Thanks to the introduction of sports gambling, Mississippi gaming tax revenues are up 5.762 percent over the same period last year.

During fiscal year 2019, which ends July 1, the Mississippi Department of Revenue has transferred more than $88 million into the general fund, an increase of more than $6.4 million over the same time last year.

Total gaming tax collections, which include contributions to local governments and a fund for improvements to roads and bridges, totaled more than $169 million from July to February. That’s an increase of more than $9.2 million from last year’s numbers.

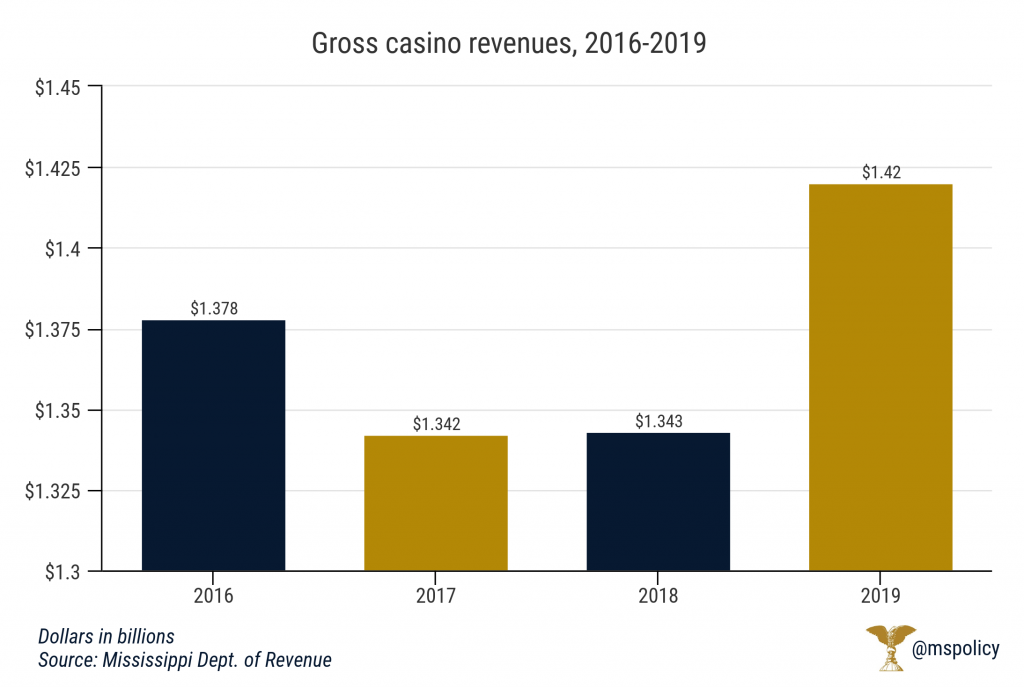

In the past four years, gross revenues for the state’s casinos have been largely flat until this year, with revenues up by more than $76 million to more than $1.42 billion. This amounts to 5.71 percent growth over the same time frame last year. That’s a $42 million increase from fiscal 2016, when the state’s casinos earned more than $1.378 million.

Only five of the state’s 28 casinos located in the central and northern parts of the state aren’t offering sports gambling. The first sports book operations in the state began taking bets in July.

If Nevada’s revenues from sports gambling are any guide, this windfall could continue to grow since Mississippi is the only state in the South with legalized sports gambling. The Louisiana Legislature might consider adding sports gambling to its casinos in its session, which starts April 8.

Nevada’s data shows that revenue from 2009 from sports pools added up to more than $118 million. In 2018, that figure grew to more than $253 million, an increase of 114.25 percent.

Mississippi, like five other states, got into the sports gaming business thanks to a 2018 U.S. Supreme Court decision, Murphy vs. National Collegiate Athletic Association, which struck down a federal law known as the 1992 Professional and Amateur Sports Protection Act.

This law allowed only Nevada casinos to host sports gambling.

In 2016, Mississippi temporarily legalized daily fantasy sports and created a study commission. The Legislature approved permanent legislation in 2017 that not only set guidelines for the Gaming Commission to regulate daily fantasy sports, but also struck language from state law that prohibited betting on sports in anticipation of a decision in the NCAA case.

