Americans have always been a transient people, often searching for new careers and better opportunities for their family.

Depending on the economy of the day, we see 30 to 40 million Americans move each year. And when they move, they bring their incomes with them. Between 1995 and 2010, some $2 trillion in adjusted gross income went from one state to another.

As a result, some states brought in billions more in incomes over the past 25 years while others lost that amount and then some.

Mississippi lost $132 million in annual AGI. Looking more closely at the state, Desoto county was the big winner, gaining $1.34 billion in annual AGI, mostly all of it from across the border in Shelby county, Tennessee. Rankin ($523 million) and Madison ($912 million) counties were the other big beneficiaries of wealth transfers in the state, but that was mostly from Hinds county, which lost $1.55 billion in annual AGI.

Not surprisingly, the Delta, which is shedding population, also saw big loses in income. The five counties of Bolivar, Coahoma, Leflore, Sunflower, Washington lost between $100 million and $250 million. That wealth was generally lost to either the Jackson metro area or both sides of the Mississippi/ Tennessee state line. Throughout the state, we saw a few areas of growth (such as Lafayette county) or decline (such as Lauderdale and Lowndes counties), but most other places were more or less stagnant. Very little wealth gained, very little wealth lost. And it was usually just in-state transfers.

The only other counties to see wealth gained from out-of-state were Hancock and Pearl River counties, along the Louisiana border. They both gained between $180 and $200 million, mostly from Louisiana.

However, Louisiana stood out as having the biggest losses in the South. The state lost some $8 billion in annual AGI, with more than $500 million shifted toward Mississippi. Among other neighbors, Alabama saw a gain of $2.5 billion and Arkansas saw a gain of $2.6 billion. Tennessee gained over $14 billion - even with the big loses from Shelby county to Desoto county.

Overall, the states that did the best won’t surprise many people. Arizona gained $35 billion in annual AGI, Texas gained $47 billion, and Florida gained $156 billion. That was at the expense of many states, but three in particular lost between $50 and $100 billion each year. This includes Illinois, California, and New York, the biggest loser of all. The Empire State lost $100 billion in annual AGI.

But why? After all, it’s tough to compete with Chicago, New York, San Francisco, and Los Angeles.

Because the states that Americans are moving to, and where they bring their income along, are low and no tax states. Florida and Texas do not charge you for working, while Arizona has a relatively low individual income tax rate. Certainly better than California, though that isn’t saying much.

When New York Gov. Andrew Cuomo was being criticized from both the left and the right for offering between $1.5 and $2 billion in taxpayer incentives to Amazon, he defended the decision saying his state needs to offer incentives to compete with states that don’t have an income tax. If a governor has to say that, it should highlight the lack of competitiveness that state has, regardless of what else it has to offer.

When states have higher tax rates, that naturally allows the state to confiscate more money from taxpayers and gives them the ability to dole out money to their preferred companies. Rather than let the market work, you have selected interests who are insulated from higher taxes at the expense of everyone else.

We all seem to understand the not-so-secret, secret sauce. Low taxes and a light regulatory touch lead to job growth. Americans then move to where there is a combination of good jobs, high quality of life, and reasonable housing costs. And the state’s that are doing things right are the ones who benefit. In other words, prosperity is closely linked to freedom-based public policies. If we want to grow and provide more opportunities in Mississippi, then let’s take the path that makes it easy to start a job, open a business, earn a side income, invest capital, serve customers, compete with incumbent businesses, and keep more of what we earn.

Economic development, incentives via the government, and economic growth, based on free market principles, should not be confused.

Well-meaning public officials, government employees, community business owners and executives, and chamber of commerce cheerleaders have the best of intentions when they propose ideas for economic development. I believe they are genuinely trying to help. I just wish they would stop. When we confuse economic development with economic growth, we make big mistakes in public finance. These two concepts may sound similar but they are, in fact, opposites. An emphasis on one or the other leads to different results.

Those of us interested in seeing economic growth advocate for broad public policies like lower taxes, a reduction of the regulatory burden on businesses, the elimination of double taxation on investments and savings, and a reliable and predictable legal and regulatory environment. In stark contrast, proponents of economic development argue for subsidies, tax abatements, and regulatory relief for specific businesses or industry types in particular regions. The latter believe the economy can be directed by government involvement; the former believe the economy will produce a better outcome when we leave it to the entrepreneurs and consumers to determine the direction.

For those of us with a belief in the durable power of free-markets, the choice is easy. We know, thanks to Adam Smith and 242 years of data, wealth is created by the free exchange between producers and consumers. If we leave markets free and allow the natural incentive of profit-seeking to work, without government trying to influence, direct, guide, orchestrate, manage or nudge, the states maximize their economic growth. Such growth is what drives long-term employment and increased prosperity. When we replace the decisions of entrepreneurs, investors, and consumers in the private market with decisions of politicians, government officials and development boards, we significantly lower the odds of achieving economic growth.

