A small win for freedom in Mississippi! Governor Tate Reeves recently signed HB3, a law that reforms the state’s Certificate of Need (CON) rules.

CON is basically a government approval process healthcare providers (like hospitals) must go through before they can add certain services, build new facilities, buy expensive equipment, or make big expansions.

HB3 makes some modest changes, allowing more flexibility for some specific providers. It also raises the dollar threshold for capital spending requiring approval.

Perhaps the most significant part of the bill is that it mandates the Mississippi Department of Health to do a study over the course of this year into the feasibility of letting smaller hospitals skip CON when providing kidney dialysis treatment and adult psychiatric services.

While HB3 does not give us the reforms Mississippi needs, it is a step in the right direction. In a legislative session that has seen most significant reforms killed in the Senate, this is one rare example of a free market reform in the 2026 session.

For decades, Mississippi has been the punchline in national discussions about economic performance - often ranked at the bottom in income, education, and opportunity.

But something remarkable has happened in recent years: the Magnolia State is undergoing a genuine resurgence, driven not by federal handouts or gimmicks, but by principled free-market reforms.

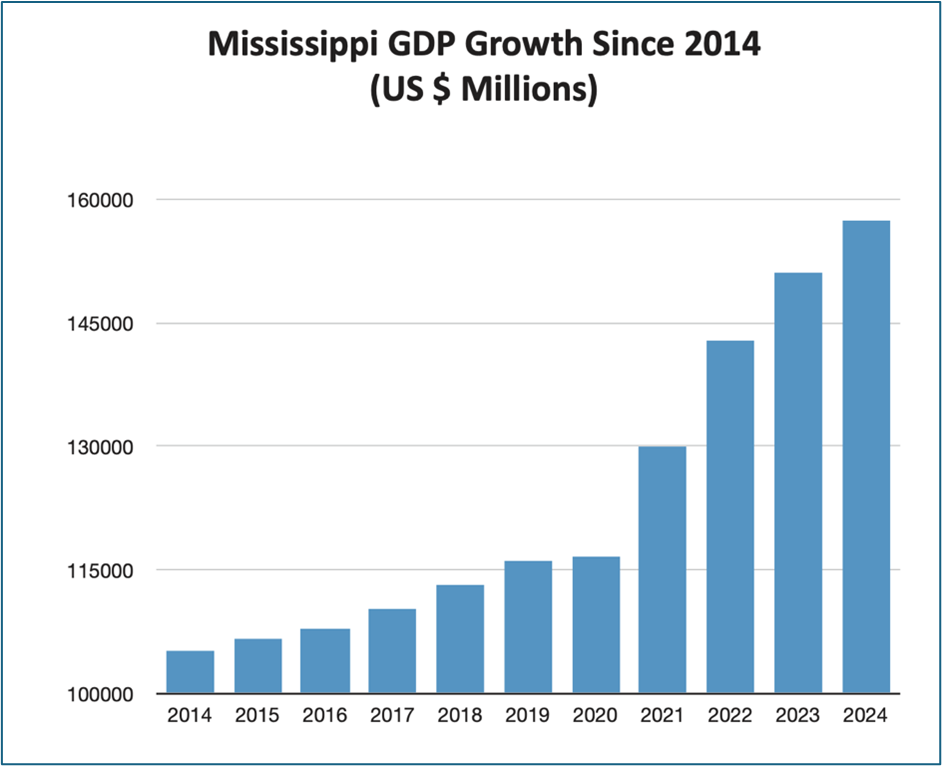

A major national publication, the Washington Examiner, recently spotlighted this transformation in a feature titled "Mississippi Turning." The article notes that Mississippi has achieved more economic growth in the past five years than in the previous 15 combined.

This isn't hyperbole; recent data from the Bureau of Economic Analysis shows Mississippi posting some of the nation's strongest GDP growth rates, including a 4.2% real GDP increase in 2024 that ranked second nationally.

What’s fueling this engine? Bold structural changes that prioritize freedom, competition, and low barriers to opportunity.

First, labor-market reforms have opened doors for workers and entrepreneurs. In 2021, Mississippi enacted universal recognition of out-of-state occupational licenses, allowing skilled professionals to bring their talents here without jumping through needless bureaucratic hoops. The state has also slashed red tape on in-state licensing requirements, eliminating hundreds of hours of mandatory training for many everyday jobs. These changes have attracted talent, put downward pressure on remaining barriers, and made it easier for Mississippians to earn a living.

