A small win for freedom in Mississippi! Governor Tate Reeves recently signed HB3, a law that reforms the state’s Certificate of Need (CON) rules.

CON is basically a government approval process healthcare providers (like hospitals) must go through before they can add certain services, build new facilities, buy expensive equipment, or make big expansions.

HB3 makes some modest changes, allowing more flexibility for some specific providers. It also raises the dollar threshold for capital spending requiring approval.

Perhaps the most significant part of the bill is that it mandates the Mississippi Department of Health to do a study over the course of this year into the feasibility of letting smaller hospitals skip CON when providing kidney dialysis treatment and adult psychiatric services.

While HB3 does not give us the reforms Mississippi needs, it is a step in the right direction. In a legislative session that has seen most significant reforms killed in the Senate, this is one rare example of a free market reform in the 2026 session.

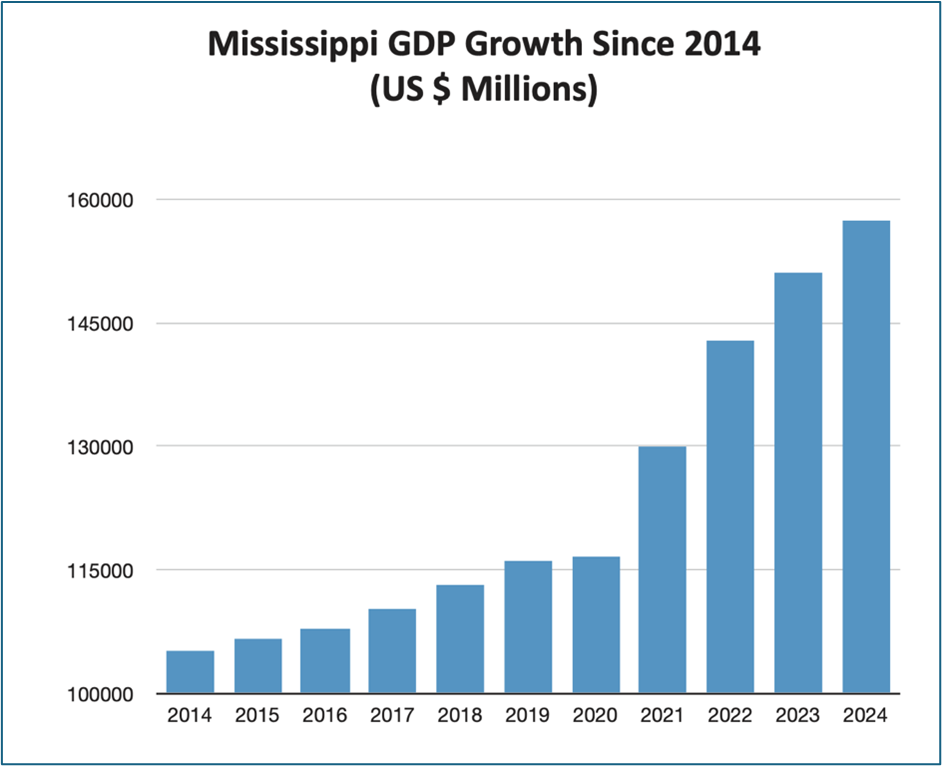

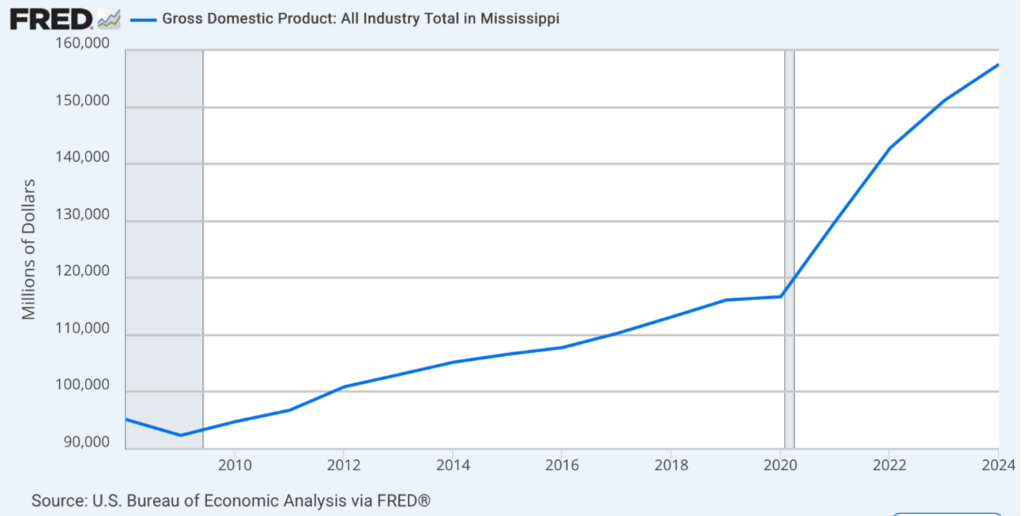

The future for our state looks bright. In just the past five years, Mississippi has seen more economic growth than in the entire fifteen years before that combined.

We’re on track to phase out the state income tax entirely, allowing families to keep more of what they earn. Mississippi has attracted a surge of new investment, and for the first time in years, our workforce participation rate is finally heading in the right direction.

Zoom out, and the picture gets even better. Contrary to the endless gloom from the pundits, the American economy has consistently outperformed expectations for decades. Since the late 1990s, the U.S. has delivered strong, steady growth that few forecasters saw coming.

But there is one dark cloud on all our horizons that we cannot forever ignore; US national debt.

As of today, US national debt stands at $38 trillion (with a capital T).

To grasp how enormous a single trillion really is, try this:

- One million seconds ago was just last week, right before Halloween.

- One billion seconds ago was early 1994, when Clinton was president and the internet was dial-up.

