Gov. Phil Bryant received a “B” on a fiscal policy report card on America’s governors for 2018.

The report from the Cato Institute measures the fiscal choices and fiscal policies of every governor in America by examining state budget actions dating back to 2016.

“Governors play a key role in state fiscal policy. They propose budgets, recommend tax changes, and sign or veto tax and spending bills. When the economy is growing, governors can use rising revenues to expand programs, or they can return extra revenues to citizens through tax cuts. When the economy is stagnant, governors can raise taxes to close budget gaps, or they can trim spending,” the report notes.

The report credited Bryant for signing business and individual tax cuts into law in 2016. This includes the phasing out of the $260 million corporate franchise tax. It also cut taxes for self-employed individuals and cut the bottom individual and corporate income tax rates from 3 percent to zero.

The report also noted that the state general fund budget has been flat over the past couple years. Further, state government employment has been trimmed. Only four states have seen greater reductions in per capita spending during this time period than Mississippi.

“This report grades governors on their fiscal policies from a limited-government perspective. Governors receiving an A are those who have cut taxes and spending the most, whereas governors receiving an F have raised taxes and spending the most. The grading mechanism is based on seven variables, including two spending variables, one revenue variable, and four tax-rate variables,” the report adds.

Bryant’s grade was best among our neighbors, topping Gov. Asa Hutchinson (R-AR), who received a C, Gov. Bill Haslam (R-TN), who received a D, and Gov. John Bel Edwards (D-LA), who received an F. The report excluded Alabama Gov. Kay Ivey, a Republican, because of her short time in office.

Reshaping our fiscal policy

While Mississippi may be headed in the right direction, our fiscal freedom has long trailed all of our neighbors. Fiscal policy includes state and local taxation, government consumption, investment, employment, and debt. Essentially, how much are you being taxed and how much of our economic activity is controlled by government? In Mississippi, our overall tax burden is a bit above average nationally. And government employment and consumption are far higher than average.

Why does this matter? Because fiscal policy often dictates domestic migration and economic growth. And people are moving to the freest states, which also happen to have the greatest opportunity, an availability of good jobs, and a reasonable cost-of-living.

Calling for a limited, or smaller, government is not a conservative taking point. It is a principle that encourages freedom and prosperity.

As the sharing economy expands, consumers win thanks to greater options and lower prices.

It is the free market working as it should. An individual has a service they can offer, they sell it on the market via a mobile app, and they are rated on their performance by the user. Other users can then make decisions based upon whether previous users had a great experience, a poor experience, or something in the middle. It is the definition of accountability, and doesn’t require government involvement.

But, of course, government must involve themselves. Solely in the name of consumer safety, because you or I apparently cannot make a decision without the government’s blessing.

However, we know those decisions are usually centered around the government’s interest in protecting the established monopiles. Those monopolies have already asked for and received the blessing of the government and feel it is their task to protect the moat around whatever industry they are in.

We saw this with the ridesharing economy a few years ago. As Uber and Lyft entered the mainstream, some localities in Mississippi took it upon themselves to ban ridesharing companies if they didn’t operate in the same fashion as the taxi monopolies. That included cities such as Jackson, Gulfport, Biloxi, and Oxford. In Oxford, law enforcement even threatened to arrest Uber drivers for running an unlicensed taxi service. After all, the city council in Oxford had adopted new ordinances after meeting with taxi drivers and owners.

Fortunately, the state acted and passed statewide regulations for transportation network companies in 2016, overriding local regulations that stifled the ridesharing economy. A year later Uber announced that they will be available statewide. And even without doing research, we can presume students at Ole Miss enjoy having Uber available.

Carsharing is another form of how individuals can make money from their car in the sharing economy. With carsharing apps, such as Zipcar, Turo, and Getaround, consumers can rent a car from an individual for a short time period as you currently do with traditional rental car companies like Enterprise and Hertz. Naturally, said car rental companies are fighting the carsharing industry.

Airbnb has had a similar experience with government regulators. Just this summer, a Biloxi city councilman, who also happens to be the president of the Mississippi Hotel and Lodging Association, announced his intentions to increase regulations and enforcement on Airbnb rentals in the Coastal city. The Mississippi Hotel and Lodging Association is the state arm of the national association that has been pushing for homesharing regulations throughout the country.

The sharing economy should be celebrated and encouraged, but all it does is provide options.

