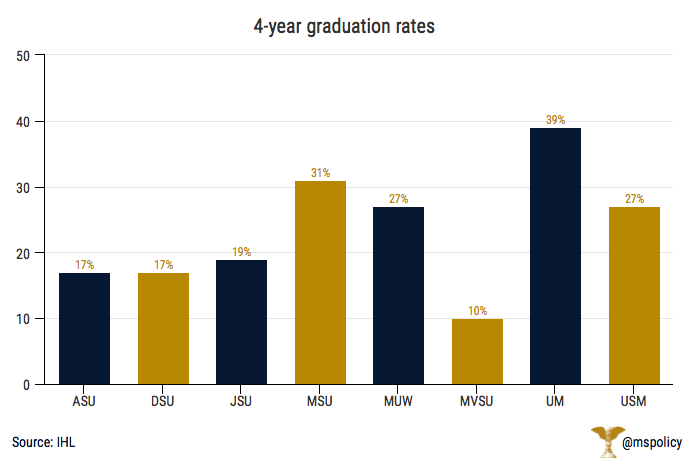

Only 29 percent of students who entered a public university in 2009 in Mississippi graduated within four years.

That is according to the most recent data from the Education Achievement Council Report Card, which was recently made available by the Institutes for Higher Learning. The national average, according to the United States Department of Education, is 40 percent for all four-year institutions and 35 percent for public institutions.

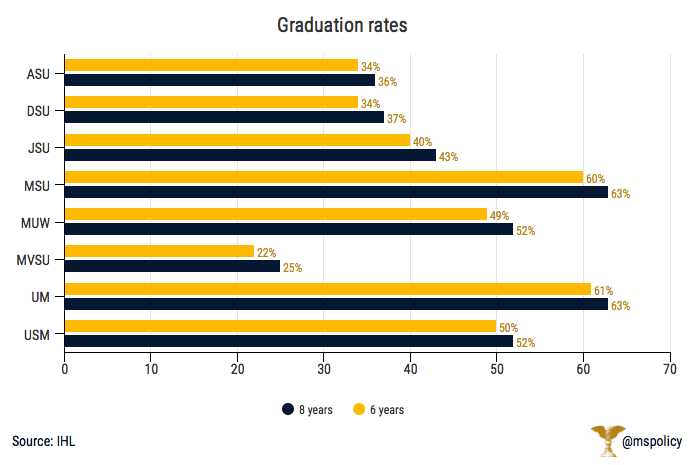

Fifty-two percent in Mississippi graduate within six years and 54 percent graduate within eight years. Nationally, 59 percent graduate (including data from both all institutions and public institutions only) within six years.

Ole Miss had the highest four-year graduation rate at 39 percent, though that is still less than two-in-five students. Thirty-one percent graduate within four years at Mississippi State. Mississippi Valley State had the lowest four-year graduation rate at just 10 percent.

Ole Miss (61 percent), Mississippi State (60 percent) and Southern Miss (50 percent) were the only three institutions to have more than half of the freshmen graduate within six years. Mississippi University for Women just missed that cut at 49 percent. Valley, once again, had the lowest six-year graduation rate at just 25 percent.

But Valley also had 47 percent of their new undergraduate students enrolled in one of more intermediate courses, with about a quarter enrolled in both math and reading courses during their first year.

In contrast, just seven percent of new undergraduate students at Mississippi State and eight percent at Ole Miss required such courses. The system average was 16 percent.

