This column appeared in National Review on August 29, 2018.

Calling for a more limited government is not just a conservative talking point, it is a principle that encourages freedom and prosperity. And it’s backed up by scientific data.

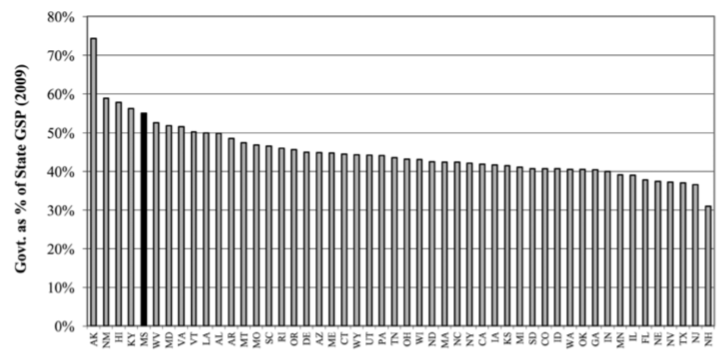

There are eight states where government controls more than half of the economy. Mississippi is one of them.

According to the Fraser Institute, government spending- federal, state, and local- accounts for 55 percent of the economy in Mississippi (as outlined in Promoting Prosperity in Mississippi). This leaves less than half of the state’s economic resources for the private sector. New Hampshire is the freest state, with just 31 percent of the economy controlled by the government. Live Free or Die indeed.

This ranking gave Mississippi the fifth largest government, behind Alaska, New Mexico, Hawaii, and Kentucky. Looking at our neighbors, government controlled between 47-50 percent of the economies in Alabama, Arkansas, and Louisiana. It is 43 percent in Tennessee.

For those that might blame federal spending, if we look at just state and local spending, Mississippi would actually move up to the fourth highest share of government control. So the federal government isn’t to blame.

Government is growing in Mississippi

Interestingly, it has not always been this way. Throughout the 1990s, government control of the economy in Mississippi ranged from about 40-45 percent.

It sat at around 45 percent at the turn of the century. And has been trending in the wrong direction since that time.

Does this matter?

Mississippi has an outsized government. It is larger than our peers. But do we need it? After all, Mississippi is a poor state and largely rural.

Regardless of the size of the state, it is problematic when resources must be dedicated to political favor seeking and lobbying rather than private sector activities. The shift is from entrepreneurship and toward lobbying. That may benefit an individual or a single company, but it does not benefit the economy.

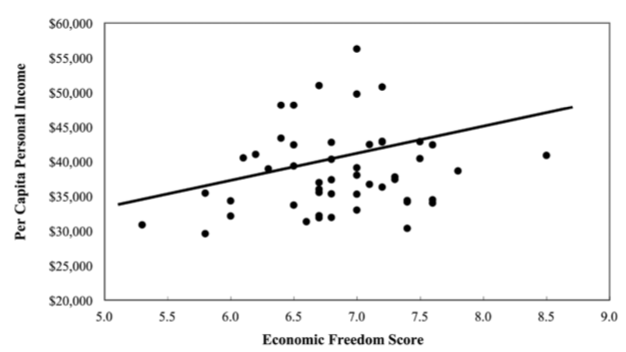

And we have data to show the correlation between economic freedom, which includes personal choice, voluntary exchange, free enterprise, and property rights, and prosperity.

When looking at the Economic Freedom of North America index and per capita income, we see a direct and clear trend. The freer the state, the greater the income.

Those who live in states with the highest per capita income live in the freest states. The poorest states rely on the government. It is not by accident.

People vote with their feet

Beyond the data and freedom indexes from the likes of Fraser, Cato, or Heritage, can you make the argument that people like the high regulation, union friendly status of states like California or New York? After all, Manhattan and San Francisco (minus the used needles and feces on the streets) are highly desirable places to live. And as a result, their cost-of-living is among the highest in the country.

