More than 40,000 Mississippians have moved off food stamp rolls over the past year, representing a decline of almost nine percent in the state.

According to the most recent data, 446,420 Mississippians were on food stamps, or the Supplemental Nutrition Assistance Program (SNAP), in August. In August 2018, that number was 489,938. Mississippi’s 8.8 percent decline was sixth highest nationally, behind only Georgia (14.4%), Indiana (14.1%), Kentucky (11.7%), New Hampshire (11.6%), and Delaware (9.6%).

Over the past several years, Gov. Phil Bryant and the legislature have moved to restore work requirements for able-bodied, childless adults who receive food stamps. This has the bonus effect of moving individuals into work and off dependency, while reducing the taxpayer burden of such programs.

A recently released report by the Foundation for Government Accountability says that work requirements have saved taxpayers $93 million since Bryant restored them in 2015 for able-bodied, childless adults who participated in SNAP.

Food stamp enrollment, according to the report, began to drop immediately in Mississippi and had fallen by 72 percent by October 2018. The drop isn’t unprecedented, as two states, Arkansas (70 percent reduction) and Florida (94 percent) posted similar numbers after instituting similar work requirements for SNAP.

Also, since 2016, the average amount of time spent in the SNAP program for able-bodied recipients in Mississippi has dropped by 60 percent.

The study shows that work requirements have decreased dependency on taxpayers by able-bodied, childless adults. According to data from the U.S. Department of Agriculture, 85 percent of these adults on food stamps weren’t working at all in Mississippi in 2015.

Those former SNAP recipients received jobs in 716 different industries and only 23 percent of them are still working in entry-level jobs such as fast food or retail. Their incomes grew by 64 percent within three months of leaving welfare.

After a year, those incomes increased by 98 percent within a year and 121 percent for those who’d left the food stamp program 18 months before.

“Conservative policies are working, and Mississippi is continuing to reap the benefits of welfare reform,” Bryant said on Twitter. “After implementation of food stamp work requirements we have seen significant improvements.”

Bryant’s administration launched a study to track results of the work requirements, as the Mississippi Department of Human Services worked with the state Department of Employment Security, the National Strategic Planning and Analysis Research Center at Mississippi State University, and FGA to track wages and the industries entered by former welfare recipients.

Up until the mid-1990s, there had been little effort at the national level to end dependence on welfare.

In 1996, then-President Bill Clinton signed into law the Federal Welfare Reform Act. It transitioned a permanent entitlement program known as Aid to Families with Dependent Children to a temporary block grant program known as Temporary Aid to Needy Families or TANF.

The new law also established work requirements for SNAP, which were later watered down as the federal government granted waivers for states to eliminate these rules for some segments of the population.

In 2015, Bryant restored the work requirements by ending the work requirement waiver. Those able-bodied childless adults who met the work requirements could stay on the program, but those who failed the meet the standard were terminated from the program starting in the first quarter of 2016.

More reforms for the state’s welfare system were still to come.

In 2017, Bryant signed into law House Bill 1090, also known as the Act to Restore Hope Opportunity and Prosperity for Everyone. Authored by state Rep. Chris Brown (R-Nettleton), the law required eligibility monitoring for Medicaid, TANF, and SNAP and required the state agencies to share eligibility data. It also enshrined the end of the state’s work requirement for SNAP into state law.

It also mandates that state agencies administering welfare programs verify residency and immigration status and bans the use of the EBT cards at ATMs at liquor stores, strip clubs, casinos, and other questionable businesses.

Thirty states still have partial time limit waivers for the food stamp program, while Mississippi is one of 17 states that have no waivers.

State Auditor Shad White ordered Mississippi Bureau of Narcotics Executive Director John Dowdy to pay back $30,122 to taxpayers over compensatory time buy-backs and a clothing allowance.

The auditor’s office issued the routine compliance audit Thursday and the crux of why Dowdy will have to pay back the money is whether he is a sworn law enforcement officer. The MBN says that because he was sworn in as director, he is able to enforce the state’s laws and carry a firearm.

The auditor’s office says that he hasn’t met the certification standards granted by the Board of Law Enforcement Standards and Training to be considered a law enforcement officer. He never graduated from a law enforcement academy and was supposed to complete his certification a year from his hiring on November 1, 2016.