- One trillion seconds ago was roughly 30,000 BC, deep in the Stone Age, when humans were still chasing mammoths.

Now here’s the gut-punch: that $38 trillion mountain of debt has roughly doubled in just the past ten years.

Costly foreign wars, mega bailouts, COVID giveaways and all those federal entitlement programs LBJ said would “end poverty”, eventually add up. (Incidentally, living standards for America’s poorest citizens are light-years higher than when those programs launched in the 1960s (indoor plumbing, air conditioning, smartphones, modern medicine), but the number of people dependent on government assistance is larger than ever).

Rather than pay for all that using tax receipts, the US government has borrowed, issuing IOUs. Today we spend more money servicing all those IOUs than we do on defense.

As my fellow Brit, the historian Niall Ferguson, likes to point out, any great power that spends more on debt servicing than on defense risks ceasing to be a great power. That was true of the Romans and the British, the Habsburgs and the Dutch.

What must America do to avoid a similar fate?

When President Trump was first elected, Elon Musk and Vivek Ramaswamy launched the Department of Government Efficiency (DOGE) with an ambitious target: to reduce annual federal spending by $2 trillion.

Because mandatory entitlement programs - Social Security, Medicare, and Medicaid - remained largely untouched, DOGE hasn’t come close to achieving that yet. The federal deficit has barely budged.

Where, one might ask, are all those Tea Party types that railed against federal overspending ten years ago as the debt to GDP ratio went from 90 percent in 2010 to 125 percent today?

If the US cannot rein in the growth of the debt, the only other way to avoid going the way of the Romans is to try to make the GDP part of the equation rise faster. In other words, to try to grow our way out of the debt.

In order to stabilize debt-to-GDP at the current 125 percent of GDP, America will need to achieve real GDP growth of about 4 - 5 percent for the next 10 to 20 years. With the advent of AI and robotics, as Elon Musk suggests, it could be done.

