Occupational licensing is usually sold as a necessity to protect the health and welfare of our citizens. It is a sign of quality that can only be achieved through an official license from the government. When in reality it is nothing more than a protectionist game that limits competition and raises cost for everyone.

In the 1950s, just five percent of workers in America needed a license to work. And these are in occupations most commonly associated with licensing — medical professionals, teachers, or lawyers. But since that time, the number of occupations that require a license has exploded.

Today, about 19 percent of Mississippians are in an occupation that requires a license. And this is particularly troubling in low and middle-income occupations. Mississippi currently licenses 66 of 102 lower-income occupations, as identified by Institute for Justice.

On average, licensing for low and middle-income occupations in Mississippi requires an individual to complete 160 days of training, to pass two exams, and to pay $330 in fees. Those numbers will vary depending on the industry. For example, a shampooer must receive 1,500 clock hours of education. A fire alarm installer must pay over $1,000 in fees.

The net result is a decrease in the number of people who can work. A study from the National Bureau of Economic Research found that occupational licensing reduces labor supply by 17 to 27 percent.

In Mississippi, the Institute for Justice estimates that licensing has cost the state 13,000 jobs. That represents two Nissan plants that could be created by reducing our licensing burden, and it wouldn’t require a dime in taxpayer incentives.

The limited consumer choice then leads to higher prices for that consumer, resulting in a hidden tax every Mississippians pays.

Occupational licensing leads to a decrease in the number of people working and an increase in costs to everyone. But is it a public good?

The empirical evidence that exists shows that is not the case. As the Obama administration said in a 2015 report, “Most research does not find that licensing improves quality or public health and safety.” The consumer is paying more without getting better results.

Instead of government licensing, there are voluntary or non-regulatory options that help entrepreneurs start and run businesses while providing the maximum options for consumers.

Key Facts

- 19 percent of workers in Mississippi need a license to work.

- Mississippi requires individuals in low and middle-income occupations to complete 160 days of training, to pass two exams, and to pay $330 in fees, on average.

- Mississippi has lost 13,000 jobs because of occupational licensing and the state has suffered an economic value loss of $37 million, according to a report from Institute for Justice.

- Mississippians pay a hidden tax of $800 every year because of licensing, according to a report from Heritage Foundation.

- In 2004, Mississippi freed hair braiders of irrelevant licensing requirements. Today, there are 2,600 hair braiders earning a living in the state.

- In 2019, Mississippi adopted the Fresh Start Act, which will help ex-offenders earn a living by prohibiting occupational licensing boards from using rules and policies to create blanket bans on ex-offenders.

Licensing Alternatives

Market competition is the least restrictive option. Without government-imposed restrictions, consumers have the widest assortment of choices, thereby giving businesses the strongest incentives to maintain a reputation for high-quality services. When service providers are free to compete, consumers can decide who provides the best services, thereby weeding out those that do not.

Quality service self-disclosure is another term for customer satisfaction. There are numerous common sites people can leave reviews such as Yelp, Google, Facebook, specific industry sites, etc. Finding out which location is providing a good customer experience is easier than ever, providing users with more complete options.

Voluntary, third-party certification allows the provider to voluntarily receive and maintain certification from a non-government organization. One of the most common examples is the National Institute

for Automotive Service Excellence (ASE) designation for auto mechanics. No mechanic is required to receive this certification, but it sends a signal to the consumer that the location with that designation is committed to quality service. And the consumer can decide whether that is important.

Voluntary bonding and insurance is the final voluntary option. By being bonded and insured, providers are showing their concern for quality to customers at the risk to their own bottom line — whether that’s through the potential for increased premiums or loss of collateral.

These are less restrictive options that do not involve the government. But there are still government- controlled options that are less intrusive than licensure.

Two legal options are private causes of action, which give consumers the right to bring lawsuits against service providers who are at fault, and deceptive trade practice acts, which allow consumers to sue businesses for practices that are deceptive or unfair.

The government can also mandate inspections as they do in a number of fields, most notably the food- service industry. It could be applied in occupations that also require licensing, such as the construction field and barbers and cosmetologists. This allows those who are trained in a field to spot potential hazards, while being less burdensome than licensure.

