Popular homesharing site Airbnb announced that they recently remitted $1 million in taxes to the state of Mississippi.

Since September 2017, Airbnb has been automatically collecting the 7 percent state sales tax and local tourism taxes on behalf of hosts and remitting the revenue directly to the state. At the time of the announcement, Airbnb anticipated collecting $245,000 during the past year.

Airbnb was able to quadruple expectations due to a 92 percent year-over-year growth for the platform in Mississippi. Over 69,000 guests utilized the service in the state during that time.

The fact that Airbnb collected and paid $1 million in taxes last year should be considered a good thing. The fact that consumers now have more choices if they want an option besides a traditional hotel is a good thing. And the fact that new competition has been inserted into the lodging industry is a good thing.

Of course, the industry that once enjoyed this monopoly doesn’t see things that way.

Linda Hornsby, executive director of the Mississippi Hotel and Lodging Association, calls it a “definite concern as it (homesharing) continues to grow.” She added, “We are monitoring the negative economic impact of that not just here in Mississippi...As it continues to grow, it exacerbates the problem.”

The so-called negative impact may be to one specific industry, but it is not to the guests who are gladly choosing this option. And it is certainly not a negative to the hosts who are earning a new income stream.

It is understandable that a group or organization that spent decades pursuing regulations to limit competition would be upset when new innovations threaten their monopoly. But the answer isn’t to impose outdated regulations on the new economy, but to deregulate existing industries.

And for government to rely on the free market and trust their citizens to be able to make the best decisions for themselves.

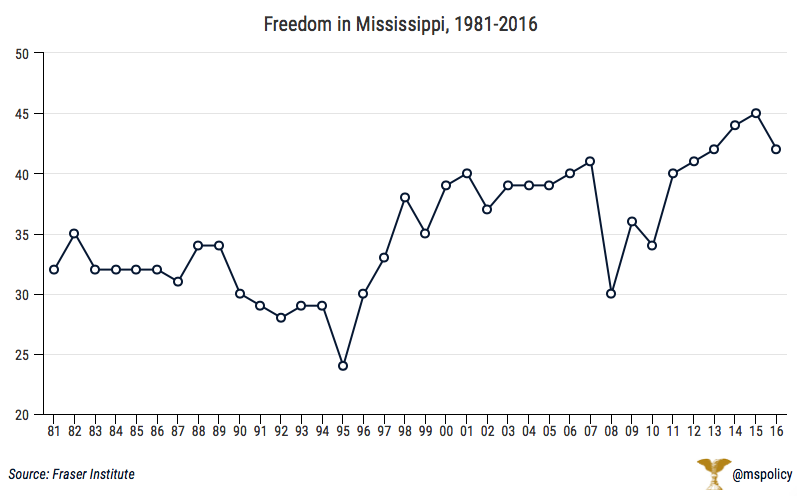

Mississippi’s freedom ranking moved up a couple spots from the previous year while our overall score actually declined slightly.

Fraser Institute’s “Economic Freedom of North America 2018” again paints a relatively bleak picture for economic freedom in Mississippi. Mississippi has been included among the “Least Free” states, those in the bottom quartile, for all but two years going back to 1998.

“The freest economies operate with minimal government interference, relying upon personal choice and markets to answer basic economic questions such as what is to be produced, how it is to be produced, how much is produced, and for whom production is intended. As government imposes restrictions on these choices, there is less economic freedom,” the report writes.

The data is reviewed among three categories: government spending, taxes, and regulations.

What are these categories important? As the size of government expands, the private sector becomes smaller and is slowly pushed out with government choosing to undertake activities beyond the traditional function of a limited government. As our tax burden and regulations grow, restrictions on private choice increase and economic freedom declines. Mississippi continues to have serious issues in both categories.

And we know what the analysis shows: The freer the state, the more prosperous it is. And the more it is growing in terms of in-migration. The least free, the more people are likely to be leaving in searching of better prospects.

...

Though Mississippi saw a slight improvement this year in overall rankings, the state has been on the wrong path over the life of the report. When it began in 1981, Mississippi was ranked 32nd. There have been some ups-and-downs along the way, including a peak at 24th in 1995. But overall, the numbers aren’t positive. The ranking of 45th that was released last year was the lowest the state has ever been.