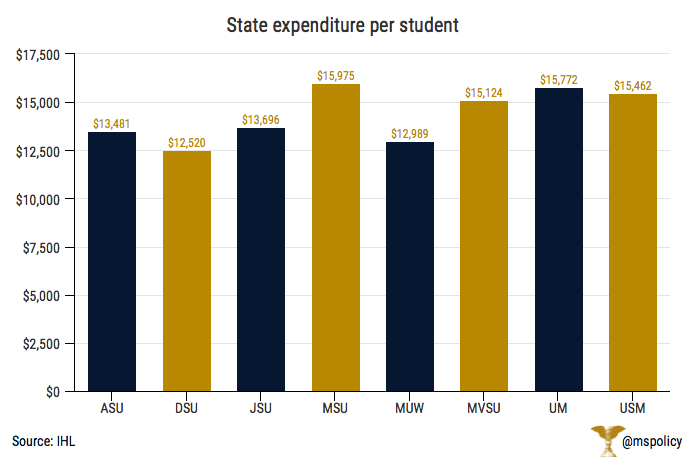

Higher education spending accounts for about 13 percent of the state budget. Broken down, the total state expenditure per full-time equivalent student topped $15,000 at half of the universities. The highest was Mississippi State at $15,975 followed by Ole Miss ($15,772), Southern Miss ($15,462), and Valley ($15,124). Delta State had the lowest mark at $12,520.

The report cards for each university can be found here.

Mississippi did not join most states in holding statewide elections on Tuesday. That will be next year when every statewide, legislative, and county office will be on the ballot.

But that doesn't mean we didn't have action in the Magnolia State.

Mississippi was in the unique position of holding two United States Senate elections, with the regularly scheduled election for the seat currently held by Sen. Roger Wicker and the special election following former Sen. Thad Cochran’s retirement earlier this year.

Wicker won going away, picking up 59 percent of the vote. In the special election, Sen. Cindy Hyde-Smith, who was appointed by Gov. Phil Bryant, will be in a runoff with Mike Espy, a former Democratic Congressman and secretary in the Clinton administration.

Under Mississippi election law, special elections are essentially a jungle primary. There is no party identification, and everyone who qualifies is on the ballot. If no candidate receives a majority, as was the case on Tuesday, a runoff is held three week later. Hyde-Smith received 42 percent of the vote, Espy was at 41 percent, and Chris McDaniel, who almost defeated Cochran four years ago, was at 16 percent.

What McDaniel’s poor showing may mean will be a question that is being asked today, and will be discussed over the next year.

Essentially, the Republican vote was the same in both Senate races. It was just slightly split in the special election. If Hyde-Smith is successful, she will join a larger Republican majority in the Senate. Pending final counts in Arizona, Republicans may be up to a 54-46 majority in the Senate when all is said and done. This has one major political implication – judicial confirmations.

Conservatives will no longer have to hold their breath on Sens. Susan Collins and Lisa Murkowski (or Jeff Flake). Perhaps now the many constitutional conservatives and federalist society members will have an opportunity to fill the vacancies and counter balance the President Obama era judges. And there will plenty of energy to use the new strength in the Senate to confirm President Trump’s judicial nominations.

What else might happen in Washington? That is to be determined with Democrats winning control of the House of Representatives. Their immediate priorities seem to be a furthering of “the resistance” with investigations and potential impeachment proceedings, but they will likely also attempt to push through a progressive agenda. Expect a lot of gridlock for at least the next two years, but for those of us who favor limited government that isn’t necessarily the worst thing in the world.

The divided government will likely be good for trade, which is a good thing for the market. Criminal justice reform should continue to receive attention. We expect to see more regulatory reform from the White House and his Cabinet, something that will benefit us all. We expect immigration and healthcare policy to continue to be lightning rods. However, we may also see bipartisan agreement on areas like infrastructure spending. Unfortunately, that probably portends an increasing debt load for the American people.

One thing we can predict with relative certainty – Speaker Nancy Pelosi and President Donald Trump will be a great spectacle. While that may not be a great compliment to the current state of affairs in our Republic, it should make for very entertaining content for television… and Twitter is guaranteed to survive for at least a few more years.

After a great deal of debate and discussion over the past year, the new food truck regulations in Tupelo do not include the controversial, and potentially illegal, restrictions that some on the council had floated.

According to the Daily Journal, the final draft looks similar to the draft that was released last month. It did not include a blanket restriction on streets that food trucks could be located, nor did it have a provision requiring food trucks to be a certain distance from brick-and-mortar restaurants.

