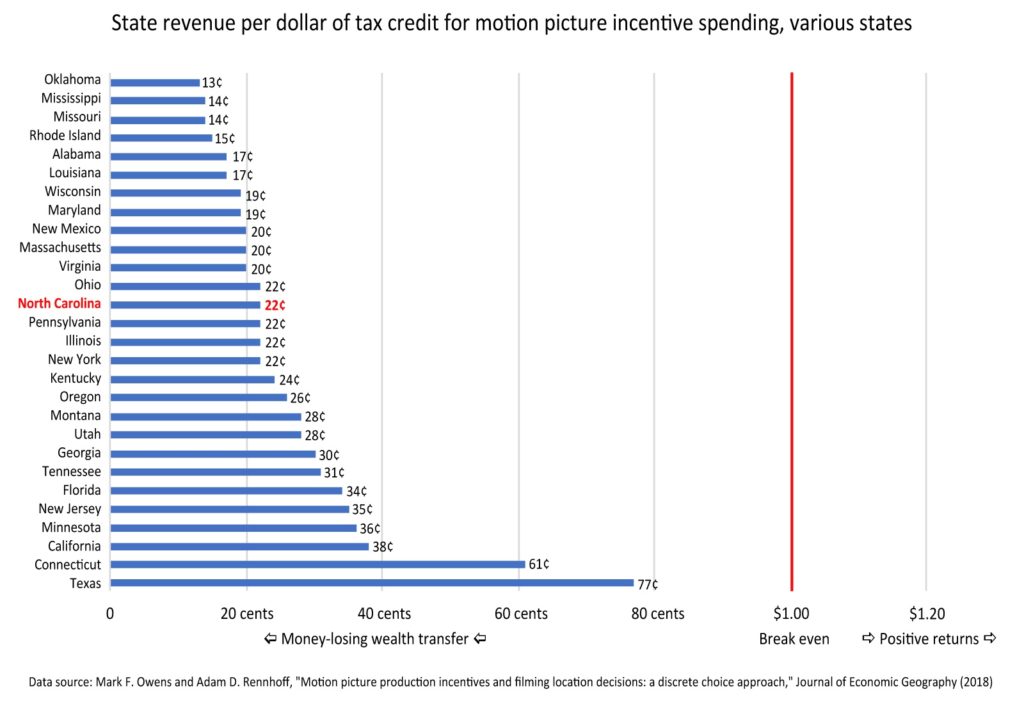

Mississippi, like many other states, has a history of dolling out tax incentives to bring Hollywood film producers to the state. And, like many other states, the net return is generally an awful investment for taxpayers.

When lawmakers were engaged in an ultimately successful effort to revive dead film incentives this past session, the few opponents that could be found in the legislature would often cite a 2015 PEER report on the program in Mississippi.

The report was mocked as being incomplete or inaccurate, or we were told of the other benefits that we couldn’t necessarily measure. Of course, proponents of film incentives didn't like what the program showed.

The report from PEER shows taxpayers receive just 49 cents for every dollar invested in the program. That means that for every dollar the state gives to production companies, we see just 49 cents in return for the general fund.

Perhaps, this was a mistake.

Maybe it was. Because, if anything, the PEER report was too favorable to Mississippi’s film incentive program. A 2017 study published by the Journal of Economic Geography by economists Mark F. Owens of Penn State University and Adam D. Rennhoff of Middle Tennessee State University looked at the impact of film incentives.

It found that Mississippi managed to return an abysmal 14 cents for every dollar of tax credit for film incentives. So, a third of what the PEER report found.

But much like the PEER report, we again see that there are no instances where film incentives are actually a net positive for any state. It’s not that Mississippi is doing something uniquely wrong. It’s that film incentives are a bad deal for everyone.

The question isn’t if we are losing money on film incentives, but how much. Because whether it’s 86 cents or “just” 51 cents, taxpayers should not be on the hook to subsidize Hollywood.

Mississippi restaurant owners who would like to allow dogs on their outside patios are now allowed to do so.

That is because of a Mississippi Department of Health rule change.

