The Mississippi State Medical Association and numerous other groups want to see cigarette taxes increased in Mississippi. They are certainly free to advocate for that point. However, they should stop their argument at “smoking is bad for you” because their strawman arguments are vague and weak on actual data.

We agree that long-term smoking is a bad health choice. The evidence is overwhelming. Yet, our policy position on the tax issue is based on reason, evidence, and data. We reach these conclusions without bias because our only motive is representing the citizens and the Constitution.

In the response to our policy view, the MSMA authors repeatedly said that every time cigarette taxes have been raised, revenues have increased.

Yes and no. Adjusted for inflation, Mississippi is receiving the same net collections from cigarette taxes as we were in 1975. The overall revenue has increased along with the 500 percent increase in taxes during this time, but real numbers are flat. New York is collecting significantly less, adjusted for inflation, in cigarette tax revenue than they were in the 1970s. Same story in Illinois. In real numbers, revenue is down significantly in those two high-tax states.

The MSMA authors also brushed aside data on cigarette smuggling. But what do we know?

Through statistical research, we can determine Mississippi’s smuggling rate would explode to 35 percent for a state surrounded by low-tax states, something the author did not dispute. As our op-ed authored explained, “The estimate is built around a statistical model, which measures the difference between smoking rates published by the federal government for each state and legal paid sales. There are often yawning gaps between the two — the amount of cigarettes that should be smoked based on sales and the amount of smoking that actually occurs — and that difference is likely explained by smuggling.”

Simply claiming that revenue will continue to increase is not an accurate statement and doesn’t erase the numerous negative side effects that will follow such a large black market. Quoting a report from two scholars on the subject, which was published by the Mercatus Center, “Cigarettes aren't illegal, but governments have artificially raised the price of the product to such a degree that their sale and purchase now is tinged with many of the consequences of full alcohol prohibition. Thanks to "prohibition by price," people commonly smuggle cigarettes across borders, usually illegally, to evade excise taxes.”

The MSMA authors also said higher taxes result in less people smoking.

According to the CDC, while consumption of cigarettes decreased 32.8% from 2000 to 2011, consumption of loose tobacco and cigars increased 123.1% over the same period. As a result, the percentage of total combustible tobacco consumption composed of loose tobacco and cigars increased from 3.4% in 2000 to 10.4% in 2011. The data suggest that certain smokers have switched from cigarettes to other combustible tobacco products, most notably since a 2009 increase in the federal tobacco excise tax that created tax disparities between product types.

The truth is people often confuse a decline in legal cigarette sales with quitting. The number that stop smoking is smaller than that reflected in official cigarette sales precisely because of smuggling and a switch to less expensive tobacco products.

And the MSMA authors said cigarettes are addictive and they kill

We agree with the evidence. And given that, perhaps the appropriate public policy action is to lead a push to ban cigarettes, not make them more expensive? As we know, it is mostly the poor and the middle class who will end up paying this regressive tax.

And should we really use the tax code to punish people for legal behavior that the state objects with? If so, why do we limit it to only one unhealthy/risky behavior? Why not include alcohol, sugary sodas, fatty foods, and risky activities like downhill skiing and playing tackle football before age 14? The reason is that we long ago decided that a free society is made up of citizens who agree to take personal responsibility for their choices and actions. Parents are responsible to teach their children about the dangers of high places, hot stoves and sharp objects; they should also be responsible to each about the dangers of alcohol, cigarettes, and drugs.

Is there a possible free-market option to improving our health and reducing harm for consumers who still want to smoke?

In fact, there are multiple products coming online across the world that are considered “harm reducing” for consumer who still wish to legally “smoke.” In addition to e-cigarettes and vaping products, there is a product on the market in over 20 countries that “roasts” the tobacco and eliminates the combustion. The early data shows it has been highly effective at converting combustion cigarette smokers without attracting new smokers. That product is currently before the FDA seeking approval now in the U.S.

This column appeared at Y'all Politics on January 25, 2019.

Cities in Mississippi have been known to continue to collect taxes even after the tax has expired. And the legislature has supported this.

The city of Baldwyn, located between Tupelo and Booneville on U.S. 45, had its 2 percent tourism tax on restaurants and hotels expire on July 1. Despite notification from the Mississippi Department of Revenue, city businesses continued to collect the tax and have collected $11,983 from it so far this year.

When a tourism tax expires, businesses have the option of refunding customers or continuing to collect the tax and remitting it to the DOR, who then puts it in the general fund.

