Not enough people in Mississippi work. Out of every 100 working age adults in our state, 46 are not in the labor force.

Nearly half of working age Mississippians are not in formal employment – and they aren’t actively looking for employment either.

At the same time, there are a record number of jobs available. According to the US Bureau of Labor Statistics, in October last year there were 80,000 unfilled jobs across the state.

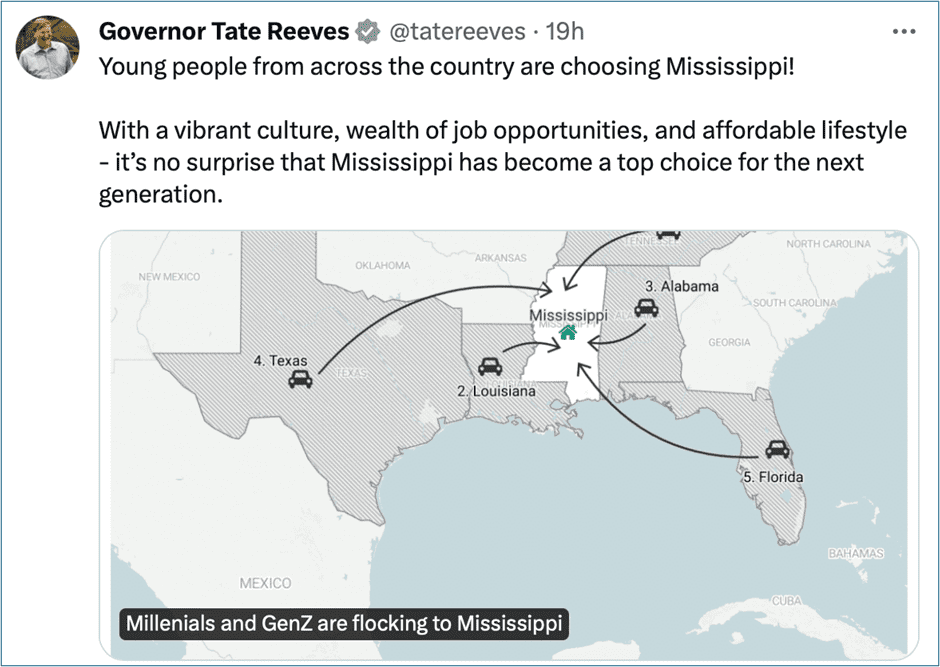

Not only are there lots of jobs available in Mississippi, but according to new research a record number of people are now moving to Mississippi to take up those opportunities. 2022 saw a net inflow of 12,000 (often young) people to our state, coming largely from Tennessee, Louisiana, Alabama, Texas and Florida.

A combination of labor market deregulation, inward investment and tax cuts seems to be transforming Mississippi for the better. Our state is no longer a place that people leave, but somewhere people move to in search of new opportunities. What can we do to ensure that more people in Mississippi take full advantage of those job opportunities?

It is not enough to merely talk about opportunities. With 80,000 job vacancies right here, right now, there are opportunities to work all around us. The issue is why some folk aren’t taking the opportunities that are there.

Some have suggested that we hire more career counsellors in high schools. I am certain that career counsellors do a wonderful job, but if that is the only policy solution, I suspect labor force participation will remain low.

If we are going to increase workforce participation, we need to ask difficult questions about welfare. Does welfare create disincentives against work?

Mississippi has a population of 2.95 million. Approximately one in five (19 percent) live below the poverty line (calculated as the minimum income needed to get by with the bare essentials.)

The way in which the myriad of assistance programs impacts the half a million plus people below the poverty line matters, and needs to be properly understood if we are to improve workforce participation.

Welfare programs can have unintended consequences, and one of them is the creation of so-called ‘benefit cliffs’. A benefit cliff is what happens when someone loses benefits if their income increases, but the benefits they lose outweigh the additional income gained.

Given the maximum income thresholds allowed, we know, for example, that if someone’s monthly income went from $400 a month to $410 a month, they would no longer qualify for some Temporary Assistance programs.

If your income rose above $1,215 a month, you could lose the right to claim Supplemental Nutrition Assistance Program (SNAP). When your income per person goes over $19,392 a year, you may no longer qualify for Medicaid (although the ‘cliff’ cut-off is not always as abrupt as is sometimes supposed).

Take into account the different benefit cliffs, and you could have a powerful range of disincentives.