A formal finding by the MBN and the Department of Public Safety on Dowdy’s status is due a week from the audit and any amounts due to the state would have to be repaid in a week. If the MBN finds that Dowdy is not a sworn law enforcement officer, the DPS will have to reimburse the state for $313,261 for employing the director after he failed to receive certification.

Dowdy ordered his staff to buy compensatory time on five separate occasions. This is paid time off earned for working past traditional work areas. Agencies are allowed to pay employees for compensatory time in lieu of time off from work.

Sworn law enforcement officers are allowed up to 300 hours, according to DPS regulations, of compensatory time, while other, regular employees are limited to 100 hours. Dowdy, from May 31, 2017 until December 14, 2018, accrued 529 hours of leave, 129 hours more than the standard of a law enforcement officer and 429 more than those for regular employees.

According to state law, the public safety commissioner (MBN is a branch of the DPS which includes the state’s crime lab and state trooper force) has to authorize the buy backs and only one of those times did Public Safety Commissioner Marshall Fisher provide permission via a memo.

The buybacks added up to $27,662 and were done over the objections of several on the MBN staff.

Dowdy also spent $2,450 in state funds on clothing, which was against the law according to the audit since he isn’t a certified law enforcement officer. Law enforcement officers are authorized a clothing allowance by state law.

Dowdy’s spending included:

- $1,244 for polo shirts, pants, sport coats, ties, and other items.

- $1,011 for boots and belts.

- $195 for Cole Haan shoes.

The auditor’s office also chastised the department for its accounting practices, reporting that MBN didn’t perform a proper monthly reconciliation for the nine bank accounts the agency holds outside of the state treasury.

Also, the department bought higher-grade gasoline on 10 percent of purchases, which goes against state regulations, which only allows regular unleaded or diesel fuel to be bought with the state Fuelman credit cards.

Five MBN employees were allowed to use agency vehicles for commuting, including Dowdy and the department didn’t record fringe benefits for the employees. This added up to $3,720 in fringe benefits in 2018.

The audit isn’t the only controversy weathered by the agency in recent months.

Former MBN chief of staff and counsel Allison Killebrew resigned on October 8. In her resignation letter, she said “I lost in faith in your (Dowdy’s) ability to do the right thing for the employees of MBN and the state of Mississippi many months ago.”

As families across the country assemble to celebrate the holidays, the nation’s largest teacher union, of which the Mississippi Association of Educators is a member, is encouraging its members to politicize the gatherings.

MAE is the state affiliate of the National Education Association, and dues from the local union support activities of the national union. Including NAE Ed Justice, which wants to see families “ring in justice this holiday season.”

How can they do that? Skip the talk about your kids, job, or the deer you killed this morning. Instead, open your meal with “conscious questions.” Such as:

- How do your beliefs about your culture and/or your faith influence what you value?

- How do these values influence your perspectives on racial and social justice?

- If you could fix one social problem this year what would it be?

- What is one commitment that you’re making this year to advance justice?

And, naturally, the kids should be involved as well. Recommended questions at the kids table:

- Did you learn anything new this year about a group of people different from you?

- Did you read a book or story that made you rethink your ideas about someone or a group of people?

We should also bring in new symbols to our holiday gatherings. Beyond lights, candles, and other common decorations, here are how the wokest among us symbolize the holidays:

- An empty plate – to symbolize all who are experiencing hunger and loss.

- A glass of water – to symbolize the need to protect access to clean water in all communities.

- A bell – to symbolize a way to pierce the silence in the face of all forms of oppression including racism, anti-Semitism, xenophobia, misogyny, and homophobia.

NAE is no stranger to delving into virtually every left-wing political issue, far beyond the teaching of social justice in public education. At their recent convention, NAE affirmed a new business item that reads:

“The NEA will include an assertion of our defense of a person’s right to control their own body, especially for women, youth, and sexually marginalized people. The NEA vigorously opposes all attacks on the right to choose and stands on the fundamental right to abortion under Roe v. Wade.”

This is a sharp change from prior years when they attempted to walk more of a middle ground on abotion, saying they support “reproduction freedom,” not abortion, while bragging about not spending money in regards to pro-abortion legal services.