Economic development policy really means the state picking the winners and losers by employing direct subsidies and tax breaks to attract or promote specific businesses or industries. An authentic effort to grow our economy would not focus on giving targeted companies the assistance and resources without providing those to all companies and industries. It is not fair to the current companies in Mississippi, who built their businesses without government help, to find themselves competing with companies subsidized by taxpayers. For too long, Mississippi has followed a policy that supposes “economic development” can be a meaningful driver of economic well-being in the state. It cannot. That policy is a losing one.

The evidence produced from analysis points convincingly to the conclusion that these targeted incentives do not produce long-term benefits in excess of their costs. In many cases, the cost-per-job is extraordinarily high. While some high-profile companies and their political allies may be better off, non-beneficiary companies may lose workers or experience wage increases, or both, and the state’s economic activity as a whole slows.

When political favor seeking is emphasized like this, it thwarts the private sector and tips the scales in favor of those companies and individuals with access to political relationships. It sends a message to the private sector that it should not focus on consumer-oriented actions, like product/service innovation or marketing, and focus resources instead on lobbying, legal representation, and elections. That’s not a recipe for sustained economic growth.

While economic development incentives, like those practiced by the Mississippi Development Authority, may lead to the creation of new jobs; that does not mean such jobs lead to the creation of economic growth. Measuring jobs alone is an insufficient way to measure economic growth. For example, roughly 90% of the Canton-based Nissan plant employees were already employed when that Madison County facility opened. Those new employees were already paying state income taxes. Yet, every job created by the state and local government incentive package was subsidized. In total, roughly $1.3 billion was promised to Nissan. According to data analyzed by Mississippi State University’s Institute for Market Studies, Nissan pays its 6,400 workers at the plant an average of $62,500, which costs taxpayers $203,125 per worker. Had that taxpayer subsidy not occurred and the dollars remained in the private sector, would individuals and businesses have found a better “investment” use? Decades of economic research and free market evidence informs us that private citizens and firms are more effective at allocating resources to their highest uses than is government.

The chief argument around government incentives is that “everyone else is doing it, so we must join the process in order to remain competitive.” That’s the wrong approach. The desire to provide incentives is an acknowledgment that our tax, regulatory, and legal system is not competitive. It says our state has not adopted freedom-based policies. Instead of offering incentives to just a few, our goal should be to create the most business-friendly climate in the country. A public policy based on freedom is how we’ll grow our economy.

Rather than increase the hand of government in our economy, we should trust the “invisible hand” of the market place and the proven incentive of profit and loss for the allocation of resources. It is either folly or hubris to think government can have the knowledge to do that more efficiently than the market. Nobel Prize-winning economist F.A. Hayek once wrote, “The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.”

This column appeared in the Clarion Ledger on November 2, 2018.

Few people would argue with the beauty of a California sunset. The bright lights of Times Square are tough to compete with. But there is one thing that can top the allure of California or Manhattan: your pocketbook.

While many on the left may argue that a certain class of Americans enjoy the high-tax, high-regulation burdens of our most liberal cities and states, and the perceived protections that go with it, the numbers paint a different picture.

Americans are moving to lower tax states where they are able to keep more of the money they earn. This isn’t a talking point, but a statistical reality based on migration data. Unfortunately, Mississippi is on the wrong side of both taxes and, as a result, in-migration.

Sales, property, and individual income taxes, as a percentage of personal income in Mississippi, are 9.9 percent, according to Cato Institute. That’s pretty high. In fact, only 14 states, including traditional high tax states like California, Connecticut, New Jersey, and New York, fared worse. All neighboring states had lower tax burdens than Mississippi. What effect does this have?

Mississippi had a net migration loss of over 3,500 in 2016. On a per capita basis, this means Mississippi lost 100 residents for every 88 the state gained. This is parallel with migration loses in Louisiana. Alabama and Arkansas were essentially flat in terms of migration while Tennessee added over 13,000 residents. For every 100 residents that Tennessee lost, they added 119.

Tennessee, a state without an individual income tax, is home to one of the lowest tax rates in the country with a tax burden of 6.5 percent. And they are reaping the benefits of smart fiscal policy. The Wall Street Journal reported in May: “Alliance-Bernstein Holding LP plans to relocate its headquarters, chief executive and most of its New York staff to Nashville, Tenn., in an attempt to cut costs…In a memo to employees, Alliance-Bernstein cited lower state, city and property taxes compared with the New York metropolitan area among the reasons for the relocation. Nashville’s affordable cost of living, shorter commutes and ability to draw talent were other factors.”

