It would be harder for a nail stylist to work in Mississippi than in almost any other state in the country if the Board of Cosmetology gets their way.

Nail technicians in Mississippi are currently required to complete 350 hours of training before they can practice in the state. Licensing is required in 49 states, with Connecticut being the lone holdout that does not require licensing or certifications for nail technicians, according to the National Association of Complementary and Alternative Medicines.

Mississippi’s 350-hour requirement is in line with the national average of 368. But a bump to 600 hours would be the second highest burden, which is shared by eight states. Only Alabama’s 750 hours would be greater.

But Sharon Clark, the executive director of the Board, made her push for expanded licensure in a meeting of the House Appropriations Committee on Tuesday, arguing that it was a sanitary issue and this will help protect the public. Because teachers don't have time to teach cleanliness in the first 350 hours.

If you’ve heard one licensing pitch, you’ve heard them all

The Board has admitted that the current licensing regime is not working well. We agree. But instead of increasing the regulations as the Board wants, the state should move to do away with the license for nail technicians and allow voluntary or non-regulatory options that help entrepreneurs start and run businesses while providing the maximum options for consumers.

What would that look like?

This begins with market competition, the least restrictive option. Without government imposed restrictions, consumers have the widest assortment of choices, thereby giving businesses the strongest incentives to maintain a reputation for high-quality services. When service providers are free to compete, consumers can decide who provides the best services, thereby weeding out those that do not.

Quality service self-disclosure is a fancy term for customer satisfaction. Think about all the common sites people can leave reviews such as Yelp, Google, Facebook, specific industry sites, etc. Finding out which location is providing a good customer experience is easier than ever, providing users with more complete options.

Voluntary, third-party certification allows the provider to voluntarily receive and maintain certification from a non-government organization. One of the most common examples is the National Institute for Automotive Service Excellence (ASE) designation for auto mechanics. No mechanic is required to receive this certification, just like you may or may not care if a mechanic has it hanging on their wall. But it sends a signal to the consumer that the location with that designation is committed to quality service. Again, if that matters.

If you would like the government to still be involved, you can continue with inspections or you may choose to require registration, as they do with hair braiders. Hair braiders previously needed to take hundreds of hours of irrelevant cosmetology classes. Now they register with the state and pay a small fee. This discourages “fly-by-night” providers, while still only creating a small barrier for providers.

Licensing makes sense in certain – and limited – fields. But if we want to encourage economic growth, we need to start trusting the free market.

Senate Bill 2004, sponsored by Sen. Kevin Blackwell, holds any party that contests a Certificate of Need, or CON, application liable for the legal costs of the applicant should their contest fail, and the CON be approved.

Essentially, this disincentivizes interested parties from attempting to have a CON denied, ultimately allowing more of these applications to be successful and lowering the cost burden for those wishing to provide healthcare solutions in Mississippi.

