Mississippi Justice Institute Director Aaron Rice has been named a recipient of the 2019 Buckley Award, given annually by America’s Future Foundation.

The Buckley Awards recognize “outstanding young professional conservatives for their above-and-beyond service to the conservative movement.” The award is in honor of William F. Buckley, who became a leader of the early conservative movement before the age of 30 by founding National Review in 1955 and hosting the public affairs television show, “Firing Line,” for 33 years. This is the only such award in the freedom movement that focuses on the achievements of liberty-minded young professionals.

“There is perhaps no honor greater for a young conservative than to receive an award in the name of William F. Buckley,” said Jon Pritchett, President and CEO of the Mississippi Center for Public Policy. “He inspired a generation of conservative intellectuals to fight boldly for foundational beliefs. That is exactly what Aaron has done since he joined the movement, but it’s also what he has done all of his life.”

Aaron received the award for recognition of his work in helping to defeat the renewal of administrative forfeiture in the legislature this year. Administrative forfeiture previously allowed agents of the state to take property valued under $20,000 and forfeit it by merely obtaining a warrant and providing the individual with a notice. In order to get the property back, an individual was required to file a petition in court within 30 days and incur legal fees in order to contest the forfeiture and recover such assets.

But due in large part to Aaron’s thought leadership through state and national op-eds, television, and radio, the renewal died without receiving a vote in committee.

“I am honored to be able to bring this award to the Mississippi Center for Public Policy, and its legal arm, the Mississippi Justice Institute,” said Rice. “Our work on administrative forfeiture was very much a team effort. I would not have been able to make any meaningful impact on my own. While I have the honor of receiving the Buckley Award, I consider it a team award to our entire organization, and the first we have been honored with. I could not be happier to be a part of that recognition for our great organization.”

“Aaron’s contributions to advancing the free society, to improving people’s lives and to working tirelessly against amazing odds in Mississippi has inspired all of us,” said Cindy Cerquitella, Executive Director of AFF. “Aaron’s work to secure the private property rights of Mississippi citizens, against the desire of so many in power is a true testament to his patriotism and commitment to the values of a free society.”

This is the first time the award has been presented to a state-based think tank that focuses exclusively on one state. Previous winners include Christina Sandefur of Goldwater Institute, Rob Bluey of Heritage Foundation, Mollie Hemingway of The Federalist, and Jim Geraghty of National Review.

Read Aaron’s full interview with America’s Future Foundation here– including more about his work in the conservative movement and some fun facts about his life.

A coalition of conservative state and national organizations, led by Mississippi Center for Public Policy, recently sent a letter to Gov. Phil Bryant in support of the Fresh Start Act.

The Fresh Start Act, Senate Bill 2871, will make it easier for ex-offenders to receive occupational licenses and earn a living.

"Employment is a vital part of reintegrating ex-offenders into their families and communities. Work is the key to staying out of prison and off of welfare. Work is an essential part of the 'success sequence' that is the pathway to prosperity in America. Studies show work reduces recidivism," the letter writes.

Under the proposed legislation, licensing authorities would no longer be able to use vague terms like “moral turpitude” or “good character” to deny a license.

Rather, they must use a “clear and convincing standard of proof” in determining whether a criminal conviction is cause to be denied a license. This includes nature and seriousness of the crime, passage of time since the conviction, relationship of the crime to the responsibilities of the occupation, and evidence of rehabilitation on the part of the individual.

An individual may request a determination from the licensing authority on whether their criminal record will be disqualifying. If an individual is denied, the board must state the grounds and reasons for the denial. The individual would then have the right to a hearing to challenge the decision, with the burden of proof on the licensing authority.

"This bill provides a unique opportunity to bring a message of hope to the thousands of Mississippians released from prison each year. Their hope is that it’s not too latefor them. Their hope is that they, too, can share in the American dream. Thanks to the leadership of Lt. Governor Tate Reeves, Speaker Philip Gunn, Senator John Polk and Rep. Mark Baker, this legislation would create a 'Fresh Start' for these ex- offenders."

The letter was signed by Mississippi Center for Public Policy, Americans for Tax Reform, American Conservative Union, Americans for Prosperity- Mississippi, Right on Crime, Empower Mississippi, and Foundation for Government Accountability.

Read the full letter here.

Private citizens should not be subjected to government harassment for supporting causes they believe in, and charities should not have to worry about their funding drying up because donors fear reprisals.

