A Mississippi Senate appropriations subcommittee hearing on Department of Public Safety funding Wednesday morphed into a discussion of excessive wait times for driver’s license renewal.

State Sen. Brice Wiggins (R-Pascagoula) criticized the DPS, represented by Commissioner Marshall Fisher, for having four-hour plus wait times for driver’s license renewals.

“The issue is simple things could be done,” Wiggins said. “Four hour wait times are flat-out unacceptable for the citizens of Mississippi. Something has to change. I’ve heard of people coming in to say they just need to change their address and they’re told come back in six hours.”

Wiggins also said that he’d support more appropriations for DPS to help reduce wait times and suggested a phone, but also said it was more than just about money. He said that the department should enact a phone-based or online appointment system to lower wait times.

Fisher told Wiggins and the subcommittee that the examiners, who make around $21,000 annually, need a pay hike. He also said he’d like to have more of the driver’s license services online.

Fisher has asked the subcommittee for a $48.75 million increase in his agency’s budget that would include a new trooper school, more officers for the Mississippi Bureau of Narcotics, and more medical examiners for the state crime lab. This increase would also cover added employer contributions to the state’s defined benefit pension system.

Fisher also asked for his agency to be released from the purview of the Mississippi Personnel Board and the Employee Appeals Board. Under state law, a bill would have to be drafted to provide DPS with an exception.

During his briefing, Fisher said the number of state troopers is critically low and the agency needs 60 more troopers. According to his numbers, there are 488 troopers on the force at present, but of those, 160 have enough service time to retire this year.

State law authorizes a force of 650 troopers.

Fifty seven troopers were added to the force after a trooper school graduated last year, while up to 54 in the present class could join the force on May 1.

According to the U.S. Department of Justice statistics, the national average is 20 troopers per 100,000 residents. Using Fisher’s numbers on troopers, the state has 17 per 100,000 residents.

Fisher also said the autopsy workload for the state’s two medical examiners is too high and that the Medical Examiner’s Office needs seven additional personnel, including two new examiners. He said the two examiners performed 1,250 autopsies last year, which is far more than 250 per examiner recommended by the National Association of Medical Examiners.

Mississippi’s defined benefit pension system has enjoyed consecutive years of above-average investment income, yet its financial position has only improved slightly.

The Public Employees' Retirement System of Mississippi — which serves most state, county and municipal employees — earned $2.385 billion in investment returns in fiscal 2018, a 9.48 percent rate of return, after earning $3.4 billion or a 14.96 percent rate of return in 2017, according to its comprehensive financial report released on December 18

The plan expects an annual return on its investments of 7.75 percent.