House Bill 653 would not only reauthorize the tax for another three years, but it’d allow the city to retroactively collect the proceeds from the now-dead tax if it is signed into law by Gov. Phil Bryant.

If HB 653 is signed into law, it’ll be the fourth time in the past three years that a reauthorization for a tourism tax also contained a provision allowing the city to retroactively collect from an expired tax.

Last year, both Southaven and Horn Lake had their tourism taxes expire. Both had provisions in the bills that reauthorized them to allow both cities to collect the tax retroactively and Gov. Bryant signed both into law.

In 2017, Senate Bill 2941 reauthorized the city of Byhalia in north Mississippi to collect its 2 percent hotel tax. The tax actually expired in July 2016, but the city continued to collect it for a year before SB 2941 allowed it to retroactively keep the proceeds.

In Mississippi, tourism taxes start as a local bill in the Legislature. These bills usually benefit a city or county in a legislator's district and are one of the last chores the Legislature wraps up before leaving town at session's end.

Once the local bill is passed, a referendum of local voters is required before the tax can go into effect. The tourism taxes usually have an expiration date of three years from passage.

The same rules that govern the passage of general and appropriation bills apply to the local bills. A three-fifths majority of both chambers are required to pass a new tax, which are pitched as temporary taxes by local leaders.

But they are often reauthorized by a new bill when they expire after three years without input from local voters.

In a little more than a week, the legislature approved a bill that supporters hope will bring broadband internet to every corner of the state.

It was a pace usually reserved for resolutions honoring high schools for winning the state championship. Or for the contributions an individual made to society.

The difference is there are high expectations for the Mississippi Broadband Enabling Act. Between most of the reporting and comments from the public, broadband will be available tomorrow or by next week at worse.

That’s a slight exaggeration, though not much of one, but the bill essentially has one key feature. And it’s a good one. The state will no longer prevent electric cooperatives from providing broadband. Removing a government regulation on any entity is always a good thing.

After that, numerous questions remain.

The first is, who will actually be served? Again, the common belief is that everyone will soon have broadband speeds at home. But we don’t know if every EPA will want to be involved in the broadband game. And if they do, we don’t know if they will serve every member in their co-op. There’s quite a difference, and cost, between bringing broadband to a suburban subdivision, that likely already has broadband from an investor-owned utility, and to the person that lives a couple miles from their nearest neighbor.

The reason AT&T, Xfinity, and C Spire have yet to enter these markets is because the business model does not work. The market does not lie.

EPAs can’t simply flip a switch and make broadband appear. Where will the money come from? While there is nothing in the bill this year, taxpayers will likely bear the burden in the future.

Most of the talk has centered about federal subsidies, which are still tax dollars even though we have this disconnect on where money in Washington comes from. And beyond that, there is the strong probability that the state will also need to be involved financially. And potentially ratepayers.

There are many bills the legislature could rush through at a similar pace. They could eliminate red tape for businesses caused by numerous government regulations, make it easier for entrepreneurs to earn a living with fewer burdensome licenses, allow parents more options in the education of their children, and lead Mississippi on the path to prosperity most states in the South have experienced.

Fortunately, they still have plenty of time.

The Mississippi Broadband Enabling Act is headed to the full Senate after the Energy Committee approved it at its meeting Tuesday.

House Bill 366— which would allow rural electric power associations to provide broadband service to their customers — will reach the Senate floor unaltered from its final House version that was approved on January 15.

Energy Committee Chairwoman and state Sen. Sally Doty (R-Brookhaven) said that one of the reasons why the bill would take effect immediately on passage was an April deadline for the EPAs, also known as co-ops, to apply for federal grants to provide broadband service.

Most bills that become law take effect on July 1, the first day of the new fiscal year.

There were two amendments that were shot down on voice votes.

State Sen. John Polk (R-Hattiesburg) wanted a 10-year requirement for EPAs to provide broadband to all of their customers.

State Sen. Josh Harkins (R-Flowood) wanted a reverse repealer, which is a legislative tactic which forces reconsideration before it can reach Gov. Phil Bryant’s desk for a signature.

Harkins voted for the bill, despite voicing some reservations on whether the EPAs would serve rural customers and not try to start building a base in more population-dense suburban areas served by EPAs.

Some of Harkins’ suburban Rankin County district is served by EPAs.

“Obviously, if this bill passes, people are going to have the expectation that they’re going to have fast internet service pretty quick,” Harkins said. “Will these companies try to reach the areas that are under served and not dense areas of population?”