Yet many policy pundits on the left, and even a few on the right, have been doing all they can to convince lawmakers across the country that the government has a compelling interest in knowing to whom you give your after-tax money. In using popular language such as “dark money” and “transparency,” the Left really means that it wants to know who funds its opposition, so it can bring pressure to bear and suppress its opponents’ speech with coercion and threats.

It’s no surprise that in blue states, including California, New York, Delaware, and New Mexico, the government is compelling 501(c) charities to disclose information about their donors. In recent years, some red states, too, including South Dakota, Utah, Alabama, and South Carolina, have also proposed legislation or regulation that would strip away donor privacy for charitable organizations, in the name of good government.

While transparency is what citizens require of their government, privacy is the constitutional right afforded to citizens. Conflating public requirements and private rights is clever but disingenuous. We should not allow proponents, from the Left or the Right, to get away with such sophistry.

In the Federalist Papers, a collection of 85 essays promoting the adoption of the United States Constitution, written by Alexander Hamilton, James Madison, and John Jay in 1787–88, the three founders used the pseudonym “Publius.” They did so because to advocate for something as radical and controversial as that revolutionary document was dangerous. Not everyone in power in 18th-century America agreed with these ideas.

The same was true of the supporters of the NAACP in the 1950s, when it was advocating for equal rights for every American. During those tumultuous times, many people of public influence and power were demanding to know the names of members or supporters of the NAACP. In NAACP v. Alabama (1958), Justice John Harlan II outlined the practical effects of compelling organizations to disclose their donor lists: It exposed them to “economic reprisals, loss of employment, threat of physical coercion, and other manifestations of physical hostilities.”

Now imagine a person today who loses his job when his climate-zealot boss finds out that he gives money to a charity that opposes the Green New Deal. Or imagine the symphony director in a major city who is publicly shamed and harassed because he dared give to a charity that supports requiring people to use the public restroom that corresponds with their biological sex. Or how about an actual case in California, where the director of the Los Angeles Film Festival was forced to resign because he supported Proposition 8, the controversial rejection of same-sex marriage. California has been a proponent of forced disclosure of donor information for years, claiming that the information would be safe in the state’s hands. Yet Kamala Harris, the former California attorney general and now a U.S. senator and presidential hopeful, “inadvertently” allowed the names of donors to roughly 1,700 non-profits to be posted on a government website.

Nadine Strossen, a New York University law professor and former president of the American Civil Liberties Union, is a strong advocate of donor privacy. “Individuals should be able to join and support organizations without having their names and other private information disclosed,” she argues. “These rights remain essential today for the ongoing advocacy of civil-society groups across the ideological spectrum.

Mississippi, where I live and work, has now become the second state, joining Arizona, to protect the privacy of non-profit donors. Governor Phil Bryant signed House Bill 1205 into law at the close of the legislative session last month. The bill codifies a long-standing practice of barring the government from demanding or releasing publicly the personal information of donors to 501(c) non-profits. At a time when partisanship seems to reign, the publication of personal information can expose citizens to intimidation and harassment from those who want to shut down speech with which they disagree. Fortunately, two states — and may others follow — have taken steps to ensure the fundamental American right of donor privacy.

“In recent years, charitable donations have been weaponized by certain groups against individuals to punish donors whose political beliefs differ from their own,” Governor Bryant said at the signing of the bill. “I was pleased to sign HB 1205, which protects free-speech rights of Mississippians who make charitable donations.” Let’s hope more governors and state legislatures follow suit.

This column appeared in National Review on April 9, 2019.

House Speaker Philip Gunn said Monday that the best accomplishments of the legislature this session included criminal justice reform, rural broadband, and human trafficking legislation.

He also doesn’t favor expanding Medicaid and also mentioned that the next legislature will have a tough task ahead when it redraws the state’s legislative districts after the 2020 U.S. Census.

Gunn made the remarks at the Stennis Capitol Press Forum about the session, which ended March 29.

Louisiana and Arkansas have expanded Medicaid for able-bodied adults under the Affordable Care Act, but Gunn said that such a decision should be left to the next legislature.

“I think under the current leadership, you’re not going to see any appetite for that,” Gunn said. “The big concern is the unknown. Once you give a benefit, you can’t take it back. The federal government can tomorrow, they withdraw their support and they can change the rules. More than that, I don’t think there is any appetite for that in the state.

“Until the taxpayers rise up and say we want this, there is not going to be an appetite for this.”

