Tax reform is on the agenda. This is excellent news for our state!

To prosper, Mississippi must create a tax environment that is friendly to both businesses and families.

We have moved in the right direction in the past three years. According to the Tax Foundation, Mississippi now ranks as the 20th most business-friendly state in terms of tax.

This improvement in our state’s tax competitiveness is a consequence of the Reeves-Gunn tax reforms. Under Governor Tate Reeves and Speaker Philip Gunn, Mississippi passed legislation to cut the state income tax to a flat 4 percent and allowed businesses to fully expense capital spending. But the tax burden in Mississippi is still too high.

Our state is surrounded by states, such as Tennessee, Alabama and Texas, that have a lower tax burden than we do. Even Louisiana manages to tax less than us.

Fortunately, we have some state leaders that recognize this. Speaker Jason White is hosting a Tax Policy Summit in September to look at what might be done. Lieutenant Governor Delbert Hosemann has announced a study group in the Senate to look at fiscal policy, with the ultimate goal, he says, to “lower the tax burden and ensure taxpayer dollars stay in taxpayer pockets”.

Mississippi’s House of Representatives also has a select committee on tax reform, which had its first hearing this week.

To be blunt, the House select committee hearing the other day was a big disappointment, especially seeing as we are a supposedly conservative state. Much of what I heard sounded like special pleading from vested interests to increase taxes, not cut them. I wondered at times if Bernie Sanders was in the room.

The hearing on tax reform began with a witness making the point that Mississippi needed to spend more money to build more road infrastructure. The conversation then became about the best way to do so; raise sales tax, tax gas more or charge motorists per mileage.

Not raising tax revenues was described as a “failure to invest”. Spending more tax dollars would pay for itself, it was asserted. Any serious review of tax policy in our state should not start with special pleading. It should start with the basic facts about the shape of Mississippi’s public finances.

The number one fact about Mississippi public finances is that we have a substantial budget surplus. That is to say politicians in our state have more of our tax dollars than they currently know what to do with.

How could we change the tax system to allow people to keep more of their own money before politicians figure out ways of squandering the surplus? That is where the select committee ought to have started.

What kind of tax reforms are feasible depends on the extent to which our budget surplus is cyclical or structural. In other words, is the budget surplus a temporary phenomenon, caused by growth at this stage in the economic cycle? Or is the surplus a surplus not withstanding fluctuations in economic performance?

This matters because if the surplus is temporary, tax reform will need to be phased in carefully to avoid having to put taxes back up again, as did Kansas. Failure to consider if our budget surplus is a blip or a longer term phenomenon allows those opposed to significant tax cuts to lazily claim Mississippi cannot afford more tax cuts. (Note how when the Senate Leadership was trying to water down the Reeves-Gunn tax cuts in 2022 they were able to get away with the claim that we would be ‘like Kansas’.)

Having established what Mississippi can - and cannot - afford in terms of tax cuts, the select committee should then consider what type of tax cuts.

One possibility would be to cut the grocery tax. This would be a relatively small but symbolic cut, which is why it tends to be favored by the Senate Leadership which is lukewarm about any significant reduction in the size of government in our state.

Another possibility would be to phase out the income tax altogether. This would be a big and bold step, and would need triggers and thresholds to ensure it was not done ‘like Kansas’.

“But who will pay for our roads, Carswell!”, I hear you say. “The witness who said we need to invest in infrastructure had a point, no?” I agree.

There are some things, like roads, that our state government does need to do. As and when we need to raise tax revenue for specific projects, like road building, then our lawmakers should propose ad hoc tax increases to pay for it.

Arkansas asked voters to approve a specific increase in sales tax, for a ten year fixed period, to pay for key state infrastructure. In other words, tax revenue was raised for a purpose. Taxes were not raised on the pretext of special pleading and then kept at the elevated level forever. What is very odd is to allow the special pleading of vested interests to be used as an argument for raising the tax burden, in a conservative voting state, and in front of a supposedly conservative-run House committee.

