Medicaid expansion is likely dead on arrival in the Mississippi House of Representatives, but additional initiatives on addressing job creation and the worsening situation in the Department of Corrections are likely.

House Speaker Philip Gunn (R-Clinton) said at a news conference Tuesday that he’s opposed to expanding Medicaid, but would be open to possible reforms and improvements to the program.

“I’m open minded and will listen to ideas, but in the traditional use of the term Medicaid expansion, no I am not for that,” Gunn said. “I’ve not had more people asking me to put more people on Medicaid.”

He also said workforce development and halting the emigration of recent college graduates to other states — a phenomena known as brain drain — is one of the priorities for the session for the House.

He said he supports the legislature appropriating money to allow all of the state’s high school students to take the ACT Workkeys test, which measures foundational skills required for success in the workplace.

The state already pays to have all public high school juniors and seniors take the ACT test, which uses four benchmarks to measure a student’s readiness for college work.

Gunn said he also supports the possibility of true dual-enrollment so high school students can receive credit for vocational tech classes taken at community colleges.

Corrections could be another issue for the House. A riot and escape from the Mississippi State Penitentiary at Parchman Farm resulted in a lockdown in prisons statewide. In the last 10 days, five inmates were killed in different state prisons, with three of the deaths coming at Parchman.

Gunn says the legislature is dependent on agency heads to keep them informed on issues in their departments. Gov.-elect Tate Reeves is in the process of searching for a new commissioner of corrections.

“Any agency, whether it’s the Department of Corrections, the Department of Public Safety, the health department, they have agency heads,” Gunn said. “We are a legislature that doesn’t meet year round and they have these agency heads that are responsible for the day to day operations.

“We trust the information they provide us and the decisions we make are only as good as the information we have. Hopefully we will have good lines of communications with the agency heads in the next four years and address all of them.”

On teacher pay, Gunn said that was a function of how much money was available. Last year, teachers received a $1,500 pay hike that will cost taxpayers $76.9 million annually.

According to the revenue estimates in the legislature’s proposed budget for fiscal 2021, there could be about $100 million in additional revenue for appropriators.

“That’s not a one-time expense, that’s now and ever more,” Gunn said about a teacher pay raise. “We’ve got to factor in how much the citizens of this state can afford. The citizens of the state bear all of these expenses and we have to keep in mind what the citizens can afford and not overspend.”

The Mobile City Council delayed a decision on whether to provide $3 million in taxpayer funds to restart passenger service between the city and New Orleans.

According to a story on Al.com, council members were set to vote on the possible outlay on December 31, but learned that the deadline for local matching funds for a federal railroad grant was extended from January 6 to February 5.

The council will wait until its January 26 meeting before deciding to commit to providing the taxpayer money, which would be provided over the first three years the twice-daily Amtrak trains would be in operation.

The Federal Railroad Administration not only extended the deadline for local matches for its Restoration and Enhancement Grant program, but increased the amount of available funds by an additional $1.9 million to $26.3 million.

Alabama leaders, most notably Gov. Kay Ivey, have balked about providing funds to restore the service that was ended in 2005 before Hurricane Katrina made landfall on the Gulf Coast.

Mississippi has already promised $15 million and Louisiana will provide $10 million to match more than $33 million in federal grants to upgrade the trackage and other infrastructure.

The three states would have to outlay more than $3.3 million apiece over the first three years of operation to keep the service running.

In addition to the possible money from Mobile for operations, either the state of Alabama or another government in the state would need to provide $2.2 million for capital improvements to the CSX-owned trackage between Mobile and the Mississippi state line.

The Southern Rail Commission is an Interstate Rail Compact created in 1982 by Congress and consists of commissioners appointed by governors from Alabama, Louisiana, and Mississippi. The group is lobbying Alabama leaders to provide taxpayer funds for the project, including $2.5 million for a branch line to connect the CSX tracks to a possible new train station planned for Mobile’s downtown airport at the Brookley Aeroplex.

A plan to shift all air travel from the Mobile Regional Airport west of the city to Brookley is already in progress and city leaders are game to making it a multimodal travel hub. One airline, Frontier, is already offering service from a temporary terminal at the airport just minutes from Interstate 10 and downtown.