One example that wasn’t cited by Gunn was Louisiana. The Pelican State expanded Medicaid in 2016 under Gov. John Bel Edwards, a Democrat. Projections by Edwards’ administration said that 306,000 new people would enroll.

This year, those numbers have climbed to 505,503, an increase of 65.2 percent.

Gunn said he was pleased that the legislature was able to pass another criminal justice reform package. The new law passed this year has several important components, including allowing the expungement of non-violent felonies, expanding the definition of intervention courts, screening for mental health for offenders to keep them out of the criminal justice system, and ending the practice of suspending driver’s licenses for the non-payment of fines or non-appearance in court.

Gunn said that the broadband bill, which allows rural electric power associations, also known as co-ops, to offer this service to customers was designed to not favor either the EPAs or established service providers such as Comcast, CSpire, and AT&T.

He said one other debate was whether to allow the EPAs, which are non-profits with tax advantages, to be able to compete against established providers with no tax advantages in profitable service areas, such as suburbs. The law requires EPAs to only be able to provide broadband service within their certificated area.

He cited the pole attachment fee — which a broadband provider or telephone company pays to a utility to attach their lines to their power poles — as one way the law didn’t favor one side or the other. In the new law, EPAs are required to charge the same pole attachment fee for either their broadband affiliate or an outside operator.

Gunn said the human trafficking legislation was designed to run the practice out of the state and he said the next step is to help victims get back on the right path.

The new law, which was signed by Gov. Phil Bryant, increases the definition for prostitution to age 18 and adds training for EMTs, firefighters, and others. He said this change to the prostitution law is to ensure that those ensnared in a ring can seek help from law enforcement without worrying about prosecution.