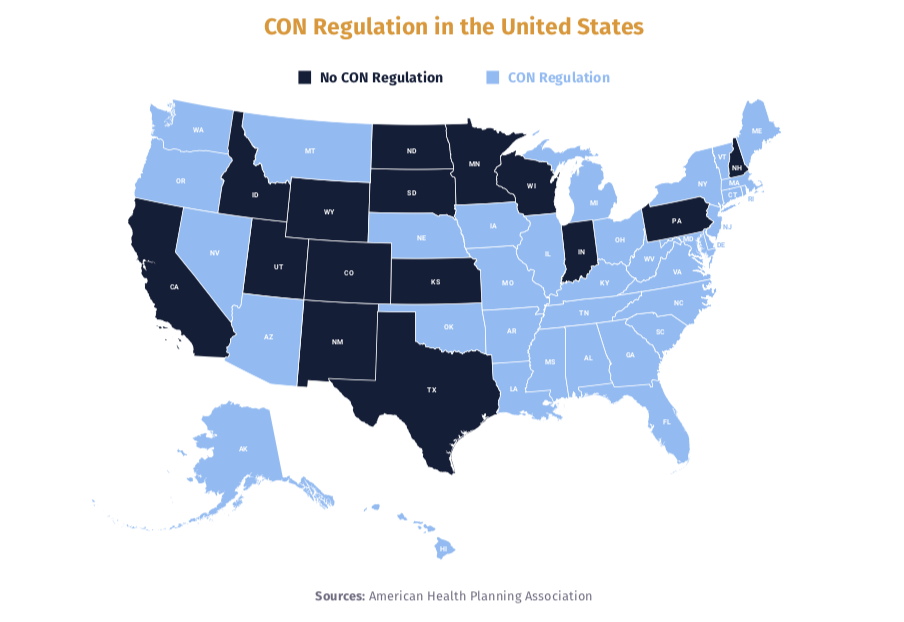

CON laws originated from federal legislation that was fully repealed in 1986. Thirty-five states, including Mississippi, still have CON laws in state legislation.

Many states issue moratoria on specific medical facilities, practices, and materials through CON laws. Mississippi’s CON law requires health care providers to seek approval from the state Department of Health to build a new facility, add beds or diagnostic equipment to an existing facility, or any other capital-related project. The regulated areas include:hospital and nursing home beds,Inpatient psychiatric beds for children, beds in chemical dependency centers, and home health services.

CON laws inevitably grant monopolies to existing medical providers with facilities already in an area and only stifle the ability of new facilities to open up. This often eliminates the possibility of competition in the medical industry between providers, keeping costs up, and quality of service down.

While the overall goal should be full repeal of CON laws, this is a step in the right direction.

MCPP has reviewed this legislation and finds that it is aligned with our principles and therefore should be supported.

Read the bill here.

Track the status of this bill and all bills in our legislative tracker.

As lawmakers propose new laws that would limit consumer options concerning vaping, which would inevitably lead to a larger black market, the federal government has confirmed that vaping related illnesses are largely from the black market, not products legally purchased in stores.

According to a new report from the Center for Disease Control and Prevention (CDC), those with illnesses were linked to marijuana vapes – not nicotine – and, at least 85 percent of those were purchased somewhere other than commercial sources. Still, even that number may be lower than the actual statistics.

Regardless, the CDC has now removed language from their website suggesting people refrain from all vaping products. Instead, they suggest you avoid purchasing products from “informal sources,” more commonly referred to as the black market.

Yet, proposals to limit vaping products would do just that.

Because of this “outbreak,” we are told we must do something, such as ban vaping and e-cigarettes. Legislation is likely in Mississippi this year. This would be just the latest example of unintended consequences.

First, the potential bans ignore the fact that e-cigarettes have proven to help tobacco smokers quit. Since 2007, these products have helped an estimated three million Americans quit smoking and a recent study published in the New England Journal of Medicine found that e-cigarettes and vaping devices were “twice as effective as nicotine replacement at helping smokers quit.”

The Royal College of Physicians proclaimed in 2016, “in the interests of public health it is important to promote the use of e-cigarettes, NRT (Nicotine Replacement Therapy), and other non-tobacco nicotine products as widely as possible as a substitute for smoking in the UK.” We can presume that would apply in the United States as well.

And there is a cost savings benefit from current smokers switching to the replacement devices. A 2017 study by R Street Institute found that taxpayers could save $2.8 billion in Medicaid costs per one percent of enrollees over 25 years if users switched from combustible cigarettes.

A ban also ignores the question of where current users, particularly the teen vapers lawmakers are particularly interested in saving, would turn. After all, teen vaping is surging.

Yet, sales of e-cigarettes have been prohibited to those under 18 since 2016 and they are now illegal to those under 21, so minors are already turning to the black-market. That should be our first clue that bans don’t work. Because the black market is the problem, as it usually is. Not the products adults are legally purchasing today.

So, because teens, who are already prohibited from purchasing these products, have resorted to the black market, we must ban adults from being able to purchase these products, at least when it comes to the fruit and candy flavors that most prefer (whether we are talking about teens or adults trying to kick the cigarette habit). This will only lead to a larger black market, and more illnesses, and more deaths. All the things those in favor of banning the products seemingly are trying to prevent. Or maybe it will just push more users back to tobacco products, which, coincidently, are at an all-time low among minors.