“MSDH wants to support local businesses in their efforts to best accommodate their clientele. We’ve looked at other southern states – including Georgia, Tennessee and South Carolina – and have modeled our policy after theirs,” Jim Craig, MSDH Senior Deputy and Director of Health Protection, said in a news release that was reported by the Clarion Ledger. “We assessed the health risks and identified the types of outdoor dining settings that would present low, minimal or no risk to the public.”

Earlier this year, the Clarion Ledger ran a story on pet-friendly restaurants in the Jackson metro area. The Mississippi Department of Health fired back saying that is illegal and that Mississippi code prohibits pets in restaurants, even outdoor areas.

MDH cited the Food and Drug Administration’s Food Code model, which is housed in the U.S. Department of Health and Human Services, for the prohibition. That model recommends prohibiting animals in food service establishments, save for service dogs.

The state didn't have to follow the FDA model. Indeed, many states had already legalized dogs in restaurants before Mississippi. These laws generally do two things. They often allow local governments to enact ordinances if they would like and they allow restaurants to choose whether they would like to welcome dogs on their property.

And with that, consumers can choose to bring their dog to a pet-friendly establishment, just as those who don’t like dogs can opt to go somewhere else. And the owner of the restaurant can decide what is better for his or her business.

What path a restaurant chooses isn’t as important as the restaurant having the ability to choose. But the now repealed prohibition on dogs in restaurants is just one of the more than 117,000 restrictions in the state’s regulatory code.

The biggest regulator in the state? As you would imagine, the same Department of Health that previously went after dogs in restaurants.

And why does this matter?

Regulatory growth has a detrimental effect on economic growth. We now have a history of empirical data on the relationship between regulations and economic growth. A 2013 study in the Journal of Economic Growth estimates that federal regulations have slowed the U.S. growth rate by 2 percentage points a year, going back to 1949. A recent study by the Mercatus Center estimates that federal regulations have slowed growth by 0.8 percent since 1980. If we had imposed a cap on regulations in 1980, the economy would be $4 trillion larger, or about $13,000 per person. Real numbers, and real money, indeed.

On the international side, researchers at the World Bank have estimated that countries with a lighter regulatory touch grow 2.3 percentage points faster than countries with the most burdensome regulations. And yet another study, this published by the Quarterly Journal of Economics, found that heavy regulation leads to more corruption, larger unofficial economies, and less competition, with no improvement in public or private goods.

A prescription for lowering the regulatory burden on a state is the one-in-two-out rule, or a regulatory cap. In 2017, one of President Donald Trump’s first executive orders was to require at least two prior regulations to be identified for elimination for every new regulation issued. This is badly needed. We have gone from 400,000 federal regulations in 1970 to over 1.1 million today.

Many years ago, British Columbia took on a similar mission. And in less than two decades, their regulatory requirements have decreased by 48 percent. The result has been an economic revival for the Canadian province.

Whether it’s a sunset provision, where regulations expire and must be reauthorized after a period of time, or one-in-two-out policy, Mississippi should move in the direction toward a smaller regulatory state with more freedom. And if a regulation is truly important to our well-being, let the regulators prove why.

A decision by the state to allow dogs in restaurants is a positive step but it won’t change the trajectory of the state’s economy, for better or worse. Rather, we need a deep dive into the unnecessary and outdated regulations of each agency with a goal of removing unnecessary barriers and inhibitors to economic growth.

Families who homeschool or send their children to private school provide a savings of more than $340 million to taxpayers. And that doesn’t even include local or federal savings, which likely doubles that number.

The state appropriated more than $2.58 billion for K-12 education this past year. This includes MAEP, general education programs, education enhancement funds, and a couple other programs. Last year, 470,000 students attended public schools, a number that will likely decrease when final enrollment numbers are released later this year.

That translates to an average of $5,500 per student, though those numbers vary.

While we don’t have ‘official’ numbers on private school students or homeschoolers, estimates based on national data and Census numbers, generally put the numbers in the range of 40,000-50,000 students in private school and 15,000-20,000 who homeschool.

Using the middle number for homeschool and private school students, those families save the state approximately $343 million. That number would be higher if we took into account local and federal funds, that make up a little less than half education funding in the state.