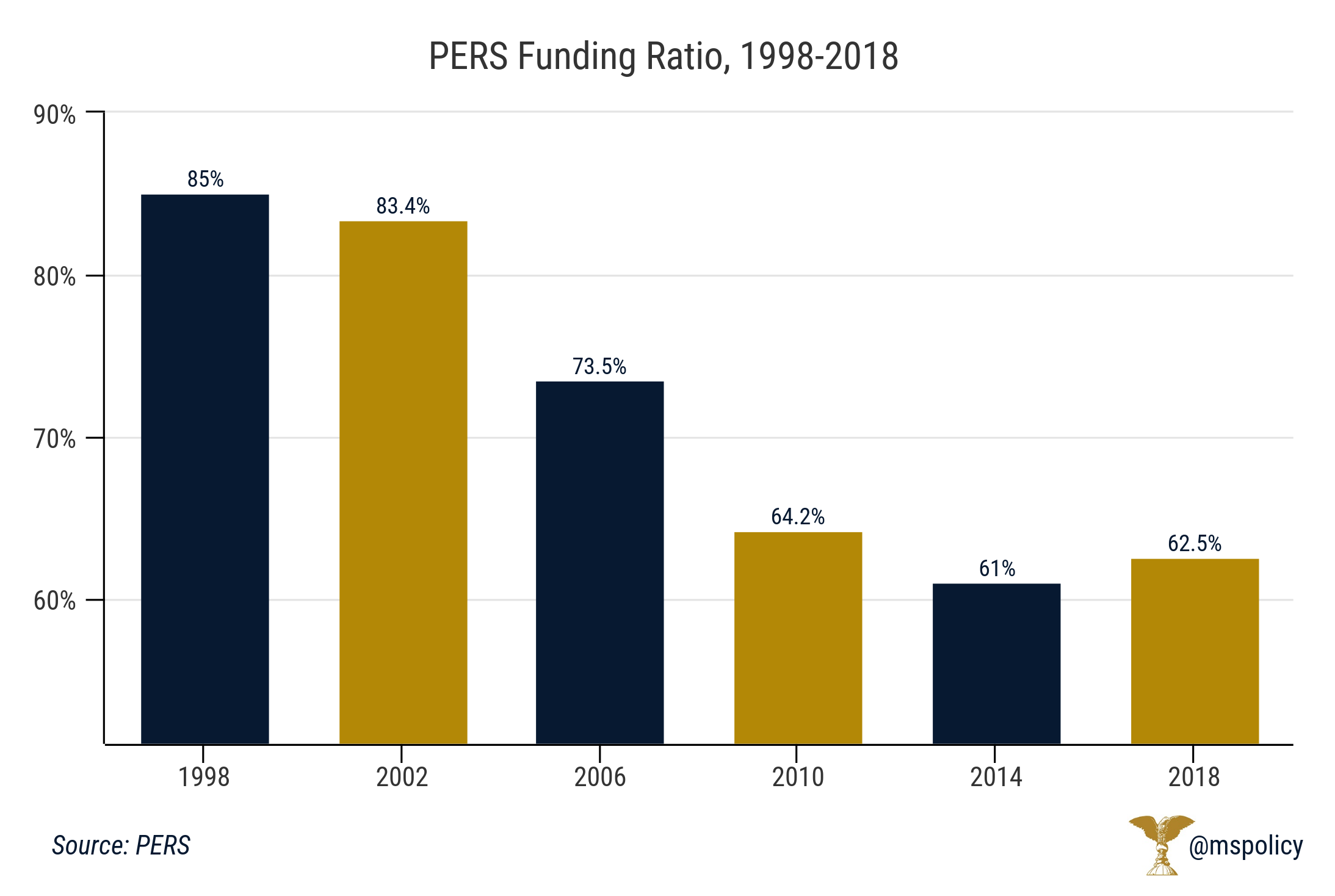

The funding ratio, which is defined as the share of future obligations covered by current assets, also ticked upward for the second consecutive year, improved from 61 percent in 2017 to 62.5 percent. As recently as 2001, the plan was 87.5 percent funded.

The funding ratio is a useful measure for gauging the health of a pension fund, as PERS was 85 percent funded in 1998.

Despite the second year of big returns on its investments, the plan’s unfunded liability remained the same at $16.6 billion. To fill this gap would require 2.76 years of all general fund tax revenue.

Along with the annual report from PERS, there are independent organizations that also track state administered pension plans. According to Pew, Mississippi has a funding gap of $18 billion. According to their report, Mississippi taxpayers would need to contribute an additional 4.6 percent to fund the system. The American Legislative Exchange Council (ALEC) has a bleaker picture for the retirement system, showing just 24 percent of promises currently funded and unfunded liabilities of over $80 billion.

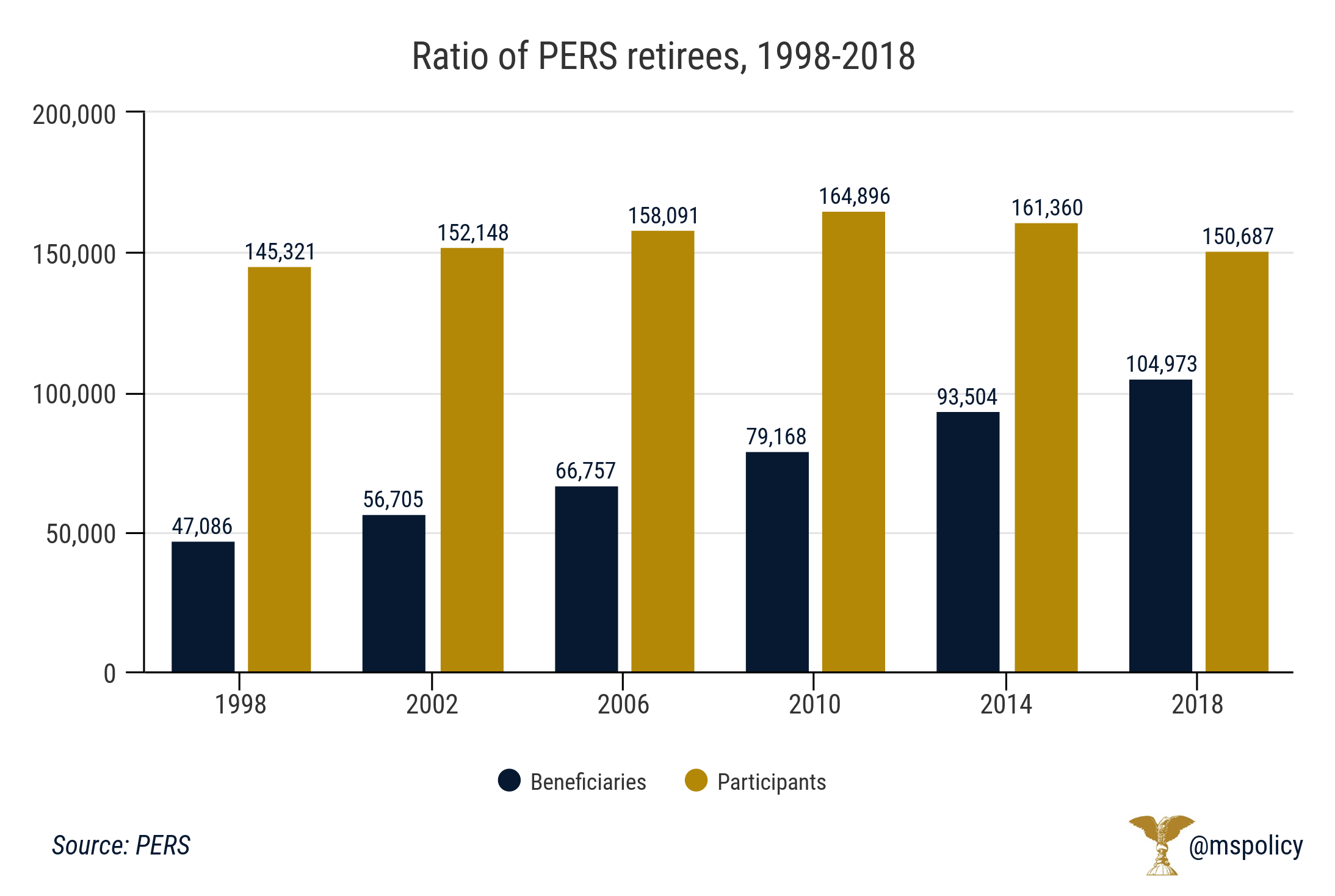

The reason is the increasing number of retirees supported by a shrinking number of contributing employees. Benefit payments added up to $2.6 billion, an increase of 5.3 percent over 2017, as the number of retirees increased from 102,260 to 104,973.