Protection for brick-and-mortar restaurants is what originally propelled this discussion.

Earlier this year, Councilman Willie Jennings said, in proposing the regulations, “I just want to make sure the established businesses are protected.” Another councilman, Markel Whittington, said brick-and-mortar restaurants have requested food truck regulations. While he didn’t feel food trucks posed a ‘threat’ to those restaurants, he believed it was appropriate for government to act ‘on behalf of select business interests.’

“I think we have to protect some of our taxpayers and high employers,” he said.

And after the first draft of the ordinance was released, Councilman Mike Bryan began to lobby for those brick-and-mortar restaurant protections, such as a ban on major roads. He continued that push until the end still calling for a Main Street parking ban.

“I feel like it is not fair to brick-and-mortar businesses to allow food trucks to park in front of their business,” Bryan said earlier.

But in the end, the controversial provisions were not included. And while there has been some support on the council, Mayor Jason Shelton has long opposed the protectionist measures.

When Tupelo leaders began discussing food truck regulations, Mississippi Justice Institute, the legal arm of Mississippi Center for Public Policy, sent a letter to the city warning of litigation if these regulations passed.

“The very regulation Tupelo is discussing—a regulation about how close a food truck should be to a restaurant—was found to be unenforceable just this past December in Baltimore. Food truck regulations around the country have been challenged over and over in court, from Louisville, to San Antonio, to Chicago, and many places in between. Cities ultimately realize that these kinds of cases are very hard to defend,” the letter said.

Having the food truck option is good for consumers and it is good for the economic interests of a city, whether that is Tupelo or any other city in Mississippi. A glance of the growing cities throughout America shows a thriving food truck market. Food trucks or brick-and-mortar restaurants is not an “either-or” proposition. They can both survive next to each other, and competition will only make each better.

And more choice for consumers is always a good thing. Because it will be the consumers who decide if food trucks are a benefit for Tupelo, not government regulators.

Economic development, incentives via the government, and economic growth, based on free market principles, should not be confused.

Well-meaning public officials, government employees, community business owners and executives, and chamber of commerce cheerleaders have the best of intentions when they propose ideas for economic development. I believe they are genuinely trying to help. I just wish they would stop. When we confuse economic development with economic growth, we make big mistakes in public finance. These two concepts may sound similar but they are, in fact, opposites. An emphasis on one or the other leads to different results.

Those of us interested in seeing economic growth advocate for broad public policies like lower taxes, a reduction of the regulatory burden on businesses, the elimination of double taxation on investments and savings, and a reliable and predictable legal and regulatory environment. In stark contrast, proponents of economic development argue for subsidies, tax abatements, and regulatory relief for specific businesses or industry types in particular regions. The latter believe the economy can be directed by government involvement; the former believe the economy will produce a better outcome when we leave it to the entrepreneurs and consumers to determine the direction.

For those of us with a belief in the durable power of free-markets, the choice is easy. We know, thanks to Adam Smith and 242 years of data, wealth is created by the free exchange between producers and consumers. If we leave markets free and allow the natural incentive of profit-seeking to work, without government trying to influence, direct, guide, orchestrate, manage or nudge, the states maximize their economic growth. Such growth is what drives long-term employment and increased prosperity. When we replace the decisions of entrepreneurs, investors, and consumers in the private market with decisions of politicians, government officials and development boards, we significantly lower the odds of achieving economic growth.

Economic development policy really means the state picking the winners and losers by employing direct subsidies and tax breaks to attract or promote specific businesses or industries. An authentic effort to grow our economy would not focus on giving targeted companies the assistance and resources without providing those to all companies and industries. It is not fair to the current companies in Mississippi, who built their businesses without government help, to find themselves competing with companies subsidized by taxpayers. For too long, Mississippi has followed a policy that supposes “economic development” can be a meaningful driver of economic well-being in the state. It cannot. That policy is a losing one.