No tax credits or deductions

Nine programs in eight states allow families to receive individual tax credits and deductions for approved educational expenses, including private school tuition, books, supplies, computers, tutors, and transportation. Tax credits lower the total taxes a person owes; a deduction reduces a person’s total taxable income.

The credits and deductions a family could receive differ among the states. Eligibility to participate also varies.

| State | Program | Individual Credit/ Deduction Cap |

| Alabama | Alabama Accountability Act of 2013 Parent-Taxpayer Refundable Tax Credits | 80% per pupil funding |

| Illinois | Tax Credits for Educational Expenses | $750 |

| Indiana | Private School/Homeschool Deduction | $1,000 |

| Iowa | Tuition and Textbook Tax Credit | $250 |

| Louisiana | Elementary and Secondary School Tuition Deduction | $5,000 per student |

| Minnesota | Education Deduction | $1,625 to $2,500 |

| Minnesota | K–12 Education Credit | $1,000 per student |

| South Carolina | Refundable Educational Credit for Exceptional Needs Children | $11,000 per student |

| Wisconsin | K–12 Private School Tuition Deduction | $4,000 to $10,000 |

Source: EdChoice

Mississippi provides no credit or deduction for private or homeschool families.

In this episode of Unlicensed, we talk about Mark Zuckerberg's recent speech in defense of free speech in the midst of political attacks by many who want to be the next president of the United States. And we spend a few minutes talking about the early days of Facebook.

Over the past year, a steady stream of op-eds have appeared in the Daily Leader and other media outlets promoting either Medicaid expansion or something called Medicaid reform.

These terms are not being accurately used, creating a false dichotomy for the uninformed reader. In order to have a balanced dialogue about both Medicaid expansion and Medicaid “reform,” we should begin by defining what is meant by both.

Medicaid is a joint federal-state health insurance program mostly controlled by the federal government. Most important, federal law determines the baseline for eligibility. States, however, are somewhat free to add additional coverage populations and services. The Affordable Care Act (“Obamacare”) attempted to force every state to expand Medicaid coverage to include able-bodied childless adults earning up to 138 percent of the federal poverty level.

The Supreme Court nullified this expansion as unconstitutionally coercive in a 2012 decision, NFIB v. Sebelius. Thereafter, states were free to decide for themselves whether to expand Medicaid to able-bodied childless adults. To date, 14 states, including Mississippi, have declined to expand Medicaid.

When policymakers debate “Medicaid expansion,” they are properly considering whether to expand Medicaid to able-bodied childless adults earning up to 138 percent of the federal poverty level. For some reason, the ACA deemed this population as most worthy of coverage, offering a 90 percent funding match. No other population is eligible for this match – not children, not the disabled, not the elderly.

Medicaid “reform” is a little bit harder to define. Some on the Left want to “reform” and “expand” Medicaid by creating a “Medicaid for All” program. Some on the Right would “reform” Medicaid by eliminating it altogether. In all fairness, neither the complete expansion nor the complete contraction of a program is a “reform.” In common parlance, a “re-form” implies the preservation of the form of the existing thing, even if that thing undergoes an extensive overhaul.

Seen in this light, it is clear that – contrary to a recent op-ed, “A conservative vote for Jim Hood” – allowing Mississippi hospitals to act as another managed care provider is not a reform. This is not to comment one way or another on whether the “Mississippi True” plan is sound or not.

It is simply to let people know that adding another managed care provider to the Medicaid insurance marketplace is a lot like adding another fast food provider to Brookhaven’s current offerings. Whether its McDonald’s or Burger King or Taco Bell, they pretty much all do the same thing and aren’t going to bring about a “reform” of anyone’s eating habits.

The second usage of the phrase “Medicaid reform” refers to a plan promoted by the hospitals called Mississippi Cares, which includes the hospital-run managed care plan. This plan would be based on a program signed into law by Mike Pence when he was governor of Indiana.

Over the past few years, the “[insert state] Cares” plan has made the rounds in Republican states. Another recent op-ed – “Medicaid reform needed in Mississippi” – tells us that what Tate Reeves calls Medicaid “expansion” is actually what the hospital association calls Medicaid “reform.”