Unlike Nevada — where players can set up an account at a casino and place wagers anywhere in the state from computers and mobile devices — Mississippi regulations require that all sports betting take place in a licensed casino and on mobile devices inside the casino property.

I was troubled to read Bill Crawford’s recent op-ed about “dark money.” It’s not honest, it’s not fair, and it’s not transparent. Bill Crawford is lying about House Bill 1205.

HB 1205 does one very simple thing: it allows a nonprofit whose donor list has been leaked by a rogue government official defend itself in state court. The bill changes nothing pertaining to nonprofit donor disclosure or transparency already required by the Secretary of State (lines 17-19). The bill changes nothing pertaining to federal donor disclosure or transparency. (Pro Tip: State law can’t override federal law or federal regulation, including IRS rules.) The bill changes nothing pertaining to Mississippi campaign finance law (lines 73-75). The bill changes nothing pertaining to a political action committee (PAC). None of these things are touched by HB 1205, and anyone who says or implies otherwise is lying.

Crawford’s first big lie is that HB 1205 is about protecting dark money. Crawford doesn’t define dark money, he just asserts that the U.S. Supreme Court allows “501(c)(4) ‘social welfare’ corporations to become fronts for dark money.”

A (c)(4) is a nonprofit organization. According to the IRS, there are 29 different types of nonprofit organizations, ranging from (c)(1)s to (c)(29)s. Are all of these nonprofits fronts for dark money? Crawford knows that if he told you your local food pantry was a front for dark money you might not believe him. So, he lies again. He claims that HB 1205 “would prohibit public agencies from requesting donor identities from 501(c)(4) organizations.”

But HB 1205 does not single out (c)(4s) for protection any more than it singles out (c)(3)s or (c)(5)s or (c)(8s) or (c)(11)s. A (c)(5), by the way, is a labor organization. Is Crawford claiming labor unions are fronts for “dark money”? A (c)(8) is a fraternal association. Is Crawford claiming the Masons are a front for “dark money”? A (c)(11) is a teacher’s retirement fund association. Is that a front for “dark money”? The options are endless for a mind wishing to see conspiracy everywhere.

Bill Crawford’s other big lie is his manipulative attempt to tarnish Gov. Phil Bryant’s reputation as a “longtime champion of transparency and accountability.” This praise seems a longtime in coming, but Crawford is correct that the governor, as well as Secretary of State Delbert Hosemann, have been great advocates for transparency. What he fails to acknowledge is that the opponents of HB 1205 are seeking to weaponize transparency – and thus undermine it altogether.

Let’s think through this new kind of transparency Bill Crawford is proposing. It’s not government transparency. It’s a kind of transparency akin to forcing Jews to wear a yellow star. This kind of transparency was used by the state of Alabama in the 1950s to try to force the NAACP to release its membership list. This is not government transparency, it is government targeting. This kind of “transparency” always begins with a big lie and a will to mislead.

Real government transparency looks like the quiet work MCPP has been doing for years. No organization has done more to promote transparency in Mississippi. We were the first to post legislative votes online, leading the legislature to begin doing so. We were the first to post video recordings of the state legislative session. We were the first to post the state budget online. We have also spent thousands of hours and dollars creating the seethespending.org website. For our efforts, we won the 2012 Champion of Good Government Award, presented at an annual meeting of the Mississippi Press Association. Another site we created, seetheschoolspending.org, contains school district spending and rankings covering more than 20 years.

Yet, you’ll find no bigger advocate of donor privacy than MCPP. You see, I believe that while the government has an obligation to open up its checkbook to taxpayers, taxpayers shouldn’t be forced to post their checkbooks or credit card statements online for everyone (including employers and employees) to see. But that’s basically what the leftist conspiracy theorists want to do: permanently post donor information, including the amount of any contribution to any nonprofit, on a government website.

I trust Gov. Bryant is going to set the record straight by signing HB 1205 and protecting the right of every individual to support the causes they believe in without fear of discrimination and retaliation. In doing so, he’ll be affirming that Mississippi is still a place – unlike California or New York or Washington State – where we understand the difference between transparency and targeting.