An Uber ride is not automatically better than a ride in a traditional taxi simply because it’s an Uber ride. Nor is a house or room rented on Airbnb automatically better than a stay in a traditional hotel. If enough users have a poor experience, no one will continue to use that service provider. There is a great incentive in providing high quality services. After all, people vote with their feet.

But having these options available allows the consumer to make better, or more complete, choices. They can decide what they use based on what they need at that moment in time. And price is usually a central part of that decision.

The reactions from “traditional” companies is to be expected. They worked hard in pursuing regulations that limit competition. But when new players enter their arena, they then often complain about the unlevel playing field.

That would be less ironic if they didn’t create that playing field. But their reaction is understandable. However, the answer isn’t to impose outdated regulations on the new economy, but to deregulate existing industries. And for government to rely on the free market and trust their citizens to be able to make the best decisions for themselves.

This column appeared in the Meridian Star on October 12, 2018.

The latest index on labor markets in America shows Mississippi performing well in some measurements, but behind most other states overall.

The report, published by the Fraser Institute, includes a comprehensive analysis of labor market performance by state. It is based on the average of the following eight key indicators:

- annual total employment growth

- annual private- sector employment growth

- total employment rate

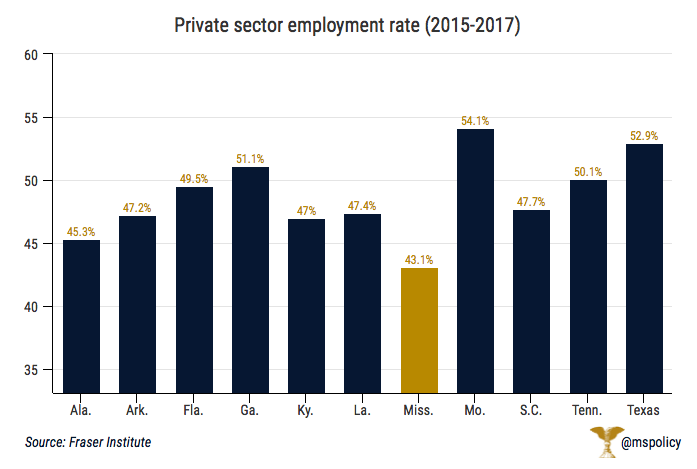

- private-sector employment rate

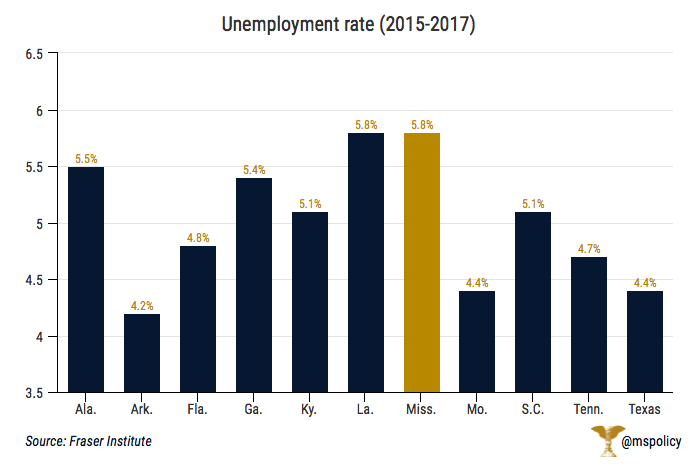

- unemployment rate

- long-term unemployment

- share of involuntary part-time workers

- output per worker (or average labor productivity)

The data was calculated using a three-year average, from 2015 through 2017.

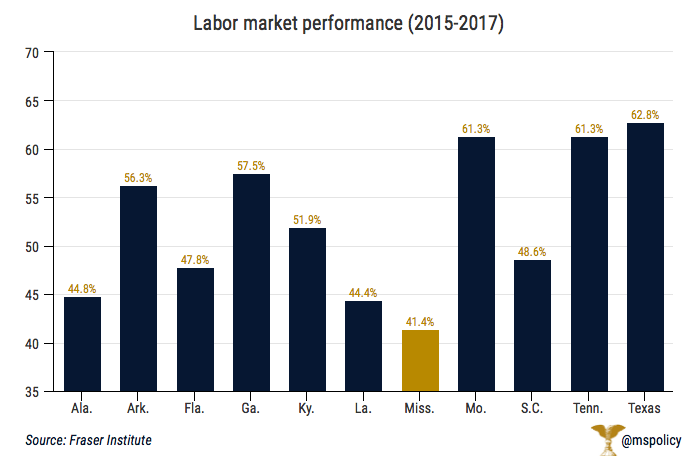

Mississippi was rated 48th overall among the 50 states with a score of 41.4 (out of 100), ahead of just New Mexico and West Virginia. North Dakota, Utah, and Minnesota led the country with scores of 80.4, 78.3, and 75.8, respectively.