Doty said that if the Legislature gives co-ops the ability to provide broadband service, it’ll be their responsibility to manage those expectations. She cautioned a constituent that stopped her in the grocery store about rural broadband.

“It’s not going to be something that’s immediate and is not necessarily going to be in all parts of the state,” Doty said. “This gives us in Mississippi another option to provide broadband services.”

The bill was authored by House Speaker Philip Gunn (R-Clinton) and it has several provisions that include:

- Removing the prohibition in state law that prohibited EPAs, also known as co-ops, from conducting any business outside providing electrical service to their customers.

- A requirement for EPAs to maintain the reliability of their electric service.

- A mandate for EPAs to conduct feasibility studies before providing broadband services.

- The EPA would be unable to use electric sales revenues to subsidize its broadband services, but it can make capital investments in the broadband entity along with utilizing loan guarantees.

- Being compelled to charge the same pole attachment fees to their broadband entity as they would to any outside private entity.

- EPAs wouldn’t be able to cut off electric service to broadband customers with delinquent bills.

The Mississippi House passed a bill Tuesday that could allow the state’s electric power associations to provide broadband service to their customers.

On Monday, the House Public Utilities Committee voted to send the House Bill 366, known as the Mississippi Broadband Enabling Act, to the floor for a vote.

The bill was authored by House Speaker Philip Gunn (R-Clinton) and it has several provisions that include:

- Removing the prohibition in state law that prohibited EPAs, also known as co-ops, from conducting any business outside providing electrical service to their customers.

- A requirement for EPAs to maintain the reliability of their electric service.

- A mandate for EPAs to conduct feasibility studies before providing broadband services.

- The EPA would be unable to use electric sales revenues to subsidize its broadband services, but it can make capital investments in the broadband entity along with utilizing loan guarantees.

- Being compelled to charge the same pole attachment fees to their broadband entity as they would to any outside private entity.

- EPAs wouldn’t be able to cut off electric service to broadband customers with delinquent bills.

“I’m not here to say this is a perfect bill,” said House Public Utilities Committee Chairman Jim Beckett (R-Bruce). “We’re not going to get everyone broadband overnight. It’s going to take a long time.”

Debate on the bill veered into a discussion over transparency with the finances of the EPAs and the membership of their boards, which are voted on by the customers.

State Rep. Robert Johnson III (D-Natchez) offered five amendments on the bill, with the first three amendments passed on voice votes. The first dealt with investor-owned utilities and the fact the act wouldn’t infringe upon their property or interests.

The second required the EPAs seeking to enact broadband service under the act to send notice of its elections to its board of directors to its customers. The last that passed concerned the information of customers via newspapers about the results of its board elections.

“When you’ve got EPAs that serve 1.8 million people in the state of Mississippi, more than half the state’s population, 60 percent are African-American and only 4.4 percent of the board membership,” Johnson said. “When you talk about women, it’s even less than that. I’m going to support this bill because the chairman (Beckett) did a good job.”

Johnson also tried to pin a reverse repealer clause on the bill, which would’ve brought it back for more work, and require EPAs offering broadband to provide quarterly financial statements to the Mississippi Public Service Commission. Both failed, with the fourth amendment defeated on a 71-42 roll call vote.

State Rep. Mark Baker (R-Brandon) accused Johnson of using the EPA amendments to improve his position regarding litigation regarding the EPAs and their finances.

The EPAs are not-for-profit corporations and are regulated by the Federal Energy Regulatory Commission. The state’s two investor-owned utilities — Entergy and Mississippi Power — are regulated by the three-member elected Mississippi Public Service Commission.

Public Service Commission Chairman Brandon Presley, a Democrat, has pushed the issue of rural broadband and was on hand for the vote.

The pole attachment fees are what outside entities pay to the utility to use their infrastructure for running lines to consumers. Since the investor-owned utilities are regulated by Federal Communications Commission when it comes to their pole attachment fees, they’re far lower than the EPAs. The co-ops aren’t subject to pricing rules on pole attachment fees and theirs are conversely higher.

Putting a provision that keeps EPAs from giving their broadband entities a discount on pole connection fees would help the issue of unfair competition in suburban areas of the state served by EPAs and traditional broadband providers such as AT&T, Xfinity and C Spire.

The loan guarantees might be a back door for subsidies, either from state or national taxpayers.