As we have seen with the left, abortion has moved from “safe, legal, and rare,” to legal until the moment of birth and funded by taxpayers. And if you disagree with that you are evil, anti-woman, and essentially support violence against women.

But the bigger question is, is it necessary for the NEA, or its affiliates, to take a position on abortion? NEA is certainly a left-wing organization, that has never been in doubt. But, what does abortion have to do with education or teachers?

One might presume a rejected item that calls for a renewed emphasis on quality education would be more in line with the NEA. That read:

“The National Education Association will re-dedicate itself to the pursuit of increased student learning in every public school in America by putting a renewed emphasis on quality education. NEA will make student learning the priority of the Association. NEA will not waiver in its commitment to student learning by adopting the following lens through which we will assess every NEA program and initiative: How does the proposed action promote the development of students as lifelong reflective learners?”

But, alas, the union rejected those ideas.

Amazon is bringing another of its distribution hubs, known as fulfillment centers, to north Mississippi and will receive $2 million in infrastructure funding and local tax breaks to do it.

The online retail giant announced this week that’ll bring the fulfillment center to Olive Branch that will eventually employ 500 workers.

According to Mississippi Development Authority spokesperson Melissa Scallan, taxpayers will provide $2 million in road improvements for the facility. Also, Desoto county will negotiate a fee-in-lieu agreement for the project which will likely involve the fulfillment center’s property taxes.

According to the release from the MDA, the million-square-foot warehouse will ship large customer items such as sports equipment, patio furniture, kayaks and bicycles.

“This announcement serves as a shining example to industry leaders around the globe that Mississippi plays to win,” Gov. Phil Bryant said in an MDA news release. “We offer a supportive business climate and integrated transportation network so companies with shipping needs, such as Amazon, can reach their customers in rapid time and remain a step ahead of their competition.”

Some of the other taxpayer-funded economic development projects in Desoto county include:

- Medline Industries will receive $3.8 million from state taxpayers to build a medical supply distribution center Southaven in Desoto county that will employ 450.

- German agricultural equipment company Krone, which moved its headquarters and 45 jobs across the state line from Memphis to Olive Branch, will receive $7.3 million in property and inventory tax breaks in addition to a $250,000 equipment relocation grant. The company could also receive some income tax rebates that could add up to $675,000 annually over the next decade.

- O’Reilly’s Auto Parts will receive $300,000 to transform a 580,000-square foot warehouse into a new distribution center that will employ 380.

From 2012 to 2017, taxpayers have spent $678 million in just MDA grants alone from 2012 to 2017.

Select incentives for a few may generate headlines or photo-ops, but it does not generate sustained economic growth.

Economic development policy really means the state picking the winners and losers by employing direct subsidies and tax breaks to attract or promote specific businesses or industries. An authentic effort to grow our economy would not focus on giving targeted companies the assistance and resources without providing those to all companies and industries.

It is not fair to the current companies in Mississippi, who built their businesses without government help, to find themselves competing with companies subsidized by taxpayers. For too long, Mississippi has followed a policy that supposes “economic development” can be a meaningful driver of economic well-being in the state. It cannot. That policy is a losing one.

The evidence produced from analysis points convincingly to the conclusion that these targeted incentives do not produce long-term benefits in excess of their costs. In many cases, the cost-per-job is extraordinarily high. While some high-profile companies and their political allies may be better off, non-beneficiary companies may lose workers or experience wage increases, or both, and the state’s economic activity as a whole slows.

When political favor seeking is emphasized like this, it thwarts the private sector and tips the scales in favor of those companies and individuals with access to political relationships. It sends a message to the private sector that it should not focus on consumer-oriented actions, like product/service innovation or marketing, and focus resources instead on lobbying, legal representation, and elections. That’s not a recipe for sustained economic growth.

And we should also acknowledge the opportunity costs of corporate welfare. By eliminating corporate welfare, Mississippi, and every state in the nation with income taxes, could reduce their personal and corporate income taxes for everyone. Or, the money that is sent to select industries could instead be used for infrastructure, healthcare, education, law enforcement, or other basic functions of government.

Rather than increase the hand of government in our economy, we should trust the “invisible hand” of the marketplace and the proven incentive of profit and loss for the allocation of resources.

Public school enrollment declined for the eighth straight year in the state, according to new data from the Mississippi Department of Education.

