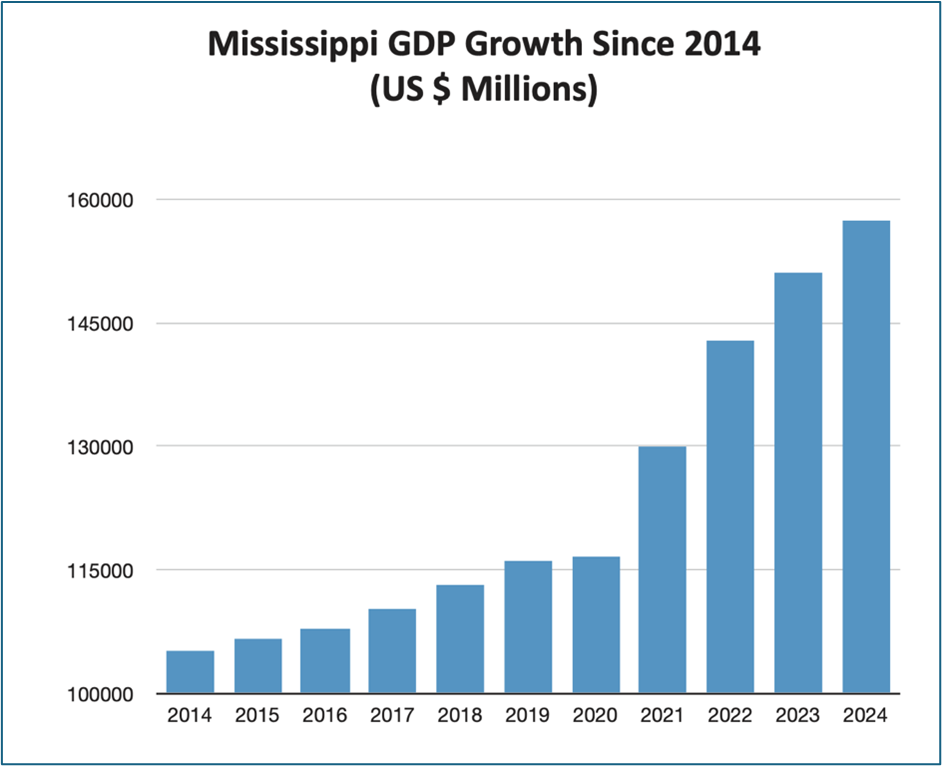

The future for our state looks bright. In just the past five years, Mississippi has seen more economic growth than in the entire fifteen years before that combined.

We’re on track to phase out the state income tax entirely, allowing families to keep more of what they earn. Mississippi has attracted a surge of new investment, and for the first time in years, our workforce participation rate is finally heading in the right direction.

Zoom out, and the picture gets even better. Contrary to the endless gloom from the pundits, the American economy has consistently outperformed expectations for decades. Since the late 1990s, the U.S. has delivered strong, steady growth that few forecasters saw coming.

But there is one dark cloud on all our horizons that we cannot forever ignore; US national debt.

As of today, US national debt stands at $38 trillion (with a capital T).

To grasp how enormous a single trillion really is, try this:

- One million seconds ago was just last week, right before Halloween.

- One billion seconds ago was early 1994, when Clinton was president and the internet was dial-up.

- One trillion seconds ago was roughly 30,000 BC, deep in the Stone Age, when humans were still chasing mammoths.

Now here’s the gut-punch: that $38 trillion mountain of debt has roughly doubled in just the past ten years.

Costly foreign wars, mega bailouts, COVID giveaways and all those federal entitlement programs LBJ said would “end poverty”, eventually add up. (Incidentally, living standards for America’s poorest citizens are light-years higher than when those programs launched in the 1960s (indoor plumbing, air conditioning, smartphones, modern medicine), but the number of people dependent on government assistance is larger than ever).

Rather than pay for all that using tax receipts, the US government has borrowed, issuing IOUs. Today we spend more money servicing all those IOUs than we do on defense.

As my fellow Brit, the historian Niall Ferguson, likes to point out, any great power that spends more on debt servicing than on defense risks ceasing to be a great power. That was true of the Romans and the British, the Habsburgs and the Dutch.

What must America do to avoid a similar fate?

When President Trump was first elected, Elon Musk and Vivek Ramaswamy launched the Department of Government Efficiency (DOGE) with an ambitious target: to reduce annual federal spending by $2 trillion.