This column appeared in the Mississippi Business Journal on March 26, 2019.

A bill that would protect the personal privacy of individuals who donate to nonprofit charities awaits the signature of Gov. Phil Bryant this week.

Authored by Rep. Jerry Turner and championed by Rep. Mark Baker, HB 1205 allows a nonprofit organization to defend itself in court if a rogue government agency or employee releases the nonprofit’s confidential donor lists.

“The enemies of free speech and free association are making our political environment toxic by seeking to silence and intimidate anyone who disagrees with them,” said Dr. Jameson Taylor, vice president for policy with MCPP. “In Montana, the governor is going after businesses who donate to trade associations like the U.S. Chamber of Commerce. In California, then-AG Kamala Harris made it a priority to obtain the donor lists of conservative groups like Americans for Prosperity. At the federal level, Nancy Pelosi and the Democrat-majority House have passed H.R. 1, which would destroy donor privacy and politicize the federal contracting process.

“Unfortunately, these tactics are not new. They were used by government officials in the 1950s in an effort to destroy the NAACP. They are being used today to bully and harass donors who give to nonprofit organizations.”

Statewide polling shows 81 percent of Mississippi voters support legislation that would protect the personal information of individuals who donate to the causes and charities of their choice. HB 1205 would do that by making it a crime for the government to release the personal information of any person who gives to an entity organized under Section 501(c) of the Internal Revenue Code.

The tax code recognizes 29 different “c” groups, all of which are nonprofits. These include: charitable nonprofits, like churches and domestic violence shelters; trade and agricultural associations; labor unions; and veterans’ groups.

“The people of Mississippi support donor privacy because we realize, perhaps more than most, how necessary it is to protect the right of everyone, regardless of race, creed or political affiliation, to support the causes they individually believe in without fear of discrimination and retaliation,” said Dr. Taylor.

See statewide polling results here.

The Mississippi legislature’s session is winding down, with only a few bills left on the calendars for both chambers.

The next deadline for general legislation is March 28, the final day to concur on amendments from the other chamber on general bills.

Here is what’s happening with some of the more interesting bills at this point in the session:

Still alive

Senate Concurrent Resolution 596 would make Mississippi the 15th state to call for a Convention of the States authorized under Article V of the U.S. Constitution. The measure passed the Senate Thursday and will be headed to the House, where passage is likely.

For a Convention of the States to occur, 34 state legislatures would have to pass similar resolutions. All of the states surrounding Mississippi have passed Article V resolutions.

House Bill 1352 is sponsored by state Rep. Jason White (R-West) and is known as the Criminal Justice Reform Act. The bill would clear obstacles for the formerly incarcerated to find work, prevents driver’s license suspensions for controlled substance violations and unpaid legal fees and fines and updates drug court laws to allow for additional types of what are known as problem solving courts.

The bill is headed to a conference committee to forge a compromise between the differences between the original and the altered version that passed the Senate.

House Bill 1205 would prohibit state agencies from requesting or releasing donor information on charitable groups organized under section 501 of federal tax law. The bill, sponsored by state Rep. Jerry Turner (R-Baldwyn), was amended in the Senate to include all organizations covered section 501 of federal tax law and the House has concurred with the changes.

The last step is Gov. Phil Bryant’s signature.

SB 2781, known as Mississippi Fresh Start Act, is sponsored by state Sen. John Polk (R-Hattiesburg). This bill would eliminate the practice of “good character” or “moral turpitude” clauses from occupational licensing regulations, which prohibit ex-felons from receiving an occupational license and starting a new post-incarceration career.

The bill was amended with a strike-all that made it identical to the original House bill. It has been returned to the Senate for concurrence. If the Senate doesn’t agree with the changes, a conference committee will try to come up with a compromise acceptable to both.

SB 2901, known as the Landowner Protection Act, would exempt property owners and their employees from civil liability if a third party injures someone else on their property.

