Gov. Tate Reeves released his first budget recommendation and it largely resembles the legislature’s budget document released a few months ago.

In his fiscal year 2021 budget, Reeves wants to spend 0.2 percent more than last year, an increase of $10.7 million. The 2021 general fund budget would be $6.374 billion, up from $6.363 billion in fiscal 2020, which ends on June 30.

The legislature’s proposed budget would be $6.27 billion.

The Reeves administration wants to spend $100 million in one-time funds for workforce development, which would be spent on:

- Modernization of the state’s community college workforce training apparatus.

- Incentives for high school graduates to earn industrial credentials.

- Exposure of Mississippi high school students to computer science and coding courses before graduation.

- Dual credit programs that would allow high school students to earn credits.

- Creating affordable bachelor’s degree programs in high-growth industries.

- Incentivizing more vocational and technical courses for high schools.

The latest revenue report from December show that tax revenues are $166 million over the estimates.

As for other appropriations, K-12 education would receive an $82.6 million increase (3.2 percent) to $2.656 billion from last year’s outlay of $2.573 billion.

Higher education would be cut by $24 million (2.8 percent) from last year’s appropriation. The Institutes of Higher Learning would take a $15.2 million cut (2.4 percent reduction) from last year’s outlay while community colleges would be cut by $9.1 million or 3.6 percent from 2020.

According to the budget’s executive summary, those cuts were in accordance with the recommendations of the Joint Legislative Budget Committee and were the result of two circumstances of one-time money included in the last budget for specific projects or employee openings that haven’t been filled in 180 days.

With Reeves’ last act as lieutenant governor signing off on the JLBC recommendation, it was no surprise that the two budgets are closely aligned.

Social welfare programs, such as Medicaid, would receive the same level of funding as last year’s appropriation. Corrections would also be level-funded from last year’s appropriation.

The biggest cuts, percentage wise, include:

- The state Oil and Gas Board’s general fund outlay would be reduced by $1 million (32.1 percent) from fiscal 2020.

- Department of Finance and Administration’s general fund appropriation would be reduced by 21.3 percent, shrinking from $65 million in fiscal 2020 to $51 million in fiscal 2021.

- Mississippi Development Authority’s appropriation would be reduced from $27 million in fiscal 2020 to $22.5 million in 2021, a cut of 17.5 percent.

- The Department of Archives and History would have its outlay shrink by 14.5 percent from $11.4 million in fiscal 2020 to $9.758 million in fiscal 2021.

- The Arts Commission would have a $155,912 reduction (9.1 percent) from last year’s appropriation.

Last year, lawmakers appropriated $6.36 billion for the state budget, a figure that balloons to $21.52 billion when federal funds are considered.

In Mississippi, the budget process starts on August 1, when state agencies submit budget.

The JLBC meets every September to hear agency heads make their pitches for their budget requests and to also receive estimates of the state’s tax revenues. The JLBC then meets in November to put together a budget and later releases the budget blueprint in December. The governor also submits a proposed budget as well.

Mississippi's general fund budget is one of the last tasks handled by the legislature before it leaves town in April. The budget is constructed as a series of funding bills for each state agency for the governor to sign into law. The new budget will go into effect on July 1.

For those that enjoyed a cold one during the Super Bowl last night, you paid among the highest taxes in the country for that beer.