This year, 465,913 students are enrolled in public schools, including both district schools and the 2,100 students in charter schools. This represents a drop of about 5,000 students or 1 percent of enrollment compared to the 2018-2019 school year. Enrollment is down 5 percent over the past five years.

The numbers would show a greater decline, but for taxpayer-funded prekindergarten. This year, prekindergarten enrollment totaled 8,339. Four years ago, it was 5,961.

Enrollment peaked at 494,590 during the 2004-2005 school year and hovered at or above 490,000 students as recently as five years ago.

At the same time, education funding has increased or held steady meaning we continue to see the spending per student increase. Last year, Mississippi topped $10,000 per student for the first time and that number will tick up this year.

Among school districts in the Jackson area, the suburban districts of Rankin County School District and the Madison County School District have long enjoyed growth in enrollment to match population growth in their counties, but that may be slowing.

In Rankin County, there has been a decline of about one percent in student enrollment over the past five years despite the county growing by about three percent during the same time period. Still, Rankin County remains the third largest district in the state with 19,160 students.

Madison County School District enrollment stands at 13,310. This represents a growth of just eight students over the past year, a small number for a district that has grown by 15 percent over the past decade.

Enrollment in the Pearl School District grew from 4,257 to 4,366 while it remained relatively steady in Clinton at 5,306. It was 5,310 last year. Hinds County School District’s enrollment stands at 5,578, a decline of more than 10 percent in the past five years.

But the district that continues to lose the most students each year is the Jackson Public School District. Enrollment is down to 22,510, a six percent drop from just the past year. Enrollment is down 20 percent in just the five years. JPS is also the school district most impacted by parents having the ability to choose charter schools for their children.

A report released today by state Auditor Shad White’s office says taxpayers spend more on administrative costs for K-12 education than most of the other southern states.

Mississippi spent 28.74 percent of its K-12 expenditures ($4.2 billion annually with local, state, and federal funds included) on expenses outside the classroom, with only Oklahoma, the District of Columbia and Texas being higher.

Outside the classroom spending is divided into two subcategories of general and school administration and these costs include spending on salaries and benefits for administrators such as superintendents, principals and their staffs, district board expenses, operations and maintenance, legal services, and non-student travel.

According to the report, Mississippi spent 9.38 percent of its education budget in 2016on general and school administration spending, second only in the South to the District of Columbia (15.27 percent). Florida spent the least as a percentage of its budget (6.41 percent).

If Mississippi spent as much of its K-12 budget on classroom-related costs as the state that keeps the highest percentage of its budget in the classroom, Maryland, there would be $250 million available to spend on everything from teacher pay raises to supplies.

According to the report, Mississippi spent an average of 8.87 percent of its K-12 expenditures on general and school administrative spending from 2006 to 2016.

Conversely, the average percentage spent in the classroom by Mississippi taxpayers was third-lowest among the 16 states, which averaged 71.26 percent of their appropriations for K-12.

Mississippi spent 71.26 percent of its expenditures in the classroom, a drop from 2006 when classroom expenses added up to 72.29 of all spending on K-12.

The Office of State Auditor recommends that districts evaluate methods by which they can streamline or cut outside-the-classroom spending. White’s office also recommended that the MDE lessen its regulatory burden on districts to cut down on administrative costs due to compliance with mandates.

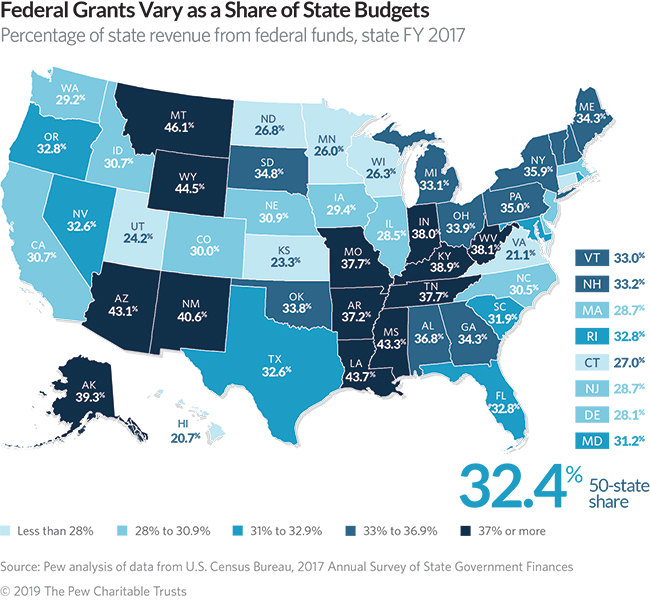

Mississippi is no longer the state most dependent on federal aid as a percentage of its budget.