If Mississippi is going to achieve meaningful tax reform, those considering it need to be less Bernie Sanders, and more Ronald Reagan. The lobbyists might not like it, but the voters will.

America faces an axis of aggression. China, Russia, Iran and North Korea are not only actively undermining US interests. They increasingly seem to be working together.

How should America respond?

According to a new report published by Mississippi Senator, Roger Wicker, America needs a new national defense strategy capable of responding to this “emerging axis of aggressors”. “21st Century Peace Through Strength: a generational investment in the US military” offers a serious analysis of US military capabilities and makes some important recommendations.

Wicker calls for an immediate $55 billion increase in military spending in 2025, on top of the almost $900 billion existing budget. The aim, he suggests, should be for the United States to spend around 5 percent of GDP on defense.

To put that in context, America today spends 3.4 GDP percent on defense, and has not spent more than 5 percent since Ronald Reagan was in the White House. Reagan famously won the Cold War, facing down the Soviet threat by beefing up American strength. Wicker envisions a similar approach in “Peace through Strength”.

What is really interesting about Wicker’s proposal is not the call for more money for the military, but his suggestion that there should be a “dramatic increase in competition in the defense industrial base”. Senator Wicker is right. Often, we think of applying free market principles to education or healthcare. There is a very powerful argument for applying free market discipline to defense spending, too.

With the national debt growing, it is vital that America gets the maximum bang for every defense buck. Wicker puts forward ideas as to how to make this happen through far reaching “acquisition reform”. Allowing more market competition in the defense sector would help ensure that America avoided the sorry fate of my own native Britain.

The UK spends about $70 billion a year on defense. That might be less than a tenth of what America spends, but it still means that the UK has the sixth largest defense budget in the world, above Japan and roughly on a parr with Russia.

Unfortunately, Britain has not been effective at converting what she is able to spend on defense into military muscle. Despite spending all that money, British aircraft carriers seldom seem to carry many aircraft. Indeed, the expensive new carriers don’t always seem to be able to spend much time at sea. The less said about British tanks the better.

UK defense acquisition has been a series of costly disasters because the defense budget is often spent in the interests of various favored suppliers, rather than the military.

I first became aware of quite how bad British defense acquisition was on a visit to Afghanistan as a Member of the British Parliament. Troops in Helmand complained about a shortage of helicopters, yet I noticed rows of American Black Hawk helicopters on the runway back in Kandahar.

Why, I wanted to know, didn’t we Brits just buy Black Hawks from the American company that made them? I soon discovered that British defense acquisition is viewed by some as a giant job creation scheme. Or else it is about filling the order books of well-connected companies, not giving the military what they need.

America needs acquisition reform to avoid defense dollars being spent by various vested interests, rather than on the best interests of the US military. Some will say that America cannot afford to increase defense spending. I worry that America cannot afford not to.

Years of federal deficits mean than the US national debt is soaring. There will be enormous pressures on federal spending. All the more reason to ensure that the US gets maximum value for every defense dollar.

Let’s hope Wicker’s reforms are acted upon whoever is in the White House.

So often politics focuses on trivia. What Wicker has done is produce a serious study to address important geo political questions that the United States is going to have to deal with.

Putting America first does not mean ignoring what is happening on the other side of the world. Merely wishing away anything outside the Western hemisphere does not make the United States more secure. It ultimately means that the world’s problems will show up at the US border.

Putting America first means investing in defense. Wicker shows how we might do that.

America is now six months away from a Presidential election. If current polls are correct and Donald Trump comes out ahead in the key battleground states, we could soon see a conservative in the White House, and a conservative-controlled Senate and House.

It is one thing to gain power. It is quite another to know what to do with it. Conservatives who try to run the federal government without a clear strategy in place soon end up being run by the federal government. Why is this so?

The administrative state, with its vast alphabet soup of federal agencies, is fundamentally un-conservative. Some might even say anti-conservative.

That is not to say that there is some sort of Deep State conspiracy against conservatives. (Federal officials struggle to issue visas or approve new medicines on a timely basis. I highly doubt they are competent enough to engage in conspiracies).