The evidence produced from analysis points convincingly to the conclusion that these targeted incentives do not produce long-term benefits in excess of their costs. In many cases, the cost-per-job is extraordinarily high. While some high-profile companies and their political allies may be better off, non-beneficiary companies may lose workers or experience wage increases, or both, and the state’s economic activity as a whole slows.

When political favor seeking is emphasized like this, it thwarts the private sector and tips the scales in favor of those companies and individuals with access to political relationships. It sends a message to the private sector that it should not focus on consumer-oriented actions, like product/service innovation or marketing, and focus resources instead on lobbying, legal representation, and elections. That’s not a recipe for sustained economic growth.

While economic development incentives, like those practiced by the Mississippi Development Authority, may lead to the creation of new jobs; that does not mean such jobs lead to the creation of economic growth. Measuring jobs alone is an insufficient way to measure economic growth. For example, roughly 90% of the Canton-based Nissan plant employees were already employed when that Madison County facility opened. Those new employees were already paying state income taxes. Yet, every job created by the state and local government incentive package was subsidized. In total, roughly $1.3 billion was promised to Nissan. According to data analyzed by Mississippi State University’s Institute for Market Studies, Nissan pays its 6,400 workers at the plant an average of $62,500, which costs taxpayers $203,125 per worker. Had that taxpayer subsidy not occurred and the dollars remained in the private sector, would individuals and businesses have found a better “investment” use? Decades of economic research and free market evidence informs us that private citizens and firms are more effective at allocating resources to their highest uses than is government.

The chief argument around government incentives is that “everyone else is doing it, so we must join the process in order to remain competitive.” That’s the wrong approach. The desire to provide incentives is an acknowledgment that our tax, regulatory, and legal system is not competitive. It says our state has not adopted freedom-based policies. Instead of offering incentives to just a few, our goal should be to create the most business-friendly climate in the country. A public policy based on freedom is how we’ll grow our economy.

Rather than increase the hand of government in our economy, we should trust the “invisible hand” of the market place and the proven incentive of profit and loss for the allocation of resources. It is either folly or hubris to think government can have the knowledge to do that more efficiently than the market. Nobel Prize-winning economist F.A. Hayek once wrote, “The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.”

This column appeared in the Clarion Ledger on November 2, 2018.

Popular homesharing site Airbnb announced that they recently remitted $1 million in taxes to the state of Mississippi.

Since September 2017, Airbnb has been automatically collecting the 7 percent state sales tax and local tourism taxes on behalf of hosts and remitting the revenue directly to the state. At the time of the announcement, Airbnb anticipated collecting $245,000 during the past year.

Airbnb was able to quadruple expectations due to a 92 percent year-over-year growth for the platform in Mississippi. Over 69,000 guests utilized the service in the state during that time.

The fact that Airbnb collected and paid $1 million in taxes last year should be considered a good thing. The fact that consumers now have more choices if they want an option besides a traditional hotel is a good thing. And the fact that new competition has been inserted into the lodging industry is a good thing.

Of course, the industry that once enjoyed this monopoly doesn’t see things that way.

Linda Hornsby, executive director of the Mississippi Hotel and Lodging Association, calls it a “definite concern as it (homesharing) continues to grow.” She added, “We are monitoring the negative economic impact of that not just here in Mississippi...As it continues to grow, it exacerbates the problem.”

The so-called negative impact may be to one specific industry, but it is not to the guests who are gladly choosing this option. And it is certainly not a negative to the hosts who are earning a new income stream.

It is understandable that a group or organization that spent decades pursuing regulations to limit competition would be upset when new innovations threaten their monopoly. But the answer isn’t to impose outdated regulations on the new economy, but to deregulate existing industries.

And for government to rely on the free market and trust their citizens to be able to make the best decisions for themselves.

Few people would argue with the beauty of a California sunset. The bright lights of Times Square are tough to compete with. But there is one thing that can top the allure of California or Manhattan: your pocketbook.

While many on the left may argue that a certain class of Americans enjoy the high-tax, high-regulation burdens of our most liberal cities and states, and the perceived protections that go with it, the numbers paint a different picture.