Going back to 1981 and for many years after that, Mississippi did much better in the government spending and taxes categories than the numbers show today. That year, Mississippi had a government spending score of 7.01 and a taxes score of 6.75. This year those scores are 4.25 and 5.85, respectively. Regulations have shown the most positive movement, from 2.27 to 5.23, though still lower than all but seven states.

In 1981, Mississippi earned a score of 5.34. This year it’s 5.11. Only two other states, Kentucky and New Mexico, have experienced decreases from 1981.

….

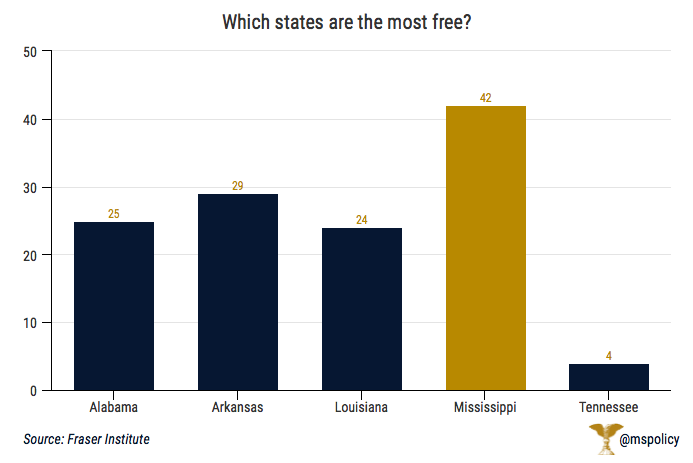

Mississippi performed poorly compared to all neighboring states, and much of the Southeast. Alabama had an overall score of 6.22 (25th), Arkansas had a score of 6.09 (29th), Louisiana had a score of 6.26 (24th), and Tennessee had a score of 7.43 (4th). Those numbers put Tennessee among the most free, placed Alabama and Louisiana in the second quartile, with Arkansas in the third quartile.

When it comes to promoting policies that restrict freedom, Mississippi is sitting on an island. And, unfortunately, paying the price.

….

Overall, this data isn’t far off from a recent report from Cato Institute. Their report, “Freedom in the Fifty States,” put Mississippi 40th overall. A five-spot jump from 2014, but still in the bottom 20 percent.

Some positive trends, but still a long way to go.

As children in Mississippi and around the country prepare for a night of trick-or-treating, they may unknowingly run afoul with local laws.

These aren’t laws restricting criminal actions often associated with Halloween mischief, such as egging a house or smashing pumpkins that belong to someone else. Rather, these are restrictions on who can trick-or-treat, how late they can be out, and what they can or can’t wear.

A story on Roanoke, Virginia’s trick-or-treating laws went viral earlier this month. In Roanoke, no one over 12 is allowed to trick-or-treat. Not only is it illegal, it is a misdemeanor punishable by up to six months in jail.

While the potential jail time might not apply, the city of Meridian also prohibits those over 12 from asking for candy. “It shall be unlawful for any person to appear on the streets, highways, public homes, private homes, or public places in the city to make trick or treat visitations; except, that this section shall not apply to children 12 years old and under on Halloween night,” the ordinance reads. And you have to be inside by 8 p.m.

Throughout the country, towns like Belville, Illinois, Bishopville, South Carolina, and Boonsboro, Maryland have similar age limits.

Meridian also restricts anyone over 12 from wearing a mask or any other disguise, unless they get a permission slip from the mayor or chief of police. Dublin, Georgia and Walnut Creek, California have similar mask restrictions.

The rest of your costume may also be illegal in some locales. In Alabama, it’s illegal to dress up as a minister, priest, nun, or any other member of clergy. Violators can be slapped with a $500 fine and a year in jail.

In a recent move that received national attention, the Kemper County Board of Supervisors approved a measure in 2016 that made it illegal for anyone to appear in public in a clown costume or clown makeup for Halloween that year. The ordinance expired the day after Halloween. That ordinance carried a fine of $150 for outlaws who wore clown costumes.