The state may choose to require registration, as they do with hair braiders. Hair braiders previously needed to take hundreds of hours of irrelevant cosmetology classes. Now they register with the state and pay a small fee. This discourages “fly-by-night” providers, while still only creating a small barrier for providers.

All of these options have one theme in common: They are better than government mandated licensure and prevent entrepreneurs from having to take state mandated classes, pay hundreds (or thousands) of dollars in classes, and take time out of their life to receive permission from the state to earn a living.

Instead, the state can protect consumers, while relying on a small government approach that promotes competition and consumer choice. This is what will encourage economic growth.

Following Arizona

Earlier this year, Arizona became the first state in the nation to provide licensing reciprocity to newcomers to the Grand Canyon State, a state that has had a steady stream of inmigration dating back a couple decades.

Right now, if you move to Mississippi, you are required to essentially start from scratch if you want a license in the field you have already been trained. Even if you’ve been mastering that work for two plus decades. But not in Arizona anymore.

What Arizona did, and a couple other states have since followed, is roll out the red carpet to new residents moving to the state and telling people they can work here without an extra unnecessary hurdle. If you got your license in Mississippi, that’s good enough for Arizona.

Mississippi should follow this model, especially in the early days before every state has done this, and make the business climate more enticing to all.

Those who wish to have wine or liquor in their homes on Christmas Day in Mississippi need to make sure they purchased their alcohol by closing time on Christmas Eve.

All alcohol that is greater than 5 percent alcohol by weight is illegal to be sold on Christmas Day. This essentially means beer and light wine can be sold in grocery stores, while liquor stores can not sell any of their goods.

Mississippi is one of 21 states with such a restriction in place. Nine states have a total ban on retail alcohol sales on Christmas. The same restriction was in place for Thanksgiving in Mississippi.

Alcohol restrictions, though probably not as silly as this, have long been a part of Mississippi’s history.

Our modern laws governing the control of alcohol are anything but that, and continue a long tradition of excess government control.

We have over empowered individual counties to define their own laws, and in so doing have created a chaotic state of regulation, difficult to understand by the average residential citizen, let alone internal and external businesses hoping to sell.

Furthermore, the state has retained an egregious amount of control of the distribution process. Mississippi has decided that, rather than allow private businesses to control the market, it will run a large warehouse in the central part of the state which will have a complete monopoly over the distribution of all spirits and wines.

As the Department of Revenue states on its own site, “the ABC imports, stores, and sells 2,850,000 cases of spirits and wines annually from its 211,000 square foot warehouse located in South Madison County Industrial Park.”

This warehouse consistently operates at capacity, and government leaders are considering a $35 million expansion. Perhaps our politicians ought to consider giving the free market a chance?

There is no reason that our government should be so deeply involved in controlling the distribution for a product. They hike up prices by a tremendous rate, limit access to the product, and determine which brands are allowed to sell in the state, leaving businesses in the dark and unable to control their own wares.

Private businesses are barred from distributing alcohol in Mississippi. While UberEats, DoorDash, and GrubHub have created thousands of jobs in other states through their delivery systems, our legislative leaders have shut down this opportunity for individuals to order alcohol with their delivery.

And while a variety of companies sell and ship wine, whiskey, and other alcoholic beverages around the country, our legislative leaders have determined that we shouldn’t have this freedom of access.

If you were shopping for a Christmas gift this year, you might find yourself looking at a wine basket, such as those at Wine & Country. However, upon checkout you will be met with the embarrassing notification that your state is one of only three in the entire nation that completely bars the shipment of any wines.

The excess regulation has made Mississippi last in the nation for craft beer development. For comparison, craft brewers currently produce $150 per capita in Mississippi, while they produce $650 per capita in Vermont. Imagine the difference such an industry could make in our state. This is thousands of tangible new jobs which are being discouraged from coming into existence by our government.

