The Republican-dominated Mississippi Senate announced its 41 committee chairs at the beginning of the session and one surprise is how many Democrats were named to lead committees.

The Senate has 36 Republicans and 16 Democrats, but 12 of the Democrats have committee chairmanships. This means that 75 percent of Democrats hold chairmanships in the Senate while only 80.5 percent of Republicans hold chairmanships.

By comparison, the 2019 Senate comprised 32 Republicans and 20 Democrats with 39 committees. Twelve Democrats held chairmanships (60 percent) compared to 29 Republicans (84.4 percent).

These numbers, of course, do not tell the entire story as some chairmanships are more powerful than others. In 2019, Democrats held important chairmanships in Corrections, Transportation, and Judiciary B. In 2020, Democrats will control Corrections, Gaming, and Public Health and Welfare.

Chairmen are important in the legislative process because they act as gatekeepers for legislation. If a chairman doesn’t support a bill, he or she can keep it off the committee’s agenda. Conversely, a chairman can push a bill to send it to the floor for a vote by the full chamber.

Using legislation authored by the new chairmen in past sessions and utilizing an annual rating of legislatures by the American Conservative Union (ACU), one can make an educated guess on what measures are likely to make it out of committees for a floor vote.

The ACU graded Mississippi legislators on their votes on 21 measures, which included: landowner protection, the Heartbeat bill, funding for the Board of Cosmetology and funding for public television, among other issues.

In the Senate, the overall average rating was 46 percent, with Republicans averaging 54 percent and Democrats 32 percent. For the new chairmen, the average Republican earned a 53.32 percent rating, while the average Democrat was a 29.42 percent.

Public Health and Welfare

State Sen. Hob Bryan (D-Amory) was appointed to chair this committee, which handled bills related to everything from physician and nurse licensure, child protective services, certificate of need, and even food service.

Bryan has been in the Senate since 1984 and was chairman of the Judiciary B Committee in the last cycle.

One piece of legislation that could be handled by his committee is a Medicaid expansion bill that would expand Medicaid eligibility to able-bodied, working-age adults who earn up to 138 percent of the poverty level. This Medicaid expansion is a key piece of the Affordable Care Act, better known as Obamacare. Bryan authored similar legislation last year and it died in the Medicaid Committee.

Bills are referred to committee by chamber leadership, in this case, the Lt. Governor. The committee assignment for any Medicaid expansion bill would be a critical indicator on whether it is supported by leadership.

Bryan scored a 40 percent in 2019 and has a lifetime rating of 36 percent from the ACU. The average Democrat score was 32 percent. He has authored bills in the past that would’ve require mandatory, comprehensive eye exams for students entering kindergarten or the first grade, would’ve forced financial institutions to adopt policies to detect transactions related to Iran or terrorism and would’ve ended the phaseout of franchise tax and one state income tax bracket passed in 2015. Most didn’t survive the committee process.

Finance

State Sen. Josh Harkins (R-Flowood) chairs this committee, which deals with bonds, taxes, incentives, exemptions, the minimum wage, and alcoholic beverage control issues. Along with the Transportation Committee, this committee would play a big role in any possible gas tax increase at the state level or a possible local option gas tax proposal.

In 2019, Harkins authored the Landowner Protection Act, which was signed into law by then-Gov. Phil Bryant and reduces the liability for property owners for injuries that occur on their property. He also previously authored Right to Try, which provides terminally ill patients with access to experimental therapies.

Harkins scored a 52 percent grade from the American Conservative Union, while the average Republican score was 54 percent.

Judiciary Committees

Like the House, the Senate has two judiciary committees named Division A and Division B. They deal with legal issues, including criminal justice reform and other issues facing the judiciary system. While there has been a division of workload where one committee handled strictly criminal issues and the other handled civil issues, it’s unknown if the new Senate leadership will continue this practice.

Division A is chaired by state Sen. Sally Doty (R-Brookhaven), who received a 52 percent score from the ACU. In 2018, she authored a bill that would’ve allowed public and private nonprofit hospitals to collect debts using the state Department of Revenue to garnish income tax refunds from debtors.

She has also worked on legislation that expanded SNAP (food stamp) benefits to drug dealers/users and that sought to create a comprehensive sex-ed program for children in public school.

State Sen. Brice Wiggins (R-Pascagoula) will chair the other judiciary committee. He received a 48 percent grade from the ACU.