A 2015 Amtrak study says that a twice-daily train between Mobile and New Orleans would draw 38,400 riders annually. Similar routes have existed from 1984 to 1985 and 1996 to 1997, but both were put on a permanent siding as the three states declined to provide more taxpayer funds.

A similar passenger train, the Hoosier Line, received $3 million annually from Indiana taxpayers to provide four days per week service between Indianapolis and Chicago. Indiana Gov. Eric Holcomb sliced the money from his proposed two-year budget that was approved in April after ridership fell 18 percent from 33,930 rides in fiscal 2014 to 28,876 in fiscal 2018.

The Federal Rail Administration — under the Consolidated Rail Infrastructure and Safety Improvements Program (CRISI) — is providing up to $32,995,516 in taxpayer funds for improving crossings, bridges, sidings and other infrastructure along the route. Some of this money could also be used by Mobile for a new train station.

These funds would also pay for preliminary engineering and federal environmental reviews needed for another project of the SRC, passenger service between Baton Rouge and New Orleans.

The federal grants that would be provided to enact Amtrak service are meant to get the service operating. The first year, the grants would provide 80 percent of the operating costs, declining to 60 percent in the second year and dwindle to 40 percent in the third.

Scores on the ACT test for both Mississippi high school juniors and seniors decreased from last year, according to data released by the Mississippi Department of Education.

The average composite scores for Mississippi juniors who took the test declined from 17.8 in 2018 to 17.6 in 2019, while the percentage of juniors who met the minimum for all four benchmarks (English, mathematics, reading and science) remained at 9 percent.

Mississippi is one of 15 states that administers the ACT to all of its high school graduates. Mississippi seniors scored an average of 18.1, down slightly from last year’s 18.3.

In 2018, 38 percent of juniors in Mississippi met the standard for English. In 2019, that number increased slightly to 39 percent. Also up was reading (up one point to 24 percent of juniors meeting the standard) and a three-point improvement in science (18 percent of juniors met the standard).

Only 15 percent of 2019 juniors met the standard for math, down from 18 percent in 2018.

Out of the 29,817 juniors that took the test in 2019 in Mississippi, only 2,683 met the standards in all four areas, which is a good indicator of the readiness to take on college-level work. Last year, it was 2,812 out of 31,254 juniors statewide.

Only Nevada (17.9 composite average) scored worse than Mississippi among the states that administer the test to 80 percent or more of its graduates.

Only 46 percent of Mississippi seniors met the standard for English (tied with Hawaii for third lowest), 29 percent met the benchmark for reading (second from the bottom), 20 percent met the math standard (worst among the 80 percent testing states) and 19 percent met the standard for science, tied for last with Nevada.

One interesting trend is how juniors in A-rated and F-rated districts compared. Of the 31 A-rated districts in Mississippi, 12 had their composite scores dip in 2019 from 2018. Ten of those were 0.5 points or more.

The Oxford School District had the biggest drop among the A-rated districts, sliding from 22 in 2018 to 20.9 in 2019.

The biggest increase was the Lafayette County School District, whose ACT score composites went up from 18.2 to 19.5.

Of the 19 F-rated districts, only seven had gains from 2018 to 2019. Two districts, had losses of a point or more. The Humphreys County School District had the biggest drop, sliding from a composite of 15 in 2018 to 13.9 in 2019.

Mississippi’s defined benefit pension fund’s fiscal position worsened after worse than average investment income in 2019 and changes to the way the staff forecasts its future finances, according to the fund’s annual report released on Wednesday.

The Public Employees’ Retirement System of Mississippi — which serves most state, county and municipal employees — now has an unfunded liability of more than $17.6 billion. Last year, it was $16.9 billion.

PERS’ actuarial staff lowered the plan’s future inflation assumption and the amount of salary increases for contributing member, which helped the unfunded liabilities increase by nearly a billion dollars.

The plan’s funding ratio, which is defined as the share of future obligations covered by current assets, shrank from 61.8 percent in 2018 to 60.9 percent, just a tick below 2017 (61 percent). While the plan’s obligations won’t be due all at once, the funding ratio presents a good view of the plan’s financial health.

The general fund tax revenue for the entire proposed state budget for fiscal 2021 is $5.85 billion. Filling PERS’ present unfunded liability would take three years of that revenue.