Second, historic tax reform is putting money back in people's pockets. Starting with the largest tax cut in state history in 2022, Mississippi phased in a flat 4% income tax. In 2025, lawmakers went further, enacting legislation to reduce the rate to 3% by 2030 and trigger annual cuts thereafter until the state income tax is fully eliminated—the first such move by a state in decades. This pro-growth policy rewards work and ambition while making Mississippi more competitive for businesses and families.

Third, a commitment to reliable, low-cost energy has made the state a magnet for investment. By resisting costly subsidized green mandates, Mississippi has kept electricity prices among the nation's lowest, powering energy-intensive industries like data centers and advanced manufacturing. Major announcements, including billions from companies like Amazon Web Services, underscore how affordable energy translates into jobs and capital inflows. Since 2020, the state has attracted tens of billions in private investment, fueling record-breaking economic development.The results speak for themselves: explosive GDP growth, surging personal incomes, rising university enrollments, and—for the first time in generations—net in-migration as people choose to move to Mississippi rather than away. Recent years have seen positive net migration, reversing long-standing outflows and signaling a brighter future.

This turnaround didn't happen by accident. It's the direct consequence of free-market ideas championed by policymakers and advocates who refused to accept the status quo. Mississippi is no longer just catching up; it's becoming a national model that other states are watching closely.

As we close out another productive year, moments like the Washington Examiner's recognition remind us that principled, steady work pays off. Mississippi is proving that freedom works—creating a freer, more prosperous place for all its citizens. Other states should take note: lower taxes, fewer regulations, and reliable energy are the path to revival.

Click here to read the Washington Examiner article.

The future for our state looks bright. In just the past five years, Mississippi has seen more economic growth than in the entire fifteen years before that combined.

We’re on track to phase out the state income tax entirely, allowing families to keep more of what they earn. Mississippi has attracted a surge of new investment, and for the first time in years, our workforce participation rate is finally heading in the right direction.

Zoom out, and the picture gets even better. Contrary to the endless gloom from the pundits, the American economy has consistently outperformed expectations for decades. Since the late 1990s, the U.S. has delivered strong, steady growth that few forecasters saw coming.

But there is one dark cloud on all our horizons that we cannot forever ignore; US national debt.

As of today, US national debt stands at $38 trillion (with a capital T).

To grasp how enormous a single trillion really is, try this:

- One million seconds ago was just last week, right before Halloween.

- One billion seconds ago was early 1994, when Clinton was president and the internet was dial-up.

- One trillion seconds ago was roughly 30,000 BC, deep in the Stone Age, when humans were still chasing mammoths.

Now here’s the gut-punch: that $38 trillion mountain of debt has roughly doubled in just the past ten years.

Costly foreign wars, mega bailouts, COVID giveaways and all those federal entitlement programs LBJ said would “end poverty”, eventually add up. (Incidentally, living standards for America’s poorest citizens are light-years higher than when those programs launched in the 1960s (indoor plumbing, air conditioning, smartphones, modern medicine), but the number of people dependent on government assistance is larger than ever).

Rather than pay for all that using tax receipts, the US government has borrowed, issuing IOUs. Today we spend more money servicing all those IOUs than we do on defense.

As my fellow Brit, the historian Niall Ferguson, likes to point out, any great power that spends more on debt servicing than on defense risks ceasing to be a great power. That was true of the Romans and the British, the Habsburgs and the Dutch.

What must America do to avoid a similar fate?

When President Trump was first elected, Elon Musk and Vivek Ramaswamy launched the Department of Government Efficiency (DOGE) with an ambitious target: to reduce annual federal spending by $2 trillion.

Because mandatory entitlement programs - Social Security, Medicare, and Medicaid - remained largely untouched, DOGE hasn’t come close to achieving that yet. The federal deficit has barely budged.

Where, one might ask, are all those Tea Party types that railed against federal overspending ten years ago as the debt to GDP ratio went from 90 percent in 2010 to 125 percent today?