The conventional wisdom is that these ordinances aren’t enforced. Police aren’t asking boys who are starting to show signs of facial hair for identification to check their age. Chances are no one is spending 365 days in a county jail in Alabama for impersonating a priest or rabbi.

Which, of course, leads to the next question: Why have such laws? We already have laws on the books to restrict actual criminal activity. We don’t need additional laws that are confusing and do little but potentially ruin a fun night for millions of children.

We simply have too many laws in this country. It should not be government’s responsibility to regulate the behavior of children on a Halloween night running through the neighborhood in pursuit of treats. That responsibility belongs to the parents, just like it should on every other night of the year.

Mississippi Center for Public Policy recently added their name in support of the First Step Act.

The First Step Act will provide meaningful reform to our criminal justice system at the federal level, similar to what we have experienced in Mississippi. We know from a long history of being one of the nation’s top incarcerators that the blunt instrument of a long sentence does little to improve the conditions of our state’s communities.

The research shows that locking up low-level offenders does not produce better public safety outcomes than effective probation tools and workforce partnerships. We also know that time in prison breaks family bonds and makes it next to impossible for a person to hold down a job. That’s a bad outcome for all of us. Instead, we should be using what we know works to move people out of the system and toward productive, law-abiding lives.

Over the past three years, Mississippi has enacted a number of key reforms. During this time, the prison population has declined by more than 10 percent, driven by a reduction in prison use for non-violent offenses. At the same time, our state’s prisons are more focused on violent offenders, who now occupy 63 percent of prison beds, as opposed to 56 percent prior to reform. Today, the property crime rate has decreased by 5 percent, while violent crime has remained at a historic low.

Mississippi, like many other states, has seen the benefits of smart criminal justice reform policies. We are confident similar results can be found at the federal level.

Read the full letter to Senator Majority Leader Mitch McConnell (R-KY) here.

Food truck regulations around the country continue to be challenged in court because they are indefensible from a legal perspective.

If Tupelo leaders continue to try to regulate these businesses in an effort to protect the brick and mortar restaurants, it is very likely the same scenario will play out in the city that gave us Elvis. The constitution specifically prohibits such economic protectionism. Our legal arm, the Mississippi Justice Institute, has already cautioned the City Council against such actions.

Rather than making the case by leveraging the consequences of a legal challenge, I would like to appeal to the leaders of Tupelo to consider the practical reasons why being on the side of economic liberty is the prudent choice. This is not a partisan issue. It is an issue of free enterprise, consumer choice, and the proper role of government in a system of capitalism.

It is not the role of government to protect any business, brick and mortar or otherwise, from competition. The free enterprise system operates correctly when consumer choice, not political blessing, is the basis of choosing the winners and losers.

From a practical standpoint, it is also a mistake to thwart a powerful economic trend like food trucks. These businesses are examples of entrepreneurs responding to market signals. In so doing, they are contributing to the local economy by serving a customer niche. Brick and mortar restaurant entrepreneurs can do the same, and many have. All of these entrepreneurs, new and old, are creating unique options and that work to build a more diverse and appealing food marketplace in Tupelo. In turn, this attracts more consumers to the downtown – creating a bigger, healthier and more prosperous local economy.

In a properly functioning economy in America, the success of a food company should be based on how good the food and service is; not on how well connected it is to the political class. In a system of capitalism, competitors respond to consumer trends with innovations and improved offerings, not by seeking government help to build a moat around their businesses. We should be encouraging entrepreneurs and risk-takers, not creating hurdles out of a misplaced sense of obligation to protect existing businesses.

In many ways, the food truck controversy is similar to those disputes we’ve seen around the country where local governments are determining how to regulate Airbnb and Uber. Rather than government looking to create new and restrictive regulations for these emerging businesses, they should be thinking about how to reduce the existing regulatory burdens on brick and mortar restaurants and hotels. The local economy would be the beneficiary of such actions and no one would argue against a policy that spurs economic growth – especially not in a state where we have struggled to experience sustainable growth in our private sector.