The bill is sponsored by state Sen. Josh Harkins (R-Flowood). The Senate declined to accept the House’s changes to the bill, so the differences will have to be settled in a conference committee.

SB 2603 would reauthorize motion picture and television production incentives for out-of-state firms that expired in 2017. Unlike the previous incentives, both bills would cap them at $10 million.

The bill sponsored by state Sen. Joey Fillingane (R-Sumrall). The bill has been returned to the Senate for concurrence.

HB 1612 would authorize municipalities to create special improvement assessment districts that would be authorized to levy up to 6 mills of property tax (the amount per $1,000 of assessed value of the property) to fund parks, sidewalks, streets, planting, lighting, fountains, security enhancements and even private security services. The tax would require the approval of 60 percent of property owners in the district.

The bill is sponsored by state Rep. Mark Baker (R-Brandon). The Senate amended the bill so it only applies to Jackson (cities with a population of 150,000 or more) and the House concurred with the changes.

It awaits the governor’s signature.

HB 1204 would allow a municipality or county to execute the winning bid in a sealed bidding process if a judge hasn’t ruled on a protection request for bids within 90 days.

The bill is sponsored by state Rep. Turner and is on the governor’s desk waiting for a signature.

Far too many candidates for office, Republicans and Democrats, believe long-term prosperity can be achieved from increased government spending and centralized programs and plans. But the evidence doesn’t support such claims, no matter how passionately or eloquently the campaigner insists.

If prosperity is our goal, we should follow the lead of high-growth, low-tax states in the Southeast that have lower taxes, lighter licensure and regulatory burdens, and a more limited government.

What does that look like?

There are several policy proposals that we would encourage any candidate for governor, lieutenant governor, or the legislature to support.

Eliminate burdensome licenses

Burdensome regulations hurt our economy and reduce employment opportunities. All totaled, there are 66 low-to-middle income occupations that are licensed in Mississippi. According to the Institute for Justice, Mississippi has lost 13,000 jobs because of occupational licensing and the state has suffered an economic value loss of $37 million.

While licenses are necessary for a few industries, the state should expand the use of voluntary certifications, adopt automatic sunsets on all licenses, and allow the Occupational Licensing Review Commission to review current, not just newly proposed, licenses. The reality is that we’ve allowed occupational licenses to become the tool for market incumbents, with lobbying apparatus, to build moats around monopolies and limit free-market completion.

Expand education scholarship account program

Mississippi became a national leader in 2015 in implementing an ESA program. Through this program, families are allowed to use the funds associated with their child’s education (i.e., their tax dollars) to choose the best educational setting for their child. For the first time, families in Mississippi, albeit a limited number of families, had a choice in their child’s education, regardless of their income.

Yet, the program is only available to students with special needs, and it serves less than 500 students per year. We should make this program available to every student in the state. By doing so, we’d be following the overwhelming empirical data that shows the benefits of school choice, saving taxpayer dollars, and putting parents back in control of their child’s education.

Cut red tape

Mississippi has more than 117,000 regulatory restrictions in the state rulebook, according to new analysis from the Mercatus Center. Why is this a cause for concern? There is considerable evidence that regulations slow economic growth and have a negative impact on investment, productivity, wages, and overall prosperity.

To reduce red tape, Mississippi should implement a regulatory cap that orders the removal of two olds rules each time a new one is added. A thriving economy is one with fewer regulations, a lighter government touch, and more freedom for small and mid-sized businesses.

Support the innovative economy

When ridesharing companies entered the market a few years ago as disruptors to the taxi monopoly, the unfortunate response from local governments was largely to regulate and limit the ridesharing economy. The legislature made the correct move in enacting statewide policy that preempts local regulation, and allows Uber, Lyft, and others to provide this new service to customers.

When it comes to other disruptors such as Airbnb or mobile food trucks, local governments are again working to protect the status quo and limit market-driven innovation. The state, through the legislature, should protect consumer choice and ensure that local governments cannot stifle competition.

Provide incentives to all businesses by lowering taxes

Mississippi, like many other states, has taken the approach that the only way to attract businesses to the state is by offering targeted taxpayer “incentives.”

