In recent years, the education system has become increasingly centralized. As the federal government has continually expanded its role in education, and academic organizations have consolidated their influence, there has also been an increasingly radical push to remove even parents themselves out of the equation.

It is interesting to note that the increasing centralization of education has directly increased with the radicalization of educational priorities and agendas. Ironically this is despite the fact that many individual parents are far less likely to embrace the latest radical proposals from the Left, such as Critical Race Theory and transgender bathrooms.

However, those within the high ranks of the education establishment often buy into such priorities. According to research, many of those in high academia have gone increasingly even further to the Left. Thus, the more education is centralized, the greater the ability of the Left to advance ideologies that would not be democratically approved by the majority of parents.

These factors of polarization and radicalization have challenged much of the status quo in the education establishment. This is true both for the administrators within the system and the parents themselves.

The National School Boards Association sent a letter requesting federal law enforcement investigate certain parents who were opposed to certain policies as “domestic terrorists.” This ultimately led to the Mississippi School Boards Association announcing that it would break from the national organization.

Meanwhile, parents across the state and country are responding as well. On the one hand, parental rights and education policy have become one of the biggest hot-button issues at the ballot box. At the same time, “families have explored and adopted different approaches to schooling on an unforeseen scale.”

Such factors shed light on a growing recognition that Washington's academic elites and education bureaucrats have overstepped their boundaries. The nature of this republic is the ability of the people to civilly push back against overreaches, whether they do it as an organization or as individuals.

This points back to the truth that an increasingly top-down structure for education is not the answer for true growth and educational excellence. Truly American education was built on the foundation that strong families, faith, limited government, and personal responsibility are the true foundation for educating the next generation. Long before the centralized educational structures of today were instituted, America still had an educated populace, that not only sustained itself – but thrived.

Perhaps the time has come that some in the American ethos are having a fundamental return back to an educational vision that seeks to preserve the things that made the nation great. The survival of the American republic depends upon future generations that are grounded in the principles of freedom and liberty. Rather than handing this over to big office buildings in Washington and the academic elites, the success of the “American experiment” proves that individual education freedom and choice are the true avenues to make this happen.

As America prepares to celebrate a day of Thanksgiving, it is important to look back and consider the lessons of our forefathers. All the way back to its humble beginnings at Plymouth Rock, the American legacy has shined as an example of what freedom and liberty can accomplish.

But in recent years, socialism has been on the rise in America. According to Pew Research, 42 percent of Americans have a positive view of socialism. In addition, the nation has seen increasingly socialistic policies based on the concepts of big government and high taxation. In light of such circumstances, it is important to consider another episode when socialism was in America – and the failure of such socialism.

This story of socialism in America happened with none other than the Pilgrims themselves. When the Pilgrims set sail on the Mayflower, their voyage was financed by a group of investors called the Merchant Adventurers. As a means to pay back the investors, the Pilgrims initially set up a socialistic economy, with a portion of the communal proceeds going back to the investors. However, this system proved to be a failure from the start.

William Bradford, the second governor of Plymouth Colony, described what happened: “The failure of this experiment... [proves] the emptiness of the theory that the taking away of private property, and the possession of it in a community, by a commonwealth, would make a state happy and flourishing; as if they were wiser than God. For in this instance, community of property (so far as it went) was found to breed much confusion and discontent, and retard much employment which would have been to the general benefit and comfort.”

To replace this failed approach, the Pilgrims instituted a system of private ownership, with each family having a farm to call their own. This led to the bountiful successes that culminated in long-term prosperity. Such a failure of socialism, when compared to capitalism, comes as little surprise. The basic principles of individual liberty and personal responsibility will always be more successful than the principles of coercion and a lack of private property.

From Plymouth Rock, all the way to the Soviet Union, socialism has an unbroken record of failure. The successful “American experiment” rejected socialism from its very start, and an embrace of socialism would ultimately spell its end. For the legacy of the Pilgrims and the Founding Fathers to continue, the lessons of history must be heeded and followed. As families gather across the nation to thank God for the blessings of the year and look back on America’s legacy, it is important to ensure that future generations will be able to reap the blessings of freedom. As the rise of socialism seeks to undermine the country's future, a return to America’s foundation just might start by looking back to the lessons of Plymouth Rock.

FOR IMMEDIATE RELEASE

(Jackson, MS): The Mississippi Center for Public Policy today released a policy paper reiterating the case for abolishing the state income tax.