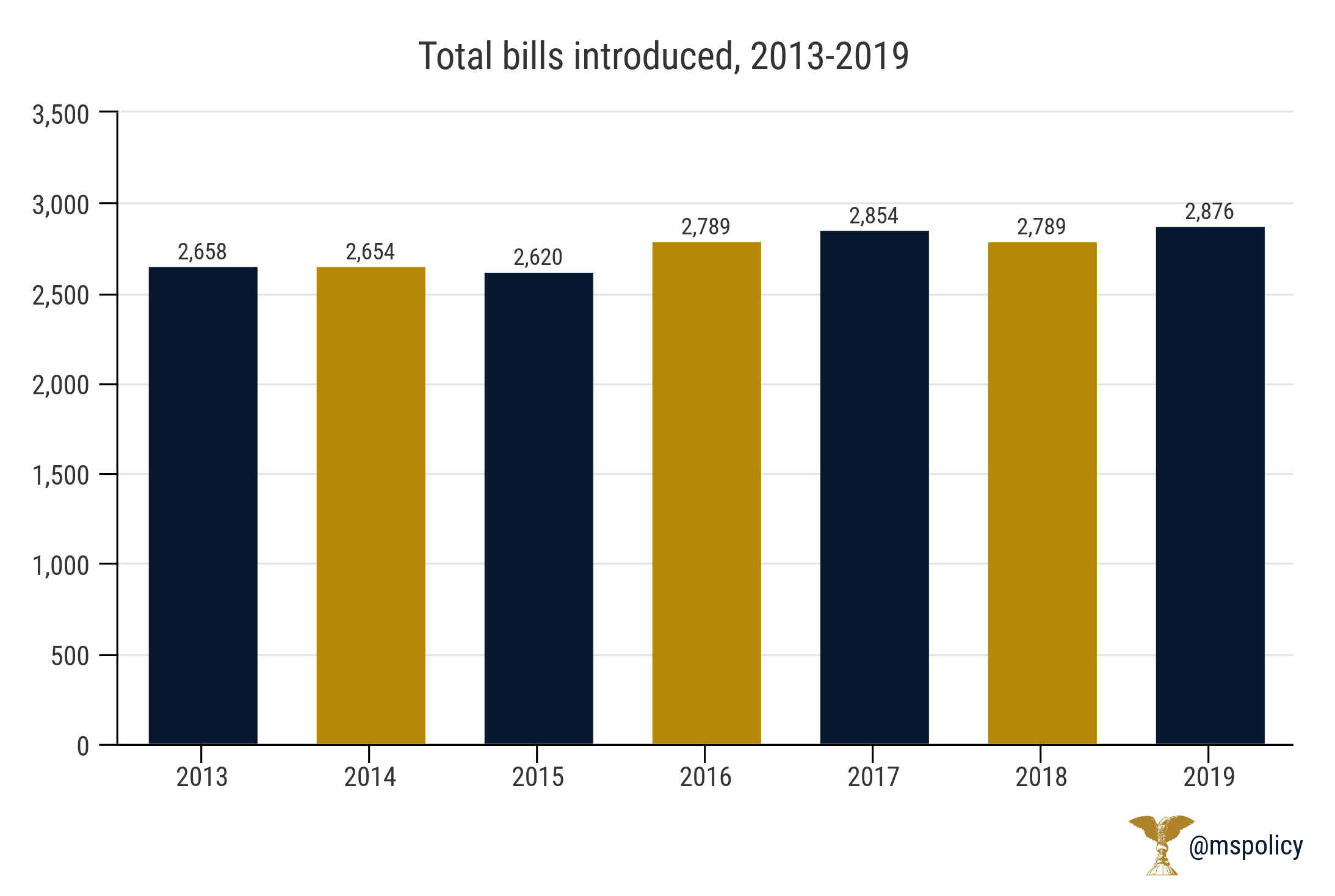

The Mississippi legislature wrapped up the 2019 session last week a few days early, but still managed to pass 366 out of the 2,876 bills that were introduced.

Some of the bills advanced the cause of economic freedom and personal liberty. Some didn’t.

Here’s everything of interest that was submitted this year, some that passed and others that died in the process:

Good bills that passed

House Bill 1205 will prohibit state agencies from requesting or releasing donor information on charitable groups organized under section 501 of federal tax law. The bill, sponsored by state Rep. Jerry Turner (R-Baldwyn), was amended in the Senate to include all organizations covered section 501 of federal tax law. The governor signed the bill on March 28.

HB 1352 is sponsored by state Rep. Jason White (R-West) and is known as the Criminal Justice Reform Act. The bill will clear obstacles for the formerly incarcerated to find work, prevents driver’s license suspensions for controlled substance violations and unpaid legal fees and fines and updates drug court laws to allow for additional types of what are known as problem solving courts.

The bill went to conference on March 27 and the two chambers voted to adopt the conference report the next day. The bill only awaits the governor’s signature to become law.

SB 2781, known as Mississippi Fresh Start Act, is sponsored by state Sen. John Polk (R-Hattiesburg). This bill will eliminate the practice of “good character” or “moral turpitude” clauses from occupational licensing regulations, which prohibit ex-felons from receiving an occupational license and starting a new post-incarceration career.

The bill died for a time in the Senate on March 28, when the first conference report was rejected by the Senate. However, a motion to reconsider kept the bill alive and it was recommitted for further conference. The resulting second compromise was accepted by both chambers on the session’s final day and now the bill awaits Bryant’s signature.

SB 2901, known as the Landowner Protection Act, will exempt property owners and their employees from civil liability if a third party injures someone else on their property.

The bill is sponsored by state Sen. Josh Harkins (R-Flowood). The versionsigned by the governor on March 29 allows civil litigation against property owners due to negligence based on the condition of the property or activities on the property where an injury took place. This was a major point of contention during debate over the bill.

HB 1613, also known as the Children’s Promise Act would allow an income tax for voluntary cash contributions by businesses to eligible charitable organizations that help children. The credit would increase the cap on individual tax credits from $1 million to $3 million.

The bill awaits the governor’s signature.

Senate Concurrent Resolution 596 makes Mississippi the 15th state to call for a Convention of the States authorized under Article V of the U.S. Constitution. The resolution was approved by the Senate and passed the House on March 27. Since it’s a resolution and not a bill, it doesn’t require the governor’s signature.

For a Convention of the States to occur, 34 state legislatures would have to pass similar resolutions.

The good bills that died too young

HB 1268 would’ve clarified state law regarding constitutional challenges to local ordinances. With local circuit courts acting as both the appellate body for appeals on specific decisions (such as bid disputes) and the court of original jurisdiction, there’s been confusion among judges regarding the law that governs challenges of local decisions, which are required within 10 days.

City and county attorneys have used this 10-day requirement on decisions to get new constitutional challenges — which are new lawsuits and not appeals — thrown out of circuit courts. This law would’ve added language that would prevent application of the 10-day requirement to constitutional challenges.