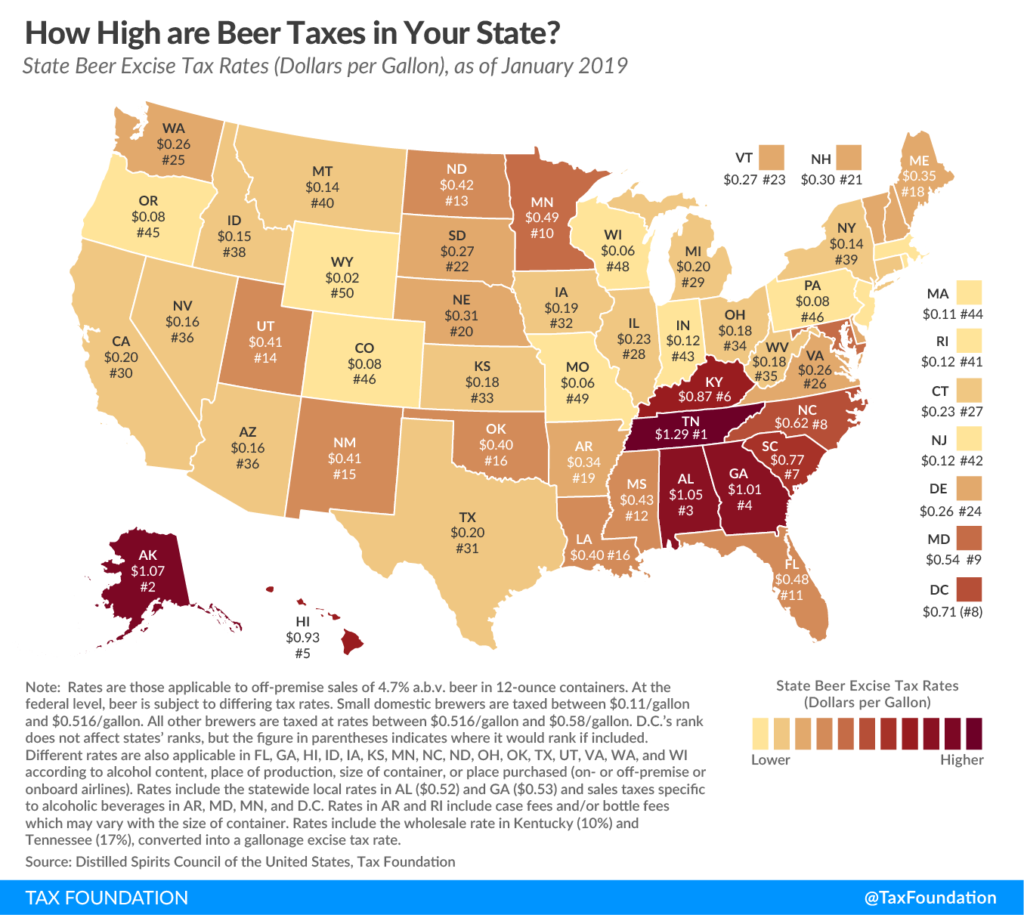

According to the Tax Foundation, Mississippians pay a beer excise tax of $0.43 per gallon. This is the 12th highest rate in the country. Mississippi just looks better than many other Southern states, who have the highest rates in the country.

Tennessee has the highest tax rate at $1.29, Alabama is third at $1.05, Georgia is fourth at $1.01, and Kentucky is sixth at $0.87. Wyoming has the lowest rates in the country at just $0.02.

In Mississippi, like most states, the excise tax is paid by wholesalers on shipments received in the state. That mean the person buying the beer doesn’t actually see it when they checkout. Rather, you will just see applicable sales taxes. But whether you can see it or not, the wholesaler just passes the costs on to the consumer. Thereby, raising the cost for the person purchasing the beer.

But the high taxes are just another example of our modern laws governing the control of alcohol, and continue a long tradition of excess government control.

We have over empowered individual counties to define their own laws, and in so doing have created a chaotic state of regulation, difficult to understand by the average residential citizen, let alone internal and external businesses hoping to sell.

Furthermore, the state has retained an egregious amount of control of the distribution process. Mississippi has decided that, rather than allow private businesses to control the market, it will run a large warehouse in the central part of the state which will have a complete monopoly over the distribution of all spirits and wines.

As the Department of Revenue states on its own site, “the ABC imports, stores, and sells 2,850,000 cases of spirits and wines annually from its 211,000 square foot warehouse located in South Madison County Industrial Park.”

This warehouse consistently operates at capacity, and government leaders are considering a $35 million expansion. Perhaps our politicians ought to consider giving the free market a chance?

There is no reason that our government should be so deeply involved in controlling the distribution for a product. They hike up prices by a tremendous rate, limit access to the product, and determine which brands are allowed to sell in the state, leaving businesses in the dark and unable to control their own wares.

Private businesses are barred from distributing alcohol in Mississippi. While UberEats, DoorDash, and GrubHub have created thousands of jobs in other states through their delivery systems, our legislative leaders have shut down this opportunity for individuals to order alcohol with their delivery.