We’ve played the prohibition game before. It doesn’t end well. During alcohol prohibition, individuals made their own liquor that was often much more dangerous than what you could legally buy prior to prohibition. Today, many people roll their own cigarettes in locales that have absurdly high taxes. Again, these are often more dangerous as you can get more nicotine by leaving out a filter.

And when it comes to vaping, teens can turn to YouTube for do-it-yourself videos on raising nicotine levels. This won’t change if and when any of these proposals to regulate or eliminate vaping or e-cigarettes becomes law.

The bans won’t provide an alternative to current cigarette smokers, nor will they stop teens from vaping. Instead, they will only increase lawlessness.

Mississippi's laws that limit who can sell alcohol and where you can purchase it need to be modernized.

Let me paint a picture with a short story: The year is 2020, on a sunny day (so not today, but maybe some day in the future) you decide to stop by the grocery store on the way home to pick up a bottle of your favorite wine. Unfortunately for you, Mississippi grocery stores aren’t legally allowed to carry wine.

No worries, you decide to drive across the county line (because your county bans the sale of liquor) to the liquor store and grab the bottle there. Unfortunately for you, every liquor store in the state is forced to go through the one government distributor for alcohol that exists in all of Mississippi, and their warehouse didn’t order enough of your brand this month.

No worries, you’re willing to wait for a few days, so you go home to order the bottle online and have it shipped to you. Unfortunately for you, the state of Mississippi is one of a slim handful of states that legally bans the shipment of wine into the state.

Thus, in the year 2020, in an age where people around the world are connected digitally in unprecedented ways, in a time that you can order a ride, groceries, fast food, and almost everything at the click of a digital button and have it in minutes, you can’t even get a bottle of wine you like.

What is the reason for this tragedy?

Look no further than the tyrannical imposition of government into affairs that it has no due right to be involved in. The common denominator throughout this series of beverage procurement failures is the over-restrictive nature of our state apparatus. Prohibition is alive and well in Mississippi, because the government controls our intake of alcoholic beverages at a rate unparalleled in the rest of the country.

What good reason is there to stop grocery stores from selling wine? Why can’t we have private alcohol distributors? Why does all liquor and wine need to be run through a single government-run warehouse in Madison? Why can’t I ship wine to my door like almost every other citizen in the country?

If you’re asking these questions like me, then you’re also probably frustrated. Apparently our state leaders think that they can run our lives better than we can. It is important to recognize that the tools of excessive regulation are not implemented solely to control alcohol. Our government has created a vast web of intrusive regulatory policies which limit the supply and impact the sellers in a variety of industries, including healthcare, food sales, and even children’s lemonade stands.

It’s worth recognizing just how much of our inflated prices and our slim range of choices is nothing more than a product of government control. Frustrating, isn’t it?

A group of physicians in Mississippi responded to the Mississippi State Board of Health’s resolution opposing medical marijuana. A ballot initiative will be in front of voters in November after Mississippians for Compassionate Care gathered more than 105,000 certified signatures.

“Sick people all across our state have waited for a long time for this option to be made available to them,” said Jamie Grantham, Communications Director for Mississippians for Compassionate Care. “The Board of Health is telling them to keep waiting, but with the medical research that’s been published concerning medical marijuana as well as countless patient testimonials across the country in the 34 other states that have medical marijuana programs, there’s no reason these patients in Mississippi should suffer any longer. They deserve better.”

The response from a group of physicians says the resolution is “filled with misinformation and outdated arguments.”

“As you know, the initiative does not require physicians to treat patients with medical marijuana, the response says. “The initiative, that was signed by more than 105,000 Mississippians, simply gives doctors in our state the opportunity to certify its use from regulated treatment centers. Your resolution offers no compelling reason why the ten members of the Board should try to stop the more than 5,700 physicians in our state from using our experiences, training, and research to consider treating our patients with medical marijuana.

“While medical marijuana is certainly not a cure-all, Mississippians with debilitating medical conditions deserve to have this option available to them. The experiences in 34 other states show that it can be effective, and we believe the benefits of medical marijuana make it a viable treatment option for many in our state who are suffering.”

The physicians signing the letter then provide a point-by-point response to the issues raised by the Board.

According to an analysis of data by the Mississippi Center for Public Policy, an overwhelming majority of certificate of need applications were recommended for approval by the state Department of Health in the last decade.

