At the end of May, Mississippi lawmakers returned for a Special Session to finalize the state’s budget after failing to reach an agreement during the regular session. The result? A more conservative budget.

For years, Mississippi’s budgets were decided behind closed doors over a single weekend during the session. Speaker Jason White and the House changed that by demanding an open, public process.

Speaker White’s commitment to transparency paid off. When Governor Tate Reeves called the Special Session, he urged fiscal restraint. This matters because Mississippi’s general fund has grown far faster than inflation since 2020.

Lawmakers listened, passing a $7.1 billion budget — a modest increase from last year and one of the most fiscally responsible in recent years. The big spend items are $3.3 billion, for education, $1.4 billion for Transportation and $431 million (up from $407 million) to try to improve our dysfunctional prison system.

Speaker Jason White was right all along. When lawmakers decide the budget in public through a proper process, they are more careful with our money. Sunlight truly is the best disinfectant.

One subplot to the budget saga merits attention. Some Senate members made a misguided attempt to cut basic funding for the State Auditor’s department, hindering its ability to function. This echoed attempts by leftist politicians in Washington, D.C., to block DOGE from auditing federal funds.

Every conservative in Mississippi should applaud the House for standing firm and restoring the State Auditor’s funding. The Auditor can continue investigating misuse of public funds. (Why would any politician scheme to block the Auditor from scrutinizing tax dollar spending? Did they really think they could do so and not look ridiculous? If Homer Simpson did political strategy, I doubt he’d make that mistake. It is political positioning 1.0.) Restraining public spending matters in Mississippi for several reasons.

First, all those efforts to pass a law to eliminate the state income tax over the coming year will amount to little unless we continue to maintain a budget surplus. The budget passed will maintain a modest surplus and sets a precedent that puts us on the road to actual income tax elimination.

Second, if Mississippi’s economy keeps growing at a rate of 3-4 percent a year, and the budget only grows by 1-2 percent a year, the size of the private sector will grow relative to the overall economy. This is the only way to lift Mississippi over the next generation from being one of the poorest states in the Union to being one of the richest.

Perhaps the most significant thing about this year’s budget is not just that it is fiscally restrained. It was decided openly and transparently. The days when billion-dollar decisions could be made by a handful of good ole boys at the Capitol in private are coming to an end.

A new generation of leaders is emerging in our state who not only support pro-growth policies. They aren’t willing to keep doing politics like its 1960-something.

What is the secret of America’s success? Federalism. Thanks to the genius of the Founders, each state is allowed to do things differently, which enables innovation.

It is so exciting to see Mississippi now leading the way with bold, free-market reforms that have begun to unleash growth, providing a model for other states to follow.

After decades being last, Mississippi is has started to see some remarkable results:

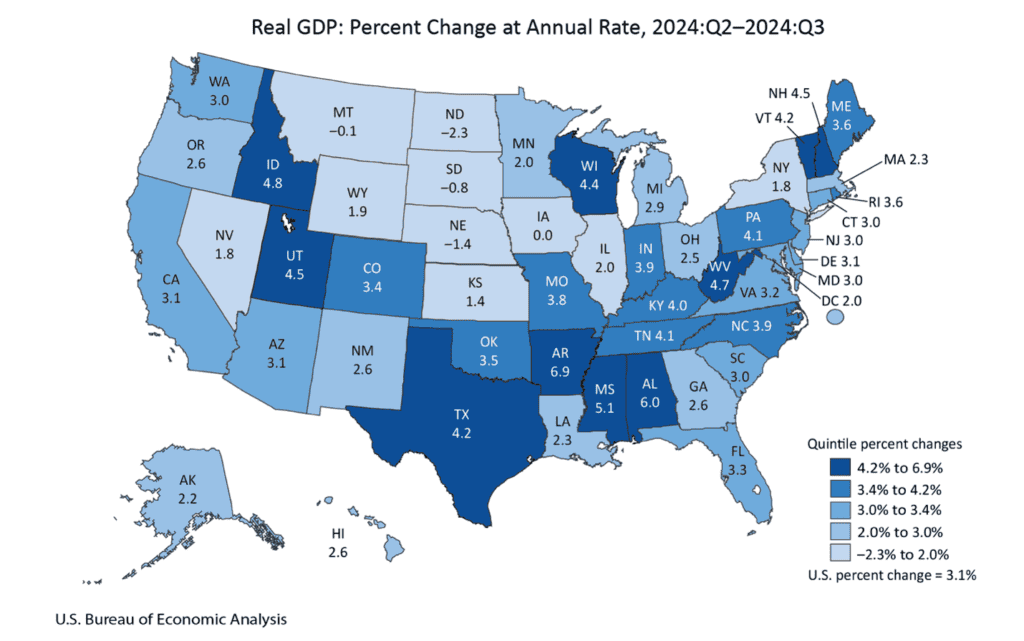

- Explosive Economic Growth: In 2024, Mississippi’s real GDP grew by 4.2%, ranking 2nd nationally, outpacing California (2.1%), New York (1.8%), and Texas (3.9%), per the BEA’s Q4 2024 data. Nominal GDP jumped 6.7% ($2.58 billion), also 2nd in the nation.