In fact, the Healthy Indiana Plan (HIP 2.0) is both an expansion and a reform, albeit a very mild reform. Five years in, HIP 2.0 is showing the limits of what states can accomplish by tinkering around the edges of Medicaid. To begin with, Indiana’s Medicaid work requirement is being challenged in court, as are similar requirements in other states. Second, the copays are quite low, albeit higher than traditional Medicaid.

For these and other reasons, the plan is not paying for itself. In 2014, Pence’s office explicitly promised that “HIP 2.0 will not raise taxes and will be fully funded through Indiana’s existing cigarette tax revenue and Hospital Assessment Fee program, in addition to federal Medicaid funding.”

Yet, in 2019, Indiana increased taxes on several fronts in order to help pay for higher than anticipated Medicaid costs. Indiana lawmakers also came very close to tripling the cigarette tax because, as the Indiana Hospital Association now readily admits, “The hospitals’ share [of HIP 2.0] is increasing at an unsustainable rate, and increasing the cigarette tax can help provide necessary relief to hospitals.”

Perhaps worst of all, Indiana’s health care costs for employer-based insurance plans are so high that out-of-state companies have adopted the mantra of “ABI: Anywhere But Indiana.” As a January 2019 report demonstrates, not even millions in profits from Medicaid expansion is preventing hospitals from shifting costs to consumers with private insurance.

Indiana’s experience with Medicaid expansion is the same as every other state’s: expensive and of arguable value for anyone but the hospitals. There is no reason to expect different results for Mississippi, even if expansion is cloaked in a veneer of “reform.”

This column appeared in the Daily Leader on October 20, 2019.

Those hoping to have the opportunity to cultivate hemp in Mississippi are keeping a close eye on the Hemp Cultivation Task Force.

The task force was created by the legislature earlier this year and will provide their findings on hemp in Mississippi prior to the 2020 legislative session. The group has held two public meetings, with a third scheduled for late November.

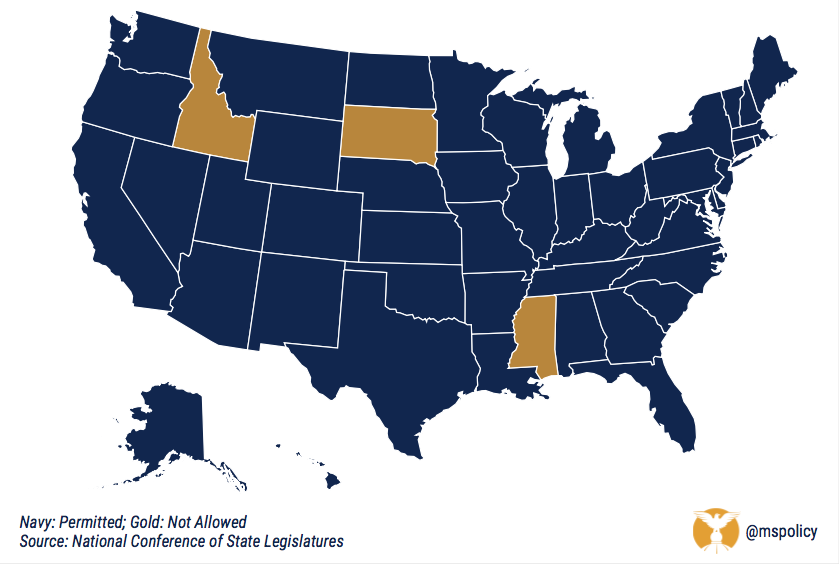

Since the time the legislature passed on legalizing hemp in Mississippi earlier this year, a number of states have chosen to move forward. We’re at the point where virtually every state – 47 total – have ok’d hemp cultivation. That doesn’t mean they are necessarily harvesting hemp right now. Just that they have begun the process.

Today, Mississippi, South Dakota, and Idaho are the holdouts.

States where hemp is legal

We don’t know what the task force will recommend. But no one should be surprised to see the deliberate process continue.