"It's time to give Mississippi a boost and get our state growing," said Douglas Carswell, President & CEO of the Mississippi Center for Public Policy. “Abolishing the state income tax would give every Mississippi worker a pay raise. It would mean they had more money to spend on their priorities and families.”

“With Mississippi’s budget in a record $ 1 billion surplus, now is the time to do it” he went on to explain. “Let’s not wait for politicians to figure out new ways to spend that surplus. Let’s use it to allow workers to keep more of their own earnings.”

MCPP's "Axe the Tax” campaign is set to popularize the argument in favor of giving Mississippi a tax break through the abolishment of the state income tax. The report highlights many key points of the argument, including:

- It would give a major tax break for working families. The median household income in Mississippi is $45,081, and under the current structure, such a household would have to pay approximately $1,600 in state income taxes. The Governor’s executive budget recommendations suggests an individual with a taxable income of $40,000 would be $1,850 better off if income tax was eliminated.

- It would make Mississippi more economically competitive. Neither Florida, Tennessee, nor Texas have state income taxes, and all three have prospered. Mississippi, however, has done less well, decreasing in population and growing less rapidly. Repealing the income tax would assist people with higher and lower incomes in a personal tax break and encourage more private consumer spending.

- It would be great for local entrepreneurs. Mississippi has a long history of giving tax cuts to big corporations. An abolition of the income tax would be a break that helps ordinary businesses – not just those that are well connected in Jackson.

While it failed to pass in the 2021 legislative session, it is likely the issue of income tax abolition will be featured prominently in the 2022 session. MCPP hopes to see cooperation between state leaders ahead of this and offers these recommendations to see a successful process:

- Keep non-income tax rates the same and appropriate the State's $1 billion surplus revenue to reduce the income tax revenues

- Appropriate 50% of budget surpluses to reduce income tax revenues until it has been entirely eliminated

- Place cap on State's general fund budget increases that prohibit increases above 1.5% annually

The Mississippi Center for Public Policy believes repealing the Mississippi income tax would be both a moral and economic good, leading to higher incomes, competitiveness, and prosperity for all Mississippians.

You can read the FULL REPORT HERE.

For media inquiries, please reach out to Stone Clanton, [email protected].

You know you’ve seriously annoyed progressives when you get singled out for a hit piece in the UK’s Guardian newspaper by one of their New York-based columnists. According to Arwa Mahdawi writing in today’s Guardian, I am a “toxic politician” whom the UK was able to "successfully export."

What was it that prompted Miss Mahdawi, whom I don’t believe I have had the pleasure of meeting, to launch such a highly personal attack on a private citizen in a national newspaper? (Besides Brexit, of course).

Her tirade seems to have been prompted by the fact that I had the temerity to point out that the United States is more prosperous and innovative that Europe.

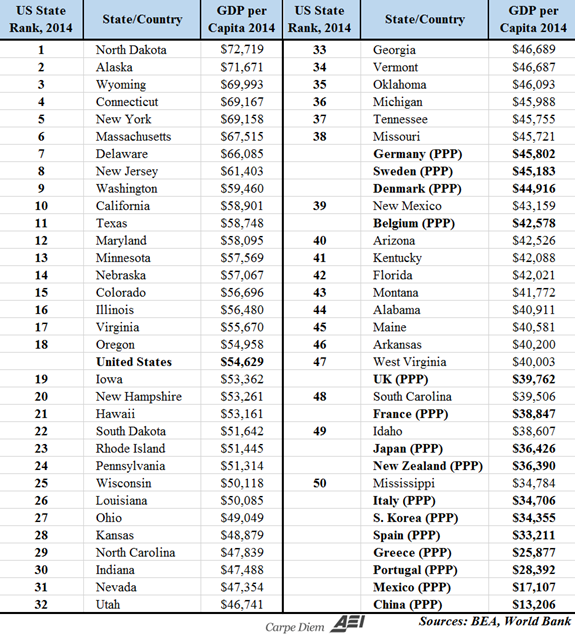

Well let’s consider the facts, for a moment. Here is a table showing how the richest countries in Europe compare the US states in terms of GDP per capita. Germany, Europe’s richest country, ranks below Oklahoma, the 38th richest state in America.

The UK is poorer that Arkansas and West Virginia. Even my own state, Mississippi, ranks above Italy and Spain. If you break the UK down by regions, Mississippi is more prosperous than much of the UK outside of London and the south east.