Existing policies have led Mississippi to have the largest shadow economy in the nation (referring to the exchange of products that are not taxed or recorded) at 9.54 percent of GDP. Moonshine is either produced or is available in every single county, which many link to the strict regulation of the alcohol industry. Our egregious taxation of alcohol products displayed here by the Department of Revenue has encouraged many companies such as Costco and Trader Joes to avoid opening locations in the state due to the lack of revenue potential on alcoholic products.

Prohibition is alive and well in Mississippi. Our government has decided we apparently can’t be trusted to make basic purchasing decisions for ourselves, so they must control what alcoholic drinks we’re allowed to have access to, how we’re allowed to receive these drinks, and from whom we’re allowed to purchase these drinks.

Be not fooled by the government “do gooders” who proclaim that they carry out policies like this for our own protection. Too many of our political leaders refuse to give freedom a chance, and instead have decided that they know better than we do when it comes to running our lives.

The fact is that while Mississippi prides itself on having a relatively low income tax, it finds dozens of other ways to tax and control its citizens.

Companies are discouraged from entering into business in the state because we have established covert taxes which discourage entrepreneurial risk taking.

Mississippi controls, regulates, and taxes alcohol worse than New York or California, so imagine what other discrete ways it is shutting down job opportunities and discouraging new business.

The cities of Brandon and Flowood are hoping to start the trend in Rankin county of banning e-cigarettes and vaping for minors. They're too late.

Minors are already prohibited from buying such products meaning the new ordinances will have little effect on the legality of vaping in Rankin county.

According to a story from WLBT, this began as a discussion among municipalities in Rankin county, along with the Sheriff's Department. Other cities are expected that follow suit.

Elected officials across the country are beside themselves in the push to outlaw vaping.

Unfortunately, America has a terrible record of accomplishment when it comes to government prohibitions. After all, the prohibition on teens purchasing e-cigarettes or vaping products is so ineffective, we don't even realize it's already the law.

Sales of e-cigarettes have been prohibited to those under 18 since 2016, so minors are already turning to the black-market. That should be our first clue that bans don’t work. Because the black market is the problem, as it usually is.

So far, the overwhelming evidence is the deaths and illnesses related to vaping were the result of black-market substances, such as vitamin E. We don't exactly know all of the details but these are not the products adults are legally purchasing today.

Indeed, prohibitions only tend to illicit more dangerous options.

During alcohol prohibition, individuals made their own liquor that was often much more dangerous than what you could legally buy prior to prohibition. Today, many people roll their own cigarettes in locales that have absurdly high taxes. Again, these are often more dangerous as you can get more nicotine by leaving out a filter.

And when it comes to vaping, teens can turn to YouTube for do-it-yourself videos on raising nicotine levels. This won’t change because of a new ordinance. Just like it didn't change because of a federal law.

While well intentioned, all this ordinance and other bans will do is increase lawlessness.

Many people like to ring in the new year with fireworks. And in Mississippi, it is easier than many other places to buy and use fireworks.

You have probably noticed temporary firework stands set up near your house in the past couple weeks and that is because Mississippi has a defined selling period. Retailers can sell fireworks during the two busiest seasons; the current period from December 5 through January 2 and from June 15 through July 5. And what retailers can sell and you can purchase is largely wide open.

But while state law provides for much freedom, many municipalities limit the use of fireworks in their city limits. Though not exhaustive, here is the rundown of whether fireworks are legal or illegal in Mississippi cities.

Fireworks are legal in the following cities:

Bay St. Louis, Horn Lake, Jackson (as of 2011), Natchez, Nettleton, Waveland.

The use of fireworks are banned in the following cities:

Aberdeen, Amory, Biloxi, Columbus, Corinth, D’Iberville, Diamondhead, Fulton, Hattiesburg, Hernando, Laurel, Long Beach, Meridian, Moss Point, Ocean Springs, Olive Branch, Oxford, Pascagoula, Pass Christian, Petal, Poplarville, Ridgeland, Southaven, Starkville, Tupelo, Vicksburg, West Point.

Disclosure: These regulations are based on recent news stories. Check with local authorities for most updated ordinance.

The default appears to be illegal, while it is largely legal in unincorporated portions of the counties.