Wiggins wrote a “red flag” bill that would’ve allowed judges to issue orders to restrain a person’s right to possess firearms. It died in committee.

He also authored a bill that would’ve expanded the definition of a gang member and increased fines for gang members convicted of a felony. Under Wiggins’ bill, they would’ve also been prohibited form parole or any early release program. It died in committee.

Education

State Sen. Dennis Debar (R-Leakesville) takes over the Education Committee. One of the biggest issues facing the committee will be the reauthorization of the state’s Education Scholarship Account program, which will end this year without legislative action.

Debar, who was in the House at the time, voted for both the Charter Schools Act of 2013 and the original ESA bill in 2015. He also voted to renew the ESA program last year. That passed the Senate, but died in the House Education Committee.

He earned a 48 percent grade from the ACU.

Gov. Tate Reeves was sworn in as Mississippi’s 65th governor today, succeeding Gov. Phil Bryant, who was term limited.

During a ceremony that was moved to the House chamber because of rain, Reeves, who previously served two terms as treasurer and lieutenant governor, delivered an inaugural address that struck a conciliatory tone in saying this will be an administration for all Mississippians.

Reeves said his priority was to grow the economy.

"A growing, vibrant economy solves more problems than any government giveaway ever could," Reeves said. "A government program helps for a month, but a good-paying career helps a family for generations. It is my mission to spend every single day creating a climate where good careers are plentiful — with every Mississippian prepared to pursue them."

Reeves said he wanted to make sure the state is not causing more problems than it solves and that it does not stand in the way of opportunity.

“We will lower barriers to innovation,” Reeves said. “We will do everything in our power to make sure this is the easiest place in America to start and grow a business…We must open doors of generational opportunity to more people in our state.”

Reeves highlighted workforce development, which has been top of the mind for seemingly every politician in the state.

“It must be our goal to compete for the very best jobs in all the world. It starts with workforce training,” Reeves added. He then called for a “history making” increase in workforce training.

Other issues Reeves outlined:

- He said we must clean up corrections “to provide for the safety of our citizens and human dignity of all in the system.”

- He called for a teacher pay raise and a new mission to have more national board certified teachers per capita than any state in the nation.

- He said we must “take care of foster kids” and help “special needs kids get the help they need.”

The American Conservative Union Foundation’s Center for Legislative Accountability has produced its 2019 report for every state’s legislature. The report, similar to the one ACU has produced annually for members of Congress for nearly a half century, is designed to reflect how state legislators feel about the role of government in the lives of individual citizens.

Spoiler alert, the Mississippi legislature did not fare well.

Conservatism, at its core, is a political philosophy based on the inherent rights of the individual and his/her natural rights to life, liberty, and the pursuit of happiness. It flows from the Lockean ideas enshrined in our founding documents that the role of government is to defend and protect our Life, Liberty, and Property. Thus, the votes of a conservative member of the legislature should reflect a commitment to limited government, free markets, and personal responsibility. On the whole, a conservative should be voting against bills that would expand the size, scope, or cost of government and for bills that would reduce taxes, regulations, and burdens on small and mid-sized businesses.

The ACU Foundation report reviewed each piece of legislation voted on in both chambers of the legislature to produce average scores of each chamber as well as individual scores for each sitting member. In the previous session, Mississippi trailed only South Carolina as the most liberal legislature controlled by Republicans, according to ACUF’s Year in Review.

The Mississippi legislature’s overall conservative score continued to fall in the 2019 session (from 49.94 percent to 47.52 percent).

“In the 2019 session, numerous Mississippi lawmakers fell trap to crony government spending programs, and unnecessary interference in the marketplace,”said Center for Legislative Accountability Director, Fred McGrath.

The share of lawmakers earning awards varied by chamber, with just four Republican representatives and zero Republican senators earning awards. Democrat representatives earned an average score of 33 percent, slightly besting Democrat senators who earned an average of 32 percent.

The top scores in the House belonged to Reps. Joel Bomgar (R-Madison), Dana Criswell (R-Olive Branch), Ashley Henley (R-Southaven), and Steve Hopkins (R-Southaven). The top score in the Senate belonged to Sen. Michael Watson (R-Pascagoula), the incoming secretary of state.