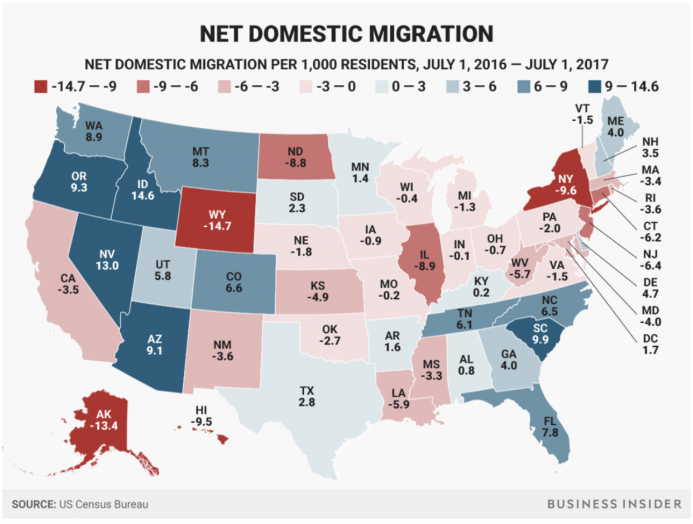

And while those locations might be desirable, net migration tells a different story. We can throw out the data, the policy wonks, and the studies and we still have this graphic.

We are free to live where we’d like in this country. And people are moving to the states that do well on the various measures of economic freedom. As a result, they are moving out of states that do not.

Do people intentionally look at these reports and determine that is where they are going to live? No, probably not. Rather, they are moving to the states with opportunity, with growth, and where the cost-of-living is reasonable. (Hint: states with less burdensome regulations.)

Here is the net migration between 2016 and 2017 among the five freest and five least free states, according to the Economic Freedom of North America index.

| State | Freedom Index Ranking | Net Migration |

| New Hampshire | 1 | 3.5 |

| Texas | 2 | 2.8 |

| Florida | 3 | 7.8 |

| South Dakota | 4 | 2.3 |

| Tennessee | 5 | 6.1 |

| Hawaii | 45 (tie) | -9.5 |

| Mississippi | 45 (tie) | -3.3 |

| New Mexico | 47 (tie) | -3.6 |

| West Virginia | 47 (tie) | -5.7 |

| California | 49 | -3.5 |

| New York | 50 | -9.6 |

The numbers speak for themselves. If we want to increase prosperity and attract new residents to the state, it starts with enacting policies that encourage and promote the principles of economic freedom.

A new report shows taxpayer funded film incentives continue to perform poorly nationwide.

The report, Calling Cut on Film Incentives, was recently released by the Beacon Center of Tennessee and focuses on the poor investment for taxpayers in the Volunteer State. While there has never been an official ROI calculation from the state of Tennessee, the report looked at three key points:

- 40 percent of the subsidized projects made less at the box office then they received in subsidies

- Several of the subsidized projects only spent a small share of their budget in state

- Many programs hold the state, i.e. taxpayers, hostage and threaten to move if they do not receive additional subsidies, similar to sports teams and corporations

A similar story in Mississippi

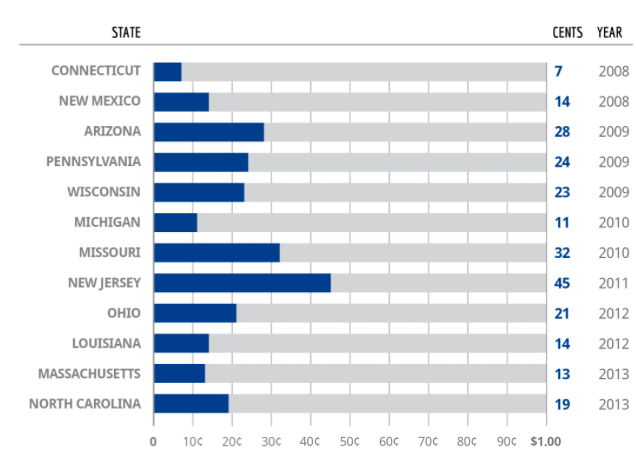

Mississippi has a similar experience with film incentives. A 2015 PEER report shows taxpayers receive just 49 cents for every dollar invested in the incentives. For those looking at a bright side, we are actually “doing better” than many other states.