PERS funding ratio 1998-2019

| 1998 | 2002 | 2006 | 2010 | 2014 | 2018 | 2019 |

| 85% | 83.4% | 73.5% | 64.2% | 61% | 61.8% | 60.9% |

The reason for the worsening financial situation is two-fold: Less money coming in from the plan’s investments and more benefits paid out to an ever-increasing number of retirees.

PERS earned $1.701 billion or a 6.64 percent rate of return on the plan’s investments, after earning $2.385 billion or a 9.48 percent rate of return in 2018.

The plan’s annual average expectation is 7.75 percent return from its investments.

The number of retirees increased from 104,973 to 107,844, a difference of 2,871. The number of active members largely held steady, decreasing just slightly from 150,687 in 2018 to 150,651 in 2019. The ratio of active employees to retirees remained at 1.4 for the second consecutive year.

Benefits paid by PERS to retirees increased by $138 million over last year to $2.7 billion, an increase of 5.3 percent from 2018.

With more retirees and more paid out in benefits than last year, the amount paid as a cost of living adjustment to PERS retirees increased again.

Last year, the plan paid $650 million in COLA to beneficiaries. This year, that amount grew 7.6 percent to nearly $700 million.

As a percentage of benefits paid, the COLA grew from 24.9 percent of benefits paid in 2018 to 25.4 this year.

PERS provides a cost of living adjustment that amounts to three percent of the annual retirement allowance for each full fiscal year of retirement until the retired member reaches age 60.

From that point, the three percent rate is compounded for each fiscal year. Since many retirees and beneficiaries choose to receive it as a lump sum at the end of the year, the benefit is known as the 13th check.

PERS unfunded liabilities (in billions)

| 2009 | 2010 | 2012 | 2014 | 2016 | 2018 | 2019 |

| $9.99 | $11.26 | $14.5 | $14.45 | $16.81 | $16.94 | $17.6 |

PERS actuaries forecast that the plan’s funding ratio — provided that the plan’s investments average 7.75 percent over the next 28 years — will be up to 83.2 percent funded by 2047.

If the plan’s finances average 6.25 percent rate of return, the plan would dip below 50 percent on its funding ratio by 2034 and bottom out slightly above 25 percent by 2049.

Change is possible

The dire situation does not need to continue.

Lawmakers should freeze the program’s overly generous COLA for three years or more. Then either tie it to the Consumer Price Index, which has recorded a rate of inflation of 2.18 percent since 1999 or go back to the old way of computing the COLA as 2.5 percent of the original benefit.

One alternate solution is mimic South Dakota’s approach to its COLA. This state indexes its COLA to the CPI and to the plan’s funding ratio — which is defined as the share of future obligations covered by current assets.

South Dakota has a minimum COLA rate of 2.1, when plan funding level is below 80 percent and a maximum of 3.1 percent when the plan is funded above 100 percent.

New hires should be transferred to a 401k plan that would increase employee contribution rates and allow them to have more control and portability over their money.

By Increasing the employee contribution rate (which now is 9 percent), this would better balance contributions by taxpayers, which have increased eight times since 1990 versus only twice for employees. Only the legislature can authorize an employee contribution increase for PERS and haven’t done so since 2009.

The state retirement system does not need to be unfunded. But it will require action.

As many prepare to hit the roads to travel for the Christmas holidays, Mississippians will be paying less than most at the pump.

According to the daily updated data from AAA, Mississippians are paying $2.21 per gallon. Missouri is slightly less at $2.206 per gallon. Mississippi’s four neighbors range from $2.23 in Louisiana to $2.30 in Tennessee.

Residents of Simpson county are paying the least for gasoline at $2.08 per gallon. Residents of Alcorn, Desoto, Hancock, Harrison Jones, Marion, Prentiss, Stone, Tate, Warren, and Yazoo are all paying $2.15 or less per gallon.

In the metro area, gas is $2.18 per gallon in Rankin county, $2.20 in Madison county, and $2.22 in Hinds county.

Californians are paying the most among the continental U.S., at $3.62 per gallon. Two counties in the state are posting averages of over $4.00 per gallon.

A significant amount of attention was dedicated to Mississippi’s gas tax during the 2019 elections, with an emphasis on raising it from candidates in both parties.