While farmers might want the state to legalize hemp, the tone of the task force hasn’t necessarily been positive. And the legislature can still do their own thing, though it might be odd to create a task force and then do something beyond what they recommend. But it’s possible.

Keep in mind that the House is already on record of removing hemp from the controlled substance list in Mississippi thanks to a floor amendment from Rep. Dana Criswell (R-Olive Branch). Attempts to make the change in committee had previously been killed, and obviously the House language was watered down to a task force when it hit the Senate a month later.

Meanwhile, South Dakota and Idaho are both preparing to act next year.

The South Dakota legislature legalized hemp last year, only to have it vetoed by Gov. Kristi Noem. They also have a Hemp Study Committee and are working on legislation for 2020. Same story in Idaho. Republican leaders have promised farmers they will be able to grow hemp next year.

So we shall see.

For now, the question is who will be the 48th state to legalize hemp? And will any state still make hemp illegal by the end of 2020?

Neither Republican gubernatorial nominee Lt. Governor Tate Reeves nor his Democratic opponent Attorney General Jim Hood offered their endorsement for the medial marijuana ballot initiative that will be before voters next fall.

The Medical Marijuana 2020 campaign recently turned in over 100,000 certified signatures in their attempt to make Mississippi the 34th state in the country to legalize medical marijuana.

Hood didn’t say how he’d vote, rather offering a vague response that he will leave it to the medial professionals to make judgments on medical marijuana.

“I did two terms as District Attorney, 16 years as Attorney General,” Hood said. “I’ve been a drug warrior for all those years, and it hadn’t worked. Medical marijuana is something that should be left up to the doctors in the medical profession. I’ve seen a few studies that it may help people get off opioids, I just don’t want it to get in the hands of kids. That’s why I’ve been raising cane about vaping…I think it’s up to the medical profession to make those decisions on the value of medical marijuana.”

Reeves made comments similar to the GOP debate this summer, where he said he was opposed to the initiative, but would respect the will of the voters if the initiative passed.

“As a father of three girls, I’m going to vote against the amendment that’s on the ballot next year,” Reeves said. “If I am elected governor and the people of Mississippi decide to vote a different way than I do then I’m going to uphold the will of the people.”

If Mississippians approve the initiative, it will be part of an ongoing trend, particularly in Republican states. Last year, voters in Missouri, Oklahoma, and Utah approved ballot initiatives to legalize medical marijuana. Two years prior, voters in Arkansas, Florida, and North Dakota did the same thing.

What would medical marijuana look like in Mississippi?

If the ballot initiative is approved by voters in November, marijuana would be legal for those with a debilitating medical condition and would have to be authorized by a physician and receive it from a licensed treatment center.

Some of these conditions include:

- Cancer

- Epilepsy and other seizure-related ailments

- Huntington’s disease

- Multiple sclerosis

- Post-traumatic stress disorder

- HIV

- AIDS

- Chronic pain

- ALS

- Glaucoma

- Chrohn’s disease

- Sickle cell anemia

- Autism with aggressive or self-harming behavior

- Spinal cord injuries

If a physician concludes that a person suffers from a debilitating medical condition and that the use of medical marijuana may mitigate the symptoms or effects of the condition, the physician may certify the person to use medical marijuana by issuing a form as prescribed by the Mississippi Board of Health. The issuance of this form is defined in the proposal as a “physician certification” and is valid for 12 months, unless the physician specifies a shorter period of time.

That individual then becomes a qualified patient. After they do this, they present the physician certification to the Mississippi Department of Health and are issued a medical marijuana identification card. The ID card allows the patient to obtain medical marijuana from a licensed and regulated treatment center and protects the patient from civil and/or criminal sanctions in the event the patient is confronted by law enforcement officers. “Shopping” among multiple treatment centers is prevented through the use of a real-time database and online access system maintained by the Mississippi Department of Health.

The Mississippi Department of Health would regulate the cultivation of marijuana, processing, and being made available to patients. There would also be limits on how much marijuana a patient could obtain.

A new report by a legislative watchdog group recommends that the legislature and the Mississippi Department of Revenue should examine the possibility of privatizing the state-run distribution of liquor and wine.