Because mandatory entitlement programs - Social Security, Medicare, and Medicaid - remained largely untouched, DOGE hasn’t come close to achieving that yet. The federal deficit has barely budged.

Where, one might ask, are all those Tea Party types that railed against federal overspending ten years ago as the debt to GDP ratio went from 90 percent in 2010 to 125 percent today?

If the US cannot rein in the growth of the debt, the only other way to avoid going the way of the Romans is to try to make the GDP part of the equation rise faster. In other words, to try to grow our way out of the debt.

In order to stabilize debt-to-GDP at the current 125 percent of GDP, America will need to achieve real GDP growth of about 4 - 5 percent for the next 10 to 20 years. With the advent of AI and robotics, as Elon Musk suggests, it could be done.

Put it another way; without an AI / Robotics induced growth surge, US debt will hit 150 – 170 percent of GDP by 2050. Mamdani-economics would then become the least of our worries, as inflation and tax rises became inevitable whoever held office.

The older I get, the more I think that there are two fundamental things that the federal government needs to get under control: mass immigration and the deficit. Do that, and states like Mississippi have a bright future. Don’t, and all the good that we might do will only matter at the margins.

FOR IMMEDIATE RELEASE

October 30, 2025

MISSISSIPPI CENTER FOR PUBLIC POLICY HONORS LEGISLATIVE HEROES AT ANNUAL GALA CELEBRATING STATE SUCCESS

JACKSON, MS – October 30, 2025 –Six of Mississippi’s leading lawmakers were presented with award to honor them for championing principled conservative policy. Rich Lowry, editor of the National Review, presented each of the winners.

Healthcare

Rep. Sam Creekmore and Rep. Hank Zuber were jointly honored for their leadership in challenging Mississippi’s Certificate of Need (CON) laws, which restrict the expansion of healthcare providers and limit patient access.

Countering DEI

Sen. Angela Hill received the award for her early and unwavering stand against the encroachment of divisive DEI (Diversity, Equity, and Inclusion) policies in Mississippi’s public universities. Long before the issue gained national attention, Sen. Hill worked to safeguard academic freedom and institutional integrity at the state’s flagship campuses.

Education Reform

Rep. Jansen Owen was recognized for leading the 2025 legislative effort to expand open enrollment through HB 1435. Though the bill passed the House with broad bipartisan support - uniting parents, educators, and lawmakers - it was ultimately blocked in the Senate.

Income Tax Elimination

Mississippi became the first state since Alaska in 1980 to phase out its personal income tax through HB1. Rep. Trey Lamar and Speaker Jason White were honored as the driving forces behind this transformative reform. Through public town halls, transparent negotiations, and superior policy arguments, the duo outmaneuvered opposition and delivered a pro-family, pro-growth tax cut that is already attracting investment and enhancing Mississippi’s competitiveness.“

These lawmakers represent the best of conservative leadership - courageous, principled, and effective,” said Douglas Carswell of the Mississippi Center for Public Policy. “Their work is making Mississippi a national model for freedom, opportunity, and common-sense governance.”

Mississippi is shedding its image as an economic laggard. Over the past five years, the state’s economic output has grown more than it did over the previous fifteen years combined.