According to Miss Mahdawi, the US can’t be more successful because she lives in New York, where she “pays way more” for her “mobile phone plan and internet than she would for comparable services in the UK or anywhere in Europe.

Apparently the relative cost of her New York phone bill proves the Europe is better than America. Or something.

Perhaps if Guardian columnists made a little more effort to try to understand what those they write hit pieces on actually thought, they might recognize that free marketers favor more free markets.

But if they did that, then they might be forced to acknowledge that one of the reasons why certain sectors of the US economy have become cartels, without enough consumer choice and competition, is precisely because America is currently led by an administration that seeks to expand the role of government and make America more European. Much easier to make childish insults.

The interesting question to ask is why so many of Europe’s elite feel the need to lash out at anyone that suggests that the American model works better that the European.

In the UK, it is constantly implied the America’s health care system is vastly inferior. Really? Five years after diagnosis, only 56% of English cancer patients survive, compared to 65% of American patients. Poorer Americans in poor states often have healthier outcomes that many in Britain.

But again, these facts are overlooked. Anyone with the temerity to mention them gets vilified (“toxic”). And the many shortcomings in the US system are cited as evidence that nothing good ever happens stateside.

When Europe’s elites talk about America, often what they say – or won’t say – tells us more about them, than anything happening over here. The reality is that by most measures the United States gives ordinary citizens far better life chances than the European Union is able to provide for her people.

Deep down Europe’s elites know this. And they fear that their own citizens know it, too. So they constantly put America down in order to maintain their own status across the pond.

Mississippi’s regulatory code is a massive body of laws with thousands of pages and about 8.9 million words. Unsurprisingly, such a large amount of rules has immense potential to burden Mississippians, inhibit economic growth, and continually increase the size of the government.

While it can be easy to get lost in the specifics of potential reforms, one basic proposal could help to simplify the deregulation process and put the state on a path to better and better reforms. This proposal would require that for every new regulation implemented by the state government, there would have to be two regulations removed.

While this is a seemingly simple proposal, the federal government applied this rule to federal regulations in the Trump Administration starting January of 2017. In turn, the federal government saw a relatively low amount of new regulations in the Trump administration. In January of 2021, President Biden repealed the rule. Thus, although the rule is no longer in effect on the federal level, states still have the opportunity to apply the rule in a state context.

Such prior success on the federal level suggests that an effective approach to deregulation is to recognize that business regulations do not occur in a vacuum. If a company does not have to deal with one specific regulation but faces burdens and obstacles from other regulations, the company may be in just as bad a position as it was before. Thus, while incremental deregulation is effective in some circumstances, the true way to see economic prosperity from deregulation is to implement broader reforms that do not just apply to a specific line of legal code.

Furthermore, while regulatory burdens can substantially affect businesses of all sizes, it is also important to note the particular burden that a strong regulatory environment can have in the Mississippi context. With a large percentage of small businesses, the weight of even one or two additional regulations could be just enough to tip the scales against many such businesses in the state. At the same time, having a regulatory model that proactively removes burdensome regulations could spell the difference between stagnation and growth for businesses across the state.

Using a one-in-two-out model, Mississippi could see a reduction in the total amount of regulatory burdens imposed on Mississippians. While the state has been effective at repealing many of the burdensome regulations, such a policy would help place a statutory cap on the amount of regulations. This is significant so that the state does not find itself incrementally growing the regulatory burden with every passing year of lawmaking.

The legislature should continue to take the lead on removing the regulatory burden in the state. While specific repeals of certain regulations can be an effective method of cutting down red tape, broader deregulation policies could make a real difference in the Magnolia State.

If there is anything we must learn from the Great Depression and FDR’s New Deal, it is that throwing policy at a wall to see what “sticks” is never a good idea. This is especially true when those policies involve trillions of dollars.

When FDR put forth his plan to save the nation, the problem in his approach was that policy did not have an indicated, narrowly defined purpose and cost the nation greatly. Coming out of the Covid pandemic, we are facing a similar situation with Biden’s Build Back Better strategy, which would ultimately cost $3.5 trillion despite the president’s insistence that it will cost nothing. Biden believes this because his assumption is that the money will be returned when we “invest in America” in areas such as climate and providing a social safety net for families and small businesses. The irony is that some in his own party do not agree as such a bill will likely add to the already daunting inflation rate.