This includes our neighbors in Louisiana, who recover only 14 cents on the dollar. They also have one of the most generous programs in the country; it was unlimited until lawmakers capped it a couple years ago. (Other reports show the Pelican State recovering 23 cents on the dollar, either way a terrible investment.)

Good for production, not the economy

Beyond Mississippi, Tennessee, and Louisiana, film incentives are universally a poor investment throughout the country. Numerous studies have been conducted on film incentives. All sobering for those worried about taxpayers. Here is a review of the return per tax dollar given, from 2008 through 2013. In these third-party studies, covering 12 different states, there was not a program that returned 50 cents on the dollar (never mind actually made money).

Source: John Locke Foundation

Since this chart was published, studies on similar programs in Florida, Virginia, and West Virginia have shown similar results. No program had a positive ROI.

If an individual was investing their own money, they would never make any of these deals. But is has been said, and proven, many times that no one spends their own money more carefully than that person.

A move in the right direction

Mississippi lawmakers have begun to scale back on the “handouts to Hollywood.” Last year, lawmakers chose not to extend the non-resident payroll portion of the incentives program. This previously allowed for a rebate on payroll paid to cast and crew members who are not Mississippi residents.

But we still have two incentives on the books. One is the Mississippi Investment Rebate, which offers a 25 percent rebate on purchases from state vendors and companies. The other is the Resident Payroll Rebate, which offers a 30 percent cash rebate on payroll paid to resident cast and crew members.

And old habits die hard. The House voted to bring back the incentives this past session. The bill didn't make it through the Senate and that incentive is still dead.

Mississippi is moving in the right direction and they are joined by other states. While all but six states had film incentives a decade ago, the number is now up to 19. Mississippi can be number 20 by removing the incentives currently on the books.

Just because other people are doing it

One of the common prescribed reasons for why need film incentives is because it’s “good” for the state to have movies filmed here. As is often the case in government, we focus on the inputs. How many films are made here? What movie star was in Mississippi? That is nice, but the focus should be on outcomes.

The other common argument is that other states are doing it. That is the point the Beacon Center made about producers holding the state hostage and threatening to move. Producers in Mississippi have raised the same point. And I am sure they have in every other state where film incentives are threatened.

However, simply because another state is wasting money does not mean Mississippi should join them.

Corporate welfare is never a good idea. It’s an even worse idea when you know we are losing money and you want to continue with or resurrect such a program. Our goal should be to have the most competitive business climate in the country. The tax breaks that a few chosen industries or companies receive should be made available to all. When we do that we will remove the need for taxpayer funded incentives.

The first – and hopefully last – special session of 2018 is now over.

The Legislature passed three bills: a $200 million infrastructure bill; a lottery bill; and a bill to distribute BP settlement money throughout the state. We reviewed the infrastructure bill earlier in the week, and it has been signed into law by the governor.

The lottery bill did not pass without drama. In fact, the most interesting part of session was that it almost did not pass at all. On Monday night, the House stunned many observers by rejecting the lottery conference report. After “sleeping on it,” several members changed their vote the next morning. The initial vote on the conference report was 53 for and 61 against. The do-over vote was 58 for and 54 against. Up until the end of the special session members who had voted “No” during the do-over were switching their vote to “Yes.”

Mississippi's path to a lottery

Once Gov. Phil Bryant came out in favor of the lottery, lawmakers began to feel it was inevitable. Long gone are the days when Gov. Ray Mabus (D) lost his re-election bid partly because of his support for the lottery. As Jake McGraw over at Rethink Mississippi details, the lottery was unconstitutional in Mississippi between 1868 and 1992. (Public opinion about lotteries seems to ebb and flow as ebbs and flows the controversy and corruption lotteries tend to facilitate.)

In 1992, voters cleared the way by amending the state constitution to allow for a lottery, but it took another 26 years before the lottery actually became law in Mississippi. One might wonder at this delay, but there is something to be said – said by James Madison, in fact – that public opinion often benefits from guidance, refinement – and delay. This refinement – owing to the divided form of government we all enjoy – is what distinguishes representative democracy from the tumult of purely majoritarian rule.

