framework and the interpretation of Roe that considered all pre-viability regulations of abortion unwarranted. 505 U. S., at 875-876, 878 (plurality opinion). On this point Casey overruled the holdings in two cases because they undervalued the State’s interest in potential life.”

Other U.S. Supreme Court decisions confirm this reasoning:

- PP v. Casey (1992): “The State has an interest in protecting the life of the unborn.”

- Webster v. Reproductive Health (1989): “We do not see why the State’s interest in protecting potential human life should come into existence only at the point of viability, and that there should therefore be a rigid line allowing state regulation after viability but prohibiting it before viability.”

Let our state lawmakers know you support this commonsense bill. Please, also, pray for women and children harmed by abortion.

To read more, see the recent news coverage on HB 1510:

Jameson Taylor, acting president of the Mississippi Center for Public Policy, a conservative think tank that helped lawmakers draft the bill, said the legislation would bring Mississippi in line with the majority of countries across the world that limit abortion after the first trimester.

"The bill is important," he said, "because it takes another step in protecting maternal health and advancing the state's interest in protecting pre-born life."

... But viability was not the only issue, Taylor said.

"The question of viability is no longer the preeminent question that the courts look at," he said. "The question is, what kind of burden does this regulation place? Does this basically make some kind of rational sense? We believe that the 15-week limit certainly meets that standard because you have 75% of countries around the world that limit abortion after the first trimester."

"Clearly, the court's thinking on this issue is evolving, as it should be," he added. "Science is also evolving."

The conservative-leaning Mississippi Center for Public Policy helped craft the bill and praised lawmakers for passing it.

Acting President Jameson Taylor said the bill protects maternal health and “further(s) the state’s interest in protecting unborn human life.” He added that the Center is “thrilled” for having played a role. …

“We would welcome the court to clarify the extent to which states can regulate abortions, particularly with regard to maternal health,” Taylor said.

“Abortion policy in the United States is based on outdated science that the rest of the world rejects,” Dr. Jameson Taylor, acting President of the Mississippi Center for Public Policy, told LifeSiteNews. “Health care professionals around the world recognize that late-term abortions, those performed after the first trimester, are harmful for women and also violate the integrity of the medical profession itself.”

“Lt. Gov. Tate Reeves and the Mississippi Senate deserve our support and prayers for making Mississippi a leading voice in protecting basic human rights and women’s health,” he said.

|

|

Victory for charter schools in Mississippi

Mississippi Justice Institute and other defendants protect constitutionality of charter schools according to trial court

(JACKSON) – Hinds County Chancery Judge Dewayne Thomas ruled today in the lawsuit challenging the constitutionality of charters schools in Mississippi. Judge Thomas ruled in favor of the charter schools and their parents, and against the Southern Poverty Law Center.

Mississippi Justice Institute (MJI) Director Shadrack White, who represents the parents of charter school students, said, “This is a critical victory for the parents and their children who attend charter schools in Mississippi. Judge Thomas saw that the constitution does not trap my clients in their traditional public schools when public charter schools provide a better option. These parents know what’s best for their children.”

The charter lawsuit turned on whether the Mississippi Constitution allowed funding from state and local governments to be spent at charter schools. “Our case was simple,” said White. “My clients pay taxes, so they should have the right to take that money to a public charter school if that is a better option for their children. These schools are making their lives better. The plaintiffs in this case, however, had an extreme argument: that the funding for charter schools, agricultural schools, some alternative schools, and other types of non-traditional public schools should be barred.”

“As this case marches forward, I am going to continue thinking about all the good that charter schools have done for my clients, like Gladys Overton and her daughter Drew,” said White. “When we started this case, Gladys told us that, in her old school, Drew experienced nonstop bullying and a difficult classroom environment. Drew moved to ReImagine Prep, a charter school in Jackson, and today she is thriving. She was the most improved student in her class last year and, like every other student at ReImagine, is learning computer coding skills to prepare her for the workforce.”

“Students like Drew are who we fight for,” added White.

####

One benefit of doing the right thing is that it just works better. We know that innovation and choice are good for parents and kids, but the economic and social impacts can also be a game changer for our state. School choice for Mississippi can help create jobs, lower the crime rate and reduce welfare dependency. School choice works and will help average Mississippians get back to work.

The following is the abstract from a new study released by the Institute for Market Studies at Mississippi State University titled Mississippi’s Game Changer: The Economic Impacts of Universal School Choice in Mississippi.