From 2009 to 2018, 91.45 percent of the applications passed the first hurdle of a health department staff review.

During the 2009 to 2018 timeframe, there were 234 analyses performed by department staff for CON applications. The Department of Health recommended authorization on 214 without conditions, two received conditional approval and one received a partial approval.

Only 17 applications were recommended for disapproval (7.26 percent) and most of these were for new providers, largely from out of state, seeking to provide services in the state.

Mississippi is one of 35 states that requires a certificate of need, which requires health care providers to seek approval from the state Department of Health to build a new facility, add beds or diagnostic equipment to an existing facility, or any other capital-related project.

The regulated areas include:

- Hospital and nursing home beds.

- Inpatient psychiatric beds for children.

- Beds in chemical dependency centers.

- Home health services.

CON approval is even mandated for non-care related capital projects such as medical office buildings, the installation of hurricane wind-resistant windows at one hospital on the Gulf Coast and authorization for a hospital to repair damage from a tornado. Thirty six applications (15.3 percent) were from providers seeking approval for cost overruns on capital projects.

Providers are also required to provide updates on whether a project goes over budget. Any capital project by a provider is mandated to provide updates on progress every six months and at the project’s completion.

When providers apply for a CON or an amendment to an existing one, this starts a 90-day process. First, the application is reviewed by the Department of Health’s Division of Health Planning and Resource Development to see if it is in compliance with the State Health Plan. This document is a blueprint composed by health department officials to centrally plan the health care needs of the state’s population.

Among the criteria reviewed by the division include:

- Need for the project.

- Economic viability.

- Possible alternatives.

- Access to the facility for underserved and indigent people.

- Relationship with existing providers in the area and in the state.

- Anticipated quality of care.

Then the division staff makes a recommendation on whether the CON should be awarded. The provider appears before an independent hearing officer who makes findings of fact and issues a second recommendation. The state’s health officer makes the final call on whether a provider receives a CON.

The only way to dispute the decision is to file an appeal in chancery court within 20 days.

CONS originated from the National Health Planning and Resources Development Act of 1974 that was signed into law by then-President Gerald Ford. This act was intended to reduce annual increases in federal health care spending and one of the cost control measures was to require states to institute CON laws to regulate health care facilities.

This requirement was later done away with by Congress. Florida was the most recent state to eliminate its certificate of need regime in June. Florida’s House Bill 21 was signed into law by Gov. Ron DeSantis on June 26 and repealed CONs for general hospitals, complex medical rehab beds and tertiary hospital services such as neonatal intensive care units and organ transplant centers.

The new law also sunsets CON requirements for specialty hospitals on July 1, 2021. The state’s CON requirements on nursing homes and hospices were not affected by the new law.

Mississippi’s certificate of need program needs some reform, but the legislature has been largely unsuccessful in the last four years in changing the system in a meaningful way.

Mississippi is one of 35 states that require a certificate of need for healthcare providers. They must receive approval from the state Department of Health to build a new facility, add beds or diagnostic equipment to an existing facility, or even when a capital project goes over budget.

Every major attempt at reform in the past four years for Mississippi’s certificate of need program has failed. Former state Rep. Mark Baker (R-Brandon) tried three times to completely eliminate the state’s CON regime in 2015, 2016 and 2017 and all three bills died in committee without a floor vote.

Former state Rep. Robert Foster (R-Hernando) also filed a reform bill in 2016 that would’ve removed most health care services and equipment from CON oversight. It also failed in committee.

The only CON reform passed by the legislature and signed into law in the last four years was a bill authored by state Sen. Josh Harkins (R-Flowood) that revised the time requirements and required public notices be issued before CON approval.

CONs originated from the National Health Planning and Resources Development Act of 1974 that was signed into law by then-President Gerald Ford. The goal was to curtail constant increases in federal health care spending by inexplicably regulating the number and services rendered by providers.

One of the cost control measures was to require states to institute CON laws to regulate health care facilities, with Mississippi passing its CON law in 1979.

The CON program in Mississippi regulates:

- Hospital beds

- Nursing home beds

- Inpatient psychiatric beds for children

- Chemical dependency beds

- Home health services

The way the process works is a provider submits an application for a new CON or an amendment to an existing CON. Officials use a document called the State Health Plan to determine whether to authorize the CON.