Mississippi becomes the 45th state to legalize the lottery, and our citizens will presumably no longer be crossing the state line to buy tickets in Louisiana, Arkansas and Tennessee. This phenomenon – that people are buying lottery tickets in other states – was one of the primary motivations to pass a lottery here. It is interesting, however, that the two states immune to this argument – Alaska and Hawaii – do not have lotteries. Just maybe these folks believe it’s bad policy.

BP money

Before going home on Wednesday, lawmakers were also forced to decide how to distribute $750 million in BP settlement funds – gotten from the 2010 Deepwater Horizon oil spill. Bickering over how to divvy up the windfall has preoccupied the Legislature for at least the past two sessions. The Senate bill proposed sending 75 percent of the money to the coast and 25 percent to the rest of the state. The House agreed, fending off several amendments and letting everyone go home Wednesday afternoon. Legislative leadership clearly wanted to avoid sending the bill to conference, where it would have become even more of a “Christmas tree.”

It has been reported that the 75 percent in settlement money will go to six counties: Hancock, Harrison, Jackson, Pearl River, Stone and George. The bill does not exactly say this. Rather, it stipulates the money will be used for programs and projects in the Gulf Coast region “as defined in the federal RESTORE Act, or twenty-five miles from the northern boundaries of the three coastal counties.” ... So which is it? The RESTORE Act’s definition of the “Gulf Coast region” goes well beyond six counties. Which definition governs how the money is to be used? The language is a bit confusing (but I ain’t a lawyer, only a Ph.D.). This confusion could spawn more squabbling – if not a lawsuit or two.

Several states have unfunded liabilities that can only be fixed with major reforms. Unfortunately, politicians find it easier to ignore the problem.

Unfunded public-pension liabilities are not a fun subject, and most politicians do all they can to avoid it. Nobody wants to be the sober one in a room full of drunks — but the party can’t go on forever, and eventually someone will have to clean up the mess.

According to a comprehensive survey by the American Legislative Exchange Council (ALEC) of 280 state-administered public-pension plans, the unfunded liabilities of state-administered pensions now exceed $6 trillion. The number increased by $433 billion in the last twelve months. An April report from Pew Charitable Trusts shows that state-pension debt has increased for 15 consecutive years. While this growing gap is a major concern for current public-sector employees and retirees, it should also worry the rest of us.

As the costs of providing current pension benefits begin to weigh on city and state budgets, other public services are getting crowded out. This is putting pressure on many pension-plan managers to seek greater returns by buying riskier assets. Decades of underfunding adds to the pressure, as governments scramble to meet unrealistic return targets and pay out promised benefits at a level the private sector moved away from decades ago. This all points to the growing possibility that many states will need to raise taxes to keep the party going. But without major pension reform, we may soon see the day when taxpayers in fiscally responsible states are asked to bail out those states that just couldn’t, or wouldn’t, stop partying.

A few examples of what some of the party favors look like will help explain why the clean-up phase will be so infuriating. The retired head of the Oregon Health & Science University takes home a pension of $76,111 — each month! Fifty-eight percent of police and firefighters in Scranton, Pa., are on disability pensions; the average retirement age of a Scranton police officer is just under 45 years old. In Nevada, the average full-career state worker will receive more than $1.3 million in lifetime pension benefits. In five states (California, West Virginia, Oregon, Texas, and New Mexico), a retiree can receive an annual pension income that exceeds his last yearly salary.

In Mississippi, the unfunded pension picture is not a pretty one. We have total unfunded liabilities of over $80 billion. On a per capita basis, that means each Mississippian is responsible for roughly $27,000 of the debt. We only have 24 percent of these promises currently funded. But this issue affects states of all sizes and politics, and from all regions.

The states with the largest per capita debt are somewhat surprising: Alaska, Connecticut, Ohio, Illinois, and New Mexico. So are the states with the smallest per capita share of debt: Tennessee, Indiana, Nebraska, Wisconsin, and North Carolina.