Put it another way; without an AI / Robotics induced growth surge, US debt will hit 150 – 170 percent of GDP by 2050. Mamdani-economics would then become the least of our worries, as inflation and tax rises became inevitable whoever held office.

The older I get, the more I think that there are two fundamental things that the federal government needs to get under control: mass immigration and the deficit. Do that, and states like Mississippi have a bright future. Don’t, and all the good that we might do will only matter at the margins.

FOR IMMEDIATE RELEASE

October 30, 2025

MISSISSIPPI CENTER FOR PUBLIC POLICY HONORS LEGISLATIVE HEROES AT ANNUAL GALA CELEBRATING STATE SUCCESS

JACKSON, MS – October 30, 2025 –Six of Mississippi’s leading lawmakers were presented with award to honor them for championing principled conservative policy. Rich Lowry, editor of the National Review, presented each of the winners.

Healthcare

Rep. Sam Creekmore and Rep. Hank Zuber were jointly honored for their leadership in challenging Mississippi’s Certificate of Need (CON) laws, which restrict the expansion of healthcare providers and limit patient access.

Countering DEI

Sen. Angela Hill received the award for her early and unwavering stand against the encroachment of divisive DEI (Diversity, Equity, and Inclusion) policies in Mississippi’s public universities. Long before the issue gained national attention, Sen. Hill worked to safeguard academic freedom and institutional integrity at the state’s flagship campuses.

Education Reform

Rep. Jansen Owen was recognized for leading the 2025 legislative effort to expand open enrollment through HB 1435. Though the bill passed the House with broad bipartisan support - uniting parents, educators, and lawmakers - it was ultimately blocked in the Senate.

Income Tax Elimination

Mississippi became the first state since Alaska in 1980 to phase out its personal income tax through HB1. Rep. Trey Lamar and Speaker Jason White were honored as the driving forces behind this transformative reform. Through public town halls, transparent negotiations, and superior policy arguments, the duo outmaneuvered opposition and delivered a pro-family, pro-growth tax cut that is already attracting investment and enhancing Mississippi’s competitiveness.“

These lawmakers represent the best of conservative leadership - courageous, principled, and effective,” said Douglas Carswell of the Mississippi Center for Public Policy. “Their work is making Mississippi a national model for freedom, opportunity, and common-sense governance.”

Mississippi is shedding its image as an economic laggard. Over the past five years, the state’s economic output has grown more than it did over the previous fifteen years combined.

According to the U.S. Bureau of Economic Analysis, Mississippi posted the second-fastest per capita GDP growth and fifth-fastest personal income growth among all states in Q4 2024. Billions in capital investment have flowed in.

This growth is happening across the state—from the Gulf Coast and Pine Belt to DeSoto County, the Jackson metro area, and the university hubs of Oxford and Starkville.

Mississippi whoooooosh!

Mississippi’s recent growth is no accident. It is down to good public policy. Since 2022, Mississippi has implemented transformative tax cuts, reduced the state income tax and lowered the grocery sales tax and easing business inventory taxes. A 2021 law streamlining occupational licensing reduced barriers for workers and entrepreneurs, with the Mississippi Secretary of State reporting a 12% increase in new business registrations in 2023 alone.

Energy in our state is affordable, Mississippi electricity rates averaging 13.43 cents per kilowatt-Hour, helping draw in energy-intensive industries, including two major data centers in Madison and Rankin counties. To top it all, Mississippi’s public universities are fueling growth, and around Oxford and Starkville, entrepreneurial ecosystems are thriving.

But to maintain this momentum, our state needs to abandon policymaking as usual and embrace bold reform. That’s why the Mississippi Center for Public Policy (MCPP) has just launched The Mississippi Miracle? Bold Reforms for Growth.

Our paper details practical steps to sustain and accelerate this momentum:

- Empower Parents Through School Choice: Let families use state funds for public, private, or homeschooling options to drive competition and elevate education standards.