And while a variety of companies sell and ship wine, whiskey, and other alcoholic beverages around the country, our legislative leaders have determined that we shouldn’t have this freedom of access.

If you were shopping for a gift online, you might find yourself looking at a wine basket, such as those at Wine & Country. However, upon checkout you will be met with the embarrassing notification that your state is one of only three in the entire nation that completely bars the shipment of any wines.

The excess regulation has made Mississippi last in the nation for craft beer development. For comparison, craft brewers currently produce $150 per capita in Mississippi, while they produce $650 per capita in Vermont. Imagine the difference such an industry could make in our state. This is thousands of tangible new jobs which are being discouraged from coming into existence by our government.

Existing policies have led Mississippi to have the largest shadow economy in the nation (referring to the exchange of products that are not taxed or recorded) at 9.54 percent of GDP. Moonshine is either produced or is available in every single county, which many link to the strict regulation of the alcohol industry. Our egregious taxation of alcohol products displayed here by the Department of Revenue has encouraged many companies such as Costco and Trader Joes to avoid opening locations in the state due to the lack of revenue potential on alcoholic products.

Prohibition is alive and well in Mississippi. Our government has decided we apparently can’t be trusted to make basic purchasing decisions for ourselves, so they must control what alcoholic drinks we’re allowed to have access to, how we’re allowed to receive these drinks, and from whom we’re allowed to purchase these drinks.

Be not fooled by the government “do gooders” who proclaim that they carry out policies like this for our own protection. Too many of our political leaders refuse to give freedom a chance, and instead have decided that they know better than we do when it comes to running our lives.

The fact is that while Mississippi prides itself on having a relatively low income tax, it finds dozens of other ways to tax and control its citizens.

Companies are discouraged from entering into business in the state because we have established covert taxes which discourage entrepreneurial risk taking.

Mississippi controls, regulates, and taxes alcohol worse than New York or California, so imagine what other discrete ways it is shutting down job opportunities and discouraging new business.

Mobile, Alabama’s City Council will delay its decision on whether to spend $3.04 million in taxpayer funds on bringing passenger rail service to the city.

The council voted unanimously to postpone the resolution until the next meeting on February 4 on whether to authorize the matching funds for Amtrak over the next three years starting in 2023. This twice-daily service would connect the Port City with New Orleans via CSX trackage that runs along the Mississippi Gulf Coast.

Mississippi has already committed about $15 million in state taxpayer money to the project, with Louisiana adding $10 million. The decision will be one day before a federal deadline to receive the matching funds from the federal government.

Stephen McNair from the Southern Railroad Commission told the council that if the city couldn’t find the funds to pay for the rail service, the train’s terminus would be in Pascagoula.

“I believe this is a train whose time has come and I’m hopeful that we can move forward positively,” Council vice president Levon Manzie said. Manzie sponsored the resolution on the council’s agenda for the rail funding, which was rejected by the council’s finance committee last week.

Gary Knoblock, a councilman at-large in Bay St. Louis, told Al.com that the Mississippi Gulf Coast is all behind bringing rail back to the area.

“I know Alabama has been concerned with the costs and whether it will bring tourists,” Knoblock said. “No one really knows until you do something. Unfortunately, you have to spend money to find out. It’s hard to make decision on something like that without knowing for sure something will happen.

The Federal Rail Administration — under the Consolidated Rail Infrastructure and Safety Improvements Program (CRISI) — is providing up to $32,995,516 in taxpayer funds for improving crossings, bridges, sidings and other infrastructure along the route.

The federal grants that would be provided to enact Amtrak service are meant to get the service online. The first year, the grants would provide 80 percent of the operating costs, declining to 60 percent in the second year and 40 percent in the third.

A 2015 Amtrak study says that a twice-daily train between Mobile and New Orleans would draw 38,400 riders annually and likely cost about $7 million annually to operate. Similar routes have existed from 1984 to 1985 and 1996 to 1997, but both ended because state taxpayer funds were no longer appropriated for that purpose.

The Southern Rail Commission is an Interstate Rail Compact created in 1982 by Congress and consists of commissioners appointed by governors from Alabama, Louisiana and Mississippi.

Senate Bill 2115, sponsored by Sen. Angela Hill, would cap fees paid to outside money managers for the state’s defined benefit pension system and require annual reporting.