Mississippi’s score placed it last among our neighboring states, and last among SEC states. Tennessee led our neighbors with a score of 61.3 followed by Arkansas at 56.3. Alabama and Louisiana were slightly ahead of Mississippi with scores of 44.8 and 44.4, respectively. Texas led SEC states with a score of 62.8.

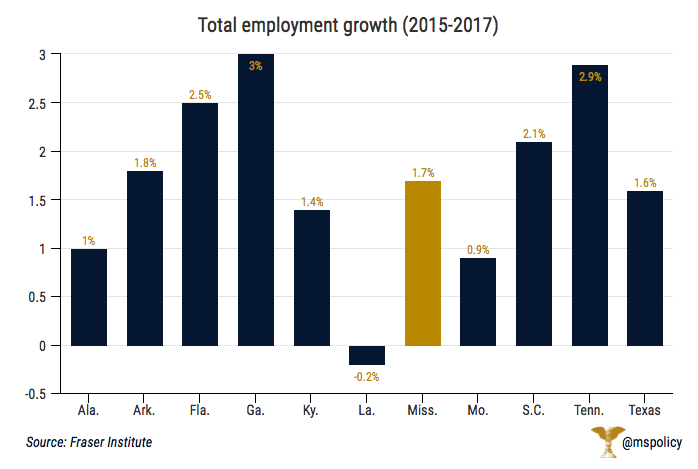

Mississippi’s best measurement among the eight categories was job growth, including job growth overall, and more importantly, private-sector job growth.

Mississippi’s total employment growth over the three-year period was 1.7 percent, this was 18th overall and 6th among SEC states. But total employment doesn’t differ on whether that growth was driven by the public or private sector. Looking specifically at private-sector job growth we see numbers that are slightly better for Mississippi.

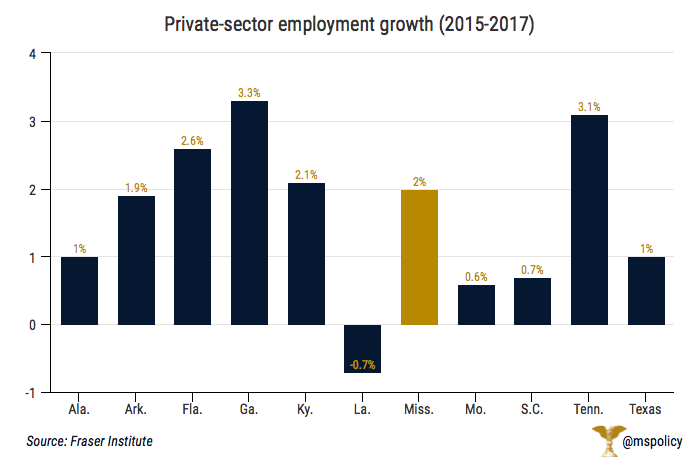

Reviewing private-sector job growth, Mississippi’s employment grew by 2 percent during this period.

Mississippi was 17th nationally in job growth, trailing only Tennessee’s 3.1 percent employment job growth among our neighbors. Louisiana had the third worst employment growth, at -0.7 percent. Among all SEC states, Mississippi placed 5th.

Recent data from the Bureau of Labor Statistics reveals similar positive numbers in terms of job growth. Employment in Mississippi grew by 1.6 percent over the previous year, behind just Tennessee among neighboring states.

But the positive news stopped there.

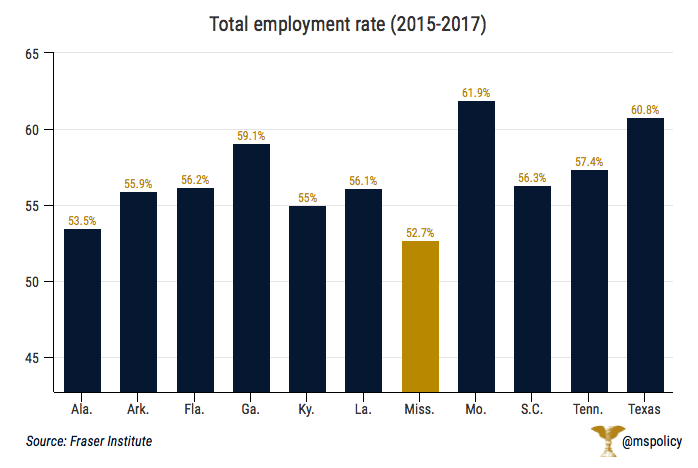

Mississippi’s total employment rate and total private-sector employment rate came in last among SEC states and 49th and 48th, respectively.