- Refocus Higher Education: Cut administrative bloat, prioritize workforce-relevant programs, and redirect resources from low-value courses to practical, job-focused education.

- Rein in Public Spending: Cap budget growth to population growth plus inflation to ensure fiscal discipline and curb waste.

- Cut Red Tape: Eliminate outdated regulations, repeal Certificate of Need laws, and create a business-friendly environment to spur innovation.

- Reform Public Procurement: Mandate transparent, competitive bidding with regular audits to prevent cronyism and maximize taxpayer value.

- Promote Welfare-to-Work: Emphasize work requirements, job training, and time-limited benefits to foster self-sufficiency and reduce program costs.

These reforms are practical policies that lawmakers can implement to improve lives across Mississippi.

To explore them in detail, visit mspolicy.org under “Publications” or email me at [email protected] for a direct link.

MCPP has a small, but highly productive team. We punch above our weight, producing policy proposals that become law, and helping set the agenda at the Capitol. We are able to do all this because we have the input of so many people across our state. Please read our proposals and share your thoughts—I want to hear what you think.

For decades, Mississippi exported people. Young people in particular tended to leave our state for places like Atlanta, Nashville, Huntsville and Austin.

I believe the tide is starting to turn. I often hear anecdotes of young people moving back to Mississippi. The data suggests that growth in our state is creating opportunities and drawing more people to move here .

Have a read of our report and help us build on this momentum.

Mississippi is on the move. Over the past five years, economic output rose more than it did over the previous fifteen.

According to data from the Federal Reserve Bank of St. Louis, Mississippi’s economic output has soared by $41.4 billion, climbing from $116.1 billion in 2019 to $157.5 billion in 2024. That’s more growth in half a decade than we saw in the previous fifteen years combined.

This growth did not happen by chance. It came about thanks to deliberate, pro-growth policies that are transforming our state.

In 2021, we saw labor market deregulation with a bill to reform occupational licensing. Then in 2022 came a substantive tax reform bill, which paved the way toward the income tax elimination bill passing in 2025. At the same time, Mississippi has kept energy costs low and rolled out the red carpet for inward investors.

Every one of these victories came about thanks to principled conservative leaders who fought for change against fierce opposition from leftist lawmakers wedded to the status quo. At the time that these reforms were proposed, there was no kumbaya consensus in favor of any of it. Change only happened because a handful of conservative leaders – and dare I say it conservative organizations - were willing to go out on a limb for it.

The Mississippi Center for Public Policy (MCPP) recently honored some of those in our legislature that truly are committed to this pro-growth agenda, and we should all celebrate their determination.

But the question remains: Is your local lawmaker part of Mississippi’s new pro-growth agenda, or are they standing in the way?

Did your own Representative and Senator help lead Mississippi’s growth, or are they one of the one’s that opposed everything but showed up for the cameras?

Despite Mississippi’s strong conservative majority, we often fall short on basic conservative priorities like school choice. Too many solid bills mysteriously “die in committee” with no explanation, no recorded votes, and no accountability. Lawmakers who oppose pro-growth policies have gotten away with vague soundbites on Supertalk, dodging any real consequences. That ends now.

The new Mississippi Freedom Index, which you can access by logging on to our website at mspolicy.org, empowers everyday Mississippians to hold their representatives accountable. This tool shows how your lawmaker voted on key pro-growth policies, details their campaign finance contributions, and even lets you message them directly.

We’ve identified four flagship growth policies that define Mississippi’s economic surge—any lawmaker who opposed them doesn’t meet our definition of a conservative, plain and simple.

So, where does your representative stand? Log on to mspolicy.org and click on the Freedom Index to find out. If any lawmaker disagrees with their rating, they’re welcome to reach out. They can post their remarks, or if they’re willing to publicly commit to supporting the policies they didn’t vote for, we’ll reconsider their score.

Mississippi is on the rise. Check the Freedom Index today—because our state’s future depends on leaders who deliver, not ones who hide.

