The city of Pearl has taken a prudent approach to the city’s finances over the past 15 months, choosing to reduce spending rather than raise taxes.

For the next fiscal year, the city’s millage rate remains at 27.5 mills and the millage rate for the Pearl School District remains at 60.40 mills.

In 2017, when the current mayor and board of alderman took office, the city’s budget was around $22 million. Last year, the city trimmed it to $18.9 million.

“I knew the struggles the city was having were daily operations,” Mayor Jake Windham said. “We have good revenues. I had a gut feeling we can run a lean budget so we did our due diligence and took the most stringent route. I felt we could dig deep while still doing the necessary things.”

This year, once again, the city did not raise taxes.

“When you decline financially, it makes everything suffer,” Windham added. “We hold ourselves accountable. Raising taxes aren’t necessarily the answer. I didn’t think we had a lean budget like you have at home. We worked with city employees and department heads to create a culture of fiscal responsibility for the city. And they bought in and we were able to turn everything around. This is the first time in eight years we didn’t borrow to pay bills.”

The savings came through reviewing every dollar that was spent and making smart decisions, like implementing a purchase order system.

But this included making difficult choices.

“You can’t cut enough office supplies when you are short falling $100,000 a month,” Windham said. “We knew we had to send people home. We had 20 leave through attrition and had 15 more layoffs.”

For the next year, the budget will increase in key areas.

“As we build revenues, we concentrate on the fundaments of government, then branch out,” Windham said. “We’ve increased where necessary, including road repairs and the clean up of the community.”

The city will also incur new expenses. They are picking up the two percent increase that city employees will pay into the Public Employment Retirement System and health insurance has gone up 18 percent over the previous year.

The city is also on the hook for $800,000 for its share of the Pearl-Richland Intermodal project that will construct a bridge over the railroad tracks on South Pearson Road.

But Windham says the city is on the right track.

“We are making bond payments we weren’t and we look to come in under budget.”

This morning, a coalition of 30 free market policy groups, including the Mississippi Center for Public Policy, sent a letter to House Ways and Means Committee Chairman Kevin Brady objecting to any expansion of the federal electric vehicle tax credit.

The letter encourages Chairman Brady to reject attempts by the EV lobby and their allies in Congress to slip a tax-credit cap increase into upcoming spending packages. Congress has a responsibility to spare American taxpayers increased economic harm from a subsidy that benefits only those who can afford expensive electric vehicles.

American Energy Alliance President Thomas J. Pyle made the following statement:

“The electric vehicle tax credit subsidizes expensive vehicles that only a fraction of wealthy Americans want and that do not necessarily pollute less than modern internal combustion engines.

“Why should a typical middle class American family — with a median annual income of $44,000 — subsidize the lifestyles of the rich and famous? Political leaders should recognize that Americans can make their own decisions about how to spend their money and what cars they want to drive. We shouldn’t give handouts to wealthy individuals to help defray the cost of their luxury vehicles.”

The full letter can be found here.

This press release is from the American Energy Alliance.

The first public charter school opened in Mississippi more than two decades after our nation’s first charter school welcomed students in Minnesota. Today, five years after state legislators finally allowed charter schools to operate in our state, it is safe to say that charter approvals continue at the same snail’s pace.

The Mississippi Charter Authorizer Board recently voted to allow a new school, Ambition Prep, to open in West Jackson next year. It was the only school to be greenlighted by the state in this cycle, though two other proposals were tabled for consideration in October.

In 2018, 16 different operators proposed opening a total of 17 schools across the state from the Coast to Jackson to the Delta. The prior two years, 18 operators filed similar letters of intent to begin the charter school application process.

But when Ambition Prep opens it will be just the sixth charter school in the state, with all but one in Jackson.

Educational entrepreneurs are interested in opening schools. And parents are interested in options. Despite the small footprint, 15-20 percent of public school students in Jackson who attend a grade that is also served by a charter school are enrolled in charter schools. And that number will only increase.

Yet in light of the slow-growing sector, limited enrollment, and swelling wait lists, we wonder whose opinion matters more when it comes to educational choice – government or parents’?

Our charter law emphasizes a rigorous application process and “high quality” schools. Yet this bottleneck has created much greater pressure for early charter schools and a less dynamic and attractive environment for new operators to enter. The restriction of charter applications to D and F-rated districts most recently left the authorizer board torn between rejecting or approving an application faster than they would like to, in the event the district’s grade changes and invalidates the nearly successful proposal.

In advance of the release of school grades, state superintendent Carey Wright cautioned against judging charter schools too quickly, since they face unique start-up and environmental challenges along with the added pressure of serving students far behind academically. But the law makes this reasonable approach difficult: schools have a very narrow timeframe in which to meet certain state-determined guidelines or be shut down.