Total employment rates include full-time and part-time work, including private-sector employees, public-sector employees, and the self-employed, as a percentage of the working age population.

Mississippi’s total employment rate is 52.7 percent, last among all SEC states and ahead of only West Virginia. Mississippi moved up to 48th in private-sector employment rates, still last among SEC states.

North Dakota led both measures of employment rates at 69.4 percent for total employment rate and 59.2 percent for private-sector employment rate.

While employment rates measure those who are working, the unemployment rate measures those actively seeking work but unable to find it.

Mississippi’s three-year average rate of 5.8 percent is tied with Louisiana for 45th in the country and tied for last among SEC states. Alabama was slightly better at 5.5 percent, but Mississippi was far behind Arkansas’ 4.2 percent and Tennessee’s 4.7 percent.

Among other Fraser measurements:

- Mississippi placed 43rd for long-term unemployment, those who experience unemployment for 27 weeks or long relative to the total unemployed, at 29.1 percent.

- The state placed 38th among share of involuntary part-time workers, those who desire to work full-time but could not find it as a result of economic conditions.

- The state placed 48th for average output per worker, which is the amount of productivity per worker.

After a confirmation process that sucked up most of the energy in and around Washington D.C. and the Twittersphere, Judge Brett Kavanaugh was confirmed as an associate justice on the Supreme Court today. He deserves to be on the Court. In the end, justice prevailed.

What he had to endure was absurd and likely sets a disturbing precedent in America

It was a wild ride that few could have expected, but we probably should have. Like it or not, this is the new norm.

When Brett Kavanaugh was nominated by President Donald Trump in June, Democrats immediately announced their opposition to the D.C. Court of Appeals judge. Rallies were instantly held and fundraising solicitations from Democratic lawmakers started flying. The name wasn't important. His record did not matter. He had to be stopped.

But there was just one problem – Democrats were in the minority and lacked the votes to block Kavanaugh. This was going to take something more than protestors or speeches.

Fresh off an upset in last year’s Alabama Senate race thanks to decades-old sexual assault allegations against Republican candidate Roy Moore, with the “me-too” moment still on the mind of many, Democrats unleashed what they believed would derail the nomination.

After three days of confirmation hearings, Christine Blasey Ford came forward to allege that she was sexually assaulted by Kavanaugh in the 1980s. With an actual name, and no longer just anonymous rumors, the tone changed. But Kavanaugh and the Republicans did not retreat. Rather, they were emboldened to fight what they saw as an unfair – and untrue – allegation. Most Republicans continued to push on even as we were being told we must trust the accuser, regardless of the allegation, regardless of the many inconsistencies, regardless if she remembered the specifics, regardless if there was nobody to corroborate her accusation.

So on the last Thursday in September we were glued to a testimony that included Ford and Kavanaugh. Ford went first. The immediate reaction? She is credible, she is real, she is compelling. Kavanaugh is toast. Until he spoke. Once again, he didn’t retreat. Rather, he maintained his innocence and we were left with evidence that was no stronger than it was the day before.

In a move that surprised many, Sen. Lindsey Graham (R-SC), often dubbed the quintessential establishment Republican by conservatives, a man despised by the grassroots, and an original "Never-Trumper," rose to the occasion and delivered fiery remarks that conservatives will not soon forget. He denounced the process and chastised his Democratic colleagues for the circus show and urged every Republican to stand strong in support of Kavanaugh.

After Senator Graham’s charged plea, the stories began to change. Ford’s allegations were no longer about evidence or fact-finding. At that moment, the confirmation process transitioned into a theater of the absurd. Attorney Michael Avenatti claimed that a client used to regularly attend “gang rape” parties at which Kavanaugh was present. Therefore, by extension, he must have been involved. Why Avenatti’s female client would continue to attend such parties is a fairly obvious question. After actual reporting was conducted by the Wall Street Journal and NBC, no one could confirm the woman’s claims. But only after most in the media – and most on Twitter – told us it was true.