On behalf of customers, competition, and consumer choice, I hope this appeal to the political leaders of Tupelo does not land on deaf ears. Cites across the country are realizing these kinds of cases are very hard to defend. However, the City Council should not vote to keep the regulatory burden for food trucks low out of a fear of the legal consequences; they should do it because it’s in the best economic interests of Tupelo.

This column appeared in the Daily Journal on October 28, 2018.

The city of Tupelo appears to have backed away from controversial regulations that would have prohibited food trucks from most high-traffic areas in the city.

But some city leaders continue their push for protections for brick-and-mortar restaurants at the expense of food truck operators.

During Monday’s work session, the city released the proposed regulations. According to the Daily Journal, this includes additional licensure and some limitations on parking but lacks the restrictions on setting up on Main and Gloster Streets, the two most prominent retails areas in the city, as originally discussed.

“We have not been protectionist and made any distance requirements between competing business,” Ben Logan, city attorney said.

Mayor Jason Shelton, a Democrat, added, “I want to be pro-business,” Shelton said. “I don’t think we need more restrictions on businesses. I think we need to look at restrictions to take away.”

New regulations have been in the works for some time now, with support for restrictions from both Democrats and Republicans.

Earlier this year, Councilman Willie Jennings said, in proposing the regulations, “I just want to make sure the established businesses are protected.” Another councilman, Markel Whittington, said brick-and-mortar restaurants have requested food truck regulations. While he didn’t feel food trucks posed a ‘threat’ to those restaurants, he believed it was appropriate for government to act ‘on behalf of select business interests.’

“I think we have to protect some of our taxpayers and high employers,” he said.

And even yesterday, Councilman Mike Bryan lobbied for brick-and-mortar restaurant protections, such as a ban on major roads. Another councilman, Buddy Palmer, also indicated his support for a ban.

“I feel like it is not fair to brick-and-mortar businesses to allow food trucks to park in front of their business,” Bryan said.

“I will always be pro-downtown businesses over food trucks,” Palmer said. “I am for brick-and-mortar businesses much more than I am for food trucks.”

When Tupelo leaders began discussing food truck regulations, Mississippi Justice Institute, the legal arm of Mississippi Center for Public Policy, sent a letter to the city warning of litigation if these regulations passed.

“The very regulation Tupelo is discussing—a regulation about how close a food truck should be to a restaurant—was found to be unenforceable just this past December in Baltimore. Food truck regulations around the country have been challenged over and over in court, from Louisville, to San Antonio, to Chicago, and many places in between. Cities ultimately realize that these kinds of cases are very hard to defend,” the letter said.

More recently, the city of Carolina Beach, North Carolina repealed its prohibition on out-of-town food trucks from serving the city after a lawsuit was filed by the Institute of Justice. Under the law that has since been scrapped, only brick-and-mortar restaurants that have been in business for more than one year could run a food truck.

“It is a shame that it took a lawsuit to convince the town to repeal such an obviously unconstitutional law,” Justin Pearson, senior attorney at IJ said. “I’m hopeful that this vote will signal the end to the town’s attempt to use the power of government to favor a handful of established businesses over the region’s entrepreneurs.”