The number of contributing employees dropped from 152,382 in 2017 to 150,687. The amount of employer (taxpayer) and employee contributions added up to $1.6 billion, about the same as the year before.

The PERS board voted this summer to increase the taxpayer contributions from 15.75 percent of payroll to 17.4 percent. The legislature will have to appropriate $75 million or more for the employer contribution for state employees, while the increase for municipal and county employees could be on the hook for $25 million or more.

The trend of increasing numbers of retirees and decreasing numbers of contributing employees will continue for the foreseeable future thanks to unfavorable demographics.

The average age of the plan's members is 44.8, up slightly from last year (44.7) and members with at least 15 years of service represent 27.9 percent of all state and municipal employees in the PERS system. In 1999, the average age of PERS members was 42.4.

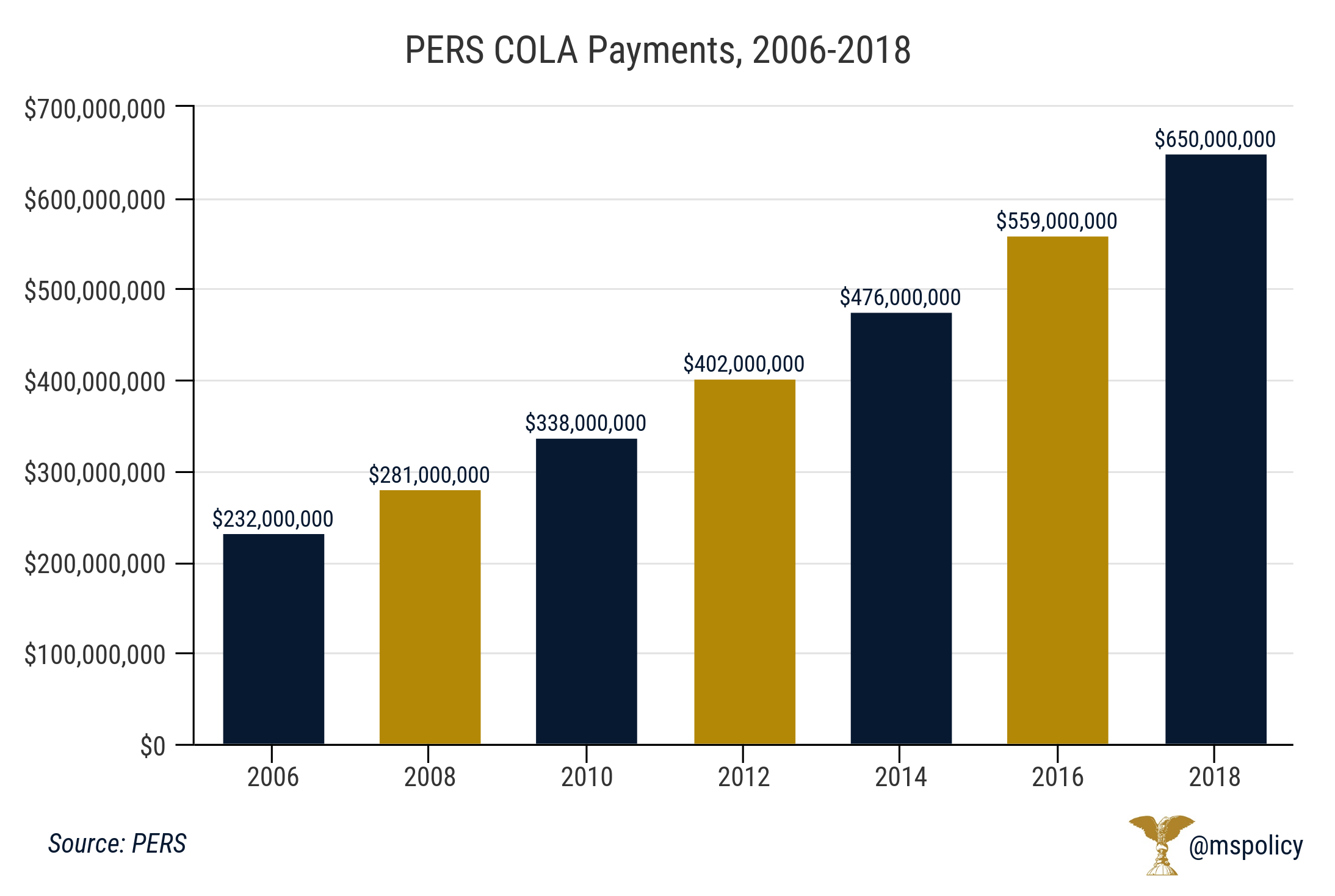

With more retirees, the plan’s payments for its cost of living increase or COLA added up to $650 million, a 7.8 increase over last year’s COLA payments of $603 million.

The fund provides a cost of living adjustment that amounts to three percent of the annual retirement allowance for each full fiscal year of retirement until the retired member reaches age 60.

From that point, the three percent rate is compounded for each fiscal year. Since many retirees and beneficiaries choose to receive it as a lump sum at the end of the year, the benefit is known as the 13th check.

Mississippi’s problems aren’t happening in a vacuum. According to the non-partisan Tax Foundation, Mississippi’s funding ratio of 58 percent in 2016 ranked 38thnationally and more than half of all states have pension funds that are less than two-thirds funded.