One of the most common refrains from limiting fireworks is safety concerns and injuries caused by fireworks. But a 2017 report from the U.S. Consumer Safety Commission says “there is not a statistically significant trend in estimated emergency department-treated, fireworks-related injuries from 2002 to 2017.”

Rest assured, you are more likely to get injured from the new toy your son or daughter got for Christmas then from fireworks-related injuries.

Noise is the other big complaint concerning fireworks, particularly after a certain time. Of course, municipal noise ordinances can and already do police that issue.

So as you celebrate a new year, make sure you don’t run afoul with government regulators that have taken it upon themselves to limit your freedoms.

The Jefferson County School District is suing Juul, arguing that the e-cigarette maker is deceptively marketing to teenagers.

The district in Southwest Mississippi, which is home to about 1,100 students, is the first in the state to file suit. Attorneys are hoping to have it certified as a class-action suit on behalf of all school districts in the state.

“Defendants’ marketing strategy, advertising, and product design targets minors, especially teenagers, and has dramatically increased the use of e-cigarettes amongst minors, like the student body in Jefferson County School District,” the lawsuit reads. “Defendants’ conduct has caused many students to become addicted to Defendants’ e-cigarette products. Plaintiff, and similarly situated school districts in Mississippi, redirected resources to combat the deceptive marketing scheme of Defendants and to educate the school children of the true dangers of e-cigarettes.”

The lawsuit also names Altria, Philip Morris, and Nu Mark as defendants.

The lawsuit says that the “vaping epidemic” has plagued the school district, leading to new costs, and a redirection of time for faculty, staff, and security. According to the lawsuit, security has to supervise students in the bathroom to ensure they are not vaping.

The school district is seeking an unspecified amount of money to pay for counselors and various education programs, damages, and attorney fees.

While this may be the first lawsuit from a school district in Mississippi, this is a rising trend across the country. School districts in Kansas, Missouri, New York, and Washington are among those filing suit, making a similar claim concerning new costs.

Much like combustible cigarettes, minors are prohibited from purchasing e-cigarettes.

It has become increasingly clear that our economy is undergoing a seismic shift, similar to that previously seen during the industrial revolution. Once again, technology is fundamentally changing how we do business as a society.

Technology stocks are on pace for a record year. For the past decade, the tech sector has led the bull market. While the overall S&P 500 has enjoyed a 24 percent increase in 2019, the S&P’s tech sector is on pace for a 41 percent gain this year. Big tech controversies, private data use, tariffs, and free speech debates aside, investors are convinced that consumer demand, creativity, competition, and private capital will continue to feed strong revenue and earnings.

While certain sectors in tech will do better than others and some tech stocks will surely falter, it is clear that tech innovation is going to be a big part of our future, no matter where we live. Why should this matter to Mississippi or Jackson? Because nothing has the potential to dramatically improve our economy like tech innovation.

Last month, a conference on technology innovation was held in Jackson. The conference featured AOL founder and billionaire Steve Case, who shared the stage with Jackson’s own Jim Barksdale. They told some fascinating stories about their decades working together through the AOL’s acquisition of Netscape and the eventual merger with Time Warner. But the most valuable information came from Case. Now a venture capitalist, Case provided some sage advice about where he’s putting his money and why, and he gave Mississippi’s political leadership some very specific direction about the future.

Case recently announced the establishment of Rise of the Rest Seed Fund II, a venture capital fund led by his investment firm, Revolution. This is his second fund designed to support entrepreneurs, start-ups, and early stage tech companies in underserved areas in the United States. Amazon founder Jeff Bezos also backs the fund along with a host of highly successful entrepreneurs, like Spanx founder Sara Blakely. Blakely says, “geography should not be the reason bight ideas don’t come to life.”

Partly due to overvaluation in places like Silicon Valley and partly due to a wide distribution of talents and ideas across America, Case is looking in cities and states outside of the traditional tech incubation zones. According to Case, roughly 85 percent of all venture capital investments are made in three states – California, New York, and Massachusetts.

His message to the leaders in Mississippi was a hopeful one. He chided lawmakers to eschew the normal corporate welfare and incentive hunting competition and instead think about better ways to get sustainable economic growth – like encouraging tech innovation.