If the US cannot rein in the growth of the debt, the only other way to avoid going the way of the Romans is to try to make the GDP part of the equation rise faster. In other words, to try to grow our way out of the debt.

In order to stabilize debt-to-GDP at the current 125 percent of GDP, America will need to achieve real GDP growth of about 4 - 5 percent for the next 10 to 20 years. With the advent of AI and robotics, as Elon Musk suggests, it could be done.

Put it another way; without an AI / Robotics induced growth surge, US debt will hit 150 – 170 percent of GDP by 2050. Mamdani-economics would then become the least of our worries, as inflation and tax rises became inevitable whoever held office.

The older I get, the more I think that there are two fundamental things that the federal government needs to get under control: mass immigration and the deficit. Do that, and states like Mississippi have a bright future. Don’t, and all the good that we might do will only matter at the margins.

FOR IMMEDIATE RELEASE

October 30, 2025

MISSISSIPPI CENTER FOR PUBLIC POLICY HONORS LEGISLATIVE HEROES AT ANNUAL GALA CELEBRATING STATE SUCCESS

JACKSON, MS – October 30, 2025 –Six of Mississippi’s leading lawmakers were presented with award to honor them for championing principled conservative policy. Rich Lowry, editor of the National Review, presented each of the winners.

Healthcare

Rep. Sam Creekmore and Rep. Hank Zuber were jointly honored for their leadership in challenging Mississippi’s Certificate of Need (CON) laws, which restrict the expansion of healthcare providers and limit patient access.

Countering DEI

Sen. Angela Hill received the award for her early and unwavering stand against the encroachment of divisive DEI (Diversity, Equity, and Inclusion) policies in Mississippi’s public universities. Long before the issue gained national attention, Sen. Hill worked to safeguard academic freedom and institutional integrity at the state’s flagship campuses.

Education Reform

Rep. Jansen Owen was recognized for leading the 2025 legislative effort to expand open enrollment through HB 1435. Though the bill passed the House with broad bipartisan support - uniting parents, educators, and lawmakers - it was ultimately blocked in the Senate.

Income Tax Elimination

Mississippi became the first state since Alaska in 1980 to phase out its personal income tax through HB1. Rep. Trey Lamar and Speaker Jason White were honored as the driving forces behind this transformative reform. Through public town halls, transparent negotiations, and superior policy arguments, the duo outmaneuvered opposition and delivered a pro-family, pro-growth tax cut that is already attracting investment and enhancing Mississippi’s competitiveness.“

These lawmakers represent the best of conservative leadership - courageous, principled, and effective,” said Douglas Carswell of the Mississippi Center for Public Policy. “Their work is making Mississippi a national model for freedom, opportunity, and common-sense governance.”

Remember the tariff debates that dominated Washington just a few months ago? For a while it was the only thing anyone seemed to talk about.

First tariffs were raised by eyewatering amounts. Then they weren’t. Eventually, after all sorts of back and forth, we saw tariffs imposed at the highest rates in decades. Free trade advocates warned of economic catastrophe, while protectionists claimed tariff revenue would fix the deficit. When immediate disaster didn’t strike, the issue seemed to fade – until now.

Two local stories that caught my eye this week suggest that we are going to hear a lot more about tariffs.

Agriculture is Mississippi’s largest industry, and soybeans the largest crop. Only a few days ago, U.S. Treasury Secretary Scott Bessent announced $10-15 billion in federal support for soybean farmers, including those in the Mississippi Delta. Why is the federal government having to support soybean farmers in one of the most fertile places in America? Exports have collapsed. China, which once bought over half our soybean crop, now purchases from Brazil due to steep retaliatory tariffs on U.S. soybeans, triggered by U.S. tariffs on Chinese goods.

In other words, federal funds are now bailing out farmers hurt by federal tariffs.

A second story that got my attention this week was about grocery prices. 53% of Americans say grocery costs are a major concern, with prices spiking last month at the fastest rate in three years. I couldn’t help also notice another news item about how coffee prices have jumped 20% in the past year, partly because of a 50% U.S. tariff on Brazilian coffee imports.

It is said that we often tend to overestimate the impact of new technology in the short term and underestimate the impact in the long term. I wonder if the same might be said of tariffs. The sky did not fall in when tariffs went up, but the lag effects of the historic hike are only just beginning to be felt by ordinary Americans.