This state health plan determines the health care needs of the state’s population, a classic case of central planning.

Where the CON hurts most is rural hospitals. According to a national report of rural hospitals, 31 of Mississippi’s 64 rural hospitals are at high financial risk. Nationally, 21 percent are listed in danger of closing their doors.

Scholars at the free-market Mercatus Center at George Mason University found that patients were more likely in states with a CON regime to have to travel outside their county for care. Using 25 years of data and controlling for factors that might influence the numbers of hospitals, states with CONs have 30 percent fewer rural hospitals per 100,000 residents.

Eliminating the CON could also reduce healthcare costs, according to some research.

A 2016 study by the federal National Institutes of Health showed that Medicaid and Medicare spending per enrollee in nursing homes declined in all states during the study, but the rate of decline was higher in states without CON policies.

The study examined Medicare and Medicaid spending on nursing homes and home health care in 44 states that didn’t change their CON laws from 1992 to 2009.

The Mississippi State Board of Health issued a resolution opposing medical marijuana. The secretary of state's office, today, officially confirmed that supporters gathered the necessary signatures for the initiative to be on the ballot in November.

The ballot initiative could make Mississippi the 34th state in the country with medical marijuana.

The state Board of Health, which would be tasked with regulating the program, approved a resolution to express their "strong opposition to the ballot initiative."

The resolution said that, "there are numerous known harms from the use of cannabis products including addiction, mental illness, increased accidents, and smoking related harms...the proposed amendment to the Mississippi State Constitution amendment would allow the use of marijuana for a very broad number of medical indications...the consumption of any combustible inhaled product is harmful to individual health...routine marijuana consumption has numerous known harms and is contrary to the mission of public health."

The Board also said that this program would expand their department beyond capacity and harm its function.

Gov. Phil Bryant, who has been a vocal opponent of the initiative since day one, also weighed in:

If a majority support the initiative, medical marijuana will become legal in the state within a year.

Mississippi is one step closer to medical marijuana after the secretary of state's office officially qualified Ballot Initiative 65 for the November, 2020 ballot.

Last fall, Mississippians for Compassionate Care, the organization that had been collecting signatures for the initiative, submitted 105,686 certified signatures of registered voters to the secretary of state. Since that time, the secretary of state’s office has been confirming that the requirements have been met.

Medical marijuana is currently legal in 33 states, with Missouri, Oklahoma, and Utah adopting ballot initiatives in 2018. In 2019, legislatures in Georgia and Texas approved medical marijuana, though the rollout has not been finalized in either state.

What would medical marijuana look like in Mississippi?

If the ballot initiative is approved by voters in November, marijuana would be legal for those with a debilitating medical condition and would have to be authorized by a physician and receive it from a licensed treatment center.

Some of these conditions include:

- Cancer

- Epilepsy and other seizure-related ailments

- Huntington’s disease

- Multiple sclerosis

- Post-traumatic stress disorder

- HIV

- AIDS

- Chronic pain

- ALS

- Glaucoma

- Chrohn’s disease

- Sickle cell anemia

- Autism with aggressive or self-harming behavior

- Spinal cord injuries

If a physician concludes that a person suffers from a debilitating medical condition and that the use of medical marijuana may mitigate the symptoms or effects of the condition, the physician may certify the person to use medical marijuana by issuing a form as prescribed by the Mississippi Board of Health. The issuance of this form is defined in the proposal as a “physician certification” and is valid for 12 months, unless the physician specifies a shorter period of time.

That individual then becomes a qualified patient. After they do this, they present the physician certification to the Mississippi Department of Health and are issued a medical marijuana identification card. The ID card allows the patient to obtain medical marijuana from a licensed and regulated treatment center and protects the patient from civil and/or criminal sanctions in the event the patient is confronted by law enforcement officers. “Shopping” among multiple treatment centers is prevented through the use of a real-time database and online access system maintained by the Mississippi Department of Health.

The Mississippi Department of Health would regulate the cultivation of marijuana, processing, and being made available to patients. There would also be limits on how much marijuana a patient could obtain.