A different approach

Many years ago, Arizona took a different approach to charters than Mississippi. In Arizona, charters have a 15-year window rather than just a 5-year window to stay in business, as they do here. But most schools take far fewer than 15 years to prove their worth. And instead of the state stepping in to close poor-performing schools, parents do.

Over the past five years, more than 200 charters schools have opened in the Grand Canyon State. In the same five years, 100 other schools have closed. The average charter school that closes in Arizona is open just four years and has an average of 62 students in its final year. Parents don’t wait for the state to say if a charter is or isn’t meeting government benchmarks. They make a determination themselves. The charter sector grows according to demand, not top-down controls, ensuring that parents can make decisions about their child’s education without delay, rather than waiting for years to have a school or seat open up. Families also have many schools to choose from if one is not the right fit.

The data shows us that choice produces better student outcomes than tight government regulations.

In 2017, National Assessment of Education Progress, or NAEP, scores showed Arizona charters again performing as high as or better than traditionally top-performing states like Massachusetts, Minnesota, and New Jersey. Arizona did this while spending half of what those states spend and educating a high-minority student population.

Schools like Jackson Academy, Jackson Prep, St. Andrew’s, St Joe’s, MRA, Hartfield, and others compete for students every day. They sell themselves on why consumers, parents, should send their children to their school. And parents make decisions on where to enroll their children based on a host of reasons, ranging from academics to athletics, from values to extracurricular activities. This has created a robust private school market in the area. Why shouldn’t public schools of choice work similarly?

We’re glad leaders in Mississippi are working to create more public education options for those who want them. But the slow pace of opening charters, and the limitations on where they can be located or who can attend, is not leading to a responsive charter marketplace anytime soon. In these early stages of development, Mississippi has the opportunity to learn from other states and decide if parent demand and satisfaction should play a greater role in the charter approval process.

After all, what’s working for Arizona just might work here too.

This column appeared in The Northside Sun on September 20, 2018.

Men make more money than woman for numerous reasons. But it is not because of discrimination.

June O’Neill, an economics professor and former Congressional Budget Office director, has researched this issue and concluded that: “The gender gap largely stems from choices made by women and men concerning the amount of time and energy devoted to a career, as reflected in years of work experience, utilization of part-time work, and other workplace and job characteristics.”

Familial roles – such as who stays home with the kids when they are sick – tend to play a larger role in determining wages than does gender. As a result of such roles – most kids want mom to be the one to stay home – women often earn less than men. But in today’s labor market, gender discrimination is not the reason why.

- “Over 60 percent of all bachelor’s degrees are awarded to women.

- “More women than men continue to graduate school and more doctorates are awarded to women.

- “Women now comprise just over half of those employed in management, professional, and related occupations.”

Indeed, a recent Bureau of Labor Statistics (BLS) report finds that “women working 35-39 hours per week last year earned 107% of men’s earnings for those weekly hours, i.e., there was a 7% gender earnings gap in favor of female workers.”

As the gender pay gap is being debunked nationwide, some in Mississippi are clamoring for a state law to address an issue that is no longer an issue.

But Mississippi, like every other state, must abide by federal wage and hour laws. These laws, among other things, prohibit discrimination based on gender. An employer in Mississippi cannot discriminate against women just because we don’t have a state law prohibiting it.