Americans are moving to lower tax states where they are able to keep more of the money they earn. This isn’t a talking point, but a statistical reality based on migration data. Unfortunately, Mississippi is on the wrong side of both taxes and, as a result, in-migration.

Sales, property, and individual income taxes, as a percentage of personal income in Mississippi, are 9.9 percent, according to Cato Institute. That’s pretty high. In fact, only 14 states, including traditional high tax states like California, Connecticut, New Jersey, and New York, fared worse. All neighboring states had lower tax burdens than Mississippi. What effect does this have?

Mississippi had a net migration loss of over 3,500 in 2016. On a per capita basis, this means Mississippi lost 100 residents for every 88 the state gained. This is parallel with migration loses in Louisiana. Alabama and Arkansas were essentially flat in terms of migration while Tennessee added over 13,000 residents. For every 100 residents that Tennessee lost, they added 119.

Tennessee, a state without an individual income tax, is home to one of the lowest tax rates in the country with a tax burden of 6.5 percent. And they are reaping the benefits of smart fiscal policy. The Wall Street Journal reported in May: “Alliance-Bernstein Holding LP plans to relocate its headquarters, chief executive and most of its New York staff to Nashville, Tenn., in an attempt to cut costs…In a memo to employees, Alliance-Bernstein cited lower state, city and property taxes compared with the New York metropolitan area among the reasons for the relocation. Nashville’s affordable cost of living, shorter commutes and ability to draw talent were other factors.”

Twenty-six states had a tax burden of 8.5 percent or greater. Of those 26, 25 had a net out-migration. Only Maine was able to buck the trend. And not surprisingly, of the 17 states that had net migration gains in 2016, all but one has a tax burden of less than 8.5 percent. All totaled, more than 500,000 individuals moved from the top 25 highest-tax states to the 25 lowest-tax states in 2016. Those high tax states lost an aggregate income of $33 billion.

Along with the relatively high individual tax burden, our business tax climate sits at 31st best, according to the Tax Foundation. Not terrible, and actually better than Alabama, Arkansas, and Louisiana, but not great either. The same report had Tennessee at 16.

So what can we do in Mississippi? We can follow the lead of high-growth, low-tax states in the Southeast that have lower taxes, lighter licensure and regulatory burdens, and a smaller government.

This past session, the legislature debated a bill known as the “Brain Drain” Tax Credit. It would have provided a three-year income-tax exemption to recent college graduates who are Mississippi residents. And there was an additional two-year exemption for those who start a business. It passed the House unanimously but died in the Senate without a vote.

States are in competition with one another. We know this because we routinely offer incentives for select companies in the form of subsidies or tax breaks, or we propose eliminating the individual income tax for three to five years for recent college graduates.

While we are always in favor of lower taxes, these moves are just an acknowledgement that our tax burden hurts individual opportunity and the state’s economic growth. We have succeeded in phasing out the lowest income tax bracket. Instead of eliminating the income tax for just a few, we should work on eliminating the income tax for all taxpayers. And instead of offering incentives to just a few, our goal should be to create the most business-friendly climate in the country – for all types, sizes, and industries.

A public policy based on freedom is the recipe high-growth states have adopted. It’s how we’ll grow our economy in Mississippi, too.

This column appeared in the Daily Leader on October 31, 2018.