The reality is that virtually none of the solutions that Biden offers in this strategy is actually free. A study from the University of Pennsylvania confirms this. In fact, the national debt is said to increase by 25 percent over 30 years if Biden’s plan comes into effect.

Mississippi should not follow suit in this approach of governance. As tempting as it is just to throw money or ideas at the wall to try to fix a problem. Good policy must have a specific purpose and not operate on assumptions that “we will just make our money back.” That may be a byproduct, but it is a substantial risk that taxpayers often cannot afford if it falls through. Prudence is key.

This is why the narrative that the government is going to “invest in America” is so dangerous. For one, the government is not an investor as if it has generated its own money. The government only has money because the people have been forced to give it money. The second problem is that “investing in America” is so vague and broad that it boils down to just flowery rhetoric, yet it is treated as some profound justification for large spending. This was FDR’s strategy and it ultimately led to several lawsuits in which the Supreme Court granted relief and put back the nation several years back in recovering from the Great Depression.

Throwing money at a wall to see what sticks might help if you have unlimited resources and no consequences; however, neither President Biden nor the Mississippi government has this luxury. If effective and positive change is to occur, we must depart from this “investing in America” narrative and support the American economy by making government smaller, not bigger.

The individual states that make up our nation are at a crossroads. The recent wave of federal funding to states across the country has triggered questions about the extent of federal involvement and the impact of federal funding on state sovereignty and public policy.

From the specific Covid grants issued by Congress, to the bureaucratic matching system for federal programs such as Medicaid, nearly every federal dollar has something attached to it that carries the will of Washington into the states. While not all of these dollars are a precursor to bad federal policy being imposed on the states, an increasingly leftist federal government is tying more and more strings to these dollars. States need a strategy to press against such actions.

This expansion of federal control using federal money has been pushed in multiple sectors. In healthcare, the Centers for Medicare and Medicaid Services has imposed a vaccinee mandate on hospitals that receive federal funding through Medicaid and Medicare. In the education sector, the Department of Education has asserted an increasingly leftist agenda through its programs, while openly asserting on its own website that “any state that does not want to abide by a federal program's requirements can simply choose not to accept the federal funds associated with that program.”

Thus, we see that while the federal government has increasingly asserted its power over the states, much of the state sovereignty issues are ultimately questions of what dollars the state will accept. The beauty of American federalism is the ability of the states to stand against federal overreach by simply refusing federal funds or agreeing to take them only under certain terms.

Such a stance has been effective in recent months. In April 2021, the Department of Education announced its intention to prioritize the teaching of Critical Race Theory as it awarded civics and history education grants to the state education systems. In response, the state of South Dakota went so far as to directly reject all federal dollars tied to such federal civics and history grant programs. In an earlier response, 20 states had voiced their opposition and the federal government largely backed down after the pushback.

This success presents an important strategy that states can use to press against the whims of Washington. This strategy is twofold -with defensive and offensive elements. As a defense, states should not enroll or expand their involvement in any federal funding program that locks the state in and subjects it to whatever future terms the federal government may impose. On the offensive side, states should directly reject any effort by the federal government to impose damaging policies that are “sugarcoated” with optional federal dollars.

Until states collectively recognize their ability and duty to refuse funds that will impose bad policies on their citizens, the federal government will likely continue down a path of brazen overreach. Conservative state legislatures should reclaim “the power of the purse.” They should consciously reject any attempt by the federal government to wrongly manipulate public policy using the power of federal dollars. The future of these United States depends on it.

In 2020, the Mississippi legislature passed a bill that included a provision to implement a digital driver’s license program that allows citizens to keep a copy of their license on their smartphones. The program is expected to roll out soon. However, there are still some unanswered questions that could pose a threat to individual liberty if not addressed.

In the first place, there must be an understanding of how most digital license programs work. The text of the bill, HB1371, specifies that the Department of Public Safety “shall develop and implement a driver's license or driving permit in electronic format as an additional option for license or permit holders. Acceptable electronic formats include display of electronic images on a cellular phone or any other type of electronic device.”

For most of the states that have implemented a digital license, the license is stored via encryption on a government-sanctioned smartphone app. Mississippi’s program development has followed this model. When the digital license is requested by law enforcement, store clerks, or others, they can scan the smartphone to verify the license's authenticity. After authenticity has been verified via cryptography, the driver’s license information is shared with the individual requesting it.