Even if a person was notionally better off when holding down a 35 hour week job, the time and effort it would take for a relatively modest increase in income might leave some feeling having a job was not worth it.

It has been suggested that benefits do not create a problem of ‘cliffs’, but of straight forward dependency. They point out, for example, that those on food stamps are not those hovering on the edge of the labor market, but full-time welfare dependents. There may be some truth in that, too.

So, what is the solution?

The answer to benefit ‘cliffs’ is not to increase welfare payments in order to remove disincentives, but to institute more stringent work requirements for those on welfare programs.

In Arkansas under Sarah Huckabee Sanders, anyone that fails to accept a suitable job within five days of being offered one, or who fails to show up for job interviews without notice, can now lose their benefits.

If we are serious about increasing workforce participation, we may well need to implement something similar.

Often in politics, it is easier to define a problem than it is to solve it.

Remember Barack Obama’s eloquent speech about the need to unite America beyond red states Vs blue states? When Obama left office, America was more politically polarized than before.

Who could forget Al Gore’s theatrics as he talked about the need to save the planet? I doubt a Gore-run administration would be able to control the country’s borders, let alone control global sea levels or the climate.

Remember how during last year’s gubernatorial race here in Mississippi, Brandon Presley, the Democrat candidate, waxed lyrically about the fate of rural hospitals? Hosing federal funds around is unlikely to change the fact that hospitals that are underused will remain underused.

Politicians can certainly make problems worse. Obama, I would argue, exacerbated America’s divisions. Gore & co have advocated for an energy policy that does nothing to control the climate, but has made people poorer. Subsidising an underused health service is unlikely to make it magically sustainable.

Occasionally, however, politicians have it in their gift to do something that really would improve things.

In a report we published this week, we show that there is a solution to Mississippi’s healthcare crisis staring us in the face: our leaders could abolish the anticompetitive laws that intentionally limit the number of healthcare providers in our state. This would improve access to healthcare and lower costs for everyone.

For years, if a healthcare provider wants to offer new services or expand existing services in 19 key areas of health care, they are required by law to get a permit. These Soviet-style permits, known as Certificates of Need (CON), are also required for a provider wanting to spend more than $1.5 million on new medical equipment, relocate services from one part of the state to another, or change ownership.

Unlike other sensible licensing requirements, CON requirements are not designed primarily to assess a provider’s qualifications, safety record, or fitness. They are about central planning to decide if each new applicant’s services are “needed” by the community. I believe that it should be up to patients and practioners to decide what is needed, not government bureaucrats.

CON laws in Mississippi limit the provision of long term care, despite demographic change that has seen the number of elderly people needing care increase dramatically. Ambulatory services, key diagnostic services, psychiatric services and many other services are all limited by CON laws.

If the case for change is so overwhelming, why has it not already been done? In any market, when there are restrictions imposed to keep out the competition, there will be various vested interests that lobby for their retention. So, too, with CON laws.

Defenders of CON restrictions suggest that CON repeal would be risky and dangerous. They like to imply that any reform would reduce access and quality would suffer.

Such concerns are unfounded. Over 100 million Americans—nearly a third of the population—live in states without CON laws in health care. Four in ten Americans live in states with limited CON regimes that apply to only one or two services, such as ambulance services or nursing homes.

If our lawmakers are serious about improving healthcare in Mississippi, I hope they read our report, which sets out not only what needs to be done, but provides a roadmap explaining how to do it.

High flying rhetoric won’t improve our state. Getting down to work and removing CON laws will.

Report identifies key reforms needed to boost health outcomes in Magnolia state

Removing outdated restrictions on health care would boost health care in Mississippi, according to a new report published today. Mississippi has some of the worst health outcomes in the country, and the full repeal of these anticompetitive laws in the health sector would cut costs and improve access to treatment.

For several decades, an official permit has been required for health care providers wanting to offer new services or expand existing services in 19 key areas of health care. These permits, known as Certificates of Need (CON), are also required for a provider wanting to spend more than $1.5 million on new medical equipment, relocate services from one part of the state to another, or change ownership.

Unlike other health care licensing laws already in place, the CON process is not designed primarily to assess a provider’s qualifications, safety record, or fitness. Instead, CON laws require regulators to centrally plan the health care sector by assessing whether each new applicant’s services are “needed” by the community. That question, however, can only be truly answered through the voluntary choices of practitioners and patients.