In the Republican gubernatorial primary, former Supreme Court Justice Bill Waller supported a gas tax increase as did Democrat Attorney General Jim Hood. Gov.-elect Tate Reeves, who defeated Waller in the primary and Hood in the general election, opposed a gas tax increase on his way to victory.

Still, there are others in powerful positions who have voiced support for at least some type of gas tax increase. And the numerous transportation related associations are not likely to give up their continual efforts to raise taxes.

But does a high gas tax correspond with a highly rated highyway system?

Not necessarily, according to an analysis that compared gasoline taxes by state and rankings from the Reason Foundation’s recently released annual Highway Report.

None of the top 10 states scored for highway efficiency and cost effectiveness were among the top 10 in the amount of gasoline tax levied on consumers. The top 10 states averaged 25.25 cents in taxes per gallon, just slightly above 24.85 cent per gallon nationwide average from the American Petroleum Institute.

Mississippi has the third lowest gasoline tax nationally (18.79 cents per gallon) and yet its highway efficiency and cost effectiveness was ranked 25th by Reason.

Out of the five states with the lowest gasoline taxes, only Alaska (49th overall) and Oklahoma (41st overall) were near the bottom.

Conversely, none of the states with the highest gasoline tax scored higher than Mississippi in the overall score, the best being Illinois at 28th. The Land of Lincoln hits motorists with a 54.98 cent tax on every gallon of gasoline.

California has the nation’s highest gasoline tax at 61.20 cents per gallon, yet it only ranked 43rd overall in the Reason Foundation report. Pennsylvania (35th in the report) has the next highest gasoline tax nationally at 58.7 cents per gallon.

Missouri was ranked third overall and its gasoline tax (17.42 cents per gallon) is the lowest in the country, yet its rural interstate pavement condition was 17th best and it also scored highly for capital and bridge disbursements per mile (second) despite having the seventh-largest state-controlled highway system nationally.

Mississippi was ranked 25th by the Reason Foundation overall, with its score bolstered by high marks for high maintenance disbursements per mile and low urban congestion.

While the Mississippi legislature has opted against raising the gas tax, the Mississippi Infrastructure Modernization Act of 2018 will send 35 percent of use tax revenues by next year to cities and counties to assist with infrastructure.

The bill will additionally authorize $300 million in borrowing, with $250 million for the Mississippi Department of Transportation and $50 million for local infrastructure not administered by MDOT.

The other part of the package was the creation of a lottery, which started selling tickets just a couple weeks ago. The first $80 million in tax revenue annually will go to the state highway fund until 2028 and the rest will be put into the Education Enhancement Fund. Just the highway fund portion alone could add up to $720 million.

State gasoline taxes are levied in addition to the federal tax of 18.4 cents, which hasn’t been increased since 1993.

The cost of going by rail to New Orleans from Mobile will likely be prohibitive for most tourists, according to analysis by the Mississippi Center for Public Policy.

Even the best-case scenario for a train trip and rides to two tourist areas — Jackson Square and Uptown — would cost 65.8 percent more than driving by car, which includes parking near Jackson Square.

Our hypothetical trip, either by rail or by car, would involve our family of four visiting the area around Jackson Square — where the Aquarium of the Americas, the beignets and coffee of the Café Du Monde, the St. Louis Cathedral and the Louisiana State Museum Cabildo are within easy walking distance — and the Audubon Zoo in Uptown.

Just round-trip train tickets would cost a family of four at least $144 (if the one-way ticket was $18 per person) or as much as $288 (if the ticket was on the high end of estimates at $30 per person one way).

Adding in rides from Uber (during non-peak hours) to get to some attractions from the train station in the New Orleans Central Business District and the cost balloons to $189.87 (low end of train ticket estimates) to as much as $333.87 at the top end.

The best-selling car in Alabama and Mississippi is the Nissan Altima, which has a 16-gallon gas tank and gets 39 miles per gallon on the highway. With regular gasoline costing $2.14 per gallon in Mobile, a tank of gas would cost $34.24.

Parking at Harrah’s New Orleans casino parking garage is $5 per hour. Assuming a three-hour excursion to Jackson Square would cost $15.