However, perhaps the most important measure for a state’s pension health is its funding ratio. This is the percentage of the total pension obligations that is currently funded. The states that are the least funded to meet obligations include Connecticut (20 percent), Kentucky (21 percent), Illinois (23 percent), Mississippi (24 percent), and New Jersey (26 percent). In other words, Connecticut has saved $1 for every $5 of known debt obligation it has for current and future state system retirees. The states in the best shape: Wisconsin (62 percent funded), South Dakota (48 percent), New York (46 percent), Tennessee (46 percent), and North Carolina (45 percent).

What do the data tell us? For starters, note the strong correlation between states that have managed their pension programs responsibly and states with pro-growth economic policies that favor free-market solutions over government ones. Note that each of the five states with the highest funding levels are also states that rely less on the government to sustain their economies. In none of these states does government control more than 45 percent of the economy, which puts these states in the top half of that measure.

On the other end of the spectrum, 57 percent of Kentucky’s economy is controlled by government, while the public sector controls 55 percent of Mississippi’s economy. Obviously, states such as New Jersey and Illinois suffer from powerful public-employee unions that resist any attempts to adjust spending, renegotiate bad contracts, or move new employees to 401(k)-type retirement accounts that require self-financing of retirement programs (as with the tens of millions of workers in the private sector). But even in states without public-sector unions, such as Mississippi, lawmakers have been hesitant to make necessary changes.

The party is over. This is an easy math problem that, unlike the financial crisis from ten years ago, everyone can see coming. Let’s turn the lights on in state capitols and city halls everywhere and get the cleanup started.

The House of Representatives changed course on Tuesday, voting in favor of a state lottery. They did this less than 24 hours after rejecting the lottery conference report. Five Republicans and three Democrats switched from a "No" vote to a "Yes" vote. Two Democrats and one Republicans switched from a "Yes" vote to a "No" vote.

With approval from the House, the lottery is on its way to Gov. Phil Bryant for his signature.

This is a historic day in Mississippi. Lawmakers rose to the occasion and passed the last part of a sustainable infrastructure funding mechanism that will also provide additional money for public education.

— Phil Bryant (@PhilBryantMS) August 28, 2018

The Mississippi Infrastructure Modernization Act

In addition to creating a state lottery, lawmakers also created the Mississippi Infrastructure Modernization Act.

This new law provides more than $1 billion in infrastructure funding over the next five years. The legislation is the result of two years of negotiation and compromise between the House and Senate, seeking to find a fiscally responsible way to provide sustainable and reliable roads funding.

Here are the details on the Mississippi Infrastructure Modernization Act:

- Provides $200 million annually for roads and bridges. Funding will reach $1.1 billion over five years. This money will come from $300 million in new bonds/debt, internet sales tax revenue from the 7 percent online sales tax, a new annual tax ($75 to $150 annually) on hybrid and electric vehicles, and sports betting revenue.

- Of note, raising the gas tax was never part of this package.

Problems with initial bill

The initial lottery bill also left much to be desired, exempting the new lottery board from state public records and open meetings laws. The House addressed this problem by adding transparency language. A House amendment to leave the door open to video gaming also slowed the bill down. This change was opposed by casino operators as well as the faith community, which had thus far voiced muted opposition to the lottery.

A decades-old debate, Mississippi will become the 45th state to enact a lottery. A lottery board, appointed by the governor, will also serve as the board of the Mississippi Lottery Corporation. It would act as a private corporation domiciled in Mississippi. The lottery is expected to generate about $80 million in annual revenue, with 35 percent of total proceeds going to the state. The remaining 65 percent will go toward administrative costs/paying vendors and prize payouts.

A new report from a libertarian think tank shows personal and economic freedom is growing in Mississippi though we are still in the bottom 20 percent.