The bill was sponsored by state Rep. Dana Criswell (R-Southaven) and passed the House by a 116-2 margin. It was passed out of the Senate Judiciary A Committee, but never made it to the Senate floor for a vote and died on the calendar.

SB 2693 would’ve pre-empted local regulation of short-term vacation rentals, such as Airbnb, and was sponsored by state Sen. Angela Burks Hill (R-Picayune). It died in committee.

HB 85 would’ve required a warrant for law enforcement agencies to use cell site simulator devices except to prevent loss of life or injury. It was authored by state Rep. Steve Hopkins (R-Southaven) and died in committee without a vote for the third consecutive year.

SB 2675 would’ve reauthorized the Education Scholarship Account program until 2024 and was sponsored by retiring state Sen. Gray Tollison (R-Oxford). The bill passed the Senate on a party-line vote, but died in the House Education Committee on deadline without a vote.

Now the program will have to be reauthorized in the next session or face extinction as the authorizing law expires on July 1, 2020.

HB 702 would’ve allowed cottage food operators to increase their maximum sales to $35,000 and advertise their products on the web. It passed the House with ease, but died in the Senate without any committee consideration.

Direct wine sales– The Mississippi legislature still refuses to allow residents to buy wine at either a grocery store (allowed in most states such as neighbors Alabama and Louisiana) or receive direct shipments at home. With the death of SB 2183 and HB 708 early in the session, we’ll have to wait until 2020’s session to possibly get a change in this regulatory hurdle. Both died without committee consideration.

Charitable health care– One would think in a poor, rural state as short of physicians as Mississippi, legislators would want to allow out-of-state, licensed healthcare providers such as physicians, nurses, optometrists and dentists to practice for a non-profit in Mississippi on a charitable basis.

Nope. Both HB 1491 and SB 2248 died in committee without a peep thanks to the lobbying power of the state’s medical establishment.

No Tim Tebows in Mississippi– Another year and the legislature still won’t allow home-schooled students to participate in extracurricular activities, such as athletics, in their respective school districts. HB 118 and SB 2912 died without a committee vote.

Thankfully dead

HB 1104 would’ve reenacted the controversial practice of administrative forfeiture. Last year, the legislature allowed the expiration of the law that authorized administrative forfeiture — which gave law enforcement agencies the ability to seize property valued at less than $20,000 with only a notice to the property owner.

The bill died in committee when support waned among lawmakers for bringing back the practice.

SB 2542, authored by state Sen. Brice Wiggins (R-Pascagoula), would’ve appropriated $4,696,500 toward bringing Amtrak service to the Mississippi Gulf Coast that was ended when Hurricane Katrina made landfall in August 2005. The bill never made it out of committee.

HB 1573 and SB 2563 were cigarette tax increases which were sponsored by state Rep. Jeff Smith (R-Columbus) and state Sen. Wiggins respectively. HB 1573 would’ve increased the tax on a pack of cigarettes to $1.68, while SB 2563 would’ve hiked the per-pack levy to $2.18. Neither bill made it out of committee.

Ugly bills that passed

HB 1612 will authorize municipalities to create special improvement assessment districts that will be authorized to levy up to 6 mills of property tax (the amount per $1,000 of assessed value of the property) to fund parks, sidewalks, streets, planting, lighting, fountains, security enhancements and even private security services. The tax will require the approval of 60 percent of property owners in the district.

The bill is sponsored by state Rep. Mark Baker (R-Brandon). The Senate amended the bill so it only applies to Jackson (cities with a population of 150,000 or more) and Bryant signed the bill on March 29.

SB 2603 will reauthorize motion picture and television production incentives for non-resident employees that expired in 2017. The bill, as originally written, capped incentives to out-of-state production companies at $10 million. This was reduced in conference to $5 million and it was signed by the governor on March 28.

HB 1283 is better known as the “Mississippi School Safety Act of 2019.” Controversially, it will require school districts to develop and conduct an active shooter drill within the first 60 days of the start of each semester.

It would also establish a monitoring center connected with federal data systems with three regional analysts monitoring social media for threats.

The bill would also create a pilot program for six school districts with a curriculum for children in kindergarten through fifth grade with “skills for managing stress and anxiety.” The pilot plan would be federally funded.

The governor signed the bill on March 29.

House Bill 366 allowed the state’s rural, non-profit electric power associations to start broadband networks. The bill zipped through the legislative process with uncanny speed, going from the House Public Utilities Committee to governor’s signature in 16 days.