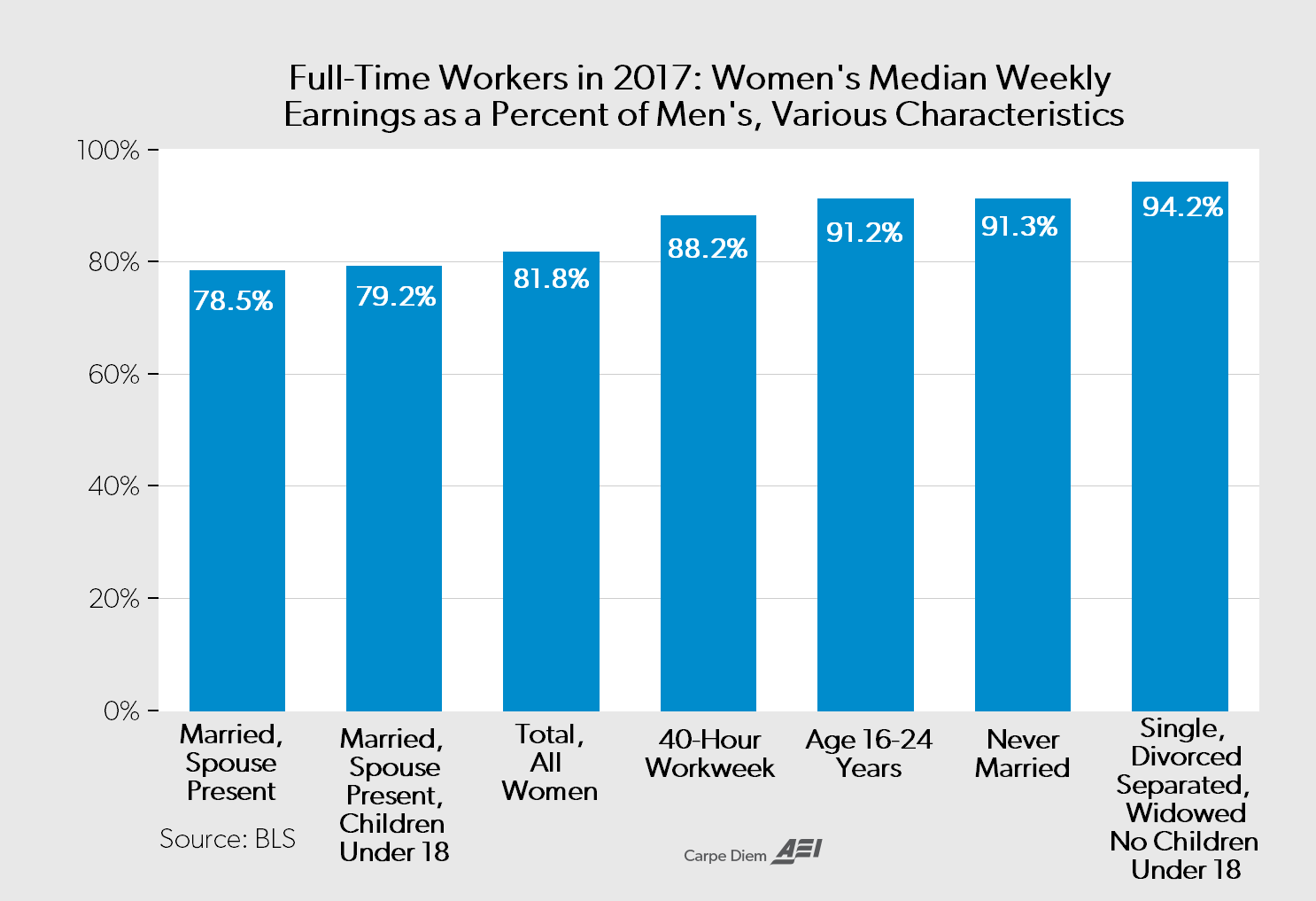

When controlling for hours worked and lifestyle choices, such as marriage, we get a clearer picture of earnings by gender.

Men work more hours than women

A review of data from the Bureau of Labor Statistics shows:

- 25.1 percent of men working full-time worked 41 or more hours per week, compared to only 14.3 percent of women. 5.8 percent of men worked 60 hours per week or more, compared to only 2.5 percent of women.

- 10.9 percent of women who worked full-time worked between 35 and 39 hours per week, compared to only 4.3 percent of men who did so.

- An estimation shows the average full-time man worked 43.2 hours per week compared to 41.5 hours for women, or 85 more hours a year.

Marital status also affects the earnings of women, as does many other factors.

- Single women who have never been married earn 91.3 percent of men’s earning, representing a gender gap of only 8.7 percent, eliminating more than half of the raw earnings gap.

- Full time women who are not married with no children under 18 earn 94.2 percent of men’s earnings, representing a gender gap of 5.8 percent, eliminating two-thirds of the raw gender gap.

- But married women, with and without children, earn 79.2 percent and 78.5 percent, respectively, of what similar men earn.

As we see, being married has a negative impact on the earnings of women. But one could also presume that that is a personal choice, and women may place greater value on flexibility, commute time, child care, and other factors important to those with children at home.

In the end, there is no gender wage gap when we compare apples to apples: doing exactly the same work while working the exact same number of hours in the same occupation.

Incomes in America rose to a new high in 2017 despite the constant talking points that the economy is only working for a few.

According to the latest data from the Census Bureau, American households have made their way solidly out of the recession and incomes continue to rise. And the report includes other significant data: Income inequality is more of a talking point than a reality and middle-income earners are actually moving up the economic ladder, not down. All while, the price of consumer goods continues to go down.

Median household income

Median household income last year was $61,372, an increase of 1.8 percent from the previous year in today’s dollars. This is the fifth consecutive annual increase after a half-decade of declines following the Great Recession. The last period of four consecutive gains was in the late 1990s.