Then there was the claim that Kavanaugh exposed himself at a party. Even though the individual who made the claim admitted to drinking heavily at the time and confessed to memory “gaps.” And she didn’t know for sure if it was actually Kavanaugh. This shouldn’t have been a story, but it was. Apparently when you are consumed with denying a seat on the Supreme Court to your political enemies, there is no time for investigation. Objective journalism was regressed to mere political advocacy. The ends justify the means.

So what was left for the left?

The claims became more outlandish. The New York Times penned an article detailing an event where Kavanaugh was involved in an altercation at a bar while a student at Yale. Did Kavanaugh sexually assault someone in the bathroom? Did he punch someone? Close, he threw ice on another patron according to the police report. Oh, and the author of the “story” previously posted her opposition to Kavanaugh on Twitter. The ends justify the means.

And then we started to hear about Kavanaugh’s anger, his temper, his drinking – and the most incriminating – his use of slang terms! With every hour and day, the collective opposition became more desperate…and far less credible. In one of the most predictable Saturday Night Live skits of all time, Matt Damon satirized the hearings with his portrayal of Kavanaugh.

Temperament seemed to be the final sticking point for opponents after an FBI probe found nothing concerning these allegations. That too lacked any credibility. After all, this man had been a federal judge for more than a decade and it never was an issue. It only became an issue, in the eyes of the opponents who ran out of other attacks, when Kavanaugh was defending himself amid these abuse claims. Had to understand why.

That was the reason Mike Espy, a Democrat running for U.S. Senate in Mississippi, gave in announcing his opposition yesterday had he been a Senator. David Baria, running in the other Senate race, has made similar comments. Both Mississippi Senators, Roger Wicker and Cindy Hyde-Smith, supported Kavanaugh.

Why did it come to this? Why were none of these accusations present at the time Kavanaugh was nominated to the D.C. Court of Appeals? After all, that is not an insignificant job. Because the Democrats had no way to stop Kavanaugh in terms of votes. Just like they couldn’t force Sen. Majority Leader Mitch McConnell (R-KY) to act on President Barack Obama’s nomination of Merrick Garland. Based on votes, Democrats could not stop McConnell and Republicans from advancing Kavanaugh’s nomination. It was going to take something more, something extraordinary.

With the goal of prolonging the process in hopes that Democrats win a majority in the Senate in November so they can block Supreme Court nominations, Democrats decided to engage in a type of political warfare not seen since the confirmation hearings of Clarence Thomas and Robert Bork.

When the allegations from Ford first surfaced after his confirmation hearings, many probably thought Kavanaugh would withdraw his nomination, presumably with the nudging of Trump or McConnell. But he didn’t. And Trump and McConnell stayed on mission. For the first time in a very long time, conservatives were able to see Republicans return fire with fire. The loudest “Never Trump” Republicans speaking in unison with Trump’s strongest supporters. It was rare air indeed.

The party in control, continuously unwilling to live up to campaign promises to repeal Obamacare or cut spending, finally fought back and won.

Few things are more important to the left than the Supreme Court. What the left has not been able to achieve legislatively, it has often won via the courts. It has become a super-legislature of sorts, dictating policy for the country – a far different version of the republic than what our founders envisioned.

But perhaps as Kavanaugh is seated on the Supreme Court, we will slowly be able to move back to that vision of less government, an empowered citizenry, and a balance of powers. Limiting the power of the judiciary would be a big win. Just expect to see people protesting outside the Court, every hour of every day, over…something.

Because the political theater is only going to get worse. With each loss to Trump, someone that the left does not believe is a legitimate president, the left will only become more enraged. They will only sharpen their claws. And the attacks will become more prevalent and more absurd. And, if past history is any indication, the attacks will come with most of the nation’s media carrying the left’s water, no matter how nonsensical and unsubstantiated their claims may be.

Yes, we have entered a time when there is very little difference between what is in the New York Times and what is on the Babylon Bee.

Moody’s Investors Services has revised the outlook for the state of Mississippi from negative to stable.

They also affirmed the Aa2 ratings on outstanding GO bonds and the Aa3 ratings on debt issued from the Mississippi Development Bank.

“The state's stable outlook, which applies to its GO as well as its appropriation debt, is supported by stabilization of revenue and economic trends and a resumption of deposits to the rainy day fund,” Moody’s wrote. “The outlook also incorporates the expected continuance of conservative fiscal management, which will help manage elevated debt levels and potential future revenue weakness.”