Parking at the Audubon Zoo is free. The total by car adds up to $49.24. Using the standard federal mileage reimbursement rate still is cheaper than rail at $83.52.

Regardless of whether tourists decide to go by rail or if by car, taxpayers will be heavily subsidizing the $65.9 million project.

Mississippi has already committed about $15 million in state taxpayer money to the project, with Louisiana adding $10 million. Alabama is balking on whether to provide its share of the matching funds.

The Federal Rail Administration — under the Consolidated Rail Infrastructure and Safety Improvements Program (CRISI) — is providing up to $32,995,516 in taxpayer funds for improving crossings, bridges, sidings and other infrastructure along the route and adding a railroad station in Mobile.

A 2015 Amtrak study predicted that 38,400 passengers would utilize restored rail service, which was ended in 2005 before Hurricane Katrina made landfall, across the Gulf Coast.

It would also operate, according to the study, at a loss of $4 million that would have to be covered by subsidies from state and local governments.

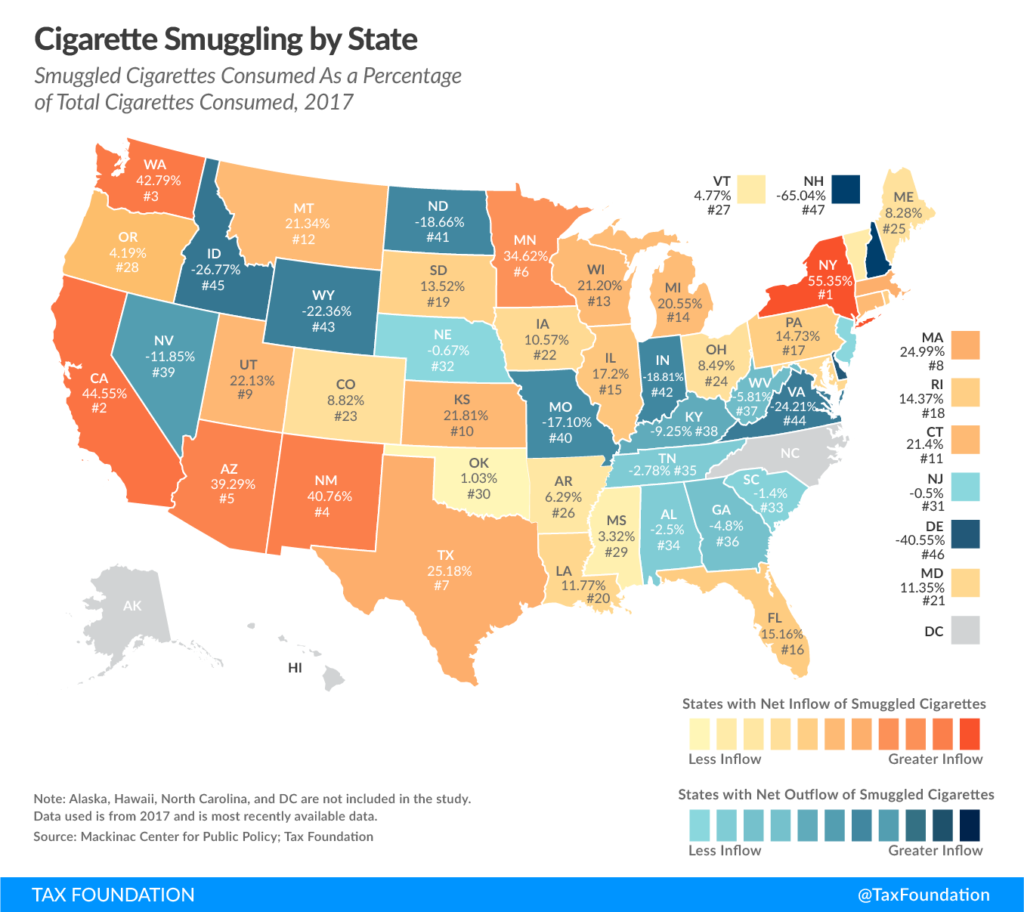

Mississippi has a small inflow of cigarettes that are smuggled from other states. A decade earlier, prior to raising taxes on cigarettes, the state has a small outflow.

That is according to a new analysis on cigarette smuggling from the Tax Foundation.