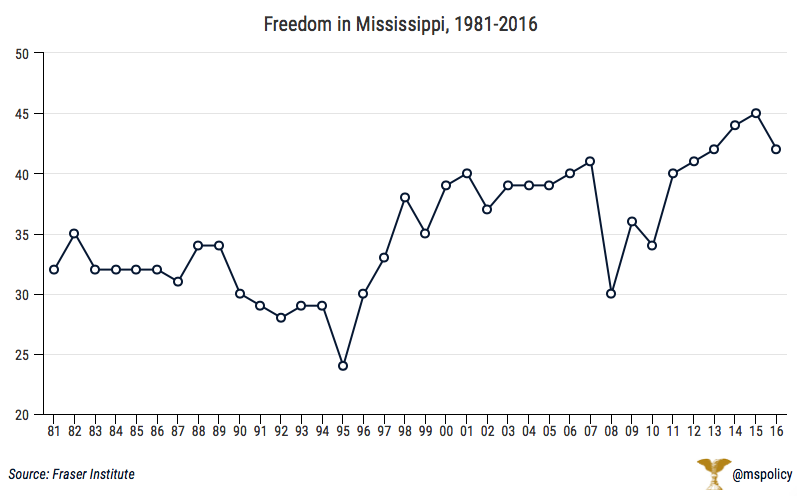

Mississippi’s freedom ranking moved up a couple spots from the previous year while our overall score actually declined slightly.

Fraser Institute’s “Economic Freedom of North America 2018” again paints a relatively bleak picture for economic freedom in Mississippi. Mississippi has been included among the “Least Free” states, those in the bottom quartile, for all but two years going back to 1998.

“The freest economies operate with minimal government interference, relying upon personal choice and markets to answer basic economic questions such as what is to be produced, how it is to be produced, how much is produced, and for whom production is intended. As government imposes restrictions on these choices, there is less economic freedom,” the report writes.

The data is reviewed among three categories: government spending, taxes, and regulations.

What are these categories important? As the size of government expands, the private sector becomes smaller and is slowly pushed out with government choosing to undertake activities beyond the traditional function of a limited government. As our tax burden and regulations grow, restrictions on private choice increase and economic freedom declines. Mississippi continues to have serious issues in both categories.

And we know what the analysis shows: The freer the state, the more prosperous it is. And the more it is growing in terms of in-migration. The least free, the more people are likely to be leaving in searching of better prospects.

...

Though Mississippi saw a slight improvement this year in overall rankings, the state has been on the wrong path over the life of the report. When it began in 1981, Mississippi was ranked 32nd. There have been some ups-and-downs along the way, including a peak at 24th in 1995. But overall, the numbers aren’t positive. The ranking of 45th that was released last year was the lowest the state has ever been.

Going back to 1981 and for many years after that, Mississippi did much better in the government spending and taxes categories than the numbers show today. That year, Mississippi had a government spending score of 7.01 and a taxes score of 6.75. This year those scores are 4.25 and 5.85, respectively. Regulations have shown the most positive movement, from 2.27 to 5.23, though still lower than all but seven states.

In 1981, Mississippi earned a score of 5.34. This year it’s 5.11. Only two other states, Kentucky and New Mexico, have experienced decreases from 1981.

….

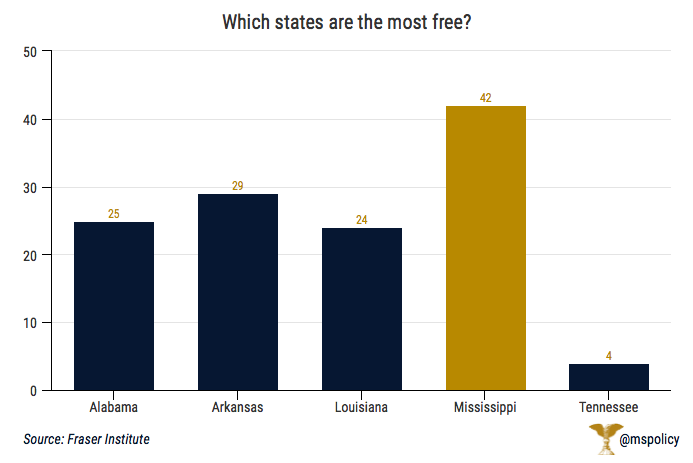

Mississippi performed poorly compared to all neighboring states, and much of the Southeast. Alabama had an overall score of 6.22 (25th), Arkansas had a score of 6.09 (29th), Louisiana had a score of 6.26 (24th), and Tennessee had a score of 7.43 (4th). Those numbers put Tennessee among the most free, placed Alabama and Louisiana in the second quartile, with Arkansas in the third quartile.