Twenty-six states had a tax burden of 8.5 percent or greater. Of those 26, 25 had a net out-migration. Only Maine was able to buck the trend. And not surprisingly, of the 17 states that had net migration gains in 2016, all but one has a tax burden of less than 8.5 percent. All totaled, more than 500,000 individuals moved from the top 25 highest-tax states to the 25 lowest-tax states in 2016. Those high tax states lost an aggregate income of $33 billion.

Along with the relatively high individual tax burden, our business tax climate sits at 31st best, according to the Tax Foundation. Not terrible, and actually better than Alabama, Arkansas, and Louisiana, but not great either. The same report had Tennessee at 16.

So what can we do in Mississippi? We can follow the lead of high-growth, low-tax states in the Southeast that have lower taxes, lighter licensure and regulatory burdens, and a smaller government.

This past session, the legislature debated a bill known as the “Brain Drain” Tax Credit. It would have provided a three-year income-tax exemption to recent college graduates who are Mississippi residents. And there was an additional two-year exemption for those who start a business. It passed the House unanimously but died in the Senate without a vote.

States are in competition with one another. We know this because we routinely offer incentives for select companies in the form of subsidies or tax breaks, or we propose eliminating the individual income tax for three to five years for recent college graduates.

While we are always in favor of lower taxes, these moves are just an acknowledgement that our tax burden hurts individual opportunity and the state’s economic growth. We have succeeded in phasing out the lowest income tax bracket. Instead of eliminating the income tax for just a few, we should work on eliminating the income tax for all taxpayers. And instead of offering incentives to just a few, our goal should be to create the most business-friendly climate in the country – for all types, sizes, and industries.

A public policy based on freedom is the recipe high-growth states have adopted. It’s how we’ll grow our economy in Mississippi, too.

This column appeared in the Daily Leader on October 31, 2018.

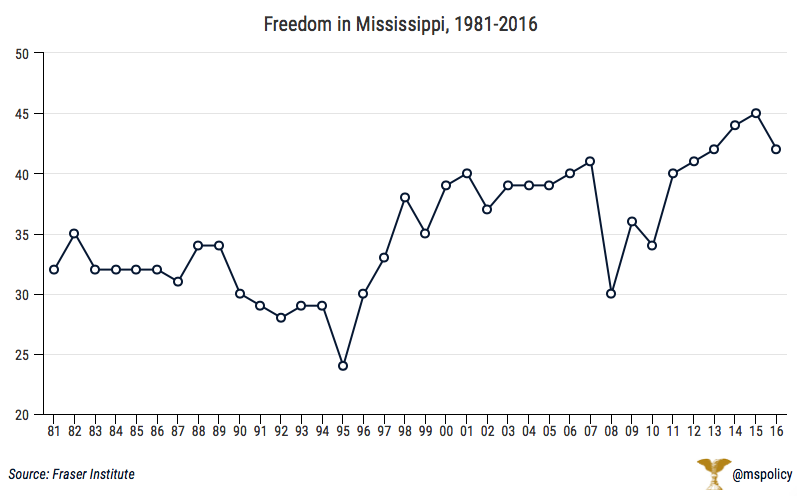

Mississippi’s freedom ranking moved up a couple spots from the previous year while our overall score actually declined slightly.

Fraser Institute’s “Economic Freedom of North America 2018” again paints a relatively bleak picture for economic freedom in Mississippi. Mississippi has been included among the “Least Free” states, those in the bottom quartile, for all but two years going back to 1998.

“The freest economies operate with minimal government interference, relying upon personal choice and markets to answer basic economic questions such as what is to be produced, how it is to be produced, how much is produced, and for whom production is intended. As government imposes restrictions on these choices, there is less economic freedom,” the report writes.

The data is reviewed among three categories: government spending, taxes, and regulations.

What are these categories important? As the size of government expands, the private sector becomes smaller and is slowly pushed out with government choosing to undertake activities beyond the traditional function of a limited government. As our tax burden and regulations grow, restrictions on private choice increase and economic freedom declines. Mississippi continues to have serious issues in both categories.

And we know what the analysis shows: The freer the state, the more prosperous it is. And the more it is growing in terms of in-migration. The least free, the more people are likely to be leaving in searching of better prospects.

...

Though Mississippi saw a slight improvement this year in overall rankings, the state has been on the wrong path over the life of the report. When it began in 1981, Mississippi was ranked 32nd. There have been some ups-and-downs along the way, including a peak at 24th in 1995. But overall, the numbers aren’t positive. The ranking of 45th that was released last year was the lowest the state has ever been.

Going back to 1981 and for many years after that, Mississippi did much better in the government spending and taxes categories than the numbers show today. That year, Mississippi had a government spending score of 7.01 and a taxes score of 6.75. This year those scores are 4.25 and 5.85, respectively. Regulations have shown the most positive movement, from 2.27 to 5.23, though still lower than all but seven states.