Since the EPAs will require some sort of capital — likely sourced through grants or loans from the federal government — to start up broadband networks, the bill went into effect after Bryant signed it on January 30.

There was also a failed bill that would’ve provided state taxpayer funds to help start up these service providers, which will have to be managed separately from the EPA’s electric services. With startup cash likely in short supply from the free market, expect the EPAs to descend on the state Capitol, hat in hand, next January asking for grants and loans to serve rural customers.

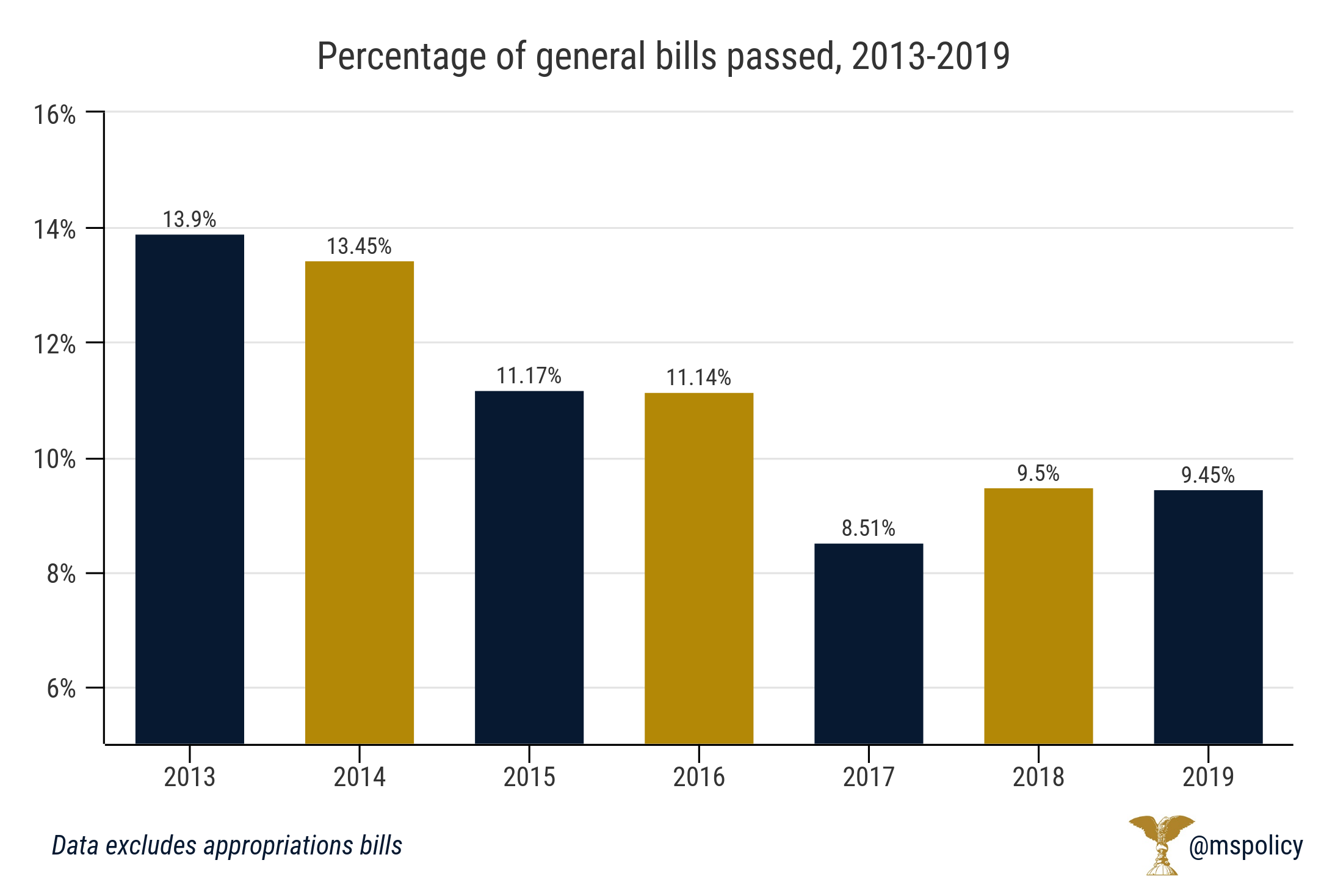

Mississippi legislators drafted plenty of bills this year, but very few became law.

Despite the largest number of total bills presented in the last six years, the percentage of them that became law (12.66 percent) was the second lowest in the same span.