Cigarette taxes are one of the easiest taxes to raise. It is a tax on an unsympathetic, and shrinking, demographic.

And voters approve a tax increase in Mississippi, as they do in virtually every poll taken on the issue regardless of the state.

Yet, that doesn’t mean raising cigarette taxes to cover budget shortfalls is good public policy. Quite the opposite, excise taxes on cigarettes are one of the least stable parts of a state budget and will likely only leave lawmakers looking for other solutions in a few years.

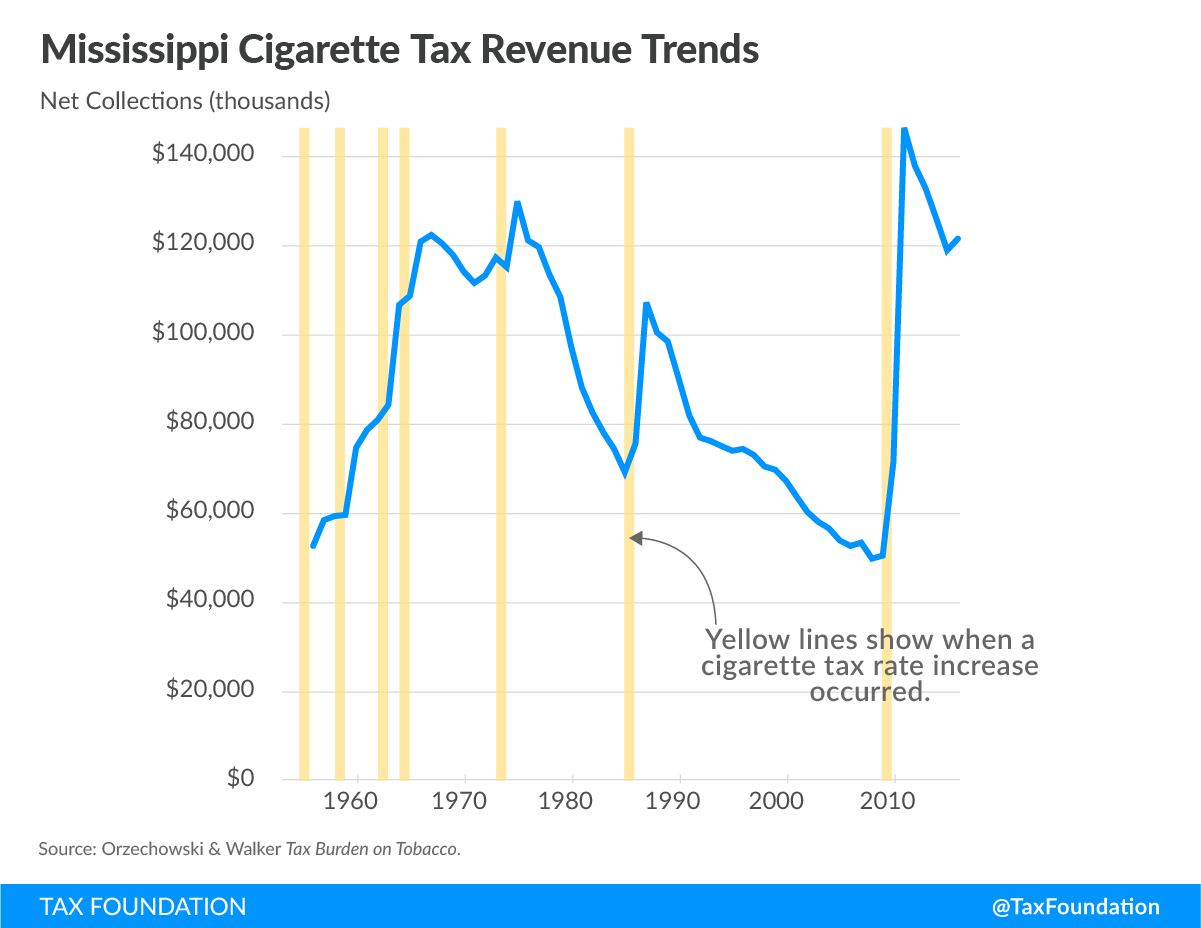

As taxes on cigarettes are constantly being raised, we have a great deal of data on this subject. What we experience is an immediate bump in revenue, followed by a falloff in collection in future years. This happened the previous three times cigarette taxes have been raised in Mississippi; 1973, 1985, and 2009.

As you can see, the state noticed an immediate uptick followed by a decrease. Today, the state is collecting the same tax revenue (adjusted for inflation) on cigarettes as it was in 1975. This, despite the fact that taxes have increased by 518 percent during this time period.