Mississippi has made history as the first state in the U.S.—aside from oil-rich Alaska—to pass legislation aimed at phasing out its income tax.

This monumental achievement, spearheaded by Governor Tate Reeves and House Speaker Jason White, marks a significant victory for the state. The newly passed bill outlines a plan to eliminate the income tax over the next decade, starting with incremental cuts and followed by a series of budget-driven "triggers."

Beginning next year, Mississippi’s income tax rate will drop in 0.25 percent increments, sliding from 4 percent to 3 percent by 2030. After that, further reductions will hinge on the state’s budget surplus. Given Mississippi’s recent track record of substantial surpluses, the income tax could vanish entirely by the mid-2030s.

So, how did Mississippi become such a trailblazer? It very nearly did not happen.

The push to eliminate the income tax has been a cornerstone of Governor Reeves’ agenda, with serious legislative efforts kicking off in 2022 under then-House Speaker Philip Gunn.

Gunn’s genius was to simplifying the state’s variable tax rates into a flat 4 percent on income above $10,000. While this didn’t eliminate the tax outright, it leveled the playing field for Mississippi households, setting the stage for broader support of full elimination.

Fast forward to this year, when Speaker Jason White and Representative Trey Lamar introduced a plan to phase out the income tax by 2037. Their initial proposal included a partial tax swap, offset by modest increases in gas and sales taxes.

What happened next was both fascinating – and, if you support income tax elimination, rather fortuitous.

The Mississippi Senate has been a constant drag on conservative reform. They have either opposed, or come to grudgingly accept, almost every conservative policy proposal over the past few years, from school choice to red tape reduction. So, too, with income tax elimination.

The Senate, reluctant to fully embrace income tax elimination, opted for a cautious approach. They amended the bill with a "trigger" mechanism, tying future tax cuts to significant revenue growth outpacing spending increases. Some in the Senate perhaps saw this as a clever stall tactic—until a fortunate blunder turned the tables.

The Senate miscalculated the formula, placing a decimal point in the wrong place. Math matters. Something the Senate design as a brake on tax cuts turned out to be an accelerator.

Unless the state government runs a deficit, future surpluses will likely drive steady cuts, and Mississippi – despite the Senate leaderships best efforts – will be as competitive in tax terms as Tennessee and Texas.

Set aside the soap opera, this is great news for our state. Already there is evidence that in 2024, by some measures, Mississippi performed well economically, and may have been one of the fastest growing states in America that year. This tax reform will only add to this Mississippi momentum.

Perhaps what the Senators math missteps shows is that Mississippi now needs to turn its attention to education reforms? If the Senators stopped blocking school choice the way they tried to block income tax elimination, maybe math standards might be better both inside and outside the legislature.

In politics, nothing moves unless it’s pushed. Change doesn’t happen because of empty platitudes—it happens because principled conservatives like you step up to demand principled policies.

At the Mississippi Center for Public Policy (MCPP), we’ve been pushing hard this legislative session for four flagship conservative priorities. With just three weeks left, here’s where we stand—and how your support is making a difference.

1. School Choice

For years, no bill allowing even basic public-to-public school choice had been granted a floor vote. This session, we saw progress: a bill passed the House with a strong majority, only to be stalled in the Senate Education Committee under Chairman Dennis DeBar.

Sadly, this proposal appears dead for now—a frustrating outcome when every neighboring state offers universal school choice, and President Trump himself champions this policy. But the opposition’s grip may be weakening. Killing bills in committee no longer comes cost free for left leaning Senators, as it did for years. If principled conservatives keep shining a light on who’s blocking progress, we will win this fight.

2. Income Tax Elimination

Governor Tate Reeves has made income tax elimination a priority, and the House agreed, passing Speaker Jason White and Rep. Trey Lamar’s HB1 bill early in the session.