Mississippi has a unique opportunity to improve its future economic condition through implementing a fully universal Education Savings Account (ESA) program. We forecast the economic impacts of such a program accrued through decreased criminal activity, increased high school graduation rates, and increased lifetime earnings. Our models assuming a higher rate of program participation find:

● Mississippi would pass West Virginia in 14 years on per capita personal income, and the advantage would grow to around $2,300 per person by the year 2036.

● Mississippi’s streets would have 9,990 fewer felons and 13,824 fewer misdemeanants by 2036, leading to a reduction of over $384 million in costs to society.

● Mississippi would have 7,798 more graduates by 2036, leading to social benefits in excess of $1.6 billion.

Our models assuming moderate rates of program growth find:

● Mississippi would pass West Virginia in less than two decades on per capita personal income and the advantage would grow to around $700 per person by the year 2036.

● Mississippi would have 6,191 fewer felons and 8,566 fewer misdemeanants by 2036, leading to a reduction of over $238 million in costs to society.

● Mississippi would have 5,338 more graduates by 2036, leading to social benefits in excess of $1 billion.

Read the full study HERE

By Shadrack White

For years, the Obama administration’s Justice Department would sue companies, reach a settlement agreement with those companies and then use these settlements to create slush funds for left-leaning groups. In doing so they secretly discriminated against organizations with different political views. Recently released internal emails show Obama administration officials discussed how settlement agreements should be drafted so that the funds could never be used for “conservative property-rights free legal services” — heaven forbid!

Unfortunately, Mississippi is also using settlement shakedowns aimed at funneling money to pet projects. Several weeks ago, the Clarion Ledger reported that Mississippi Attorney General Jim Hood obtained $2.5 million in a settlement with banks and credit rating bureaus and that money would be spent on a financial literacy program for Mississippians. The move is unconstitutional, and even if it weren’t, it’s bad policy.

The AG’s plan is bad policy because it invites unilateral control of spending by one person or a small group. Taxpayers deserve to have spending done in the open by the people that we elect to do that job, the Legislature.

“But Shadrack, isn’t the money going to a good cause?” you might ask. There are many good causes — public education, transportation, health care — competing for state funding. This is all the more reason to make sure that money is not being appropriated in the dark by bureaucrats but rather in light of day where it can be weighed against alternative ways to spend the money.

If you are inclined to disagree, think of this: what if the AG were a conservative who sued and obtained a settlement from Planned Parenthood and then set up a fund that paid for a pro-life crisis pregnancy center? I might like that idea, but my guess is others would then suddenly see the value in a different process for appropriating the money.

The rule of law is about setting up processes that function the same way every time — fair rules for everyone — regardless of whether you happen to like the person in charge and what they are doing. And, as required by the state constitution, this means any settlement money must be sent to the Legislature’s General Fund. Article 4 of the Mississippi Constitution indicates no branch other than the Legislature is given appropriating powers.

If it feels like you’ve heard this argument about settlements before, you have. In 1998, then-Attorney General Mike Moore filed a suit against and then reached a settlement with the big tobacco companies. The money from that settlement was used to fund a nonprofit established by Moore called The Partnership for a Healthy Mississippi. In 2005, Gov. Haley Barbour intervened in the AG’s tobacco suit and claimed the AG’s settlement illegally steered money away from the Legislature and to the Partnership.

The governor’s challenge went all the way to the Mississippi Supreme Court. The court stated that one thing was obvious: “(t)he Legislature holds the purse strings” and “the right of the Legislature to control the public treasury . . . is firmly and inexpugnably established in our political system.”

Of course, every case is different, and the AG seems to believe some loophole allows him to spend this current settlement money without legislative approval. But governing and spending by loophole is poor policy. Moreover, the tobacco settlement case shows the state Supreme Court would take a dim view of other elected officials circumventing the appropriations process.

The Mississippi Supreme Court could clarify that these settlements are unconstitutional, but to do so they would have to wait for a case about this question to reach them. The Legislature and governor could also do this through a statute.

If they did, they would be following the lead of the Trump administration, which has now put a stop to the sue-and-settle tricks so prevalent under Obama. At the federal level, settlement money must now go directly into the federal budget and be properly appropriated by Congress. The U.S. Senate even has a bill to codify the Trump policy into law. No doubt, the federal budget process, as well as the state budget process, could use some improvement. But at least there is a constitutionally protected process in place. Elected officials here could follow the Trump administration and respect this process instead of determining for themselves how to spend money that is not theirs.