When it comes to promoting policies that restrict freedom, Mississippi is sitting on an island. And, unfortunately, paying the price.

….

Overall, this data isn’t far off from a recent report from Cato Institute. Their report, “Freedom in the Fifty States,” put Mississippi 40th overall. A five-spot jump from 2014, but still in the bottom 20 percent.

Some positive trends, but still a long way to go.

As children in Mississippi and around the country prepare for a night of trick-or-treating, they may unknowingly run afoul with local laws.

These aren’t laws restricting criminal actions often associated with Halloween mischief, such as egging a house or smashing pumpkins that belong to someone else. Rather, these are restrictions on who can trick-or-treat, how late they can be out, and what they can or can’t wear.

A story on Roanoke, Virginia’s trick-or-treating laws went viral earlier this month. In Roanoke, no one over 12 is allowed to trick-or-treat. Not only is it illegal, it is a misdemeanor punishable by up to six months in jail.

While the potential jail time might not apply, the city of Meridian also prohibits those over 12 from asking for candy. “It shall be unlawful for any person to appear on the streets, highways, public homes, private homes, or public places in the city to make trick or treat visitations; except, that this section shall not apply to children 12 years old and under on Halloween night,” the ordinance reads. And you have to be inside by 8 p.m.

Throughout the country, towns like Belville, Illinois, Bishopville, South Carolina, and Boonsboro, Maryland have similar age limits.

Meridian also restricts anyone over 12 from wearing a mask or any other disguise, unless they get a permission slip from the mayor or chief of police. Dublin, Georgia and Walnut Creek, California have similar mask restrictions.

The rest of your costume may also be illegal in some locales. In Alabama, it’s illegal to dress up as a minister, priest, nun, or any other member of clergy. Violators can be slapped with a $500 fine and a year in jail.

In a recent move that received national attention, the Kemper County Board of Supervisors approved a measure in 2016 that made it illegal for anyone to appear in public in a clown costume or clown makeup for Halloween that year. The ordinance expired the day after Halloween. That ordinance carried a fine of $150 for outlaws who wore clown costumes.

The conventional wisdom is that these ordinances aren’t enforced. Police aren’t asking boys who are starting to show signs of facial hair for identification to check their age. Chances are no one is spending 365 days in a county jail in Alabama for impersonating a priest or rabbi.

Which, of course, leads to the next question: Why have such laws? We already have laws on the books to restrict actual criminal activity. We don’t need additional laws that are confusing and do little but potentially ruin a fun night for millions of children.

We simply have too many laws in this country. It should not be government’s responsibility to regulate the behavior of children on a Halloween night running through the neighborhood in pursuit of treats. That responsibility belongs to the parents, just like it should on every other night of the year.

Mississippi Center for Public Policy recently added their name in support of the First Step Act.

The First Step Act will provide meaningful reform to our criminal justice system at the federal level, similar to what we have experienced in Mississippi. We know from a long history of being one of the nation’s top incarcerators that the blunt instrument of a long sentence does little to improve the conditions of our state’s communities.

The research shows that locking up low-level offenders does not produce better public safety outcomes than effective probation tools and workforce partnerships. We also know that time in prison breaks family bonds and makes it next to impossible for a person to hold down a job. That’s a bad outcome for all of us. Instead, we should be using what we know works to move people out of the system and toward productive, law-abiding lives.

Over the past three years, Mississippi has enacted a number of key reforms. During this time, the prison population has declined by more than 10 percent, driven by a reduction in prison use for non-violent offenses. At the same time, our state’s prisons are more focused on violent offenders, who now occupy 63 percent of prison beds, as opposed to 56 percent prior to reform. Today, the property crime rate has decreased by 5 percent, while violent crime has remained at a historic low.

Mississippi, like many other states, has seen the benefits of smart criminal justice reform policies. We are confident similar results can be found at the federal level.

Read the full letter to Senator Majority Leader Mitch McConnell (R-KY) here.