ACU Foundation researched and selected a range of bills before the Mississippi legislature that determined a member’s adherence to conservative principles. They selected bills that focused on Ronald Reagan’s philosophy of the “three-legged stool”: 1) fiscal and economic: taxes, budgets, regulation, spending, healthcare, and property; 2) social and cultural: 2nd amendment, religion, life, welfare, and education; and 3) government integrity: voting, individual liberty, privacy, and transparency. This wide range of issues gives citizens an accurate assessment that conveys which of Mississippi’s elected leaders best defend the principles of a free society: Life, Liberty, and Property.

Frankly, I’m not surprised by the results. I have to come to understand that too many members of the Mississippi legislature and too many citizens on the Magnolia State equate “Conservatism” with “Republicanism.” It’s simply not so. Conservatism is a philosophy and Republicanism is a party. It’s not enough to be a supporter of our Second Amendment, traditional family values, and Judeo Christian beliefs. Most members of the Mississippi legislature, and certainly virtually all Republicans, fit that description. In addition to those ideas, we also need representatives who will vote to preserve the proper role of government.

As citizens, we need to hold our elected representatives accountable to self-governance and insist that they each learn to say “nay.” A conservative will say “nay” to increasing spending, expanding government dependency, adding taxes, and increasing regulatory capture.

In 2019, the Mississippi Center for Public Policy decided to read every bill that made it out of committee from either chamber and to score each bill based on a simple “green, yellow, red” system. On our website, you can find a summary of every bill, which we do in real time as the bills comes out. Then, you’ll see what we think of the bill. If we think the bill expands the size, scope, or cost of government or weakens individual liberty, we’ll mark it “red.” If the bill improves competition and consumer choice or preserves liberty, we’ll mark it “green.” If we need more information or don’t consider the bill to be a meaningful action, we’ll make it “yellow.” We do this not only to aid members of the legislature, but also do give the public a chance to see if their own representative votes like a conservative, or only talks like one.

This year, citizens will be able to compare how often their own representative votes for Life, Liberty, and Property directly on the site. It’s a new feature for this session. We’ll be watching…and so will the ACU.

When people leave Mississippi, they don’t go empty handed. They take their jobs, financial assets, and tax revenue with them.

Mississippi has lost $1.09 billion in wealth transfers to other states dating back to 2010. This is a change of negative 2 percent, ranking 30th nationwide, according to analysis of IRS data from the Illinois Policy Institute. Arkansas had a small decline of $287 million, while Louisiana lost $2.49 billion.

Alabama ($471 million) and Tennessee ($7.14 billion) both had positive transfers of wealth. Florida had the highest wealth transfer, both in terms of actual dollars ($88.95 billion) and percentage gain (20%).

Wealth transfers and population shifts go hand-in-hand.

Mississippi’s population declined by 4,871 last year. Mississippi and neighboring Louisiana, which saw a decrease of 10,896 residents, are the only states in the south to lose population over the past year. This is a continuing trend. Mississippi lost more than 3,000 residents the year prior.

But every other southern state south of Virginia (not named Louisiana), had positive domestic migration numbers last year. Some smaller, like 0.8 in Arkansas, some larger, like 10.3 in South Carolina. This is the difference between a positive and negative wealth transfer for a state.

Mississippi is in a dangerous cycle, but it is one that can be corrected. There are policies the state can adopt that would put Mississippi ahead of the curve when it comes to national policy and positioning the state to be competitive nationwide.

For starters, Mississippi needs to move away from a desire to overregulate commerce and embolden government bureaucrats. Mississippi has more than 117,000 regulations that cut across every sector of the economy. A successful model to stem this growing tide would be a one-in, two-out policy where for every new regulation that is adopted, two have to be removed. If a regulatory policy is so important, let’s make the government prove it.

The Trump administration adopted a similar executive order in 2017, and the numbers show we are actually seeing decreases greater than two-to-one, and these are not insignificant regulatory reductions.

This could be particularly beneficial in healthcare and tech policy. No department regulates more than the Department of Health, but our goal should be a push toward free market healthcare reforms that encourage choice and competition. In tech policy, the state has the opportunity to be one of the first states to essentially open the door for innovation, rather than one where entrepreneurs need to seek permission from the state. If Mississippi wants to get in the technology world, and we are convinced this is essential, a permissionless innovation policy in healthcare would be a big step in the right direction.