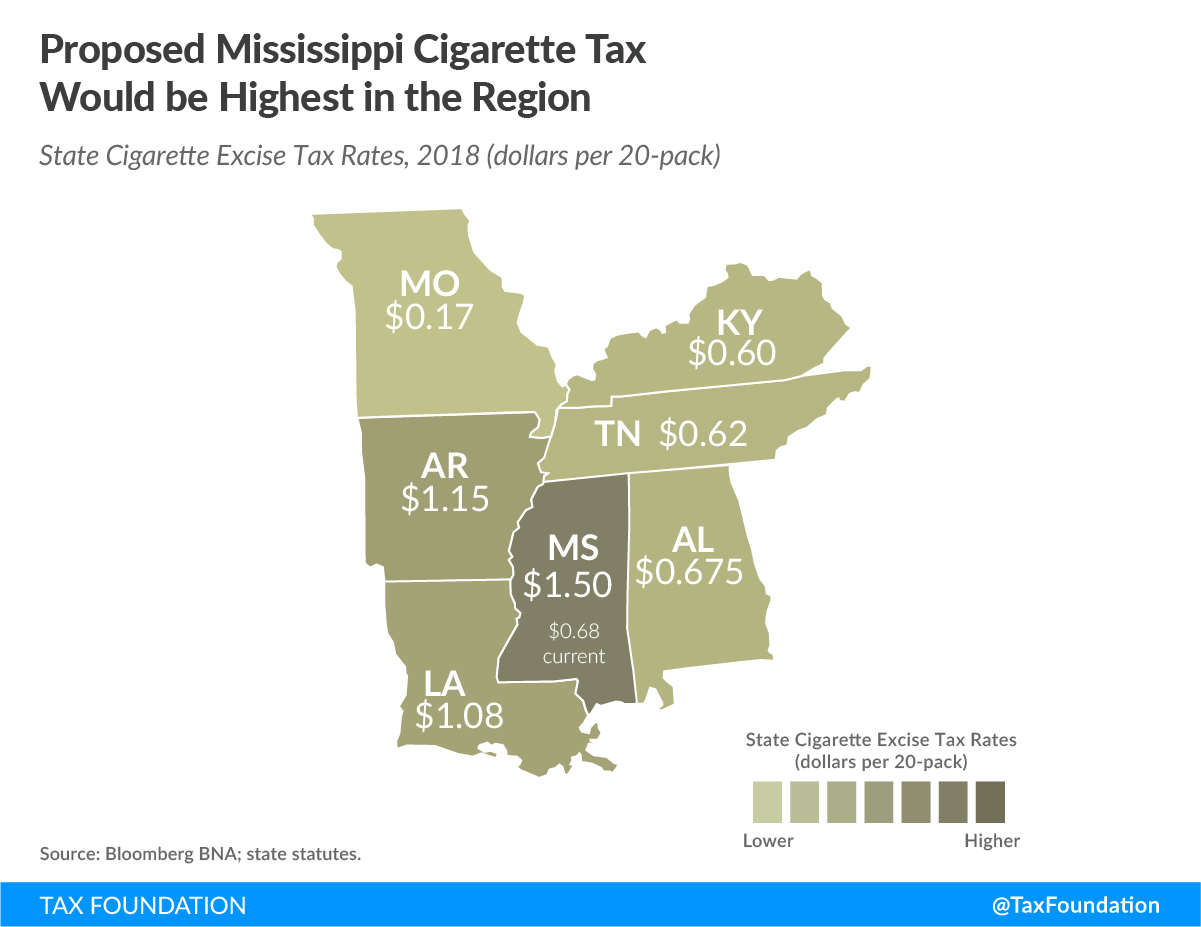

A second thing happens when a state adopts the highest cigarette tax rates in their region: people look elsewhere for cigarettes. The proposed $1.50 increase (to $2.18) that some are pursuing would place Mississippi’s tax rate at least 90 percent higher than Arkansas and Louisiana and more than 200 percent above that in Tennessee and Alabama. And as a result, even less revenue is collected.

Cigarette usage has been declining since the 1960s and that trend is not slowing, even if Mississippi is above the national average. If the goal of health advocates is to see that number reach zero, it will happen because of continued education, not taxes.