Lotteries tend to be popular with the public because they conjure up dreams of easy money and the good life. Indeed, Mississippi voters approved the concept of a state lottery in 1992 when they repealed a constitutional ban on lotteries. That same year, Mississippi’s first dockside casino opened. While many forms of gambling are now legal in Mississippi, state law still prohibits the operation of a lottery and the in-state purchase of lottery tickets.

In evaluating whether Mississippi should legalize the lottery, lawmakers should realize, first and foremost, that the lottery is a kind of tax – and that, in particular, it is a regressive, or unfair, tax that has negative social impacts.

The Lottery is a New Tax

The primary purpose of a state-monopolized lottery is to generate revenue for the state. This reality is not well understood. There are essentially two types of lotteries: those operated by private vendors; and those controlled by government. Because private lotteries have historically been plagued by corrupt practices (and not infrequently government-run lotteries as well), states have sought to control their own lotteries.

Currently, all but a handful of states have state-controlled lottery monopolies. These monopolies are unique insofar as they are not “natural monopolies.” Road building, sewerage provision, and until recently, mail delivery, are examples of natural monopolies typically presumed to be properly controlled by government. In the case of the lottery no overriding financial or logistical reason justifies a government monopoly.

The state’s monopoly over the lottery allows it to charge a price for the lottery ticket that is well above what a private lottery might charge. This excess charge is essentially a tax. The tax is around 27 percent, but it varies in every state. This 27 percent surcharge is what in gambling parlance is called “the vig.” It’s what “the House” gets regardless of the outcome. In the case of the lottery, the House is the state – and it has a big edge. After the government gets its take, the rest of the money generated by the lottery will go toward winnings and administration. Then, the actual winner has to pay state and federal income taxes on top of that.

It might seem strange to think of the lottery as a tax. The Tax Foundation explains:

Lottery revenue meets all three tests for defining a tax. Current U.S. Supreme Court Justice Stephen Breyer laid out the criteria for defining a tax when he decided the San Juan Cellular case for the First Circuit Court of Appeals in 1992. Breyer argued that a judge should consider who imposes the assessment, who pays the assessment, and what the revenue is spent on.

In the case of a lottery, the Mississippi legislature would be imposing the assessment – just like any other tax, as opposed to a targeted fee imposed by a state agency. Likewise, lottery ticket buyers represent “a broad swath of the public,” rather than a “narrow group that benefits from a particular government service.” In its application, the lottery thus functions like a tax, rather than a fine or fee. Finally, lottery revenue is generally fungible, or at least spent on a “broadly defined benefit.” In short, the lottery meets all three legal tests for defining a tax.

The following statements by lottery proponents confirm this conclusion:

“The Legislature is not passing any revenue (tax increase). That (lottery revenue) is money available for education – should be spent on education.” – Mississippi Attorney General Jim Hood

“When you’re looking at some of the challenges that we’re having and you see a revenue bill that would generate somewhere between 50 and 60 million dollars – just an estimate – I think that's something that needs to be taken seriously by the members of both the House and the Senate.” – Mississippi Governor Phil Bryant

“I think it should go to education. But in as much as when we earmark money, sometimes we take that money from that department, so with that in mind, the best thing would be to just put it in the general fund.” – State Rep. Alyce Clarke

In summary, the lottery is a “revenue bill” that will be passed with the intention of generating money for the General Fund, or at least, for a broadly defined purpose, such as education. In other words, it meets the legal definition of a tax.

Lottery proponents often balk at defining the lottery as a tax, asserting that buying a lottery ticket is voluntary. Because the state would hold a monopoly over the lottery, however, the tax is not voluntary at all. In order to purchase a lottery ticket, consumers must pay the lottery tax. True, participating in the lottery is not mandatory, but neither is purchasing a car, earning income, or doing all manner of things that are taxed. As long as the primary purpose of the lottery is to generate revenue, and as long as a significant portion of lottery profits are collected as revenue, the lottery is a tax.

Under Mississippi’s joint legislative rules (rule 18), all bills generally related to revenue must be accorded a 3/5 vote by the legislature. Because the lottery is a tax (and, at a minimum, related to raising revenue) any bill that would create a state-controlled lottery must pass by a 3/5 vote in the Mississippi legislature. Otherwise, the lottery will be challenged in state court.

Because the lottery is a tax, its fiscal impact must also be evaluated in light of other forms of taxation. While all taxes influence behavior in some way, economists generally agree taxes should have low compliance costs, be fairly applied and minimize negative social impacts.