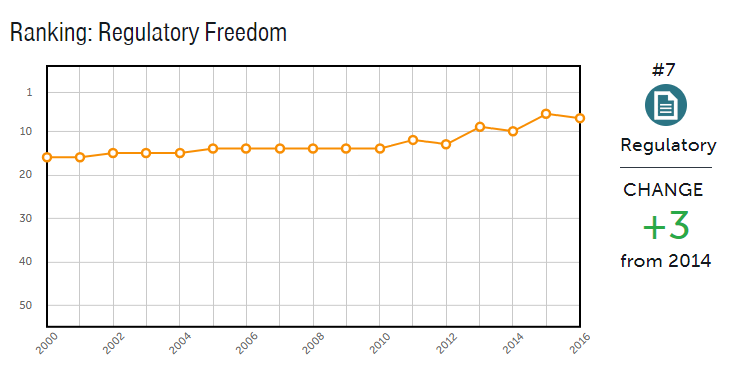

Cato Institute’s Freedom in the Fifty States tracks freedom based on fiscal policy, regulatory policy, and personal freedom. Mississippi came in at 40th overall, a five spot jump from 2014, though still lower than our peak of 32 in the early-2000s.

So what are we doing well?

Our regulatory policy is in the top 10, and is moving in the right direction. Two years ago, lawmakers adopted a new law that will require all new licensing regulations to be approved before they take effect, ensuring new attempts to stifle competition will be reviewed before they are finalized.

On land use freedom, health insurance freedom, labor market freedom, lawsuit freedom, and occupational freedom, which all encompass our regulatory policy, Mississippi is in the top half of all states in each category.

Where can we improve?

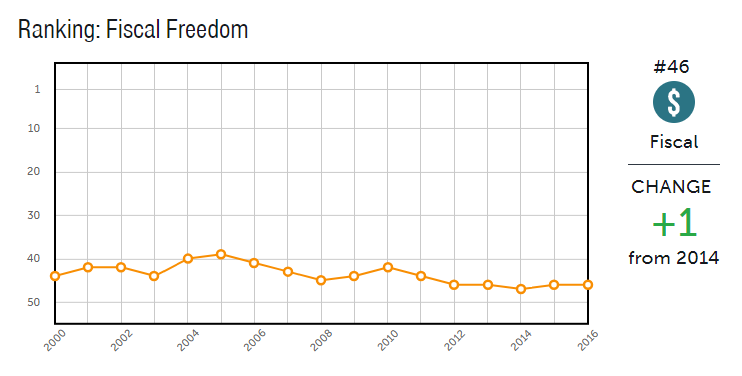

That was the good. But when it comes to fiscal policy, we have much room for growth. And it appears we are only moving backwards.

Fiscal policy includes state and local taxation, government consumption, investment, employment, and debt. Essentially, how much are you being taxed and how much of our economic activity is controlled by government?

“Mississippians’ overall tax burden is a bit above average nationally at 9.9 percent, but local taxes are quite low. This fiscal centralization goes along with a lack of choice among local government (less than 0.4 per 100 square miles). Debt is much lower than average, but government employment and consumption are far higher than average. State and local employment is 17.7 percent of private sector employment,” the report notes.

Policy recommendations? Reduce spending on health and hospitals, where we are the third most liberal spending state, and on education and public welfare, where we spend well more than the national average as a share of the economy. Make government smaller, and reduce state taxes.

Two years ago the legislature eliminated the 3 percent income tax bracket, permitted self-employed individuals to deduct half of their federal self-employment taxes, and removed the franchise tax on property and capital when fully implemented. That will help our future rankings.

And while fiscal freedom has been going in the wrong direction, we are on the right course in personal freedom, largely due to the criminal justice reforms lawmakers have begun to make. We currently came in 34th. To move in to the top half, we need to continue on the right path with those reforms.

How are our neighbors doing?

Among our four border states, we were the only state below 31st overall. Alabama, Louisiana, and Arkansas were rated 28th, 30th, and 31st respectively. The outlier- in a good way- was Tennessee at 7th.

| State | Overall | Fiscal | Regulatory | Personal |

| Mississippi | 40 | 46 | 7 | 34 |

| Alabama | 28 | 19 | 23 | 49 |

| Arkansas | 31 | 33 | 14 | 47 |

| Louisiana | 30 | 22 | 32 | 30 |

| Tennessee | 7 | 3 | 10 | 45 |

As we mentioned, regulatory policy is our strength and Mississippi’s 7th place ranking topped all neighboring states, including Tennessee. Personal freedom was a wash, only Louisiana enjoyed a rating higher than our 34th.