According to a report by the Congressional Research Service, there is $690 million in loans and grants available for the Telecommunications Infrastructure Loan and Loan Guarantee Program. This program, administered by the Rural Utilities Service of the U.S. Department of Agriculture, provides grants and loans for areas that lack high-speed broadband coverage.

A bill known as “The Mississippi Broadband Enabling Act” is moving fast through the House.

The legislation is designed bring broadband to every corner of Mississippi, so says its supporters.

Who can be against that? Likely not many members of the House. This bill will allow the cooperatives that brought electricity to rural Mississippi to do the same with high-speed internet.

But as with most policy, we should dig deeper beyond the title or the talking points before proceeding. Because this legislation leaves more questions than answers.

To begin, the mission of Electric Power Associations (EPAs), as defined by current law, is to make “electric energy available at the lowest cost consistent with sound economy and prudent management of the business of such corporations.”

Today, EPAs can lease their pole attachments to internet providers. However, because their rates are very high, significantly higher than the rates of investor owned utilities that are regulated by the state, it is cost prohibitive. That is a business decision made by both entities, but it is still an option.

While EPAs cannot provide internet services themselves, even without this legislation they can already create a separate entity and provide the services using their pole attachments.

The truth that everyone knows is that rural broadband is expensive. It has not been feasible in the private sector to offer a product at a price point people can afford or are willing to pay. That does not change because of this legislation.

While the initial focus of EPAs was rural electricity, they serve many suburban areas today as population shifts occurred. They would likely be the prime targets for EPAs, as they will be the easiest to reach, but many of those customers already have the option of AT&T, Xfinity, or C Spire.

Will an EPA run fiber for several miles to reach one or two houses at the end of a gravel road? And can they do that for $50 a month or whatever consumers believe is a reasonable price? Those are some of the questions to be asked.

Because, if it is not feasible as the market has shown, it seems inevitable that this plan will open the door for a ratepayer and state taxpayer bailout.

A proposal floated by a Mississippi coalition to increase the state’s cigarette excise tax by 221 percent — to $2.18 per pack — would result in a huge increase in tax evasion and avoidance, according to a recent statistical analysis.

If the increase is adopted, Mississippi will find itself surrounded by lower-taxed states, which will encourage cross-border shopping by individuals and large scale smuggling, too, among other undesirable consequences.

It was anecdotal evidence about cigarette tax evasion and avoidance, or “smuggling,” that led one of the authors (LaFaive) and two of his colleagues to estimate the degree to which cigarettes are smuggled between states, as well as from Mexico and to Canada. They estimate that through 2016, Mississippi’s smuggling rate was a mild 4 percent.

The estimate is built around their statistical model, which measures the difference between smoking rates published by the federal government for each state and legal paid sales. There are often yawning gaps between the two — the amount of cigarettes that should be smoked based on sales and the amount of smoking that actually occurs — and that difference is probably explained by smuggling.

The model can be used to make “what-if” estimates based on proposed changes in tax rates. At an excise tax of $2.18 per pack, smuggling would leap from 4 percent to 35 percent of the total market. That is, of all the cigarettes consumed in Mississippi after such a tax hike, 35 of every 100 cigarettes would be smuggled. The model also reports that 21 percent of all consumption would be a function of “casual” smuggling. Casual smuggling is represented by individuals who typically buy lower-taxed smokes elsewhere for personal consumption.

The degree of casual tax avoidance or evasion makes sense when you consider that Mississippi, at $2.18 per pack, would be surrounded by lower taxed states Tennessee (62 cents); Alabama (67.5 cents); Louisiana ($1.08); and Arkansas ($1.15). Consider too, that Missouri, which imposes a tax of just 17 cents — the lowest in the country — is only a short drive through Arkansas.

When tax rates vary substantially across state borders, that gives people an incentive to shop elsewhere for their smokes and for larger, organized crime cells to engage in large, long-haul smuggling operations.

For example, New York State imposes a state excise tax of $4.35 per pack, and New York City tacks on an additional $1.50. Nearby Virginia — a five-hour drive — imposes a tax of only 30 cents. It is this difference that consumers seek to save (and smugglers try to profit from) by acquiring lower priced, often illegal cigarettes. In New York, inbound trafficking is rampant and news stories about it are easy to find.

Just last November, the New York state attorney general announced a 242-count indictment involving 17 cigarette smugglers who moved over 18 million untaxed smokes into the Empire State. That’s just one cell and one bust. There have been many others. This is something Magnolia State lawmakers should consider before taking up legislation that could make Mississippi’s smuggling look more like a New York racket.