In 1981, Mississippi earned a score of 5.34. This year it’s 5.11. Only two other states, Kentucky and New Mexico, have experienced decreases from 1981.

….

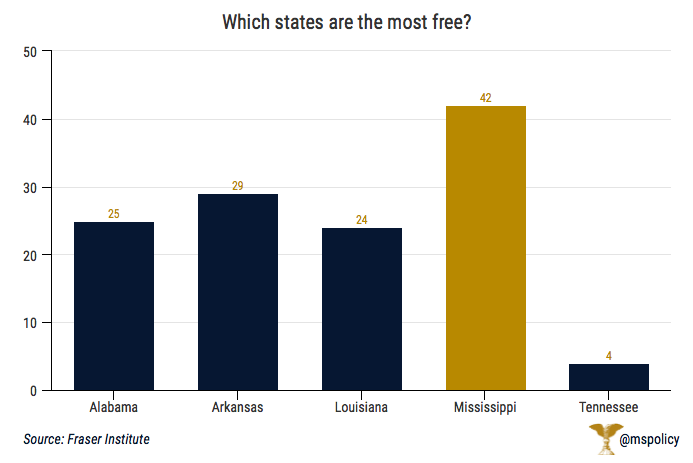

Mississippi performed poorly compared to all neighboring states, and much of the Southeast. Alabama had an overall score of 6.22 (25th), Arkansas had a score of 6.09 (29th), Louisiana had a score of 6.26 (24th), and Tennessee had a score of 7.43 (4th). Those numbers put Tennessee among the most free, placed Alabama and Louisiana in the second quartile, with Arkansas in the third quartile.

When it comes to promoting policies that restrict freedom, Mississippi is sitting on an island. And, unfortunately, paying the price.

….

Overall, this data isn’t far off from a recent report from Cato Institute. Their report, “Freedom in the Fifty States,” put Mississippi 40th overall. A five-spot jump from 2014, but still in the bottom 20 percent.

Some positive trends, but still a long way to go.

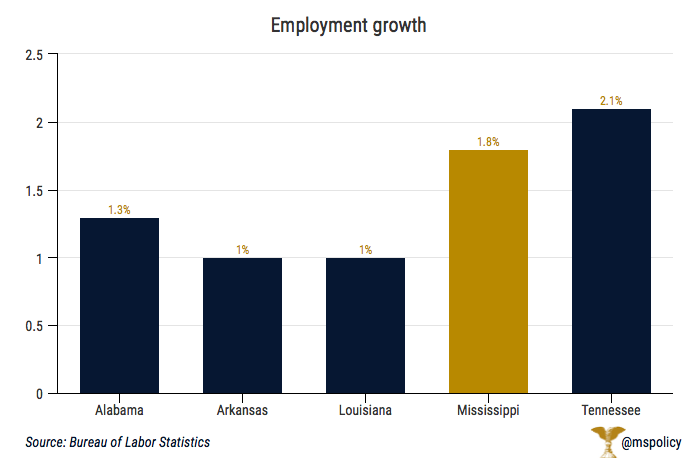

Mississippi payrolls have added more than 20,000 jobs over the past year with employment numbers setting a new record.

According to the most recent data from the Bureau of Labor Statistics, there are now 1.17 million people in the state working. That’s a boost from a little less than 1.15 million a year ago. This is a statistically significant employment change of 1.8 percent. Only Tennessee, who saw a 2.1 percent growth, posted better numbers among neighboring states.

Alabama’s employment grew by 1.3 percent, while employment grew by 1 percent in Arkansas and Louisiana.