No, the problem is the mindset of those that work for the administrative state. Or, what the French call “déformation professionnelle.”

Those that work for big government bureaucracies tend to favor more government. If your career is spent working for a federal agency, you will perhaps see federal fiat as the answer, whatever the question.

Many of those that work for the government are very smart. Smart enough, in fact, to fall for the conceit that you can successfully engineer social and economic outcomes from above.

Now that Diversity, Equity, & Inclusion has become the official ideology of America’s public institutions, federal officials likely find it easier to implement “diversity strategies” and talk about “microaggressions” than deliver competent government.

Being part of a national bureaucracy in Washington makes you more inclined to want to work closely with supranational bureaucracies such as the UN, WHO, or the EU.

What can an incoming conservative administration do about all this? It is not enough to instruct the administrative state to govern differently. We need a plan to re-wire the administrative state itself. Here’s how:

1. Find the Right People.

Donald Trump’s decision to appoint Neil Gorsuch, Brett Kavanaugh, and Amy Coney Barrett to the Supreme Court proved to be one of the most consequential things he has done. As a result, the US Supreme Court now has a conservative majority for the first time in over half a century.

Trump did not appoint the right people to the Supreme Court because he happened to know them. It was the Federalist Society that identified and vetted suitable candidates for him.

I am delighted to be (a small) part of a project run by the Heritage Foundation and others to help identify the right people not so much for judicial appointments, but for positions across government. Unless conservatives find the right people to install in the myriad of federal agencies, those that work in those agencies will nominate their own and little will change.

2. Shrink the Federal Machine.

Argentina’s new President Milei almost halved the number of government departments in the week after he took office. U.S. conservatives should do something similar.

Do we really need a US Department of Education (created in 1980) or federal Housing department (1965)? Surely education and housing are matters that can be left to each state?

Why stop there? There are currently 438 US federal agencies and sub-agencies. Conservatives should go full Milei on them.

3. Control the spending.

What is the single biggest threat to the United States? It’s not China or Islamism. It is the ballooning national debt. The US national debt is now growing by $1 trillion every 100 days.

Conservatives urgently need to bring federal spending under control.

Remember that kerfuffle a few months back when Rep Kevin McCarty tried and failed to be elected House Speaker dozens of times? One of the objections that the conservative refuseniks had was the fact that Congress did not seem to control federal spending.

The process by which Congress approves federal budgets is far too convoluted. One committee approves agriculture budgets, another defense, and so on. This makes it easier for various vested interests to ensure that their preferred spending items get approved.

We need to return to the principle that there is some form of unified Congressional budgetary oversight. This is the only chance of restoring Congressional control over the administrative state’s spending.

4. Return authority to the states.

The 10th Amendment clearly states that “powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.”

Since the days of Woodrow Wilson, there has been a creeping coup that has seen federal agencies, abetted by the Supreme Court, usurp the primacy of the states. Until now.

In a little noticed ruling in 2022, in West Virginia v. the Environmental Protection Agency, the Supreme Court essentially said that a federal agency could not presume to make policy the way the EPA was trying to. The ruling puts a question mark over the presumption that Congress has delegated major political and economic questions to executive agencies.

Conservatives need to build on this, and other similar rulings, to push back against decades of self-aggrandizement by federal agencies.

How often do conservative voters vote for conservative leaders, but end up with more soft-left statism? I would argue that this has been a constant feature of U.S. politics for over half a century, with a brief break from business as usual when Ronald Reagan was in the White House for 8 years in the 1980s.

Unless we are to see more of the same, we need to ensure that if and when conservatives gain control of the federal government, they use their one chance to achieve fundamental, strategic change to the way America is run. There may never be another.

Our aim must not be just to oust liberals, or even to install a particular leader. Our goal should be to renew America by overturning the incremental coup that has created in Washington DC an administrative state that our Founders never envisioned and never sanctioned.