It comes back to fiscal policy. Arkansas is ranked 33rd, Louisiana is 22nd, Alabama is 19th. Tennessee? 3rd. So what are they doing? “The Volunteer State lacks an income tax, and both state and local tax collections fall below the national average. We show state-level taxes falling from 5.1 percent of adjusted personal income in FY 2007 to 4.3 percent in FY 2014 and then back up to 4.5 percent in FY 2017. Local taxes have also fallen a bit since 2006, from about 3.7 to 3.3 percent of income. State and local debt is low, at 17.2 percent of income, and so is government consumption and investment, at 9.7 percent of income. Government employment is only 10.7 percent of private employment, a big drop since 2010 as the job market has recovered,” the report mentions.

Over the past several years, Mississippi has made improvements in several areas. Only five states made greater gains over the past four years. Still, 40th isn’t where we want to hang our hat. By moving our fiscal policies closer to our neighbors, we will begin to enjoy a freer, and more prosperous, state.

“No one is leaving this special session without getting something.” … Mississippi Legislator

Update: The House has changed course and voted in favor of a lottery Tuesday afternoon, sending the conference report creating a state lottery to the governor.

The 2018 special session took a surprising turn on Monday as the House voted down the state lottery conference report (SB 2001) by a bipartisan vote of 54 to 60. Moments later, the same lottery bill passed the Senate 31 to 17. The conference report was necessary because the Senate declined to agree to a House amendment that left the door open to video gambling. Democrats, led by House Minority Whip David Baria, were also disappointed that the bill does not directly allocate money for K-12 education.

The lottery bill has been held on what is called a motion to reconsider. This means that when the House reconvenes at 12:30, lottery supporters will have another chance to get a majority vote. If the motion is tabled (i.e., defeated), the lottery is likely dead for this special session.

Status of BP money

With the defeat of the lottery bill in the House, it has become clear why the special session call has not yet been expanded to include the so-called BP money. At issue is approximately $700 million in BP settlement funds. Options for the money include allocating a majority of the funds to either 3 (or 6) coastal counties. Or at least some of the money could be sent to all 82 Mississippi counties. Many observers predict a 70%/30% split between the two blocks.

The promise of getting more BP money or the threat of getting no BP money will be used by lottery supporters eager to flip the House vote. Whether this threat has any merit remains to be seen. But it would seem that Democrats have more to gain from delaying the lottery because they can use the issue next year to both advocate for more K-12 funding. They can also fault Republicans for cutting taxes and not spending more on infrastructure. Moreover, while the lottery remains popular statewide, pockets of resistance in conservative areas are fierce. It may even be enough to get some members “primaried.”

Problems with initial bill

The initial lottery bill also left much to be desired, exempting the new lottery board from state public records and open meetings laws. The House addressed this problem by adding transparency language. A House amendment to leave the door open to video gaming also slowed the bill down. This change was opposed by casino operators as well as the faith community, which has thus far voiced muted opposition to the lottery – and this morning may be wondering if they should have done more to oppose the bill.

A decades-old debate, Mississippi would become the 45th state to enact a lottery if the House approves. A lottery board, appointed by the governor, would also serve as the board of the Mississippi Lottery Corporation. It would act as a private corporation domiciled in Mississippi. The lottery is expected to generate about $80 million in annual revenue, with 35 percent of total proceeds going to the state. The remaining 65 percent will go toward administrative costs/paying vendors and prize payouts. It is MCPP’s contention that this 35 percent of revenue is essentially a tax and that the lottery bill is primarily a revenue bill.

The Mississippi Infrastructure Modernization Act

Also on Monday, the House sent HB 1 on to the governor.

HB 1 provides more than $1 billion in infrastructure funding over the next five years. The legislation is the result of two years of negotiation and compromise between the House and Senate, seeking to find a fiscally responsible way to provide sustainable and reliable roads funding. The Mississippi Infrastructure Modernization Act:

- Provides $200 million annually for roads and bridges. Funding will reach $1.1 billion over five years. This money will come from $300 million in new bonds/debt, internet sales tax revenue from the 7 percent online sales tax, a new annual tax ($75 to $150 annually) on hybrid and electric vehicles, and sports betting revenue.