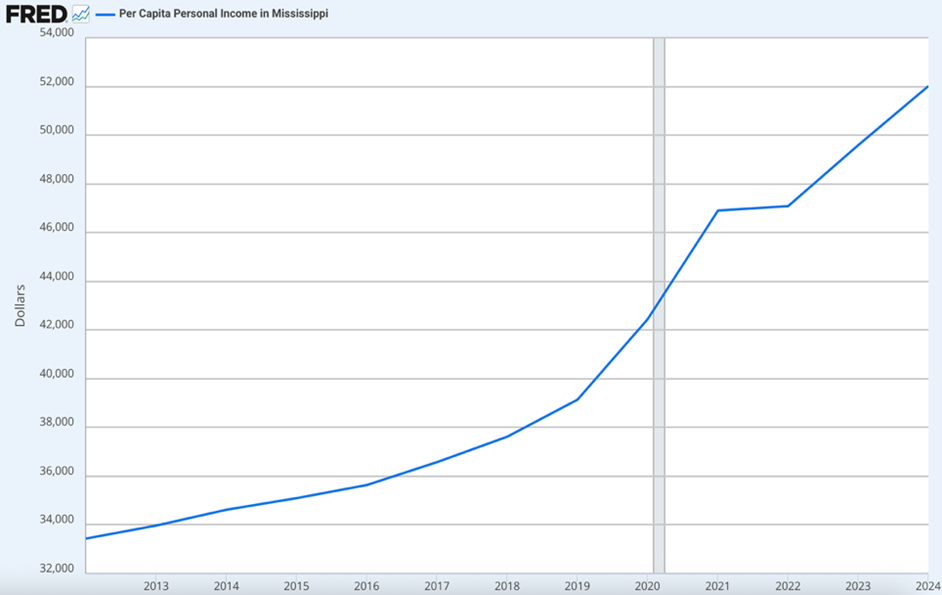

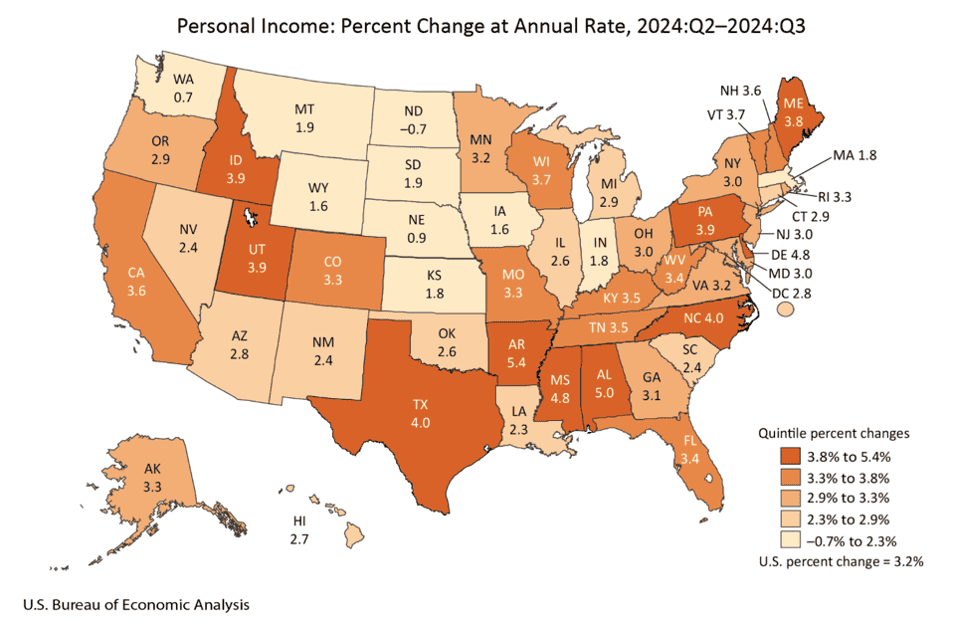

- Surging Incomes: Personal income growth ranked 4th nationally in Q3 2024. From 2000 to 2022, per capita income soared 140% (3.6% annually), from $21,500 to $46,200. With our low cost of living, Mississippians are enjoying one of the most rapid increases in living standards in America.

Mississippi personal income has increased rapidly

- Global Competitiveness: Being a British immigrant, I was fascinated to see that in 2023, Mississippi’s per capita output surpassed the UK’s. Even better, this year, we’re projected to overtake Germany’s per capita output.

- Investment Boom: Over $20 billion in new investment projects have been announced in the past couple of years. That means private dollars are investing in the future of our state because they think we have a great future.

This economic renaissance didn’t happen by accident. Growth is a direct consequence of the kind of free market reform MCPP has been advocating for:

- Historic Tax Cuts: In 2022, Mississippi passed the largest tax cut in state history, phasing in a 4% flat income tax by 2026.

- Labor Market Deregulation: By reducing red tape, we’ve empowered businesses to hire and innovate, boosting job creation (some estimates suggest 56,000 export-related jobs in 2022 alone).

- Conservative Budget Responsibility: A steady budget surplus has been important.

- Low cost energy: Mississippi managed to avoid a lot of the renewable energy policies that have pushed up costs in places like California.

We need to maintain this new momentum – and to do that there are plenty more policy changes we must make. Education standards are not as good as some would like to suggest. It is vital that we allow school choice. There are far too many red tape restrictions holding back the local economy, especially the protectionist rules in the healthcare sector.

Most important of all, perhaps, our state leaders need to restrain public spending, which has increased rapidly. We need to ensure that we continue to control spending so that we maintain modest budget surpluses.

But let’s take a moment to recognize that Mississippi is actually doing rather well. So much so, in fact, that other states might have something to learn from what our state leaders have got right.

President Trump has established a baseline 10 percent tariff on nearly all imports. Additionally, the White House announced plans for reciprocal tariffs on 57 countries. A week later, on April 9, the administration then paused these reciprocal tariffs for 90 days.

We don’t know if the reciprocal tariffs will take effect after July 9. What is certain is that in addition to the 10% baseline tariff, there is a 25% tariff targets car imports and most goods from Canada and Mexico, and a staggering 125% tariff is in place on most Chinese imports.

Some of my conservative friends like to imply that tariffs are part of a cunning plan to eliminate the federal income tax. They point out that until 1913 America did not have a federal income tax, and the federal government was largely funded by tariffs.

Now I’m all in favor of eliminating income taxes, and I spent much of the last legislative session in Mississippi advocating for the repeal of our state income tax. But the numbers don’t add up for replacing the federal income tax with tariffs. To generate the $2.6 trillion annually that the income tax provides, tariffs would need to average 127% on all imports (even accounting for an estimated 20% drop in import volume). Do that and only rich folk will be able to shop at Walmart.

Others have told me that we need these tariffs to protect American industry against offshoring and the loss of American jobs overseas. Really?

US output today is close to three times higher than it was when LBJ was President. US factories make almost twice as much stuff as they did when Ronald Reagan left the White House. The growth in US industrial output happened while tariffs declined from 6-8 percent in 1969 to about 2 percent by 2010 (with a slight increase by 2020 due to higher tariffs on China).

It is true that the number of manufacturing jobs in America has fallen, as manufacturing output has risen. But that is because fewer workers in industry are able to make more. The same thing happened in farming a century before. The loss of farming or manufacturing jobs has not made Americans poorer. It means Americans went and found work in better paying jobs.

That’s why the total number of jobs in America has risen despite the fact that the proportion of Americans working in manufacturing has fallen. There were 70 million jobs in 1969 and there are 160 million jobs today. So much for free trade taking away our jobs.

“But what about China?” some say

America should be worried about China. It’s alarming that China’s Jiangnan Shipyard builds more ships in a single year than all U.S. shipyards combined. It’s concerning that China produces more drones in a day than the U.S. does in a year.

