Mississippi taxpayers, both at the state and local levels, often provide rafts of incentives to lure new industry to a community and “create” jobs.

The Mississippi Development Authority has several infrastructure and job training grant programs and tax incentives that include rebates on income tax paid by employees. Counties can offer tax breaks on property taxes, which support local schools and other local government services.

Here are some of the more recent examples, with calculations on how much the incentives cost per job.

Krone

According to a story from Memphis TV station WREG, Mississippi taxpayers will be paying a heavy price in grants and tax incentives to get a German agricultural implement company to move its North American headquarters and 45 jobs across the state line from Memphis to Olive Branch.

Mississippi will provide a $7.3 million in property and inventory tax breaks, in addition to a $250,000 grant to relocate its equipment. Krone could also receive incentives that rebate some income taxes for its employees to the company, provided the workers are paid at least $37,521 annually.

That could add up to $675,000 annually over the next decade.

All of those incentives, if realized, could add up to $8,225,000 or about $182,777 per job.

Amazon

Amazon announced in December that it will be building a fulfillment center in Marshall County in north Mississippi. The 554,000-square-foot center will employ 850 with a $15 per hour minimum wage and these employees will pick, pack and ship household consumer goods to customers.

Mississippi taxpayers will provide a $2 million grant for construction assistance and a $4 million grant for road improvements, according to MDA spokeswoman Tammy Craft. Marshall County will provide about $6.3 million in assistance for road improvements and a property tax exemption.

All of those incentives, if realized, could add up to $12.3 million or about $14,470 per job.

Enviva

Enviva and Mississippi officials announced that the company — which makes wood pellets that fuel overseas power plants — will build a $140 million pellet mill and a $60 million loading terminal at the port in Pascagoula.

Enviva is expected to hire 90 employees in Lucedale, with 300 loggers and truckers possibly finding work supplying logs to the company.

Mississippi taxpayers will be providing $4 million in grant funds, with $1.4 million for a water well and a water tank, while the other $2.5 million is for other infrastructure needs and site working, according to Craft. George County will provide $13 million in property tax breaks over the next 10 years.

All of those incentives, if realized, could add up to $17 million or about $188,888 per job.

Counting the jobs of loggers and truckers not directly employed at the George County pellet mill, that figure shrinks to $43,589 per job.

The Huntington Ingalls shipyard in Pascagoula could be getting another handout from state taxpayers.

House Bill 983 would provide Huntington Ingalls Industries with $45 million from state bonds. The bill says the funds are for capital improvements, investments and upgrades for the shipyard.

The bill passed the full House and is now headed for the Senate.

This isn’t the first time legislators have borrowed money on the taxpayers’ credit card to fund improvements as the shipyard, as the state has borrowed $307 million for Ingalls improvements since 2004.

Last year, the legislature added $45 million to fund improvements at the shipyard to the “Christmas Tree” bond bill for various items.

Huntington Ingalls Industries received $45 million in 2017 from state taxpayers, $45 million in 2016, $20 million in 2015, $56 million in 2008, $56 million in 2005 and $40 million in 2004.

The company leases the land for its Pascagoula shipyard from the state and is exempt from property taxes. It is one of south Mississippi’s largest employers, with 11,000 workers.

Huntington Ingalls’ Pascagoula yard builds Arleigh Burke class destroyers, America class amphibious warfare ships, San Antonio class amphibious dock ships for the Navy and the Legend class national security cutter for the U.S. Coast Guard.

The yard is also competing to build the Navy’s next frigate and several new Coast Guard heavy icebreakers.

Ingalls also has a shipyard in Newport News, Virginia that builds Gerald Ford class aircraft carriers and Virginia class submarines. The company earned $8.2 billion in revenue in 2018 and was awarded $9.8 billion in new contracts in 2018, bringing the company’s total contract backlog to $23 billion.

Contract awards for Ingalls in the fourth quarter of 2018 included a $931 million contract for the construction of the 10th and 11th Legend class cutters and an $883 million contract for construction of an Arleigh Burke class destroyer. The yard also received a $1.4 billion contract for another San Antonio class ship.