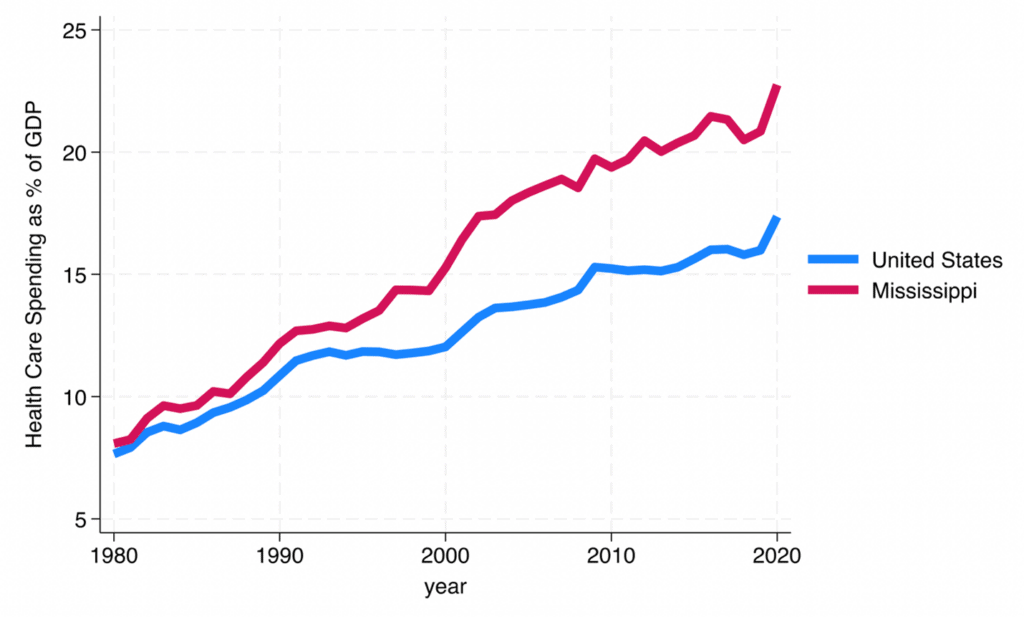

Did you know that Mississippi spends a higher share of our overall wealth on healthcare than almost any other state in America? Yet despite this, we still have some of the worst health outcomes in the country.

Source: AFP Mississippi report on Certificate of Need, James Bailey

Some believe that the answer is to spend an even larger amount by expanding Medicaid. Mississippi’s House of Representatives has just voted to do precisely that.

The debate over Medicaid expansion now appears to hinge on whether under the expansion scheme there will be any realistic work requirement. Critics fear that without a robust requirement for recipients of free health care to be in work, Medicaid expansion is little more than a something-for-nothing system of soft socialism.

It remains to be seen if the Senate will support the House’s bill – and if it will do so by a large enough margin to overturn any future gubernatorial veto.

There is, however, another proposal that has attracted far less attention that really would improve healthcare in our state.

Healthcare in Mississippi is deliberately restricted by a set of laws known as Certificate of Need, or CON, laws. These laws require anyone wanting to expand existing services or offer new services to apply for a Certificate of Need permit. By not issuing permits to new operators, competitors are kept out of the market - which suits the existing providers.

Our recent report on Certificate of Need reform shows how harmful this red tape can be. If we removed this protectionist red tape, we would get far more bang for our buck, however much the legislature decided to spend on Medicaid.

Florida, Tennessee and both North & South Carolina have all recently removed their CON laws – and they each have significantly better healthcare as a consequence.

Now there is a chance that Mississippi might do something similar. Rep Zuber’s excellent bill (HB 419) opens the possibility that some CON rules could be repealed.

Of course, now that the bill is before the House, every sort of parasitic vested interest is frantically lobbying to kill the bill.

Why? CON confers on existing providers a means to legally exclude the competition.

Imagine in the search engine Yahoo! had been able to use CON laws to shut down Google? Or if Friends Reunited could have used CON laws to prevent Facebook? Or if the folk that made DVDs could have used CON to prevent Netflix from taking off? CON laws have been doing precisely this to healthcare in our state.