To see a future upgrade, Moody’s said Mississippi needs:

- Growth in state wealth levels reflecting a sustained progress trending to national average

- Sustained increase in fund balance

- Substantial decrease in debt and pension liabilities

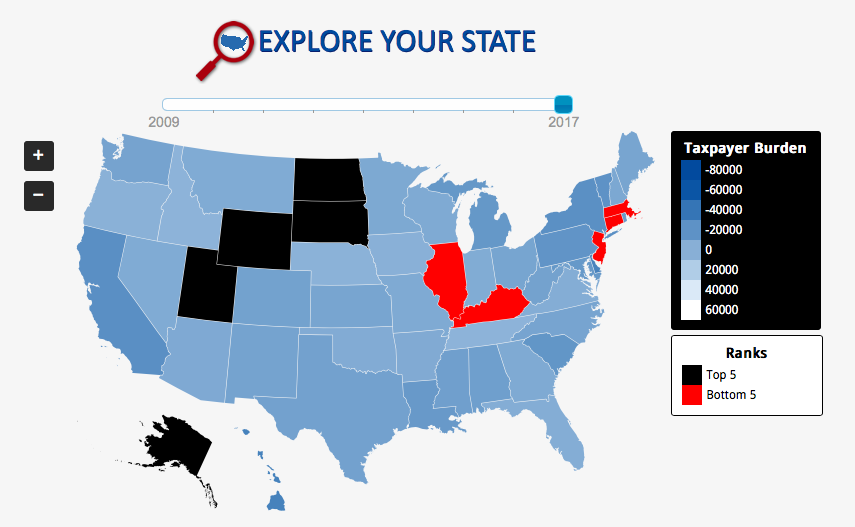

Pension liabilities are a major issue for the state, as they are for most states. A recent report from Truth In Accounting noted Mississippi’s unfunded retirement obligations. And because of the state’s debt burden of $8.3 billion, each taxpayer has a burden of $11,300.

In September, S&P Global Ratings similarly revised the state’s general obligation debt outlook from negative to stable.

“Now, all three of Mississippi’s credit ratings are strong and positive,” said Treasurer Lynn Fitch. “Taxpayers will benefit from recent efforts to meet economic challenges head-on, such as putting money back into the Rainy Day Fund and strengthening PERS’ funding policy. Better ratings mean the bond issuances currently in the works for capital and transportation improvements across the State will yield better deals for taxpayers.”

A depletion of financial reserves, economic underperformances, and persistent growth in retiree benefit liabilities could lead to a future downgrade.

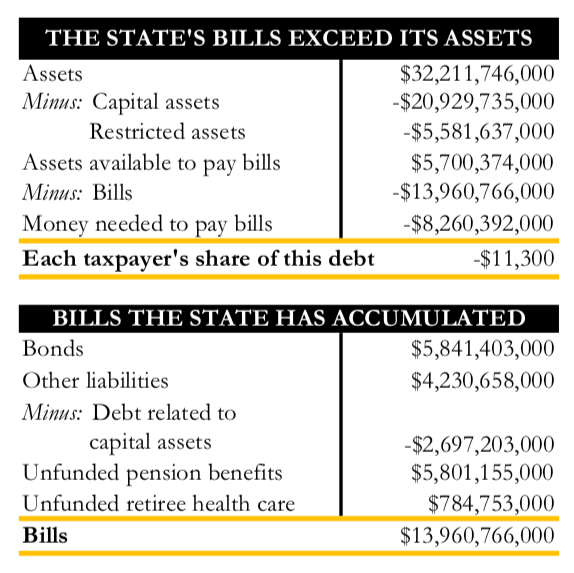

A new analysis of financial reports gives Mississippi a “D” for the state’s fiscal health.

According to the report from Truth In Accounting, Mississippi’s finances were ranked 33rd among the 50 states. Based on money available, each taxpayer would have to pay $11,300 to cover the state’s bill.

A large part of that problem is due to retirement obligations for state workers.

“Mississippi's elected officials have made repeated financial decisions that have left the state with a debt burden of $8.3 billion, according to the analysis. That burden equates to $11,300 for every state taxpayer. Mississippi's financial problems stem mostly from unfunded retirement obligations that have accumulated over many years. Of the $16 billion in retirement benefits promised, the state has not funded $5.8 billion in pension and $784.8 million in retiree health care benefits,” the report notes.

The report shows:

- Mississippi has $5.7 billion available in assets to pay $14 billion worth of bills.

- The outcome is a $8.3 billion shortfall and a $11,300 Taxpayer Burden.

- Despite reporting all of its pension debt, the state continues to hide $596.4 million of its retiree health care debt.