Ingalls spent $202,400 on lobbying efforts at the Legislature in 2018. You can find the reports from the Secretary of State’s website here and here.

The Environmental Protection Agency isn’t just coming to your local power plant, they’re coming to you live on Mississippi Public Broadcasting.

Well, not exactly the EPA. Rural Voices Radio will be using a $25,954 grant given by the agency to the Mississippi Writing/Thinking Institute to produce programming related to the Gulf of Mexico.

What is Rural Voices Radio you ask?

A short format program undertaken by the Mississippi Writing/Thinking Institute at Mississippi State University, Rural Voices Radio works with both children and adults so that they can experience what it’s like to work in radio with participants generally sharing essays or poems about their life in Mississippi. In a statement the EPA said that the grant will provide “hands-on opportunities to help change behaviors of Gulf residents as ‘keepers of the Coast’ with vested interest in its protection.”

After the agency spent 12 years trying to understand what to do about the billions of gallons of raw sewage spilling into the Pearl River, the public need only to rejoice as taxpayer money is funding programs like Rural Voices Radio.

The grant serves as an excellent example of how the agency has conducted its business in recent years.

The pretext to the existence of the EPA has largely centered on the notion that the EPA serves as the sole defender of our nation’s environmental wellbeing. Therefore, all actions undertaken by the agency, regulatory or otherwise, serve to benefit the public good. While the agency may sometimes place restrictions on heavy polluters, the average American most likely won’t have much contact with the EPA, except when they’re drinking their clean water and breathing in high-quality air.

Repeated by both proponents of the agencies goals and bureaucrats inhabiting it, the “sole defender” notion has not proved itself indicative of reality. Companies of all sizes have demonstrated not only the ability to self-regulate but a desire to protect our environment. In short, market forces and the profit motive appear to be great motivators. Meanwhile, the EPA has deviated from its original mandate becoming increasingly fond of regulating the behavior of individuals rather than organizations. Simultaneously, the agency has demonstrated ineffectiveness when it is made to address a true crisis.

While the grant provided to the Mississippi Writing/Thinking Institute demonstrates wasteful spending by the government, it also represents an investment in which the only desired outcome is the alteration of individual behavior.

These actions, the earliest iterations of which are generally undertaken with noble intentions, seek to gratify the neo-puritanical desires of those who regulate, seeking to expand upon what they are permitted to regulate. Such activity creates a self-gratifying cycle, which further expands the scope of their bureaucracy.

It is fundamentally wrong to have taxpayer dollars be used to influence the content of any broadcast, let alone one which seeks to change the behavior of those who it is meant to reach. For too long the EPA has operated disconnected from the interests of those for which it was established to serve, wasting taxpayer money on projects unrelated to its mandate while failing to fulfill its most basic obligations.

It would be in the interest of all taxpayers to see grants such as the one provided to the Mississippi Writing/Thinking Institute end immediately and a system introduced in which the mandate of the EPA is transferred to state agencies to enforce and interpret as they see fit.

A bill that passed the Mississippi House could give a tax credit to recent college graduates who decide to work in the state for five years, but there are plenty of conditions.

House Bill 816— also known as the Mississippi Educational Talent Recruitment Act — would provide recent graduates (within two years) from a four-year university or a post-graduate program such as medical school who live and work in Mississippi a rebate equal to all or a portion of the amount of their state income tax liability.

It’s designed to combat the “brain drain” of young, college-age professionals from the state but the conditions to qualify for the credit are numerous.

Community college graduates aren’t covered by the rebate program. Also, someone wishing to participate would be required to apply for the credit with the Mississippi Department of Revenue, which would review the application and determine if the applicant is eligible.

Then they’d have to reside in the state for five years to receive a 50 percent rebate of their state income tax liability.

If they own property in the state (either residential or commercial), establish a business registered with the Secretary of State’s office or serve as a licensed teacher, they can receive a rebate equal to their full state income tax liability.

The bill is authored by state Rep. Trey Lamar (R-Senatobia) and passed the House on February 8 by a 111-2 margin.

According to data from the U.S. Census Bureau, the data is mixed. Estimates by the Census Bureau for 2017 indicate that the state has 389,103 adults between the ages of 25 to 34, with 88,496 possessing at least a four-year degree or better.