But if China is our primary concern, why hit countries like Vietnam, South Korea, and India—potential competitors to China—with crippling tariffs?

Tariffs won’t eliminate the federal income tax, reverse a supposed industrial decline, or solve the question of how to deal with an aggressive China. What they will do is make you poorer and America less competitive.

Consider your cell phone. Apple has already stated that tariffs will increase its costs by nearly $1 billion this quarter alone. That extra cost? It’s coming out of your pocket when you buy your next iPhone. To dodge new tariffs on Chinese goods, Apple is shifting much of its manufacturing from China to India. Don’t expect new iPhone factories in Mississippi or Michigan—think Madras instead.

Ironically, the high-value work on smart phone production—the design, software, and chips—is already done in the U.S. Tariffs will simply move low-value assembly from one Asian nation to another, leaving you to foot the bill.

My big fear this that tariffs won’t just be seen as having triggered an economic downturn. By doing so they will overshadow all those other conservative wins.

During my recent trip to Washington, several administration insiders suggested that the current tariff strategy is part of a broader plan. They claim tariffs are being used as leverage to dismantle restrictions on U.S. exports to other countries.

Whether or not this was the original intent, I hope it becomes the retrospective rationale. For instance, if a close ally like the UK, which runs a trade deficit with the U.S., agreed to eliminate all its tariffs and allow any product sold in America to be sold in the UK, the U.S. could respond in kind. Such a trade agreement with the UK could set a precedent, encouraging other allies—Japan, India, Australia—to follow suit. The result might be the complete removal of trade barriers between the U.S. and its allies. That’s the optimistic scenario. The alternative is higher costs for everyone, leaving us all poorer.

Mississippi was the second fastest growing state in the last quarter of 2024, according to new data from the US Bureau of Economic Analysis. Output per person in the Magnolia state increased faster than any state besides Arkansas.

One set of data might be a fluke, but then the previous quarterly data told a similar growth story. We are starting to see a trend as Mississippi takes off economically.

Mississippi’s been stuck at 50th out of 50 for so long, some struggle to believe we could be anywhere else. But here’s the kicker: our per capita GDP zipped past Britain’s in 2023 and is set to overtake Germany’s this year. If the explosive growth from late 2024 keeps up, we’ll leapfrog several U.S. states in the next decade. That “last place” label? It’s starting to peel off.

What’s behind this turnaround? Free market reforms—plain and simple. Mississippi was held back by high taxes, stifling regulations, and cartels—especially the one under the Capitol dome in Jackson—calling the shots.

A generation ago, Mississippi’s economic development strategy was to send long serving politicians to Washington DC to hustle for handouts. If federal subsidies made a state rich, ours would have been the wealthiest state in the Union.

But today, we’re growing because bold leaders—backed by your support—are pushing pro-growth policies:

- Tax Cuts: Since we started trimming the income tax to a flat 4% in 2022, the Mississippi Development Agency estimates there’s been a whopping $19 billion inward investment. Businesses are flocking here, confident that their payroll taxes will tumble.

- Flexible Labor Market: Already an “at-will” employment state, Mississippi passed a little noticed law in 2021 to ease occupational licensing. Local boards are increasingly under pressure to reduce onerous red tape.

- Business-Friendly Planning: While other states drown companies in approval processes, Mississippi rolls out the welcome mat.

- Cheap Energy: Two new data centers are coming, and they’ll need oodles of electricity. Good thing Mississippi’s natural gas and nuclear keep our electricity cheap—around 13.43 cents per kWh versus California’s wallet-busting 34.26 cents. Affordable energy is turbocharging our growth.

Mississippi has only adopted pro-growth policies because a handful of bold conservative leaders have been prepared to fight for them. Just three weeks ago, our Senate’s current leadership was maneuvering against income tax elimination.

Imagine what we could achieve if the Senate was on board with free market reform? We’re surrounded by states with school choice, but our Senate blocked even a modest public-to-public option. Healthcare’s tangled in “certificate of need” nonsense, and Senate leaders killed that fix too.

Mississippi is on the rise, but we need to double down on pro-growth reforms, especially school choice. Thank you for standing with us—together, we’re making Mississippi boom!

Did you know that Mississippi is now one of the fastest growing states in America? Only two states saw real GDP rise faster than it did here in the third quarter of 2024.