- Of note, raising the gas tax was never part of this package.

There is a common assumption that we often hear about Mississippi government. It is that the government is too small and we have reduced taxes too much. Therefore, revenues are down, and we have less money to spend on key government responsibilities, and that is the reason we trail much of the country in various rankings.

This makes for an easy soundbite, and at first glance it might appear to make sense. But of Mississippi’s many problems, the size of government is not one of them. Indeed, we have relied too much on government to grow the economy rather than enact market based policies that have allowed other states to prosper.

As Mississippi was experiencing minimal growth for more than two decades, other states in the middle of the country were prospering. They grew because of policies that emphasized economic freedom and limited government.

Mississippi has the fifth largest government share of state economic activity, and that is due to state and local spending, not federal funds. While there is a large contingent who would want to see the government spend more, it would actually be pretty difficult.

When the government grows, the state has increased ownership and the private sector shrinks. And economic freedom, which is based on free markets and voluntary exchange, individual liberty, and personal responsibility, wanes.

According to the most recent Fraser Institute Economic Freedom of North America report, which measures government spending, taxes, and labor market freedom, Mississippi was ranked 45th among the 50 states. Similarly, Cato Institute’s Freedom in the Fifty States, which measures economic and personal freedom, placed Mississippi 40th in their most recent rankings.

What is the correlation between economic freedom and prosperity? The freer states are more prosperous, have higher per capita incomes, more entrepreneurial activity, and lower poverty rates. We have the model. We need to just look at what similar states have done for economic growth. And it is important to know the difference between the reality of economic growth and the practice of economic development; those can be very different things.

Government incentives, often in the name of economic development and being ‘business-friendly,’ attempt to lure businesses to the state through financial benefits, such as site preparation, infrastructure, job training, or special tax breaks. The only reason these incentives are necessary is because of higher taxes or policies that burden businesses. Instead of special incentives for a few, Mississippi should work to provide a favorable climate for every business. And let the market decide where a business locates or expands. An economic development officer can sell low taxes and low regulatory burdens to a company looking for a great location like Mississippi. What’s more, the data shows us that such policies allow existing businesses already in our state to expand and grow from a small employer to a large employer without getting any incentives from the taxpayers. That’s economic growth.

Being business friendly isn’t based on who can seek the most favors, it is based on how free your state is.

To their credit, state leaders have attempted to improve the economic climate of Mississippi, most notably through tax and regulatory reform. In 2017, the legislature adopted a new law that will require all new licensing regulations to be approved before they take effect, ensuring new attempts to stifle competition will be reviewed before they are finalized.

And the Taxpayer Pay Raise Act in 2016 will eliminate the 3 percent income tax bracket, allow self-employed individuals to deduct half of their federal self-employment taxes, and remove the franchise tax on property and capital when fully implemented. Even though Mississippi’s overall tax burden is still above the national average, this will move Mississippi closer to a flatter income tax and make our business climate more competitive.

These reforms weren’t easy, but showed forward thinking to align us closer with neighboring states. Making the case for spending more money on your favorite government program is not what is needed to prosper. We need to think much bigger than that. If we want to do better than the bottom ten in categories like per capita income, it starts with doing better in categories like business friendliness, regulatory practices, and tax rates.

This column appeared in the Commercial Dispatch on August 25, 2018.

Gov. Phil Bryant has called a special session to begin this Thursday. Lawmakers will address infrastructure repairs and maintenance, along with the allocation of BP money, according to the governor's call.

“We will be able to add roughly $200 million into roads and bridges in the state of Mississippi,” said Gov. Bryant. “It will start the first year of 2019 and go into $260 million that will grow after that, so you will eventually reach the $300 million, but in the first three years of this plan, we have put over $600 million into roads and bridges in the state of Mississippi without raising taxes.”

Where will the money come from? Dr. Jameson Taylor, Vice President for Policy at Mississippi Center for Public Policy, provides a preview of the special session.