We should also not require people to receive permission from the state to work when they do move here. Open the door to productive citizens by allowing for universal recognition of licensing, following the path paved by Arizona. If you have been licensed in one state, that license should be good in Mississippi. Again, we could be ahead of the curve.

At the same time, our occupational licensing regime should be reviewed. Today, 19 percent of Mississippians need a license to work. It was 5 percent in the 1950s. While there are some occupations where a license is obviously prudent, we’ve expanded into far too many occupations.

This serves to lower competition and increase costs for consumers, while not providing those consumers with a better product. Occupational licensing is an example of how Mississippi misses the opportunity to grow her economy by acting in defensive ways to protect the slices of our economic pie for the well-connected when the reality is we could create a much bigger economic pie if we encouraged more creative disruption, competition, and risk-taking.

Finally, Mississippi needs to shed its abundant reliance on government and the public sector. Whether for public assistance, grants, contracts, jobs, or specific tax breaks, the citizens and companies in Mississippi are too dependent on state government. And the state is too dependent on the federal government. We have the third highest level of economic dependence on federal grants-in-aid in the nation (43%) and the fourth highest level of our economy driven by the public sector in the country (55%). Politicians, state agency directors, and government bureaucrats cannot create the economic growth we need. They can, however, work together with our various representatives and create an environment that allows and encourages private economic activities. Ultimately, with such an environment, it will be the entrepreneurs, business owners, productive workers, creative disruptors, capitalists, managers, and consumers who deliver the economic growth we all seek.

Mississippi can share the success of our neighbors. It will just take work.

Medicaid expansion, campus free speech, regulatory reform, teacher pay raises, and infrastructure spending are some of the issues that the Mississippi legislature will likely tackle in the session that starts today.

Since this session follows an election year, legislators will be in town until May 10, about a month longer than usual.

Last year’s session ended on March 29, nine days before legislators were supposed to leave town.

With a longer session, the deadlines will be pushed back. February 24 is the deadline for bills to be introduced and March 10 is the first deadline for bills to be passed out of committee in the originating chamber.

Medicaid expansion

One of the biggest issues facing the legislature is the possible expansion of Medicaid for able-bodied, working adults up to 138 percent of the poverty level under the Affordable Care Act, better known as Obamacare.

Thirty-six states have expanded Medicaid, which has the federal government cover 90 percent of the costs. The other 10 percent.

Any attempt to expand Medicaid will likely face the veto pen of incoming Gov. Tate Reeves, who made stopping expansion one of the primary issues of his campaign.

Incoming Lt. Gov. Delbert Hosemann is open to the idea, but House Speaker Philip Gunn is less supportive.

If Louisiana is any indication, participation and thus costs will far exceed estimates. According to a report by the Louisiana-based Pelican Institute, the state expected 306,000 new enrollees when it expanded Medicaid eligibility, but that number has ballooned to 456,361 according to recent data from the Louisiana Department of Health. That’s an increase of 49.1 percent.

A study by Institutes for Higher Education in 2015 said that it’d cost taxpayers $159.1 million per year by 2025 if 95 percent of the eligible population participated in the expansion (310,039 enrollees).

Campus free speech

As evidenced by events over the past year, work remains on ensuring that the state’s universities and community colleges don’t restrict the free speech rights of students and faculty.

The Foundation for Individual Rights in Education filed a lawsuit in U.S. District Court in September on behalf of a former Jones County Junior College student who was stopped several times by campus police and administrators from exercising his free speech rights. Attorneys for the college are seeking dismissal of the case in a filing on December 5.

One of the ways that the legislature could protect the free speech rights of students is enacting legislation that would prevent the creation of restrictive speech codes, keep administrators from disinviting speakers (especially controversial ones), create a series of disciplinary sanctions for students and anyone else who infringes the free speech rights of others, and allow people whose First Amendment rights were curtailed on campus to be compensated for court costs and attorney fees.

Regulatory reform

A study by the Mercatus Center at George Mason University found that the state’s administrative code has 9.3 million words and 117,558 restrictions. To read all of it would take 13 weeks of 40-hour work weeks and some breaks.

This regulatory morass places a heavy burden on businesses to stay in compliance and could be reduced with some common-sense reforms.

One of those would be a law that’d require the state’s regulatory bodies to strike two regulations for every new one that the board or commission seeks to enact.