Were you aware that personal income in our state rose more here than almost anywhere in the US this past year?

New data from the Bureau of Economic Analysis shows that Mississippi is on the up.

For as long as anyone can remember, Mississippi has ranked 50th out of 50. Not for much longer, perhaps. According to this new data, ours’s was one of the top performing states in 2024. If we keep growing for the next few years the way we did in 2024, we won’t be bottom of the class for much longer.

Mississippi’s success is not an accident. It’s a consequence of a number of key free market reforms:

- Labor market deregulation, with an Occupational Licensing law in 2021.

- Tax cuts with legislation to cut the state income tax to a flat 4 percent in 2022.

- Further tax reform to make it more tax efficient for businesses in 2023.

- Education funding reform as a step towards school choice in 2024.

These reforms have begun to energize our state. They make it easier for people to get ahead, for businesses to invest, and for families to spend their income on their priorities. They draw in inward investment, which is changing our state for the better.

If Mississippi is not to lose this momentum, we need to go even further. That is why MCPP has just published a Blueprint for Mississippi – a list of the ten key reforms that would lift our state to the top of the economic table.

The number one reform we need to prosper is school choice. Why? School choice is the only way to be certain of raising standards. The better job we do of educating young people, the greater their chances of leading a prosperous, fulfilling life.

Our Blueprint sets out how we can accomplish school choice, giving every family in our state the choices that today only the very rich enjoy.

To prosper, our state needs less regulation and less government. Our Blueprint sets out proposals to cut taxes further and dismantle the costly, leftist bureaucracy that seems to be in control no matter who you vote for.

Decades of crony cartel politics has stifled innovation in our state. Years of lobbyists cutting cozy deals in the Capitol that commercially advantage their clients has held Mississippi back. A lot of the intentionally restrictive laws that limit health care provision simply need to go. Our Blueprint sets out how to make this happen.

MCPP has been a driving force behind many of the key free market reforms that have helped energize our state. But at every opportunity, crony cartel politics has tried to prevent change.

The crony cartel will try again. It’s what self-serving cartels do. Already they are mobilizing half-baked arguments against school choice. They are lobbying to maintain intentionally restrictive laws that hold back the healthcare economy. Brace yourself for politicians explaining why we can’t afford tax cuts despite a healthy surplus.

In politics, nothing moves unless it is pushed. MCPP won’t just publish our Blueprint. We will push and push hard. Mississippi’s future is too important to let bad politics get in the way.

Mississippi could be on the cusp of transformative changes. If we keep going, we will not only no longer be 50th, but we could become – like Tennessee or Alabama – a state that young people want to move to, not leave.

Download a copy of our blueprint here!

Remember when Japan was predicted to overtake America?

Back in the 1980s, Japan was the coming country. Japan’s economy had enjoyed decades of rapid growth. Her exports where everywhere, and with inventions like the Sony Walkman, it looked as though Japan was the technological future, too.

America looked like a power in decline. Forty years ago, many traditional US industries were failing. Crime seemed out of control.

By the mid 1990s, Japan’s GDP was 71 percent that of the US - and the gap looked to be closing. One “expert”, Herman Kahn predicted that Japan would surpass America as the world’s largest economy by 2000.

Today? Japan’s economy is a quarter the size of America’s. Japan hasn’t produced much innovation since the Tamagotchi (Don’t ask). Despite all the talk about Japanese electronic wizardry, the great digital innovations of the past few decades have happened on this side of the Pacific.

Today, of course, we’re told that the great ascending power is not Japan, but China. China’s economic growth over the past 40 years has been phenomenal. In industry after industry, Chinese exports have crushed the competition. China, unlike Japan, is not just an economic competitor but a strategic rival to the United States, pursuing an aggressively expansionist policy in the Pacific, south Asia and parts of Africa.

By 2021, China’s GDP was almost 80 percent that of the US and the experts were telling us China would overtake America within a couple of decades.

But look at what has happened since. China’s economy seems to have peaked as a percentage of US output. China has even more debt-induced malinvestment than Japan had during the 80s asset bubble.

Chinese demographics (current Total Fertility Rate 1.02) are in an even worse shape than Japan’s (TFR 1.30). And China’s fiscal position is unlikely to improve with all of President Xi’s imperial ambitions to fund.