“If you want to know why Mississippi does not have medical care where it is most needed, CON laws bear much of the blame. They intentionally take away options for health care,” explained Douglas Carswell, President and CEO of the Mississippi Center for Public Policy.

“What started out a generation ago as a misguided attempt to restrict increases in health costs has become a legally-sanctioned protectionist scheme. These outdated laws are indefensible and must go.”

CON laws in Mississippi limit the provision of long term care, despite demographic change that has seen the number of elderly people needing care increase dramatically. Ambulatory services, key diagnostic services, psychiatric services and many other services are all limited by CON laws.

The report, authored by Matthew Mitchell, one of America’s leading experts on health care regulation, references overwhelming evidence which shows that CON laws mean higher spending, less access, and diminished quality of care.

Mitchell’s report identifies a road map for reform, highlighting how full abolition could be achieved. “The evidence from other states without CON laws not only shows how a Mississippi without CON would enjoy greater access to lower cost and higher quality care, but it also gives us a roadmap for how to do it. In the report, I talk about 11 different strategies for reform,” said Mitchell.

“The Governor and the new Speaker have both committed to improving health outcomes in Mississippi by repealing restrictive practices. We are excited to see legislation aimed at CON repeal, as well as action by the Board of Health to remove the red tape,” added Carswell.

Last year, Mississippi Republicans won an overwhelming majority. Could 2024 be the year when they use that majority to deliver the kind of big, strategic change our state desperately needs?

Here are a number of reforms that Mississippi conservatives have it in their gift to implement, which would transform the long term prospects of our state for the better.

- Education Freedom:

2024 could be the year that we give every family in the state control over their child’s share of education tax dollars, through an Education Freedom Account. Arkansas passed legislation to do precisely that last year. Tennessee and Louisiana are poised to do something similar. Rather than trailing behind, Mississippi lawmakers should take the lead, delivering big, strategic change to improve education in this state, too.

The Mississippi Center for Public Policy recently held a public rally for education freedom, with Corey DeAngelis and local educators, helping mainstream the idea. Recent polls now show overwhelming public support.

- Affordable healthcare:

Too many families in Mississippi cannot get health coverage. Rather than hosing federal dollars at the problem, we need to look at what states like Florida are doing to innovate, with alternatives to insurance-based healthcare. This means ending the restrictive Certificate of Need laws that prevent new low cost health care providers from operating. It also means allowing nurse practitioners more autonomy. The Mississippi Center for Public Policy will soon publish a roadmap on how to go about removing CON laws.

- Tax cuts:

In 2023 Mississippi had a large state budget surplus. Rather than wait for politicians to think up new ways to spend that surplus, we need to see tax cuts in 2024. One option would be a further reduction in the state income tax.

Our neighboring states are reducing the tax burden on families and businesses. If we want to reverse the population decline in our state, we need to do so too.

- Abolish DEI (Diversity, Equity & Inclusion):

In recent months we have seem appalling behaviour by ‘woke’ academics at several leading universities. It is now clear that DEI is destroying American academia. So why are public universities in Mississippi still running DEI programs? The Governor of Oklahoma recently issued an order terminating funding for DEI programs in public universities in that state. Mississippi needs to stop the rot in public universities and end DEI programs in 2024.

While those are our top four priorities for 2024, here are some other things we would like to see our law makers deliver:

- Women’s Bill of Rights / Parents Bill of Rights: Early last year, we invited Riley Gaines to speak in Jackson as part of our campaign to mainstream the idea of protecting women’s rights. We are thrilled to see so many people come out in support of the idea of building on the safeguards already contained within the Mississippi Fairness Act.

- PERS reform: The laws of math make the current public employee retirement scheme (PERS) unsustainable. Mississippi needs reforms so that young people starting work in the public sector have defined contribution, rather than defined benefit, pensions. Unless we make this change now, our grandchildren will end up with a massive tax bill. 2024 is the year when we need to see sensible changes made to PERS.

- Ballot initiative: Citizens in our state used to have a right of ballot initiative. Over a thirty year period, almost 70 initiative attempts to change the state constitution were made, with only three being successful. A failure to update the rules for triggering such initiatives means that we no longer have this right in practice. MCPP would like to see the right of ballot initiative restored, allowing citizens to change state law.