The Public Employees’ Retirement System of Mississippi serves most state, municipal and county employees (150,651 active employees and 107,844 beneficiaries) and is only 61.6 percent fully funded.

Its unfunded liability amounts to $17.6 billion or more than three years of all general fund tax revenue. While that liability isn’t due at once, the figure provides an insight into the health of PERS.

Last year, PERS’ plan investments earned $1.7 billion and total service fees represented more than $102 million of that total. In 2018, PERS’ investments earned $2.3 billion and manager fees added up to more than $103 million.

The bill, if signed into law, would require the PERS Board of Trustees to review all investment contracts and reduce investment fees by half by June 30, 2021.

The saved monies would be put back into PERS and the Board would have to report to the legislature on or before December 31 of each year on how much it spent for investment management services.

While this wouldn’t be a huge boost to PERS’ bottom line, reducing the amount PERS pays to outside money managers would allow more money to stay with the fund and provide more capital for investments.

MCPP has reviewed this legislation and finds that it is aligned with our principles and therefore should be supported.

Read the bill here.

Track the status of this bill and all bills in our legislative tracker.

A report by a state watchdog says there isn’t enough evidence to conclude that public prekindergarten programs have a positive long-term impact.

The PEER Committee (Joint Legislative Committee on Performance Evaluation and Expenditure Review) issued a report on the state’s taxpayer-funded prekindergarten program, which began as the Early Learning Collaborative Act of 2013.

The Mississippi Department of Education runs the program, which has received $21,229,151 since fiscal 2017 to assist 14 early learning collaboratives (a district or countywide council that submits an application that involves a public school district) in implementation for 2,200 students.

MDE evaluated the sites (either a public or private school, licensed child care center, or Head Start Center) and found 59 successful and put three on probation.

| Fiscal Year | Legislative appropriation | Funds distributed to collaboratives | MDE administrative costs |

| 2017 | $4 million | $3,833,881 | $166,118 |

| 2018 | $4 million | $3,802,598 | $197,401 |

| 2019 | $6,529,634 | $6,252,161 | $277,472 |

| 2020 | $6,699,517 | *$6,414,826 | *$284,691 |

*Estimates using percentages mandated in Senate Bill 2395

The report also says that MDE should investigative several sites for highly unlikely results on several assessments used to measure whether the program prepares students for kindergarten. It also criticized the MDE for its evaluation criteria for the program participants, which uses a “rate of readiness” score.

The report says the measure fails to adequately measure collaborative and site performance. The MDE, according to the report, has added two more assessment tests to measure the success of grant recipients.

MDE also requires prekindergarten program participants to use a curriculum that PEER says is not evidence based, as required by the authorizing law from 2013. The curriculum, known as Opening the World of Learning or OWL, doesn’t meet the requirements in state law because it has not been tested at multiple, random sites across heterogeneous populations. PEER said the only test conducted found that OWL was worse than another curriculum in comparison.

Collaboratives must match state funds on a one to one basis and those can include local tax dollars and federal funds. Taxpayers pay $2,150 per student for a full-day program and $1,075 for a half-day one.

Also, MDE is prohibited from reserving more than 5 percent of the appropriation for administrative costs and funds can be carried over to the next fiscal year if they’re not used.

MDE has asked for an increase of $3,276,616 over last year’s appropriation of $6,699,517 for the prekindergarten program in fiscal 2021, which starts July 1.

This was PEER’s second evaluation of the program after another report was filed in 2015.

With this year’s session just a week old, the Mississippi Senate has already filed two bills that would increase teacher pay after the legislature passed one in last year’s session.

Senate Bill 2001, authored by state Sen. Dennis DeBar (R-Leakesville), would provide a 2.27 percent increase on average for teachers over the present pay scale or about a $1,000 hike for most teachers.

With Lt. Gov. Delbert Hosemann having already announced Senate chairmanships, the chamber has the advantage in getting legislation onto the calendar. The House will announce theirs this week.

With DeBar recently appointed as Senate Education Committee chairman, SB2001 could be headed to the floor as soon as next week.

The biggest increases would be for the lowest base pay scale, with those with one to four years of experience receiving a 3.09 percent pay hike, improving from $35,890 to $37,000 or a boost of $1,110.