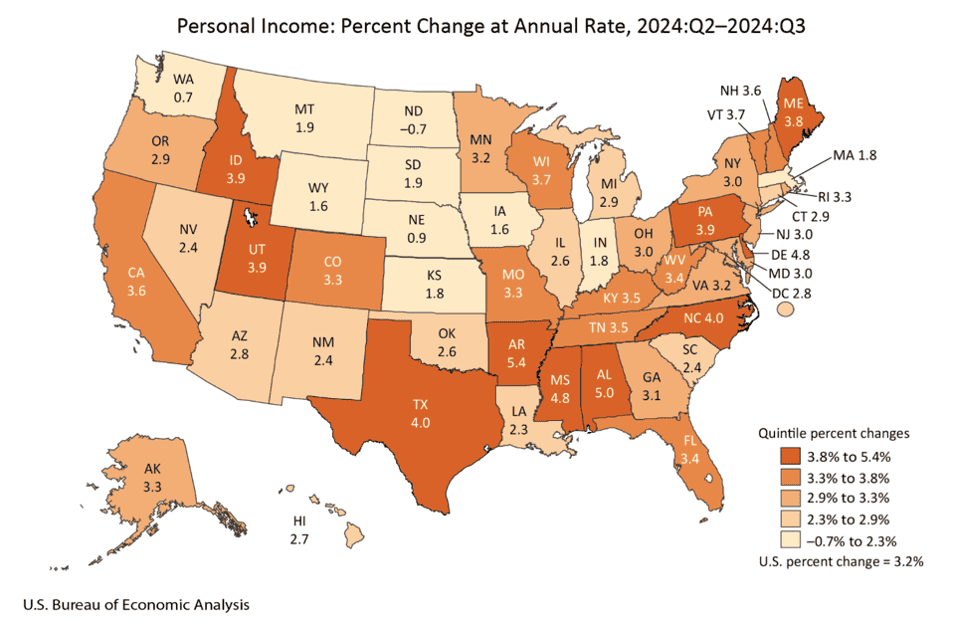

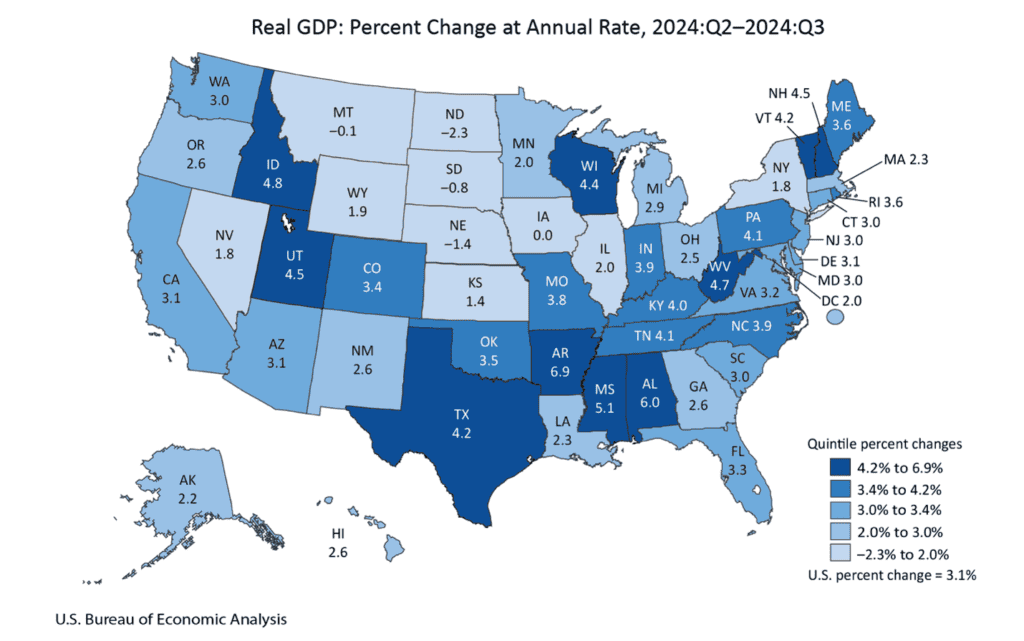

According to the U.S. Bureau of Economic Analysis, Mississippi posted the second-fastest per capita GDP growth and fifth-fastest personal income growth among all states in Q4 2024. Billions in capital investment have flowed in.

This growth is happening across the state—from the Gulf Coast and Pine Belt to DeSoto County, the Jackson metro area, and the university hubs of Oxford and Starkville.

Mississippi whoooooosh!

Mississippi’s recent growth is no accident. It is down to good public policy. Since 2022, Mississippi has implemented transformative tax cuts, reduced the state income tax and lowered the grocery sales tax and easing business inventory taxes. A 2021 law streamlining occupational licensing reduced barriers for workers and entrepreneurs, with the Mississippi Secretary of State reporting a 12% increase in new business registrations in 2023 alone.

Energy in our state is affordable, Mississippi electricity rates averaging 13.43 cents per kilowatt-Hour, helping draw in energy-intensive industries, including two major data centers in Madison and Rankin counties. To top it all, Mississippi’s public universities are fueling growth, and around Oxford and Starkville, entrepreneurial ecosystems are thriving.

But to maintain this momentum, our state needs to abandon policymaking as usual and embrace bold reform. That’s why the Mississippi Center for Public Policy (MCPP) has just launched The Mississippi Miracle? Bold Reforms for Growth.

Our paper details practical steps to sustain and accelerate this momentum:

- Empower Parents Through School Choice: Let families use state funds for public, private, or homeschooling options to drive competition and elevate education standards.