There were 2,876 bills — 127 more than the six-year average of 2,749 — that were drafted in this year’s session, which ended Friday. With 104 of them being appropriations bills — which fund state agencies and make up the budget — that left 2,772 general bills.

Only 260 general bills were passed by both chambers in the legislature and either have been signed or are awaiting the signature of Gov. Phil Bryant. That’s a rate of 9.45 percent for those keeping score at home.

Most bills signed into law by Bryant will go into effect on July 1, the first day of the new fiscal year.

The average in the last six years has been 11.01 percent for general bills and 14.38 percent for all bills.

Comparing the session with last year, 9.5 percent of all general bills and 12.87 percent of all bills in that session became law.

While the number of bills dropped has gone up in the last four years, the number that survive the process in the legislature to make it to the governor’s desk has shrunk every years since 2016.

The highest percentage session was 2013, when 17.27 of all bills and 13.9 percent of all general bills became law. That session had 2,658 total bills and 2,554 general ones.

The chances that this year’s bills passed by the legislature are signed by the governor are good. This session, Bryant vetoed only three out of 366 bills after averaging four vetoes per session the last three years.

Here are the bills Bryant vetoed in this year’s session:

- Senate Bill 2669 would’ve extended the repeal date on the Mississippi Development Authority’s Local Governments Capital Improvements Revolving Loan Fund. His veto message said another bill he signed, House Bill 713, reauthorized the program, thus eliminating the need for SB 2669.

- HB 576 would’ve allowed the State Superintendent of Education to send a representative in their stead to the State and School Employees Health Insurance Management Board. The governor said in his veto message that it would create an undesirable situation and precedent regarding the composition of the board.

- HB 666 would’ve increased the minimum age for the commitment of youthful offenders to the state training school from age 10 to age 12. Bryant’s veto message said the bill would prevent Youth Court judges from placing violent offenders ages 10 and 11 in either the state school or secured detention.

| Session year | Total bills | Appropriations | General | All bills passed by both chambers | General bills passed by both chambers | % of total bills passed | % of general bills passed |

| 2019 | 2,876 | 104 | 2,772 | 366 | 262 | 12.73% | 9.45% |

| 2018 | 2,789 | 104 | 2,685 | 359 | 255 | 12.87% | 9.50% |

| 2017 | 2,854 | 104 | 2,750 | 338 | 234 | 11.84% | 8.51% |

| 2016 | 2,789 | 104 | 2,685 | 403 | 299 | 14.45% | 11.14% |

| 2015 | 2,620 | 104 | 2,516 | 385 | 281 | 14.69% | 11.17% |

| 2014 | 2,654 | 104 | 2,550 | 447 | 343 | 16.84% | 13.45% |

| 2013 | 2,658 | 104 | 2,554 | 459 | 355 | 17.27% | 13.90% |

| Averages | 2,749 | 2,645 | 394 | 290 | 14.39% | 11.02% |

Mississippi Center for Public Policy commends Gov. Phil Bryant for signing legislation that will protect and ensure the privacy of individuals who donate to charitable causes in Mississippi.

“We are very proud that Gov. Bryant has signed into law a piece of legislation that reinforces the American tradition of anonymous speech and the freedom of association to which citizens are entitled,” said Jon Pritchett, President and CEO of Mississippi Center for Public Policy. “Many on the left oppose this bill because they want to know who funds their opposition so they can bring pressure to bear on them and suppress their speech with coercion and harassment. Mississippi has now proudly defended the rights of citizens to support causes about which they care deeply.”

House Bill 1205, authored by Rep. Jerry Turner (R-Baldwyn) and championed by Rep. Mark Baker (R-Brandon), allows a nonprofit to defend itself in court if its confidential donor list is leaked by a rouge government agency or bureaucrat.

“The enemies of free speech and free association are making our political environment toxic by seeking to silence and intimidate anyone who disagrees with them,” said Jameson Taylor, Vice President for Policy for MCPP. “That is why this legislation is so essential and we thank Lt. Governor Reeves and Speaker Gunn for their work to get this important bill to the Governor’s desk.”

Protecting the privacy of those who donate to nonprofits is widely popular across the state with 81 percent of voters, including 91 percent of Republicans, 79 percent of independents, and 69 percent of Democrats, saying they support a law that protects the personal information of such donors.