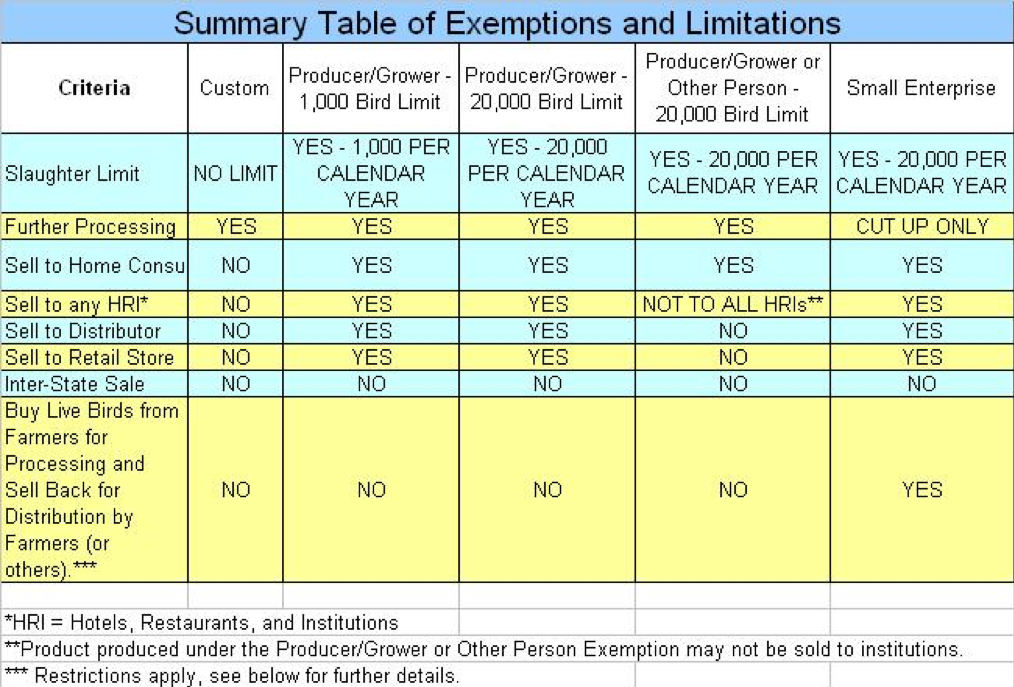

Mississippi regulators are preventing small poultry producers from operating a sustainable business by severely restricting the sale of safe and healthy poultry products.

The consequence is more limited access to diverse food options for families, students, hospital patients, restaurateurs and chefs.

More specifically, Mississippi Department of Agriculture (MDAC) regulations prohibit all but direct farm-to-consumer sales by small-scale poultry producers. This is contrary to Mississippi law, which has adopted a federal exemption that allows small producers to sell to grocery stores, restaurants, hotels, hospitals and other institutions.

In conformity with federal law, Mississippi law technically incorporates the federal 20,000 bird exemption, which allows poultry producers who raise fewer than 20,000 birds a calendar year to sell these birds without being subject to daily inspection and other facility requirements. MDAC regulations, however, do not recognize this mandated exemption in any meaningful way.[1]

This means that Mississippi is forcing small poultry producers to follow federal requirements that were drafted with large-scale producers in mind. These requirements are onerous and expensive and address the unique problems created by large-scale poultry production.[2] It is not appropriate to subject small producers to these requirements, which is why federal law has always allowed for a small producer (20,000 bird) exemption. Unlike other states that recognize the federal 20,000 bird exemption, Mississippi prohibits all but direct farm-to-consumer sales for small farmers. This completely undermines the purpose of the exemption. Mississippi agricultural regulations ban small producers from selling to restaurants, grocery stores, hotels, schools and hospitals. As a result, small poultry producers are denied access to distribution channels currently open to large producers.

What is the solution?

State law should clearly define what a small-scale producer is (consistent with the federal definition of a 20,000 bird producer) and clarify that these producers are not subject to the same inspection requirements that large producers operate under. In particular, state law should clarify that small producers are not subject to mandatory daily inspection and other facility requirements. State law should also clarify that small producers may sell to restaurants, grocery stores, hotels, schools and hospitals. Alternatively, MDAC could issue new rules that actually conform to the federal 20,000 bird exemption and thus rectify the current contradiction between state law and agency regulatory practice.

More than 40 states have adopted the 20,000 bird federal exemption. Granted, not all of these states are actually implementing the full range of federal exemptions. In neighboring Alabama, for instance, farmers with the exemption may only sell in farmer’s markets, as well as direct from the farm. Louisiana, on the other hand, has fully implemented the 20,000 bird exemption and allows sales to retail outlets, restaurants and various institutions. Louisiana has also adopted the federal small enterprise exemption pertaining to the processing of dressed exempt poultry (see table below).

North Carolina stands out as one of the states with the best and clearest regulatory guidance. Their policy allows for the slaughter, processing and distribution of poultry without mandatory daily inspection. The regulations also spell out requirements aimed at protecting consumer health and safety. These include: sanitary standards and practices, detailed recordkeeping, and mandatory labelling that identifies the processor and provides for safe handling instructions. These requirements essentially follow federal law.