- Refocus Higher Education: Cut administrative bloat, prioritize workforce-relevant programs, and redirect resources from low-value courses to practical, job-focused education.

- Rein in Public Spending: Cap budget growth to population growth plus inflation to ensure fiscal discipline and curb waste.

- Cut Red Tape: Eliminate outdated regulations, repeal Certificate of Need laws, and create a business-friendly environment to spur innovation.

- Reform Public Procurement: Mandate transparent, competitive bidding with regular audits to prevent cronyism and maximize taxpayer value.

- Promote Welfare-to-Work: Emphasize work requirements, job training, and time-limited benefits to foster self-sufficiency and reduce program costs.

These reforms are practical policies that lawmakers can implement to improve lives across Mississippi.

To explore them in detail, visit mspolicy.org under “Publications” or email me at [email protected] for a direct link.

MCPP has a small, but highly productive team. We punch above our weight, producing policy proposals that become law, and helping set the agenda at the Capitol. We are able to do all this because we have the input of so many people across our state. Please read our proposals and share your thoughts—I want to hear what you think.

For decades, Mississippi exported people. Young people in particular tended to leave our state for places like Atlanta, Nashville, Huntsville and Austin.

I believe the tide is starting to turn. I often hear anecdotes of young people moving back to Mississippi. The data suggests that growth in our state is creating opportunities and drawing more people to move here .

Have a read of our report and help us build on this momentum.

At the end of May, Mississippi lawmakers returned for a Special Session to finalize the state’s budget after failing to reach an agreement during the regular session. The result? A more conservative budget.

For years, Mississippi’s budgets were decided behind closed doors over a single weekend during the session. Speaker Jason White and the House changed that by demanding an open, public process.

Speaker White’s commitment to transparency paid off. When Governor Tate Reeves called the Special Session, he urged fiscal restraint. This matters because Mississippi’s general fund has grown far faster than inflation since 2020.

Lawmakers listened, passing a $7.1 billion budget — a modest increase from last year and one of the most fiscally responsible in recent years. The big spend items are $3.3 billion, for education, $1.4 billion for Transportation and $431 million (up from $407 million) to try to improve our dysfunctional prison system.

Speaker Jason White was right all along. When lawmakers decide the budget in public through a proper process, they are more careful with our money. Sunlight truly is the best disinfectant.

One subplot to the budget saga merits attention. Some Senate members made a misguided attempt to cut basic funding for the State Auditor’s department, hindering its ability to function. This echoed attempts by leftist politicians in Washington, D.C., to block DOGE from auditing federal funds.

Every conservative in Mississippi should applaud the House for standing firm and restoring the State Auditor’s funding. The Auditor can continue investigating misuse of public funds. (Why would any politician scheme to block the Auditor from scrutinizing tax dollar spending? Did they really think they could do so and not look ridiculous? If Homer Simpson did political strategy, I doubt he’d make that mistake. It is political positioning 1.0.) Restraining public spending matters in Mississippi for several reasons.

First, all those efforts to pass a law to eliminate the state income tax over the coming year will amount to little unless we continue to maintain a budget surplus. The budget passed will maintain a modest surplus and sets a precedent that puts us on the road to actual income tax elimination.

Second, if Mississippi’s economy keeps growing at a rate of 3-4 percent a year, and the budget only grows by 1-2 percent a year, the size of the private sector will grow relative to the overall economy. This is the only way to lift Mississippi over the next generation from being one of the poorest states in the Union to being one of the richest.

Perhaps the most significant thing about this year’s budget is not just that it is fiscally restrained. It was decided openly and transparently. The days when billion-dollar decisions could be made by a handful of good ole boys at the Capitol in private are coming to an end.

A new generation of leaders is emerging in our state who not only support pro-growth policies. They aren’t willing to keep doing politics like its 1960-something.

What a win! This week, Mississippi made history as the first state in the U.S.—aside from oil-rich Alaska—to pass legislation eliminating the income tax. While nine other states have never had an income tax, Mississippi is blazing a trail by actively dismantling it.

“So what?”, you might say. “Why does this matter if full elimination is still a decade away?” The answer is simple: it’s already transforming our state for the better. Eliminating the income tax makes Mississippi a magnet for growth. Look at Texas, Florida, and Tennessee—three southern states without income taxes that are booming. Even Arkansas recently lowered its rate to stay competitive with us!