Using the previous pay hike as a guide ($76.9 million for $1,500), this pay hike could cost taxpayers about $51.3 million annually.

Another bill, SB2024, authored by state Sen. David Jordan (D-Greenwood), would increase teacher pay to the Southeastern average. A starting teacher at the lowest certification level would have their pay increase from $35,890 to $40,000 by the 2023-2024 school year.

Teachers are paid according to their certification level and experience and districts can offer more than the base pay. Teachers also receive small annual increases in their base salary and bigger ones when they earn higher certification levels.

These bills are under consideration as the legislature tries to appropriate funds to cover the teacher pay hike from last year.

The Senate has referred a bill, House Bill 1, to the Senate Appropriation Committee that was passed by the House last week. The bill would provide a deficit appropriation of $18.5 million.

The legislature appropriated $58,442,743 in last year’s session based on calculations submitted by the MDE. Those original calculations said there were 31,157 teaching positions. The actual number was 40,991.

A raise passed by the legislature this year would mark the fourth pay hike for teachers since 2000. In 2000, a $337 million plan was enacted over a six-year span. In 2014, a two-year, $100 million plan passed by the legislature increased teacher pay $1,500 in the first year and $1,000 in second.

The push to reduce our regulatory burden has picked up steam in the states, and even Washington, D.C. Will Mississippi join the mix in 2020?

Regulations are restrictions written in Mississippi code. Some are statutory, some are administrative. And these regulations often operate in the dark. We know Mississippi has a code book that consists of 9.3 million words and 117,558 restrictions, but that is only because of the work of James Broughel and Jonathan Nelson at the Mercatus Center at George Mason University.

Why does this matter?

Regulatory growth has a detrimental effect on economic growth. We have a history of empirical data on the relationship between regulations and economic growth. A 2013 study in the Journal of Economic Growth estimates that federal regulations have slowed the U.S. growth rate by 2 percentage points a year, going back to 1949. A recent study by the Mercatus Center estimates that federal regulations have slowed growth by 0.8 percent since 1980. If we had imposed a cap on regulations in 1980, the economy would be $4 trillion larger, or about $13,000 per person.

On the international side, researchers at the World Bank have estimated that countries with a lighter regulatory touch grow 2.3 percentage points faster than countries with the most burdensome regulations. And yet another study, this published by the Quarterly Journal of Economics, found that heavy regulation leads to more corruption, larger unofficial economies, and less competition, with no improvement in public or private goods.

What are we seeing throughout the country?

In Arizona, Gov. Doug Ducey has issued a new executive order requiring three regulations to be eliminated for every new regulation created.

“Since 2015, Arizona has eliminated 2,289 regulations, saving taxpayers over $134 million,” according to the press release. “Today’s executive order also renewed a moratorium on all new regulatory rulemaking by state agencies in Arizona - the sixth year in a row the moratorium has been issued. Agencies may seek exceptions for limited reasons, such as protecting public health or safety, advancing job creation or economic development, or reducing or eliminating burdens or government waste.”

Prior to Ducey’s three out/ one in executive order, the standard had been two out/ one in. The Trump administration issued such a regulation shortly after his inauguration in 2017. In three years, we have seen a 3.5 to 1 ratio when it comes to a reduction in significant regulatory actions. This has eliminated over $50 billion in regulatory costs, according to the administration.

Idaho is the gold standard

In the past year, Idaho has cut 75 percent of its regulationsaccording to Gov. Brad Little’s office to become the least regulated state in the country. Their regulatory count is now just 41,000 restrictions (compared to Mississippi’s 117,000+).

Idaho was in a unique situation because the state legislature essentially repealed their entire state code book when the legislature adjourned without renewing the regulations, something they are required to do each session because the state has an automatic sunset provision. That gave Little’s office the ability to review every regulation and decide what should stay and what could go. The legislature will now have the ability to give approval to the governor’s new administrative code.

Idaho found itself in this position because of an automatic sunset in its law; something that is usually renewed but was not in 2019.

What can Mississippi do?

Mississippi can – and should – join the regulatory cutting game. Here are three actions we can take this year:

- Require each agency to conduct an audit of their own administrative code.

- Require that two regulations be removed from the administrative code for every new regulation that is proposed.