Among the ages 18 to 24 cohort, the bureau estimates the state has 303,818 residents in 2017, with 18,568 of them with at least a four-year degree.

In 2010, the state had 378,363 residents between the ages of 25 to 34, with 78,699 of them with at least a four-year degree. Among those ages 18 to 24, there were 307,897, with 15,394 with at least a bachelor’s degree.

The number of residents ages 18 to 24 decreased by 1.32 percent between 2010 and 2017, while those in the older range (ages 25 to 34) increased by 2.83 percent over the same time frame.

The state, as a whole, had its population decline by 3,000 residents between July 1, 2017 and June 30, 2018 and was the third time in four years the population has declined.

A similar bill, also authored by state Rep. Lamar, failed in the Senate last year.

Even in an election year, the Mississippi legislature is pondering tax increases.

There isn’t a gasoline tax increase bill that will survive the February 27 deadline for appropriation and revenue bills to be voted out of the originating chamber, but there are still other tax hikes on the table for cigarettes and hotel and restaurants.

Several cigarette tax hike bills are active in both chambers:

HB 1499 would increase the excise tax on non-cigarette tobacco products such as cigars and chewing tobacco from 15 percent to 22.5 percent, while HB 1500 would raise the per-pack cigarette tax rate from 68 cents to $1.18. Both are sponsored by state Rep. Bob Evans (D-Monticello).

Senate Bill 2665 would increase the per-pack tax to $2.18, which would be seven cents higher than the national average and much higher than surrounding states. It is sponsored by state Sen. Willie Simmons (D-Cleveland).

The cigarette tax hike bills most likely to pass are HB 1573, which is sponsored by state Rep. Jeff Smith (R-Columbus) and SB 2563, authored by state Sen. Brice Wiggins (R-Pascagoula). HB 1573 would increase the tax on a pack of cigarettes to $1.68, while SB 2563 would hike the per-pack levy to $2.18.

As for tourism taxes, there are several bills out there that would levy taxes on local hotels and restaurants to finance tourism-related projects.

In Mississippi, tourism taxes start as a local bill in the Legislature. These bills usually benefit a city or county in a legislator’s district and are one of the last chores the Legislature wraps up before leaving town at session’s end.

Once the local bill is passed, a referendum of local voters is required before the tax can go into effect. The tourism taxes usually have an expiration date of three years from passage. The money is collected by the business and sent to the Mississippi Department of Revenue, which then sends the proceeds back to the municipality or county that levied the tourism tax.

There are 90 of these taxes collected by the DOR on behalf of local governments in fiscal 2018, up from 59 in 2004. The DOR collected $98,275,512 from these levies in fiscal 2019.

One of the tourism tax bills, HB 653, is already sitting on the desk of Gov. Phil Bryant and it would resurrect a dead tourism tax for the city of Baldwyn, located between Tupelo and Booneville on U.S. 45.

The law would not only reauthorize the 2 percent tourism tax on restaurants and hotels for another three years, but also allow the city to retroactively collect the tax after it expired on July 1. A companion bill is SB 2277 and it was double-referred to the Senate Local and Private and Finance committees.

Despite notification from the state Department of Revenue, businesses in Baldwyn continued to collect the tax and have collected $13,765 from it so far this year. The city, which has a population of 3,304 according to the U.S. Census Bureau, will receive these proceeds despite the tax going off the books for a year.

HB 325 has already been signed into law by Gov. Bryant and is already in effect. The new law authorizes the city of Columbus and Lowndes County to levy a 2 percent tax on food and alcoholic beverages sold in restaurants with annual sales of $100,000 or more.

Of the proceeds, $400,000 will go to the city for parks and recreational activities, including maintenance and repair of facilities. Another $300,000 will go to the county for the same purpose and $250,000 will go to the Golden Triangle Development LINK, which will be used to fund promotion of community and economic development.

HB 1611 would reauthorize the city of Flowood’s 3 percent hotel tax and allow the fund to be used for construction of a conference center in the city. HB 1611 is in the hands of the House Local and Private Committee. SB 2988 is the companion bill in the Senate.