- Mississippi's reported net position is inflated by $1.4 billion, largely because the state defers recognizing losses incurred when the net pension liability increases.

A specific breakdown of assets and bills.

“Mississippi's financial condition is not only alarming but also misleading as government officials have failed to disclose significant amounts of retirement debt on the state’s balance sheet,” the report continues. “Residents and taxpayers have been presented with an unreliable and inaccurate accounting of the state government’s finances.”

The taxpayer burden in Mississippi is down slightly from the past two years when it was $11,800 (2015) and $11,900 (2016). However, just nine years ago the burden was only $4,900 per resident.

Louisiana had the worst taxpayer burden among Mississippi’s neighbors at $15,500 per resident. Alabama was similar to Mississippi at $11,800 while Arkansas had a burden of $3,600 per resident.

Tennessee was in the best position, earning a B from Truth in Accounting, with a $2,500 taxpayer surplus. Nine years ago, Tennessee had a $600 taxpayer burden. But they have been steadily moving in the right direction and have been in the black for the past six years.

New Jersey had the greatest burden at more than $61,000 per resident. Alaska had the strongest surplus, $56,500 per resident.

The Mississippi Bureau of Narcotics has begun to return property that the agency seized after the administrative forfeiture law was repealed.

This past session, the Mississippi legislature allowed the administrative forfeiture provision to sunset, meaning the previous law ceased to be in effect at the end of June. Administrative forfeiture allows agents of the state to take property valued under $20,000 and forfeit it by merely providing the individual with a notice. An individual would then have to file a petition in court to appeal.

On September 19, 2018, MBN sent notices allowing retrieval of seized property, totaling more than $100,000, to eight individuals. This includes:

- $3,757 of seized currency to Courtney Walker of Biloxi

- $3,000 of seized currency and two rifles to Michael Willis of Cyrstal Springs

- $88,737 of sized currency to Luis Medeles and Christopher Zavala, both of Brownsville, Texas

- $1,860 of seized currency to Dewayne Spearman of Pontotoc

- $11,938 of seized currency to Tejinder Kaur of Brandon

- $2,300 of seized currency and a pistol to Dexter Danzel Conner of Tuscaloosa, Ala.

- A seized handgun and a holster to Jessica Meredith of Florence

On September 10, the Mississippi Justice Institute sent a letter to MBN advising the agency of the change in the law after it became apparent that they were continuing to seize property after the July 1 repeal date.

“We are glad to see that the Mississippi Bureau of Narcotics is not only following the law, but is taking corrective action in cases where administrative forfeiture procedures were incorrectly used,” said Aaron Rice, Director of the Mississippi Justice Institute. “As a public interest law firm dedicated to ensuring that our laws are carried out in a way that protects liberty and honors constitutional rights, we are happy to have been able to assist MBN in carrying out its duties while remaining in compliance with new changes in Mississippi law.”

Until 2017, Mississippi was the wild west of sorts when it came to civil asset forfeiture. In 2015, the Mississippi Bureau of Narcotics, along with local police departments, seized nearly $4 million in cash.

They seized amounts as low as $75. They seized trucks, cars, ATVs, riding lawnmowers, utility trailers, and 18-wheelers; an arsenal of assorted handguns, shotguns, and rifles; cell phones, cameras, laptops, tablets, turntables, and flat screen TVs; boat motors, weed eaters, and power drills; and one comic book collection, according to a report from Reason.

And that does not include numbers from police departments that work independently of the Bureau of Narcotics. Until 2017, they didn’t track or publish asset forfeiture data.

Moreover, family members, especially parents, often had their cars or other property seized for the alleged crimes of their children. This happened even though the parents are not connected to the illegal activity. For example, in 2015, the Desoto County Sheriff’s Department agreed to return a 2006 Chevy Trailblazer owned by the mother of the petitioner, Jesse Smith, in exchange for $1,650.

In 2017, the legislature provided needed reforms. Now, seizing agencies must obtain a search warrant issued by a judge within 72 hours of seizing property. And all forfeitures are posted on a publicly accessible website.