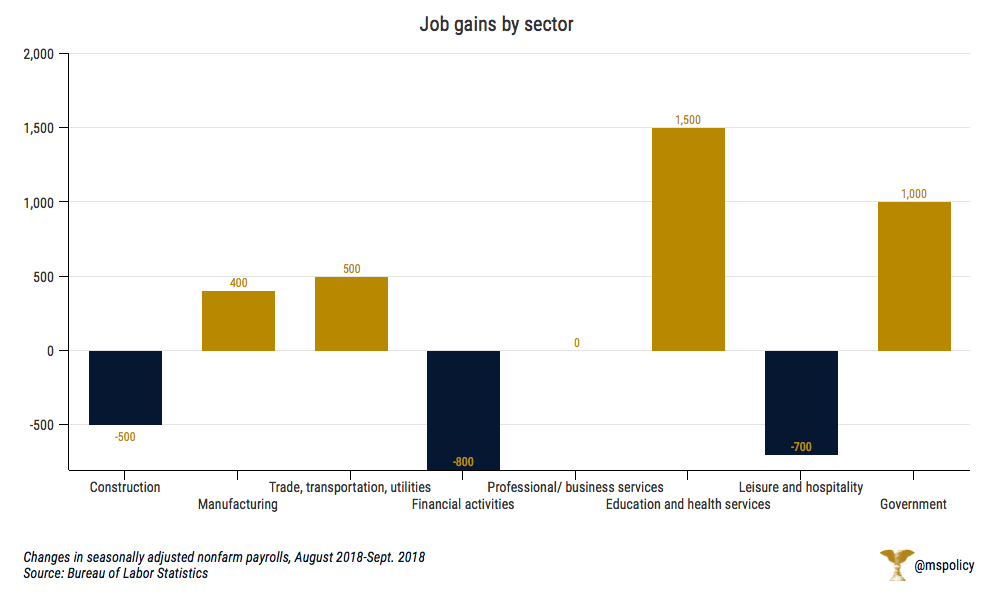

Mississippi added jobs in four sectors over the past month. The largest gains were in education and health services (+1,500 jobs) and government (+1,000 jobs). Manufacturing and trade, transportation, and utilities posted slight gains, while professional and business services growth was flat. Construction, financial activities, and leisure and hospitality showed loses over the past month.

Over the past year, construction (-200) is the only sector to post a decrease in employment. The largest gainer over the past year was professional and business services (+6,400).

Mississippi has also seen a large gain in the public sector, particularly over the past three months. Government has added 2,800 jobs over the past year with 1,600 jobs added alone in the past quarter. Government jobs account for 14 percent of the jobs created in Mississippi over the past year. This is significant because a growing public sector can often stifle the growth of the private sector.

In this measurement, Mississippi far outpaced our neighbors. Louisiana’s government was down 200 jobs last month. Arkansas’s government did not change and Tennessee added 100 government jobs between August and September. Alabama’s government added 300 jobs last month.

Mississippi’s unemployment rate remained steady at 4.8 percent. That is a near record low for the state, but is still the fourth highest in the nation. Only Louisiana, at 5 percent, has a higher rate in the Southeast.

While some may be sad to see Sears head into bankruptcy, it is the free market working.

As Sears goes through bankruptcy, we will likely see nostalgic perspectives on the 130-year-old retailer. But through the ups and downs of retail, one constant remains; consumers decide and the market always wins.

Fifty-years ago, if one had suggested Sears would go bankrupt and just a fraction of their stores would remain open, most sane people would have laughed. Now, we know the rest of the story. Sears started as a mail-order catalog before transitioning into a brick-and-mortar force that grew with suburban America and the boom of indoor malls.

That boom included Jackson, Mississippi. While Sears long had a presence in the city, it would serve as the first anchor for the new Metrocenter Mall in 1978, the state’s largest mall. For years, both Sears and the mall hummed along…until people began to make other choices. In 2012, Sears was the last anchor to leave, effectively ending whatever claim Metrocenter still had at labeling itself a mall.

…..

There has already been – and there will continue to be – stories about mismanagement at Sears or about some other decisions from the past decade or so that necessitated the bankruptcy. But we know what killed Sears. It was the same thing that made Sears into a retail giant – creative destruction. Fighting to give consumers new and better options, Sears created unique and valuable shopping experiences for consumers. Today, other options are causing consumers to spend their money elsewhere. It is the order of things in a free market.

The “elsewhere” might be Wal Mart, which is able to sell goods at a deeper discount than Sears, while also selling groceries. It might be Best Buy or Home Depot/ Lowes, which offer Sears-size stores for a single retail category, providing consumers with far greater choice. Perhaps it’s Amazon, which has put pressure on every remaining retail giant. In the final analysis, nothing remained in the value proposition of Sears that gave people a compelling reason to shop there.

In the end, capitalism gave us better options. Creative destruction, which has been the driving force behind American ingenuity for the past century, ruled the day.

Someone else provided the market with a value proposition that consumers voluntarily decided was better. In much the same way that, once upon a time, Sears provided a better value proposition than general stores or five-and-dimes, which had dotted downtowns in an earlier era. The same creative destruction that made Sears a retail juggernaut would eventually be the reason for its slow death over the past decade.

…..

Sears gave the masses access to affordable household goods largely before anyone else. But the free market, and retail in particular, is about appealing to modern tastes and changing behavior. For many years, Sears had been losing its relevance. Nostalgia is good for writing an obituary, but is largely unhelpful in keeping most businesses open.

No one likes to see a business close, particularly one that has been around for more than a century and likely evokes found memories from early eras. But for consumers in Mississippi and around the country, we don’t have to worry. The market, via you, the consumer, spoke long before Sears filed for bankruptcy protection.

The latest index on labor markets in America shows Mississippi performing well in some measurements, but behind most other states overall.