HB 1610 and HB 1602 would allow the city of Clarksdale to hit residents with a 14 mill property tax increase ($14 per every $1,000 of assessed value) to fund capital improvements in the city. The two bills are in the hands of the House Local and Private Committee.

HB 1601 would allow the city of Saltillo to levy a 2 percent tax on hotels and restaurants for tourism, economic development, infrastructure and parks and recreation. SB 2853 is the companion bill in the Senate. The city has a population of 4,987, according to the U.S. Census Bureau.

HB 1565 would give Starkville the authority to increase its existing hotel and restaurant tax by 1 percent to finance construction of a new sports complex and improve existing sports and recreation facilities.

HB 1423 would allow Lexington to impose a 2 percent tax on restaurants to fund recreation, tourism and parks. According to the Census Bureau, the city has a population of 1,523.

SB 2185 would authorize Carrollton to impose a 2 percent tax on restaurants to fund tourism and parks and recreation. Carrollton has an estimated population of 178, according to the Census Bureau.

SB 2896 would authorize North Carrollton to hit local restaurants with a 2 percent tax to fund improvements for tourism and parks and recreation. North Carrollton has an estimated population of 444, according to data from the Census Bureau.

SB 2854 would allow Charleston to levy a 2 percent tax on restaurants to fund tourism and parks and recreation projects. The city has an estimated population of 1,958.

A widely-hailed economic development deal hatched in 2016 is no more.

A story by the Sun-Herald says that a $36 million deal to bring a shipyard and 1,000 jobs to Gulfport by Edison Chouest Offshore subsidiary TopShip has been dead since December.

The Mississippi Development Authority told the Sun-Herald that it failed to meet benchmarks for a $68 million investment and completed construction. TopShip proposed reducing its investment to $34 million and only 250 employees, but state officials refused to budge on the original requirements.

TopShip was supposed to receive $11 million in bond funds plus tax and other incentives that could’ve added up to $25 million to refurbish its facility on the Industrial Canal, which was formerly owned by Huntingdon Ingalls.

Chouest already had a shipyard right down the road from the new one.

According to the Sun-Herald story, Harrison County invested $12 million in Hurricane Katrina recovery funds to open the Gulf Ship yard in 2006. The week before the announcement in February 2016, Gulf Ship laid off workers and was down to only 110 employees, according to the Sun-Herald.

A statement from MDA said TopShip did not receive any state funds.

Analysis by the Institutes for Higher Education said that the project would generate a net positive annual return for Mississippi starting in 2017.

The Port of Gulfport received $567 million in Community Development Block Grant Disaster Recovery funds from the U.S. Department of Housing and Urban Development. This money for the “Port of the Future” was predicated on the port creating 1,300 jobs, with many of them supposed to go to low-income residents.

HUD allowed the port to consider 326 jobs at a casino hotel located on property owned by the port. According to the most recent status report issued by the port in 2017, the facility now has created 425 jobs verified by HUD.

Chouest did a similar shell game in Louisiana with incentives. In 2008, WVUE TV reported that Pelican State taxpayers invested $42 million for Chouest to build a shipyard in Houma and hire 1,000 employees.

The company closed a nearby shipyard that it also owned, the North American Fabricators Facility, and the state told WVUE TV that it simply transferred jobs from the old shipyard to the new one.

In August 2012, Louisiana officials amended the agreement to give Chouest more time to meet the job creation goals.

TopShip was known during the February 5, 2016 special session as “Project Crawfish” and was part of a $274 million incentive deal that also lured a Continental Tire plant to Hinds County.

The process to pass the bill in the special session only took five hours from bill drafting to Gov. Phil Bryant’s signature.

The state’s record on economic development incentives is filled with some successes, like Nissan, Toyota and Yokohama.

But for every success, there is the infamous beef plant in Yalobusha County, which cost the state more than $50 million in guaranteed loans, and biofuel producer KiOR, which owes the state more than $69 million on a no-interest loan.

Stion Solar owes the state $93 million after it shuttered its solar plant in Hattiesburg.

A bill in the Mississippi legislature could have taxpayers spending nearly $4.7 million to help restore passenger rail service to the Mississippi Gulf Coast.