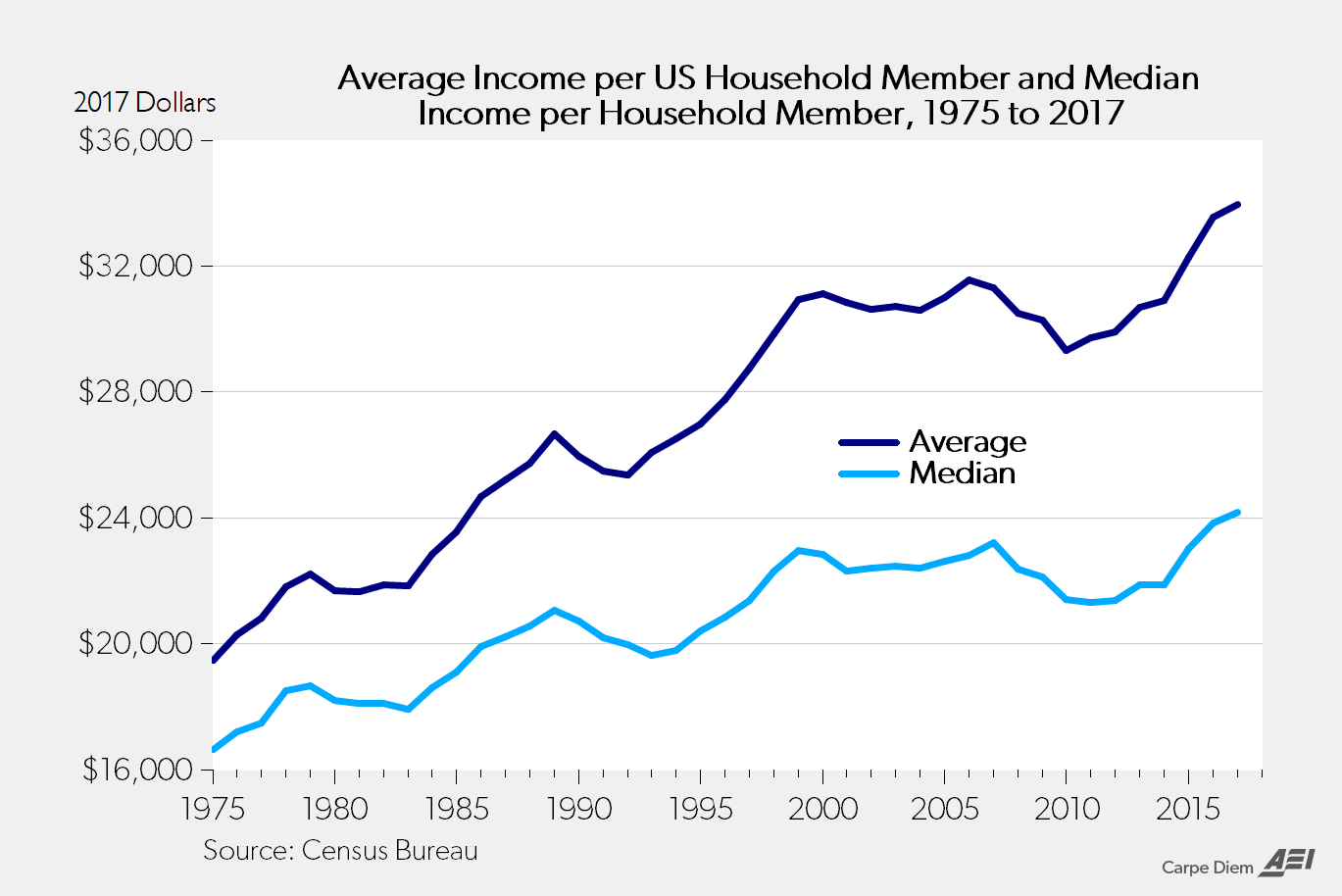

Compared to 1975, annual incomes per household member, again in today’s dollars, are up more than $12,000. That means each America has an additional $1,000 in additional income per month than they did forty years ago.

Income inequality

One of the most common refrains we hear in politics today is about the rising income gap. It has spurred a new belief in socialism, and propelled the candidacy of Democratic-Socialist Bernie Sanders in 2016. Other have since followed in his footsteps.

President Barack Obama once called it the “defining challenge of our time.”

Two data points show that the shares of total income earned by the top 20 percent and the top 5 percent are relatively static. Meaning, the rich aren’t getting richer at the expense of everyone else. Over the past two decades, the income shares of the top 20 percent and the top 5 percent have remained stable at 49-51 percent and 21-22 percent, respectively.

As the chart shows, these percentages are relatively static during this time.