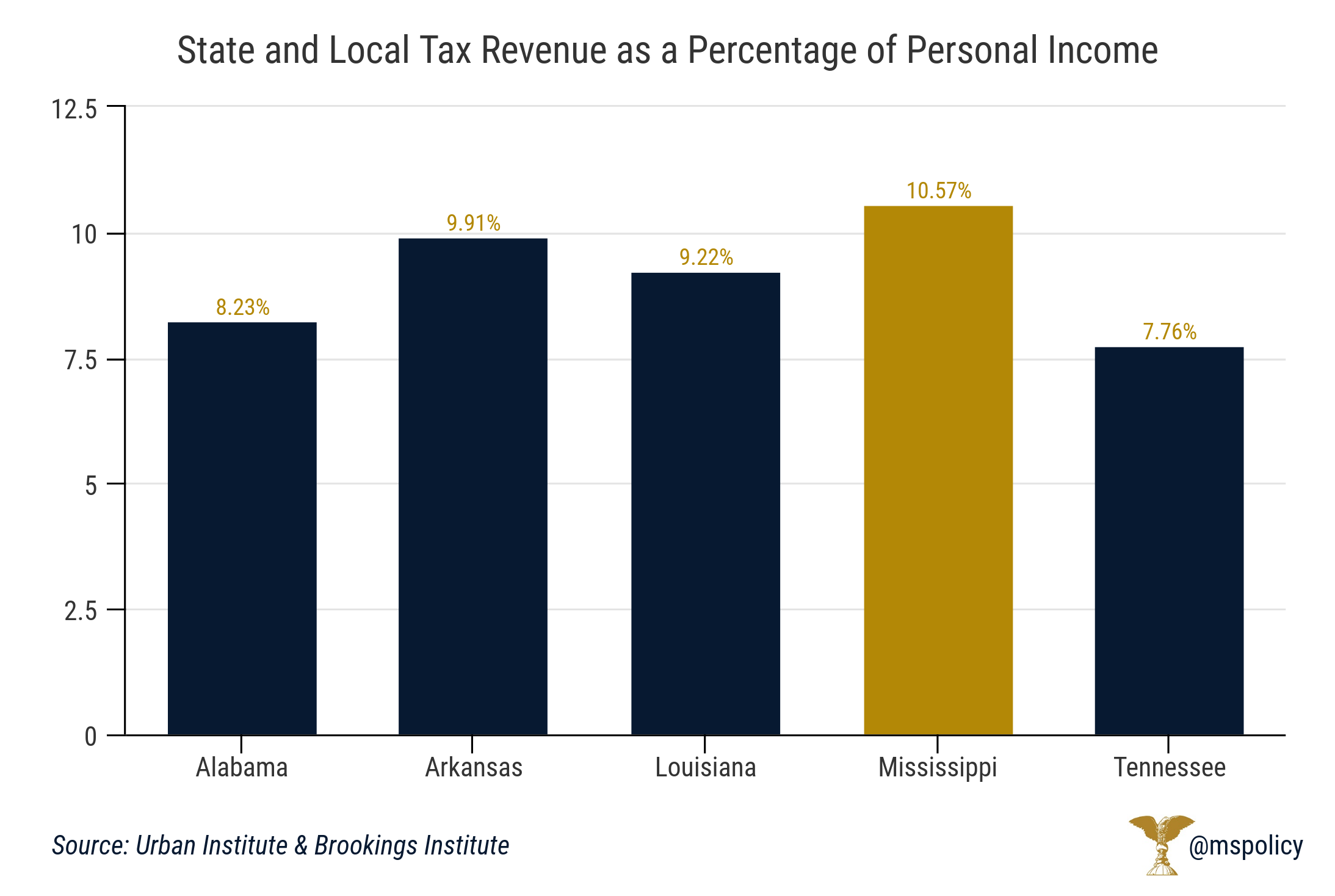

Cigarette taxes are easy. But the comprehensive tax reform that Mississippi needs is far more complex. The state has one of the highest total tax rates as a percentage of personal income in the Southeast. While Mississippi’s local and state tax revenue rate is 10.57 percent, the four neighboring states range from 7.76 percent to 9.91 percent.

And unfortunately for Mississippi, Americans, and their wealth, are moving to low tax states. So what can we do in Mississippi? We can follow the lead of high-growth, low-tax states in the Southeast that have lower taxes, lighter licensure and regulatory burdens, and a smaller government.

The highest tax rates in the country may be found in California or New York, but Mississippians have among the highest tax burdens in the Southeast, even outpacing national averages.

As a percentage of personal income, Mississippians have a state and local tax revenue rate of 10.57 percent. The national average is 10.08 and the Southeast average is 8.57.

Among neighboring states, Alabama has a rate of 8.23, Arkansas is 9.91, Louisiana is 9.22, and the income-tax free state of Tennessee is 7.76. This means Tennessee runs their government for about 25 percent cheaper than Mississippi. Mississippi is the only state in the Southeast, save for West Virginia, over 10 percent. The Mountaineer state is the highest in the region at 11.23.

Mississippi’s percentage has gone up steadily over the past few years. From 2010-2012, it ranged from 9.84 to 9.88. But this trend has, unfortunately, been going in the wrong direction over the past four decades. In 1977, the national average was 10.82 and Mississippi was at 9.82. The national average has decreased .7 percent, while Mississippi’s average has increased .8 percent.

Why does this matter? Because Americans are fleeing high tax states and moving to low tax states.

Twenty-six states had a tax burden of 8.5 percent or greater. Of those 26, 25 had a net out-migration. Only Maine was able to buck the trend. And not surprisingly, of the 17 states that had net migration gains in 2016, all but one has a tax burden of less than 8.5 percent. All totaled, more than 500,000 individuals moved from the top 25 highest-tax states to the 25 lowest-tax states in 2016.

Those high tax states, Mississippi among them, lost an aggregate income of $33 billion.

So what can we do in Mississippi? We can follow the lead of high-growth, low-tax states in the Southeast that have lower taxes, lighter licensure and regulatory burdens, and a smaller government.

Gov. Phil Bryant received a “B” on a fiscal policy report card on America’s governors for 2018.

The report from the Cato Institute measures the fiscal choices and fiscal policies of every governor in America by examining state budget actions dating back to 2016.

“Governors play a key role in state fiscal policy. They propose budgets, recommend tax changes, and sign or veto tax and spending bills. When the economy is growing, governors can use rising revenues to expand programs, or they can return extra revenues to citizens through tax cuts. When the economy is stagnant, governors can raise taxes to close budget gaps, or they can trim spending,” the report notes.

The report credited Bryant for signing business and individual tax cuts into law in 2016. This includes the phasing out of the $260 million corporate franchise tax. It also cut taxes for self-employed individuals and cut the bottom individual and corporate income tax rates from 3 percent to zero.

The report also noted that the state general fund budget has been flat over the past couple years. Further, state government employment has been trimmed. Only four states have seen greater reductions in per capita spending during this time period than Mississippi.

“This report grades governors on their fiscal policies from a limited-government perspective. Governors receiving an A are those who have cut taxes and spending the most, whereas governors receiving an F have raised taxes and spending the most. The grading mechanism is based on seven variables, including two spending variables, one revenue variable, and four tax-rate variables,” the report adds.

Bryant’s grade was best among our neighbors, topping Gov. Asa Hutchinson (R-AR), who received a C, Gov. Bill Haslam (R-TN), who received a D, and Gov. John Bel Edwards (D-LA), who received an F. The report excluded Alabama Gov. Kay Ivey, a Republican, because of her short time in office.