As recently as 2008, Europe’s economy was about the same size as the United States’. Today, America’s economy is twice the size of Europe’s. Looking at the number of large companies established over the past 50 years on either side of the Atlantic. Home Depot, a single US company, eclipses all the new businesses created in the European Union since 1974.

So why are Japan, China and Europe all in their different ways underperforming America? Because each are, in their different ways, reverting back to a type of political economic tradition far less successful than America’s.

Japan, superficially Western in so many ways since 1945, has behind that façade a strongly corporatist political economy. A handful of well-connected conglomerates are able to dominate markets, but shielded from internal competition, they don’t innovate. (To appreciate how stifling this is, try to imagine what America might be like, for example, if IBM was the only computer company, with all the competitors kept out.)

China, after a brief move towards market liberalization begun by Deng Xiaoping, is reverting to what you might think of as a Ming tradition. Dissent is stamped on. A bureaucratic elite micromanages and controls. The sclerotic effects are already being felt.

Europe, repeated rescued from an indigenous form of autocracy by the Anglosphere powers (1704, 1815, 1914, 1944, Cold War), is tragically reverting to type. Today, a courtly elite enthroned in Brussels attempts to regulate and control ever more aspects of social and economic life across the Continent, destroying it in the process (Mercifully, Britain escaped from this in 2016 and might yet return to a more Atlantic tradition).

To flourish, the United States needs to stay true to the political and economic model envisaged by the Founders; limited government, lower taxes and liberty. The good news is that with the new administration in Washington, this may well be about to happen. Elon Musk is determined not only to cut federal spending (something America urgently needs to do to avoid bankruptcy). He is looking to turbo charge productivity growth, moving people from the public to the private sector, and radically cut red tape. Reports of America’s relative decline seem to me to be wildly exaggerated. If Musk and co deliver half of what they are promising, we might just be on the cusp of an extraordinary period of progress and innovation in America. The divergence between America and the rest of the world is only going to accelerate.

I feel an overwhelming sense of privilege to be onboard!

What a result! Trump has bounced back to win the White House, gaining a majority of the popular vote for the Republicans for the first time in 20 years. The Republicans also won the Senate and held the House, meaning that they have a mandate, and the means to deliver it, in a way they have not had for a generation.

If the incoming administration is going to turn America around, they urgently need to get to grips with the three existential challenges the US faces, namely soaring debt, mass immigration and a debilitating lack of & self-belief.

Every hundred days the US national debt is rising by $1,000,000,000,000. US national debt is already relatively higher than it was at the end of the Second World War – and this year, we will pay more on the interest to service the national debt than we do on defense. As Elon Musk, now one of Trump’s inner circle, says, unless this changes, debt will destroy America the way it did other great powers.

Trump needs to take an axe, the way Argentina’s President Milei has, and close many of the 400 federal agencies, starting with the Departments of Education. Certain welfare programs need to go, too.

When Musk bought Twitter / X, he fired 80 percent of the staff, and output rose. Let’s hope he is allowed to do something similar to the federal bureaucracy. Musk, who recently complained that it takes him longer to get permission to launch a rocket than it takes his team to build it, understands how red tape is stifling America. Dramatically removing red tape, and legally sanctioning federal agencies that overreach their actual mandates, would raise economic growth.

Faster growth and reduced federal spending would, in time, close the deficit. Over the past four years, 10 million immigrants have entered America – me being one of them. But the number entering illegally has soared. Set aside the unfairness of allowing in people that don’t abide by the rules the rest of us are required to follow, it is not a good idea for America to accept large numbers of people from culturally incompatible countries. See Europe for details.

As a new arrival, I constantly marvel at how fortunate I am to live in America. But it bothers me that many Americans don’t see how awesome their country is.

Too many Americans – especially young Americans – have been taught to despise their own country by smart-stupid liberals in the education system who think that self-loathing is a mark of sophistication, when in reality it betrays a lack of it. The ‘woke’ insanity in the classroom needs to stop.

Trump has already indicated he will abolish federal Diversity, Equity & Inclusion programs on day one. He will be President as America celebrates her 250th birthday on July 4th, 2026. Trump needs to ensure it becomes a celebration of all that is good and admirable about this country, and not a woke-fest.

The only certain way to take back control of the education system from smart-stupid liberals is through school choice.