There may yet be something in what the free traders keep trying to tell us. Defenders of free trade have been reluctant to speak up. I suspect that may be about to change. By the time of the midterm elections, I suspect millions of Americans will be feeling the effects of tariffs. Tariffs? We are going to hear a lot more about them than some people expect.

When Javier Milei burst onto the scene as a presidential candidate in Argentina in 2023, brandishing a chainsaw, many dismissed him as unhinged. His radical libertarian platform was presented by the media as evidence of Argentina’s tragicomic decline.

Argentina was poorer in 2023 than it had been two decades earlier. That year, the economy contracted sharply, inflation spiraled, and public finances remained in disarray, propped up by repeated IMF bailouts.

A hundred top economists signed a letter warning Argentina against electing Milei. When Argentinians promptly elected him president, the experts all agreed that we should pity the Argentines for their folly.

But then of course Milei was crazy enough to actually do in office what he said he was going to do.

He slashed government, shutting down entire departments and reducing spending, leading to Argentina’s first budget surplus in over a decade in 2024. He cautiously began cutting taxes.

Milei eliminated exchange rate controls, rental market restrictions, and burdensome licensing requirements that once stifled the economy. The entrenched Peronist system of political graft is being dismantled.

As a result, living standards are rising rapidly, economic output is growing, and inward investment is surging. Young Argentines are no longer fleeing the country—instead, they’re returning home.

In other words, Argentina is doing what Mississippi has been doing; cutting taxes, removing restrictions, encouraging inwards investment – and seeing a surge in growth as a consequence.

Mississippi’s conservative leaders might not normally brandish chainsaws, but when it comes to implementing free market reforms, they have been as effective as Argentina’s Milei.

Mississippi started to implement bold tax reforms from 2022, reducing the state income tax to a flat 4 percent. This year we passed a law to phase out the income tax altogether.

In 2021, Mississippi passed the Universal Recognition of Occupational Licenses Act, a significant step towards labor market deregulation in an “at will” employment state.

The Magnolia state side-stepped most of the renewable energy nonsense that pumped up energy costs elsewhere. Today, Mississippi has some of the most affordable electricity in the country.

These are the reasons there has been a flood of inward investment into Mississippi. It’s why Mississippi is seeing a manufacturing boom.

Mississippi’s free market reforms explain why there has been more economic growth in our state in the past five years than there was over the previous fifteen years combined.

Free market reforms explain why we had one of the fastest growing states in America at the end of last year. In 2025, Mississippi’s per capita GDP is projected to surpass Germany’s.

Just like Argentina, Mississippi still has all those condescending ‘experts’ to contend with. The same sort of people who dismissed the idea that free market Argentina might flourish, still won’t accept that Mississippi is shaping up to be one of America’s new economic success stories.

I’ve experienced first-hand supposedly rational, educated individuals flatly refusing to accept the evidence that Mississippi is flourishing. Why? To acknowledge that a southern, conservative - and now increasingly free market - state was flourishing would undermine their progressive world view.

Perhaps that is just another reason we should all want Mississippi to keep growing.

Mississippi is shedding its image as an economic laggard. Over the past five years, the state’s economic output has grown more than it did over the previous fifteen years combined.

According to the U.S. Bureau of Economic Analysis, Mississippi posted the second-fastest per capita GDP growth and fifth-fastest personal income growth among all states in Q4 2024. Billions in capital investment have flowed in.

This growth is happening across the state—from the Gulf Coast and Pine Belt to DeSoto County, the Jackson metro area, and the university hubs of Oxford and Starkville.

Mississippi whoooooosh!

Mississippi’s recent growth is no accident. It is down to good public policy. Since 2022, Mississippi has implemented transformative tax cuts, reduced the state income tax and lowered the grocery sales tax and easing business inventory taxes. A 2021 law streamlining occupational licensing reduced barriers for workers and entrepreneurs, with the Mississippi Secretary of State reporting a 12% increase in new business registrations in 2023 alone.

Energy in our state is affordable, Mississippi electricity rates averaging 13.43 cents per kilowatt-Hour, helping draw in energy-intensive industries, including two major data centers in Madison and Rankin counties. To top it all, Mississippi’s public universities are fueling growth, and around Oxford and Starkville, entrepreneurial ecosystems are thriving.