Reshaping our fiscal policy

While Mississippi may be headed in the right direction, our fiscal freedom has long trailed all of our neighbors. Fiscal policy includes state and local taxation, government consumption, investment, employment, and debt. Essentially, how much are you being taxed and how much of our economic activity is controlled by government? In Mississippi, our overall tax burden is a bit above average nationally. And government employment and consumption are far higher than average.

Why does this matter? Because fiscal policy often dictates domestic migration and economic growth. And people are moving to the freest states, which also happen to have the greatest opportunity, an availability of good jobs, and a reasonable cost-of-living.

Calling for a limited, or smaller, government is not a conservative taking point. It is a principle that encourages freedom and prosperity.

A new analysis of financial reports gives Mississippi a “D” for the state’s fiscal health.

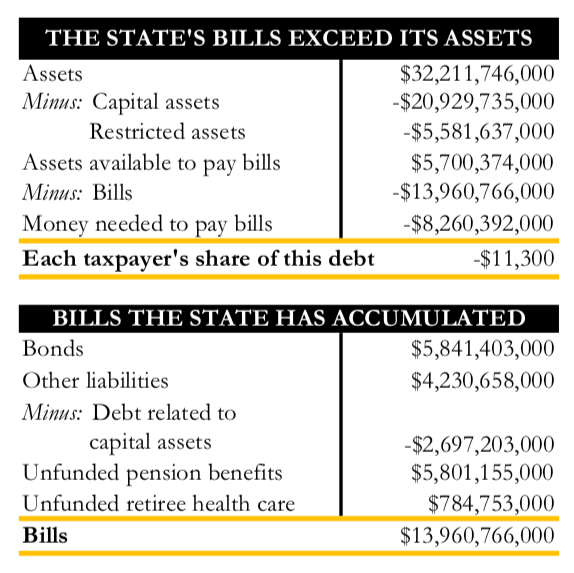

According to the report from Truth In Accounting, Mississippi’s finances were ranked 33rd among the 50 states. Based on money available, each taxpayer would have to pay $11,300 to cover the state’s bill.

A large part of that problem is due to retirement obligations for state workers.

“Mississippi's elected officials have made repeated financial decisions that have left the state with a debt burden of $8.3 billion, according to the analysis. That burden equates to $11,300 for every state taxpayer. Mississippi's financial problems stem mostly from unfunded retirement obligations that have accumulated over many years. Of the $16 billion in retirement benefits promised, the state has not funded $5.8 billion in pension and $784.8 million in retiree health care benefits,” the report notes.

The report shows:

- Mississippi has $5.7 billion available in assets to pay $14 billion worth of bills.

- The outcome is a $8.3 billion shortfall and a $11,300 Taxpayer Burden.

- Despite reporting all of its pension debt, the state continues to hide $596.4 million of its retiree health care debt.

- Mississippi's reported net position is inflated by $1.4 billion, largely because the state defers recognizing losses incurred when the net pension liability increases.

A specific breakdown of assets and bills.

“Mississippi's financial condition is not only alarming but also misleading as government officials have failed to disclose significant amounts of retirement debt on the state’s balance sheet,” the report continues. “Residents and taxpayers have been presented with an unreliable and inaccurate accounting of the state government’s finances.”

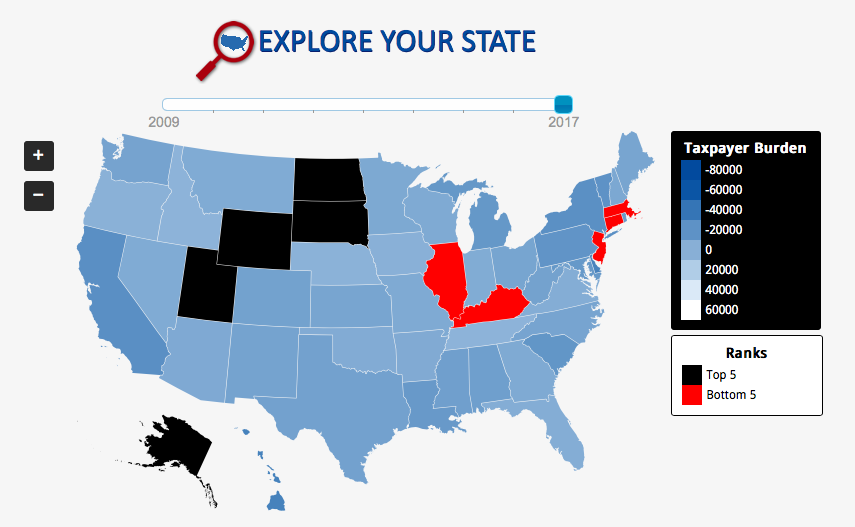

The taxpayer burden in Mississippi is down slightly from the past two years when it was $11,800 (2015) and $11,900 (2016). However, just nine years ago the burden was only $4,900 per resident.

Louisiana had the worst taxpayer burden among Mississippi’s neighbors at $15,500 per resident. Alabama was similar to Mississippi at $11,800 while Arkansas had a burden of $3,600 per resident.

Tennessee was in the best position, earning a B from Truth in Accounting, with a $2,500 taxpayer surplus. Nine years ago, Tennessee had a $600 taxpayer burden. But they have been steadily moving in the right direction and have been in the black for the past six years.

New Jersey had the greatest burden at more than $61,000 per resident. Alaska had the strongest surplus, $56,500 per resident.

Americans for Tax Reform today led a coalition of 58 conservative groups and activists, including the Mississippi Center for Public Policy, in support of the Tax Reform 2.0 legislation set to be voted on by the House of Representatives later this week.