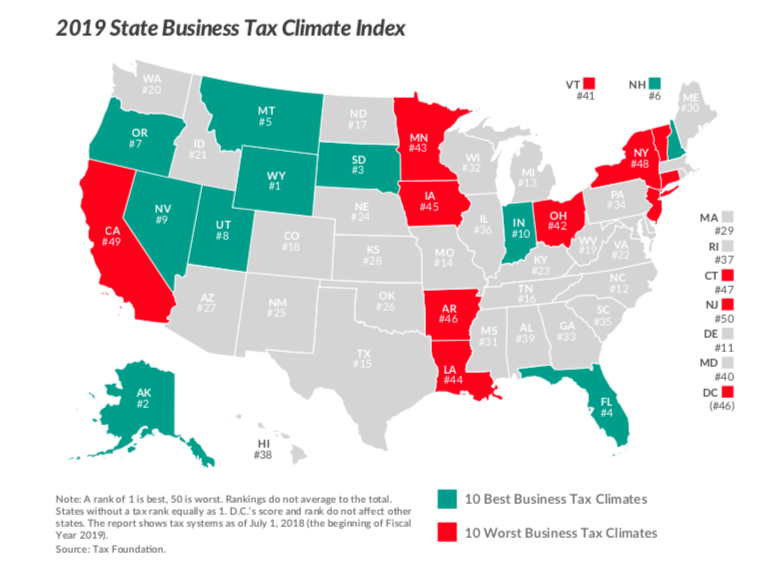

Mississippi’s business tax climate rating dropped slightly over the past year.

The Tax Foundation’s “State Business Tax Climate Index” grades each state on the burden of their corporate taxes, individual income taxes, sales taxes, property taxes, and unemployment insurance taxes. Fewer policy areas are as important as tax policy when it comes to economic growth.

The five highest rated states were Wyoming, Alaska, South Dakota, Florida, and Montana, while the five worst states in terms of business tax climate were New Jersey, California, New York, Connecticut, and Arkansas.

Mississippi’s ranking isn’t that much different from where it has been the past four years, ranging from a high of 29 (in 2016 and last year) to a low of 31 (this year). In 2017, the state ranked 30th. Still, Mississippi did drop slightly from the previous year.

This change, however, isn’t due to negative action taken by the state but simply because other states had passed Mississippi. One of those was Kentucky, the biggest gainer nationwide. They moved up 16 spots from 39th to 23rd after a series of tax reforms in the Bluegrass State.

Compared to our neighbors, Tennessee is doing the best by far. The income-tax-free state was rated 16th. Mississippi, however, bested our three other border states: Alabama (39), Louisiana (44), and Arkansas (46). That is good, but not anything to necessarily celebrate as it says more about their poor-performance.

Looking within the different tax categories, Mississippi did best with respect to unemployment insurance taxes (5) and corporate taxes (15). In fact, the corporate taxes topped all neighboring states, including Tennessee. However, Mississippi’s rankings for individual taxes (27), sales taxes (35), and property taxes (36) held the state back.

Generally speaking, the states with the best business tax climate are also the states that having a growing economy and a growing population.

A school district in Mississippi appears to have backtracked from comments that appeared in a recent article detailing the district’s new proposed policy for homeschool students.

According to the Delta Democrat Times, Greenville Public School District Deputy Superintendent Glenn Dedeaux said the district is “legally responsible to ensure every child of educating age receives an adequate education” and he warned that not all homeschool curricula “are approved by the Mississippi Department of Education to meet the necessary standards.”

Dedeaux also implied that homeschoolers must take subject matter tests to graduate.

Regardless of what you may or may not think about homeschooling, these comments run counter to Mississippi law. Indeed, Mississippi has one of the most parent-friendly homeschool laws in the country.

Mississippi code specifically says:

[I]t is not the intention of this section to impair the primary right and the obligation of the parent . . . to choose the proper education and training” for their child, “and nothing in this section shall ever be construed to grant, by implication or otherwise, to the State of Mississippi . . . any right or authority to control, manage, supervise or make any suggestion as to the control, management or supervision” of the private education of children. Further, “this section shall never be construed so as to grant, by implication or otherwise, any right or authority to any state agency or other entity to control, manage, supervise, provide for or affect the operation, management, program, curriculum, admissions policy or discipline of any such school or home instruction program.

To homeschool in Mississippi, a family must file a certificate of enrollment with the school attendance officer where the family resides. They must do this by September 15. Beyond that, parents have the freedom to make their own education decisions for their children.

While there is not official data on the number of homeschoolers in Mississippi, estimates put it at around 17,000 students statewide. If homeschoolers were a single district, they would be the fourth largest district in the state.

Dan Beasley, an attorney with the Home School Legal Defense Association, reached out to Dedeaux. Dedeaux said he was misquoted in the original article. And, to his credit, he understands he has no authority over which program a homeschool family selects.

Mississippi families who choose to homeschool their children should not be susceptible to illegal attempts by school districts to regulate their education.