But to maintain this momentum, our state needs to abandon policymaking as usual and embrace bold reform. That’s why the Mississippi Center for Public Policy (MCPP) has just launched The Mississippi Miracle? Bold Reforms for Growth.

Our paper details practical steps to sustain and accelerate this momentum:

- Empower Parents Through School Choice: Let families use state funds for public, private, or homeschooling options to drive competition and elevate education standards.

- Refocus Higher Education: Cut administrative bloat, prioritize workforce-relevant programs, and redirect resources from low-value courses to practical, job-focused education.

- Rein in Public Spending: Cap budget growth to population growth plus inflation to ensure fiscal discipline and curb waste.

- Cut Red Tape: Eliminate outdated regulations, repeal Certificate of Need laws, and create a business-friendly environment to spur innovation.

- Reform Public Procurement: Mandate transparent, competitive bidding with regular audits to prevent cronyism and maximize taxpayer value.

- Promote Welfare-to-Work: Emphasize work requirements, job training, and time-limited benefits to foster self-sufficiency and reduce program costs.

These reforms are practical policies that lawmakers can implement to improve lives across Mississippi.

To explore them in detail, visit mspolicy.org under “Publications” or email me at [email protected] for a direct link.

MCPP has a small, but highly productive team. We punch above our weight, producing policy proposals that become law, and helping set the agenda at the Capitol. We are able to do all this because we have the input of so many people across our state. Please read our proposals and share your thoughts—I want to hear what you think.

For decades, Mississippi exported people. Young people in particular tended to leave our state for places like Atlanta, Nashville, Huntsville and Austin.

I believe the tide is starting to turn. I often hear anecdotes of young people moving back to Mississippi. The data suggests that growth in our state is creating opportunities and drawing more people to move here .

Have a read of our report and help us build on this momentum.

At the end of May, Mississippi lawmakers returned for a Special Session to finalize the state’s budget after failing to reach an agreement during the regular session. The result? A more conservative budget.

For years, Mississippi’s budgets were decided behind closed doors over a single weekend during the session. Speaker Jason White and the House changed that by demanding an open, public process.

Speaker White’s commitment to transparency paid off. When Governor Tate Reeves called the Special Session, he urged fiscal restraint. This matters because Mississippi’s general fund has grown far faster than inflation since 2020.

Lawmakers listened, passing a $7.1 billion budget — a modest increase from last year and one of the most fiscally responsible in recent years. The big spend items are $3.3 billion, for education, $1.4 billion for Transportation and $431 million (up from $407 million) to try to improve our dysfunctional prison system.

Speaker Jason White was right all along. When lawmakers decide the budget in public through a proper process, they are more careful with our money. Sunlight truly is the best disinfectant.

One subplot to the budget saga merits attention. Some Senate members made a misguided attempt to cut basic funding for the State Auditor’s department, hindering its ability to function. This echoed attempts by leftist politicians in Washington, D.C., to block DOGE from auditing federal funds.

Every conservative in Mississippi should applaud the House for standing firm and restoring the State Auditor’s funding. The Auditor can continue investigating misuse of public funds. (Why would any politician scheme to block the Auditor from scrutinizing tax dollar spending? Did they really think they could do so and not look ridiculous? If Homer Simpson did political strategy, I doubt he’d make that mistake. It is political positioning 1.0.) Restraining public spending matters in Mississippi for several reasons.

First, all those efforts to pass a law to eliminate the state income tax over the coming year will amount to little unless we continue to maintain a budget surplus. The budget passed will maintain a modest surplus and sets a precedent that puts us on the road to actual income tax elimination.

Second, if Mississippi’s economy keeps growing at a rate of 3-4 percent a year, and the budget only grows by 1-2 percent a year, the size of the private sector will grow relative to the overall economy. This is the only way to lift Mississippi over the next generation from being one of the poorest states in the Union to being one of the richest.

Perhaps the most significant thing about this year’s budget is not just that it is fiscally restrained. It was decided openly and transparently. The days when billion-dollar decisions could be made by a handful of good ole boys at the Capitol in private are coming to an end.

A new generation of leaders is emerging in our state who not only support pro-growth policies. They aren’t willing to keep doing politics like its 1960-something.