- Young Enterprise Act: Mississippi ought to do more to encourage young people to become entrepreneurs. One way to do this could be to exempt minors from having to obtain costly permits and licenses, or collect and remit sales taxes, when they want to run a small business. A few years ago, such a proposal was considered in the state legislature. We would love to see it revived.

If Mississippi conservatives passed these eight or so laws, they would transform our state for the better. No longer would we be considered a laggard by some, but as a leader.

Green energy – folly or the future?

Former White House energy adviser, Mark Mills, addressed at a packed lunch meeting in Jackson, Mississippi, at an event attended by key state policy makers and members of the public.

Mills, a senior fellow at the Manhattan Institute, talked about some of the implications of the rush to renewable energy. In order to meet net zero carbon dioxide emissions targets, Mark Mills outlined the scale of infrastructure construction that would be required.

“Mark Mills has an encyclopaedic knowledge about energy policy. He laid out some of the hard facts about what it would take to ditch our dependence on oil and gas.” said Douglas Carswell of the Mississippi Center for Public Policy.

“Mark Mills warned about making the same mistake that Germany has made. Over there, politicians rushed into renewable energy, and in doing so pushed up the cost of energy. This has now priced German industry out of the world market” Carswell added.

“If Mississippi wants to keep on attracting more industry, we need to ensure that we continue to have a plentiful supply of affordable energy”.

“Transitioning to renewables might sound like a bright idea in Washington DC” Carswell added. “Mark Mills showed that unless the federal government can change the laws of physics it is just not realistic. America would need to install thousands of new giant wind turbines each week, cover a vast area in solar panels and build dozens of new nuclear plants each year.”

“Politicians might talk glibly about moving to electric vehicles” he added. “Mark Mills pointed out that we would need hundreds of new charging stations, each one requiring the same amount of electricity as a steel mill. The capacity and infrastructure simply won’t be there to achieve this rush to renewables”.

The event was hosted jointly by Bigger Pie Forum and the Mississippi Center for Public Policy. Several members of the state legislature and Public Service Commissioners attended and asked questions.

To watch Mark Mills, talk online, click here:

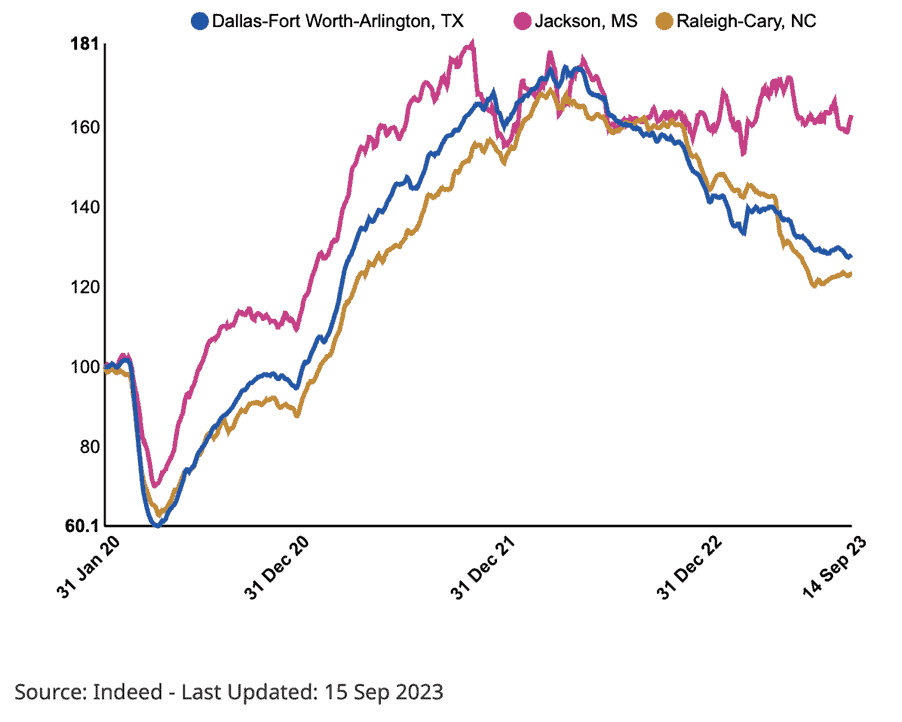

Job hiring website, Indeed.com, has published data showing the Jackson metro area to be one of the best performing metro areas in America for new job postings.