At the federal level, President Donald Trump’s administration has enacted similar policies starting in 2017 that eliminated $13.5 billion in regulatory costs in fiscal 2019. In fiscal 2020, this could generate savings of $51.6 billion according to government estimates.

Gasoline tax hike

There is also a push for a gasoline tax hike for Mississippi drivers. Right now, they pay 37.19 cents in state and federal taxes on every gallon of gasoline, about 11 cents a gallon less than the national average. The state’s gas tax was last increased in 1987.

The Mississippi Department of Transportation requested $1.1 billion for fiscal 2021. Of that budget request, $559 million is from federal funds, $305 million from the state’s gasoline tax, $161 million from other state taxes and $75 million from state truck and bus taxes and fees.

The Office of State Aid Roads has requested $195,463,799 in from special and federal funds, which helps maintain 25,857.04 miles of county roads that are considered “feeder” routes between the state highways. This money also goes to maintaining 5,368 bridges on these routes

Also possible is a local option gasoline tax that is similar to Florida’s that would allow counties and municipalities to hold referendums on increasing local excise taxes on gasoline by a few cents. This would require a constitutional amendment and is probably unlikely.

Seemingly forgotten is the Mississippi Infrastructure Modernization Act of 2018 that was passed in a special session. The law diverts 35 percent of the state’s use tax revenues by next year to cities and counties to help with infrastructure. It also authorized $300 million in borrowing, with $250 million for the Mississippi Department of Transportation and $50 million for local infrastructure not administered by MDOT.

The infrastructure bill also increased registration fees for owners of hybrid and electric vehicles and is redirecting gaming tax revenue from sports wagering to roads and bridges.

The legislature also created a lottery, the first $80 million in tax revenue annually going to the state highway fund until 2028 and the rest put into the Education Enhancement Fund.

In the first week of sales, the lottery earned of $8,932,200, with $1.9 million going to roads and bridges statewide.

Teacher pay raise

One of the first things that legislators will have to tackle is a deficit appropriation of $18.5 million to cover the $1,500 pay increase for the state’s teachers passed in last year’s session.

Due to problems with an antiquated computer system, the Mississippi Department of Education reported a smaller number of eligible teaching positions than actually existed.

The $1,500 pay hike likely won’t be the only raise teachers receive from the legislature. During the campaign, both Reeves and Hosemann supported increasing teacher pay to the “southeastern average.”

With $100 million in additional revenue available to appropriators, Mississippi teachers could see more in their wallets. Teachers have enjoyed three pay hikes since 2000, beyond their annual step increases.

Mississippi teachers are the lowest paid nationally (average of $44,926 before the increase took effect in July), but when the state’s low cost of living is factored in, their pay ranks 35th, according to analysis of data by North Carolina’s John Locke Foundation.

Using the new raise as a guide, every $1,500 in raises will add up to about $76.9 million annually. An 11.29 percent increase that would bring the average Mississippi teacher’s salary to about $50,000 would cost about $263 million annually.

The 2020 Mississippi legislative session gavels in Tuesday at noon to begin the 125-day session that follows an election year. But most anticipate the session won’t last the full length, which would put Sine Die on May 10.

After the elections, Speaker Philip Gunn (R-Clinton) was chosen by the Republican caucus to continue serving as speaker. He will begin his third session in that role this year. Rep. Jason White (R-West), a top lieutenant of Gunn’s who served as chairman of Rules last term, has been tapped by the caucus to serve as speaker pro tempore, the number two position in the House.

Though a formality, they will need to be voted on by the full body.

White replaces Rep. Greg Snowden (R-Meridian), the previous pro temp, who lost in the Republican primary last summer.

The Senate will see more changes, starting at the top. Sec. of State Delbert Hosemann was elected lieutenant governor in the fall and he will soon occupy the office Gov.-elect Tate Reeves held for the previous eight years.

And Sen. Dean Kirby (R-Pearl), who has been in the senate for nearly three decades, has been tapped to serve as the president pro tempore of the Senate. Kirby is replacing Sen. Gray Tollison (R-Oxford), who decided not to run for re-election.

Because of the extended session, the legislative calendar is pretty empty for the first two months. The deadline for introducing general bills is not until February 24, with a March 10 deadline for committees to report on bills. But dates can be moved up.