The only reason the Magnolia State went down in the rankings is because three other states vastly increased their dependence, not because lawmakers in Mississippi were able to wean the state off federal aid.

The recent analysis from The Pew Charitable Trusts reveals that, on average, nearly one third of state revenue came from the federal government in 2017, a near 50-year high. Federal grants helped states pay for healthcare, social services, education, transportation, and other infrastructure.

In the last four years on average, 44.38 percent of Mississippi’s budget came from federal funds.

Montana was the leader in federal funds, with 46.1 percent of its revenues coming from that source. Wyoming (44.5 percent) was second, Louisiana (43.7) was third and Arizona (43.1 percent) was fifth.

Only two of those states — Mississippi and Wyoming — have not expanded Medicaid under the so-called Affordable Care Act (also known as Obamacare) to able-bodied, working adults.

Hawaii (20.7 percent), Virginia (21.1) and Kansas (23.3) had the lowest shares of their revenue coming from federal funds.

On average, the share of state budgets nationally that came from federal funds added up to 32.4 percent.

Mississippi was one of seven states were federal funds were the largest revenue source, outstripping state tax revenues. The others included Alaska, Arizona, Louisiana, Montana, New Mexico, and Wyoming.

Federal funds represent about 45 percent of Mississippi’s total budget

| Year | Federal Funds | Total funds | Percentage |

| 2020 | $9,381,841,075 | $21,082,964,275 | 44.5 |

| 2019 | $9,372,443,748 | $20,855,445,148 | 44.9 |

| 2018 | $9,109,854,566 | $20,538,282,858 | 44.4 |

| 2017 | $ 9,129,408,882 | $20,905,097,426 | 43.7 |

In the fiscal 2020 budget, 44.5 percent of Mississippi’s revenues ($9.38 billion out of $21 billion) came from federal funds. In fiscal 2019, 44.9 percent of the state’s revenues ($9.37 billion out of $20.86 billion) originated from federal funds.

According to the analysis, 26 states had declines in their share of revenues coming from federal dollars. The trend, however, was that federal funds as a percentage of state budgets were at the fourth-highest level according to Pew data going back to 1961.

In 2017, federal dollars accounted for $639 billion of the $1.97 trillion in revenue collected by state governments.

Taxpayers will pay $300,000 to bring a distribution center for auto parts retailer O’Reilly Auto Parts to Horn Lake in Desoto County in north Mississippi.

According to Mississippi Development Authority spokesperson Tammy Craft, the agency will provide a $250,000 grant for workforce training and a $50,000 grant for equipment installation.

The company will refit a 580,000-square foot warehouse purchased in February at the DeSoto 55 Logistics Center and will create 380 job. Horn Lake will also provide property tax exemptions.

O’Reilly Auto Parts is moving its distribution center, one of the 27 it has nationally, from Little Rock, Arkansas to Horn Lake. Missouri-based O’Reilly Auto Parts has 5,000 stores in 47 states and will convert the former Little Rock distribution center into what it callsa super hub store.

In a news release, MDA executive director Glenn McCullough Jr. said that Mississippi’s location in the center of the Southeast provides strategic advantages for the company.

Gov. Phil Bryant said the announcement marks 1,300 state-assisted jobs that have been created via various projects in Desoto County.

These projects include:

- Medline Industries, which will bring 450 jobs to Southaven in DeSoto County and will receive $3.8 million from state taxpayers to build a medical supply distribution center.

- German agricultural equipment company Krone, which moved its headquarters and 45 jobs across the state line from Memphis to Olive Branch, will receive $7.3 million in property and inventory tax breaks in addition to a $250,000 equipment relocation grant. The company could also receive some income tax rebates that could add up to $675,000 annually over the next decade.

From 2012 to 2017, taxpayers have spent $678 million in just MDA grants alone from 2012 to 2017.