He suggested policy makers in Mississippi should think about how to permit tech innovations, rather than how to protect incumbent industries. He spent some time discussing how tech innovation could lead to a faster economic recovery than anything the government could try to orchestrate. He even suggested a robust tech innovation sector in Mississippi could be the antidote to brain drain, causing a “boomerang effect,” bringing talented and ambitious Mississippians back to the Magnolia State for jobs, opportunities, and improved quality of life.

At the Mississippi Center for Public Policy, our job is to recommend evidence-based policy ideas to help our political leaders make prudent decisions. This is why we are beginning an effort to encourage leaders to adopt a “permissionless innovation” policy. We should welcome and encourage creative disruption and work to reap the benefits of technological progress. We must not let existing or new regulatory policy act as a barrier to tech innovation. We recognize that long-term economic growth and human flourishing necessitates the promotion rather than the diminution of technological innovation.

To accomplish this, we ought to seek equally innovative policy solutions, which can jumpstart local entrepreneurship and economic growth. Our goal should be to build into our regulatory code a presumption of net good when dealing with new technologies and innovation.

In so doing, it is our belief that we can energize the existing marketplace and encourage businesses and entrepreneurs to see Mississippi as a more friendly state for risk-taking and creative disruption…and perhaps encourage some of our best and brightest to come back home.

This editorial appeared in the Clarion Ledger on December 5, 2019.

Today, on December 5, in the year 1933, the 21st Amendment was ratified, officially ending the thirteen year nationwide prohibition on alcohol and leaving future regulation to the states. However, prohibition did not find its death in Mississippi until 1966, at which point it was the last dry state in the union.

Mississippi has a long history of attempting to control alcohol consumption. It was the first state to pass some form of prohibition in 1908, and then was the first state to ratify the 18th amendment, creating a federal prohibition in 1918.

While prohibition inspired some great blues songs and classic literary characters it was bad public policy. For years before 1966, many establishments openly sold alcohol to customers, and the state even placed a 10 percent tax on the sale of alcohol, essentially making a mockery of its own prohibition laws.

Public policy ought to be rational and easily comprehendible by the public. Our modern laws governing the control of alcohol are anything but that, and continue a long tradition of excess government control.

We have over empowered individual counties to define their own laws, and in so doing have created a chaotic state of regulation, difficult to understand by the average residential citizen, let alone internal and external businesses hoping to sell.

Furthermore, the state has retained an egregious amount of control of the distribution process. Mississippi has decided that, rather than allow private businesses to control the market, it will run a large warehouse in the central part of the state which will have a complete monopoly over the distribution of all spirits and wines.

As the Department of Revenue states on its own site, “the ABC imports, stores, and sells 2,850,000 cases of spirits and wines annually from its 211,000 square foot warehouse located in South Madison County Industrial Park.”

This warehouse consistently operates at capacity, and government leaders are considering a $35 million expansion. Perhaps our politicians ought to consider giving the free market a chance?

There is no reason that our government should be so deeply involved in controlling the distribution for a product. They hike up prices by a tremendous rate, limit access to the product, and determine which brands are allowed to sell in the state, leaving businesses in the dark and unable to control their own wares.

Private businesses are barred from distributing alcohol in Mississippi. While UberEats, DoorDash, and GrubHub have created thousands of jobs in other states through their delivery systems, our legislative leaders have shut down this opportunity for individuals to order alcohol with their delivery.

And while a variety of companies sell and ship wine, whiskey, and other alcoholic beverages around the country, our legislative leaders have determined that we shouldn’t have this freedom of access.

If you’re shopping for a Christmas gift, you might find yourself looking at a wine basket, such as those at Wine & Country. However, upon checkout you will be met with the embarrassing notification that your state is one of only three in the entire nation that completely bars the shipment of any wines.

The excess regulation has made Mississippi last in the nation for craft beer development. For comparison, craft brewers currently produce $150 per capita in Mississippi, while they produce $650 per capita in Vermont. Imagine the difference such an industry could make in our state. This is thousands of tangible new jobs which are being discouraged from coming into existence by our government.