Rather than offering tax breaks to a few, allowing the government to play favorites, and requiring business owners to subsidize their competition, we should lower the tax rates on all businesses and make Mississippi the most attractive state for businesses of all sizes and types.

Do not expand Medicaid

Despite the claim of expansion advocates, there is no pile of money sitting around that states are “leaving on the table” when they choose not to expand Medicaid. The fact is that any expansion adds to our federal debt and will cost the state hundreds of millions of dollars.

Medicaid is already a broken system. Adding more patients to the system will exacerbate things, and the patient outcomes will only worsen the poor quality of care currently being provided to the elderly, disabled, and poor. Furthermore, an expansion of Medicaid will certainly crowd out the essential funding needs for schools, roads, and public safety.

We believe these policy proposals represent the path to long-term, sustainable economic growth. Based on the evidence, public policies of economic freedom, individual liberty, free markets, and limited government will allow the state to experience business growth, entrepreneurship, higher labor productivity and wages, and, as a result, greater economic prosperity for all Mississippians who are ready and willing to prosper.

This column appeared in the Clarion Ledger on March 20, 2019.

Few items can unify Americans more than a universal disdain for the government.

A recent Axios Harris Poll tracked the reputation of the most visible brands in America to find who is the most liked, and the most disliked. The scores were broken down into several categories: affinity, ethics, growth, products/ service, citizenship, vision, culture, character, trajectory.

Wegmans, a supermarket chain in the Northeast and mid-Atlantic, topped the list. They were followed by Amazon, Patagonia, L.L. Bean, and Walt Disney.

On the other end of the spectrum? The U.S. government, coming in dead last, behind a tobacco company, a bank with a fake accounts scandal, a bankrupt retail chain, and the Trump organization.

And there is no partisan divide. Republicans ranked the government 95, Democrats ranked it 98, and independents ranked it dead last. Among category scores, the government came in between 96 and 100 on each. Although to be fair, the growth rating of 98th is a little low. If there is one thing the government is doing, it is growing.

The survey represents a national sample, and was conducted from November through January. The first group, 6,118 adults, was asked to identify two companies they believe have the best and worst reputations. Then, the 100 “most visible companies” were ranked by a second group of 18,228 adults.

Wednesday was the fourth big deadline in the Mississippi legislature for general, non-revenue, bills to be approved by the entire opposite chamber.

The next deadline for legislation is Tuesday, the final day for floor action on appropriations and revenue bills from the other chamber.

Here are the some of the bills that survived and others that died:

Still alive

House Bill 1352 is sponsored by state Rep. Jason White (R-West) and is known as the Criminal Justice Reform Act. The bill would clear obstacles for the formerly incarcerated to find work, prevents driver’s license suspensions for controlled substance violations and unpaid legal fees and fines, and updates drug court laws to allow for additional types of what are known as problem solving courts.

The bill passed the Senate by a 49-2 margin. The bill will have to go to conference with the House to iron out the differences between the original and the altered version that passed the Senate.

House Bill 1205 would prohibit state agencies from requesting or releasing donor information on charitable groups organized under section 501 of federal tax law. The bill, sponsored by state Rep. Jerry Turner (R-Baldwyn), was passed by a 32 to 18 margin in the Senate margin after being amended to include all organizations covered by section 501 of federal tax law.

SB 2781, known as Mississippi Fresh Start Act, is sponsored by state Sen. John Polk (R-Hattiesburg). This bill would eliminate the practice of “good character” or “moral turpitude” clauses from occupational licensing regulations, which prohibit ex-felons from receiving an occupational license and starting a new post-incarceration career.

The bill was amended with a strike-all that made it identical to the original House bill. The bill was passed by the House by a 114-2 margin and was amended twice more on the floor, meaning the differences between the present guise of the bill and the original will have to be settled in a conference committee later in the session.

SB 2901, known as the Landowner Protection Act, would exempt property owners and their employees from civil liability if a third party injures someone else on their property.

The bill is sponsored by state Sen. Josh Harkins (R-Flowood). The bill has been returned to the Senate for concurrence. If the Senate doesn’t agree with the changes by the House, the two sides will have to settle their differences with the bill in a conference committee.