CON laws in Mississippi are one of the last vestiges of the good ole boy system that has held Mississippi back.

Last year, Mississippi Republicans won an overwhelming majority. Could 2024 be the year when they use that majority to deliver the kind of big, strategic change our state desperately needs?

Here are a number of reforms that Mississippi conservatives have it in their gift to implement, which would transform the long term prospects of our state for the better.

- Education Freedom:

2024 could be the year that we give every family in the state control over their child’s share of education tax dollars, through an Education Freedom Account. Arkansas passed legislation to do precisely that last year. Tennessee and Louisiana are poised to do something similar. Rather than trailing behind, Mississippi lawmakers should take the lead, delivering big, strategic change to improve education in this state, too.

The Mississippi Center for Public Policy recently held a public rally for education freedom, with Corey DeAngelis and local educators, helping mainstream the idea. Recent polls now show overwhelming public support.

- Affordable healthcare:

Too many families in Mississippi cannot get health coverage. Rather than hosing federal dollars at the problem, we need to look at what states like Florida are doing to innovate, with alternatives to insurance-based healthcare. This means ending the restrictive Certificate of Need laws that prevent new low cost health care providers from operating. It also means allowing nurse practitioners more autonomy. The Mississippi Center for Public Policy will soon publish a roadmap on how to go about removing CON laws.

- Tax cuts:

In 2023 Mississippi had a large state budget surplus. Rather than wait for politicians to think up new ways to spend that surplus, we need to see tax cuts in 2024. One option would be a further reduction in the state income tax.

Our neighboring states are reducing the tax burden on families and businesses. If we want to reverse the population decline in our state, we need to do so too.

- Abolish DEI (Diversity, Equity & Inclusion):

In recent months we have seem appalling behaviour by ‘woke’ academics at several leading universities. It is now clear that DEI is destroying American academia. So why are public universities in Mississippi still running DEI programs? The Governor of Oklahoma recently issued an order terminating funding for DEI programs in public universities in that state. Mississippi needs to stop the rot in public universities and end DEI programs in 2024.

While those are our top four priorities for 2024, here are some other things we would like to see our law makers deliver:

- Women’s Bill of Rights / Parents Bill of Rights: Early last year, we invited Riley Gaines to speak in Jackson as part of our campaign to mainstream the idea of protecting women’s rights. We are thrilled to see so many people come out in support of the idea of building on the safeguards already contained within the Mississippi Fairness Act.

- PERS reform: The laws of math make the current public employee retirement scheme (PERS) unsustainable. Mississippi needs reforms so that young people starting work in the public sector have defined contribution, rather than defined benefit, pensions. Unless we make this change now, our grandchildren will end up with a massive tax bill. 2024 is the year when we need to see sensible changes made to PERS.

- Ballot initiative: Citizens in our state used to have a right of ballot initiative. Over a thirty year period, almost 70 initiative attempts to change the state constitution were made, with only three being successful. A failure to update the rules for triggering such initiatives means that we no longer have this right in practice. MCPP would like to see the right of ballot initiative restored, allowing citizens to change state law.

- Young Enterprise Act: Mississippi ought to do more to encourage young people to become entrepreneurs. One way to do this could be to exempt minors from having to obtain costly permits and licenses, or collect and remit sales taxes, when they want to run a small business. A few years ago, such a proposal was considered in the state legislature. We would love to see it revived.

If Mississippi conservatives passed these eight or so laws, they would transform our state for the better. No longer would we be considered a laggard by some, but as a leader.

Green energy – folly or the future?

Former White House energy adviser, Mark Mills, addressed at a packed lunch meeting in Jackson, Mississippi, at an event attended by key state policy makers and members of the public.

Mills, a senior fellow at the Manhattan Institute, talked about some of the implications of the rush to renewable energy. In order to meet net zero carbon dioxide emissions targets, Mark Mills outlined the scale of infrastructure construction that would be required.