Existing policies have led Mississippi to have the largest shadow economy in the nation (referring to the exchange of products that are not taxed or recorded) at 9.54 percent of GDP. Moonshine is either produced or is available in every single county, which many link to the strict regulation of the alcohol industry. Our egregious taxation of alcohol products displayed here by the Department of Revenue has encouraged many companies such as Costco and Trader Joes to avoid opening locations in the state due to the lack of revenue potential on alcoholic products.

Prohibition is alive and well in Mississippi. Our government has decided we apparently can’t be trusted to make basic purchasing decisions for ourselves, so they must control what alcoholic drinks we’re allowed to have access to, how we’re allowed to receive these drinks, and from whom we’re allowed to purchase these drinks.

Be not fooled by the government “do gooders” who proclaim that they carry out policies like this for our own protection. Too many of our political leaders refuse to give freedom a chance, and instead have decided that they know better than we do when it comes to running our lives.

The fact is that while Mississippi prides itself on having a relatively low income tax, it finds dozens of other ways to tax and control its citizens.

Companies are discouraged from entering into business in the state because we have established covert taxes which discourage entrepreneurial risk taking.

Mississippi controls, regulates, and taxes alcohol worse than New York or California, so imagine what other discrete ways it is shutting down job opportunities and discouraging new business.

The Mississippi Hemp Cultivation Task Force’s draft report released on in November that stops short of a specific policy recommendation for the legislature, but provides useful information for potential legislation.

Mississippi is one of only three states where hemp cultivation is illegal and the legislature could take up the issue in January, when it returns to Jackson for the annual regular session.

Hemp is derived from strains of the cannabis sativa plant with low amounts (0.3 percent content or less) of the psychoactive substance in marijuana known as THC. The plant can be cultivated for its fiber, which can be used in insulation, rope, textiles, and other products.

The seeds are also a good source of protein and are edible by humans or animals. The flowers of the plant can be used for cannabidiol, or CBD oil production with possible benefits still being studied by scientists both in Mississippi and nationwide.

The report admits that some states who began pilot hemp cultivation programs under the 2014 Farm Bill — such as Kentucky, Oregon, North Carolina and Virginia — are at “some advantage,” but would still have to reconcile their programs with draft federal regulations that came out on October 31.

These new rules govern hemp cultivation nationally after the2018 U.S. Farm Bill authorized the growing and sale of hemp.

The report says that the state will have the advantage, as a possible late adopter of hemp cultivation, in having the benefit of other state’s experiences.

Economics

Hemp, according to the report, has some pitfalls when it comes to whether Mississippi farmers could effectively cultivate it for profit.

Supply chains for hemp-related products are not mature, according to the report. Also, verification issues with keeping crops below the legal 0.3 percent THC threshold and what to do if a crop goes “hot” and tests over that standard.

The report also says Kentucky’s program quickly spawned 70 licensed processors. There is also a Charleston, Mississippi-based company, Kengro, which imports Kentucky hemp for processing to fiber for animal bedding products for Ecofibre, an Australian-based company that does business in both CBD oil and hemp fiber/seed markets.

Projections from the state’s two agricultural universities, Mississippi State and Alcorn State, suggest that fiber or grain production, and especially combined production, could offer an economically viable alternative to other staple Mississippi crops such as corn, cotton, and soybeans. Researchers used data from Kentucky and Missouri and adjusted it for Mississippi.

Growing hemp for grain and fiber would be the state’s most profitable crop next to cotton grown in the Delta.

The report also says that more states approving hemp production means supplies will increase while prices will drop.

Agronomy

According to the report, finding hemp strains that will grow in Mississippi’s climate will be a huge obstacle to cultivation and finding such strains could take several years.

Also, there are no approved pesticides or herbicides authorized by the U.S. Food and Drug Administration.

The report says much research still needs to be conducted on hemp, including:

- Crop protection products to control weed competition, disease and insects.

- Improved harvesting and post-harvest management techniques.

- The effects of environmental on THC level to ensure producers don’t exceed regulatory thresholds.

- Product development.