- Enact a sunset provision on every administrative code that requires the legislature to decide whether each regulation should stay or go.

Mississippi’s biggest regulators

Barely three days into session, the Mississippi House of Representatives passed a bill that would fully fund the teacher pay hike passed last session.

House Bill 1 will appropriate $18,446,578 to ensure that the $1,500 pay hike for the state’s 40,991 public school teachers is fully funded through the end of the fiscal year (June 30).

The deficit appropriation bill was passed out of the appropriations committee Wednesday with a vote by the full chamber on Thursday.

The legislature appropriated $58,442,743 in last year’s session based on calculations submitted by the MDE. Those original calculations said there were 31,157 teaching positions. The actual number was 40,991 and the raise will cost taxpayers $76.9 million annually.

The Mississippi Department of Education said in July it conducted an additional review of the number of state-funded teaching positions. MDE officials found that there were additional positions eligible for the increase that weren’t in the Mississippi Student Information System as ones funded by the Mississippi Adequate Education Program, the funding formula that determines how state funds are distributed to the school districts. Only MAEP-funded positions were eligible for the pay hike.

The problem lies in the antiquated MSIS system, which has issues with its interoperability with district systems for data. The issues forced MDE to recount the number of raise-eligible teaching positions by hand.

The legislature appropriated $500,000 as part of MDE’s appropriation to start the process on upgrading it.

The expanded list of teaching positions in addition to classroom teachers, counselors, teacher assistants, and librarians includes specialized positions such as dyslexia therapists, audiologists, and psychologists.

Since 2000, Mississippi teachers have received three pay increases beyond annual step increases. In 2000, a $337 million plan was enacted over a six-year span. In 2014, a two-year, $100 million plan passed by the legislature increased teacher pay $1,500 in the first year and $1,000 in second.

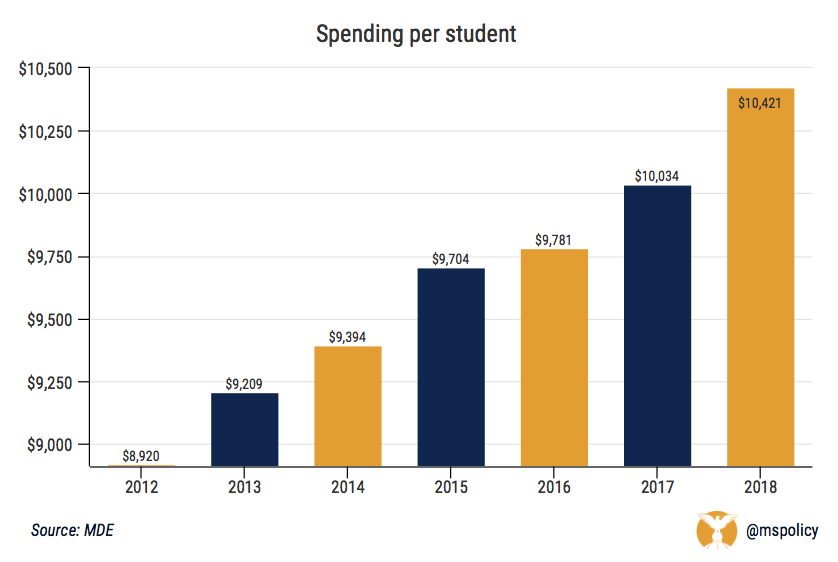

The state of Mississippi continues to see an increase in spending per student.

Last year, Mississippi, including state, local, and federal sources, spent $10,421 per student, according to the Mississippi Department of Education. This total is based on average daily attendance, which was 432,198. The year prior, Mississippi spent $10,034 per student, the first time the state eclipsed $10,000 per student.

Spending per student has continued to increase in Mississippi. In 2012, the state was spending $8,920 per student. It increased to $9,209 in 2013, $9,394 in 2014, $9,704 in 2015, and $9,781 in 2016.

Simultaneous to the increase in per-student-expenditures, the average daily attendance has also decreased each year. While that number was slightly above 432,000 this year, it was 461,000 in 2012. This represents a drop of more than 6 percent. Enrollment numbers decreased again for the 2019-2020 school year, and, presuming education funding is not reduced, the per- student-average will only continue to increase.