A win for small farmers and economic growth

North Carolina’s deregulation of small poultry producers has been a win-win for both small and large producers. The market for each of these products is different. For many consumers seeking farm-fresh chicken, the choice is not between purchasing small-scale or large-scale produced products. The choice is between purchasing small-scale produced chicken or no chicken at all.

North Carolina’s example is illustrative. While the state has more than 1,000 small-scale producers, Sanderson Farms recently opened a plant with the capacity to slaughter and process 1.25 million birds a week. Consider that Sanderson Farms’ stock has increased many times over, going from roughly $6 a share in 2000 to $100 a share today. Clearly, their business model can accommodate small-scale producers selling to a different customer base. In addition, it is often said that small businesses are a key economic driver. Small farms are small businesses. Freeing small farmers and entrepreneurs from onerous regulations that 40 other states do not have will help Mississippi’s economy grow.

Federal Poultry Exemptions

Table taken from eXtension Foundation as adapted from USDA FSIS guidebook.

[1]Cf. definition of “retail food establishment” at § 69-1-18: “‘Retail food establishment’ means any establishment where food and food products are offered for sale to the ultimate consumer and intended for off-premise consumption.” Under this section, MDAC rules at 100.04 require “all poultry products offered for sale at a retail food establishment” to be slaughtered and processed according to state/federal guidelines. Thus, “no retail food establishment’ may sell poultry provided by a farmer actually operating under the 20,000 bird exemption. Cf. http://www.sos.ms.gov/ACCode/00000093c.pdf

[2]In the late 1960s, under the Johnson administration, the federal government forced states to follow federal inspection guidelines, even for products not entering interstate commerce – that is, products produced and sold only within the boundaries of a single state. The “Meat Act” included various “personal use” exemptions for custom slaughterhouses. The “Poultry Act” also allowed for conditional exemptions for small producers and businesses – i.e., the 1,000 and 20,000 bird exemptions. Exempt operators are NOT exempt from all federal requirements. They are exempt from continuous bird-by-bird inspection, and accordingly, the daily presence of a federal inspector. In other words, the 1,000 and 20,000 bird allowances exempt the processor from mandatory inspection. Federal law also permits a small enterprise exemption that allows a restauranteur, for instance, to purchase live chickens and then slaughter, dress and sell them to customers. It is unclear whether Mississippi allows this practice. For more information from FSIS, see the PowerPoint presentation by Robert Ragland, “Poultry Exemptions Under the Federal Poultry Products Inspection Act.”

As the sharing economy expands, consumers win thanks to greater options and lower prices.

It is the free market working as it should. An individual has a service they can offer, they sell it on the market via a mobile app, and they are rated on their performance by the user. Other users can then make decisions based upon whether previous users had a great experience, a poor experience, or something in the middle. It is the definition of accountability, and doesn’t require government involvement.

But, of course, government must involve themselves. Solely in the name of consumer safety, because you or I apparently cannot make a decision without the government’s blessing.

However, we know those decisions are usually centered around the government’s interest in protecting the established monopiles. Those monopolies have already asked for and received the blessing of the government and feel it is their task to protect the moat around whatever industry they are in.

We saw this with the ridesharing economy a few years ago. As Uber and Lyft entered the mainstream, some localities in Mississippi took it upon themselves to ban ridesharing companies if they didn’t operate in the same fashion as the taxi monopolies. That included cities such as Jackson, Gulfport, Biloxi, and Oxford. In Oxford, law enforcement even threatened to arrest Uber drivers for running an unlicensed taxi service. After all, the city council in Oxford had adopted new ordinances after meeting with taxi drivers and owners.

Fortunately, the state acted and passed statewide regulations for transportation network companies in 2016, overriding local regulations that stifled the ridesharing economy. A year later Uber announced that they will be available statewide. And even without doing research, we can presume students at Ole Miss enjoy having Uber available.

Carsharing is another form of how individuals can make money from their car in the sharing economy. With carsharing apps, such as Zipcar, Turo, and Getaround, consumers can rent a car from an individual for a short time period as you currently do with traditional rental car companies like Enterprise and Hertz. Naturally, said car rental companies are fighting the carsharing industry.