This proposal is split into three pieces of legislation: H.R. 6760, the Protecting Family and Small Business Tax Cuts Act, H.R. 6757, the Family Savings Act, and H.R. 6756, the American Innovation Act.

Most importantly, Tax Reform 2.0 strengthens the gains made by the Tax Cuts and Jobs Act last year by making individual and small business tax cuts permanent. This tax reduction could not be made permanent when TCJA passed because of a combination of liberal obstructionism, arcane Senate rules, and an unwillingness to reduce out-of-control federal spending.

The legislation also updates retirement, education, and family savings accounts and promotes innovation and entrepreneurship for small businesses.

The full letter can be found here.

This press release is from the Americans for Tax Reform.

The city of Pearl has taken a prudent approach to the city’s finances over the past 15 months, choosing to reduce spending rather than raise taxes.

For the next fiscal year, the city’s millage rate remains at 27.5 mills and the millage rate for the Pearl School District remains at 60.40 mills.

In 2017, when the current mayor and board of alderman took office, the city’s budget was around $22 million. Last year, the city trimmed it to $18.9 million.

“I knew the struggles the city was having were daily operations,” Mayor Jake Windham said. “We have good revenues. I had a gut feeling we can run a lean budget so we did our due diligence and took the most stringent route. I felt we could dig deep while still doing the necessary things.”

This year, once again, the city did not raise taxes.

“When you decline financially, it makes everything suffer,” Windham added. “We hold ourselves accountable. Raising taxes aren’t necessarily the answer. I didn’t think we had a lean budget like you have at home. We worked with city employees and department heads to create a culture of fiscal responsibility for the city. And they bought in and we were able to turn everything around. This is the first time in eight years we didn’t borrow to pay bills.”

The savings came through reviewing every dollar that was spent and making smart decisions, like implementing a purchase order system.

But this included making difficult choices.

“You can’t cut enough office supplies when you are short falling $100,000 a month,” Windham said. “We knew we had to send people home. We had 20 leave through attrition and had 15 more layoffs.”

For the next year, the budget will increase in key areas.

“As we build revenues, we concentrate on the fundaments of government, then branch out,” Windham said. “We’ve increased where necessary, including road repairs and the clean up of the community.”

The city will also incur new expenses. They are picking up the two percent increase that city employees will pay into the Public Employment Retirement System and health insurance has gone up 18 percent over the previous year.

The city is also on the hook for $800,000 for its share of the Pearl-Richland Intermodal project that will construct a bridge over the railroad tracks on South Pearson Road.

But Windham says the city is on the right track.

“We are making bond payments we weren’t and we look to come in under budget.”

During the recently concluded special session, lawmakers passed a $1 billion infrastructure bill, created a lottery, and distributed BP settlement money throughout the state.

House Speaker Pro Temp Greg Snowden (R-Meridian) and Sen. Hob Bryan (D-Amory) offered their take on the five-day session at Monday’s Stennis-Capitol Press Luncheon in Jackson.

“I believe this is five of the most productive days I’ve experienced,” Snowden said.

Snowden reviewed the three bills at length, calling House Bill 1, the infrastructure bill, essentially a House bill. It will divert money from new bonds, internet sales tax revenue from the 7 percent online sales tax, a new annual tax ($75 to $150 annually) on hybrid and electric vehicles, and sports betting revenue.

Snowden brought up the fact that two United States Supreme Court rulings paved the way for the internet sales tax and sports betting revenue, arguing it was not something they could have done during the regular session.

“We passed three major pieces of legislation,” Snowden added. “You might disagree with them but you can’t say we didn’t get it done. Everyone knew it had to happen, just didn’t know how. And this was a bicameral success. Both bodies worked together for the good of the state. It will be transformative for one or two generations.”

And Snowden noted the bipartisan support.

“Even the lottery wasn’t partisan,” Snowden said.

Bryan had a slightly less optimistic perspective

“Every bad idea imaginable all squared into one session,” is how Bryan began his time at the podium. “The lottery will always be a bad idea. It is not right for the government to run a numbers racket. It preys on the poor, especially poor who are most susceptible.”

Bryan then raised the point of their being little meaningful discussion or debate on the lottery. Under the lottery bill that passed, a five-member board appointed by the governor will oversee a private corporation to run the lottery. The initial bill removed the lottery board from state public records and open meetings laws. The House added open meetings provisions after passing the Senate, but Bryan still didn’t like the idea of a private entity running the lottery. He went so far as to raise the potential for conflicts of interest between the lottery board and private corporations.

“There was so much going on but never time to focus on this huge entity that will have lots of money outside of government controls,” Bryan said. “Some of us tried to slow things down but we were unable.”

Snowden, who voted against the lottery each time it was before the House, said he opposes the lottery because it doesn’t make “good economic sense.” But he added it was better for a private corporation to be running it than the state.

And he noted, “I think it’s fair to say Mississippians wanted a lottery.”

Bryan also mentioned that the infrastructure funding is essentially diverting money from the general fund to cover the new transportation funds.

“This is not an improvement for our state,” Bryan said. “The notion that we’ve done anything to help road maintenance just ain’t so.” He added that this was a short-term solution, noting loss of revenue from multiple tax cuts and government incentives for private companies are taking money from the general fund.

Snowden defended the health of the economy and the budget.

“The health of the economy is not the same thing as revenue in state coffers,” Snowded added. “You don’t judge the health of the economy by how your general fund is doing. We’ve been responsible fiscally and will continue to be.”