Since we began reducing our rate to a flat 4% in 2022, the Mississippi Development Agency reports an extraordinary $25 billion in inward investment. Businesses are flocking here, confident that the payroll tax burden is fading away. This victory isn’t just about economics—it’s a triumph for conservative reform.

Around the Governor’s desk on Thursday evening, we saw bold leadership from Speaker Jason White, Rep. Trey Lamar, and a few dedicated others who fought for this change. We should not forget the role of former Speaker, Philip Gunn, either. Mississippi is, as you know, full of southern charm. One consequence of this is that each time a significant reform passes in the state legislature, there is a tendency to pretend that the change came about because of some kind of kumbaya consensus.

This win came from grit, not just goodwill. Days ago, some were still resisting real elimination. Minds moved because of determined advocacy. This success proves that the roadblocks to reform can be overcome with bold, principled leadership.

There might be a consensus about income tax elimination now, but it is a new consensus, won by bold conservative leaders fighting for it. We salute those that put principle on the line and fought for change!

Mississippi has made history as the first state in the U.S.—aside from oil-rich Alaska—to pass legislation aimed at phasing out its income tax.

This monumental achievement, spearheaded by Governor Tate Reeves and House Speaker Jason White, marks a significant victory for the state. The newly passed bill outlines a plan to eliminate the income tax over the next decade, starting with incremental cuts and followed by a series of budget-driven "triggers."

Beginning next year, Mississippi’s income tax rate will drop in 0.25 percent increments, sliding from 4 percent to 3 percent by 2030. After that, further reductions will hinge on the state’s budget surplus. Given Mississippi’s recent track record of substantial surpluses, the income tax could vanish entirely by the mid-2030s.

So, how did Mississippi become such a trailblazer? It very nearly did not happen.

The push to eliminate the income tax has been a cornerstone of Governor Reeves’ agenda, with serious legislative efforts kicking off in 2022 under then-House Speaker Philip Gunn.

Gunn’s genius was to simplifying the state’s variable tax rates into a flat 4 percent on income above $10,000. While this didn’t eliminate the tax outright, it leveled the playing field for Mississippi households, setting the stage for broader support of full elimination.

Fast forward to this year, when Speaker Jason White and Representative Trey Lamar introduced a plan to phase out the income tax by 2037. Their initial proposal included a partial tax swap, offset by modest increases in gas and sales taxes.

What happened next was both fascinating – and, if you support income tax elimination, rather fortuitous.

The Mississippi Senate has been a constant drag on conservative reform. They have either opposed, or come to grudgingly accept, almost every conservative policy proposal over the past few years, from school choice to red tape reduction. So, too, with income tax elimination.

The Senate, reluctant to fully embrace income tax elimination, opted for a cautious approach. They amended the bill with a "trigger" mechanism, tying future tax cuts to significant revenue growth outpacing spending increases. Some in the Senate perhaps saw this as a clever stall tactic—until a fortunate blunder turned the tables.

The Senate miscalculated the formula, placing a decimal point in the wrong place. Math matters. Something the Senate design as a brake on tax cuts turned out to be an accelerator.

Unless the state government runs a deficit, future surpluses will likely drive steady cuts, and Mississippi – despite the Senate leaderships best efforts – will be as competitive in tax terms as Tennessee and Texas.

Set aside the soap opera, this is great news for our state. Already there is evidence that in 2024, by some measures, Mississippi performed well economically, and may have been one of the fastest growing states in America that year. This tax reform will only add to this Mississippi momentum.

Perhaps what the Senators math missteps shows is that Mississippi now needs to turn its attention to education reforms? If the Senators stopped blocking school choice the way they tried to block income tax elimination, maybe math standards might be better both inside and outside the legislature.

How much do you imagine it costs to send a child to public school in Hinds County every year? $5,000 per year? Maybe $10,000? $15,000?

Actually, according to data from the Mississippi Department of Education, when you divide the number of students attending school by the total expenditure, in 2023-24 Hinds County spent $16,589 per student.

That is more than twice the average private school fees in our state. Indeed, $16,589 is not far off what it would cost to send your child to a top private school.

Now ask yourself if each child in Hinds County is getting a top education for that $16,589? Of course not. A large chunk of the kids can’t read or do basic math. One in three of them regularly skip school.

So, why not give families in Hinds County the right to take a portion of that $16,589 and allocate it to a school of their choice?

It’s not just Hinds County. The same question could be asked in Madison ($17,037 spent for every public school pupil per year) or Rankin ($15,198 per pupil per year), or Canton ($18,683) or De Soto ($13,820).