The report, published by the Fraser Institute, includes a comprehensive analysis of labor market performance by state. It is based on the average of the following eight key indicators:

- annual total employment growth

- annual private- sector employment growth

- total employment rate

- private-sector employment rate

- unemployment rate

- long-term unemployment

- share of involuntary part-time workers

- output per worker (or average labor productivity)

The data was calculated using a three-year average, from 2015 through 2017.

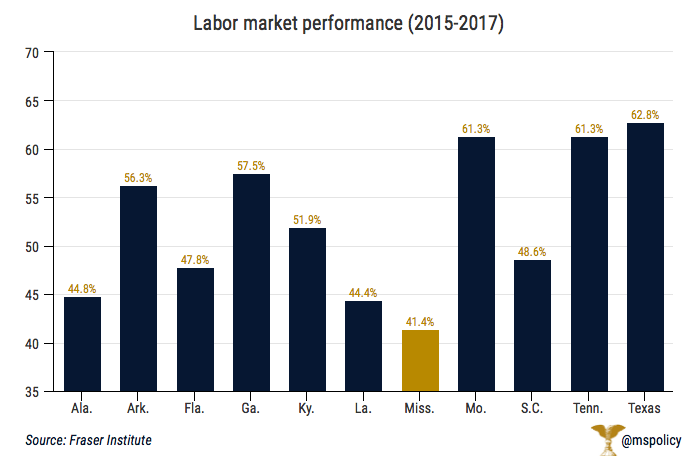

Mississippi was rated 48th overall among the 50 states with a score of 41.4 (out of 100), ahead of just New Mexico and West Virginia. North Dakota, Utah, and Minnesota led the country with scores of 80.4, 78.3, and 75.8, respectively.

Mississippi’s score placed it last among our neighboring states, and last among SEC states. Tennessee led our neighbors with a score of 61.3 followed by Arkansas at 56.3. Alabama and Louisiana were slightly ahead of Mississippi with scores of 44.8 and 44.4, respectively. Texas led SEC states with a score of 62.8.

Mississippi’s best measurement among the eight categories was job growth, including job growth overall, and more importantly, private-sector job growth.

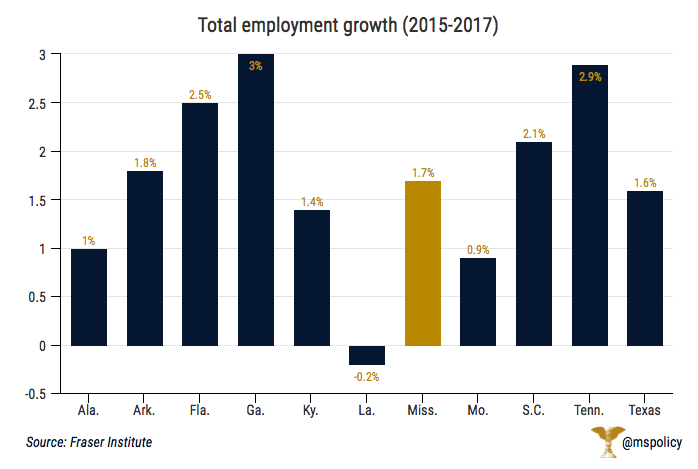

Mississippi’s total employment growth over the three-year period was 1.7 percent, this was 18th overall and 6th among SEC states. But total employment doesn’t differ on whether that growth was driven by the public or private sector. Looking specifically at private-sector job growth we see numbers that are slightly better for Mississippi.

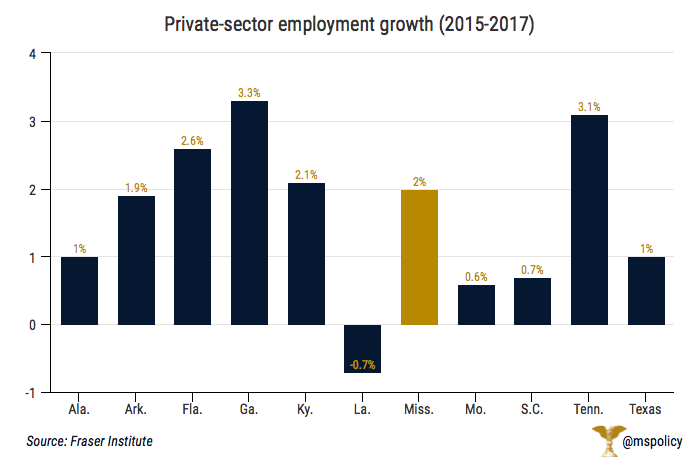

Reviewing private-sector job growth, Mississippi’s employment grew by 2 percent during this period.