Moreover, smuggling is not the only consequence of high cigarette taxes. Others include brazen theft of cigarettes from retailers and wholesalers, shipment hijackings, violence against people and police, cases of murder-for-hire, accidental deaths involving police pursuits and public employee corruption.

All of the risks associated with higher cigarette excise taxes could be worthwhile if they led to far more people kicking the habit. Research shows, however, that as much as 85 percent of the after-tax change in legal paid sales is a function of tax avoidance and not quitting. Cigarette sales may drop dramatically, but it does not follow that smoking rates do.

None of this should suggest that either of us wish to encourage smoking. Neither of us are smokers and we would discourage others from starting. But the data shows us that there are far more effective ways — including tobacco alternatives, non-combustion substitutes, and innovative harm-reduction products — to reduce smoking than raising taxes.

The evidence from around the country and elsewhere tells us that relatively high cigarette excise tax rates can produce every sort of mischief, including undermining the very health goals such taxes were adopted to address.

This editorial was co-authored by Michael LaFaive. He is senior director of fiscal policy for the Mackinac Center for Public Policy and author of “Prohibition by Price: Cigarette Taxes and Unintended Consequences,” a chapter in the book, “For Your Own Good.”

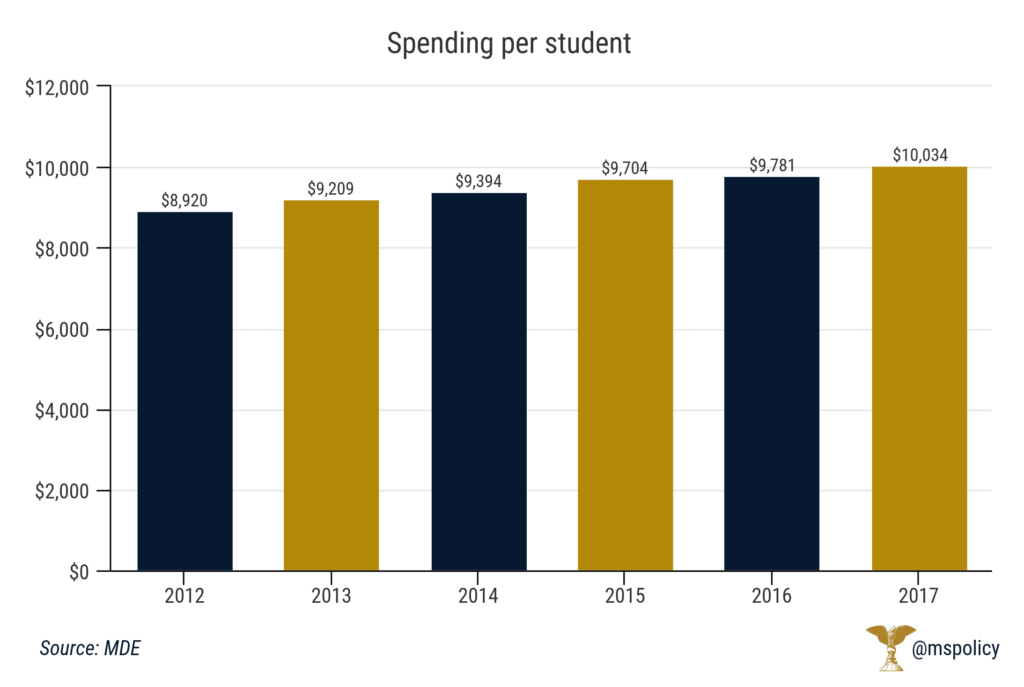

The state of Mississippi eclipsed spending $10,000 per student last year.

According to the 2017-2018 Superintendent’s Annual Report, released Thursday, the state spent $10,034 per student, on average. This amount was based on average daily attendance, which was 439,599 students last year.

This marks the sixth straight year that the average expenditure per student has increased. In 2012, the state was spending $8,920 per student. It increased to $9,209 in 2013, $9,394 in 2014, $9,704 in 2015, and $9,781 last year.

On a district-by-district basis, spending per student fluctuated from a high of over $21,000 per student in the Montgomery County School District to a low of $7,800 in the Lincoln County School District. The Kemper County School District, Amite County School District, Moss Point School District, and Lumberton School District rounded out the top five.

Eighty-six districts spent more than $10,000 per student, and 24 spent more than $12,000 per student.