The middle class

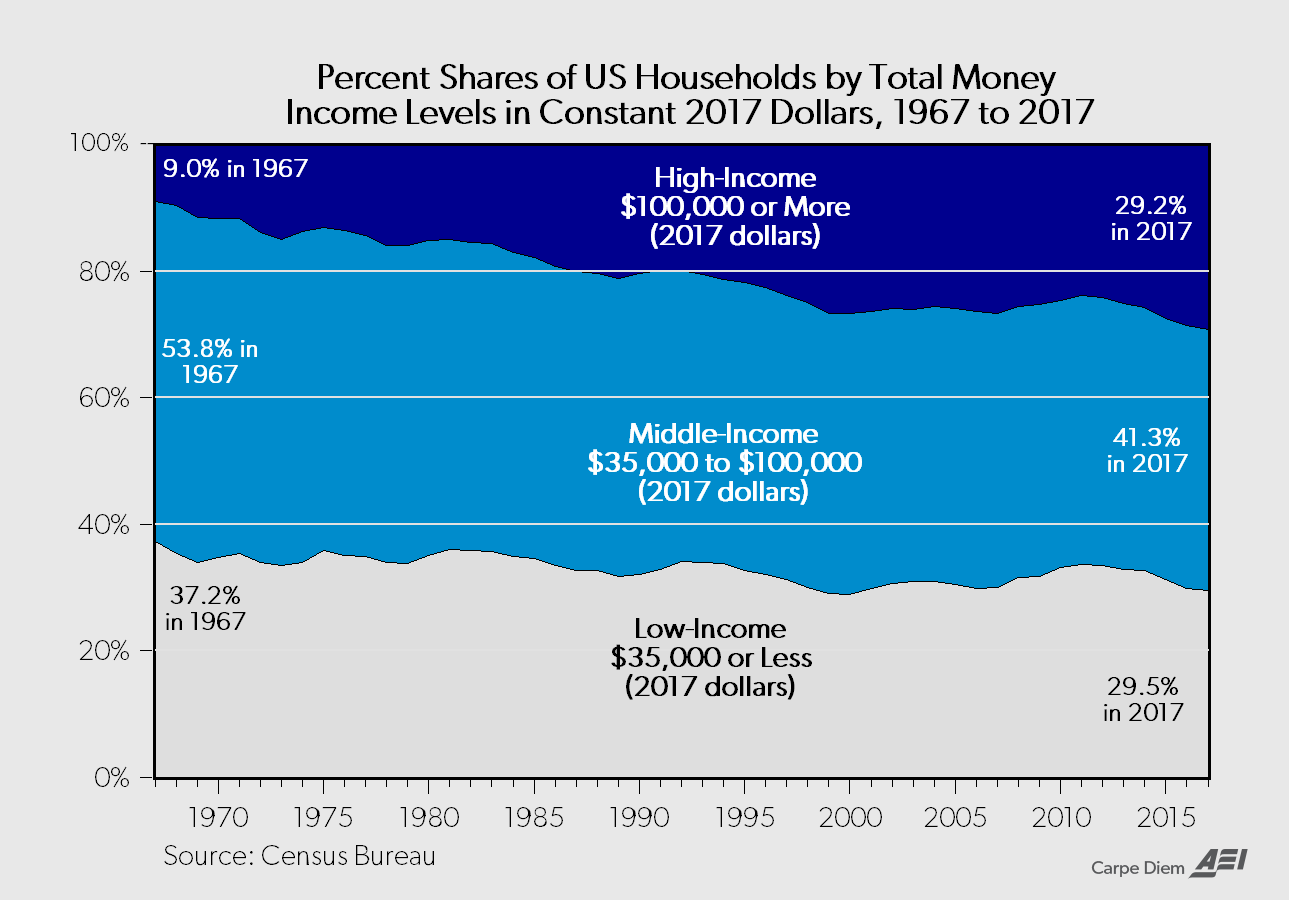

Another common refrain is the disappearing middle class. After all, in 1967 53.8 percent of the population was considered middle income, those who make between $35,000-$100,000 (in today’s dollars). But the middle class is getting smaller because they are moving up to higher income groups. That is a good thing.

The size of high-income earners, those who make $100,000 or more is 29.2 percent. Forty years ago, only 9 percent fit in this category. That represents a growth of high earners of 224 percent. Meanwhile the share of low-income earners, those who make $35,000 or less, has fallen from 37.2 percent in 1967 to 29.5 percent today. A decrease of 20 percent.

Price of consumer goods

Usually involved in this discussion is the fact that everything seems much more expensive than it was a few decades ago. A lot of this is nostalgia, but there are some items that are indeed more expensive, significantly more so in many cases. That primarily includes healthcare and higher education, two sectors of the economy that are heavily regulated and influenced by the government.

Housing, which is often negatively impacted (in terms of cost to the consumer) by local government regulations, has largely kept pace with inflation.

But most every day consumer goods, everything from cars and home furnishings to appliances and clothing, have become more affordable. What do these goods have in common? They are controlled by the free market, not the government.