Even if you take the Department of Education’s own more conservative figure for per pupil spending (which includes all the ‘no-show’ students), Mississippi still spends an average of $14,676 per student.

Despite all that money, 4 in 10 fourth graders in Mississippi public schools cannot read properly. Eight in 10 eighth grade kids in Mississippi were not proficient in math in 2022. One in 4 kids routinely skips school.

Nor has $14,676 per student spending translated into better teacher pay. Notwithstanding recent pay increases, our teachers still earn significantly less than they did in 2010, when you adjust for inflation.

If you happen to be one of the fortunate families happy with the public education options available, great. No need to change and no one is proposing any changes that will affect you. But why not allow those families unhappy how things are the freedom to take their tax dollars to a school that best meets their needs?

Suggesting this provokes outrage not from parents, but from various vested interests who like things the way they are. They like a system that puts the $14,676 they get for your child into their administration budget, rather than the classroom. School superintendents making more than the Governor want to keep control of their multimillion dollar budgets for a reason. It’s a boondoggle for bureaucrats.

School Choice will not impoverish public schools. The legislation that Speaker Jason White is proposing would allow families control over the state portion of funding, not locally raised revenues or federal dollars.

In Hinds County, for example, that would mean families being able to allocate no more than $6,700 of the $16,589 overall per pupil funding. (Rather than depleting Hinds County public schools’ budget, actually it would make Hinds County better off in terms of per pupil spend.)

Giving families control over $6,700 of the state funds will not mean a flood of kids coming into your well run school district. Why not? Because the legislation proposed specifically gives school boards the final say on capacity.

What anti School Choice campaigners really fear is not the “wrong” kids coming to your school. What they fear is that you start wondering what the heck they’ve been doing with the $14,676 they get for your child or grandchild every year.

All of the arguments we are now hearing against School Choice in Mississippi have been heard in each of the surrounding states that have since adopted School Choice.

Alabama’s new Educations Savings Account program, which has just opened for applications, has been wildly oversubscribed. The program provides $7,000 funding per student attending a participating private school, while those enrolled in home education programs are eligible for $2,000 per student.

Arkansas allows all K-12 students access to an Education Savings Account from 2025, into which the state government pays the state portion of per pupil funding ($6,600 per year). Families will be able to use this $6,600 money they are given to pay for their child education, including private school tuition. Arkansas also allows public to public school transfers, allowing districts to define capacity.

Louisiana’s GATOR program starts in 2025-26 and establishes an Education Savings Account for those on low incomes, with the details are still being finalized as the law only recently passed. Louisiana already has public to public School Choice.

Texas and Tennessee, too, are at this very moment debating legislation that would create a universal Education Savings Account for families in those states, too.

None of the scare stories we now hear in Mississippi materialised in any of these neighboring states. None of these states has been bankrupted like the critics claimed by letting mom and dad have parent power. Instead, all the evidence suggests School Choice has started to improve education outcomes.

Did you know that Mississippi is now one of the fastest growing states in America? Only two states saw real GDP rise faster than it did here in the third quarter of 2024.

Were you aware that personal income in our state rose more here than almost anywhere in the US this past year?

New data from the Bureau of Economic Analysis shows that Mississippi is on the up.

For as long as anyone can remember, Mississippi has ranked 50th out of 50. Not for much longer, perhaps. According to this new data, ours’s was one of the top performing states in 2024. If we keep growing for the next few years the way we did in 2024, we won’t be bottom of the class for much longer.

Mississippi’s success is not an accident. It’s a consequence of a number of key free market reforms:

- Labor market deregulation, with an Occupational Licensing law in 2021.

- Tax cuts with legislation to cut the state income tax to a flat 4 percent in 2022.

- Further tax reform to make it more tax efficient for businesses in 2023.

- Education funding reform as a step towards school choice in 2024.

These reforms have begun to energize our state. They make it easier for people to get ahead, for businesses to invest, and for families to spend their income on their priorities. They draw in inward investment, which is changing our state for the better.

If Mississippi is not to lose this momentum, we need to go even further. That is why MCPP has just published a Blueprint for Mississippi – a list of the ten key reforms that would lift our state to the top of the economic table.

The number one reform we need to prosper is school choice. Why? School choice is the only way to be certain of raising standards. The better job we do of educating young people, the greater their chances of leading a prosperous, fulfilling life.