“Mark Mills has an encyclopaedic knowledge about energy policy. He laid out some of the hard facts about what it would take to ditch our dependence on oil and gas.” said Douglas Carswell of the Mississippi Center for Public Policy.

“Mark Mills warned about making the same mistake that Germany has made. Over there, politicians rushed into renewable energy, and in doing so pushed up the cost of energy. This has now priced German industry out of the world market” Carswell added.

“If Mississippi wants to keep on attracting more industry, we need to ensure that we continue to have a plentiful supply of affordable energy”.

“Transitioning to renewables might sound like a bright idea in Washington DC” Carswell added. “Mark Mills showed that unless the federal government can change the laws of physics it is just not realistic. America would need to install thousands of new giant wind turbines each week, cover a vast area in solar panels and build dozens of new nuclear plants each year.”

“Politicians might talk glibly about moving to electric vehicles” he added. “Mark Mills pointed out that we would need hundreds of new charging stations, each one requiring the same amount of electricity as a steel mill. The capacity and infrastructure simply won’t be there to achieve this rush to renewables”.

The event was hosted jointly by Bigger Pie Forum and the Mississippi Center for Public Policy. Several members of the state legislature and Public Service Commissioners attended and asked questions.

To watch Mark Mills, talk online, click here:

Mississippi’s top 50 public officials now cost the taxpayer over $10 million a year for the first time. The state’s top 50 highest paid officials saw their salaries increase 5 percent from an average of $193,678 last year to $205,000 this year.

According to the 2023 Mississippi Fat Cat report, published by the Mississippi Center for Public Policy, Mississippi now has some of the highest paid public officials in America.

Mississippi’s State Superintendent for Public Education has made over $300,000 per year for a number of years now. Mississippi also now has two local school superintendents each earning about a quarter of a million dollars a year.

Forty percent of those on the Fat Cat list are school superintendents, who enjoyed bumper pay rises. Those school superintendents on the Fat Cat list received an average 14% pay increase, taking them to over $200,000 a year.

The $10.3 million cost salary of Mississippi’s 50 highest-paid public officials would be enough to pay the salaries of:

- 189 nurses (at $54,284 per year)

- 178 State Troopers (at $57,680 per year)

- 191 teachers (at $53,699 per year)

- 227 Mississippians receiving the median income ($45,180 per year)

Mississippi’s 50 Fat Cats are paid more than America’s 50 state governors. While the 50 Mississippi Fat Cats receive a combined total of $10.3 million a year, the combined salary of America’s 50 state governors is a mere $7.4 million.

The Humphreys County Superintendent, for example, with a mere 1,257 students, is paid more than the governor of Texas, with a population of 30 million.

The Jackson Public Schools Superintendent, who oversees a district with approximately 20,000 students, makes more than the Governor of Florida, which has a population of more than 21 million.

Fat Cat pay does not necessarily reflect public service performance. Some of the highest-paid public officials preside over some of the worst education outcomes.

The Fat Cat report acknowledges that some highly paid officials provide good value for money for the taxpayer, and that high salaries in the public sector are not necessarily a bad thing.

However, the report also recommends changes to ensure that there is accountability when it comes to top public sector pay. Suggestions include:

- Requiring a greater degree of oversight by the legislature when it comes to significant salary increases.

- Using a state-mandated formula to calculate the maximum allowable salary for school superintendents.

- Restricting the amount of education funding that can be spent on administration.

- Potentially amending Section 25-3-39 of the Mississippi code to remove many of the exemptions to restrictions on unapproved limits.

A link to the report can be found here.

Income tax elimination is top of the political agenda in Mississippi, and it is potentially the most exciting economic reform in our state in a generation.

Under the Mississippi Tax Freedom Act, approved by the House of Representatives by a massive majority, no one earning less than $40,000 a year would pay any state income tax at all.