For some, they may be struggling. They may not have bounced back from the recession or perhaps life choices put them in a less-than-desirable situation. But we know, when we move past the talking points and political campaigns, Americans have never been doing better. The middle class isn’t shrinking. It’s getting wealthier. Incomes are not growing apart. And every day purchases aren’t getting more expensive.

Thanks to capitalism and the free market.

Preliminary data shows that overall enrollment in Mississippi’s eight public universities and 15 community and junior colleges is down over the previous year.

Enrollment for the fall of 2018 stands at 80,592, compared to 81,378 last year.

Among Mississippi’s eight public universities, enrollment is up at Alcorn State, Mississippi State, Mississippi Valley State, and Southern Mississippi. Enrollment is down at the other four universities: Delta State, Jackson State, Mississippi University for Women, and Ole Miss.

Southern Miss enjoyed the largest growth, from 14,478 students to 14,743, an increase of 1.8 percent. Their freshman class grew from 1,903 students last year to 2,115 this year. Mississippi State grew by 1.5 percent, from 21,883 students to 22,201. State’s freshman class grew from 3,438 students to 3,599.

Ole Miss, including enrollment at the University of Mississippi Medical Center in Jackson, has the largest enrollment in the state at 23,258. That is down 2.2 percent from last year when the system enrolled 23,780 students. This is the second consecutive year of a decline. Last year’s enrollment was down 1.9 percent. The freshman class at Ole Miss is down 6.5 percent, from 3,697 students to 3,455.

The biggest drop, however, was at Jackson State. Enrollment is down to 7,709 from 8,558 last year. This represents at 9.9 percent decrease.

Total student enrollment, Fall 2017 compared to Fall 2018

| Institution | 2017 | 2018 | Number change | % change |

| Alcorn State | 3,716 | 3,753 | 37 | 1% |

| Delta State | 3,789 | 3,784 | -5 | -0.1% |

| Jackson State | 8,558 | 7,709 | -849 | -9.9% |

| MSU | 21,883 | 22,201 | 318 | 1.5% |

| MUW | 2,789 | 2,738 | -51 | -1.8% |

| MVSU | 2,385 | 2,406 | 21 | 0.9% |

| Ole Miss | 23,780 | 23,258 | -522 | -2.2% |

| Southern | 14,478 | 14,743 | 265 | 1.8% |

| Totals | 81,378 | 80,592 | -786 | -1% |

Enrollment among Mississippi’s 15 junior and community colleges fell to 72,255, a decline of 0.8 percent from the previous year. Pearl River (2.6 percent), Southwest Mississippi (2.9 percent), Northeast Mississippi (2.9 percent), and Mississippi Delta (3.2 percent) were the largest gainers.

Coahoma (-5.2 percent), Northwest Mississippi (-5.8 percent), and Meridian (-6.3 percent) had the biggest drop percentage wise. Hinds, whose enrollment was flat, remains the largest school in the community college system at 11,833 students.

The city of Tupelo is in the process of drafting new regulations for food truck operators within the city limits.

According to the Daily Journal, city leaders hope to have an ordinance before the council in October. This has been in the works for some time now, with leaders talking about food truck regulations back in May.

At that time, Councilman Willie Jennings said, in proposing the regulations, “I just want to make sure the established businesses are protected.” Another councilman, Markel Whittington, said brick-and-mortar restaurants have requested food truck regulations. While he didn’t feel food trucks posed a ‘threat’ to those restaurants, he believed it was appropriate for government to act ‘on behalf of select business interests.’

“I think we have to protect some of our taxpayers and high employers,” he said.

The proposed ordinance would likely prohibit food trucks from operating on public property along major thoroughfares. Major thoroughfares include virtually all of Main and Gloster streets, two of the most prominent retail areas in the city.

And they also happen to be where most food trucks are currently located.

When Tupelo leaders began discussing food truck regulations, Mississippi Justice Institute, the legal arm of Mississippi Center for Public Policy, sent a letter to the city warning of litigation if these regulations passed.

“The very regulation Tupelo is discussing—a regulation about how close a food truck should be to a restaurant—was found to be unenforceable just this past December in Baltimore. Food truck regulations around the country have been challenged over and over in court, from Louisville, to San Antonio, to Chicago, and many places in between. Cities ultimately realize that these kinds of cases are very hard to defend,” the letter said.

More recently, the city of Carolina Beach, North Carolina repealed it’s prohibition on out-of-town food trucks from serving the city after a lawsuit was filed by the Institute of Justice. Under the law that has since been scrapped, only brick-and-mortar restaurants that have been in business for more than one year could run a food truck.

“It is a shame that it took a lawsuit to convince the town to repeal such an obviously unconstitutional law,” Justin Pearson, senior attorney at IJ said. “I’m hopeful that this vote will signal the end to the town’s attempt to use the power of government to favor a handful of established businesses over the region’s entrepreneurs.”