Law enforcement and regulation

The report says that law enforcement personnel and canine officers are unable to discern the difference between marijuana and legal hemp except with laboratory analysis.

Among the concerns about hemp cultivation include:

- Inability to distinguish between legal hemp and marijuana (greater than 0.3 percent THC content) on the side of the road.

- Law enforcement officers would be unable to conduct arrests and prosecutors would be unable to prosecute marijuana cases, as in areas of Florida, Georgia, Ohio and Texas where simple possession of marijuana cases aren’t being prosecuted.

- A backlog at the Mississippi Crime Laboratory of 400 exhibits per month.

- It would cost $500,000 for the crime lab to perform THC chemical analyses.

The report also says that since resources of state agencies needed for regulation are under stress, lawmakers much have a plan needed to “support the infrastructure needed to ensure public safety related to hemp cultivation and hemp products.”

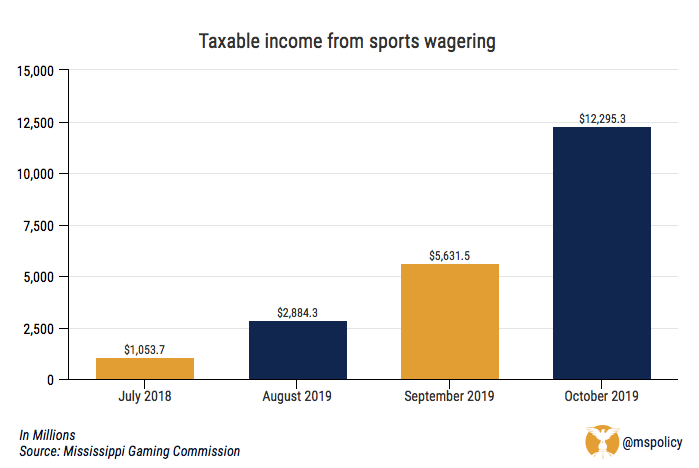

The combination of professional and college football, along with a competitive seven-game World Series, helped make October a solid month for sports wagering in Mississippi.

The total taxable revenue for the month was a little more than $12.2 million, an 18 percent increase from October of last year for the state. Those numbers varied by regions, however. The northern and central regions had minimal gains of 5 and 4 percent, while Coastal casinos posted a change of more than 24 percent. Also of note, more than half of the revenue was from baseball.

Because of the timing of the most popular sporting events to place bets on, revenue from sports wagering has– and will – continue to fluctuate greatly by month.

And competition will only continue to increase for money from sports betting since the Supreme Court legalized the practice last year. For now, the Coast has been saved from Louisiana’s inability to pass legislation legalizing sports betting in the Pelican State. They will surely try again.

Other states have moved faster.

In Arkansas, sports betting became legal in July. A year ago, voters approved a ballot initiative legalizing sports betting and the Oaklawn Racing Casino Resort in Hot Springs, is the first to welcome betters. While the timeline is still to be determined, a casino closer to home, Southland Gaming & Racing in West Memphis, is expected to begin collecting wagers soon. Competition has swallowed a lot of the revenue Mississippi once experienced, and this would likely add further pains to Tunica area sports betting operations.

Tennessee could also add to those pains, but they have some work to do. The state passed an online-only sports betting bill earlier this year, but it has many issues – requiring sportsbooks to buy official league data to settle in-play wagers, a very expensive entry point and high taxes, and a ban on prop bets in NCAA games. Much work remains before the Volunteer State is taking bids.

Legislation was introduced in Alabama this year, but it did not move and most consider sports betting a long-shot with our neighbors to the east.

While competition and the general ebb and flow of sporting events people like to place wagers on will always remain, Mississippi’s requirement that you must be in a casino to place bets greatly limits the pool of those who will legally bet.

As we see, it can be a boon during the World Series or March Madness, but generally speaking a person in Jackson isn’t going to drive to Vicksburg to place a bet on a random baseball game in July. They will continue to bet illegally because bookies are not going to disappear overnight.

While Mississippi made a positive first step in being ahead of the curve when it comes to sports betting, all of the data shows that states need to create an avenue for individuals to bet online to generate the most revenue.