Additionally, the polling revealed that 76 percent of Mississippi voters said they would be less likely to give to a charity if they knew their personal information, including the amount of their contribution, would be posted on a government website.

This would have an especially chilling effect in a state like Mississippi, which has a long history of charitable giving.

See statewide polling results here.

Recent polling shows donor privacy legislation is widely popular with every demographic of Mississippi voter.

House Bill 1205 would protect donor privacy by allowing a nonprofit to defend itself in state court if its donor list is leaked by a rogue government bureaucrat. Eighty-one percent of voters said they would support legislation protecting the personal information of those who donate to charitable causes. Only 11 percent said they would be opposed.

Even more telling, 76 percent of Mississippi voters said they would be LESS likely to give to a charity if they knew their personal information, including the amount of their contribution, would be posted on a government website.

“Without the protections HB 1205 puts into place, charitable giving all across Mississippi will decline. This would be a tragedy because Mississippi has long been recognized as one of the most charitable states in the country,” said Dr. Jameson Taylor, Vice President for Policy with the Mississippi Center for Public Policy. “Mississippi’s donor privacy legislation will make sure charitable gifts in Mississippi go toward their real purpose, instead of being used on expensive legal fees that arise when a nonprofit has to defend itself from government bullying.”

“Many donors prefer to keep their giving out of the spotlight because they fear consumer boycotts, retaliation by public officials, or even threats to their safety as a result of having their personal support for causes made public,” Jon Pritchett, President and CEO of Mississippi Center for Public Policy said. “Transparency and public disclosure are requirements on our government; privacy and confidentiality are rights of the citizens. We must protect those fundamental rights and not be misled by groups who falsely but loudly claim something different.”

“Mississippi’s donor privacy legislation changes nothing pertaining to Mississippi campaign finance law,” concluded Dr. Taylor. “It changes nothing pertaining to political action committees (PACs). And it does not, and cannot, change anything pertaining to federal donor disclosure or nonprofit requirements.”

See statewide polling results here.

Wait times at the DMV have become a discussion topic over the past several months as it has been known to take several hours to get your driver’s license at some locations. Naturally, the immediate reaction is that we need to increase the size of the staff and/ or increase their pay.

But we can modernize the process of obtaining or renewing your driver’s license thanks to technology. But that will require innovation. And likely privatization.

There once was a time when the process of renting a movie consisted of going to a video rental store, selecting the video you’d like, and bringing the empty box to the cashier who would then give you your selection. Depending on the time of day, a store may or may not have been open, and, if it was, you may or may not have had to wait in line. If it was a Friday night, you probably did.

Then innovation happened. As it always does in the private sector. Netflix, in its original form, delivered movies to your home and Redbox set up self-service kiosks outside of various businesses throughout the country. Before long, Blockbuster was gone and the once thriving, store-based video rental business is a thing of the past.

Which brings us to the Department of Motor Vehicles and the process of getting a driver’s license in the state of Mississippi.

There has been a great deal of attention to the long wait lines at DMVs in the metro Jackson area and elsewhere. Department of Public Safety Commissioner Marshall Fisher was questioned about this at a hearing in January. Higher pay for examiners was brought up, as were appointment systems. But that just skims over the larger issue.

DMVs need to be brought into the 21st century, but there is little vision to make that happen.

We have a limited number of kiosks inside the DMV and you can renew your license online if your address has not changed. That needs to be expanded. And that also presumes the kiosk is working.

Instead of a kiosk that is limited and only open when the DMV is open, we can put Redbox style kiosks outside of city halls or county courthouses, based on demand. They would be accessible 24 hours a day and could serve a variety of functions.

Renewing your license with no changes is easy, but we can do much more today. These kiosks have technology to read documents containing your new address. If you moved from out of state, they can quickly confirm your current license from that state. If your license is suspended or you owe back fees, the kiosk will recognize that. If you are getting a license for the first time, they will be able to serve you. You could even take your exam at the kiosk. They can take pictures. They can do vision exams. They can accept cash, checks, or credit cards.

We would just need a limited number of examiners to respond to the times the computers couldn’t read an address, or a similar incident.

Simply because the government is failing to do something efficiently does not mean we should enlarge the government. And hope they do it better. Because this is a problem at DMVs across the country, whether you’re in Mississippi or states where government employees make significantly more.

There is no incentive or motivation to innovate. All of these ideas are closer than we may think, or expect. And for the person who has to take a day off from work to get a new license, they sound pretty good.