Food trucks are already regulated like brick-and-mortar establishments. They must already obtain a license from the city and the state, along with a health permit from the Department of Health.

During the recently concluded special session, lawmakers passed a $1 billion infrastructure bill, created a lottery, and distributed BP settlement money throughout the state.

House Speaker Pro Temp Greg Snowden (R-Meridian) and Sen. Hob Bryan (D-Amory) offered their take on the five-day session at Monday’s Stennis-Capitol Press Luncheon in Jackson.

“I believe this is five of the most productive days I’ve experienced,” Snowden said.

Snowden reviewed the three bills at length, calling House Bill 1, the infrastructure bill, essentially a House bill. It will divert money from new bonds, internet sales tax revenue from the 7 percent online sales tax, a new annual tax ($75 to $150 annually) on hybrid and electric vehicles, and sports betting revenue.

Snowden brought up the fact that two United States Supreme Court rulings paved the way for the internet sales tax and sports betting revenue, arguing it was not something they could have done during the regular session.

“We passed three major pieces of legislation,” Snowden added. “You might disagree with them but you can’t say we didn’t get it done. Everyone knew it had to happen, just didn’t know how. And this was a bicameral success. Both bodies worked together for the good of the state. It will be transformative for one or two generations.”

And Snowden noted the bipartisan support.

“Even the lottery wasn’t partisan,” Snowden said.

Bryan had a slightly less optimistic perspective

“Every bad idea imaginable all squared into one session,” is how Bryan began his time at the podium. “The lottery will always be a bad idea. It is not right for the government to run a numbers racket. It preys on the poor, especially poor who are most susceptible.”

Bryan then raised the point of their being little meaningful discussion or debate on the lottery. Under the lottery bill that passed, a five-member board appointed by the governor will oversee a private corporation to run the lottery. The initial bill removed the lottery board from state public records and open meetings laws. The House added open meetings provisions after passing the Senate, but Bryan still didn’t like the idea of a private entity running the lottery. He went so far as to raise the potential for conflicts of interest between the lottery board and private corporations.

“There was so much going on but never time to focus on this huge entity that will have lots of money outside of government controls,” Bryan said. “Some of us tried to slow things down but we were unable.”

Snowden, who voted against the lottery each time it was before the House, said he opposes the lottery because it doesn’t make “good economic sense.” But he added it was better for a private corporation to be running it than the state.

And he noted, “I think it’s fair to say Mississippians wanted a lottery.”

Bryan also mentioned that the infrastructure funding is essentially diverting money from the general fund to cover the new transportation funds.

“This is not an improvement for our state,” Bryan said. “The notion that we’ve done anything to help road maintenance just ain’t so.” He added that this was a short-term solution, noting loss of revenue from multiple tax cuts and government incentives for private companies are taking money from the general fund.

Snowden defended the health of the economy and the budget.

“The health of the economy is not the same thing as revenue in state coffers,” Snowded added. “You don’t judge the health of the economy by how your general fund is doing. We’ve been responsible fiscally and will continue to be.”

Calling for a more limited government is not just a conservative talking point, it is a principle that encourages freedom and prosperity. And it’s backed up by scientific data.

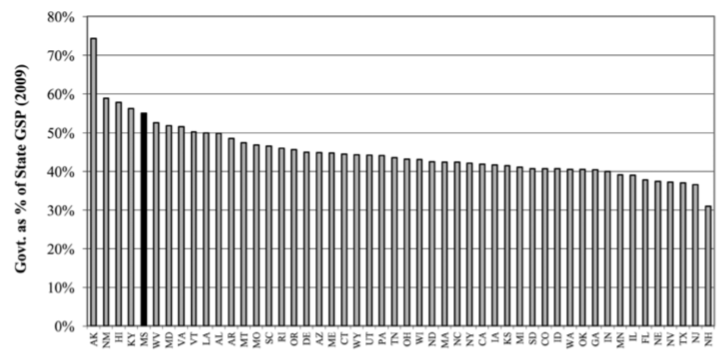

There are eight states where government controls more than half of the economy. Mississippi is one of them.

According to the Fraser Institute, government spending- federal, state, and local- accounts for 55 percent of the economy in Mississippi (as outlined in Promoting Prosperity in Mississippi). This leaves less than half of the state’s economic resources for the private sector. New Hampshire is the freest state, with just 31 percent of the economy controlled by the government. Live Free or Die indeed.

This ranking gave Mississippi the fifth largest government, behind Alaska, New Mexico, Hawaii, and Kentucky. Looking at our neighbors, government controlled between 47-50 percent of the economies in Alabama, Arkansas, and Louisiana. It is 43 percent in Tennessee.