The House plan is prudent, too. In order to ensure that we can afford to scrap state income tax, the plan commits to further eliminate the income tax as other sources of tax revenue grow. There is nothing rash or risky about this approach. What the House plan would do is make our state competitive. At the moment we are surrounded by states that do not have any state income tax – states like Tennessee, Texas and Florida.

In order to be able to grow our state, we need this plan to pass. That is why it is so disappointing to see the Senate offer an alternative plan which would not eliminate the income tax at all.

The Senate plan proposes eliminating the 4% income tax rate. Sounds great, no?

In reality, so few pay much tax at that rate anyhow, it would mean that the average Mississippi worker was only about $200 a year better off. That would not be enough to by a Subway sandwich each week.

The Senate plan cannot credibly be called a tax elimination plan. I am not certain that it does much to reduce the amount of tax people pay at all.

The Senate plan implies a significant reduction in the amount of tax we pay when we get a new car tag. But this is disingenuous. Since most of the car tag tax is local, the state reduction that the Senate implies would mean a reduction in your car tag tax of no more than $5.

The House plan is the only plan under consideration that would give back to Mississippi taxpayers much of the billion dollar surplus in the state budget. The Senate plan, however, leaves politicians free to spend that money instead. Perhaps that is the intention?

Taking into account all of the changes proposed, including changes to the sales tax rate, the House plan would leave almost every Mississippian, under pretty much every scenario, better off. It is difficult to see how anyone would be made significantly better off under the Senate plan. I fear that the tax plan that the Senate has proposed risks undermining the credibility of those calling for tax breaks altogether. We are all familiar with politicians who run campaigns against “the swamp” but then disappear to DC to enjoy lunch with lobbyists. How do you imagine voters would react when they discover that the car tag tax reduction they are being sold as part of the Senate plan will only reduce their car tag by $5?

We are at a critical moment in the future of our state, and I hope that our lawmakers will do the right thing and seize this chance to make our state properly competitive. Unless our lawmakers find a way of coming together behind a plan that actually lifts the tax burden, our state will continue to lag behind.

FOR IMMEDIATE RELEASE

(Jackson, MS): The Mississippi Center for Public Policy continues to push for the elimination of the State Income Tax.

"The House has produced a plan that hands back to taxpayers much of the billion-dollar surplus in the state budget. Unfortunately, the counter-proposal that the Senate has now come up with leaves politicians free to spend that money instead," said President & CEO Douglas Carswell. "The Senate plan cannot credibly be called a tax elimination plan. I am not certain that it does much to reduce the amount of tax people pay at all."

Under the Mississippi House of Representatives tax plan:

- A Mississippian making a gross income of $40,000 a year would get an approximate $1,500 reduction in taxes through eliminating the income tax, according to a summary published by the House. This translates to an approximate net income increase of 3.8%. That would leave Mississippi workers with more money each month to spend on themselves and their families. It would make our state tax competitive, like Tennessee and Texas, neither of which have a state income tax anymore.

Underthe Mississippi Senate tax plan:

- A Mississippian making a gross income of $40,000 a year would get an approximate $260 reduction in taxes. This would be a mere 0.65% net income increase.

- In addition, although the Senate plan removes the 4% bracket from the income tax, there is no path in the plan that aims towards the total elimination of the state income tax.

Senior Director of Policy & Communications Hunter Estes said, "Mississippians deserve to keep more of their own money. We’re glad that our legislators are coming together to recognize this. However, one of these proposals is far stronger than the other. Our political leaders ought to stick to the promises made to their constituents and commit to a full repeal of the income tax, as proposed within the House plan."

The Mississippi Center for Public Policy believes the state needs real tax real tax relief, and repealing the income tax would be both a moral and economic good, leading to higher incomes, competitiveness, and prosperity for all Mississippians.

While both the Senate and House plans give commendable tax cut proposals, the House plan carries the most promise as a catalyst for true tax relief and long-term growth. Rather than merely giving Mississippians tax breaks that are well-intentioned but non-transformative, the time has come for state leaders to give the people meaningful tax relief.

For media inquiries, please reach out to Stone Clanton, [email protected].