Now, the Senate’s liberal leadership is stalling, with a critical deadline looming this Tuesday. If HB1 fails, it will be a deliberate choice by Lt. Governor Delbert Hosemann, whose stance aligns more with liberals than with conservative taxpayers. We can’t waver. We must rally behind leaders like the Governor and Speaker who take bold conservative stands—and call out those who don’t. To achieve change, conservative organizations must not equivocate.

3. Outlawing DEI

When State Auditor Shad White exposed how Diversity, Equity, and Inclusion (DEI) programs in higher education were costing taxpayers millions, some at the Capitol scoffed. For years, they buried anti-DEI bills.

But the truth is out: DEI has been rampant, and Shad White was right. Now, an anti-DEI bill banning these wasteful, divisive practices is finally nearing the Governor’s desk. This is what happens when principled conservatives push forward. You’ve helped make this possible—thank you.

4. Removing Red Tape

In healthcare, excessive regulations stifle progress and hurt our economy. Two steadfast conservatives, Rep. Zuber and Rep. Creekmore, have worked tirelessly to cut this red tape. Their bill is on the cusp of becoming law—a testament to what principled leadership can achieve.

What’s Next?

The final weeks of the session could bring surprises. The Senate might dig in, forcing a special session, or conservative Senators could step up, demanding action on income tax elimination, anti-DEI measures, and red tape reduction—policies voters like you support. As Barry Goldwater famously said, “Extremism in defense of liberty is no vice. Moderation in pursuit of justice is no virtue.” Your commitment to these principles is driving change in Mississippi.

The Mississippi legislature has a clear conservative mandate yet sometimes struggles to get things done. Why?

State Governor Tate Reeves clearly has a vision for Mississippi. He wants to promote economic growth and eliminate the state income tax. He’s also pretty big on law & order, efforts to improve the education system and work force development. Agree with him or not, it’s undeniable that he has a plan for our state.

So, too, does the Speaker of the House, Jason White. He’s made an income tax elimination bill his number one goal for this session. Under Speaker White’s leadership the House has also passed bills to extend school choice and reduce the red tape that restricts healthcare. The House is moving forward with purpose.

But what about the Senate? What’s their plan? Two months into a three-month session, it remains a mystery. Instead, the Senate leadership has spent much of the session saying “no” to nearly every proposal on the table. School choice? (Almost) killed in committee. Restoring the ballot initiative? Denied. Income tax elimination? Don’t hold your breath.

The Senate leadership has blocked conservative reforms at every turn—without offering any ideas of their own. This is baffling. Mississippians have overwhelmingly elected conservative leaders to every statewide office. Yet here we are, watching the Senate leadership stall policies that align with the values voters supported, all while failing to present an alternative path forward.

Normally at this stage of a session, if the House and Senate were gridlocked, you would expect a negotiation. How can the House negotiate with a Senate leadership that struggles to even articulate what it wants?

This isn’t a one-off. We’re seeing a pattern emerge.

First, the House signals its intent for reform—think Speaker White’s focus on income tax elimination and school choice this year, or school funding reform last year. Then, the Senate responds with silence—no counterproposals, no vision. Finally, when the House sends its bills over, Senate leadership works to kill them, often without a serious alternative. Is this really the best we can do

Contrast this with Washington. In just over a month since President Trump began his second term, we’ve seen a flurry of bold initiatives. He’s accomplished more in weeks than some Mississippi leaders have in years.

Our taxpayers deserve better than a legislature that can’t agree on basic conservative priorities like empowering parents in education or cutting taxes. For too long, the process in Jackson has been shrouded in mystery. Bills “die in committee” with no explanation, no accountability, and no recorded votes. We’re told the support isn’t there—yet no one sees the tally. It’s time for transparency.

That’s why the Mississippi Center for Public Policy (MCPP) is stepping up. We have four clear goals for this session: Public-to-public school choice, Income tax elimination, Anti-DEI legislation and Certificate of Need repeal.