Senate Bill 2542, authored by state Sen. Brice Wiggins (R-Pascagoula), would appropriate $4,696,500 toward bringing Amtrak service to the Mississippi Gulf Coast that was ended when Hurricane Katrina made landfall in August 2005.

The bill also says the money would be spent on improving freight rail service in the area as well.

The money would represent part of Mississippi’s share to restoring the east route of the tri-weekly Sunset Limited, which ran through the Mississippi Gulf Coast connecting Orlando, Florida with Los Angeles.

The service was terminated east of New Orleans in 2005.

According to the Southern Rail Commission, an advocacy group seeking more extensive passenger rail in the South, all three states on the route between Mobile and New Orleans would have to contribute money to qualify for Consolidated Rail Infrastructure Safety and Improvements grant program matching funds that could add up to $35.5 million.

The SRC cites a May 2018 study by the Trent Lott National Center at Southern Mississippi University that says that construction and renovation of the rail lines on the Coast would add $34 million to the state’s economy. It also says restoration of passenger rail on the Mississippi Gulf Coast between Mobile and New Orleans would add $6 million annually to the economy.

Like many long-distance routes, a new Sunset Limited train that connects Orlando with Los Angeles wouldn’t be profitable and would require annual subsidies from Alabama, Florida, Louisiana and Mississippi taxpayers. Amtrak’s own numbers in its 2015 feasibility study indicate that restoring service from New Orleans to Orlando would result in a $5.48 million loss annually.

Just running a roundtrip, standalone train from Mobile to New Orleans would yield a loss of $4 million. Having both a tri-weekly train from Orlando to Los Angeles and a separate round trip service between Mobile and New Orleans connection would result in an annual loss of $9.49 million.

This figure doesn’t include improvements to the rail infrastructure and stations along the route, which would cost, at minimum, $14,718,000 for just the restoration of passenger rail service and $102,954,000 for what the study says is a service level for ongoing operations.

Passenger rail hasn’t fared well in Mississippi, which has two Amtrak routes that pass through the state.

The Crescent train connects New Orleans with New York, while the City of New Orleans links the city with Chicago.

The most recent Amtrak numbers from 2017, show that the number of passengers boarding and detraining in Mississippi decreased from 118,200 in 2011 to 100,500 in 2017. That’s a decrease of nearly 15 percent.

The study blamed delays with the train as one of the key factors in the lowered ridership. These delays, according to the study, were due to interference with freight operations from CSX — which owns the track between New Orleans and Mobile — and equipment malfunctions with Amtrak locomotives and passenger cars.

The Gulf Coast Working Group’s report to the U.S. Congress on restoring Gulf Coast rail service also mentions that limited space with rail yards and bridge crossings would “present a challenge to operating passenger trains on schedule.”