According to Indeed’s job posting index, the Jackson metro area jobs postings are 54 percent higher now than they were in February 2020. Of all the metro areas in America, only Phoenix in Arizona and Spokane in Washington performed better than Mississippi’s state capital.

“Indeed’s data on jobs growth shows Jackson Mississippi is outperforming most other American cities when it comes to jobs posting growth since February 2020” explained Douglas Carswell of the Mississippi Center for Public Policy.

“The Jackson metro area has since that time outperformed cities such as Raleigh, North Carolina and even Dallas, Texas in terms of new jobs postings on Indeed”.

“Clearly this is only one set of data from one job hiring firm, but it is indicative of a broader trend we are now seeing in Mississippi”, Carswell continued. “This state is on the up”.

“Since Governor Tate Reeves signed into law a universal occupational licensing law, and with all that inward investment flowing into the state, the jobs market has picked up. Mississippi is now part of a wider southern economic success story”.

China is going to become the world’s number one economic superpower, we were told. And as China takes off economically, they said, she is going to become just like the rest of us.

This is what I call the China fallacy, and neither of the assumptions that underpin it are true.

China has indeed had three decades of double-digit growth. Her take off has been so spectacular, China went from being a largely agrarian economy that accounted for less than 2 percent of world output in 1980 to almost a fifth of output now.

But far from becoming more like us, China under President Xi seems to be becoming not just un-Western, but increasing anti-Western.

Twenty years ago, when China was admitted to the World Trade Organisation and President Clinton talked of China as a ‘strategic partner’, all the clever people in Washington said China would move our way.

By letting China join the international system, the experts said, China would become part of it. Think of all those tens of millions of middle class Chinese, they assured us. Soon, like the middle classes in America and Europe, they would be demanding all the trappings of liberal democracy.

Two decades later China is busy trying to subvert the international order. Chinese foreign policy seems to be all about creating rival structures and processes. Chinese government agents engage in the kind of espionage activities you might expect from a hostile foe.

Those that perpetuated the China fallacy used to tell us that following the British handover of Hong Kong, China would grow to become more like Hong Kong. Instead, the opposite has happened. Hong Kong has been brought into line with the rest of China, and what limited freedoms her people had have been taken away.

Far from taking her place at the international table, China behaves as if she wants to overturn it. China amasses troops in the western Pacific, bullying Taiwan and making little secret of her plan to invade the island. This would be the moral equivalent of the United States threatening to annex Vancouver Island.

Rather than becoming more Western, China’s government continually seeks new ways to restrict her citizens from accessing the internet. Digital technology has been harnessed to monitor the day to day activities of her own people. The autocrats that preside over China are so thin skinned and morally bankrupt, then actively clamp down on the Falun Gong movement. This would be the moral equivalent of the US government trying to shut down yoga classes.

The assumption that China, under the communist party, is ever going to emulate the West is wrong. Wrong, too, is the other side of the China fallacy – the assumption that China is destined to be a great superpower.

For as long as I can remember, highbrow magazines have been publishing articles forecasting that China’s economy will overtake America’s. At one time, we were told this would happen in the 2020s. Then it was the 2030s. Now I read it is supposed to happen before 2050.

I predict that China’s economy will never overtake America’s. Only last year, China ceased to be the most populous country on the planet, as India overtook her. China’s demographic future looks ominous.

Today there are 1.4 billion people in China. By the end of this century, some estimate that China’s population will have fallen about 40 percent to 800 million.

The next few years will see a significant fall in China’s economic growth, I suspect.

It is relatively easy to produce big gains in economic output when you move farm workers into factories (see Soviet Russia in the 1950s for details).

China was able to accelerate economically as a consequence of Deng Xiaoping’s reforms. Deng’s policies were not only market-friendly. Under Deng, decision-making was relatively decentralized. Maritime provinces had lots of autonomy. Beijing did not try to pre-empt every decision.

Under Xi, China has abandoned the Deng reforms, and reverted to what you might call the Ming tradition of top down control. It is not an encouraging precedent.

Far from being an economic dynamo, China is on course to becoming the next Japan. Like China, Japan was once supposed to overtake America. Instead, a previously thriving, export-driven economy has been reduced to stagnation by demographics and debt.

China may not become the world’s economic superpower, but this does not mean that China is not a threat. Quite the opposite.