In many states like our own Mississippi, a coalition of liberal activists, like the so-called Parents’ Campaign, and anti-school choice Republicans, such as Lieutenant Governor Delbert Hosemann, have come together to block school choice.

Trump has made it clear he intends to address this, and Trump has indicated he will push for a federal law to give families school choice through a tax credit.

Trump is the most pro school choice President in the history of America, and I doubt Team Trump will take kindly to any anti school choice Republicans who carry on opposing public to public school choice and tax credits. State legislation on school choice in the 2025 session is likely to be closely watched by Team Trump.

Any anti school choice Republicans from Mississippi going to Mar-a-Lago to try to solicit Trump endorsements are likely to be disappointed. Their future trips are as likely to be as unsuccessful in that regard as their previous ones. Like last time, I very much doubt President Trump will offer anti school choice wannabes so much as a photo opportunity if they continue to oppose public to public school choice.

If you live in Mississippi, you will shortly have a Republican President in the White House, and a Republican Congress and Supreme Court in Washington DC. You, of course, already live in a state run by a Republican Governor, under a Republican-run legislature. If we can’t deliver conservative policy now, then when?

Now is the time for Mississippi – and America – to use this opportunity and place the country on an authentically conservative path.

America faces an axis of aggression. China, Russia, Iran and North Korea are not only actively undermining US interests. They increasingly seem to be working together.

How should America respond?

According to a new report published by Mississippi Senator, Roger Wicker, America needs a new national defense strategy capable of responding to this “emerging axis of aggressors”. “21st Century Peace Through Strength: a generational investment in the US military” offers a serious analysis of US military capabilities and makes some important recommendations.

Wicker calls for an immediate $55 billion increase in military spending in 2025, on top of the almost $900 billion existing budget. The aim, he suggests, should be for the United States to spend around 5 percent of GDP on defense.

To put that in context, America today spends 3.4 GDP percent on defense, and has not spent more than 5 percent since Ronald Reagan was in the White House. Reagan famously won the Cold War, facing down the Soviet threat by beefing up American strength. Wicker envisions a similar approach in “Peace through Strength”.

What is really interesting about Wicker’s proposal is not the call for more money for the military, but his suggestion that there should be a “dramatic increase in competition in the defense industrial base”. Senator Wicker is right. Often, we think of applying free market principles to education or healthcare. There is a very powerful argument for applying free market discipline to defense spending, too.

With the national debt growing, it is vital that America gets the maximum bang for every defense buck. Wicker puts forward ideas as to how to make this happen through far reaching “acquisition reform”. Allowing more market competition in the defense sector would help ensure that America avoided the sorry fate of my own native Britain.

The UK spends about $70 billion a year on defense. That might be less than a tenth of what America spends, but it still means that the UK has the sixth largest defense budget in the world, above Japan and roughly on a parr with Russia.

Unfortunately, Britain has not been effective at converting what she is able to spend on defense into military muscle. Despite spending all that money, British aircraft carriers seldom seem to carry many aircraft. Indeed, the expensive new carriers don’t always seem to be able to spend much time at sea. The less said about British tanks the better.

UK defense acquisition has been a series of costly disasters because the defense budget is often spent in the interests of various favored suppliers, rather than the military.

I first became aware of quite how bad British defense acquisition was on a visit to Afghanistan as a Member of the British Parliament. Troops in Helmand complained about a shortage of helicopters, yet I noticed rows of American Black Hawk helicopters on the runway back in Kandahar.

Why, I wanted to know, didn’t we Brits just buy Black Hawks from the American company that made them? I soon discovered that British defense acquisition is viewed by some as a giant job creation scheme. Or else it is about filling the order books of well-connected companies, not giving the military what they need.

America needs acquisition reform to avoid defense dollars being spent by various vested interests, rather than on the best interests of the US military. Some will say that America cannot afford to increase defense spending. I worry that America cannot afford not to.

Years of federal deficits mean than the US national debt is soaring. There will be enormous pressures on federal spending. All the more reason to ensure that the US gets maximum value for every defense dollar.

Let’s hope Wicker’s reforms are acted upon whoever is in the White House.

So often politics focuses on trivia. What Wicker has done is produce a serious study to address important geo political questions that the United States is going to have to deal with.

Putting America first does not mean ignoring what is happening on the other side of the world. Merely wishing away anything outside the Western hemisphere does not make the United States more secure. It ultimately means that the world’s problems will show up at the US border.