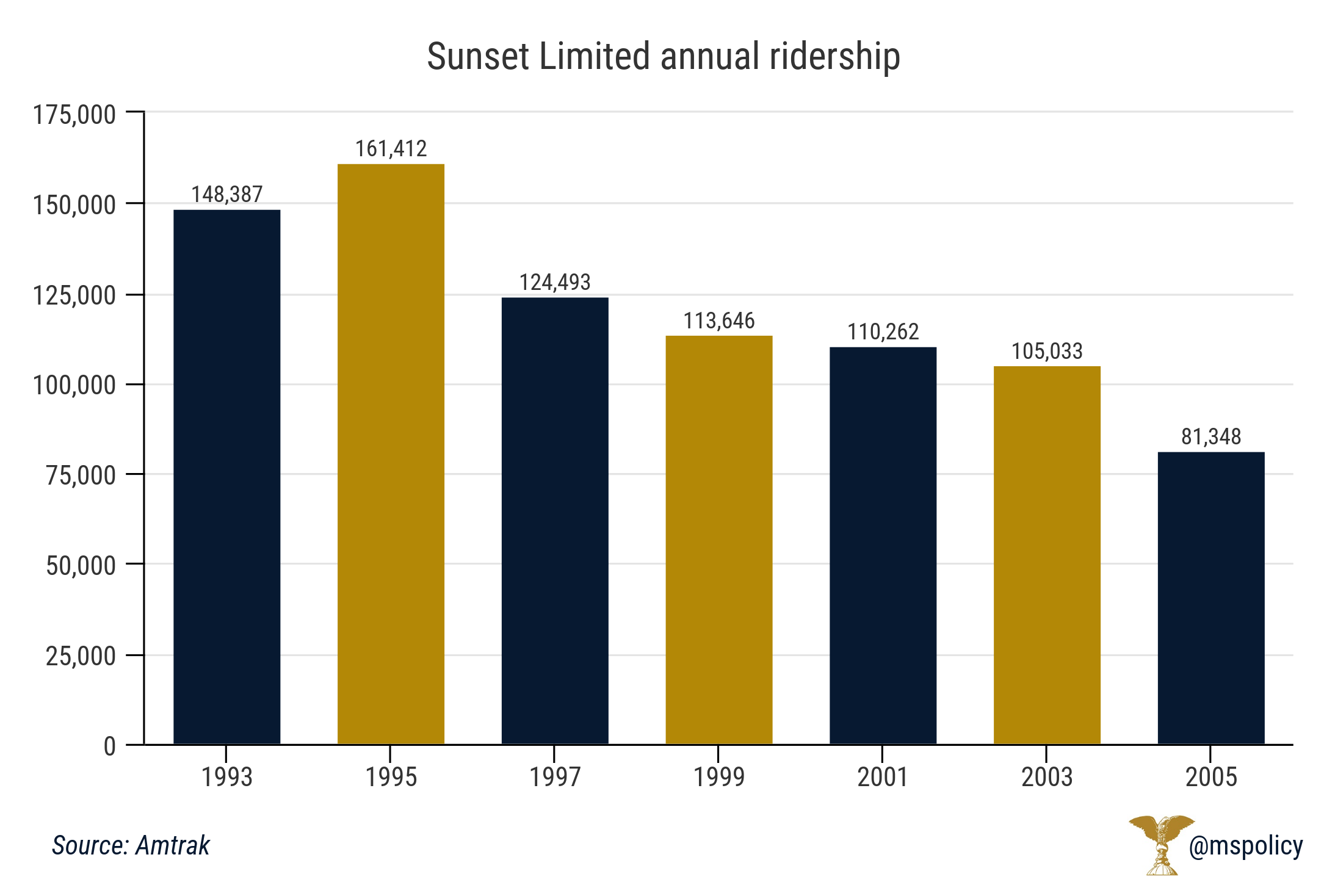

According to the Amtrak 2015 feasibility study for restoration of rail service east of New Orleans, total trips declined from 148,387 in fiscal 1993 to 81,348 in 2005, a decrease of 45.2 percent.

Even taking into account that the federal government’s fiscal year ends on September 30, the numbers still pale when the final full year of service (2004) is considered, down 35 percent from 1993.

The state pension board ordered its staff to write a new regulation Tuesday that will remove a long-standing prohibition and allow legislators to draw both their salary and pension benefits.

The 10-member Board of Trustees for the Public Employees’ Retirement System of Mississippi voted on a motion to replace its existing regulation, which forbids legislators and other state elected officials who are PERS retirees from collecting both a salary and their retirement benefits.

The new regulation will go into effect on January 1, 2020, just in time for the next legislative session.

State Sen. Sollie Norwood (D-Jackson) asked Attorney General Jim Hood’s office for an opinion on sitting legislators receiving both a salary and their PERS retirement.

An AG’s opinion doesn’t carry the force of law, but can protect an agency from legal action if followed.

Hood’s opinion said that there was no basis in law for the prohibition by PERS regulations since most who serve in the legislature have a full-time job in addition to their legislative duties.

This prohibition doesn’t apply to local elected offices, such as mayor, alderman or county supervisor, who can receive both their retirement benefits and 25 percent of the retiree’s average compensation.

PERS Executive Director Ray Higgins said the new regulation would work similarly to those governing former retirees serving as elected officials with their local governments.

“Essentially, the AG’s opinion says we should apply those same parameters (with PERS retirees serving as local elected officials) in state law to those serving in the legislature,” Higgins said.