Airbnb has had a similar experience with government regulators. Just this summer, a Biloxi city councilman, who also happens to be the president of the Mississippi Hotel and Lodging Association, announced his intentions to increase regulations and enforcement on Airbnb rentals in the Coastal city. The Mississippi Hotel and Lodging Association is the state arm of the national association that has been pushing for homesharing regulations throughout the country.

The sharing economy should be celebrated and encouraged, but all it does is provide options.

An Uber ride is not automatically better than a ride in a traditional taxi simply because it’s an Uber ride. Nor is a house or room rented on Airbnb automatically better than a stay in a traditional hotel. If enough users have a poor experience, no one will continue to use that service provider. There is a great incentive in providing high quality services. After all, people vote with their feet.

But having these options available allows the consumer to make better, or more complete, choices. They can decide what they use based on what they need at that moment in time. And price is usually a central part of that decision.

The reactions from “traditional” companies is to be expected. They worked hard in pursuing regulations that limit competition. But when new players enter their arena, they then often complain about the unlevel playing field.

That would be less ironic if they didn’t create that playing field. But their reaction is understandable. However, the answer isn’t to impose outdated regulations on the new economy, but to deregulate existing industries. And for government to rely on the free market and trust their citizens to be able to make the best decisions for themselves.

This column appeared in the Meridian Star on October 12, 2018.

The Mississippi Bureau of Narcotics has begun to return property that the agency seized after the administrative forfeiture law was repealed.

This past session, the Mississippi legislature allowed the administrative forfeiture provision to sunset, meaning the previous law ceased to be in effect at the end of June. Administrative forfeiture allows agents of the state to take property valued under $20,000 and forfeit it by merely providing the individual with a notice. An individual would then have to file a petition in court to appeal.

On September 19, 2018, MBN sent notices allowing retrieval of seized property, totaling more than $100,000, to eight individuals. This includes:

- $3,757 of seized currency to Courtney Walker of Biloxi

- $3,000 of seized currency and two rifles to Michael Willis of Cyrstal Springs

- $88,737 of sized currency to Luis Medeles and Christopher Zavala, both of Brownsville, Texas

- $1,860 of seized currency to Dewayne Spearman of Pontotoc

- $11,938 of seized currency to Tejinder Kaur of Brandon

- $2,300 of seized currency and a pistol to Dexter Danzel Conner of Tuscaloosa, Ala.

- A seized handgun and a holster to Jessica Meredith of Florence

On September 10, the Mississippi Justice Institute sent a letter to MBN advising the agency of the change in the law after it became apparent that they were continuing to seize property after the July 1 repeal date.

“We are glad to see that the Mississippi Bureau of Narcotics is not only following the law, but is taking corrective action in cases where administrative forfeiture procedures were incorrectly used,” said Aaron Rice, Director of the Mississippi Justice Institute. “As a public interest law firm dedicated to ensuring that our laws are carried out in a way that protects liberty and honors constitutional rights, we are happy to have been able to assist MBN in carrying out its duties while remaining in compliance with new changes in Mississippi law.”

Until 2017, Mississippi was the wild west of sorts when it came to civil asset forfeiture. In 2015, the Mississippi Bureau of Narcotics, along with local police departments, seized nearly $4 million in cash.

They seized amounts as low as $75. They seized trucks, cars, ATVs, riding lawnmowers, utility trailers, and 18-wheelers; an arsenal of assorted handguns, shotguns, and rifles; cell phones, cameras, laptops, tablets, turntables, and flat screen TVs; boat motors, weed eaters, and power drills; and one comic book collection, according to a report from Reason.

And that does not include numbers from police departments that work independently of the Bureau of Narcotics. Until 2017, they didn’t track or publish asset forfeiture data.

Moreover, family members, especially parents, often had their cars or other property seized for the alleged crimes of their children. This happened even though the parents are not connected to the illegal activity. For example, in 2015, the Desoto County Sheriff’s Department agreed to return a 2006 Chevy Trailblazer owned by the mother of the petitioner, Jesse Smith, in exchange for $1,650.

In 2017, the legislature provided needed reforms. Now, seizing agencies must obtain a search warrant issued by a judge within 72 hours of seizing property. And all forfeitures are posted on a publicly accessible website.