National figures on what each state is spending tend to vary widely depending on the source. The U.S. Census, which tracks public education finances, showed a national average of $11,762 during the 2016 fiscal year. However, the same data had Mississippi spending just $8,702, almost $1,000 less than what the state reported.

Simultaneous to the increase in per-student-expenditure, the average daily attendance has also decreased each year. While that number was just under 440,000 this year, it was 461,000 in 2012. This represents a drop of more than 4.5 percent. Enrollment numbers decreased again for the 2018-2019 school year, and, presuming education funding is not reduced, the per- student-average will only continue to increase.

Maintaining diversity departments at Mississippi State University and the University of Mississippi are hitting taxpayers in the wallet.

According to records obtained by the Mississippi Center for Public Policy, the University of Mississippi spent $1,249,868 of its 2018-2019 budget on diversity related operations, which include the Division of Diversity and Community Engagement, Center for Inclusion and Cross Cultural Engagement and the McLean Institute for Public Service and Community Engagement.

Mississippi State University spent $803,756 on diversity-related activities that include the Institutional Diversity and Inclusion Division and the Holmes Cultural Diversity Center.

As a percentage of their total budgets ($681 million for Ole Miss and $364 million for Mississippi State), Ole Miss and Mississippi State are both outspending the University of Michigan on diversity-related activities. Michigan was the flashpoint for two landmark U.S. Supreme Court cases involving race-based admissions policies.

The Ann Arbor-based school has a budget of more than $3 billion and spent more than $2 million on its diversity agenda with 12 employees. In 2014, the U.S. Supreme Court upheld a Michigan ballot initiative that prevented race-based admissions at the state’s institutions of higher education with a 6-2 decision in Schuette v. Coalition to Defend Affirmative Action.

The ballot initiative was in response to the 2003 U.S. Supreme Court decision, Grutter v. Bollinger, that upheld affirmative action admission policies at Michigan and other universities.

The University of Alabama has six full-time employees dedicated solely to two diversity-related organizations, the Diversity Equity and Inclusion office and the Women and Gender Resource Center. The Tuscaloosa-based institution had a budget of $2.14 billion in 2017.

Louisiana State University has nine full-time employees whose role is dedicated to diversity-related issues. LSU had a budget of $1.018 billion in 2018.

Ole Miss spent 95.8 percent of its diversity-related budget ($1,249,868) on personnel-related costs. That adds up to $1,197,080 in 2018-19 for eight full-time employees with more budgeted for part-time student workers.

That figure could also increase with four unfilled positions, two of which (assistant vice chancellors for diversity and community engagement) pay $120,000 apiece per year.

What are the objectives of the various diversity departments on college campuses?

Former Ole Miss Chancellor Jeffrey Vitter called diversity “a hallmark of education” and said that it “enriches the environment and experiences of all our campus constituents.”

In the diversity plan at Ole Miss, the university wants to increase the enrollment and graduation rate of minorities, hire more minorities in administrative, faculty and staff positions, change the curriculum to one that “enhances multicultural awareness and understanding,” and increase the use of minority vendors by the university.

Mississippi State has 11 full-time employees and more money budgeted for part-time student workers whose job descriptions are based on increasing campus diversity. Personnel-related costs absorb 82.2 percent of the diversity program’s budget at State.

MSU’s diversity plan is similar, with goals to increase diversity in both enrollment and among administration, faculty and staff along with providing more contracts to minority vendors.

Diversity is a lucrative career, especially at Ole Miss. The university pays Katrina Caldwell, the Vice Chancellor for Diversity and Community Engagement, $205,000 per year. She received a $5,000 raise in 2018 after being hired from Northern Illinois University.

According to her bio on the university website, Caldwell’s duties include “leadership and coordination of UM’s efforts to create and supervise a diverse, inclusive and welcoming environment for all members of the community.”

Are taxpayers seeing a benefit for this spending? Not according to a paper from the National Bureau of Economic Research that shows that having a diversity staff doesn’t translate to an increase in the hiring of “underserved” racial and minority groups.

The paper, authored by Baylor University economists Steven Bradley, James Garven, Wilson Law and James West, took a look at data from U.S. universities from 2001 to 2016 that hired an executive level chief diversity officer and whether the diversity of their faculty and administrative hires increased as a result.

The four didn’t find any significant evidence that hiring a diversity officer results in more hiring of minority faculties and administrators and that the pool of diverse Ph.D. candidates is limited as many often accept employment outside the academy.

According to their research, two thirds of all U.S. universities have a chief diversity officer on staff.