Cigarette taxes are one of the easier targets for lawmakers looking for additional revenue as you combine a large network of health advocates pushing for the tax and a shrinking, unsympathetic demographic of smokers.

That is why cigarette taxes have routinely been floated in the legislature since the last increase in 2009. Even though we know the unintended consequences, particularly with a massive hike such as the 221 percent increase that was unsuccessful last year.

Mississippi has a mild inflow of smuggled cigarettes at 3.32 percent, according to a new analysis from the Mackinac Center for Public Policy and the Tax Foundation. That means for every 100 cigarettes that are consumed in Mississippi, three are smuggled from other states. That is 29th highest in the country.

Mississippi is surrounded by states to the north and east that have lower (though slightly lower in some cases) taxes, including Alabama, Georgia, Kentucky, Missouri, and Tennessee. Each of those states actually have a positive rate of outbound smuggling, ranging from 2.5 percent in Alabama to 17.1 percent in Missouri.

In a review of cigarette smuggling in 2006, prior to the most recent tax hike, Mississippi had a small outbound rate of 1.7 percent.

The estimate is built around a statistical model which measures the difference between smoking rates published by the federal government for each state and legal paid sales. There are often yawning gaps between the two — the amount of cigarettes that should be smoked based on sales and the amount of smoking that actually occurs — and that difference is probably explained by smuggling.

The model can be used to make “what-if” estimates based on proposed changes in tax rates, as compiled by the Mackinac Center last year. At an excise tax of $2.18 per pack, as proposed in 2019, smuggling would leap from the current rate to 35 percent of the total market. That is, of all the cigarettes consumed in Mississippi after such a tax hike, 35 of every 100 cigarettes would be smuggled.

The model also reports that 21 percent of all consumption would be a function of “casual” smuggling. Casual smuggling is represented by individuals who typically buy lower-taxed smokes elsewhere for personal consumption.

The evidence from around the country and elsewhere tells us that relatively high cigarette excise tax rates can produce every sort of mischief, including undermining the very health goals such taxes were adopted to address.

The Mississippi legislature released its proposed fiscal year 2021 budget Wednesday, which will cut $93.7 million from last year’s total in state funds.

Last year, lawmakers appropriated $6.36 billion on the state budget, a figure that balloons to $21.52 billion when federal funds are considered.

This year’s proposed 2021 budget would reduce that to $6.27 billion (state funds) and $21.19 billion with federal funds included.

These funds include the general fund, Education Enhancement, Health Care Expendable, and Tobacco Control funds. Just the general fund alone is $4.9 million less than last year’s appropriations.

Legislators will also have $100.3 million more to appropriate, as the state’s tax revenue collections as evidenced by the November revenue report, are $135.5 million above the revenue estimate for this year’s budget.

Among the recommended appropriations in the proposed budget include:

- $18.5 million to fund the teacher pay raise shortfall (deficit appropriation) due to the Mississippi Department of Education’s underestimate of the number of raise-eligible teachers due to problems with their computer system.

- $4.4 million for a new 60-graduate state trooper school. These new troopers will hit the road in fiscal year 2021.

- A $977,415 increase for the Department of Public Safety to fund officer pay increases.

The JLBC also recommends that the state defund most vacant positions and delete 3,406 of those unfilled jobs while reducing funding for travel and contractual services. The state’s so-called “rainy day” fund, known as the Working Cash Stabilization Reserve Funds, is up to $678 million.

By law, lawmakers have to set aside two percent of state tax revenue each year to keep the fund filled and protect vital government services from revenue shortfalls during economic downturns.

The 2021 proposed budget would provide a slight increase for K-12 education ($9.54 million or 0.37 percent) from last year’s outlay and reduce the appropriation for the state’s universities by $18.1 million (2.56 percent).

Community colleges would also take a $9.1 million cut from the 2020 budget (3.61 percent cut).

The recommendation by the Joint Legislative Budget Committee isn’t binding and the real number won’t be known until the session’s end in May, when the appropriation bills for each agency are passed into law by the legislature. The fiscal 2021 budget won’t go into effect until July 1.

In Mississippi, the way the budget process works is state agencies submit budget requests by August 1.

The JLBC meets every September to hear agency heads make their pitches for their budget requests and to also receive estimates of the state’s tax revenues.