Mississippi was 17th nationally in job growth, trailing only Tennessee’s 3.1 percent employment job growth among our neighbors. Louisiana had the third worst employment growth, at -0.7 percent. Among all SEC states, Mississippi placed 5th.

Recent data from the Bureau of Labor Statistics reveals similar positive numbers in terms of job growth. Employment in Mississippi grew by 1.6 percent over the previous year, behind just Tennessee among neighboring states.

But the positive news stopped there.

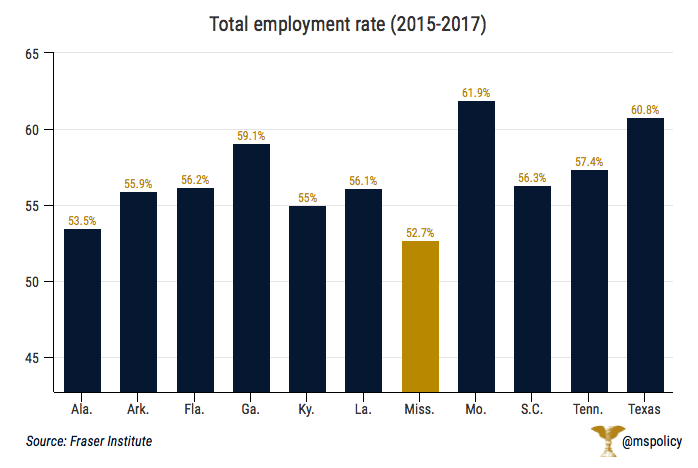

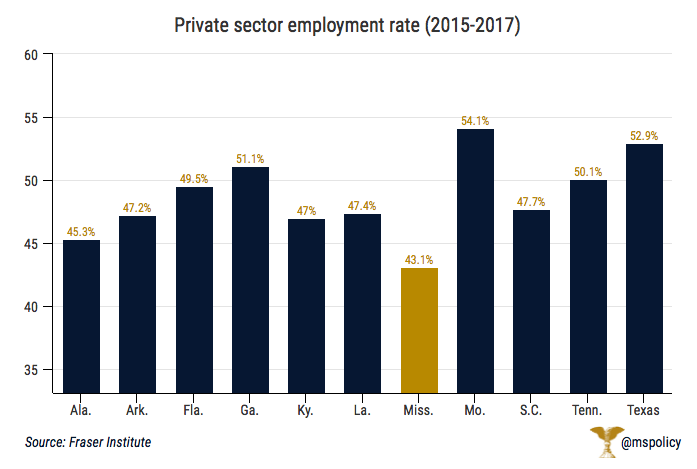

Mississippi’s total employment rate and total private-sector employment rate came in last among SEC states and 49th and 48th, respectively.

Total employment rates include full-time and part-time work, including private-sector employees, public-sector employees, and the self-employed, as a percentage of the working age population.

Mississippi’s total employment rate is 52.7 percent, last among all SEC states and ahead of only West Virginia. Mississippi moved up to 48th in private-sector employment rates, still last among SEC states.

North Dakota led both measures of employment rates at 69.4 percent for total employment rate and 59.2 percent for private-sector employment rate.

While employment rates measure those who are working, the unemployment rate measures those actively seeking work but unable to find it.

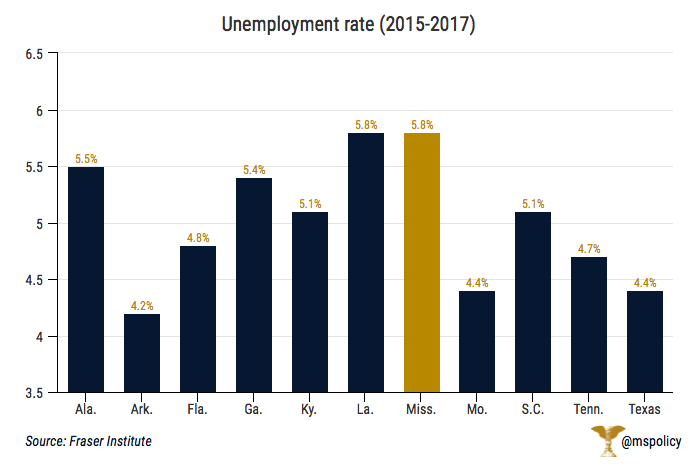

Mississippi’s three-year average rate of 5.8 percent is tied with Louisiana for 45th in the country and tied for last among SEC states. Alabama was slightly better at 5.5 percent, but Mississippi was far behind Arkansas’ 4.2 percent and Tennessee’s 4.7 percent.

Among other Fraser measurements:

- Mississippi placed 43rd for long-term unemployment, those who experience unemployment for 27 weeks or long relative to the total unemployed, at 29.1 percent.

- The state placed 38th among share of involuntary part-time workers, those who desire to work full-time but could not find it as a result of economic conditions.