For those that might blame federal spending, if we look at just state and local spending, Mississippi would actually move up to the fourth highest share of government control. So the federal government isn’t to blame.

Government is growing in Mississippi

Interestingly, it has not always been this way. Throughout the 1990s, government control of the economy in Mississippi ranged from about 40-45 percent.

It sat at around 45 percent at the turn of the century. And has been trending in the wrong direction since that time.

Does this matter?

Mississippi has an outsized government. It is larger than our peers. But do we need it? After all, Mississippi is a poor state and largely rural.

Regardless of the size of the state, it is problematic when resources must be dedicated to political favor seeking and lobbying rather than private sector activities. The shift is from entrepreneurship and toward lobbying. That may benefit an individual or a single company, but it does not benefit the economy.

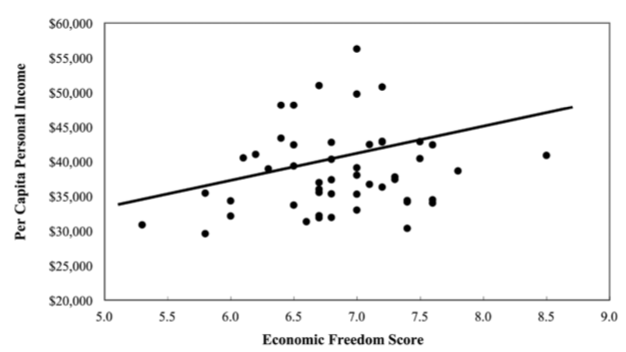

And we have data to show the correlation between economic freedom, which includes personal choice, voluntary exchange, free enterprise, and property rights, and prosperity.

When looking at the Economic Freedom of North America index and per capita income, we see a direct and clear trend. The freer the state, the greater the income.

Those who live in states with the highest per capita income live in the freest states. The poorest states rely on the government. It is not by accident.

People vote with their feet

Beyond the data and freedom indexes from the likes of Fraser, Cato, or Heritage, can you make the argument that people like the high regulation, union friendly status of states like California or New York? After all, Manhattan and San Francisco (minus the used needles and feces on the streets) are highly desirable places to live. And as a result, their cost-of-living is among the highest in the country.

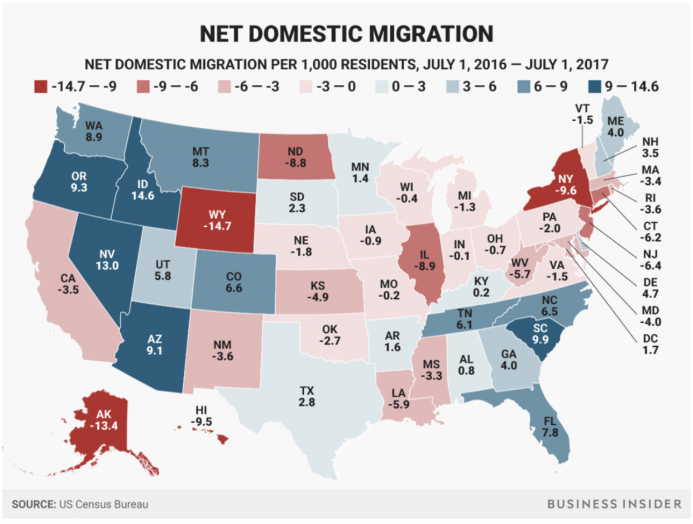

And while those locations might be desirable, net migration tells a different story. We can throw out the data, the policy wonks, and the studies and we still have this graphic.

We are free to live where we’d like in this country. And people are moving to the states that do well on the various measures of economic freedom. As a result, they are moving out of states that do not.

Do people intentionally look at these reports and determine that is where they are going to live? No, probably not. Rather, they are moving to the states with opportunity, with growth, and where the cost-of-living is reasonable. (Hint: states with less burdensome regulations.)

Here is the net migration between 2016 and 2017 among the five freest and five least free states, according to the Economic Freedom of North America index.

| State | Freedom Index Ranking | Net Migration |

| New Hampshire | 1 | 3.5 |

| Texas | 2 | 2.8 |

| Florida | 3 | 7.8 |

| South Dakota | 4 | 2.3 |

| Tennessee | 5 | 6.1 |

| Hawaii | 45 (tie) | -9.5 |

| Mississippi | 45 (tie) | -3.3 |

| New Mexico | 47 (tie) | -3.6 |

| West Virginia | 47 (tie) | -5.7 |

| California | 49 | -3.5 |

| New York | 50 | -9.6 |

The numbers speak for themselves. If we want to increase prosperity and attract new residents to the state, it starts with enacting policies that encourage and promote the principles of economic freedom.