The opinion also said that PERS retirees who are elected to the legislature could be treated like those who return to the state workforce after retirement.

Under this opinion, a legislator who is a PERS retiree could receive pay on a half time/half pay scenario using the time and pay of a full-time position or receive 25 percent of what they were paid during their four highest years of service.

They would still have to contribute to PERS, but would receive no benefit from those contributions. Taxpayers would also have to contribute as the employer portion of each retiree serving in the legislature.

Higgins said that the agency would write a new regulation that would satisfy both the AG’s opinion and maintain the plan’s qualified status with the U.S. Internal Revenue Service.

Losing this status as a defined benefit plan means the plan’s investment income could be taxed and member contributions would cease to be pre-tax.

“It’s very important that we protect that qualified status and not do anything that could put us out of compliance with federal tax law,” Higgins said. “That’s very important to the system as well as our membership.”

There were several bills proposed in the Mississippi legislature that gave legislators the right to collect their retirement pay while serving at the Capitol, but all died in committee.

Mississippi Attorney General Jim Hood wants to roll back the tax cuts passed by the legislature, but fell just short of advocating for a gasoline tax increase to fund infrastructure.

The four-term Democrat Attorney General is running for governor in 2019 and made his remarks at the Stennis Capitol Press Forum Monday.

Hood wants more spending for infrastructure, citing a 2015 report by the Mississippi Economic Council that says taxpayers need to spend $375 million more per year on roads and bridges. He says how it’s funded depends on who gets elected to the legislature.

“I think if we have the same folks back (in the legislature), with a little bit of leadership, we present them with the opportunity to fund the road bill, you’re going to see the pressure on by the voters this next election cycle to figure out a way that we’re able to pay for our roads,” Hood said.

“A fuel tax is one of the considerations. There are a ton of trucks that go through right here on (Interstates) 55 and 20 every day coming from out of state. They’re paying tax on that fuel, it isn’t Mississippians are necessarily paying, but they’re paying a lot less than Louisiana or Alabama or Tennessee. Those are some things we have to consider, but I don’t know if that (a gasoline tax increase) is the answer to fix it.”

Mississippi’s tax on diesel is 18 cents per gallon. Tennessee charges 24 cents in tax per gallon of diesel, while Louisiana’s diesel fuel tax is 20 cents per gallon and Alabama’s is 19 cents per gallon.

He also said that the majority of the $400 million tax cut passed by the Legislature that eliminated one income tax bracket and started the phase out of the state’s corporate franchise tax goes to out-of-state corporations.

Hood also said he favors more spending on education, including free tuition for community college students, and expanding Medicaid.

He said expanding Medicaid would require legislative action in the form of appropriations, since the federal government would cover 90 percent of the cost while state taxpayers would be responsible for the rest.

“The votes are there if you go about it by explaining to people you can expand Medicaid without raising taxes,” Hood said. “The other states that have expanded Medicaid have put fees on hospital beds and the hospitals have gotten the money back, they’ve done some on sin taxes. There are avenues to do it.”

Expanding Medicaid, according to a 2015 study by the Institutes of Higher Education, would cost more than $117 million in general fund revenue in 2020 in a worst case scenario (with 95 percent enrollment).

That worse-case scenario cost would increase to $159.1 million by 2025.

Lt. Gov. Tate Reeves said earlier this year at the Stennis luncheon that he doesn’t support expanding Medicaid, which he called Obamacare.

Hood also strongly supports allowing retirees in the Public Employees’ Retirement System of Mississippi to be able to collect their benefits while in office. A November opinion by his office says that the PERS regulation prohibited elected officeholders in state government, such as legislators, from continuing to be paid their retirement benefits has no basis in state law.

According to PERS regulations, a re-employed retiree will have their benefits terminated and become again a contributing member with contributions paid by both the employer (taxpayers) and the employee. This doesn’t apply to county and municipal elected officials.

“People can run that are retirees,” Hood said. “The legislature could’ve changed that, but they were too cowardly and ran when the light hit them on that.

“It’s time for us to put people in that legislature that know something about education, that know something about law enforcement, that know something about mental health, that know something that affect people in our state instead of those that are super partisan.”