- The state placed 48th for average output per worker, which is the amount of productivity per worker.

Moody’s Investors Services has revised the outlook for the state of Mississippi from negative to stable.

They also affirmed the Aa2 ratings on outstanding GO bonds and the Aa3 ratings on debt issued from the Mississippi Development Bank.

“The state's stable outlook, which applies to its GO as well as its appropriation debt, is supported by stabilization of revenue and economic trends and a resumption of deposits to the rainy day fund,” Moody’s wrote. “The outlook also incorporates the expected continuance of conservative fiscal management, which will help manage elevated debt levels and potential future revenue weakness.”

To see a future upgrade, Moody’s said Mississippi needs:

- Growth in state wealth levels reflecting a sustained progress trending to national average

- Sustained increase in fund balance

- Substantial decrease in debt and pension liabilities

Pension liabilities are a major issue for the state, as they are for most states. A recent report from Truth In Accounting noted Mississippi’s unfunded retirement obligations. And because of the state’s debt burden of $8.3 billion, each taxpayer has a burden of $11,300.

In September, S&P Global Ratings similarly revised the state’s general obligation debt outlook from negative to stable.

“Now, all three of Mississippi’s credit ratings are strong and positive,” said Treasurer Lynn Fitch. “Taxpayers will benefit from recent efforts to meet economic challenges head-on, such as putting money back into the Rainy Day Fund and strengthening PERS’ funding policy. Better ratings mean the bond issuances currently in the works for capital and transportation improvements across the State will yield better deals for taxpayers.”

A depletion of financial reserves, economic underperformances, and persistent growth in retiree benefit liabilities could lead to a future downgrade.

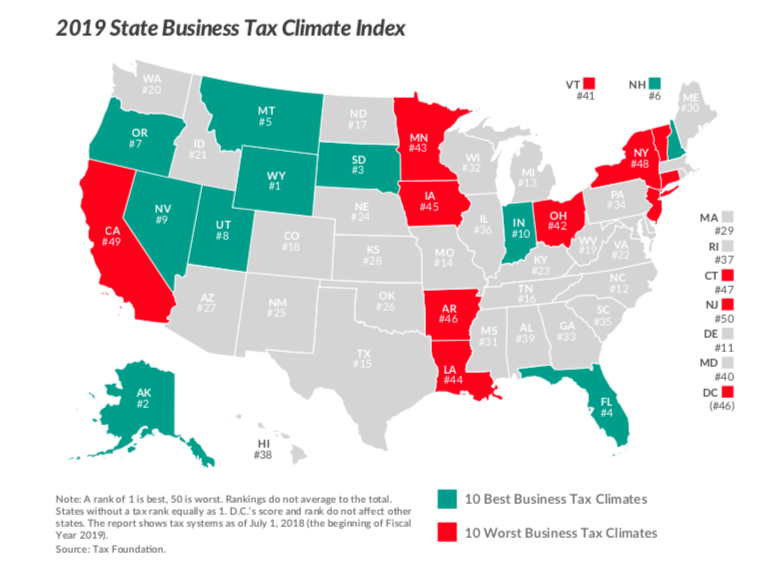

Mississippi’s business tax climate rating dropped slightly over the past year.

The Tax Foundation’s “State Business Tax Climate Index” grades each state on the burden of their corporate taxes, individual income taxes, sales taxes, property taxes, and unemployment insurance taxes. Fewer policy areas are as important as tax policy when it comes to economic growth.

The five highest rated states were Wyoming, Alaska, South Dakota, Florida, and Montana, while the five worst states in terms of business tax climate were New Jersey, California, New York, Connecticut, and Arkansas.

Mississippi’s ranking isn’t that much different from where it has been the past four years, ranging from a high of 29 (in 2016 and last year) to a low of 31 (this year). In 2017, the state ranked 30th. Still, Mississippi did drop slightly from the previous year.

This change, however, isn’t due to negative action taken by the state but simply because other states had passed Mississippi. One of those was Kentucky, the biggest gainer nationwide. They moved up 16 spots from 39th to 23rd after a series of tax reforms in the Bluegrass State.

Compared to our neighbors, Tennessee is doing the best by far. The income-tax-free state was rated 16th. Mississippi, however, bested our three other border states: Alabama (39), Louisiana (44), and Arkansas (46). That is good, but not anything to necessarily celebrate as it says more about their poor-performance.

Looking within the different tax categories, Mississippi did best with respect to unemployment insurance taxes (5) and corporate taxes (15). In fact, the corporate taxes topped all neighboring states, including Tennessee. However, Mississippi’s rankings for individual taxes (27), sales taxes (35), and property taxes (36) held the state back.

Generally speaking, the states with the best business tax climate are also the states that having a growing economy and a growing population.