The Lottery is a Bad Tax

In comparison to other taxes, the lottery is particularly bad policy. To begin with, the lottery is an inefficient tax with high administrative costs. Observes economist Dr. Roy Cordato: “To raise a dollar’s worth of state revenue through a lottery could cost anywhere from 20 to over 50 times more than it would cost to raise the same dollar through other forms of taxation.” These administrative costs are thought to range between 15 percent and 20 percent and go toward advertising and paying retailers who sell lottery tickets.

In addition, the lottery is an unfair, or “regressive” tax. Generally speaking, “a regressive tax imposes a greater burden (relative to resources) on the poor than on the rich.”

In 2015, Americans spent $73 billion on lottery tickets. That’s about $630 for every household in the United States. It’s also about the same amount spent on the SNAP (Food Stamps) program annually. According to the Associated Press, Americans spend more on the lottery than on “movies, video games, books, music and sports tickets combined.”

Every American household, however, is not spending $630 on the lottery. Generally, the poorest one-third of Americans buy more than half of all lottery tickets. Even the North American Association of State and Provincial Lotteries, an industry association group, acknowledges 25 percent of lottery players earn less than $25,000 annually.

A report from Harvard’s Shorenstein Center on Media, Politics and Public Policy reviews some of the academic literature demonstrating the regressivity of the lottery tax:

A 2012 report in the Journal of Gambling Studies finds that “those in the lowest fifth in terms of socioeconomic status (SES) had the ‘highest rate of lottery gambling (61%) and the highest mean level of days gambled in the past year (26.1 days).’”

A 2011 study, also in the Journal of Gambling Studies, concludes the “poor are still the leading patron of the lottery.”

A 2010 report in the Journal of Community Psychology observes that “lottery outlets are often clustered in neighborhoods with large numbers of minorities, who are at greatest risk for developing gambling addictions.”

Likewise, a 2009 survey commissioned by the South Carolina lottery found that those earning less than $40,000 a year constitute the majority of lottery players, even though they make up less than one-third of the state’s population. Another 10-year study that looked at lottery sales data in 39 states found “a strong and positive relationship between sales and poverty rates” (but not a similar relation between poverty and movie ticket sales, movies being an alternative form of inexpensive entertainment). The authors, however, conclude that “the poor are relatively more likely to see the lottery as a financial investment, and relatively less likely to play for entertainment.” Similarly, other research suggests lottery ticket purchases are financed by forgoing basic necessities. Generally, the breakdown is a 3 percent reduction of spending on food; and a 7 percent reduction on rent and other items.

Again, all this is to say that the lottery is a regressive tax disproportionately paid by low-income people.

In terms of tax policy, it’s also helpful to consider what kind of behavior a lottery tax encourages or discourages. The real question here is whether a state lottery would encourage more gambling or whether it would merely capture gambling that is already occurring via other lotteries in neighboring states.

The answer is complex. Clearly, Mississippi is hoping to both capture a market that exists (and is being diverted to other states) and also develop a new market. The strongest argument for a state lottery is that the state is losing lottery tax revenue to other states when Mississippi residents buy lottery tickets in other states. Interestingly enough, the two states immune to this dynamic – Alaska and Hawaii – do not have state lotteries.

Clearly, for many Mississippi residents, travelling to another state to buy a lottery ticket constitutes an investment of time and money – what economists call an “opportunity cost.” Some evidence suggests that, all things being equal, large jackpots are necessary to attract middle-class and out-of-state customers to buy out-of-state lottery tickets. When the jackpot is high enough, people will drive to another state to buy a lottery ticket. These same customers are more likely to play the lottery as a form of entertainment.

By contrast, low-income players disproportionately favor scratch-off (instant win) lottery cards; and the largest segment of lottery revenue (as high as 80 percent) comes from scratch-off games. For this reason, scratch-off cards represent the worst, and most regressive, form of lottery taxation. While the state is likely “losing” some revenue to players who cross the border to play scratch-offs, the spontaneous nature of such play suggests the loss is minimal. No doubt, a legalized lottery will see targeted advertising aimed at creating new players for these games. As in other states, much of this advertising will appear in low-income neighborhoods. As in other states, every year will see new marketing plans aimed at attracting new players. As in other states, new and more games will be developed with the hope of increasing frequency of play. In order to keep generating revenue from the lottery tax, the government will become the foremost proponent of gambling in Mississippi.

Some readers will note that this brief is silent about the ethics of a lottery. From an economic perspective, a lottery is destructive because it is a nonproductive activity. As stated above, the lottery, at best, is a form of entertainment; at worst, it is encouraging poor financial decisions by those who can least afford to gamble away their resources. In terms of tax policy, the lottery constitutes a high new tax with a regressive impact on the majority of players.