SB 2603 would reauthorize motion picture and television production incentives for out-of-state firms that expired in 2017.

The bill sponsored by state Sen. Joey Fillingane (R-Sumrall). The bill was passed by the House on March 7 by a 101- 16 margin and has been returned to the Senate for concurrence.

HB 1612 would authorize municipalities to create special improvement assessment districts that would be authorized to levy up to 6 mills of property tax (the amount per $1,000 of assessed value of the property) to fund parks, sidewalks, streets, planting, lighting, fountains, security enhancements and even private security services. The tax would require the approval of 60 percent of property owners in the district.

The bill is sponsored by state Rep. Mark Baker (R-Brandon) and passed the House 93-22 Thursday after failing to get a two-thirds majority on its first pass on the floor. It’s been referred to the Senate Finance Committee.

HB 1204 would allow a municipality or county to execute the winning bid in a sealed bidding process if a judge hasn’t ruled on a protection request for bids within 90 days. The bill is sponsored by state Rep. Turner and was passed by the Senate on Tuesday.

More dead than fanny packs

HB 702 would’ve allowed cottage food operators to increase their maximum sales to $35,000 and advertise their products on the web. The bill was sponsored by state Rep. Casey Eure (R-Saucier) and didn’t get a vote in the Senate despite passing the House by a 117-0 margin.

HB 1268 would’ve clarified state law regarding constitutional challenges to local ordinances. With local circuit courts acting as both the appellate body for appeals on specific decisions (such as bid disputes) and the court of original jurisdiction, there’s been confusion among judges regarding the law that governs challenges of local decisions, which are required within 10 days.

City and county attorneys have used this 10-day requirement on decisions to get new constitutional challenges — which are new lawsuits and not appeals of decisions — thrown out of circuit courts. This law would’ve added language that would prevent application of the 10-day requirement to constitutional challenges.

The bill was sponsored by state Rep. Dana Criswell (R-Southaven).

A bill that could protect the donor lists of non-profit organizations was passed by the Senate before deadline on Tuesday.

House Bill 1205 would prohibit state agencies from requesting or releasing donor information on charitable groups organized under section 501 of federal tax law. Some of these groups can engage in political activity.

The bill, which is sponsored by state Rep. Jerry Turner (R-Baldwyn) was originally written to include all of the different 501(c) designations. The bill was amended in the Senate Accountability, Efficiency, Transparency Committee for the bill’s protections to only include 501(c)(3) organizations, which are prohibited from political activity.

A floor amendment changed the bill’s language back to that in the original House language and removed a reverse repealer, which is a legislative tactic on a bill designed to keep alive and invite further discussion by preventing it from becoming law.

“It is an honor to support legislation that prevents corruption and intimidation by protecting the right of people to give to nonprofits of their choice and to prevent the politicization of the right of individuals to give to the causes they hold dear,” said state Sen. Jenifer Branning (R-Philadelphia).

State Rep. Mark Baker (R-Brandon) was one of the bill’s co-sponsors in the House and presented it on the floor. He said it’s an issue that cuts both ways and isn’t aimed at just right-leaning 501(c) groups.

“The right associated to privately contribute to non-profits anonymously, to me, is critical to the exercise of the First Amendment,” Baker said. “Protecting this right is crucial to the health and the freedom of our society. There are groups that do things that I don’t agree with, but I agree that they have the right to keep their donors private.”

Several Democrat senators railed against the amended bill, which passed the Senate on a largely party line vote of 32 to 18.

“If you pass this amendment, you will open the biggest loophole since we passed campaign finance disclosure in Mississippi,” said state Sen. David Blount (D-Jackson). “If you pass this amendment, you are saying that 501(c)(4)s can get involved with your campaign or your opponent’s campaign.

“As long as they don’t expressly advocate the election or defeat of a candidate, they can do whatever they want and not disclose anything.”

State Sen. David Jordan (D-Greenwood) was even more strident in his criticism of the amendment.