There will be some new faces in Jackson, but Republicans will continue to enjoy large majorities in each chamber, with one race too be determined. Rep. Ashley Henley (R-Southaven) has filed an elections challenge in House District 40. She was defeated by Democrat Hester Jackson McCray by 13 votes, as of the last count. It will now be up to the House to determine the fate of that seat.

Along with the election challenge in the House, the next big move will be the appointments of committees by Gunn and Hosemann.

In this episode of Unlicensed, MCPP's Jon Pritchett sat down with National Review Institute scholar Andy McCarthy to talk about his book Ball of Collusion, impeachment, the Deep State, and more.

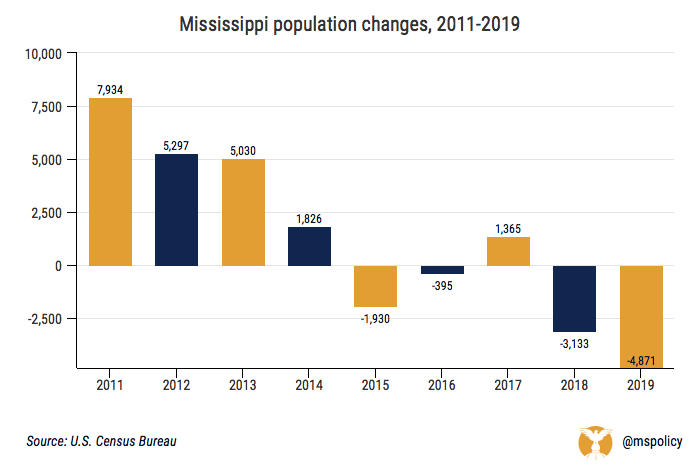

Mississippi suffered its fourth population decline over the past five years in 2019.

According to new estimates from the U.S. Census Bureau, the state’s population declined by 4,871, the sixth highest total in the country. Mississippi and neighboring Louisiana, which saw a decrease of 10,896 residents, are the only states in the south to lose population over the past year. This is a continuing trend.

But what’s happening in Mississippi is an outlier in the South, save for the Pelican State.

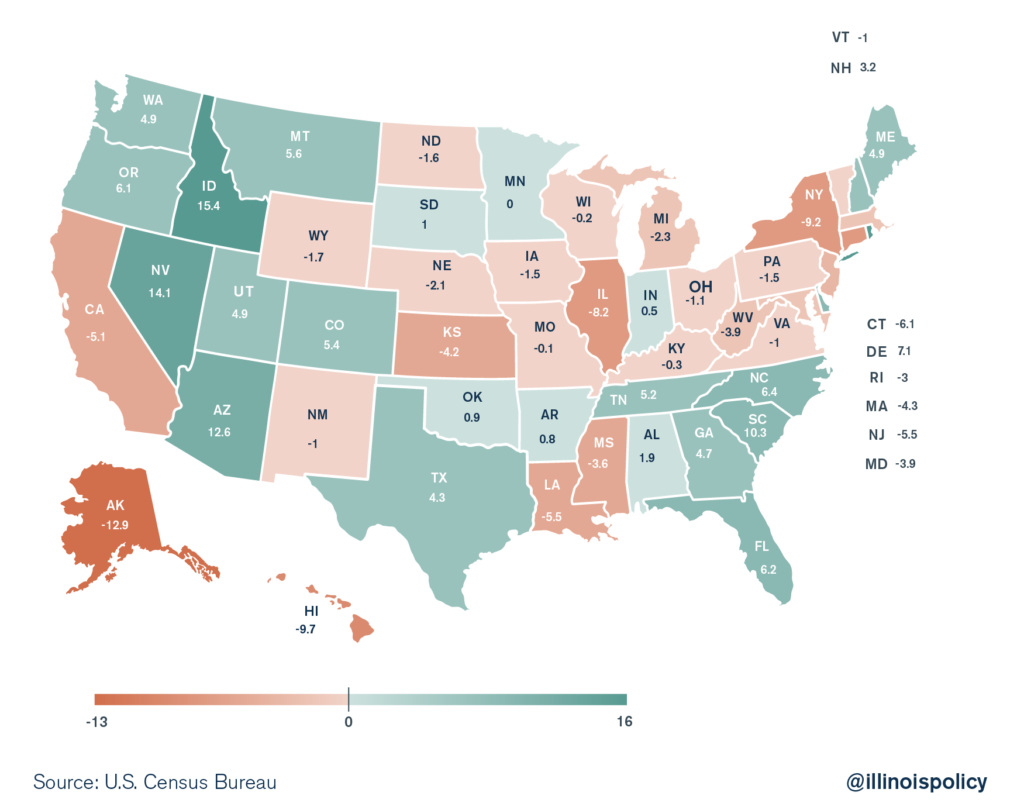

A look at the map of domestic migration, which measures where Americans are moving over the past year, shows a picture of the haves and the have-nots when it comes to population growth.