Putting America first means investing in defense. Wicker shows how we might do that.

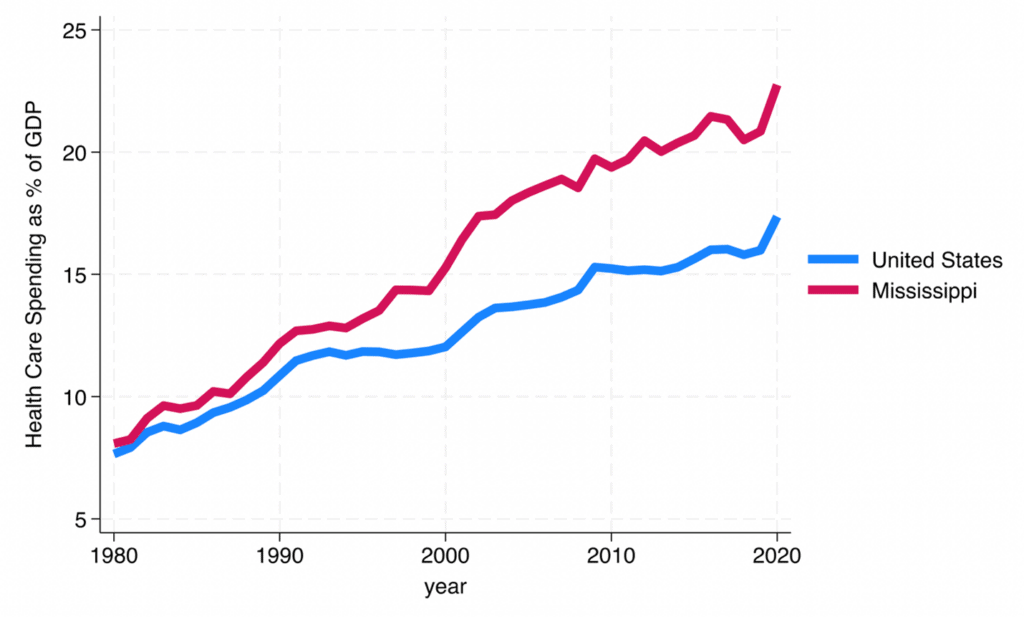

Did you know that Mississippi spends a higher share of our overall wealth on healthcare than almost any other state in America? Yet despite this, we still have some of the worst health outcomes in the country.

Source: AFP Mississippi report on Certificate of Need, James Bailey

Some believe that the answer is to spend an even larger amount by expanding Medicaid. Mississippi’s House of Representatives has just voted to do precisely that.

The debate over Medicaid expansion now appears to hinge on whether under the expansion scheme there will be any realistic work requirement. Critics fear that without a robust requirement for recipients of free health care to be in work, Medicaid expansion is little more than a something-for-nothing system of soft socialism.

It remains to be seen if the Senate will support the House’s bill – and if it will do so by a large enough margin to overturn any future gubernatorial veto.

There is, however, another proposal that has attracted far less attention that really would improve healthcare in our state.

Healthcare in Mississippi is deliberately restricted by a set of laws known as Certificate of Need, or CON, laws. These laws require anyone wanting to expand existing services or offer new services to apply for a Certificate of Need permit. By not issuing permits to new operators, competitors are kept out of the market - which suits the existing providers.

Our recent report on Certificate of Need reform shows how harmful this red tape can be. If we removed this protectionist red tape, we would get far more bang for our buck, however much the legislature decided to spend on Medicaid.

Florida, Tennessee and both North & South Carolina have all recently removed their CON laws – and they each have significantly better healthcare as a consequence.

Now there is a chance that Mississippi might do something similar. Rep Zuber’s excellent bill (HB 419) opens the possibility that some CON rules could be repealed.

Of course, now that the bill is before the House, every sort of parasitic vested interest is frantically lobbying to kill the bill.

Why? CON confers on existing providers a means to legally exclude the competition.

Imagine in the search engine Yahoo! had been able to use CON laws to shut down Google? Or if Friends Reunited could have used CON laws to prevent Facebook? Or if the folk that made DVDs could have used CON to prevent Netflix from taking off? CON laws have been doing precisely this to healthcare in our state.

CON laws in Mississippi are one of the last vestiges of the good ole boy system that has held Mississippi back.