Just over a century ago, a recently industrialized power, Germany, started to challenge the international order. Economically and militarily powerful, Germany nonetheless sensed that other powers were not so far behind. Among German’s leaders there was a sense that if Germany was serious about rearranging the furniture in Europe, she had a limited window of opportunity to do so. The consequences of that mindset were catastrophic.

My fear is that China under the communist party sees herself caught in a similar window of opportunity. Her demographic calamity, coupled with slow growth, mean that her relative power will only decline.

America is right to be strengthening her fleet in the Pacific (Three cheers to Mississippi Senator, Roger Wicker, for providing such leadership on this – America will be safer for it). It is also important that America works with an alliance of countries, including Australia and Japan to ensure the security of the Pacific.

China might not be the world’s number one economic power, but I suspect she will be the world’s biggest geopolitical headache for the foreseeable future.

The shame of it! Mississippi has found itself in the humiliating position of being compared disobligingly to the United Kingdom. Just last week, the Financial Times ran a column asking, “Is Britain really as poor as Mississippi?”

Most Mississippians do not spend much time worrying about comparisons to Britain. The same cannot be said about those on the other side of the Atlantic. For Brits—and I am one, though now based in Jackson, Mississippi—the issue of whether they are more or less prosperous than Mississippi has become a thing. Indeed, the Financial Times now calls it “the Mississippi Question.”

It was nine years ago that Fraser Nelson, the editor of The Spectator, first suggested that the U.K. was poorer than any U.S. state but Mississippi. This came as an uncomfortable shock for many in Britain for whom the word Mississippi conjures up clichés about the Deep South, as a byword for backwardness. Every time anyone has made the comparison since, there has been an indignant outburst from Britons keen to denounce the data.

In practice, when it comes to trying to provide a definitive answer to the Mississippi Question, no uniform, up-to-date set of data exists. But if you take the most recent U.S. figures for GDP per state, divide it by the population of Mississippi, you get a pretty accurate figure for GDP per capita in current dollar values. Make the same calculation for the U.K., with total GDP data divided by the population, and you end up with two comparable numbers.

Last year, by my math, the U.K.’s output per person was $45,485; Mississippi’s was higher, at $47,190. If Britain were invited to join the U.S. as the 51st state, its citizens would be at the bottom of the table for per capita GDP. Some might say that for Mississippi, that is still disconcertingly close.

“That’s not fair!” the critics would counter. “When you compare the wealth of nations, you need to look at how far the money goes. Things cost more in the U.K. than in Mississippi.” To adjust the raw numbers, the argument goes, you need to use an economist’s tool called Purchasing Power Parity. Sure enough, when you consider differences in the price of things in Britain and America, the U.K. does appear richer than Mississippi. Thus, after such PPP adjustments, the Financial Times analyst suggested that for 2021 Mississippi’s per capita GDP was a mere $46,841 to the U.K.’s $54,590 (though conceding that, without the London effect, much of Britain was relatively poorer than the Magnolia State).

“Hold on!” we on Team Mississippi retort. “Why adjust the numbers for our state using U.S. national data?” Here, a dollar goes a lot further than it would in New England or on the West Coast. To produce PPP-adjusted numbers for Mississippi that reflect the buying power of a dollar in places like New York or San Francisco, we say, is absurd. And sure enough, tinkering with the numbers to reflect purchasing power in Mississippi itself makes it doubtful that the U.K. would still come out ahead.

Perhaps more interesting, however, than how you cut the numbers for any given year is the fact that the gap between Mississippi and Britain seems to be growing. Never mind PPP. Just run the numbers for GDP per capita in current dollars for the first part of 2023, rather than 2022, and see that Mississippi’s output is rising at a faster rate than Britain’s.

Over the past 30 years, several southern states have seen rapid economic growth. States like Texas and cities such as Nashville have become economic hubs to rival California or Chicago. North Carolina, Georgia, Tennessee, and even Alabama have all flourished. Mississippi was missing out. Until now.

Historically, business in Mississippi was highly regulated. Licenses used to be mandatory in order to practice many of even the most routine professions. The state has now lifted a lot of these restrictions, deregulating the labor market. According to a recent report by the American Legislative Exchange Council, a group representing conservative state legislators, the size of Mississippi’s public payroll has been pared back. In 2013, there were 645 public employees per 10,000 population; today, the number is down to 607. Last year, Mississippi also passed the largest tax cut in recent history, reducing the income tax rate to a flat 4 percent.