Large swaths of the Northeast and Midwest show a declining population, while the interior west, west coast (save for California), and the Southeast saw population gains. Substantial gains in some states.

Domestic migration growth rate in 2019

Mississippi had a negative domestic migration rate of 3.6, meaning for every 100 residents that moved to Mississippi last year, 103.6 left, according to analysis of Census numbers from the Illinois Policy Institute. Louisiana had a negative rate of 5.5. Every other southern state, south of Virginia, had positive numbers. Some smaller like 0.8 in Arkansas, some larger like 10.3 in South Carolina.

So people aren’t leaving the South, or running for liberal policy (see California, Illinois, and New York), they are just leaving Mississippi.

Mississippi over the past decade

While Mississippi’s population grew by about 20,000 during the first four years of this decade, there has been a sharp reversal dating back to 2015, save for a small positive uptick in 2017. The declines have been particularly noticeable over the past two years, losing more than 3,000 residents in 2018 and nearly 5,000 last year.

Mississippi’s population growth over the past decade was only 45th best. Even Louisiana, who has been on the negative side of things recently, had growth of about 2.5 percent last decade (compared to being slightly above zero in Mississippi).

Tennessee had the 17th highest growth in the country, while Alabama and Arkansas were middle of the pack.

Reversing the trend

We can look at Mississippi and say things like, “we don’t have any cool large cities today that people want to move to.” But honestly, were Salt Lake City or Raleigh or Nashville that cool 30 years ago? They certainly looked and performed much differently than they do today.

People moved to those places because of opportunity. And there are policies the state can adopt that would put Mississippi ahead of the curve when it comes to national policy and positioning the state to be competitive nationwide.

For starters, Mississippi needs to move away from a desire to overregulate commerce and embolden government bureaucrats. Mississippi has more than 117,000 regulations that cut across every sector of the economy. A successful model to stem this growing tide would be a one-in, two-out policy where for every new regulation that is adopted, two have to be removed. If a regulatory policy is so important, let’s make the government prove it.

The Trump administration adopted a similar executive order in 2017, and the numbers show we are actually seeing decreases greater than two-to-one, and these are not insignificant regulatory reductions.

This could be particularly beneficial in healthcare and tech policy. No department regulates more than the Department of Health, but our goal should be a push toward free market healthcare reforms that encourage choice and competition. In tech policy, the state has the opportunity to be one of the first states to essentially open the door for innovation, rather than one where entrepreneurs need to seek permission from the state. If Mississippi wants to get in the technology world, and we are convinced this is essential, a permissionless innovation policy in healthcare would be a big step in the right direction. In his recent article in the Mississippi Business Journal, Auditor Shad White pointed out the opportunity to focus on creating high margin businesses and jobs with a focus on healthcare tech innovation.

We should also not require people to receive permission from the state to work when they do move here. Open the door to productive citizens by allowing for universal recognition of licensing, following the path paved by Arizona. If you have been licensed in one state, that license should be good in Mississippi. Again, we could be ahead of the curve.

At the same time, our occupational licensing regime should be reviewed. Today, 19 percent of Mississippians need a license to work. It was 5 percent in the 1950s. While there are some occupations where a license is obviously prudent, we’ve expanded into far too many occupations.

This serves to lower competition and increase costs for consumers, while not providing those consumers with a better product. Occupational licensing is an example of how Mississippi misses the opportunity to grow her economy by acting in defensive ways to protect the slices of our economic pie for the well-connected when the reality is we could create a much bigger economic pie if we encouraged more creative disruption, competition, and risk-taking.

If Mississippi is to grow its economy, it will require not only keeping our best and brightest but also attracting others to come to the Magnolia State. Places like Tennessee, Georgia, and the Carolinas did not lose their Southern identities by encouraging newcomers. The economic engines in those states grow because of the quality of the entrepreneurs, capitalists, scientists, and productive people. Not that long ago, Charlotte and Meridian were exactly the same size. Economies are dynamic and once they get momentum, amazing things can happen. There is also the probability that a growing economy will have a “boomerang effect” – bringing back people born and educated here who left to pursue greater opportunities.