Bills addressing each of these priorities have been drafted. By session’s end, every lawmaker will have had the chance to support them. Soon, we’ll launch an online tool for our 80,000 subscribers statewide, showing which Senators, Representatives, and statewide officials earn a “Trump approval”—and which one’s side with the progressive agenda. Mississippians deserve to know who’s delivering and who’s dodging.

The roadblocks to good conservative policy must be exposed. With your support, we’re shining a spotlight on the legislature and holding our leaders accountable.

You have a chance to help us move Mississippi closer to School Choice.

Right now, a critical bill — HB1435 — is hanging in the balance. This legislation, which has already passed the House, would give parents the power to choose the best public school for their kids, no matter their zip code (provided there was capacity).

But here’s the urgency: it’s stuck in the Senate Education Committee, and unless they vote to approve it by Tuesday, this opportunity will slip away. Please help us to make sure that does not happen!

Mississippi stands at a crossroads. All around us—Arkansas, Alabama, Tennessee, Louisiana—parents already enjoy the freedom of School Choice. HB1435 is a vital next step: public-to-public school choice.

Just last week, President Trump himself called on states like ours to rise up and pass laws like this. He’s counting on us. Our kids are counting on us. And I’m counting on YOU.

Here’s what I need you to do before Tuesday:

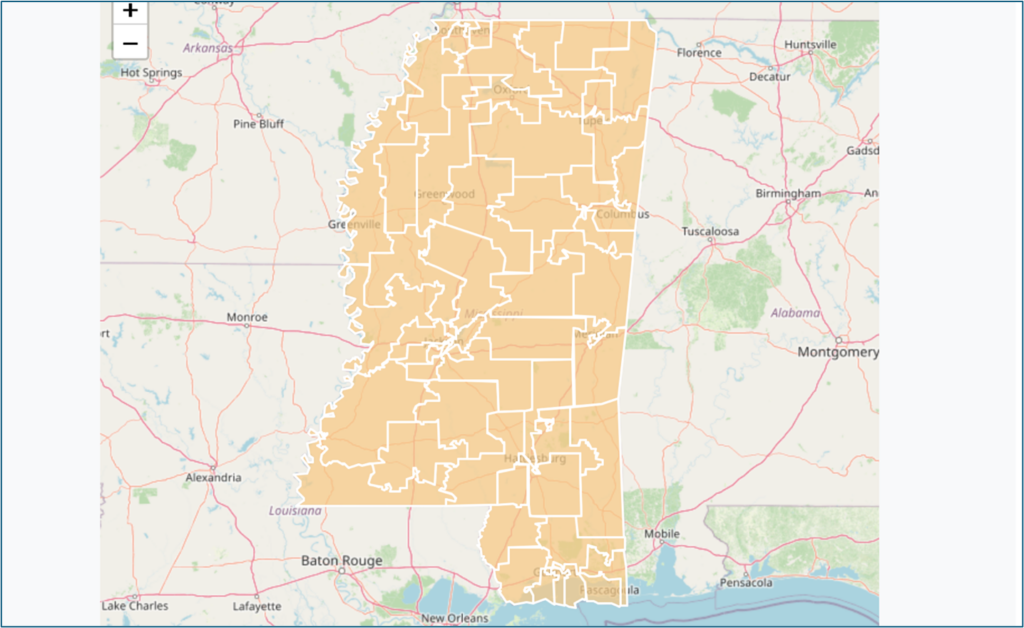

- Click the map below to find your State Senator.

2. Send them a short email. Tell them: “I’m a Mississippi voter, and I expect you to APPROVE HB1435!”

3. Share this mission with a friend—let’s build a wave of voices they can’t ignore.

If we all act, our lawmakers will have to listen!

You’re not just sending an email—you’re lighting a spark for change!

Thank you for standing with me in this fight. Start your week knowing you've made a difference—if you haven't taken action yet, now is the perfect time!