How did this come about? Policy makers here have drawn inspiration from the State Policy Network, a constellation of state-level think tanks, borrowing ideas that have worked well elsewhere. We got the idea for labor-market deregulation from Arizona and Missouri. Tennessee inspired us to move toward income-tax elimination. Florida’s success stands as an example of how we could reduce more red tape.

What was once just a trickle of inward investment has turned into a steady flow. Growth is up, visibly: The areas of prosperity along the coast and around the state’s thriving university towns are getting larger, even if pockets of deprivation in the Delta remain.

Perhaps many in Britain find it hard to accept that Mississippi has overtaken them economically because they still think of Mississippi as cotton fields and backwoods poverty, peopled by folk who subsist on God, guns, and grits. But what if Britons’ reluctance to face changing economic realities comes from an outdated perception of themselves?

Most of my fellow Brits like to think that they live in a prosperous free-market society. They have not fully grasped the way in which their country has been sleepwalking toward regulatory regimentation. Stringent new regulations on landlords have seen thousands of owners pull out of the market, resulting in a dire shortage of rental accommodation. New corporate diversity requirements have imposed additional costs across the financial-services sector, with little evidence that bank customers are getting a better deal. Restaurants are required to display a calory count for each serving on their menus.

Individually, none of these restrictions matters all that much. But together, this relentless micromanagement inhibits innovation and growth. And Brits have become so accustomed to government red tape, they no longer seem to see the crimson blizzard that blankets so many aspects of their economic, and even social, life.

To be fair to them, for many years it did not seem to matter that taxes rose and the regulatory burden grew heavier. Thanks to the use of monetary stimulus in place of supply-side reform since the late 1990s, the country’s economy seemed to defy gravity, engineering the sort of growth that high tax and tight regulation might otherwise preclude. Few in the U.K. seemed to notice as ever more aggressive doses of monetary stimulus were required to stave off a downturn. Only now that the option of further monetary stimulus has been exhausted are the cumulative consequences of 30 years of folly becoming apparent.

To recognize that one’s country has been run on a false premise for three decades is difficult. To have to acknowledge that Britain is now poorer than the poorest state in the Union could prompt a moment of self-reckoning that many Brits seem determined to postpone.

Britain’s recurrent fixation with the Mississippi Question tells us as much about the country’s state of mind as it does about GDP. Rather than confront uncomfortable truths, my countrymen dispute the data. Instead of facing up to the consequences bad public policy in Britain, many blame Brexit, or Ukraine.

Putin’s war on Ukraine might have caused higher energy prices, but it alone does little to explain Britain’s poor economic performance. As for Brexit, though opinion formers who originally opposed it love to blame the country’s woes on it now, they never seem to ask why, if leaving the European Union was the cause of Britain’s lack of growth, Britain has still managed to outperform much of Europe.

Since Britain voted to leave the EU in 2016, the U.K. economy has grown by 5.9 percent. German GDP has only increased by 5 percent. Unlike Germany, the U.K. has so far also managed to avoid recession. Far from a reduction in trade, Britain has seen a boom in exports, especially in the service sector, since withdrawing from the EU trade block. Service exports grew by nearly 18 percent in real terms from 2016 to 2022—the strongest growth in this sector among the G7 countries, according to OECD data, and far more than in neighbors such as Italy, Germany, and France.

In any case, Nelson posed the Mississippi Question nearly two years before Britain voted to leave the EU. The country’s lackluster output, productivity, and growth were apparent long before Brexit. Leaving the EU should have been a perfect opportunity to correct course, but little has been done to address the problem. In fact, after leaving the EU, Britain has been hit by a succession of disastrous policy choices.

Having rushed to impose a lockdown in the early stages of the coronavirus pandemic, British ministers insisted on ever more draconian measures long after it was apparent that such steps were disproportionate, as well as ruinously expensive. Then, in the name of achieving Net Zero targets on “decarbonizing” the U.K. economy by 2050, successive governments have made rash commitments to move to renewables. Higher energy costs have helped price British industry out of world markets.

Instead of changing course, ministers have stuck stubbornly to their dogma—even though the latest moves to outlaw the internal combustion engine and new emissions regulations are making car ownership unaffordable for millions.

Mississippi has managed to borrow good ideas proven to work elsewhere. Britain, by contrast, has preferred to pioneer its own bad ideas. The former approach helps explains why Mississippi is emerging as part of a wider southern success story. The latter approach accounts for why a once successful country is really struggling.