Select incentives for a few may generate headlines or photo-ops, but it does not generate sustained economic growth.

Economic development policy really means the state picking the winners and losers by employing direct subsidies and tax breaks to attract or promote specific businesses or industries. An authentic effort to grow our economy would not focus on giving targeted companies the assistance and resources without providing those to all companies and industries.

It is not fair to the current companies in Mississippi, who built their businesses without government help, to find themselves competing with companies subsidized by taxpayers. For too long, Mississippi has followed a policy that supposes “economic development” can be a meaningful driver of economic well-being in the state. It cannot. That policy is a losing one.

The evidence produced from analysis points convincingly to the conclusion that these targeted incentives do not produce long-term benefits in excess of their costs. In many cases, the cost-per-job is extraordinarily high. While some high-profile companies and their political allies may be better off, non-beneficiary companies may lose workers or experience wage increases, or both, and the state’s economic activity as a whole slows.

When political favor seeking is emphasized like this, it thwarts the private sector and tips the scales in favor of those companies and individuals with access to political relationships. It sends a message to the private sector that it should not focus on consumer-oriented actions, like product/service innovation or marketing, and focus resources instead on lobbying, legal representation, and elections. That’s not a recipe for sustained economic growth.

And we should also acknowledge the opportunity costs of corporate welfare. By eliminating corporate welfare, Mississippi, and every state in the nation with income taxes, could reduce their personal and corporate income taxes for everyone. Or, the money that is sent to select industries could instead be used for infrastructure, healthcare, education, law enforcement, or other basic functions of government.

Rather than increase the hand of government in our economy, we should trust the “invisible hand” of the marketplace and the proven incentive of profit and loss for the allocation of resources.

A report by a legislative watchdog says the Tunica County Board of Supervisors needs reforms to its procedures to ensure that it doesn’t engage in deficit spending and complies with state law on various issues.

The Joint Legislative Committee on Performance Evaluation and Expenditure Review (PEER Committee) issued the report in light of budgetary concerns that included:

- A $4.3 million deficit from October 1, 2012 to August 31, 2019.

- The county’s general fund had a negative balance of $4.9 million and the report says the county was using its road fund to pay expenses in contravention of state law.

- In April 2018, the board transferred $5 million to the general fund from its road funds, a practice also contrary to state law. An opinion from the attorney general informed the board that the transfer wasn’t permissible, but the board didn’t authorize repayment of the $5 million to the road fund until PEER began its investigation.

- The county assessed a nine-mill property tax for the road fund in 2015 and overtaxed county residents by $5.5 million from 2015 to 2017 because it was inaccurate in its projection of future road maintenance and construction expenditures.

- Minutes of the board’s meetings didn’t always specify why the body went into executive session as required by law.

- In fiscal 2014, the county was forced by a court order to refund $190,000 to one taxpayer after being in non-compliance with state law on the issuance of tax levies.

Tunica County revenues declined because of declining gaming fee expenses, falling 26 percent between 2013 and 2018. The county received 62 percent of its revenues during the same span from gaming fees.

The county has six casinos, down from a high of nine in 2014.

The report says there are also problems with the way the county spends taxpayer funds.

The board has an arrangement with the North Delta Regional Housing Authority on a program to build and rehabilitate homes in the county for the elderly and handicapped, but had no signed contract either between the NDRHA and the county.

The county later moved all administrative and operational responsibilities for the program to the non-profit Tunica County Housing Inc. in 2014.

The board voted to appropriate $1.6 million from county taxpayers to the organization, with no supporting documentation on how the funds were expended or whether any work. The Tunica County Housing Inc., which was involved in the program, spent 41 percent of its budget ($681,000) provided by taxpayers on administrative costs.

The Better Business Bureau and the Charities Review Council both agree that administrative costs shouldn’t exceed 35 percent for a grant-issuing organization.

The county’s attorney, John Keith Perry Jr., blasted the report in his response letter that PEER includes from examined agency or subdivision.

He said that county officials only had two “small windows of four hours” to review and respond to the PEER report, less than what had been given to other agencies in the past. He also accused PEER of being focused on “a few hot-button issues of a political nature.”

He also said the county reserves the right to do a more thorough response when allowed to study the full and final report.