“The only difference between this amendment and Jesse James is you need a horse,” Jordan said. “This really hurts the system. We have enough corruption at the national level and now you want to bring it to the state level and that’s wrong.”

HB 1205 is being held on a motion to reconsider, which means the Senate will have until Friday to send it to the House for concurrence since it was changed.

If the House concurs with the changes, the bill will go to Gov. Phil Bryant. If not, the two chambers will have to settle their differences in a conference committee.

According to federal law, 501(c)(3) groups have to disclose their donor lists to the IRS, which are not disclosed on publicly available tax filings. These organizations are eligible to receive tax-deductible contributions, but can’t engage in direct political activity.

The IRS recently changed its regulations in July to remove donor lists from the publicly-available tax forms for 501(c)(4) and 501(c)(6) organizations. Changing the rules for 501(c)(3) organizations would require action by Congress.

Two days before the Framers signed the Constitution, one delegate noticed a defect in the plan. He rose to point out that under the current proposal, only Congress could initiate the process of amending the Constitution. But if the federal government grew out of control, it could never be counted on to rein in its own power. There needed to be a way for the states to initiate the amendment process.

The other convention delegates agreed and unanimously voted to add provisions to Article V, which equipped the states with the power to call for a convention at which delegates would make amendment proposals—which would then have to be ratified by the states.

The day the Framers feared, when the federal government would far exceed its legitimate powers, arrived years ago. Congress has long exercised powers that are not constitutionally authorized. At the same time, in an effort to avoid hard choices and increase its members’ reelection chances, Congress has delegated most of the actual work of legislating to faceless, unaccountable bureaucracies, which continue to grow unchecked.

The Federal Register, which contains all proposed and final regulations issued by federal agencies, has published over 3.2 million pages. If it were printed and stacked, it would be taller than the Washington Monument. This mountain of regulation—not even legislation—slows economic growth, stifles innovation, and prevents countless Americans from pursuing their version of the American Dream.

The growth in our federal government has also led to unsustainable federal spending. The federal debt recently topped $22 trillion. Our country’s entire GDP is only 20.5 trillion, meaning that if we took every penny that is earned or produced by every American over the course of a year, we still could not pay off our debt. Every American’s share of the debt is currently about $67,000, and within 10 years, every man, woman, and child will owe $100,000. Future generations of Americans are being born into staggering debt for services they will never see.

The Supreme Court has been complicit in this perversion of the constitutional order, failing in its duty to serve as a check on the power of the legislative and executive branches. As the federal government has grown large enough to control every facet of our lives, so has the importance of the Supreme Court grown. The Court now routinely rules on the most important political issues in American life, including healthcare, immigration, affirmative action, abortion, political gerrymandering, and campaign finance. These “winner takes all” decisions have led to more polarization and a more toxic political discourse.

With a conservative majority on the Court, there is hope that the constitutional ship can be righted. But it will take decades to uproot the mountain of bad precedent that has built up for nearly a century. We should all hope that the federal courts will finally begin taking their constitutional role seriously. But we should do more than hope.

It is long past time for the states to exercise their sovereign power under Article V to call for a convention to reign in the federal government’s power. Two thirds of the states must call for such a convention. Thirteen states have already done so, and a Convention of States Resolution is currently pending in the Mississippi legislature. Mississippi should join the call.

While some have expressed worry that the convention may make things worse and not better, citizens are amply protected from any threats to their liberty. The convention call that Mississippi legislators are considering would limit the proposals that could be considered to those that either impose fiscal restraints on the federal government or limit its power and jurisdiction. Other states have also voted to allow discussion of proposals to impose term limits on federal officials, but Mississippi’s resolution does not include that subject.

Moreover, any amendments that are proposed by the convention would have to be ratified by three quarters of the states. Any ill-considered amendments would not survive that crucible.

The far greater risk is inaction. We know with certainty that, without action from the states, our federal government will continue to grow and spend unchecked. Amending our Constitution to remedy this threat is no insult to our founders. It’s an acknowledgement of their wisdom in equipping us with the tools necessary to overcome a threat to our Republic which they foretold so many years ago.

This editorial appeared in the Clarion Ledger on March 13, 2019.