Our Blueprint sets out how we can accomplish school choice, giving every family in our state the choices that today only the very rich enjoy.

To prosper, our state needs less regulation and less government. Our Blueprint sets out proposals to cut taxes further and dismantle the costly, leftist bureaucracy that seems to be in control no matter who you vote for.

Decades of crony cartel politics has stifled innovation in our state. Years of lobbyists cutting cozy deals in the Capitol that commercially advantage their clients has held Mississippi back. A lot of the intentionally restrictive laws that limit health care provision simply need to go. Our Blueprint sets out how to make this happen.

MCPP has been a driving force behind many of the key free market reforms that have helped energize our state. But at every opportunity, crony cartel politics has tried to prevent change.

The crony cartel will try again. It’s what self-serving cartels do. Already they are mobilizing half-baked arguments against school choice. They are lobbying to maintain intentionally restrictive laws that hold back the healthcare economy. Brace yourself for politicians explaining why we can’t afford tax cuts despite a healthy surplus.

In politics, nothing moves unless it is pushed. MCPP won’t just publish our Blueprint. We will push and push hard. Mississippi’s future is too important to let bad politics get in the way.

Mississippi could be on the cusp of transformative changes. If we keep going, we will not only no longer be 50th, but we could become – like Tennessee or Alabama – a state that young people want to move to, not leave.

Download a copy of our blueprint here!

Local mom, Amanda Kibble, is celebrating an important win for her family, and for school choice.

Earlier this year, Governor Tate Reeves signed HB 1341 into law. This new law gives military families in Mississippi the right to transfer their children to any traditional public school around the state, assuming that the receiving school has capacity. Early indications suggest this is extremely popular, with lots of military families using school choice to switch schools.

Amanda, and her family, found out the hard way that the law might not apply to those who serve their country in the National Guard. There was a real risk that Amanda’s son might lose his place at his preferred school.

That’s when Amanda approached MCPP, and we took up her case. MCPP has a long history of fighting for school choice, and our legal arm, the Mississippi Justice Institute has successfully litigated in defense of school choice.

I am delighted that Attorney General, Lynn Fitch, has now issued an opinion that the new school choice law for military families also applies, at least in part, to those in the National Guard. Three cheers for the AG!

If military families now have public-to-public school choice, why shouldn’t everybody? That is exactly what our “Move Up, Mississippi!” campaign aims to achieve.

This week’s win for school choice makes it all the more disappointing that the new State Superintendent for Education, Lance Evans, took a sideswipe at school choice recently.

Speaking at a lunch in Jackson, Evans criticized school choice, suggesting that if a single dollar of public money went into private schools, those private schools should be subjected to the regulatory oversight that public schools are subject to.

Those that oppose school choice, and indeed I suspect Mr. Evans, know full well that extending state oversight across the private school sector would be untenable – which is why they suggest it. But it is not the clever argument against school choice that they might imagine.

Giving every family in our state the right to choose a public school, as military families are now able to do, would not transfer public dollars into private schools.

Amanda Kibble and those military families that now have school choice are not taking money out of public schools. Does Lance Evans oppose their right to choose a school for their child?

MCPP proposes that under a separate program, families that attend private schools, or who home school, could get a tax credit reflecting the fact that they are already paying for a place at a public school that they are not taking.

Evans attack on parent power was not the worst of it. More disappointing was the plodding presentation that preceded it about how amazing education is in our state.

Evans trumpeted the fact that about a third of districts were rated D or F in 2016. Now only a handful are rated D or F. This, he implied, was evidence of progress, rather than a reflection of a broken accountability system.

When officials invoke the broken grading system as evidence of improvement, it is not just the credibility to the grading we should question.

How bizarre, that in a solidly Republican-run state, we have somehow ended up with an anti-school choice official in charge? Are the nine-member State Board of Education aware of Evans’ anti-school choice position? Are the various state leaders that appointed those members of the Board?

Since 2000, the number of students in America has increased by 5 percent. The number of teachers by around 10 percent. The number of education administrators, however, has shot up by 95 percent.

No wonder the education bureaucrats don’t want mom and dad to have control over where their child’s share of the education budget goes. They might start to demand that it goes into the classroom.

Lance Evans talked about making private schools accountable. Private schools already are accountable to every fee-paying parent. The issue is how to ensure that public schools are made similarly accountable, too.

We need to give every family in our state the public-to-public school choice that military families now have.