The JLBC meets in November to put together a budget and later releases the budget blueprint in December

The governor also submits a proposed budget as well.

Alabama’s resistance to providing taxpayer money for passenger rail service between Mobile and New Orleans could put the project on hold.

At a meeting of the Southern Rail Commission on December 6, commissioners discussed how to get Alabama leaders to agree to provide taxpayer money to get twice-daily passenger trains that could cost at least $65.9 million in capital outlays.

The service between Mobile and New Orleans would cost each state $3.045 million annually to operate and Mississippi and Louisiana have already committed to providing their shares. Alabama leaders, including Gov. Kay Ivey, are balking about providing taxpayer funds.

“When you start a new rail line, you have to grow ridership. The cost of operating the train the first two or three years is why we need a source of funding,” said John Spain, an SRC commissioner from Louisiana.

Alabama’s resistance could prove to be the project’s undoing, as Federal Rail Administration grants for restoration and enhancement for rail infrastructure could be reduced or even scrapped for 2020.

John Robert Smith, former Meridian mayor and Transportation for America chairman, told the commission that there’s no guarantee of an appropriation for 2020 Restoration and Enhancement grants.

Mississippi has already committed about $15 million in state taxpayer money to the project, with Louisiana adding $10 million. The commitments, according to Smith, would be due a year after the first trains began operation.

The Federal Rail Administration — under the Consolidated Rail Infrastructure and Safety Improvements Program (CRISI) — is providing up to $32,995,516 in taxpayer funds for improving crossings, bridges, sidings and other infrastructure along the route and adding a railroad station in Mobile.

These funds would also pay for preliminary engineering and federal environmental reviews needed for another project of the SRC, passenger service between Baton Rouge and New Orleans.

The federal grants that would be provided to enact Amtrak service are meant to get the service online. The first year, the grants would provide 80 percent of the operating costs, declining to 60 percent in the second year and 40 percent in the third.

The SRC says the rail service is the final piece of the puzzle for the Gulf Coast’s post-Katrina future.

“We’re sitting in millions of dollars of investment made after (Hurricane) Katrina that is really starting to pay off,” said Knox Ross, commissioner for Mississippi and former Pelahatchie mayor. “You see cities that have leveraged federal investments from Katrina recovery funds that give them downtowns where people want to walk around in, want to live in.

“One piece of the puzzle that is missing is a way to get people here, get them around. That’s what the train is about and it can get people to the downtowns of the cities while connecting the bookends of our coast, Mobile and New Orleans.”

A 2015 Amtrak study says that a twice-daily train between Mobile and New Orleans would draw 38,400 riders annually. Similar routes have existed from 1984 to 1985 and 1996 to 1997, but both ended because state taxpayer funds were no longer appropriated for that purpose.

A similar passenger train, the Hoosier Line, received $3 million annually from Indiana taxpayers to provide four days per week service between Indianapolis and Chicago. Indiana Gov. Eric Holcomb cut the money from his proposed two-year budget that was approved in April after ridership fell 18 percent from 33,930 rides in fiscal 2014 to 28,876 in fiscal 2018.

Already, other federal money is being earmarked for needed improvements on the existing tracks, which are owned by freight carrier CSX. Service between Mobile and New Orleans was ended in 2005 before Hurricane Katrina made landfall on the Gulf Coast.

Another CRISI grant of $8 million for rail infrastructure is going to the Port of Pascagoula, where it will help provide transportation for wood pellets from a soon-to-be built mill near Lucedale.

A 13-year-old earmark from late Sen. Thad Cochran of $846,000 would help Pascagoula build a platform for the potential service.

Commissioners also said there will be another Amtrak inspection train running along the Gulf Coast route within 24 months. The last one ran in 2016.

Commissioners also discussed a study done by Jacksonville State University concerning passenger rail service between Birmingham and Mobile. Operating such a train would cost between $12 million and $32 million to operate annually and would result in $23.6 million per year in additional tourism spending.

The study used similar methodology to a study by the University of Southern Mississippi that said that restoring passenger rail service could generate $282.58 million for the Magnolia State’s economy.

The SRC is an Interstate Rail Compact created in 1982 by Congress and consists of commissioners appointed by governors from Alabama, Louisiana and Mississippi.