There’s no rule that Mississippi has to lose population. Alabama, with whom we share much in common, had a domestic migration growth of 1.9 last year. States like Tennessee, Georgia, and Florida may have done better, but we are not automatically immune to the success of our neighbors.

Finally, Mississippi needs to shed its abundant reliance on government and the public sector. Whether for public assistance, grants, contracts, jobs, or specific tax breaks, the citizens and companies in Mississippi are too dependent on state government. And the state is too dependent on the federal government. We have the third highest level of economic dependence on federal grants-in-aid in the nation (43%) and the fourth highest level of our economy driven by the public sector in the country (55%). Politicians, state agency directors, and government bureaucrats cannot create the economic growth we need. They can, however, work together with our various representatives and create an environment that allows and encourages private economic activities. Ultimately, with such an environment, it will be the entrepreneurs, business owners, productive workers, creative disruptors, capitalists, managers, and consumers who deliver the economic growth we all seek.

As the state auditor appropriately ended his article in the Mississippi Business Journal, the time to act is now.

A new tax credit designed to help children being raised in the state’s foster care system and passed this session has reached its cap for business donations, but individuals still have time to take advantage before the year ends.

The way the Children’s Promise Tax Credit works is businesses and individuals donate to eligible organizations that help children. Then they fill out a form and send it to the state’s Department of Revenue.

For businesses, the credit is a dollar for dollar up to 50 percent of its state tax liability.

Individual taxpayers can receive a dollar for dollar credit up to $1,000 of their liability. Those without a liability have five years to apply the credit before it expires.

House Bill 1613 passed nearly unopposed in the legislature this session and went in effect on July 1.

There is a $5 million cap for corporate donations that was reached soon after the credit went into effect. Individuals wanting to participate have a $3 million cap.

Sean Milner is the executive director of the Baptist Children’s Village, which receives 37 percent of its funding from individual donations, but none from state or federal funds. He said he’s had a hard time explaining the new tax to donors for an unusual reason.

“The law is so good that people are having a hard time understanding it. Not because it’s difficult to understand, but quite honestly it makes too much sense and people aren’t used to things coming out of the legislature that make this much sense,” Milner said. “The idea that you can give your money to someone who’s serving the state’s needs as opposed to having to pay taxes, that’s difficult for people to understand.”

According to the state Department of Revenue, $2,751,042.18 of the individual credit has yet to be allocated.

Milner says that the number of allocated credits doesn’t show how much of an impact the credit has had on his donors. He said that most of his donors, who are individuals giving between $25 and $100, aren’t itemizing and won’t be taking advantage of the credit’s advantages.

He said when his organization sent out a letter with directions on how to utilize the new credit to existing donors, the checks continued to flow in despite most not taking advantage of the program.

“Everybody is so generous in Mississippi. They give money and expect nothing in return,” Milner said. “They don’t report this or keep the receipt to put on their taxes for some kind of receipt. It’s a great law and it’s taking a little while for people to catch on.”

Erin Kate Goode is the executive director of the Jackson-based Center for Pregnancy Choices Metro Area. She said donations to her organization, which uses a licensed medical clinic to educate pregnant women about their choices including adoption and parenting, have been three times as much as the same time last year.

While she has a donor that is matching gifts during that time, she says the tax credit is definitely helping.

“The gifts have been a higher level than they were last year,” Goode said. “It (the credit) frees people up to give more.”

Milner said another advantage of the credit is that it creates a partnership between childcare agencies, the business community, and general public and that the benefits from that relationship has yet to be seen.

Bob Anderson is a CPC donor and a board member and says that he hopes that people don’t get lost in applying for the tax credit, which he says is not difficult.

“The pot of money for it (the tax credit) is largely there this year, but I think in the future, it’s going to go a lot quicker,” Anderson said. “This credit is a great way to direct money to these organizations that directly help children. A lot of government organizations have a lot of overhead, but the CPC and organizations like them are very streamlined, very efficient. I used to joke they could cut a nickel in half and make 20 cents out of it.

The DOR will accept applications from businesses starting January 1 by email for the credit for 2020.