At first glance, this concept of a digital driver’s license might seem to be a fairly straightforward advancement for the digital age. To a certain degree, this is true. There is nothing inherently wrong with implementing a digital license option in addition to the traditional plastic driver’s license. However, digital licenses bring a level of complexity that is not quite there for physical licenses, and this complexity must be properly addressed.

In the first place, it is important to consider the potential threats to individual liberty that can occur if a digital license program is poorly designed and does not have the proper protections in place for citizens. There are several essential issues to consider.

For instance, consider the circumstances where a driver’s license might be requested. Such examples might include traffic stops, certain purchases, and entrance into restricted buildings. Under traditional circumstances, the physical card would be presented, and there is no centralized reporting structure that logs when and where the license is used. However, in the context of a digital license, this could change.

If the digital license app was programmed to report to the DMV as it was used, such data could be compiled to track citizens' actions. Depending on how the app is designed, this data could include the date, time, location, and the circumstances of the digital license being presented.

Instead of having such a system, any digital license should have authentication protocols that can operate offline without reporting the license usage details to the DMV. This is essential to prevent a digital license from being a tool of systematic state government surveillance.

In addition, there have been plans made in Mississippi to eventually expand the proposed digital driver’s license app by allowing citizens to also include additional state-issued documents such as hunting licenses, real estate licenses, and concealed carry permits. This brings in the question of how much data centralization could eventually be placed into the digital license app.

While the concept of a voluntary centralized digital wallet for government-issued licenses is one thing, there is a potential slippery slope. Already, some in the state have proposed including non-licensing information, such as Covid vaccination cards. At this time, officials have insisted that the option to include other documents in the digital wallet in addition to a standard driver’s license would be strictly voluntary. However, it is important to maintain in the future that the digital ease of adding additional information to a digital wallet should never lead to even more data being requested or digital wallets becoming mandatory.

These are complicated matters that require careful thought and analysis. Yet, despite all of these complexities, the state has had a relatively low amount of public communications on the eventual parameters for the digital license program. For something as fundamental as license identification protocols, and something as complex as mobile app technology, the state should be entirely transparent on the final procedures for development and implementation.

It is essential so that the personal liberty of Mississippians is never compromised for the sake of digital technology. The concept of license digitization comes as no surprise in an increasingly digital world. But the proper guardrails must be in place to ensure that such digitalization is never a precursor for the erosion of individual liberties.

FOR IMMEDIATE RELEASE

(Jackson, MS): The Mississippi Justice Institute and its client, Gulf Coast Restaurant Group, have halted the Biden administration's unconstitutional vaccine mandate for private employers.

The U.S. Fifth Circuit Court of Appeals, on Saturday, temporarily blocked enforcement of the Occupational Safety and Health Administration’s (OSHA) mandate pending further review by the court, finding that there is "cause to believe that there are grave statutory and constitutional issues with the Mandate."

The Mississippi Justice Institute (MJI) represents Gulf Coast Restaurant Group – the corporate family of restaurants such as Half Shell Oyster House and the Rackhouse – in the litigation challenging the vaccine mandate for private employers. Gulf Coast Restaurant Group, like many other businesses, is already struggling with labor shortages and believes that the vaccine mandate will lead to further staffing reductions and harm to its business and customers.

"We are grateful that the court recognized the serious constitutional concerns raised by this mandate and has stayed its enforcement pending further review,” said MJI Director, Aaron Rice. “We will continue fighting to put a permanent stop to this unprecedented federal overreach."

"We are delighted to hear this news from the court,” said Kevin Fish, Vice President of Gulf Coast Restaurant Group. “We know that hard-working Mississippians who were worried about potentially losing their jobs can take a huge sigh of relief."

Attorney General Lynn Fitch represents the State of Mississippi in the lawsuit. "I encourage everyone to consider vaccination, but the decision is yours and the President should not force anyone to vaccinate for fear of losing their jobs, especially not on the cusp of the holidays," said Fitch. "I appreciate Gulf Coast Restaurant Group and the Mississippi Justice Institute standing with me on behalf of the 84 million American workers who will be impacted by this mandate."

This temporary stay represents a major initial victory in the challenge to the Biden administration’s vaccine mandate for private employers. MJI and Gulf Coast Restaurant Group look forward to continuing the fight in court.

Please direct all media inquiries to Stone Clanton, [email protected].