The Joint Legislative Committee on Performance Evaluation and Expenditure Review or PEER Committee released the report, which also criticized the DOR for worker safety, equipment maintenance, customer service, and inventory issues at the state-owned warehouse which handles distribution for liquor and wine in the state.

The PEER study said that divesting the wholesaling of wine and liquor would likely reduce the revenue collected for the state from alcoholic beverage sales. The study also said that contracting out management of the state-owned liquor warehouse to a private firm would likely not save taxpayers much money, likely 10 percent or less.

Divesting the distribution of wine to private firms, according to the study, would also result in lower revenue collections, but could benefit operations at the warehouse.

The Alcoholic Beverage Control warehouse employs 106 state workers, held 427,709 cases of booze (the capacity is 450,000 cases) and can ship 20,000 cases per day.

In fiscal 2018, the ABC generated $114.2 million in revenue. Subtracting the cost for warehouse operations ($5.03 million) and ABC enforcement ($2.07 million), the wholesale operation generated revenue of $107.1 million for the state treasury.

In the 2019 session, the legislature appropriated up to $4 million for additional warehouse space, but PEER said in its report that the DOR doesn’t have a formal plan for incorporating new space into its operations.

According to PEER, one of the problems with the state-run warehouse is that any special order items cost the state because the DOR must purchase them in advance to have them shipped to the warehouse.

The warehouse receives payment only when the retailer receives the special order. Also, since the items in the warehouse belong to vendors and are not purchased by the state, taxpayers are responsible for broken or damaged goods in the warehouse.

Mississippi is one of 17 states that is what is known as a control state. The DOR regulates the sale of alcohol in Mississippi through the licensing of retailers, taxation at both the wholesale and retail levels, and wholesaling of both liquor and wine. The Magnolia State is one of five states that wholesale both wine and distilled spirits.

The DOR, unlike some other control states, doesn’t manage retail locations like Alabama does, for example.

The Mississippi Center for Public Policy has joined other organizations in opposing legislation related to the so-called Green New Deal.

Virtually every provision of the Green New Deal, ranging from trillions of dollars in new spending to onerous rules on automobiles and airplanes, would be disastrous to households and businesses across America. The U.S. economy needs abundant, low-cost sources of energy, not bank-breaking regulations that make it more difficult for Americans to live their lives.

Earlier this year, members of the U.S. Senate introduced a resolution, S.J. Res. 8, calling for the creation of a radical, ill-thought-out “Green New Deal.” This complete and unrealistic overhaul of the U.S. economy would have devastated hardworking American families. According to the American Action Forum, the plan would cost Americans anywhere from $51.1 trillion to $92.9 trillion, or $316,010 to $419,010 per household, over ten years.

Not surprisingly, the Senators who proposed this preposterous resolution refused to support the measure when it was brought to the floor. A motion to invoke cloture and proceed to consideration of the Green New Deal failed by a vote of 0-57. None of the resolution’s sponsors supported it.

Normally when such imprudent policy ideas meet such a resounding defeat in the U.S. Senate, it means that these ideas will be relegated to the dustbin of political debate. Unfortunately, many members of Congress who refused to support this plan on the Senate floor are currently devising strategies to implement provisions of the Green New Deal by attaching them to important pending legislation.

Important measures to support American troops, fund the government or maintain economic growth must not be imperiled by ill-considered policies from a fringe resolution. Energy policy deserves dedicated legislation that offers policies that would lower costs for Americans. Removing senseless restrictions on drilling and fracking and repealing existing “renewable” mandates are just two possible paths toward greater energy affordability and increased choices for consumers. Congress should also pursue dedicated legislation that repeals wasteful government “clean energy” programs that subsidize boondoggles at significant expense to taxpayers.

American consumers deserve an abundance of options to heat their homes and fuel their vehicles. Sneaking Green New Deal provisions into unrelated legislation would only lead to higher costs and undermine transparency in government. We urge the Senate to oppose any attempt to hold meaningful bills hostage in order to enact the misguided Green New Deal.

You can read the full letter here.